Overview

Families facing the challenge of bad credit often feel overwhelmed, but there is hope. By understanding your credit scores and exploring specific loan options such as FHA, VA, and USDA loans, you can take meaningful steps toward securing a home loan. We know how challenging this can be, but with the right information, you can significantly improve your financial profile.

Monitoring your credit reports is crucial. Addressing inaccuracies and making timely payments can greatly enhance your chances of obtaining favorable mortgage terms. Remember, diligence and informed decision-making are key to overcoming financial hurdles. You’re not alone in this journey; we’re here to support you every step of the way.

Taking proactive steps can make a world of difference. Consider reaching out to financial advisors who can guide you through the process. Your dream of homeownership is within reach, and with commitment and effort, you can make it a reality.

Introduction

Navigating the world of home loans can be daunting, especially for families grappling with bad credit. We understand how challenging this can be. However, with the right knowledge and strategies, homeownership can still be an achievable goal. This article delves into practical steps families can take to secure home loans despite financial setbacks.

- Understanding credit scores is crucial.

- By exploring suitable loan options and implementing effective strategies, families can enhance their loan eligibility.

- What challenges do families face in this pursuit?

- More importantly, how can they turn these obstacles into opportunities for success?

- We’re here to support you every step of the way.

Understand Your Credit Score and Its Impact

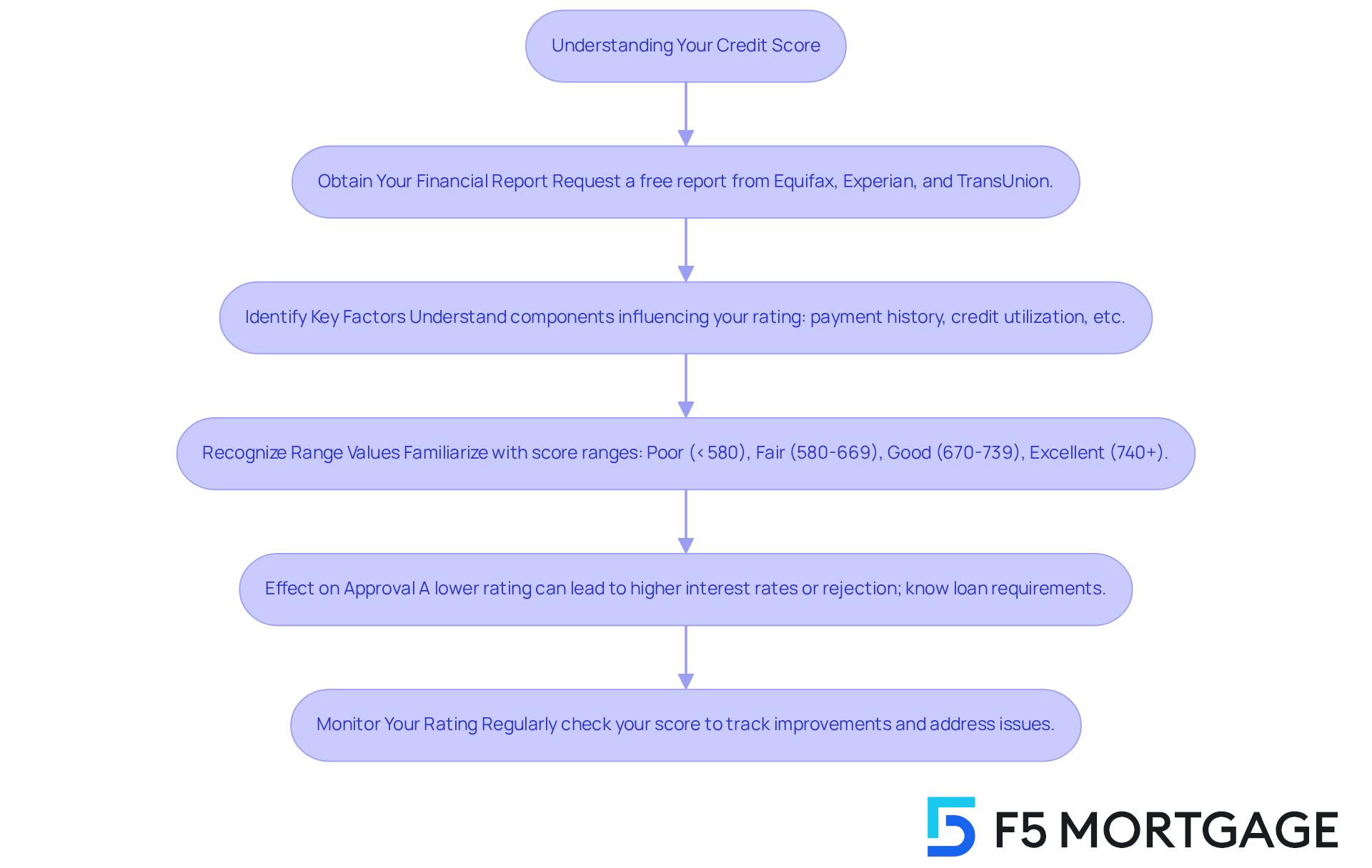

Understanding your financial rating is essential when seeking home loans with bad credit, especially if your financial history isn’t perfect. Credit ratings range from 300 to 850, with higher scores indicating better creditworthiness. Here’s how you can effectively assess your credit score:

- Obtain Your Financial Report: Start by requesting a free financial report from major agencies—Equifax, Experian, and TransUnion. This allows you to check your current rating and review your financial background. Remember, you can access one free report from each bureau annually.

- Identify Key Factors: It’s important to understand the components that influence your rating: payment history (35%), credit utilization (30%), length of credit history (15%), types of credit utilized (10%), and new credit inquiries (10%). Knowing these factors is crucial for improving your score.

- Recognize Range Values: Familiarize yourself with the range values: below 580 is considered poor, 580-669 is fair, 670-739 is good, and 740+ is excellent. Understanding where you stand helps you assess your financing options and potential interest rates.

- Effect on Approval: A lower financial rating can lead to higher interest rates or even rejection of your application. Typically, conventional loans require a minimum rating of 620, while FHA loans may accept ratings as low as 500 with a larger down payment. This flexibility can open doors for families facing financial difficulties in obtaining home loans with bad credit.

- Monitor Your Rating: Regularly checking your credit rating is vital to track improvements or declines, especially before applying for a mortgage. This proactive approach allows you to address issues like unpaid collection accounts, which can significantly impact your score. Experts note that even a modest increase of 20-30 points can lead to better mortgage terms, potentially saving you thousands over the life of the loan.

Real-life examples highlight the importance of financial ratings in home buying. Families who actively monitor and improve their financial ratings have successfully transitioned from being denied financing to securing favorable mortgage terms. By prioritizing debt repayment and correcting errors on financial statements, many have transformed their financial situations. It’s a testament to the fact that with diligence and the right strategies, homeownership is within reach, even for those looking for home loans with bad credit.

Explore Loan Options for Bad Credit Borrowers

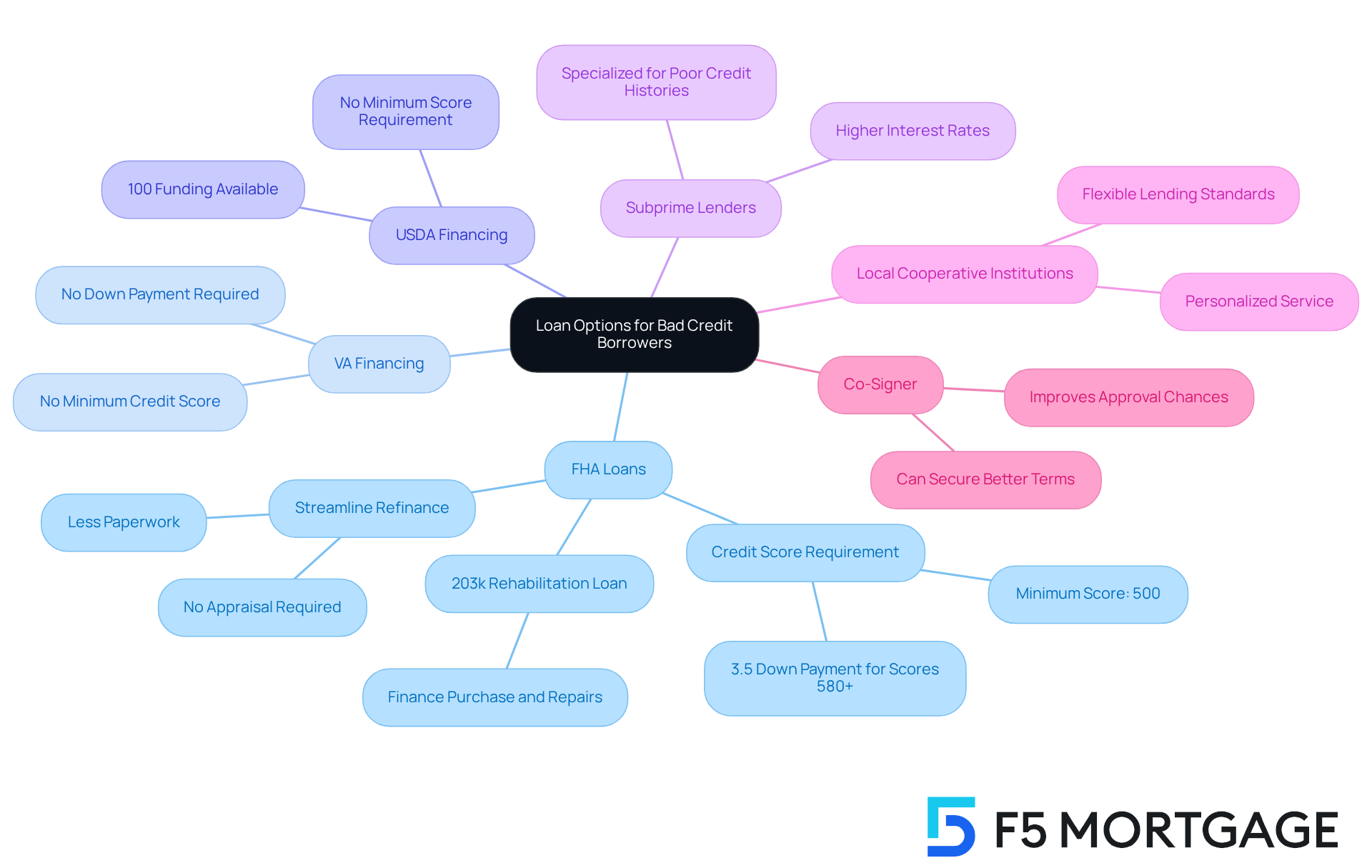

Understanding your financial rating is essential, and we know how challenging this can be. The next step is to explore home loans with bad credit available for individuals with a less-than-perfect financial history. Here are some viable choices that might help you on your journey:

-

FHA Loans: The Federal Housing Administration (FHA) offers loans with flexible credit criteria. You can qualify with a rating as low as 500, provided you make a 10% down payment. If your score is 580 or above, you might be eligible for a more favorable 3.5% down payment, making homeownership more attainable.

-

VA Financing: If you are a veteran or active-duty personnel, consider VA financing. It often has no minimum financial rating requirement and does not require a down payment. This makes it an excellent choice for those with a challenging financial background.

-

USDA Financing: For families looking to buy homes in rural areas, USDA financing offers 100% funding with no minimum score requirement. However, individual lenders may have their own criteria, so it’s important to check with them directly.

-

Subprime Lenders: Some lenders specialize in offering financing to individuals with poor financial histories. While home loans with bad credit may come with higher interest rates, they can provide a pathway to homeownership for those who might otherwise face denial.

-

Local cooperative institutions often provide more flexible lending standards and personalized service compared to traditional banks, making them a viable option for individuals seeking home loans with bad credit.

-

Consider a Co-Signer: If possible, having a co-signer with strong financial standing can significantly improve your chances of approval. This may also help secure better terms, enhancing your overall borrowing experience.

We’re here to support you every step of the way as you navigate these options.

Take Steps to Improve Your Loan Eligibility

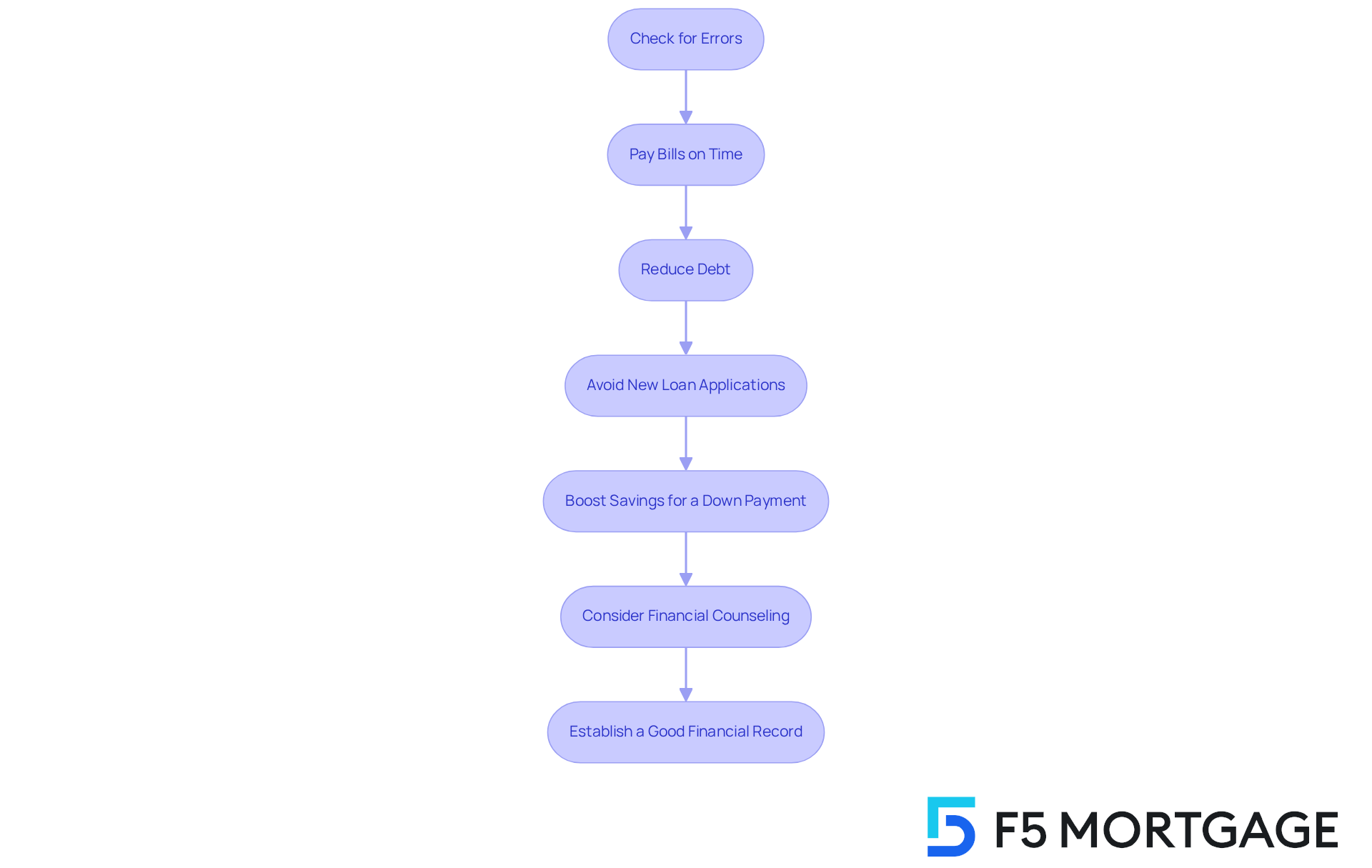

Enhancing your loan eligibility is a proactive approach that can significantly improve your chances of securing a mortgage. We know how challenging this can be, and we’re here to support you every step of the way. Here are essential steps to consider:

-

Check for Errors: Regularly review your financial report for inaccuracies or outdated information. Challenging inaccuracies with the reporting agency can potentially improve your rating, as they are obligated to examine disputes within 30 days.

-

Pay Bills on Time: Consistently settling your bills promptly is essential for financial health. Payment history represents 35% of your FICO rating, making it one of the most effective methods to enhance your borrowing potential. Setting up reminders or automatic payments can help ensure you never miss a due date.

-

Reduce Debt: Decreasing your card balances is crucial for enhancing your utilization ratio, which should ideally remain below 30% of your overall limit. This ratio represents 30% of your rating, so handling it efficiently can result in substantial enhancements. Furthermore, keeping a Debt-to-Income (DTI) ratio under 43% is vital for qualifying for home loans with bad credit, as an improved DTI can lead to more favorable mortgage rates.

-

Avoid New Loan Applications: Each new inquiry can temporarily decrease your rating. To sustain a better rating while getting ready for a mortgage, avoid applying for new cards or financing.

-

Boost Savings for a Down Payment: A bigger down payment can assist in mitigating a lower rating and might obtain more favorable loan conditions. Aim for at least 10% if possible, as this can demonstrate financial stability to lenders.

-

Consider Financial Counseling: If managing debt is challenging, seeking help from a certified counseling service can provide personalized strategies to improve your financial situation and score.

-

Establish a Good Financial Record: For individuals with restricted financial backgrounds, think about opening a secured card or becoming an authorized user on a relative’s account. This can help create a favorable financial history, which is essential for mortgage approval.

Real-life examples illustrate the effectiveness of these strategies. Families who diligently challenged inaccuracies on their financial reports often experienced substantial score enhancements, allowing them to qualify for improved mortgage options. By taking these steps, you can enhance your credit profile and increase your chances of securing home loans with bad credit.

Conclusion

Understanding the pathways to secure home loans with bad credit is crucial for families striving for homeownership despite financial challenges. We know how daunting this can feel, but by taking informed steps to assess and improve credit scores, exploring various loan options, and enhancing eligibility, families can transform their aspirations into reality.

This article outlines essential strategies to help you navigate this journey. Start by obtaining your credit reports and identifying key factors that influence your credit scores. Then, explore viable loan options such as FHA, VA, and USDA financing. Remember, improving your loan eligibility is significant. Diligent practices like timely bill payments, reducing debt, and correcting inaccuracies on financial reports can make a difference. Real-life examples serve as inspiring reminders that with determination and the right approach, favorable mortgage terms are attainable.

Ultimately, families facing the hurdles of bad credit should remember that proactive engagement with their financial health can yield significant benefits. By educating yourselves on credit scores, exploring diverse financing options, and committing to improving your financial standing, you can open doors to homeownership. The journey may be challenging, but the rewards of achieving a secure home loan are well worth the effort. We’re here to support you every step of the way.

Frequently Asked Questions

Why is understanding my credit score important when seeking home loans?

Understanding your credit score is crucial because it affects your creditworthiness, which influences your ability to secure home loans and the interest rates you may receive.

How can I obtain my credit report?

You can request a free financial report from major credit agencies—Equifax, Experian, and TransUnion. You are entitled to one free report from each bureau annually.

What factors influence my credit score?

The key factors that influence your credit score include payment history (35%), credit utilization (30%), length of credit history (15%), types of credit utilized (10%), and new credit inquiries (10%).

What are the different credit score ranges?

Credit scores range from 300 to 850: below 580 is considered poor, 580-669 is fair, 670-739 is good, and 740+ is excellent.

How does my credit score affect my loan approval?

A lower credit score can result in higher interest rates or rejection of your loan application. Conventional loans typically require a minimum score of 620, while FHA loans may accept scores as low as 500 with a larger down payment.

Why is it important to monitor my credit score regularly?

Regularly checking your credit score helps you track improvements or declines, allowing you to address issues that may affect your score, such as unpaid collection accounts. Even a modest increase in your score can lead to better mortgage terms.

Can improving my credit score help me secure better mortgage terms?

Yes, actively monitoring and improving your credit score can lead to securing favorable mortgage terms, potentially saving you thousands over the life of the loan.

Are there real-life examples of individuals improving their credit scores for home loans?

Yes, many families have successfully transitioned from being denied financing to securing favorable mortgage terms by prioritizing debt repayment and correcting errors on their financial statements.