Overview

Securing a VA loan with bad credit is indeed possible. We know how challenging this can be, but families can navigate specific steps to enhance their financial profiles and improve their chances of approval. While the VA does not enforce a minimum credit score, it’s important to understand that most lenders prefer scores of 620 or higher. By taking proactive measures, such as:

- Making timely payments

- Reducing debt

families can significantly improve their borrowing conditions. We’re here to support you every step of the way.

Introduction

Navigating the path to homeownership can feel overwhelming, especially for families facing the challenge of bad credit. We understand how daunting this journey can be, but VA loans offer a unique lifeline. Designed specifically for veterans and active-duty service members, these loans come with significant advantages, such as no down payment and competitive interest rates.

Yet, the question remains: how can families with less-than-ideal credit scores successfully secure these loans? This article aims to provide you with essential steps, strategies, and insights needed to overcome credit hurdles. Together, we will explore how to unlock the door to homeownership through VA financing, empowering you every step of the way.

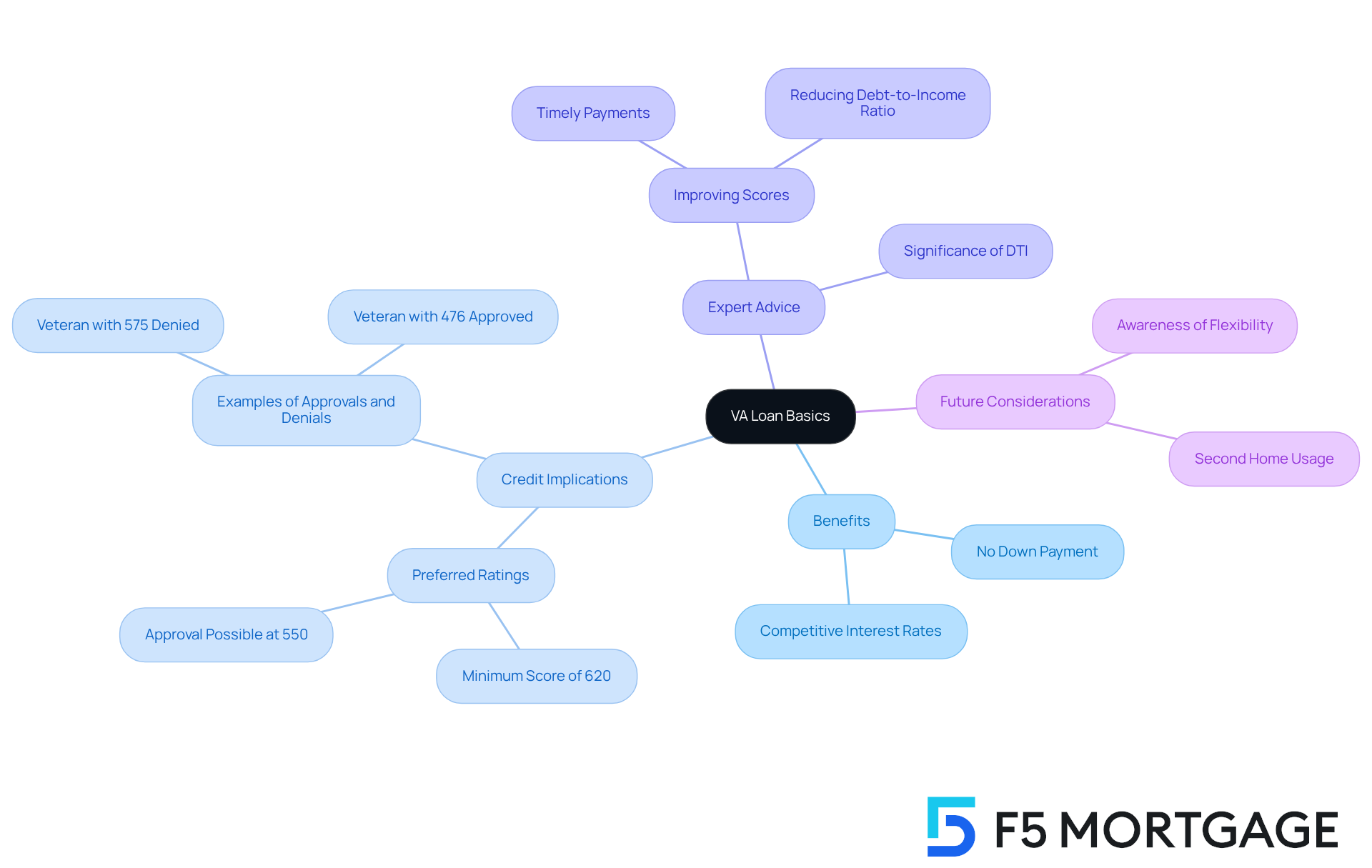

Understand VA Loan Basics and Bad Credit Implications

VA financing, backed by the U.S. Department of Veterans Affairs, is designed to assist veterans, active-duty service members, and select members of the National Guard and Reserves in purchasing homes. One of the most significant benefits of VA financing is the absence of a down payment requirement, which can greatly ease the path to homeownership for families. Additionally, these loans often come with competitive interest rates, making them an appealing choice for many.

However, we understand that having a poor financial history can complicate the approval process. While the VA does not impose a minimum financial rating requirement, most lenders prefer ratings of 620 or higher. This preference suggests that individuals with lower financial ratings may face challenges in securing a mortgage, potentially leading to higher interest rates and increased overall costs. For instance, veterans with financial ratings as low as 550 have managed to obtain VA mortgages, but they often encounter higher monthly payments and interest fees throughout the life of the loan.

Real-life examples illustrate this situation:

- A veteran with a rating of 575 was denied a VA mortgage due to a recent credit card default.

- Another veteran with a rating of 476 was approved despite having late payments, thanks to documented extenuating circumstances.

These cases underscore the variability in lender requirements and the importance of presenting a solid overall financial profile.

Experts emphasize that improving financial scores before applying for a VA mortgage can lead to significantly better borrowing conditions. Simple actions such as making timely payments, reducing debt-to-income ratios, and checking financial reports for errors can enhance reliability. Generally, a maximum DTI ratio of 43% is required for home financing, and a more favorable DTI can yield competitive mortgage rates. As financing officer Tim Alvis points out, “The VA doesn’t have a minimum score requirement, but most lenders require at least a 620 score to qualify.”

As we look to 2025, the landscape for VA financing remains beneficial for families, with many veterans unaware of the flexibility in borrowing standards. Understanding these nuances, including the importance of DTI and refinancing options available through F5 Mortgage, can empower families to navigate the VA financing process more effectively, ensuring they are well-prepared to achieve their homeownership dreams. However, it’s crucial to recognize that while obtaining a VA loan with bad credit is possible, it may not always be the most prudent financial choice. Additionally, families should be mindful of the 4% rule on VA financing, which limits seller concessions, and the possibility of using a VA mortgage for a second home.

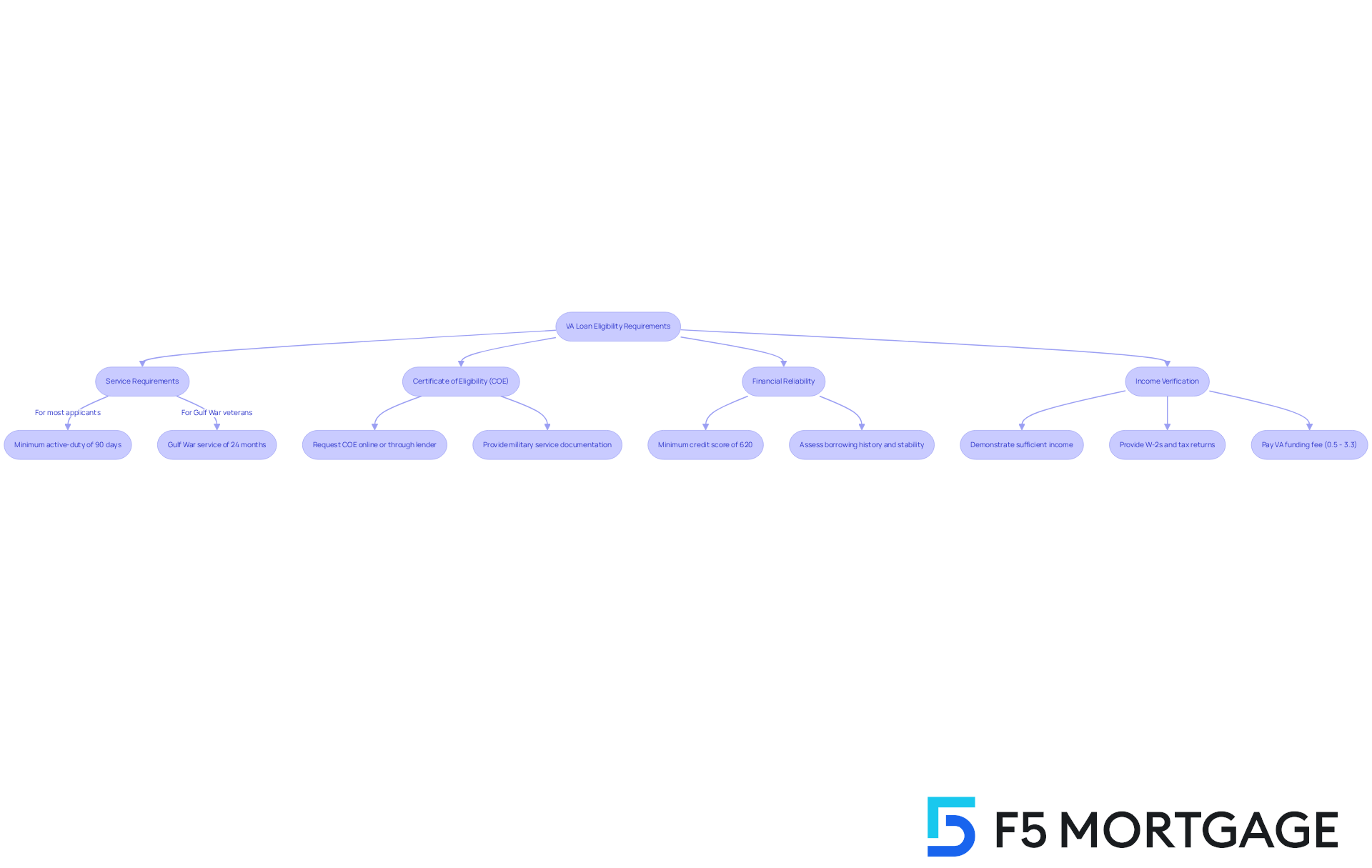

Review Eligibility Requirements for VA Loans

To qualify for a VA loan, applicants must meet specific eligibility criteria, which include:

-

Service Requirements: We understand that military service is essential, with a minimum active-duty period of at least 90 continuous days for most applicants. For those who served during the Gulf War, this requirement extends to 24 continuous months. Importantly, VA mortgages now offer greater flexibility in financing, as there are no limits for borrowers with full entitlement.

-

Certificate of Eligibility (COE): Acquiring a COE from the VA is crucial, as it confirms your eligibility for financing. You can request this certificate online or through your lender, but be sure to have documentation of your military service ready, such as your Form DD214 for veterans or a current statement of service for active-duty members.

-

Financial Reliability: While the VA does not enforce a minimum rating, lenders typically look for a score of at least 620 for a VA loan with bad credit. Your borrowing history and financial stability will be assessed to determine your ability to repay the VA loan with bad credit. This aligns with common mortgage qualification criteria for refinancing in California, where a minimum credit score of 620 is often required for conventional financing programs.

-

Income Verification: It’s important to demonstrate sufficient income to cover mortgage payments. This may involve providing W-2s and tax returns. Additionally, most borrowers need to pay a VA funding fee, which ranges from 0.5 percent to 3.3 percent of the amount borrowed, depending on various factors.

Steps to Verify Eligibility:

- Review your service record to confirm your eligibility based on the required active-duty duration.

- Apply for your COE through the VA website or your lender, ensuring you have the necessary documentation ready.

- Gather financial documents, including proof of income, to present to your lender for assessment.

Real-world examples highlight the importance of the COE in securing a VA mortgage. Many veterans have successfully navigated this process, emphasizing the significance of understanding the eligibility requirements. For instance, a veteran who served for 181 days during the post-Vietnam War period faced challenges in gathering the necessary documentation but ultimately obtained their COE and secured a VA benefit, illustrating the pathway to homeownership available through this program.

Statistics indicate that the minimum active-duty service requirement varies based on the period of service, with most veterans needing at least 90 days to qualify. This flexibility allows numerous service members to access the benefits of VA financing, making homeownership more attainable. Furthermore, homes funded by VA financing must meet basic property standards to ensure safety and hygiene, which is essential for applicants to understand.

Refinancing Options for VA Loans:

VA loans provide specific refinancing options that can greatly benefit homeowners. The VA Interest Rate Reduction Refinance Loan (IRRRL) is designed to lower your interest rate and monthly payment, making it an appealing choice for those seeking to alleviate their financial burden. Additionally, the VA cash-out refinance enables homeowners to tap into their home equity for various financial needs, offering flexibility in managing expenses. Understanding these options can empower you to make informed decisions regarding your mortgage.

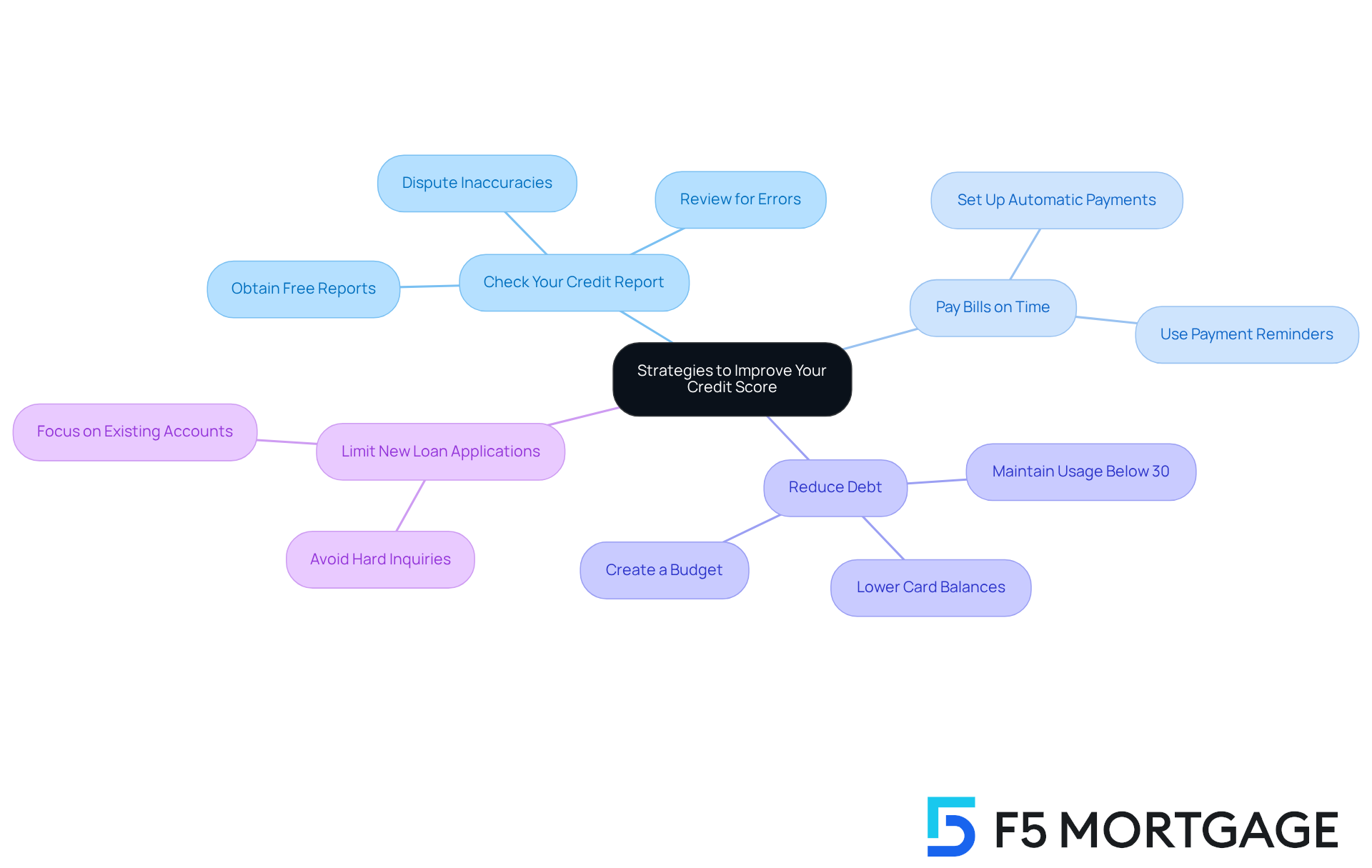

Implement Strategies to Improve Your Credit Score

Boosting your financial rating can greatly enhance your chances of securing a VA loan with bad credit. We understand how challenging this process can be, and we’re here to support you every step of the way. Here are some effective strategies to consider:

-

Check Your Credit Report: Obtain a free copy of your credit report from the three major credit bureaus—TransUnion, Experian, and Equifax. Review it thoroughly for any errors or inaccuracies, as mistakes can negatively impact your score. As stated by the Federal Trade Commission, around 10 million Americans encounter expensive report mistakes, which can lead to increased expenses for loans and insurance. If you discover discrepancies, contest them quickly to ensure your report reflects correct information.

-

Pay Bills on Time: Consistently settling your bills promptly is one of the most effective methods to enhance your creditworthiness. Transaction history constitutes a substantial part of your rating assessment, so arranging automatic transfers or alerts can assist you in evading late charges and overlooked transactions. Financial experts note that timely payments can significantly improve your creditworthiness.

-

Reduce Debt: Aim to lower your card balances to improve your debt-to-limit ratio, which is a key factor in determining your rating. Ideally, keep your usage below 30% of your total borrowing limit. This not only assists your rating but also demonstrates responsible financial management to potential lenders. Remember, a reduced financial rating can lead to elevated interest rates and monthly payments for a VA loan with bad credit, making it essential to handle your debt efficiently.

-

Limit New Loan Applications: Each time you request new financing, a hard inquiry is made on your report, which can temporarily reduce your rating. To maintain a healthy financial profile, limit new applications and focus on managing your existing accounts. Specialists advise exercising caution with new loans to prevent unnecessary declines in your rating.

Action Steps:

- Utilize free monitoring tools to track your rating and receive notifications for any changes.

- Set up reminders for bill payments to avoid late fees and maintain a positive payment history.

- Create a budget to effectively manage and reduce your debt, ensuring you stay within your financial limits.

By applying these strategies, families can improve their credit scores, simplifying the process to qualify for a VA loan with bad credit and achieve their homeownership objectives.

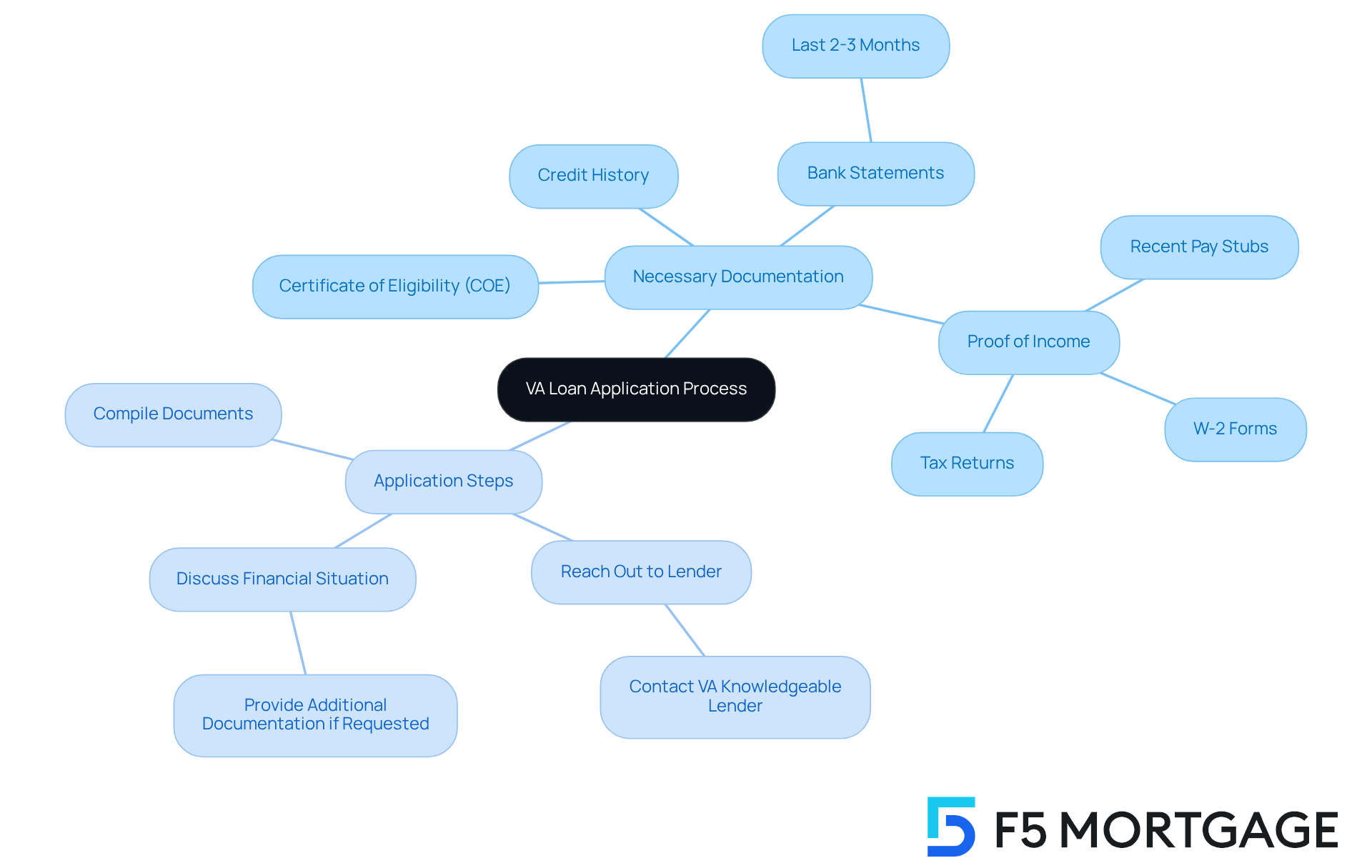

Gather Necessary Documentation and Apply for Your VA Loan

When applying for a VA mortgage, we know how challenging this can be. Gathering the right documents is essential for a seamless application process. Here are the essential items you will need:

- Certificate of Eligibility (COE): This document verifies your eligibility for a VA loan based on your military service.

- Proof of Income: Include recent pay stubs, tax returns, and W-2 forms to demonstrate your income stability.

- Credit History: While lenders will pull your credit report, having a summary of your credit history can provide additional context.

- Bank Statements: Prepare statements from the last two to three months to showcase your financial health and spending behavior.

Application Steps:

- Compile all necessary documents in a single folder for easy access.

- Reach out to a lender knowledgeable about VA financing to start the application procedure. F5 Mortgage can assist you in understanding the refinancing process and help you select the appropriate option based on your eligibility. Keep in mind that refinancing may have stricter application requirements than conventional financing.

- Be ready to discuss your financial situation and provide any additional documentation if requested. Remember, possessing a higher credit score and a low debt-to-income ratio can enhance your opportunities for obtaining favorable financing conditions.

Comprehending the documentation requirements can significantly simplify your VA financing application. Many lenders prefer to see a solid employment history, and gaps in employment may raise concerns. If you possess a bankruptcy record, it’s crucial to reveal this information to your lender. It does not automatically disqualify you from receiving a VA mortgage, but it must be conveyed.

Real-world examples illustrate the importance of preparation: families who meticulously gathered their documents often experienced faster processing times, typically ranging from 30 to 45 days once under contract on a home. This proactive strategy not only minimizes delays but also improves the chances of obtaining favorable financing conditions, such as a VA loan with bad credit. By being well-prepared, you can navigate the VA loan process with confidence and ease.

Conclusion

Securing a VA loan with bad credit may feel overwhelming, but it is achievable for many families. We understand how challenging this can be, and the key lies in grasping the basics of VA loans, recognizing the implications of credit scores, and implementing strategies to enhance financial profiles. With the right knowledge and preparation, veterans and service members can navigate the complexities of the VA loan process, ensuring they are well-equipped to realize their dream of homeownership.

Throughout this article, we’ve outlined essential steps to facilitate your journey:

- Verifying eligibility

- Gathering necessary documentation

- Employing effective credit improvement strategies

Each aspect plays a crucial role in boosting your chances of securing favorable loan terms. Real-world examples illustrate that while challenges exist, many have successfully obtained VA loans despite their credit scores. This highlights the importance of a comprehensive approach to the application process.

Ultimately, the significance of this information extends beyond just securing a loan; it empowers families to take control of their financial futures. By actively working to improve credit scores and understanding the nuances of VA financing, families can open doors to homeownership that might otherwise seem closed. Embracing these strategies not only fosters financial stability but also contributes to a brighter future, making the dream of owning a home a reality for those who have served.

Frequently Asked Questions

What is a VA loan?

A VA loan is a mortgage backed by the U.S. Department of Veterans Affairs, designed to assist veterans, active-duty service members, and select members of the National Guard and Reserves in purchasing homes.

What are the key benefits of VA financing?

Key benefits of VA financing include the absence of a down payment requirement and competitive interest rates, which can ease the path to homeownership for families.

Is there a minimum credit score requirement for VA loans?

The VA does not impose a minimum credit score requirement; however, most lenders prefer a credit score of 620 or higher.

Can individuals with bad credit obtain a VA loan?

Yes, individuals with bad credit can obtain a VA loan, but they may face challenges such as higher interest rates and increased overall costs.

What are some real-life examples of veterans with low credit scores obtaining VA loans?

One veteran with a rating of 575 was denied a VA mortgage due to a recent credit card default, while another veteran with a rating of 476 was approved despite late payments, thanks to documented extenuating circumstances.

What actions can individuals take to improve their chances of securing a VA loan?

Individuals can improve their chances by making timely payments, reducing their debt-to-income ratios, and checking financial reports for errors.

What is the maximum debt-to-income (DTI) ratio required for VA financing?

The maximum DTI ratio required for VA financing is generally 43%.

What is the significance of the 4% rule in VA financing?

The 4% rule limits seller concessions in VA financing, which is important for families to consider when planning their home purchase.

Can VA loans be used for purchasing a second home?

Yes, it is possible to use a VA mortgage for a second home.

What should families be aware of when considering a VA loan with bad credit?

While obtaining a VA loan with bad credit is possible, it may not always be the most prudent financial choice, and families should assess their overall financial situation before proceeding.