Overview

This article serves as a comprehensive guide for veterans seeking to secure a VA home loan, even with bad credit. We understand how challenging this can be, and we want to assure you that there are unique benefits to VA financing that can help you achieve your dream of homeownership. With no down payment required and lower interest rates available, the path to owning a home is more accessible than you might think.

Let’s explore the eligibility requirements together, and walk you through the step-by-step application process. We’re here to support you every step of the way, and we’ll also share effective strategies to improve your creditworthiness. By understanding these aspects, you can feel empowered to take control of your financial future.

Remember, despite the financial challenges you may face, homeownership is within your reach. Take the first step today, and let us guide you through this journey toward a brighter tomorrow.

Introduction

Navigating the path to homeownership can be daunting, especially for veterans with bad credit. We understand how challenging this can be. VA home loans present a unique opportunity, offering favorable terms such as no down payment and lower interest rates. This makes them an ideal choice for those facing financial challenges.

However, many potential borrowers remain uncertain about their eligibility and the steps necessary to secure these loans.

How can veterans leverage the benefits of VA financing while overcoming the obstacles posed by a less-than-perfect credit history? We’re here to support you every step of the way.

Understand VA Home Loans and Their Benefits

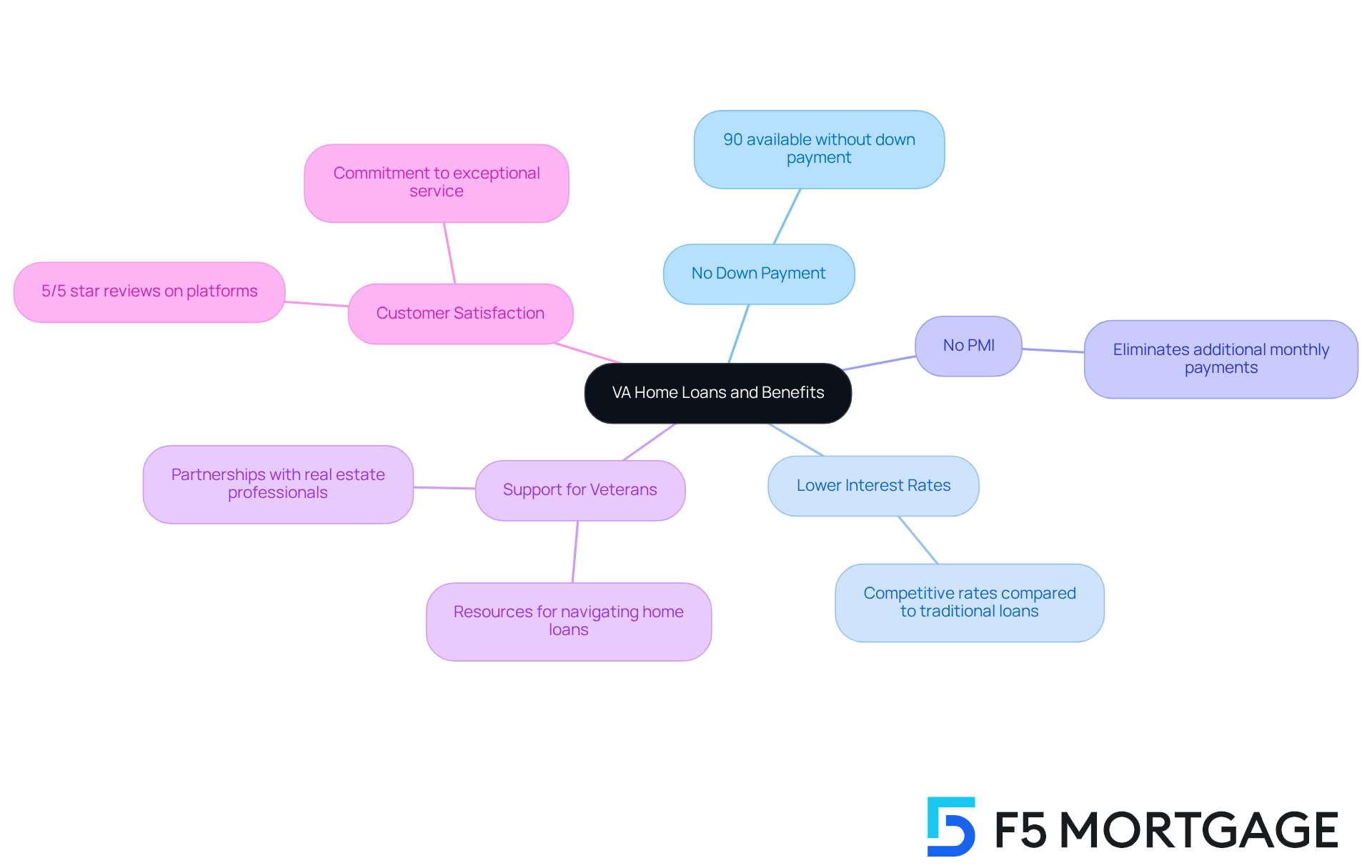

VA home financing offers a unique mortgage solution tailored specifically for qualified veterans, active-duty service personnel, and select members of the National Guard and Reserves. We understand how challenging the journey to homeownership can be, and a notable advantage of VA financing is the absence of a down payment requirement. This greatly reduces the barrier to owning a home. In fact, around 90% of VA financing options are available without any down payment, making it an attractive choice for those with limited savings.

Moreover, VA mortgages typically feature lower interest rates compared to traditional financing options. This leads to significant savings throughout the financing period, which can be particularly beneficial for veterans applying for a VA home loan with bad credit. They can secure favorable terms that might otherwise be out of reach. Additionally, VA financing eliminates the need for private mortgage insurance (PMI), a common requirement for other financing types, further decreasing monthly payments.

These combined benefits position VA financing as a highly appealing choice for veterans striving to attain homeownership, especially in today’s competitive housing market. At F5 Mortgage, we’re here to support you every step of the way, providing a variety of VA financing options, including both adjustable and fixed rates. Our commitment to exceptional customer satisfaction is reflected in our 5/5 star reviews on platforms like Lending Tree, Google, and Zillow.

We strive to enhance home buying opportunities for all, including those exploring down payment assistance programs that can further ease the path to homeownership. Together, we can make your dream of homeownership a reality.

Determine Your Eligibility for a VA Home Loan

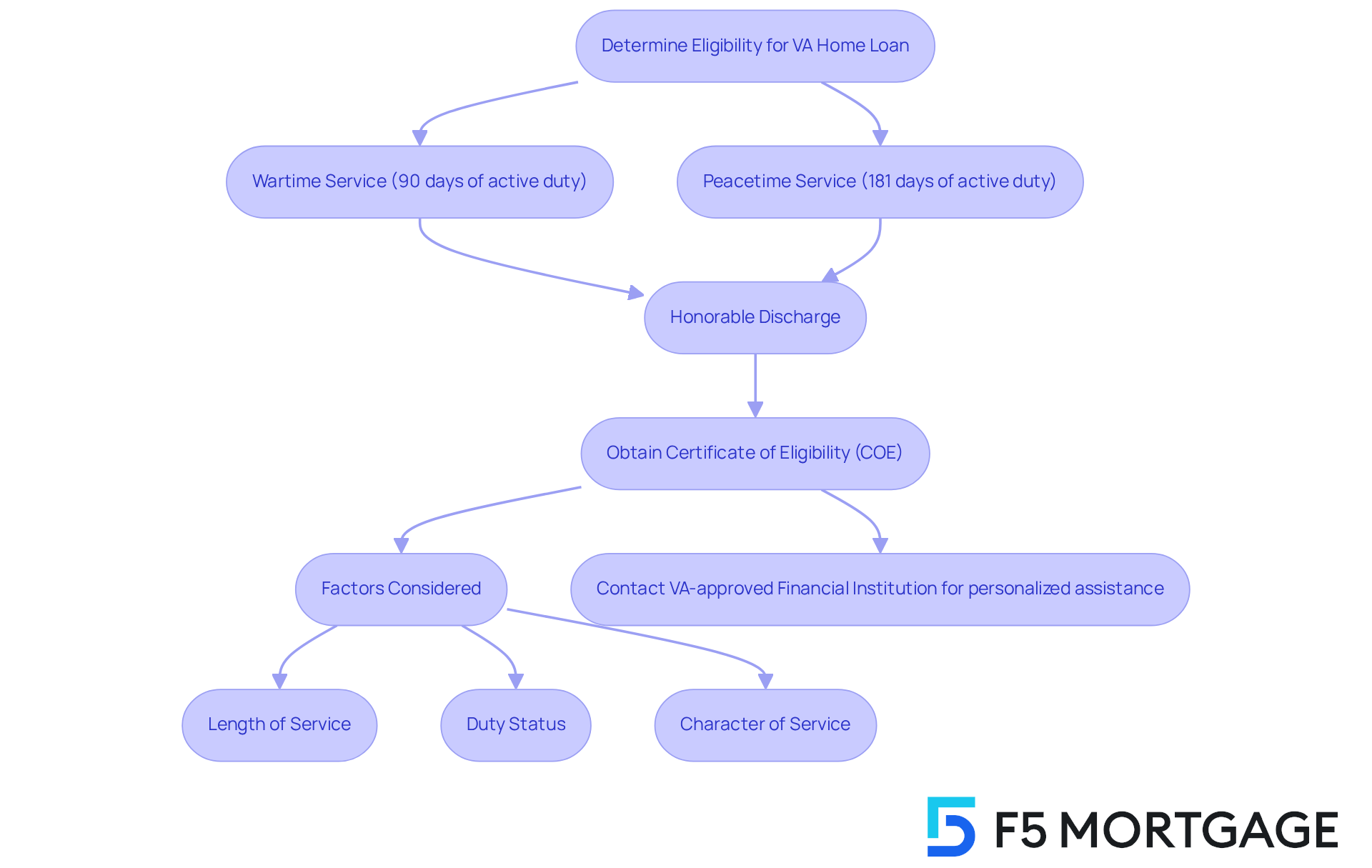

Navigating the process of obtaining a VA home loan with bad credit can feel overwhelming, but we’re here to help you every step of the way. To qualify, you need to meet specific eligibility criteria set by the Department of Veterans Affairs (VA). Generally, this means serving at least:

- 90 days of active duty during wartime

- 181 days during peacetime

Along with receiving an honorable discharge. A crucial step in this journey is obtaining your Certificate of Eligibility (COE), which serves as proof of your qualification for a VA mortgage. You can easily request your COE online through the VA’s eBenefits portal or through your financial institution, making the process much simpler.

Your COE considers various factors, including your length of service, duty status, and character of service. For example, if you haven’t fully utilized your VA entitlement, you might find that you can secure financing without a down payment, even for properties valued up to $2 million. Many people mistakenly believe that a displayed entitlement amount, like $36,000, limits their borrowing potential.

If you’re feeling uncertain about your eligibility for a VA home loan with bad credit, we recommend reaching out to a VA-approved financial institution or a mortgage broker who specializes in VA financing. They can provide personalized guidance tailored to your situation, ensuring you understand the requirements and helping you navigate the application process effectively. With nearly 3.7 million veterans currently benefiting from the VA Home Loan program, knowing how to obtain your COE is essential for accessing these valuable home financing options.

Follow the Step-by-Step Application Process

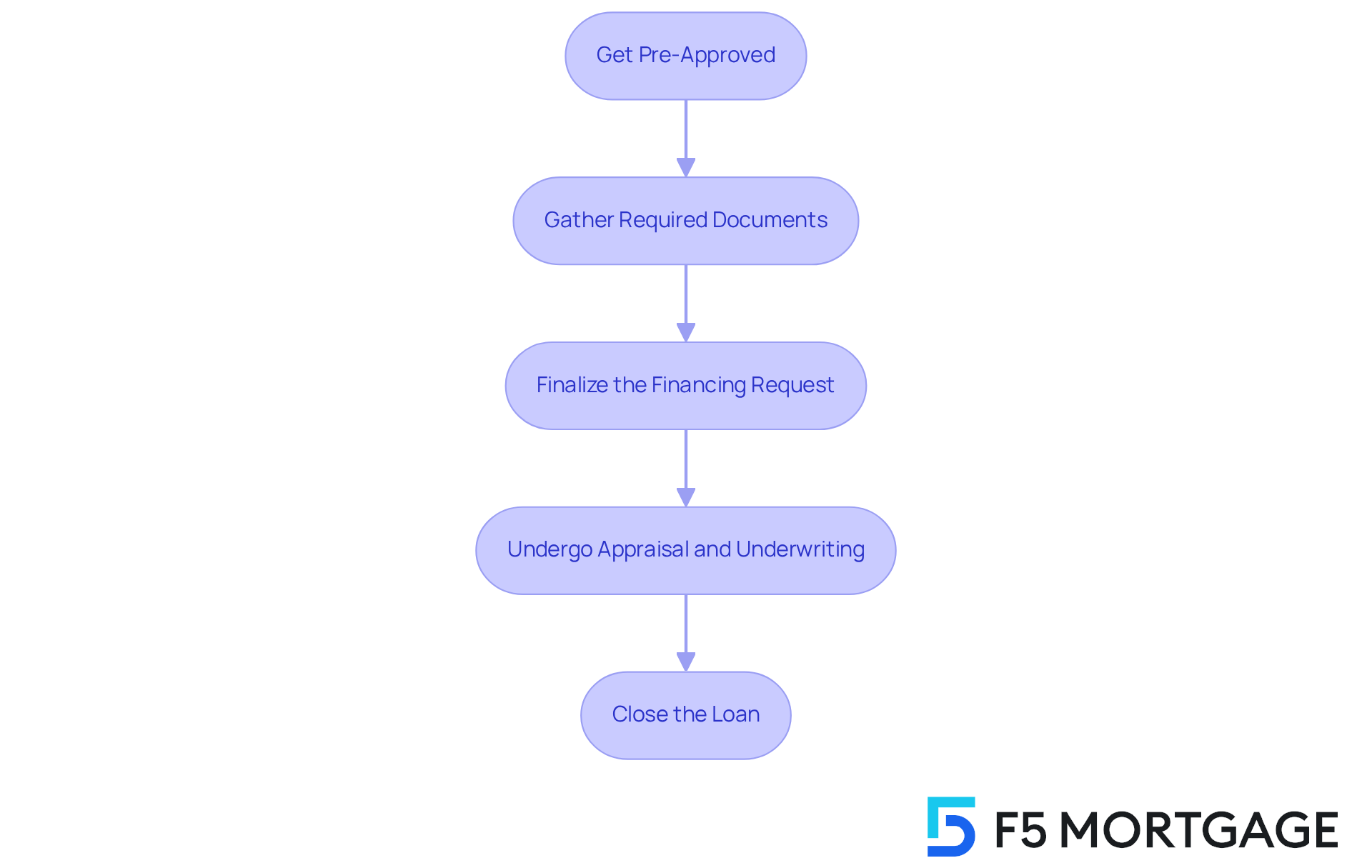

Navigating the application process for a VA home loan with bad credit can feel overwhelming, but we’re here to support you every step of the way. Here are several key steps that can help you along this journey:

-

Get Pre-Approved: Begin by selecting a VA-approved financial institution to secure pre-approval for your mortgage. This crucial step not only clarifies your borrowing capacity but also sheds light on your financial standing. Understanding where you stand is essential for making informed decisions.

-

Gather Required Documents: Collect the necessary documentation, which includes your Certificate of Eligibility (COE), proof of income like recent pay stubs and tax returns, along with any additional financial information that may be requested. Having these documents ready can significantly speed up the pre-approval process, easing some of the stress.

-

Finalize the Financing Request: Complete the financing application with your chosen financial institution, ensuring you provide comprehensive details about your financial history and the property you wish to acquire. This thoroughness helps streamline the underwriting process, making it smoother for you.

-

Undergo Appraisal and Underwriting: Once your application is submitted, the lender will arrange for an appraisal to assess the property’s value. At the same time, the underwriting process will evaluate your creditworthiness and the associated lending risks. We know how challenging this can be, but rest assured that this is a standard part of the process.

-

Close the Loan: If all criteria are met, you’ll move to the closing stage, where you’ll sign the final paperwork and receive the keys to your new home. It’s vital to understand all closing costs and fees involved to avoid any surprises, ensuring you feel confident as you take this significant step.

Securing a VA home loan with bad credit can be a straightforward process, especially when you are well-prepared. As mortgage experts often mention, possessing a pre-approval letter not only enhances your standing as a buyer but also increases your chances of obtaining favorable financing conditions. By following these steps and ensuring you have the necessary documentation, you can navigate the VA financing process with confidence and peace of mind.

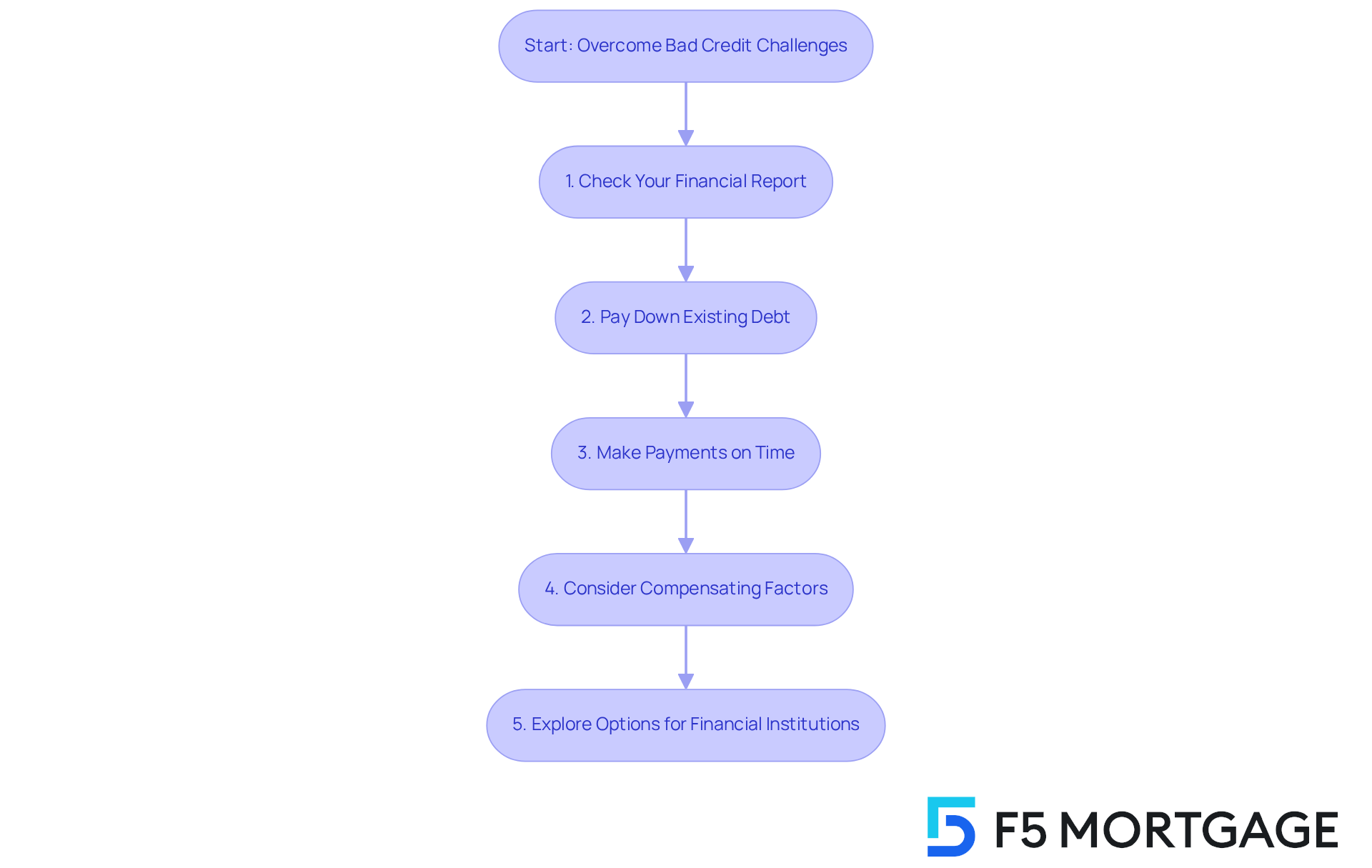

Overcome Bad Credit Challenges in Your Application

A poor financial history doesn’t prevent you from getting a VA home loan with bad credit. We understand how challenging this can be, and we’re here to support you every step of the way. Here are some effective strategies to enhance your chances of approval:

-

Check Your Financial Report: Start by obtaining a copy of your financial report from the three major bureaus—Equifax, Experian, and TransUnion. Examine it thoroughly for mistakes or inaccuracies that could be adversely affecting your results. Challenging these discrepancies can lead to a rapid increase in your financial rating.

-

Pay Down Existing Debt: Focus on lowering your card balances and any remaining loans. A reduced debt-to-income ratio not only enhances your borrowing potential but also makes you a more appealing candidate. For example, keeping a utilization ratio under 30% is favored by financial institutions. Remember, some lenders may approve VA loans with ratings as low as 550, so lowering your debt can significantly improve your eligibility.

-

Make Payments on Time: Consistently settling your bills promptly is essential for enhancing your credit rating. Payment history represents approximately 35% of your FICO rating, so establishing reminders or automatic payments can help ensure you never overlook a due date. As Jim Quist, President of NewCastle Home Loans, wisely states, “Sticking with on-time debt payments can help you grow your score over time.”

-

Consider Compensating Factors: Lenders may take into account compensating factors such as a stable employment history, a larger down payment, or a co-signer to offset your borrowing challenges. Discuss these options with your financial institution to strengthen your application. This adaptability is significant, particularly because the VA does not establish a minimum rating, yet individual financiers usually have their own criteria, generally in the mid-600s.

-

Explore Options for Financial Institutions: Since the VA does not enforce a minimum credit rating, different providers have varying prerequisites. Some may be more lenient than others, allowing for approvals with scores as low as 550. Comparing offers from multiple lenders can help you find the best terms available. As noted in various case studies, borrowers who shop around often find better rates and terms that suit their financial situation.

By implementing these strategies, you can improve your credit profile and increase your chances of securing a VA home loan, even with a less-than-perfect credit history. Remember, every step you take brings you closer to your goal.

Conclusion

Securing a VA home loan, even with bad credit, is a viable path to homeownership for veterans and active service members. We understand how challenging this can be, and the unique benefits of VA financing—such as no down payment, lower interest rates, and the absence of private mortgage insurance—create a supportive environment for those facing financial hurdles. By recognizing these advantages and the eligibility criteria, potential borrowers can feel empowered to take the necessary steps toward achieving their homeownership dreams.

Throughout this article, we have outlined key strategies to navigate the application process successfully. These strategies include:

- Determining eligibility

- Obtaining a Certificate of Eligibility

- Following a structured application process

- Overcoming credit challenges

Each step is crucial. By gathering the right documentation, seeking pre-approval, and addressing any credit issues, veterans can significantly enhance their chances of securing a loan. The emphasis on checking financial reports, reducing debt, and exploring various lenders showcases the proactive measures that can lead to favorable outcomes.

Ultimately, the journey to homeownership through a VA home loan is not just about financial capability; it is also about resilience and determination. By leveraging the resources available and implementing the recommended strategies, veterans can conquer the obstacles posed by bad credit. Taking action today can pave the way for a brighter future, turning the dream of homeownership into a reality. We’re here to support you every step of the way.

Frequently Asked Questions

Who is eligible for VA home loans?

VA home loans are available for qualified veterans, active-duty service personnel, and select members of the National Guard and Reserves.

What is a key advantage of VA home financing?

A significant advantage of VA home financing is the absence of a down payment requirement, making it easier for individuals with limited savings to own a home.

How many VA financing options are available without a down payment?

Approximately 90% of VA financing options are available without any down payment.

Do VA mortgages typically have higher or lower interest rates compared to traditional financing?

VA mortgages typically feature lower interest rates compared to traditional financing options, leading to significant savings over the loan period.

Is private mortgage insurance (PMI) required for VA loans?

No, VA financing eliminates the need for private mortgage insurance (PMI), which further decreases monthly payments.

How can VA financing benefit veterans with bad credit?

Veterans applying for a VA home loan with bad credit can secure favorable terms that might otherwise be out of reach, thanks to the benefits of VA financing.

What types of VA financing options does F5 Mortgage offer?

F5 Mortgage offers a variety of VA financing options, including both adjustable and fixed rates.

How does F5 Mortgage ensure customer satisfaction?

F5 Mortgage is committed to exceptional customer satisfaction, as reflected in their 5/5 star reviews on platforms like Lending Tree, Google, and Zillow.

Are there additional programs available for homebuyers seeking assistance?

Yes, F5 Mortgage also explores down payment assistance programs to further ease the path to homeownership for individuals.