Overview

This article is designed to help families navigate the important decision of upgrading their homes by comparing second mortgages and Home Equity Lines of Credit (HELOCs). We understand how challenging this can be, and we aim to provide clarity on these options.

Second mortgages offer fixed-rate stability, making them a reliable choice for larger expenses. In contrast, HELOCs provide flexible access to funds, which can be incredibly useful for ongoing projects. By highlighting these key differences—such as disbursement methods, interest rates, and repayment terms—we hope to guide you toward the option that best fits your financial needs.

Ultimately, our goal is to empower you with the knowledge to make informed decisions. We’re here to support you every step of the way as you consider the best path forward for your family’s financial future.

Introduction

Understanding the financial landscape of home equity options is crucial for families looking to upgrade their living spaces. We know how challenging this can be, and we’re here to support you every step of the way. When faced with the choice between a second mortgage and a Home Equity Line of Credit (HELOC), homeowners can unlock the potential of their property’s value.

However, it’s essential to navigate the distinct features, benefits, and risks associated with each option. As the popularity of HELOCs continues to rise, many are left pondering: which financing method truly aligns with their needs?

This article delves into the key differences between second mortgages and HELOCs, equipping families with the insights necessary to make informed decisions for their financial future.

Define Second Mortgages and HELOCs

A second mortgage vs HELOC offers a financing option secured against a property that already has a primary loan. This allows homeowners to leverage the equity they have built up over time. However, it’s important to understand that this loan is subordinate to the first mortgage, meaning it will be repaid only after the primary mortgage in the event of foreclosure.

In contrast, a Home Equity Line of Credit (HELOC) functions as a revolving line of credit. This enables homeowners to borrow against their home equity as needed, much like using a credit card. Borrowers have the flexibility to draw from this line, repay it, and borrow again. This makes home equity lines of credit a great choice for ongoing expenses or home improvement projects.

Recent trends indicate a growing preference for home equity lines of credit among homeowners. Many are seeking alternatives to cash-out refinancing. In 2025, approximately 1.3 million home equity lines of credit were originated, reflecting a significant shift in borrowing behavior. Financial advisors note that the flexibility of HELOCs is particularly appealing for families looking to fund renovations or upgrades. They can access funds incrementally based on their project needs.

For example, property owners may utilize a HELOC to fund kitchen renovations or bathroom improvements. This approach not only increases their home’s worth but also allows them to keep their main loan at a lower interest rate. This strategic method empowers families to optimize their home equity without the obligation of a fixed loan when considering a second mortgage vs HELOC. We know how challenging financial decisions can be, and we’re here to support you every step of the way.

Compare Key Features of Second Mortgages and HELOCs

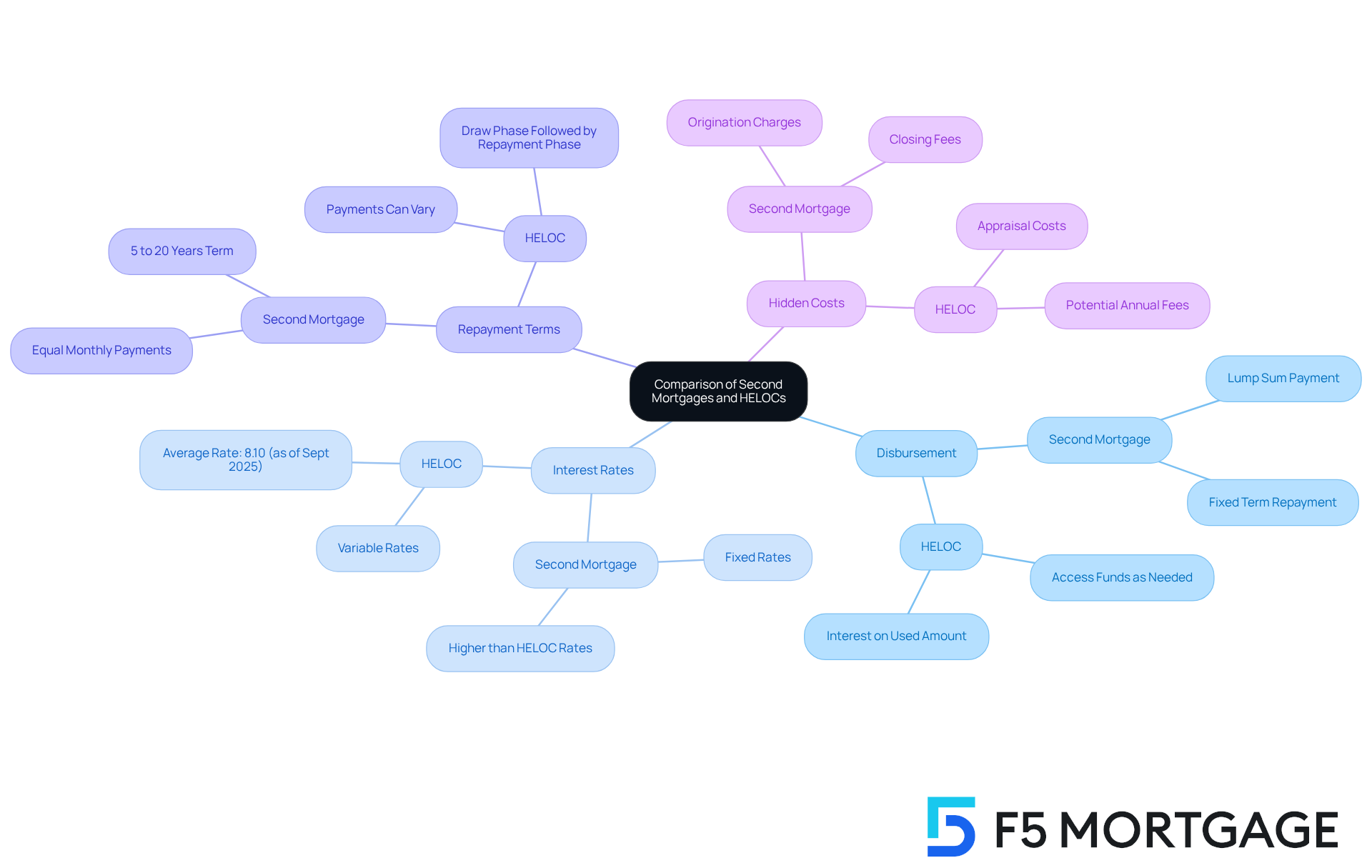

When comparing second mortgages and HELOCs, it’s important to understand some key features that can impact your financial decisions:

- Disbursement: A second mortgage typically provides a lump sum that you repay over a fixed term with consistent monthly payments. In contrast, a HELOC allows homeowners to access funds as needed, up to a set limit, and you only pay charges on the amount you use during the draw period, which usually lasts about 10 years.

- Interest Rates: Second loans often come with fixed rates, ensuring your monthly expenses remain consistent. On the other hand, HELOCs generally feature variable rates that can change over time, potentially leading to higher costs if rates rise. As of September 3, 2025, HELOC rates average 8.10%, which is currently lower than those for the second mortgage vs heloc options.

- Repayment Terms: Second mortgages usually have a specified repayment plan, requiring equal monthly contributions of principal and interest. Conversely, home equity lines of credit include a draw phase followed by a repayment phase, during which you begin repaying both principal and interest. This can lead to payment variations, especially if you only paid interest during the draw phase. Repayment terms for home equity lines of credit can extend up to 20 years.

- Hidden Costs: Both home equity lines of credit and second loans may incur additional expenses, such as closing fees, origination charges, and appraisal costs, which can diminish the perceived benefits of lower rates.

Understanding these differences between second mortgage vs heloc is crucial for homeowners like you who are looking to make informed financial decisions regarding home equity options. We know how challenging this can be, and we’re here to support you every step of the way.

Evaluate Pros and Cons of Second Mortgages and HELOCs

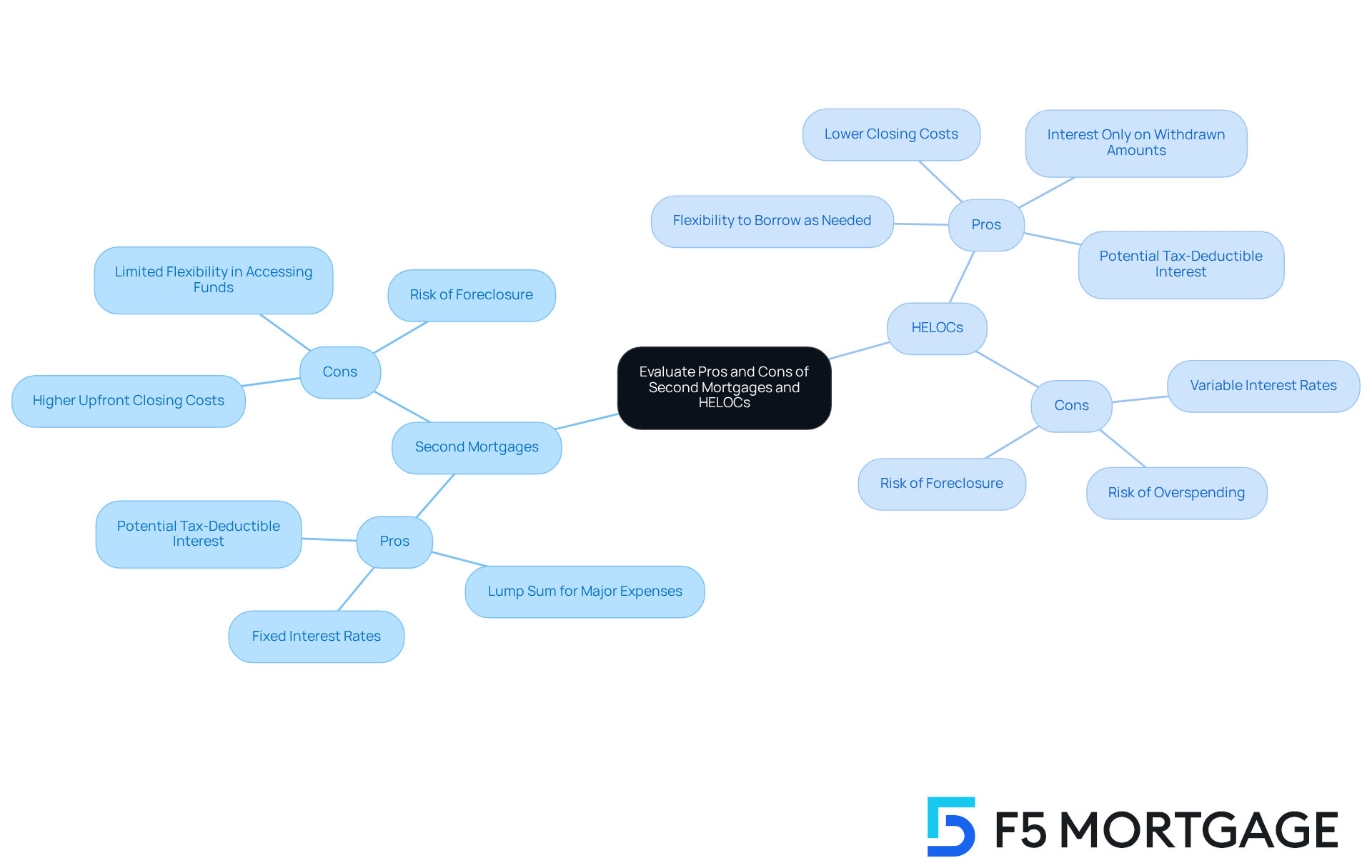

When considering your financial options, it’s important to evaluate the unique advantages and challenges of second mortgage vs HELOC, as both present aspects that deserve your careful attention.

Second Mortgages:

-

Pros:

- With fixed interest rates, you can enjoy stability in your monthly payments, making budgeting a little easier.

- They are perfect for significant, one-time expenses like home renovations or debt consolidation, providing you with a lump sum upfront.

- If you use the funds for home improvements, you might find that interest charges are tax-deductible, offering potential financial benefits.

-

Cons:

- Be aware that second mortgages generally incur higher upfront closing costs compared to HELOCs, which can affect your initial affordability.

- You may find limited flexibility in accessing funds, as the entire loan amount is disbursed at once, requiring careful planning to use it wisely.

- It’s important to remember that failing to maintain payments could lead to foreclosure, posing a significant risk to homeowners.

HELOCs:

-

Pros:

- HELOCs offer the flexibility to borrow as needed, making them suitable for ongoing expenses like home repairs or education costs.

- Typically, they come with lower closing costs and fees than a second mortgage, which enhances your affordability.

- You only pay interest on the amount you withdraw, which can lead to reduced initial charges during the draw period.

- Depending on how you use the funds, interest may also be tax-deductible, providing additional financial benefits.

-

Cons:

- Keep in mind that variable interest rates can lead to fluctuating monthly payments, complicating your financial planning.

- The ease of access to funds might encourage overspending, which could lead to financial strain.

- Since your residence acts as security, not making contributions could risk losing your property, emphasizing the importance of prudent borrowing.

-

Additional Considerations:

- Most lenders require a minimum credit score of 640-660 for HELOCs and home equity loans, which is crucial for you to understand your eligibility.

- HELOCs generally feature a 10-year draw period during which only interest is owed, followed by a repayment phase involving both principal and interest.

We know how challenging navigating these options can be, and we’re here to support you every step of the way. Take the time to weigh these factors carefully, and you’ll be better equipped to make the right decision for your family’s financial future.

Identify Ideal Use Cases for Second Mortgages and HELOCs

Understanding when to utilize a second mortgage vs HELOC can significantly influence your financial outcomes. We know how challenging it can be to navigate these options, and we’re here to support you every step of the way.

Second Mortgages can be particularly advantageous for homeowners seeking a substantial amount for major renovations or repairs. They provide a lump sum that can cover extensive projects. For instance, homeowners who modernize their properties often see an increase in market value, enhancing their equity position. Additionally, if you’re looking to combine high-interest debt into one manageable installment, this option simplifies your financial responsibilities.

Moreover, if you appreciate consistent payments, second loans typically have fixed interest rates, ensuring stability in budgeting. However, it’s crucial to consider the risks involved, as failure to repay a second mortgage can lead to foreclosure.

On the other hand, HELOCs are best suited for homeowners desiring flexibility in borrowing for ongoing projects or expenses. Whether it’s home improvements or educational costs, a HELOC allows you to draw funds as needed. If you may not require a large sum upfront but prefer to access smaller amounts over time, this option is ideal for gradual renovations.

For those comfortable with variable interest rates, HELOCs can fluctuate, making it essential to manage potential payment changes carefully. It’s important to note that the risk of foreclosure exists if repayments are not made.

Recent trends indicate that many homeowners are leveraging these financial tools for renovations. A significant portion of home equity is being tapped for such purposes. For example, from May 2020 to May 2025, the national median home price increased significantly, leading to homeowners gaining an average of nearly $150,000 in wealth. Additionally, tappable equity grew by $5.7 trillion, indicating a robust increase in home values.

Financial experts recommend assessing your personal financial situation and project scopes to determine the most suitable option between a second mortgage vs HELOC. Remember, we’re here to help you make the best decision for your family’s needs.

Conclusion

Understanding the distinctions between second mortgages and Home Equity Lines of Credit (HELOCs) is essential for families considering home upgrades. We know how challenging it can be to navigate these options, but both enable homeowners to leverage their property equity. Yet, they serve different financial needs and preferences. By grasping the nuances of these financing tools, families can make informed decisions that align with their renovation goals and financial circumstances.

Key points discussed include the fundamental differences in disbursement methods, interest rates, and repayment terms:

- Second mortgages provide a lump sum with fixed payments, which is ideal for substantial one-time expenses.

- HELOCs offer a flexible, revolving line of credit suitable for ongoing projects.

Each option has its own pros and cons, from the stability of fixed rates to the potential risks associated with variable rates and foreclosure. Recognizing when to use each type of financing can greatly influence the financial outcomes for homeowners.

Ultimately, as property values continue to rise and homeowners seek ways to invest in their homes, understanding the implications of choosing between a second mortgage and a HELOC becomes increasingly significant. Families are encouraged to carefully evaluate their financial situations, project scopes, and long-term goals before making a decision. By doing so, they can optimize their home equity and ensure that their financial choices contribute positively to their family’s future. We’re here to support you every step of the way.

Frequently Asked Questions

What is a second mortgage?

A second mortgage is a financing option secured against a property that already has a primary loan, allowing homeowners to leverage the equity they have built up over time.

How does a second mortgage differ from a Home Equity Line of Credit (HELOC)?

A second mortgage is a lump sum loan that is subordinate to the first mortgage, while a HELOC functions as a revolving line of credit, enabling homeowners to borrow against their home equity as needed, similar to a credit card.

What are the advantages of using a HELOC?

The advantages of a HELOC include flexibility in borrowing, the ability to draw and repay funds as needed, and its suitability for ongoing expenses or home improvement projects.

What recent trends have been observed in the use of HELOCs?

There has been a growing preference for HELOCs among homeowners, with approximately 1.3 million HELOCs originated in 2025, indicating a shift in borrowing behavior towards alternatives to cash-out refinancing.

Why might homeowners choose a HELOC for home renovations?

Homeowners might choose a HELOC for renovations because it allows them to access funds incrementally based on their project needs, helping to increase their home’s value while maintaining a lower interest rate on their main loan.

What type of projects can HELOCs be used for?

HELOCs can be used for various projects, such as funding kitchen renovations or bathroom improvements, making them a strategic choice for homeowners looking to enhance their property.