Overview

If you’re a homeowner grappling with bad credit, guaranteed home equity loans might be a lifeline for you. These loans provide a viable way to tap into your property’s value, even when your credit history is less than ideal. We know how challenging this can be, and it’s important to explore options that can help you regain financial stability.

One of the key features of these loans is their lower credit score requirements. This means that even if your credit isn’t perfect, you may still qualify. Additionally, equity-based authorization allows you to secure a loan based on the value of your home, rather than solely on your credit score. This can be a game-changer for many families.

However, it’s essential to understand the associated risks and costs. We’re here to support you every step of the way, ensuring that you make informed decisions. As you consider this option, take the time to weigh the benefits against potential drawbacks. By doing so, you can empower yourself to make the best choice for your financial future.

Introduction

Navigating the financial landscape can be particularly daunting for homeowners with bad credit. We understand how overwhelming it can feel, especially when seeking to tap into the equity of your property.

Fortunately, guaranteed home equity loans offer a lifeline, allowing individuals to leverage their home’s value despite past financial struggles. However, this process is fraught with challenges and complexities. What are the essential steps to ensure success in securing this type of financing?

Understanding the nuances of eligibility, application procedures, and potential pitfalls is crucial for anyone looking to transform their financial future through home equity. We’re here to support you every step of the way, ensuring you feel empowered and informed as you navigate this journey.

Understand Guaranteed Home Equity Loans for Bad Credit

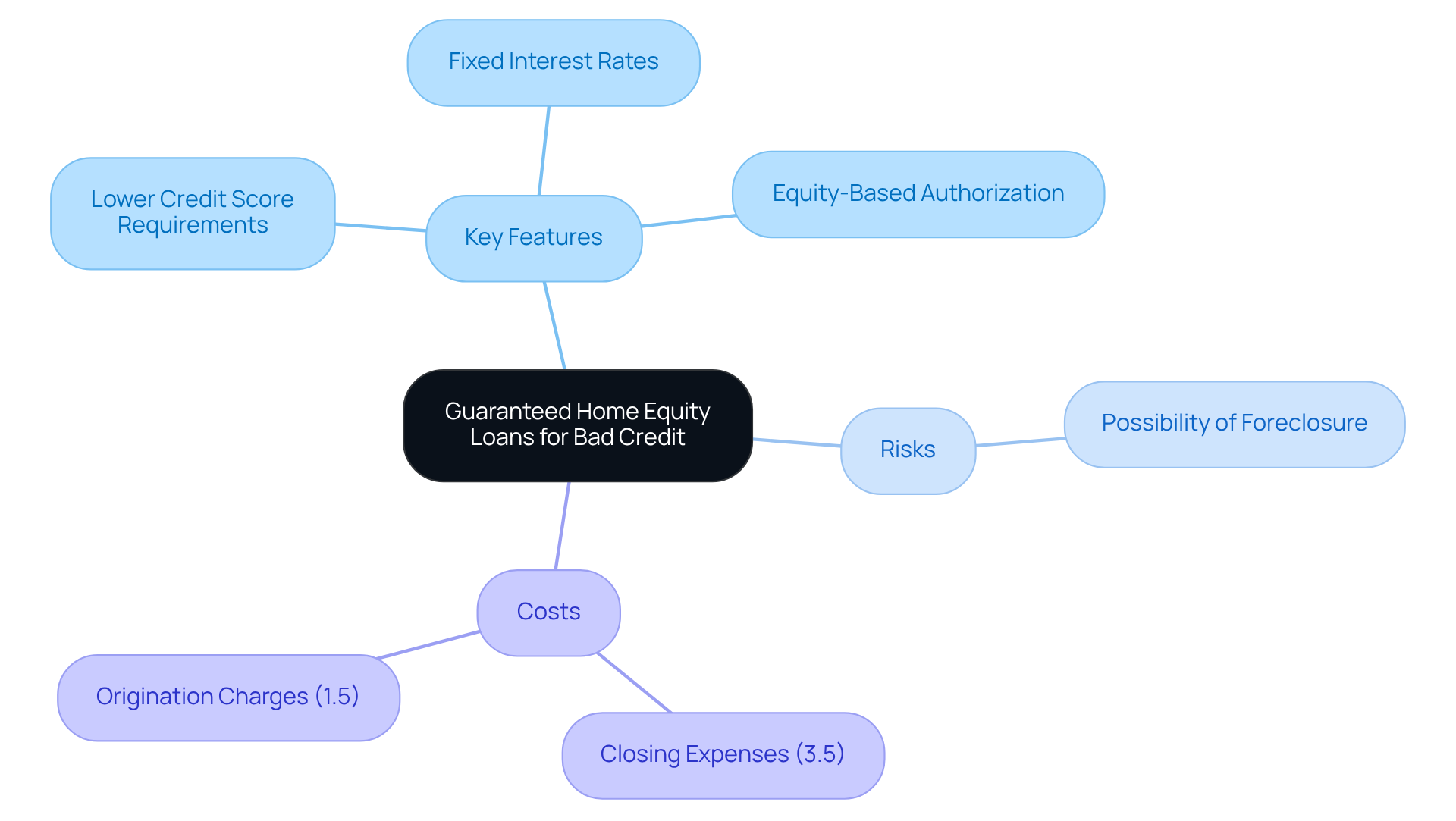

Guaranteed residential financing options, such as a guaranteed home equity loan with bad credit, are thoughtfully designed to assist property owners in unlocking the value of their homes, even when faced with challenging financial histories. These financial aids empower borrowers to leverage their property’s worth as security, making them a viable choice for individuals with less-than-ideal financial backgrounds. Let’s explore some key features of guaranteed home equity loans that can make a difference:

- Lower Credit Score Requirements: Many lenders offering guaranteed loans may accept credit scores as low as 620, significantly broadening access for those with poor credit histories. This flexibility is crucial, especially since many traditional lenders typically prefer scores above 700.

- Fixed Interest Rates: These financial products often feature fixed interest rates, ensuring predictable monthly payments that can help borrowers manage their budgets effectively.

- Equity-Based Authorization: Authorization for these financial products primarily hinges on the equity in your home rather than solely on your financial history. This approach can be particularly beneficial for those who may feel limited due to their credit history when looking for a guaranteed home equity loan with bad credit.

However, it’s important to approach these financial agreements with care, as they come with risks, including the possibility of foreclosure if payments are missed. Understanding the costs associated with guaranteed home financing is also essential. Typically, closing expenses for these types of financing are around 3.5% of the amount borrowed, and the average origination charge is about 1.5%. Additionally, obtaining an appraisal is vital, as it determines the current market value of your property and the amount of equity you possess, which can influence your rates.

In summary, a guaranteed home equity loan with bad credit offers a valuable opportunity for property owners with challenging financial histories to access their home’s value. As long as you understand the associated risks and requirements, you can take steps toward a more secure financial future. Remember, we’re here to support you every step of the way.

Check Eligibility Requirements and Qualifications

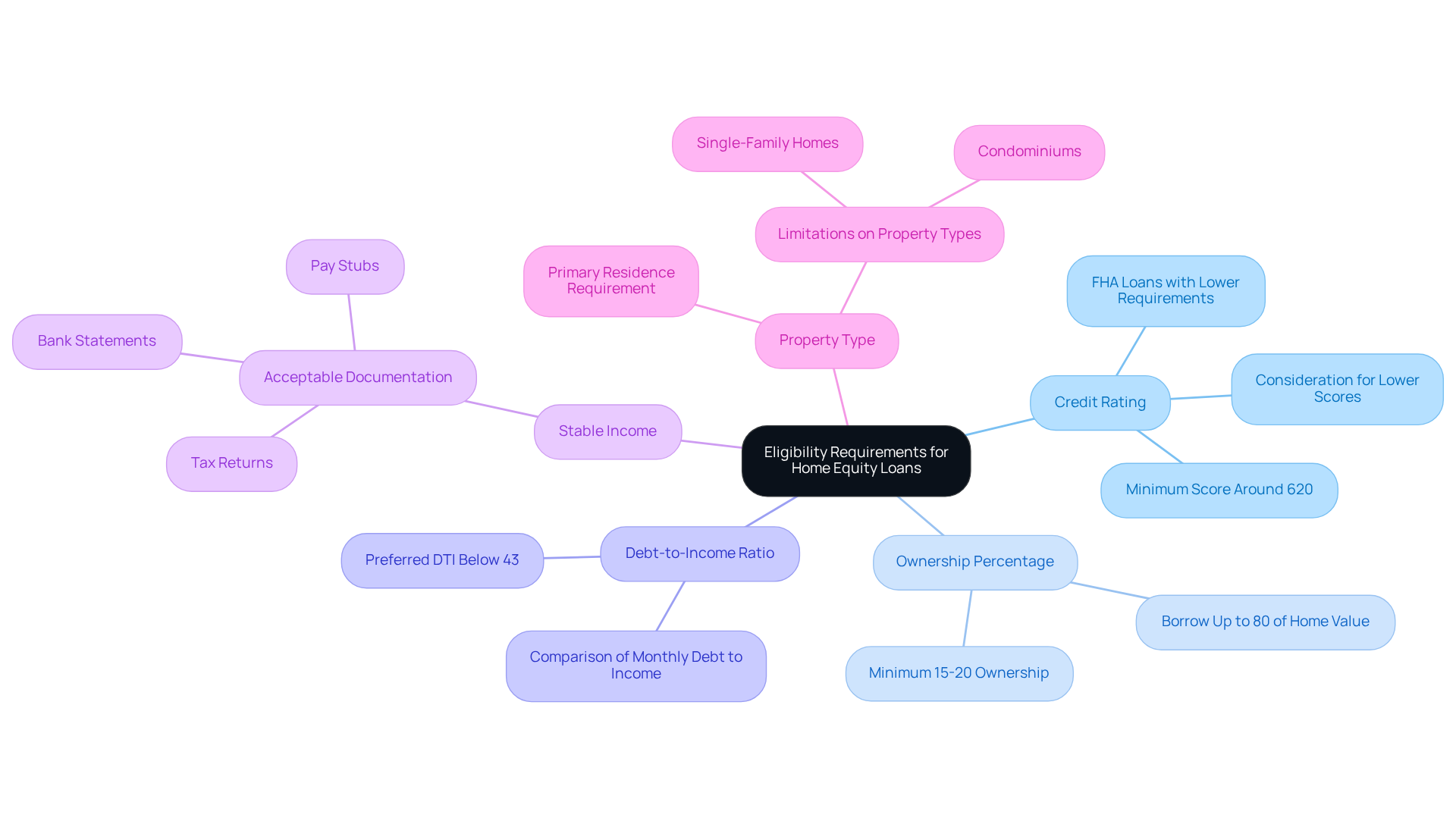

To qualify for a guaranteed home equity loan with bad credit, we understand that borrowers often face specific criteria that can differ from one lender to another. Here are the key requirements that can help you navigate this process with confidence:

- Credit Rating: We know how challenging this can be. While most lenders establish a minimum score around 620, some may consider lower scores for a guaranteed home equity loan with bad credit if other financial factors are favorable. FHA loans may even have lower credit score requirements, making them a viable option for a guaranteed home equity loan with bad credit, which can be beneficial for those facing credit challenges.

- A minimum of 15-20% ownership in your property is typically required. This means your outstanding mortgage balance should be significantly less than your home’s current market value. Homeowner financing allows property owners to borrow up to 80% of their value, giving you access to substantial funds for various needs.

- Debt-to-Income Ratio: Lenders usually prefer a debt-to-income (DTI) ratio below 43%, comparing your monthly debt obligations to your gross monthly income. Maintaining a favorable DTI is crucial for securing competitive mortgage solutions, and we’re here to support you every step of the way.

- Stable Income: Demonstrating a stable income is essential. Acceptable documentation includes pay stubs, tax returns, or bank statements to confirm your capacity to repay the debt.

- Property Type: The property must serve as your primary residence. Some lenders may establish limitations on the type of property suitable for residential financing, such as single-family homes compared to condominiums.

Furthermore, if you’re in Colorado, please note that homeowners may need to retain their current mortgage for a specific duration before qualifying to refinance. An appraisal plays a crucial role in the refinancing process and can affect your eligibility. The lender will request a property appraisal to determine the current market value of your asset, revealing how much ownership you possess and influencing your rates. It’s also vital to recognize the potential dangers linked to property financing. Neglected payments can lead to foreclosure, which is a significant concern for borrowers, especially those with a challenging financial history.

By ensuring you meet these requirements before applying for a guaranteed home equity loan with bad credit, you can streamline the process and improve your chances of securing approval. Remember, you are not alone in this journey, and we’re here to guide you through every step.

Follow the Step-by-Step Application Process

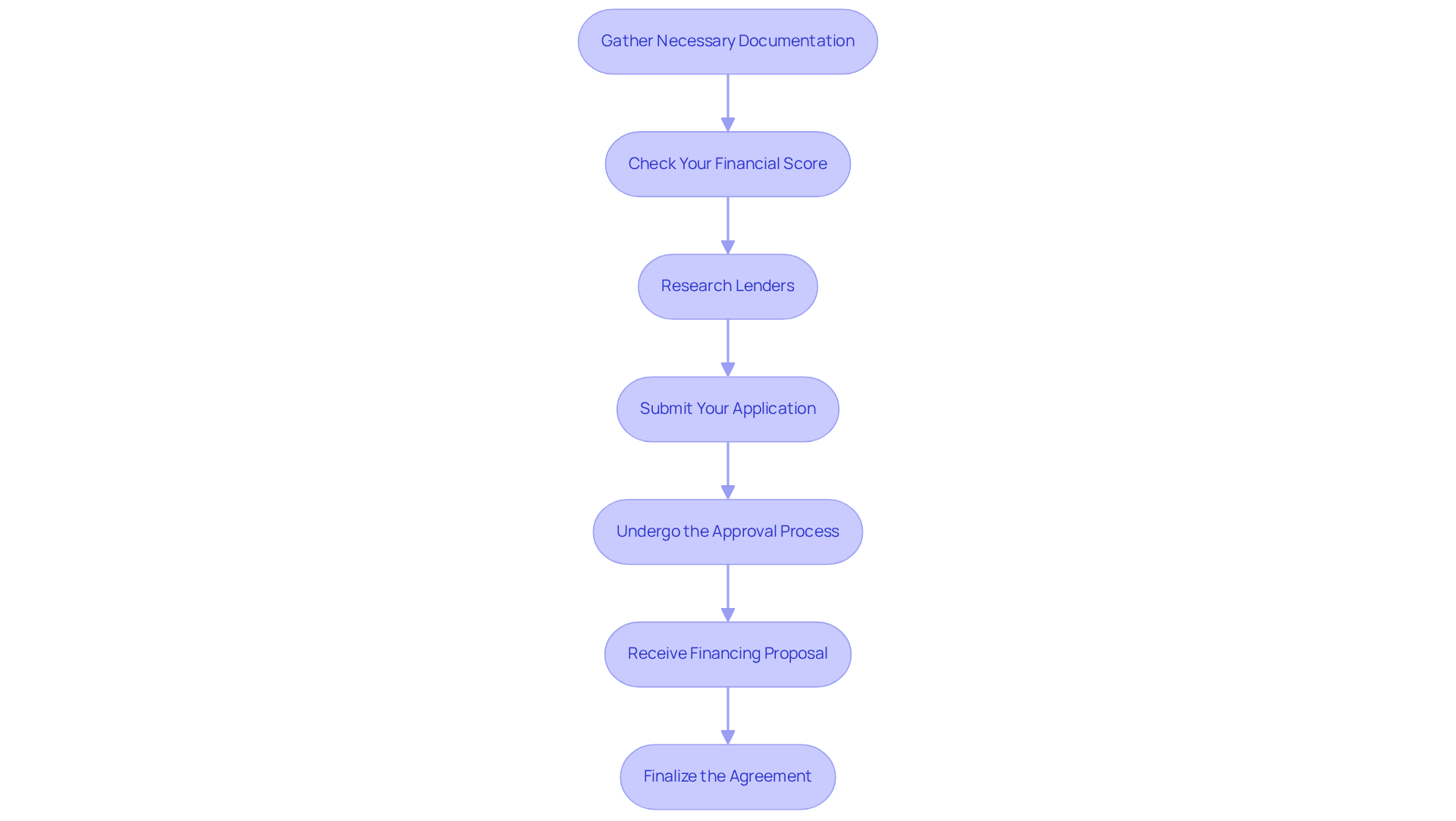

Navigating the application process for a guaranteed home equity loan with bad credit can feel overwhelming, but we’re here to support you every step of the way. Here’s a compassionate guide to help you through:

-

Gather Necessary Documentation: Start by collecting essential documents like proof of income, tax returns, bank statements, and details about your current mortgage. This step lays a strong foundation for your application.

-

Check Your Financial Score: Before you apply, take a moment to verify your financial score. Understanding where you stand can help identify areas for improvement, empowering you to make informed decisions.

-

Research Lenders: It’s important to compare various lenders. Look for those who provide a guaranteed home equity loan with bad credit, especially if your financial record isn’t perfect. Pay attention to terms, interest rates, and customer reviews to find the best fit for your needs.

-

Submit Your Application: When you’re ready, fill out the application form with accurate information. Be prepared to provide the documentation you gathered earlier. This is a crucial step in your journey.

-

Undergo the Approval Process: After submitting your application, the lender will review your financial information to assess your eligibility. This may involve a credit check and an appraisal of your home, which can feel daunting, but it’s a standard part of the process.

-

Receive Financing Proposal: If you’re approved, you will receive a financing proposal that outlines the terms, interest rate, and repayment schedule. Take your time to review this carefully before accepting, ensuring it aligns with your financial goals.

-

Finalize the Agreement: Once you accept the offer, you will go through the closing process. This includes signing documents and concluding the financing, bringing you one step closer to achieving your financial aspirations.

By following these steps, you can streamline your application and increase your chances of approval, making the journey a little easier. Remember, we know how challenging this can be, and we’re here to guide you through it.

Troubleshoot Common Challenges in the Application Process

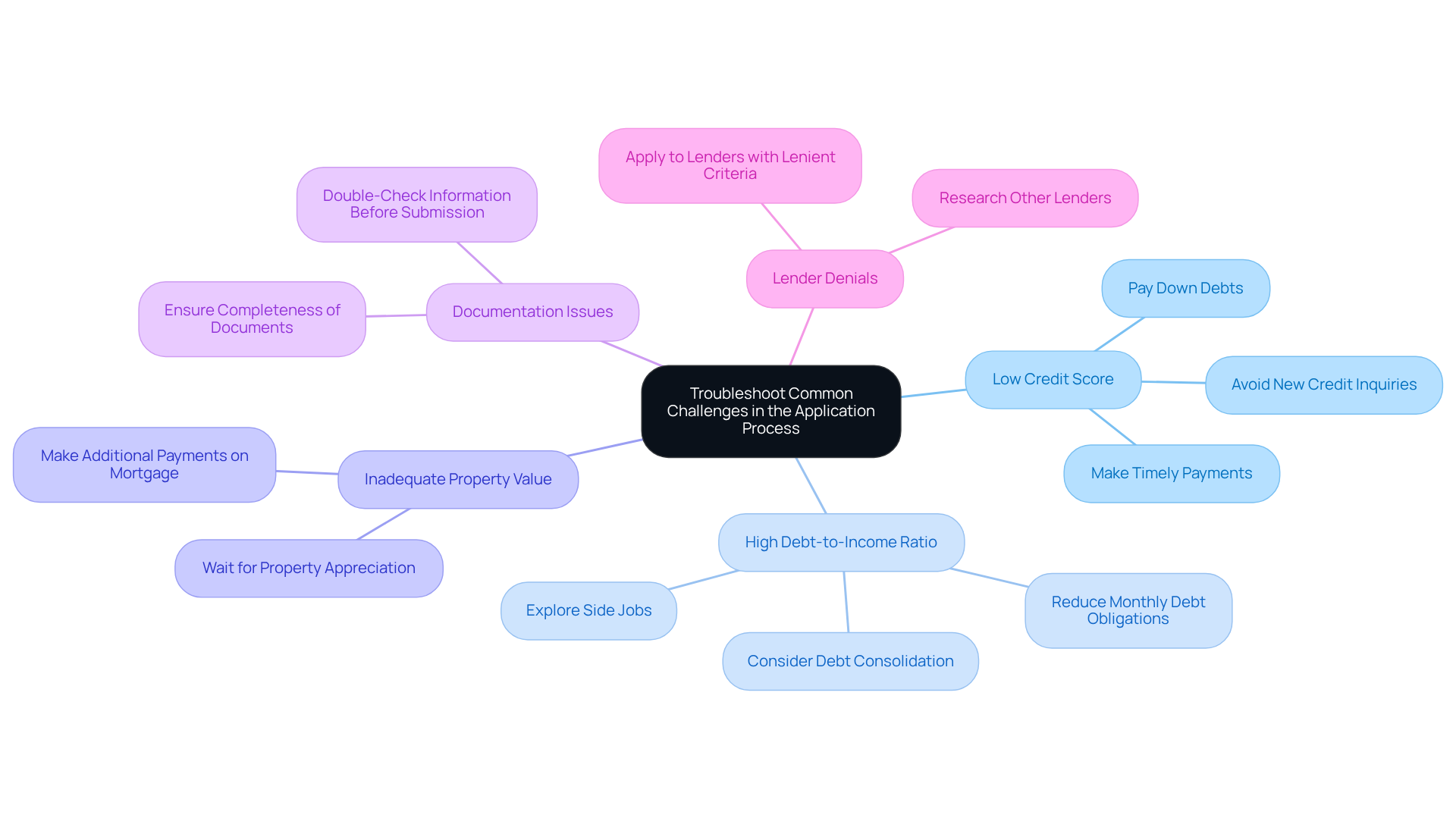

Securing a property loan can be a challenging journey, and we understand how overwhelming it may feel. Here are some common hurdles you might face, along with supportive strategies to help you navigate them:

- Low Credit Score: If your credit score falls below the required threshold, don’t lose hope. You can improve it by paying down debts, making timely payments, and steering clear of new credit inquiries before applying.

- High Debt-to-Income Ratio: A high DTI can be daunting, but there are steps you can take. Focus on reducing your monthly debt obligations—consider consolidating debts or exploring side jobs to boost your income.

- Inadequate Property Value: If your property lacks sufficient value, remember that patience can pay off. Waiting for your residence to appreciate or making additional payments on your mortgage can help you increase your stake more quickly.

- Documentation Issues: It’s crucial to ensure all your documents are complete and accurate. Missing or incorrect information can delay your approval process. Take a moment to double-check everything before submission.

- Lender Denials: If one lender denies your application, don’t be discouraged. Different lenders have different criteria. Researching and applying to others who may be more lenient can open new doors for you.

By being aware of these challenges and preparing for them, you can enhance your chances of successfully obtaining a guaranteed home equity loan. Remember, we’re here to support you every step of the way.

Conclusion

Navigating the process of securing a guaranteed home equity loan with bad credit can be a transformative step for property owners facing financial challenges. We understand how daunting this may feel, but these loans are designed to provide opportunities for individuals who might otherwise feel excluded from traditional lending options. By leveraging home equity, you can find financial relief or invest in your future.

Key features include:

- Lower credit score requirements

- Fixed interest rates

- Equity-based authorization

Understanding the eligibility criteria and following a structured application process can significantly enhance your chances of approval. If you face challenges such as low credit scores or high debt-to-income ratios, proactive strategies can help you feel empowered rather than overwhelmed.

Ultimately, the journey to obtaining a guaranteed home equity loan with bad credit is about more than just securing funds; it’s about reclaiming your financial stability and opening doors to new possibilities. By arming yourself with knowledge and support, you can confidently navigate this process, turning your home’s equity into a pathway for a more secure financial future. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a guaranteed home equity loan for bad credit?

A guaranteed home equity loan for bad credit is a financial option designed to help property owners access the value of their homes, even if they have challenging financial histories.

What are the credit score requirements for guaranteed home equity loans?

Many lenders offering guaranteed loans may accept credit scores as low as 620, making these loans more accessible for individuals with poor credit histories.

Do guaranteed home equity loans have fixed interest rates?

Yes, guaranteed home equity loans often feature fixed interest rates, which provide predictable monthly payments for borrowers.

How is authorization for guaranteed home equity loans determined?

Authorization for these loans primarily depends on the equity in your home rather than solely on your financial history, which can benefit those with poor credit.

What are the risks associated with guaranteed home equity loans?

The main risk is the possibility of foreclosure if payments are missed, so it is important to approach these financial agreements with caution.

What are the typical costs associated with guaranteed home equity loans?

Closing expenses for these loans are usually around 3.5% of the amount borrowed, and the average origination charge is about 1.5%.

Why is obtaining an appraisal important for guaranteed home equity loans?

An appraisal is vital as it determines the current market value of your property and the amount of equity you possess, which can influence your loan rates.

What should borrowers understand before pursuing a guaranteed home equity loan?

Borrowers should understand the associated risks, costs, and requirements of guaranteed home equity loans to make informed financial decisions.