Overview

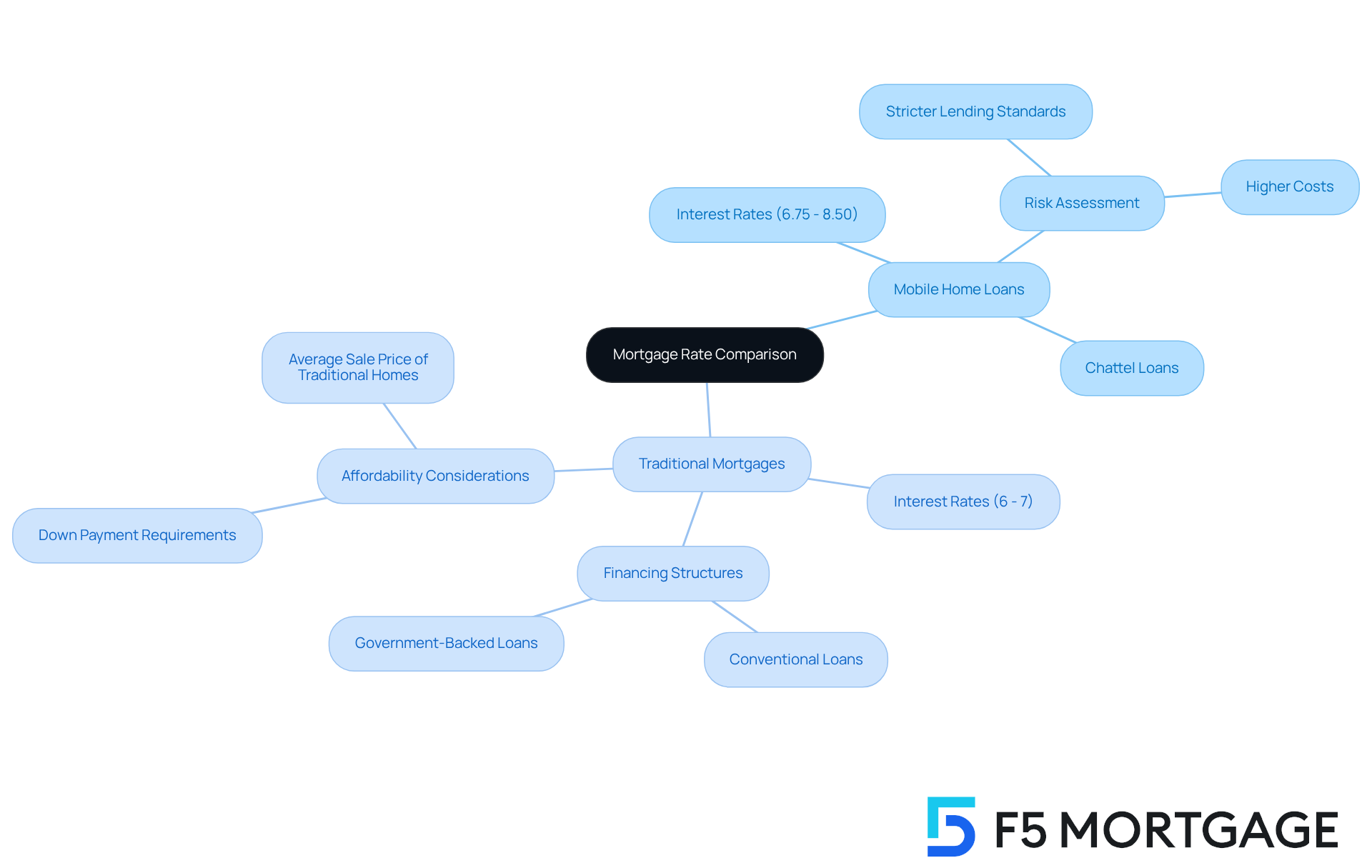

Navigating the world of mobile home financing can feel daunting, especially when you discover that mobile home interest rates are generally higher than those for traditional mortgages. Currently, rates for mobile homes range from 6.75% to 8.50%, while conventional loans sit between 6% and 7%. We understand how challenging this can be, and it’s important to know that this disparity stems from the classification of mobile homes as personal property. This classification results in stricter lending standards and higher perceived risks for lenders.

These factors can significantly affect your financing options and overall affordability as a potential buyer. We’re here to support you every step of the way, helping you navigate these complexities. By understanding the reasons behind these rates, you can make informed decisions and explore the best financing solutions available to you. Remember, you’re not alone in this journey, and there are resources available to assist you in achieving your dream of homeownership.

Introduction

The landscape of home financing is evolving, and we know how challenging this can be. Understanding the nuances between mobile home and traditional mortgage rates is crucial for prospective buyers like you. Mobile home interest rates typically range from 6.75% to 8.50%, while conventional loans hover between 6% and 7%. The stakes are high, and it’s important to navigate these options carefully.

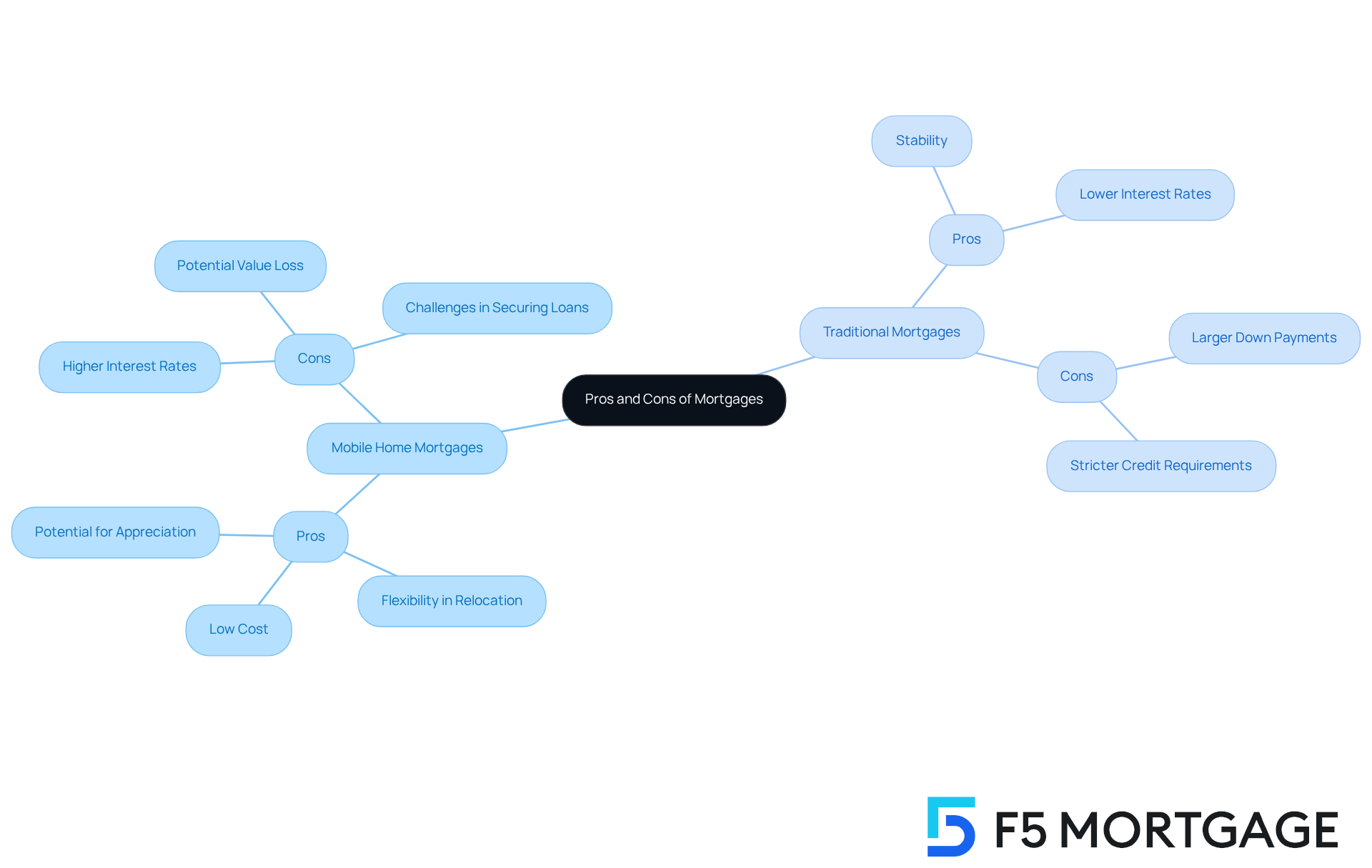

This article delves into the pros and cons of both financing routes, revealing strategies to help you make informed decisions. What factors contribute to these differing rates? How can you leverage this knowledge to secure the best possible deal in a fluctuating market? We’re here to support you every step of the way as you explore your options.

Understanding Mobile Home vs. Traditional Mortgage Rates

As we step into early 2025, it’s important to recognize that mobile home interest rates typically range from 6.75% to 8.50%. In contrast, conventional loan percentages usually fall between 6% and 7%. This difference in fees can be attributed to the unique classification of manufactured homes, which often leads to financing through chattel loans. These loans tend to carry higher interest rates compared to traditional mortgages that are backed by real estate.

Lenders often view manufactured homes as riskier investments. This perspective results in stricter lending standards and, consequently, increased costs. For instance, homes that are not permanently affixed to land may not qualify for conventional financing, complicating the borrowing process even further. Understanding these nuances is essential for potential buyers, as they directly affect financing options and overall affordability in today’s market.

We know how challenging navigating these financial waters can be, but you’re not alone. By familiarizing yourself with these distinctions, you can make more informed decisions and feel empowered in your journey toward homeownership. Remember, we’re here to support you every step of the way.

Key Factors Influencing Interest Rates

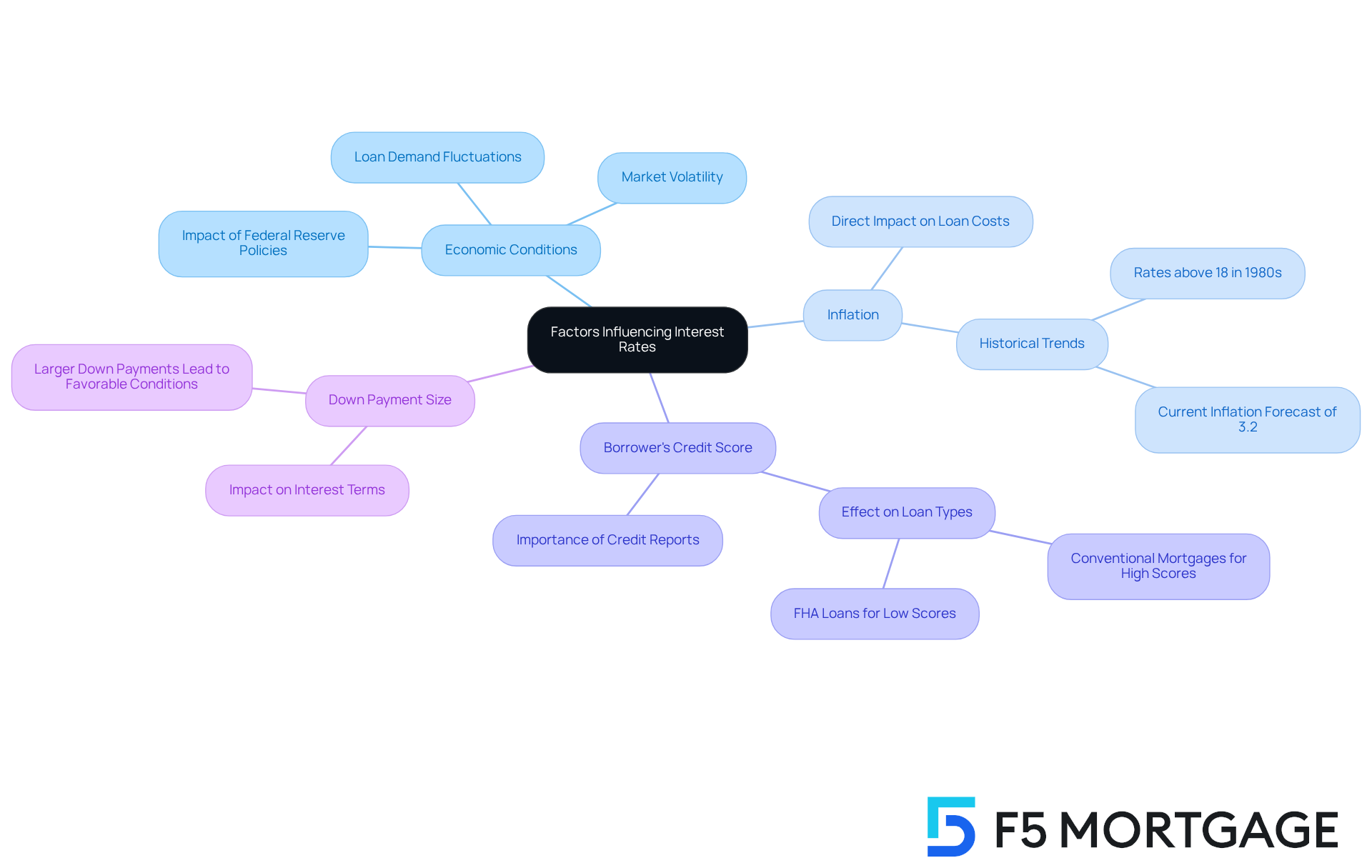

Several essential factors significantly influence mobile home interest rates as well as those for conventional mortgages. Economic conditions, particularly inflation and the Federal Reserve’s monetary policies, play a crucial role in determining mobile home interest rates in this landscape. As the economy improves, the demand for loans typically rises, leading to higher costs. Conversely, during economic downturns, interest rates may drop to encourage borrowing. For instance, the Federal Reserve’s recent cut on September 17 resulted in a temporary decrease in home loan rates; however, they have since increased, highlighting the market’s volatility.

Inflation has a direct impact on home loan costs. When inflation rises, lenders often increase mobile home interest rates to sustain their profit margins. This trend is evident in history, where rates soared above 18% in the early 1980s. Current forecasts suggest an inflation rate of 3.2% for the coming year, which could influence mobile home interest rates.

On an individual level, a borrower’s credit score is vital; higher scores generally lead to lower costs. For example, those with excellent credit may find conventional mortgages more beneficial, while individuals with scores below 600 might discover FHA loans to be a better fit. Additionally, the size of the down payment can affect interest terms, as larger down payments often result in more favorable conditions.

Real-life examples illustrate these dynamics effectively. Research from Freddie Mac indicates that homebuyers can save between $600 to $1,200 annually by comparing offers from different lenders, particularly in a fluctuating market. This underscores the importance of strategic decision-making in loan applications, empowering borrowers to navigate the complexities of financing with confidence. At F5 Mortgage, we are dedicated to helping you find the best offer, whether that means securing favorable terms or connecting you with top realtors to assist in your property journey. As Glen Luke Flanagan wisely states, “Comparing rates on different types of loans and exploring options with various lenders are both essential steps in securing the best loan for your situation.

Pros and Cons of Mobile Home and Traditional Mortgages

When evaluating manufactured housing loans, one of the main benefits is their low cost. These residences typically expense less than conventional houses, making them accessible to a wider array of purchasers. For instance, the typical cost of a new manufactured dwelling is approximately $124,000, compared to more than $400,000 for a new single-family residence. This affordability allows buyers to consider living in higher-cost areas that may otherwise be out of reach. Additionally, manufactured residences are categorized as personal property, resulting in distinct financing and tax consequences compared to conventional houses. They also offer flexibility in terms of relocation, which can be appealing for those who may need to move frequently.

However, we know how challenging it can be to fund manufactured residences due to mobile home interest rates. Many lenders impose higher mobile home interest rates and down payments compared to traditional mortgages, making it more difficult to secure a loan. Moreover, manufactured residences are more prone to lose value over time, unlike conventional houses that typically gain in worth. Recent data suggests that although manufactured residences have experienced some appreciation, they still face a greater risk of value decrease. It’s also significant to note that mobile residences represent 6% of all occupied housing, highlighting their importance in the housing market.

In contrast, traditional mortgages provide stability and typically lower interest rates, but they require larger down payments and stricter credit requirements. Understanding these pros and cons is crucial for buyers, as it enables them to make informed choices that align with their financial situations and long-term goals. Furthermore, with adequate upkeep, manufactured residences can increase in worth, which differs from the usual belief of decline. This potential for appreciation, along with the life expectancy of manufactured structures being 50 years or longer, can enhance their investment potential. Overall, mobile homes provide access to prime locations at a fraction of the cost of traditional homes, making them an attractive option for many buyers.

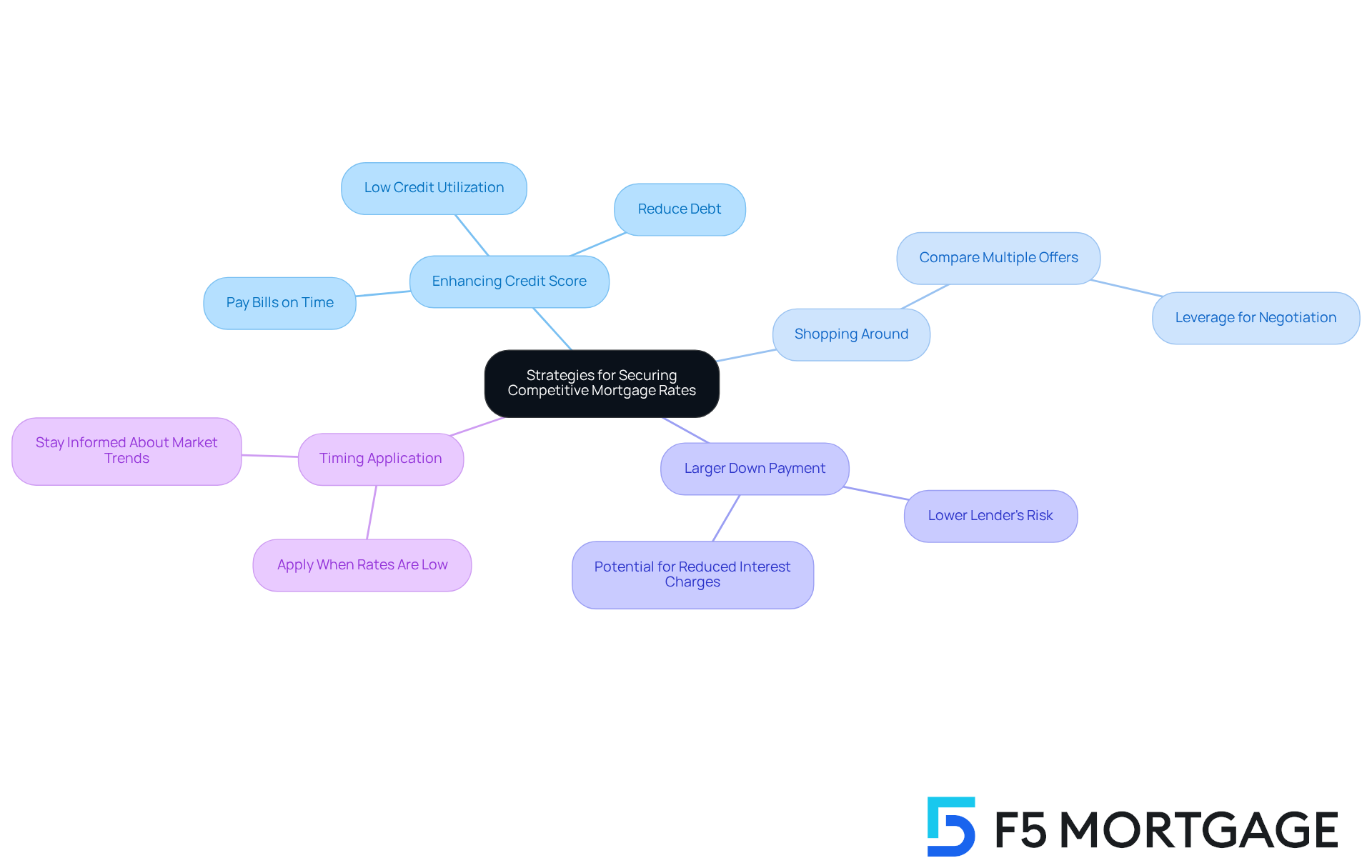

Strategies for Securing Competitive Mortgage Rates

Navigating the mortgage landscape can feel overwhelming, but there are effective strategies that can help you secure competitive terms. One of the most important steps is enhancing your credit score. A higher score can significantly reduce your interest charges. You can achieve this by:

- Consistently paying your bills on time

- Reducing existing debt

- Maintaining a low credit utilization ratio

For instance, borrowers who successfully lowered their credit utilization from 40% to 20% often saw their scores rise, enabling them to qualify for better terms.

It’s also vital to shop around and compare offers from multiple lenders. This not only helps you identify the best prices but also gives you leverage for negotiation. Many families have found success by applying to several lenders, discovering offers that were much lower than their initial quotes.

Consider providing a larger down payment as well. This can lower the lender’s risk and may lead to reduced interest charges. For example, a borrower who increased their down payment from 5% to 20% frequently received a more favorable offer due to the decreased perceived risk by the lender.

Timing your application can make a difference too. Applying for a loan when interest rates are low can lead to substantial savings. By staying informed about market trends, you can take advantage of favorable conditions when they arise.

By implementing these strategies, you can navigate the mortgage process more effectively and secure the best possible rates. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Understanding the intricacies of mobile home interest rates versus traditional mortgage rates is crucial for potential buyers like you. We know how challenging this can be, especially when navigating financing options that vary based on factors such as credit scores and economic conditions. Recognizing these differences can significantly affect your affordability and overall homeownership experience. By making informed decisions that align with your financial goals, you empower yourself in this journey.

Key insights from the article highlight that mobile home loans often come with higher interest rates. This primarily stems from their classification and the perceived risk by lenders. Economic factors, including inflation and the Federal Reserve’s monetary policies, further contribute to the volatility of these rates. Additionally, when weighing the pros and cons of mobile homes versus traditional mortgages, you’ll find a landscape where affordability and flexibility coexist with certain risks, such as depreciation in value.

Ultimately, navigating the mortgage landscape requires strategic decision-making and a proactive approach. By enhancing your credit score, comparing offers from multiple lenders, and timing your applications wisely, you can secure more favorable mortgage terms. Embracing these strategies not only empowers you in your home-buying journey but also reinforces the importance of being well-informed in a complex financial environment. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What are the typical interest rates for mobile homes and traditional mortgages as of early 2025?

As of early 2025, mobile home interest rates typically range from 6.75% to 8.50%, while conventional loan percentages usually fall between 6% and 7%.

Why do mobile home loans have higher interest rates than traditional mortgages?

Mobile home loans often have higher interest rates due to the unique classification of manufactured homes, which typically leads to financing through chattel loans that carry higher costs compared to traditional mortgages backed by real estate.

How do lenders view manufactured homes in terms of risk?

Lenders often view manufactured homes as riskier investments, which results in stricter lending standards and increased costs for borrowers.

What challenges might arise when financing a mobile home?

Challenges in financing a mobile home include the fact that homes not permanently affixed to land may not qualify for conventional financing, complicating the borrowing process.

Why is it important for potential buyers to understand the differences between mobile home and traditional mortgage rates?

Understanding the differences is essential for potential buyers as it directly affects their financing options and overall affordability in the market.