Overview

The term MIP, or Mortgage Insurance Premium, is crucial for many families navigating the homeownership journey. It refers to the insurance required for mortgages insured by the Federal Housing Administration (FHA), which protects lenders from losses if a borrower defaults. We understand how challenging this process can be, especially for first-time buyers or those with lower credit scores.

MIP plays a significant role in making homeownership more accessible. By allowing lower down payments, it reduces the financial burden on families, making their dreams of owning a home more attainable. Recent rate adjustments have further decreased overall borrowing costs, providing additional relief.

We’re here to support you every step of the way as you explore your options. Remember, with the right guidance and resources, homeownership is within reach. If you have any questions or need assistance, don’t hesitate to reach out.

Introduction

We know how daunting it can be to navigate the complexities of mortgage financing. Yet, one term shines brightly as a beacon of opportunity for aspiring homeowners: Mortgage Insurance Premium (MIP). This essential component not only protects lenders but also opens doors for individuals, especially first-time buyers, to secure financing with lower upfront costs.

As MIP continues to evolve, recent adjustments have created significant savings for borrowers. So, how can potential homebuyers leverage these changes to maximize their financial benefits and navigate the path to homeownership more effectively? We’re here to support you every step of the way.

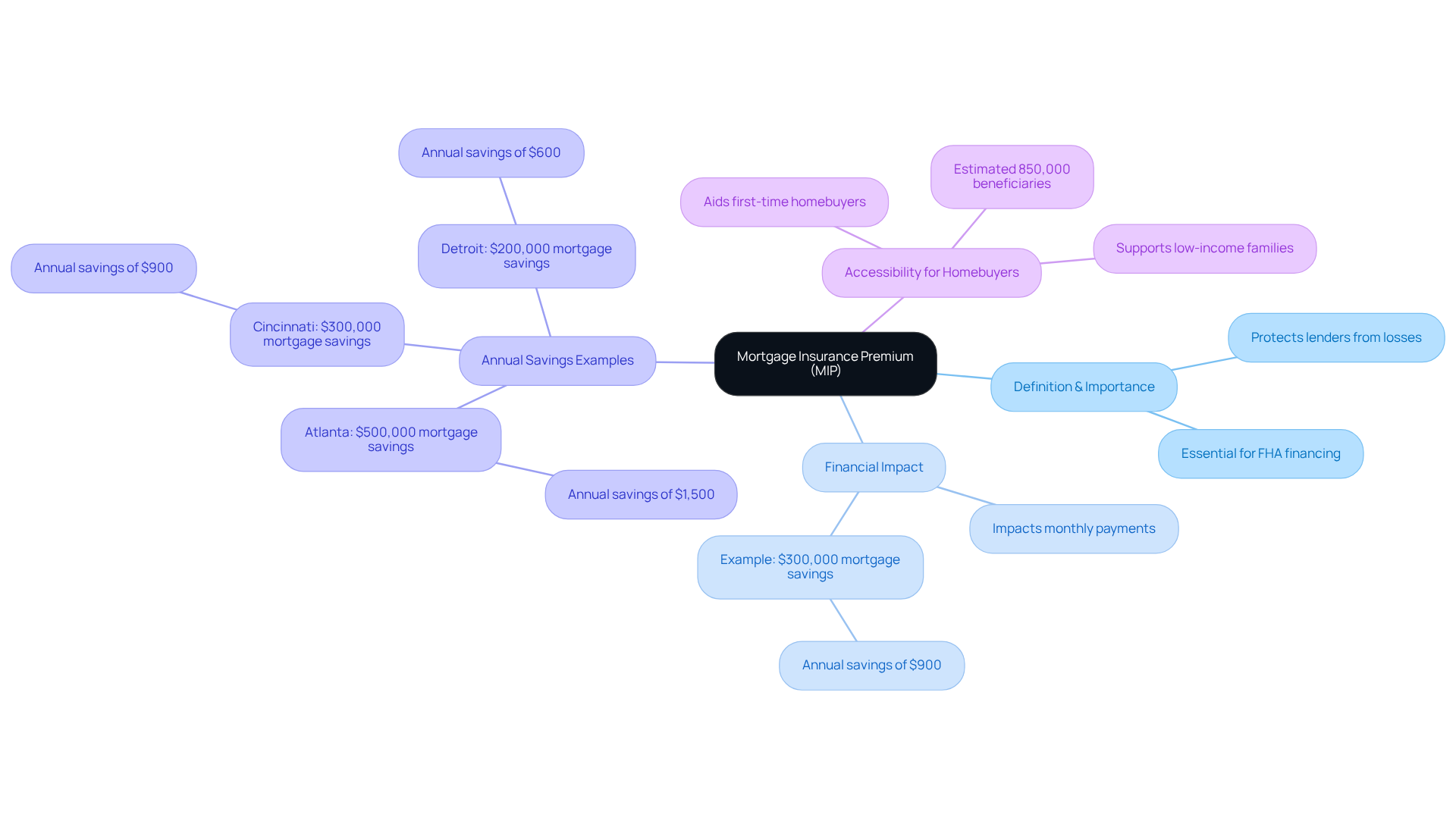

Define MIP: Understanding the Term and Its Importance

The MIP meaning, or Mortgage Insurance Premium, is a vital component for mortgages insured by the Federal Housing Administration (FHA). It protects lenders from potential losses if a borrower defaults, making it an essential aspect of FHA financing for everyone, regardless of their credit score or down payment. This insurance opens doors to funding with lower upfront costs, enhancing homeownership opportunities for many families.

Understanding MIP meaning is crucial for homebuyers because it significantly impacts their monthly mortgage payments and overall borrowing expenses. For example, a person with a $300,000 mortgage might save around $900 each year due to recent MIP reductions. These savings can be redirected towards home improvements or other important financial goals. In cities such as Atlanta, buyers with a $500,000 mortgage could save up to $1,500 annually, clearly illustrating the tangible benefits of MIP adjustments.

The importance of MIP meaning extends beyond individual savings; it plays a key role in making FHA financing more accessible, particularly for first-time homebuyers and individuals from historically underrepresented communities. As of July 2025, the ongoing adjustments to MIP rates reflect a broader initiative aimed at easing financial burdens on borrowers, ultimately fostering a more inclusive housing market.

For families considering refinancing options, understanding how MIP interacts with overall mortgage costs can be beneficial. The cost of finalizing a mortgage refinance in California typically ranges from 2% to 5% of the borrowed amount. For instance, if your new loan amount is $300,000, you can expect to pay between $6,000 and $15,000 in closing costs. By comparing lenders like F5 Mortgage, known for competitive rates and personalized service, homeowners can strategically explore refinancing opportunities to secure lower rates and flexible terms, ultimately improving their financial situation.

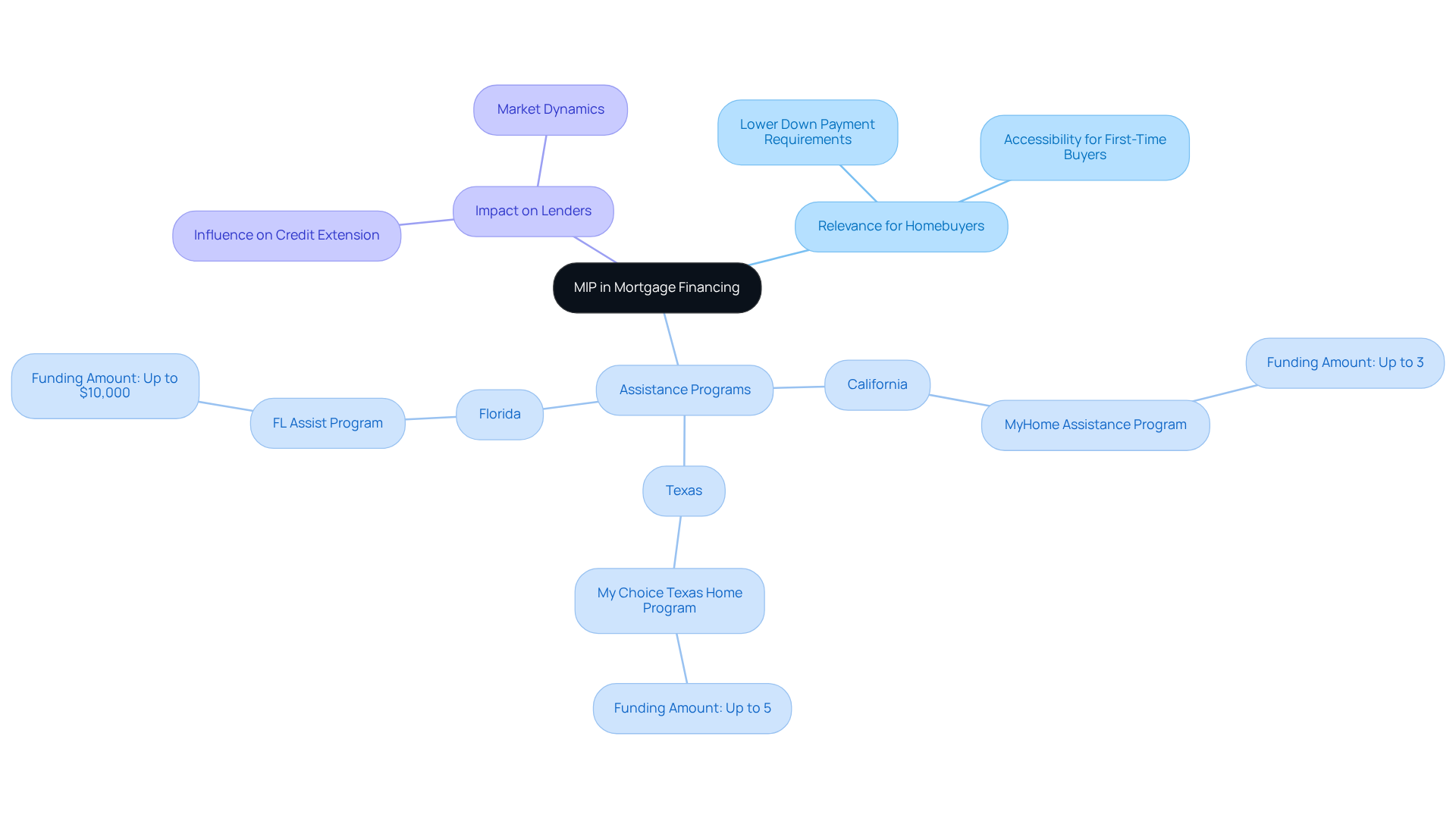

Contextualize MIP in Mortgage Financing: Relevance for Homebuyers

In the context of mortgage financing, mip meaning plays a vital role in helping homebuyers qualify for funding that they might not otherwise secure. We know how challenging this can be, especially for first-time home purchasers and individuals with limited savings. FHA financing, which requires MIP, has an mip meaning that is particularly advantageous because it allows initial contributions as low as 3.5%. This makes homeownership more accessible for those who struggle to meet the higher down payment requirements of traditional loans.

At F5 Mortgage, we understand the importance of support. That’s why we offer numerous down payment assistance programs in states like California, Texas, and Florida, enhancing opportunities for families looking to own their homes. For instance, the MyHome Assistance Program in California provides up to 3% of the home’s purchase price. Similarly, Texas’s My Choice Texas Home program offers up to 5% for down payment and closing assistance. In Florida, programs like FL Assist can provide up to $10,000, making homeownership more attainable.

Furthermore, the mip meaning can significantly influence lenders’ willingness to extend credit, thereby impacting the overall housing market. When combined with these assistance programs, it significantly increases the financial feasibility for homebuyers. We’re here to support you every step of the way. Exceptional customer satisfaction at F5 Mortgage, highlighted by numerous testimonials, underscores the effectiveness of these programs in guiding clients throughout their home financing journey.

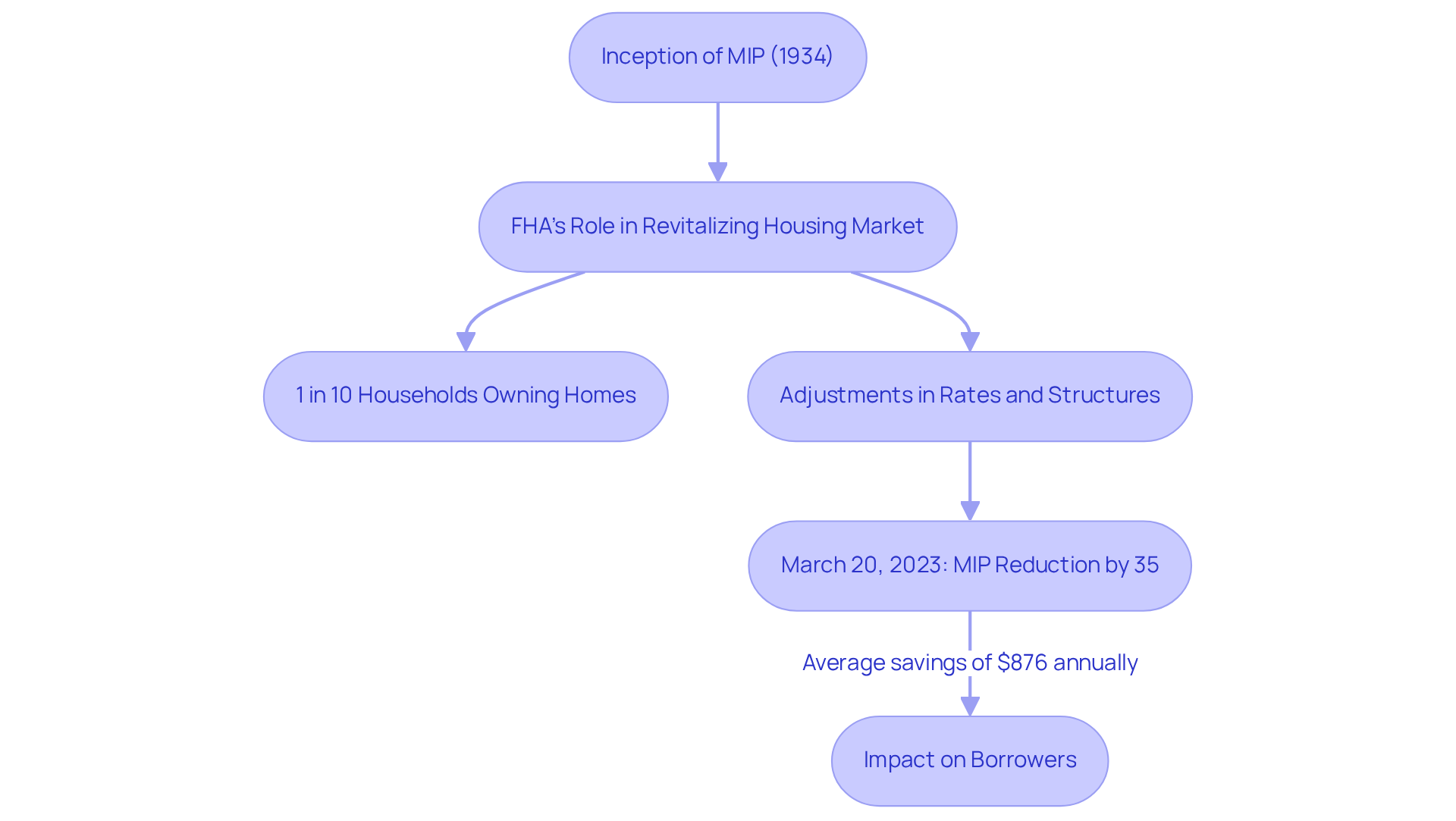

Trace the Origins of MIP: Historical Development and Evolution

The concept of mortgage insurance, particularly the mip meaning, originated from a genuine need for security in lending practices, especially during tough economic times. Since its inception in 1934, the Federal Housing Administration (FHA) has been dedicated to revitalizing the housing market by providing insurance to lenders against defaults by clients. At that time, only 1 in 10 households owned homes, highlighting the vital role of MIP meaning in the promotion of homeownership.

The mip meaning refers to its design, which protects lenders while allowing individuals to secure financing with lower down payments. Over the years, MIP has evolved, with adjustments in rates and structures reflecting changes in the housing market and economic conditions. A significant milestone occurred on March 20, 2023, when the U.S. Department of Housing and Urban Development reduced the Annual MIP by 35%. This change translated to average savings of $876 each year for over 682,000 loan recipients.

Today, the mip meaning is a crucial element of FHA lending, enabling lenders to extend financing to a broader range of clients while minimizing their risk. The historical evolution of MIP illustrates its essential role in shaping the landscape of American home financing. We know how challenging the mortgage process can be, but understanding mip meaning and its benefits can empower you on your journey to homeownership.

Identify Key Characteristics of MIP: Components and Functionality

Navigating mortgage insurance can feel overwhelming, but understanding its components can make a significant difference. The term MIP meaning refers to Mortgage Insurance Premium, which consists of two primary elements:

- The Upfront Mortgage Insurance Premium (UFMIP)

- The annual premium.

The UFMIP is a one-time charge paid at closing, typically calculated as a percentage of the loan amount, ranging from 1.75% to 3.5%, depending on the specifics of your financing.

The annual premium, on the other hand, is divided into manageable monthly payments that are included in your mortgage costs. These rates can vary based on the amount borrowed, the loan term, and the size of your down payment.

We know how challenging it can be to keep track of these costs, especially when considering the recent announcement from the FHA. They have proposed a reduction of the annual mortgage insurance premium by 0.5 percent, which could save the average FHA borrower around $900 each year. This change aims to make homeownership more attainable for an additional 250,000 families.

Understanding these components is essential for anyone seeking financing, as they directly impact the total cost of your loan and your monthly payments. It’s important to note that the mip meaning is generally non-cancellable. This means that borrowers may need to continue these payments throughout the life of the loan unless they refinance or meet specific criteria, such as reaching a certain equity threshold.

Additionally, there are proposals to eliminate certain MIP categories established in 2016, as their mip meaning is now considered economically outdated. This would further simplify the mortgage insurance landscape, making it easier for families to navigate their options.

Remember, we’re here to support you every step of the way as you explore your mortgage options.

Conclusion

Understanding the meaning of MIP—Mortgage Insurance Premium—is essential for anyone navigating the complexities of FHA financing. We know how challenging this can be. This critical insurance not only safeguards lenders against potential defaults but also significantly enhances the accessibility of homeownership for a diverse range of borrowers. By lowering upfront costs and offering more favorable financing terms, MIP plays a pivotal role in transforming the housing landscape, particularly for first-time homebuyers and those with limited savings.

Throughout this article, we’ve highlighted key points, including the financial benefits of MIP. Imagine the annual savings that can be redirected toward other financial goals. The historical context of MIP’s development reveals its evolution and ongoing adjustments, especially the recent reductions in rates aimed at easing financial burdens. Furthermore, understanding MIP’s components, such as the Upfront Mortgage Insurance Premium and annual premiums, is crucial as they directly affect overall mortgage costs.

In conclusion, the significance of MIP extends beyond individual savings; it fosters a more inclusive housing market and empowers families to achieve their homeownership dreams. As the mortgage landscape continues to evolve, staying informed about MIP and its implications can lead to smarter financial decisions. Embracing this knowledge not only enhances your personal financial health but also contributes to a broader movement toward equitable access to housing for all. We’re here to support you every step of the way.

Frequently Asked Questions

What does MIP stand for and what is its significance?

MIP stands for Mortgage Insurance Premium, which is essential for mortgages insured by the Federal Housing Administration (FHA). It protects lenders from potential losses if a borrower defaults, making it a crucial aspect of FHA financing.

How does MIP benefit homebuyers?

MIP allows homebuyers to access funding with lower upfront costs, enhancing homeownership opportunities. It significantly impacts monthly mortgage payments and overall borrowing expenses.

Can you provide an example of the savings associated with MIP?

For instance, a person with a $300,000 mortgage might save around $900 each year due to recent MIP reductions. In cities like Atlanta, buyers with a $500,000 mortgage could save up to $1,500 annually.

Why is understanding MIP important for first-time homebuyers?

Understanding MIP is crucial for first-time homebuyers as it plays a key role in making FHA financing more accessible, particularly for individuals from historically underrepresented communities.

What are the expected costs when refinancing a mortgage in California?

The cost of finalizing a mortgage refinance in California typically ranges from 2% to 5% of the borrowed amount. For example, on a $300,000 loan, closing costs could range from $6,000 to $15,000.

How can homeowners strategically explore refinancing options?

Homeowners can compare lenders like F5 Mortgage, known for competitive rates and personalized service, to explore refinancing opportunities that may offer lower rates and flexible terms, ultimately improving their financial situation.