Overview

This article is dedicated to helping you maximize a £500,000 investment in family home upgrades. We know how challenging it can be to navigate this process, so we’ve outlined key steps for effective planning and execution.

- First, it’s essential to define your investment objectives. Understanding what you hope to achieve will guide your decisions moving forward.

- Next, exploring suitable financing options is crucial. There are various paths you can take, and we’re here to support you every step of the way.

- Additionally, understanding the potential returns on renovations is vital. This knowledge empowers homeowners to make informed decisions that not only enhance property value but also improve living comfort.

By following these steps, you can feel confident in your choices, knowing that your investment will positively impact your family’s home and lifestyle.

Introduction

Navigating the world of home renovations can be both exciting and overwhelming, especially with a significant £500,000 investment at stake. We understand how challenging this can be. Homeowners are increasingly recognizing that strategic upgrades not only enhance their living spaces but also significantly boost property value. However, with so many options available, how can you determine the most effective path to maximize returns?

This guide is here to support you every step of the way. We will delve into essential strategies for:

- Defining your investment objectives

- Selecting suitable financing options

- Understanding the potential returns on various home improvements

Along the way, we will address the common challenges homeowners face in this transformative journey, empowering you to make informed decisions.

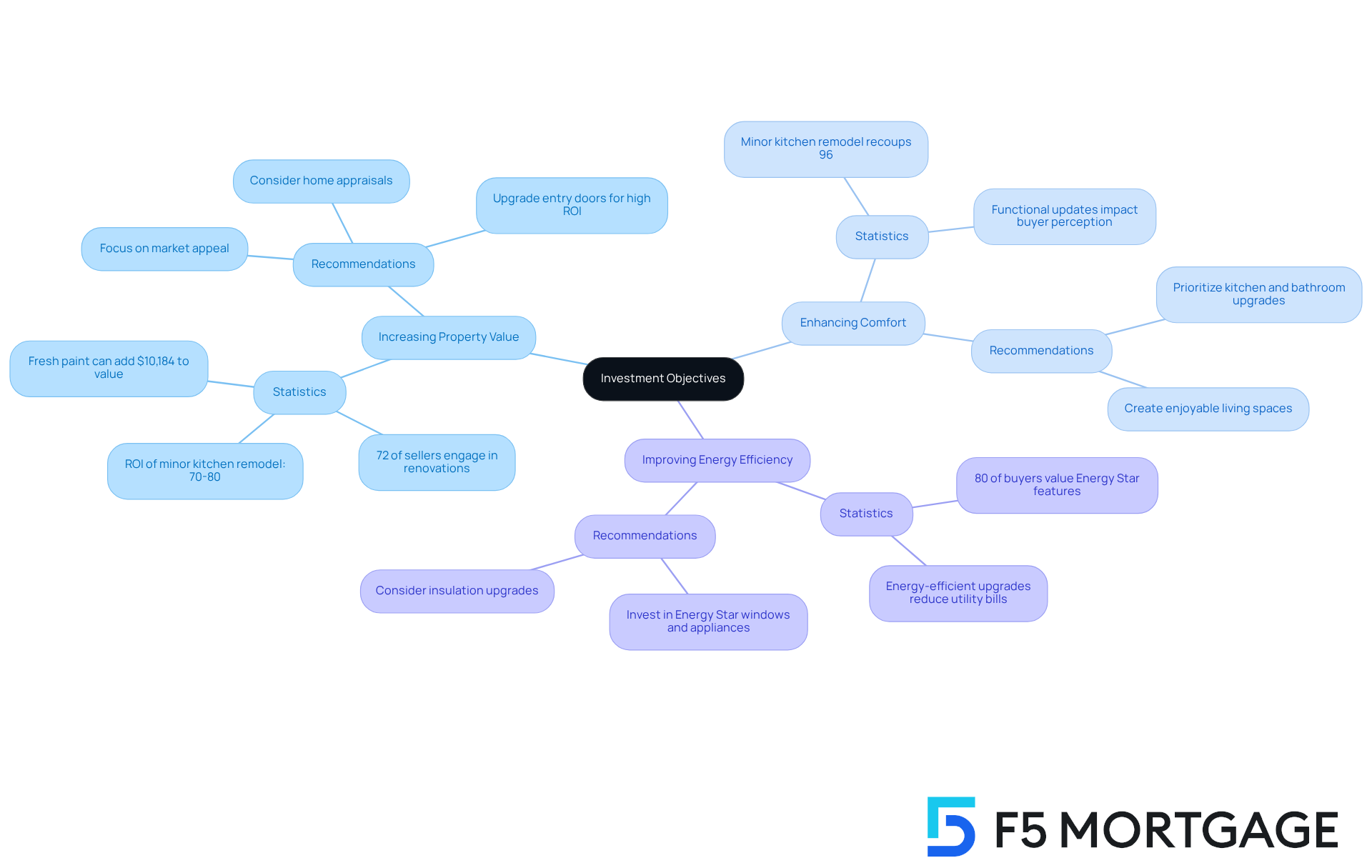

Define Your Investment Objectives

Participating in a family conversation is crucial to clarify your goals for the 500k investment in renovations. We know how challenging this can be, but considering the following key factors can help guide your decisions:

- Increasing Property Value: If selling is on the horizon, prioritize renovations that enhance market appeal. Statistics indicate that 72% of property sellers engage in enhancement projects to ready their residences for sale, suggesting a strong link between upgrades and increased property value. Additionally, understanding the role of home appraisals in determining property value and equity is vital for optimizing mortgage rates.

- Enhancing Comfort: Reflect on how to create a more enjoyable living space. Upgrades that improve functionality, such as kitchen and bathroom renovations, are particularly effective. Minor kitchen remodels yield an impressive ROI of 70%-80%. Personalized support from F5 Mortgage can help tailor your financing options to meet these goals.

- Improving Energy Efficiency: If reducing utility bills is a priority, consider energy-efficient upgrades. Homebuyers increasingly value Energy Star windows and appliances, with 80% deeming them essential or desirable. These enhancements not only reduce expenses but also increase the property’s marketability.

Once you have established these objectives, document them to guide your decision-making throughout the renovation process. Remember, we’re here to support you every step of the way. F5 Mortgage provides resources like consultations with loan specialists and the capability to import financial data for precise evaluations, ensuring that your investments align with your family’s objectives and maximize the potential return on your property improvements.

Choose Suitable Investment Products

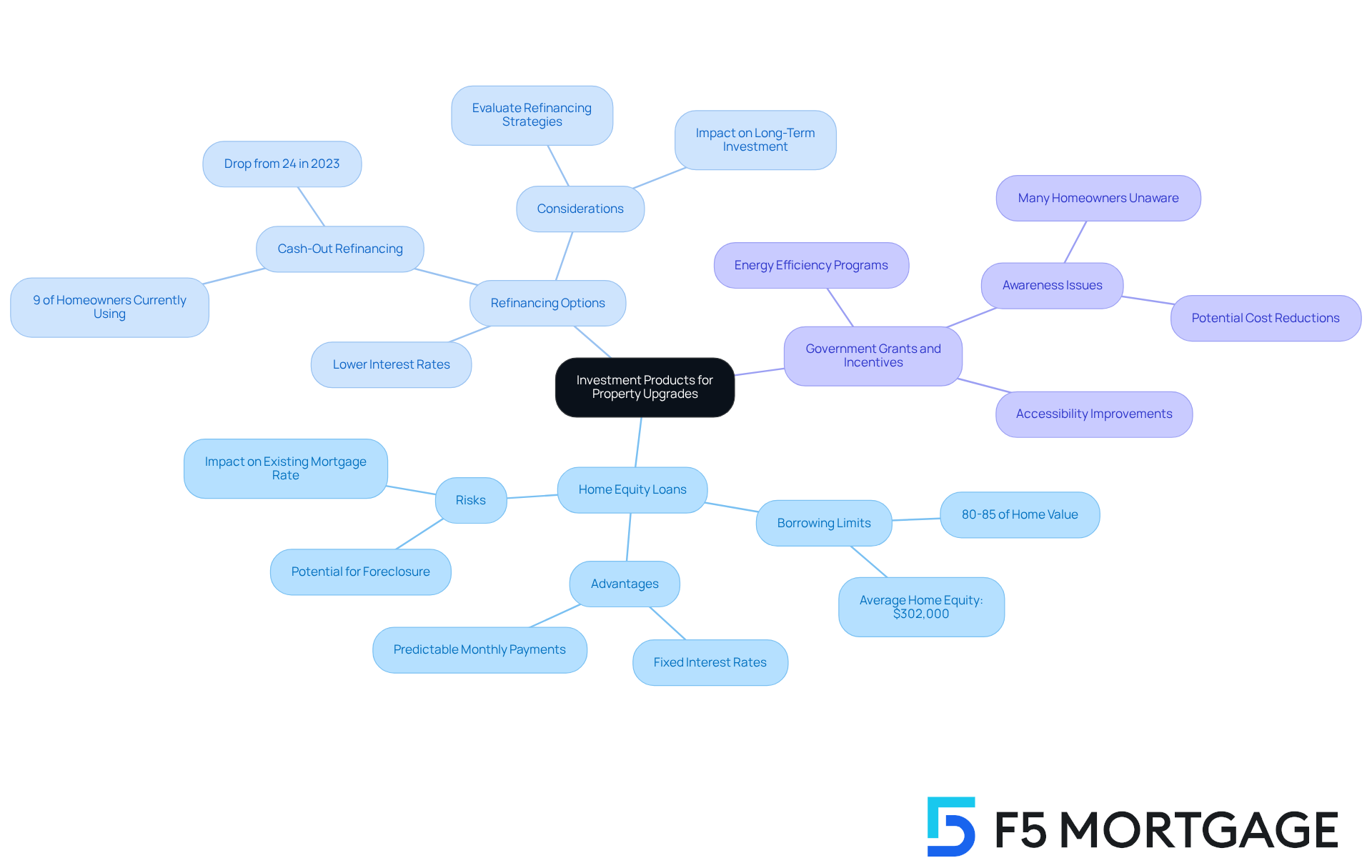

When considering financing for property upgrades, we know how challenging this can be. It’s essential to explore various investment products that align with your goals. Here are some key options to consider:

-

Home Equity Loans: For homeowners with sufficient equity, home equity loans present a cost-effective solution for financing renovations. These secured loans usually permit borrowing up to 80-85% of your property’s value, offering consistent monthly payments and fixed interest rates. With the typical mortgage-holding property owner having around $302,000 in equity, utilizing this asset can enable substantial renovations.

-

Refinancing Options: Refinancing your mortgage can unlock lower interest rates or cash-out options, enabling you to access funds for upgrades. Recent statistics show that only 9% of property owners are presently choosing cash-out refinancing for enhancements, a significant drop from 24% in 2023. This shift highlights the need for homeowners to carefully evaluate their refinancing strategies to maximize their investment.

-

Government Grants and Incentives: Exploring available programs can reveal financial support for residential improvements, especially those focused on boosting energy efficiency or accessibility. Many homeowners are unaware of these opportunities, which can significantly reduce improvement expenses.

By understanding these financing avenues, we’re here to support you every step of the way, enabling you to make informed decisions that not only enhance your living spaces but also contribute to the long-term value of your properties.

Implement Effective Asset Allocation Strategies

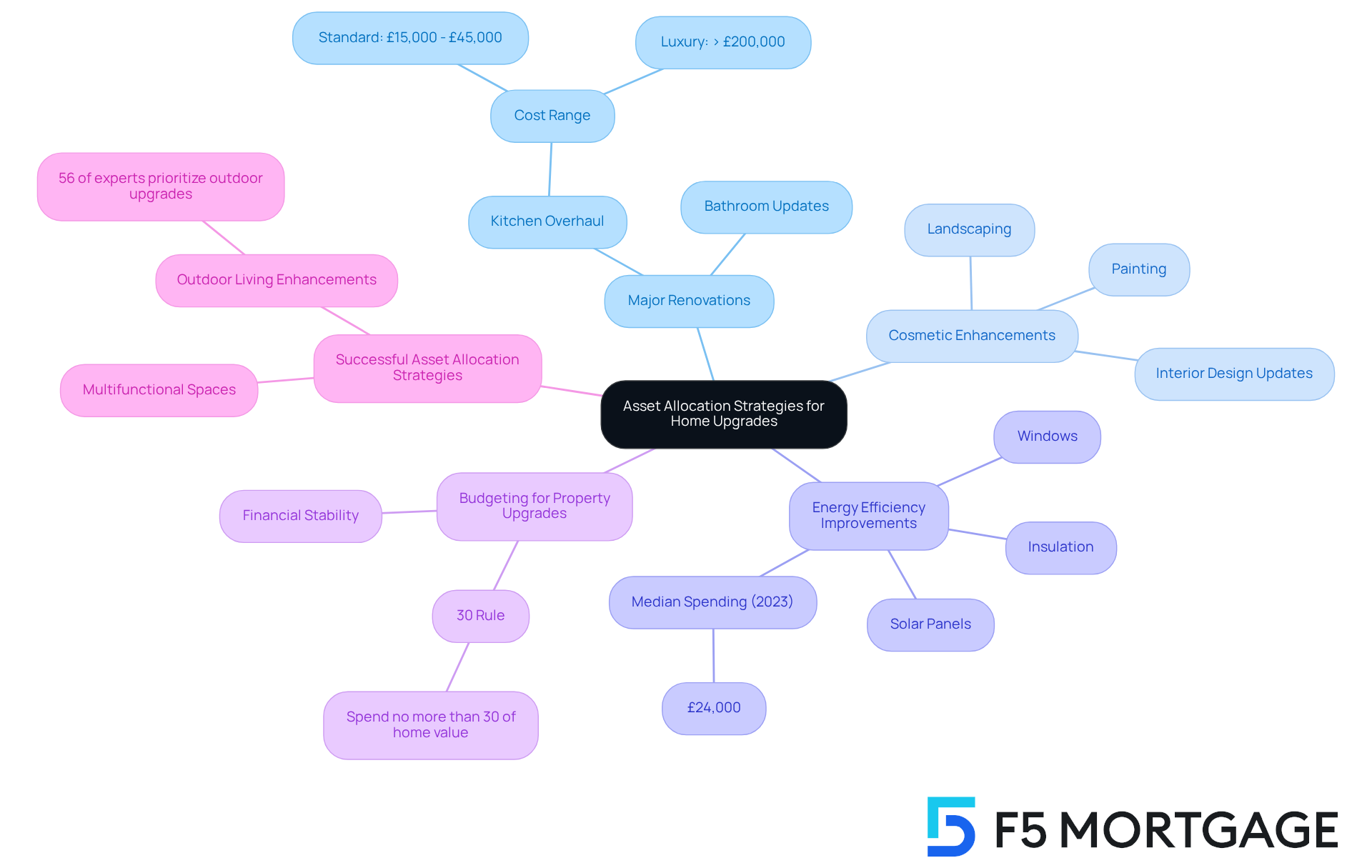

To effectively allocate your investment of 500k for home upgrades, it’s essential to consider strategies that truly resonate with your needs and aspirations.

-

Major Renovations: We understand that dedicating a substantial portion of your budget to structural changes or expansions can be daunting. However, significant improvements, like kitchen or bathroom updates, can greatly increase your property’s worth. For instance, a complete kitchen overhaul can range from £15,000 to £45,000, while luxury upgrades might surpass £200,000. It’s worth noting that median spending on home renovations has increased by 60% since 2015, reflecting the rising costs associated with these projects.

-

Cosmetic Enhancements: Allocating resources for aesthetic upgrades, such as painting, landscaping, and interior design updates, can be a fulfilling way to enhance your home. These enhancements improve curb appeal and create a welcoming atmosphere without breaking the bank, making your space feel more like you.

-

Energy Efficiency Improvements: Investing in energy-saving enhancements like insulation, windows, or solar panels not only lowers long-term utility expenses but also boosts your property’s marketability. We know how important it is for homeowners to prioritize energy efficiency, with median yearly expenditure on such improvements reaching £24,000 in 2023.

-

Budgeting for Property Upgrades: Financial advisors often suggest following the 30% guideline, which indicates spending no more than 30% of your property’s value on renovations. This approach helps maintain financial stability while enhancing your living space. As one financial advisor wisely noted, “Budgeting wisely for property enhancements is essential to maximizing your investment and ensuring long-term satisfaction.”

-

Successful Asset Allocation Strategies: Consider the growing trend of multifunctional spaces and outdoor living enhancements. With 56% of experts suggesting that outdoor enhancements are a priority for homeowners in 2025, allocating funds for these areas can yield significant returns.

By strategically allocating your investment across these categories, you can maximize the effect of your property enhancements while ensuring financial prudence. Remember, we’re here to support you every step of the way as you navigate this journey.

Understand Potential Returns on Your Investment

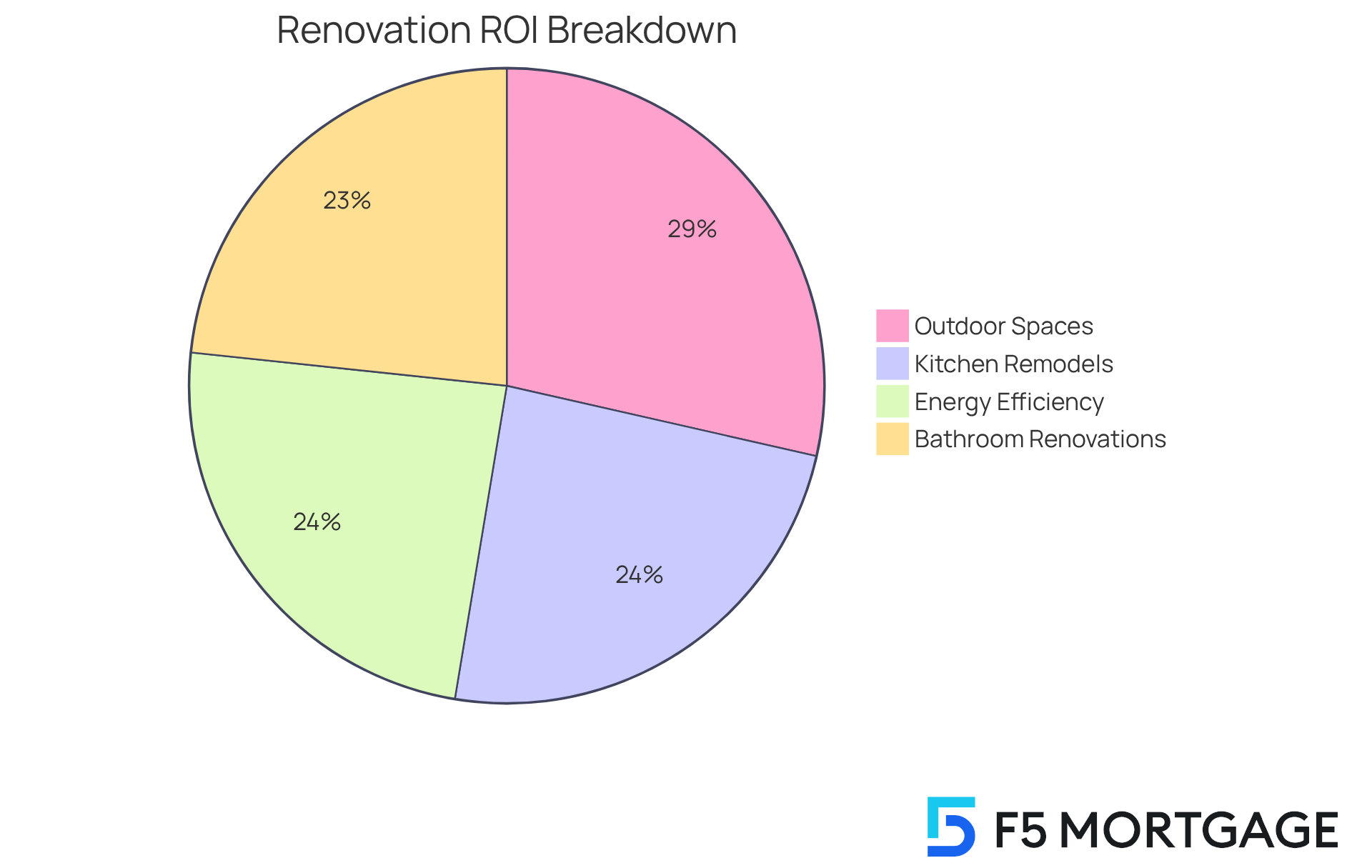

Understanding the potential return on investment (ROI) for residential upgrades is crucial for optimizing your financial commitment. We know how challenging it can be to navigate these decisions, so let’s explore some key insights into various renovations that can truly make a difference.

-

Kitchen Remodels: Minor kitchen remodels are celebrated for their high ROI, often recouping between 70% and 80% of costs. A well-executed kitchen renovation not only enhances the functionality of your home but also boosts its aesthetic appeal, making it a priority for many homeowners. Real-life examples show that investing in improvements such as appliance upgrades, cabinet refacing, and new countertops can yield substantial returns.

-

Bathroom Renovations: Similarly, bathroom upgrades typically provide a strong ROI, averaging around 72.7% of costs recouped at resale. Updating old bathrooms enhances daily comfort and also elevates the property’s market value. Features like energy-efficient fixtures and stylish designs can further enhance these returns, ensuring your investment pays off.

-

Energy Efficiency Improvements: Consider upgrades like installing energy-efficient windows, adding insulation, and incorporating energy-efficient appliances. These enhancements can lead to significant savings on utility bills while increasing overall property value. More buyers are seeking homes with these improvements, making them a smart investment.

-

Outdoor Living Spaces: Adding or upgrading outdoor living areas, such as decks, can significantly increase property value, with an average ROI of around 89%. This option is particularly appealing for homeowners looking to enhance their property’s value while creating enjoyable spaces for family gatherings.

While focusing on these high-yield upgrades, it’s essential to avoid excessive enhancements. Ensure that your expenditures align with the market worth of your residence. By making informed decisions, you can effectively increase your property’s value while enjoying the benefits of improved living spaces. We’re here to support you every step of the way as you navigate these important choices.

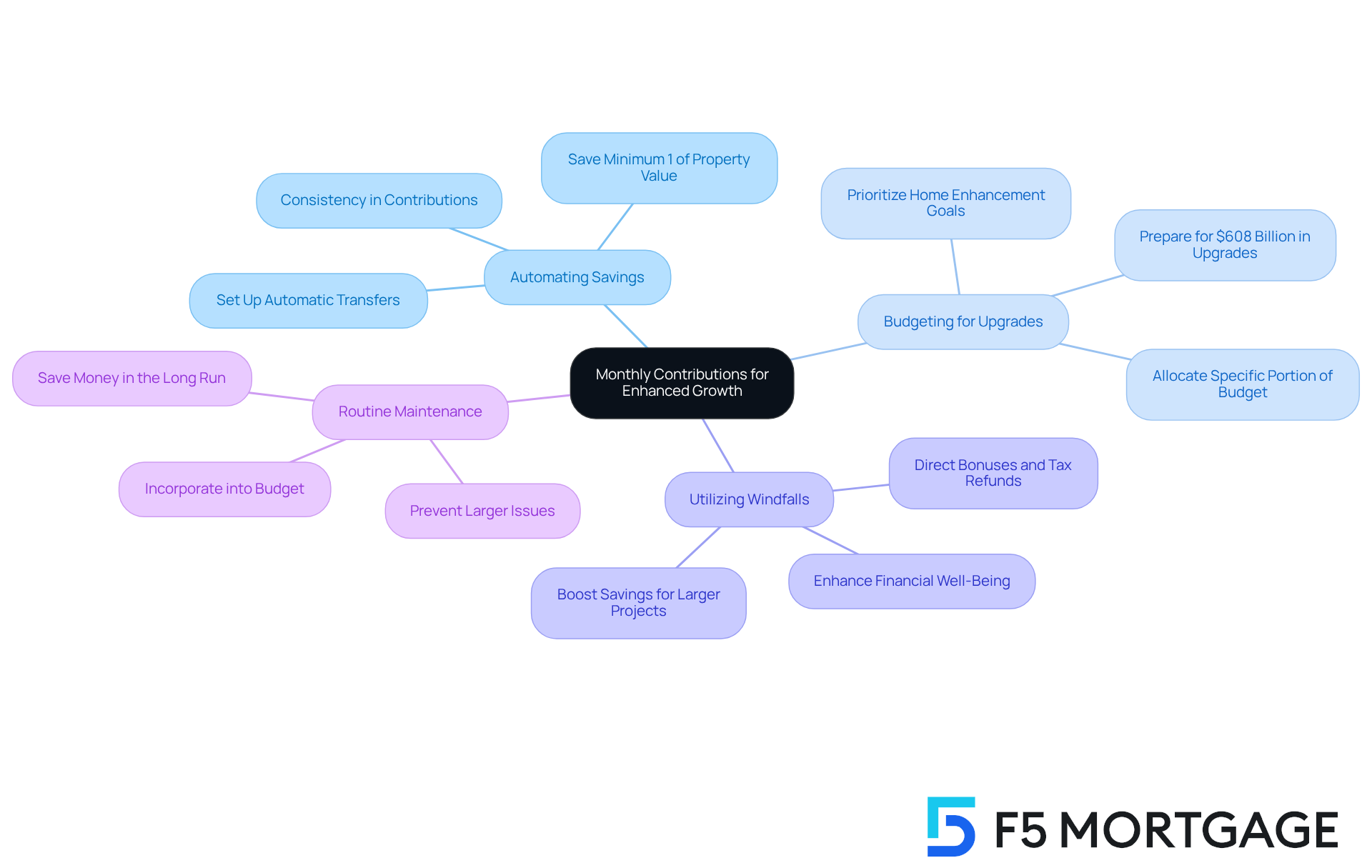

Incorporate Monthly Contributions for Enhanced Growth

Creating a monthly savings strategy for your renovation fund can significantly enhance your financial preparedness for improvements. We understand how challenging this can be, so here are some effective strategies to consider:

-

Automating Savings: Setting up automatic transfers to a dedicated home improvement account can simplify your savings journey. This approach not only ensures consistency but also helps you build your fund without the temptation to spend the money elsewhere. Even small monthly contributions can accumulate over time, making a substantial difference. In fact, financial specialists suggest saving a minimum of 1% of your property’s worth each year for maintenance and improvements, which can truly assist your budgeting efforts.

-

Budgeting for Upgrades: Consider allocating a specific portion of your monthly budget for improvements. By viewing this as an essential expense, you can prioritize your home enhancement goals and alleviate financial pressure when projects arise. With Americans expected to allocate $608 billion on residential upgrades and upkeep this year, establishing a strong budget is essential for your peace of mind.

-

Utilizing Windfalls: If you receive bonuses, tax refunds, or unexpected income, consider directing these funds towards your renovation fund. This strategy can provide a significant boost to your savings, allowing you to tackle larger projects more swiftly. As financial advisors often recommend, using windfalls for savings can enhance your overall financial well-being and readiness for renovations.

-

Routine Maintenance: Incorporating routine maintenance into your budget can help prevent larger issues down the line. Regular upkeep not only saves you money in the long run but also ensures your home remains in good shape.

By applying these approaches, you can establish a strong financial foundation for your renovations, ensuring you are well-prepared for both scheduled and unforeseen enhancements. We’re here to support you every step of the way.

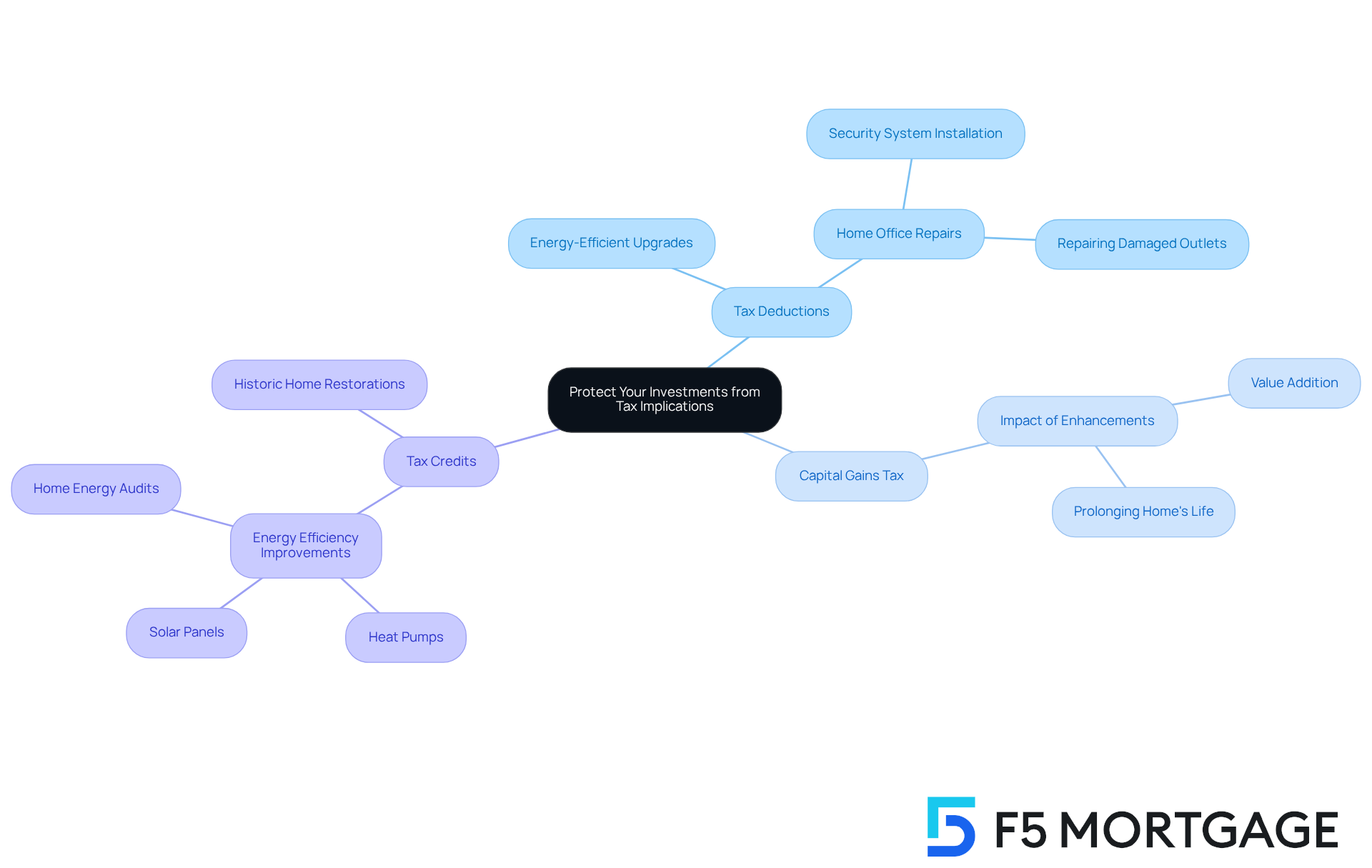

Protect Your Investments from Tax Implications

We understand how challenging it can be to navigate the tax consequences of your property improvements. Consulting with a tax expert can provide you with valuable insights tailored to your situation.

Consider the following important aspects:

- Tax Deductions: Some home improvements, particularly energy-efficient upgrades, may qualify for tax deductions, which can ease your financial burden.

- Capital Gains Tax: It’s crucial to be mindful of how enhancements can influence your capital gains tax when selling your property, as this can significantly impact your returns.

- Tax Credits: Explore the available tax credits for specific enhancements, such as energy efficiency improvements, which can provide further financial relief.

By taking these steps, you empower yourself to make informed decisions that support your financial well-being.

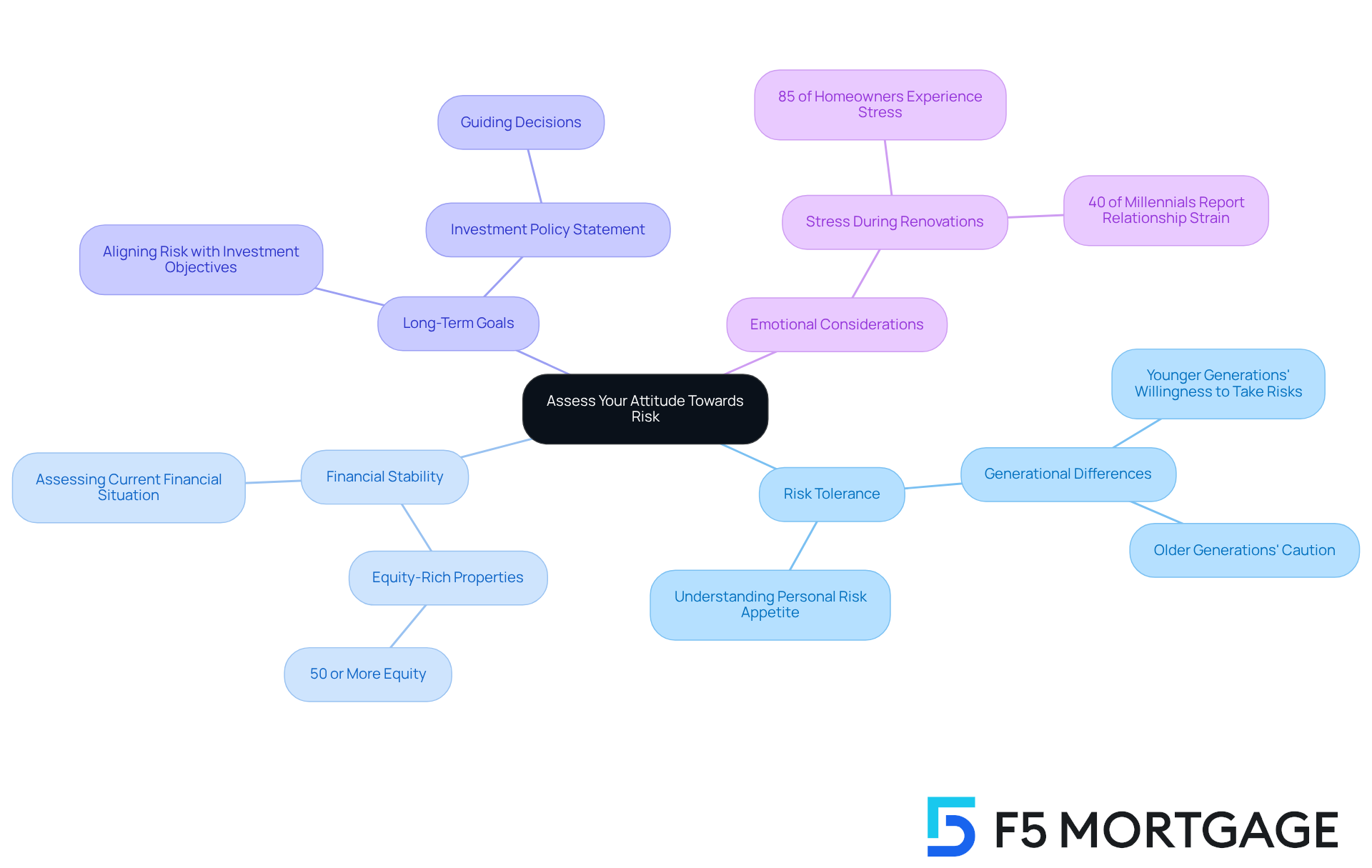

Assess Your Attitude Towards Risk

When planning your property upgrades, we know how challenging it can be to reflect on your comfort level with financial risk. Consider these important aspects:

- Risk Tolerance: Are you comfortable with high-risk investments that could potentially yield higher returns? Understanding your risk appetite is crucial. Younger generations often exhibit a greater willingness to take risks compared to older family members, and it’s essential to evaluate where you stand.

- Financial Stability: Assess your current financial situation to determine how much risk you can afford to take. With almost half of all mortgaged properties regarded as ‘equity-rich,’ indicating owners possess 50% or more equity, you may have substantial equity that can be utilized for improvements. However, it’s vital to ensure that your financial foundation is solid before proceeding.

- Long-Term Goals: Align your risk tolerance with your long-term investment objectives. This alignment ensures a cohesive strategy that not only addresses immediate home improvement needs but also supports your broader financial aspirations. Financial consultants suggest maintaining an investment policy statement that outlines your risk tolerance, directing your choices during the improvement process. Additionally, be mindful that renovation projects can be emotionally taxing; over 85% of homeowners report experiencing stress during renovations, and 40% of millennials noted that these projects strained personal relationships.

By carefully considering these factors, you can make informed decisions that enhance both the value of your home and your overall financial well-being. We’re here to support you every step of the way.

Conclusion

Maximizing a £500k investment in family home upgrades requires a thoughtful approach that aligns with your personal goals and market trends. We know how challenging this can be, but by defining clear investment objectives, you can prioritize renovations that enhance comfort and functionality while significantly increasing your property value. The insights shared emphasize the importance of strategic planning and informed decision-making in achieving the best outcomes from your home improvements.

Understanding various financing options, such as home equity loans and government grants, is crucial. It’s also essential to consider effective asset allocation strategies. Investing in high-return renovations, like kitchen and bathroom upgrades, alongside energy-efficient improvements, can yield substantial returns. Additionally, incorporating a monthly savings strategy can further bolster your financial readiness for upcoming projects, ensuring that funds are available when you need them.

Ultimately, we encourage you to take proactive steps in your renovation journey. By evaluating your risk tolerance and considering tax implications, you can protect your investments and make choices that contribute to long-term financial stability. Embracing these strategies not only enhances your living spaces but also secures a brighter financial future, reinforcing the significance of thoughtful investment in home improvements.

Frequently Asked Questions

What should I consider when defining my investment objectives for renovations?

When defining your investment objectives, consider increasing property value, enhancing comfort, and improving energy efficiency. Document these goals to guide your decision-making throughout the renovation process.

How can renovations increase property value?

Renovations that enhance market appeal, such as kitchen and bathroom upgrades, can significantly increase property value. Statistics show that 72% of property sellers undertake enhancement projects to prepare their homes for sale.

What types of renovations improve comfort in a home?

Upgrades that improve functionality, particularly kitchen and bathroom renovations, are effective in enhancing comfort. Minor kitchen remodels can yield a return on investment (ROI) of 70%-80%.

How can energy efficiency upgrades benefit my home?

Energy-efficient upgrades, such as installing Energy Star windows and appliances, can reduce utility bills and increase marketability. Approximately 80% of homebuyers consider these features essential or desirable.

What financing options are available for property upgrades?

Key financing options include home equity loans, refinancing options, and government grants and incentives. Home equity loans allow borrowing against your property’s value, while refinancing can unlock lower interest rates or cash-out options.

What are home equity loans and how do they work?

Home equity loans are secured loans that allow homeowners with sufficient equity to borrow up to 80-85% of their property’s value. They typically offer consistent monthly payments and fixed interest rates.

What should I know about refinancing my mortgage for renovations?

Refinancing can provide lower interest rates or cash-out options for accessing funds for upgrades. Recent statistics indicate a decline in homeowners choosing cash-out refinancing, underscoring the importance of evaluating refinancing strategies.

Are there any government programs available for home renovations?

Yes, there are government grants and incentives available for residential improvements, particularly those focused on energy efficiency or accessibility. Many homeowners may be unaware of these opportunities that can significantly reduce improvement costs.