Overview

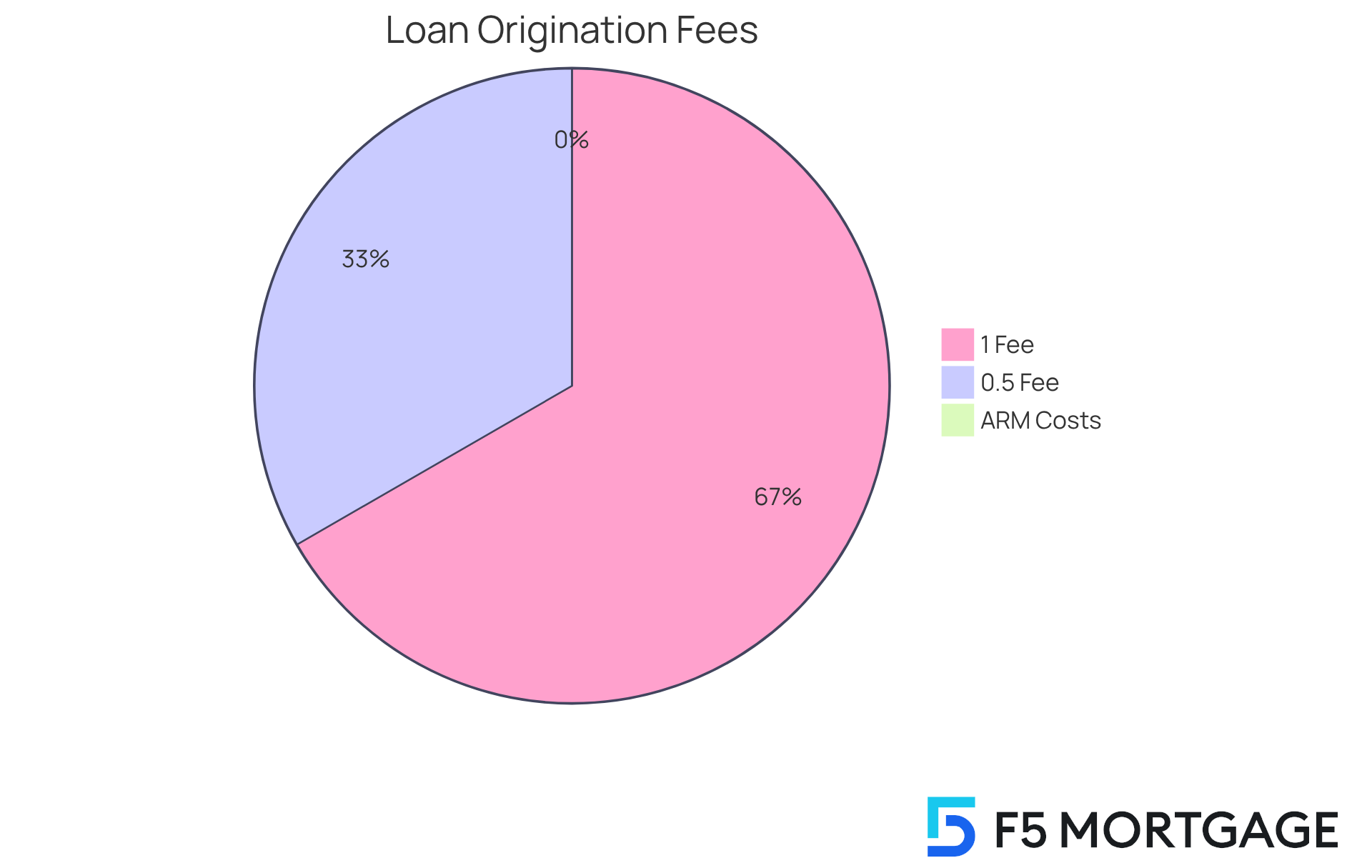

This article delves into the costs linked to loan origination fees in mortgages, offering valuable negotiation tips to assist borrowers in minimizing these expenses. We understand how challenging navigating these fees can be, especially when they typically range from 0.5% to 1% of the loan amount. It’s crucial to grasp these fees for making informed financial decisions.

To empower you, we provide strategies such as:

- Comparing lender estimates

- Leveraging your credit scores

By doing so, you can negotiate better terms that align with your financial goals. Remember, you’re not alone in this journey; we’re here to support you every step of the way as you seek to reduce your mortgage costs.

Introduction

We know how challenging it can be to understand the intricacies of mortgage origination fees. For many borrowers, these fees—typically ranging from 0.5% to 1% of the total loan amount—can feel overwhelming. Yet, they play a crucial role in the overall cost of securing a mortgage. By delving into the specifics of these charges, you can uncover strategies to negotiate better terms and potentially save thousands of dollars.

However, with varying fees and conditions among lenders, how can you effectively navigate this complex landscape? It’s important to ensure that you are not only informed but also empowered to make the best financial decisions for your family. We’re here to support you every step of the way.

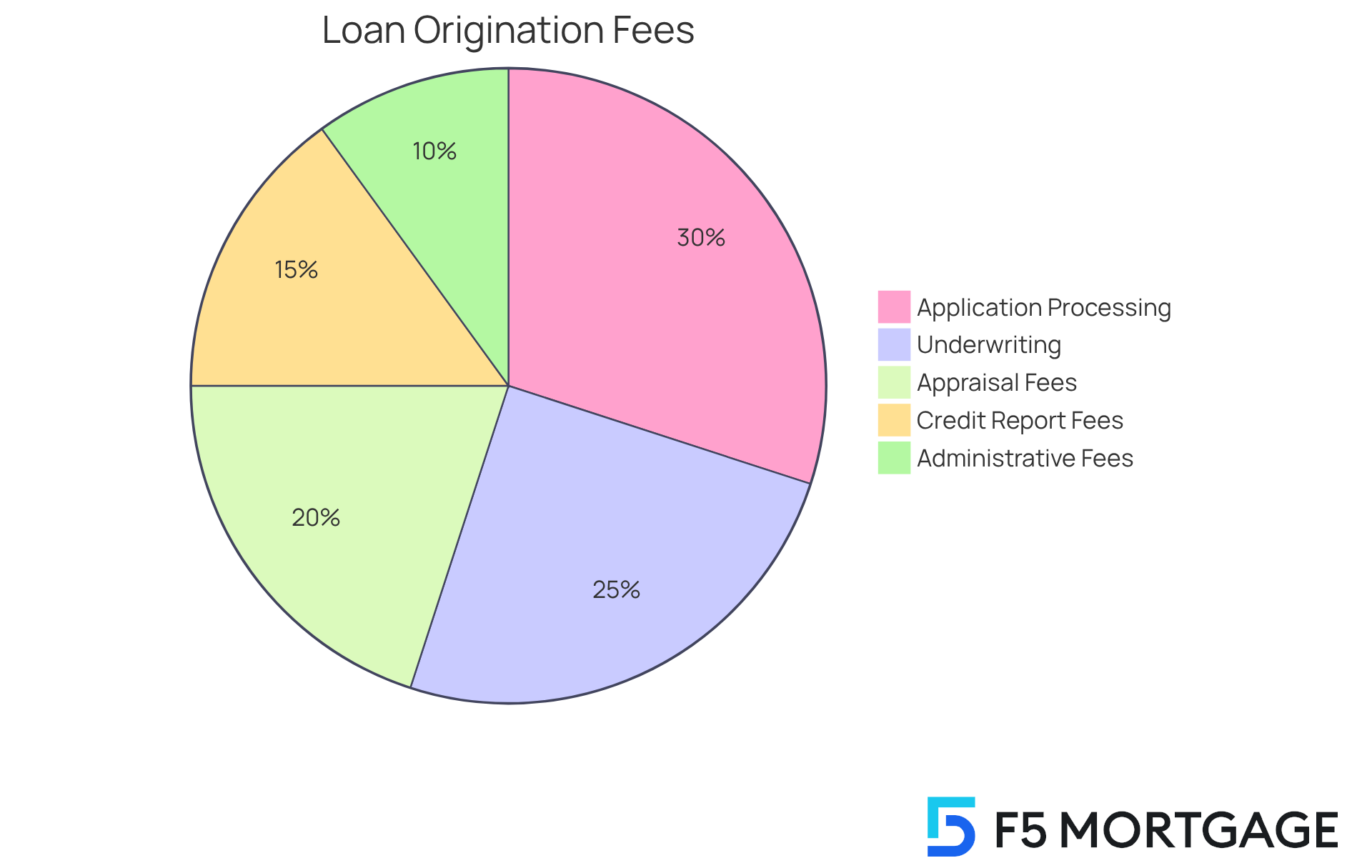

Define Loan Origination Fees and Their Purpose

Understanding loan initiation costs can feel overwhelming, especially when you’re navigating the mortgage process. These to cover the expenses related to handling your . They typically encompass services such as application processing, underwriting, and financing the loan. You might find that these range from 0.5% to 1% of the total loan amount. For a $500,000 mortgage, this could mean costs between $2,500 and $5,000.

It’s important to recognize that a significant portion of mortgage requests includes . This highlights the necessity for applicants to compare proposals and negotiate terms. As industry expert Wachtel wisely notes, “The loan estimate offers the client with the details to compare rates and expenses between lenders.” We always recommend that you request multiple and conduct your due diligence.

Grasping these charges is essential for anyone seeking a loan, as they directly impact the total expense of securing a mortgage. Costs can vary greatly among providers, and by , you can benefit from competitive rates and .

Additionally, you might explore ways to manage these costs, such as seeking assistance from family and friends or negotiating seller concessions. It’s also crucial to weigh the potential trade-offs between setup charges and interest rates, as this can significantly affect the long-term expense of your mortgage.

By staying informed about these aspects, including the importance of , you can navigate your options more effectively. We’re here to support you every step of the way, empowering you to make educated decisions regarding your mortgage financing.

Examine Typical Costs of Loan Origination Fees

Loan setup charges typically range from 0.5% to 1% of the . For instance, on a $300,000 loan, you can expect to pay between $1,500 and $3,000 in setup charges. These costs can be influenced by several factors, such as the lender’s specific policies, your creditworthiness, and the complexity of the loan application. If you have a higher credit rating, you may qualify for a compared to someone with a lower score, as lenders often adjust fees based on perceived risk.

To fully understand all related expenses, it’s crucial to carefully review your . This document provides a detailed breakdown of all costs, including , empowering you to make informed choices about your mortgage options. By comparing offers from various lenders, you can identify differences in and , ultimately helping you choose the most cost-effective loan for your needs.

Additionally, when exploring mortgage options, it’s important to recognize the different types of loans available, such as . ARMs often feature lower introductory rates compared to fixed-rate mortgages, making them appealing for those who plan to pay off their mortgage quickly or refinance in a few years. However, it’s essential to be aware of the potential risks associated with variable rates and the significance of interest adjustment caps that protect you from substantial rate increases.

By considering these factors and , you can take advantage of tailored to your unique financial situation. We know how challenging this can be, and we’re here to .

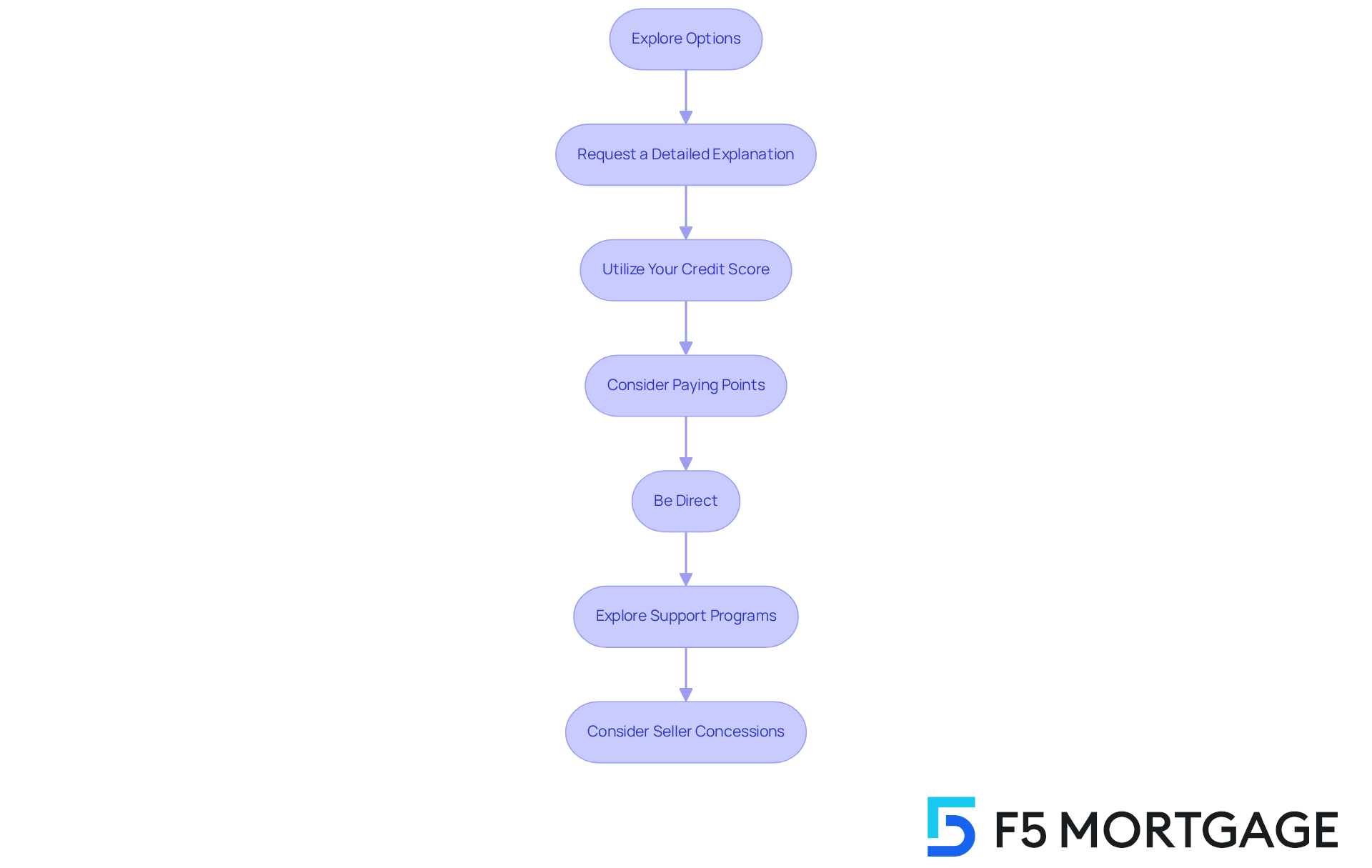

Explore Negotiation Strategies for Lowering Origination Fees

Bargaining on initial charges can significantly for borrowers, and we know how challenging this can be. Here are some effective strategies to consider:

- Explore Options: Start by collecting estimates from various lenders to compare . This not only helps you understand the market rate but also provides leverage during negotiations. Typically, initial charges vary from 0.5% to 1% of the loan sum, which translates to between $2,039 and $4,077 on a $407,700 mortgage. Even small differences can lead to substantial savings.

- Request a Detailed Explanation: Don’t hesitate to ask your lender for a breakdown of the fee. Understanding its components can reveal areas where negotiation is possible, potentially leading to reductions.

- Utilize Your Credit Score: A solid credit score can often lead to . If you have a strong credit profile, leverage it as a bargaining tool to negotiate better terms.

- Consider Paying Points: Some lenders may offer the option to reduce fees in exchange for a higher interest rate or vice versa. Evaluate which option aligns better with your long-term financial goals, as typically lowers your interest rate by about 0.25%.

- Be Direct: Don’t hesitate to ask your lender if they can lower the setup fee. Many lenders are open to negotiation, especially if they want to secure your business. In fact, borrowers who actively negotiate can often achieve average savings of several hundred dollars.

- Explore Support Programs: Investigate that may help lessen initial expenses, including processing fees. For instance, programs like the MyHome Assistance Program in California offer up to 3% of the home’s purchase price, while Texas has the My Choice Texas Home program providing up to 5% for down payment and closing assistance. Florida also offers alternatives such as the Florida Assist Second Mortgage Program, which can supply up to $10,000 for initial expenses. These programs can be particularly beneficial for .

- : In certain situations, you can negotiate with the seller to cover the initiation fee as part of the closing expenses. This can alleviate some financial burden at closing, especially if you ask the seller to make repairs or upgrades as part of your offer. Remember, negotiating can be stressful, so keep your goals in mind and don’t hesitate to walk away if an agreement can’t be reached.

Additionally, be aware of the processes. Your lender will provide you with a Loan Estimate detailing the charges and expenses of your loan, but remember these figures may vary by as much as 10% before closing. Before you close, your lender will send you a Closing Disclosure detailing your final numbers so you can see exactly what you’re paying for.

By utilizing these methods, individuals can successfully manage the intricacies of initial charges and possibly lower their total mortgage expenses. We’re here to support you every step of the way.

Differentiate Origination Fees from Other Mortgage Costs

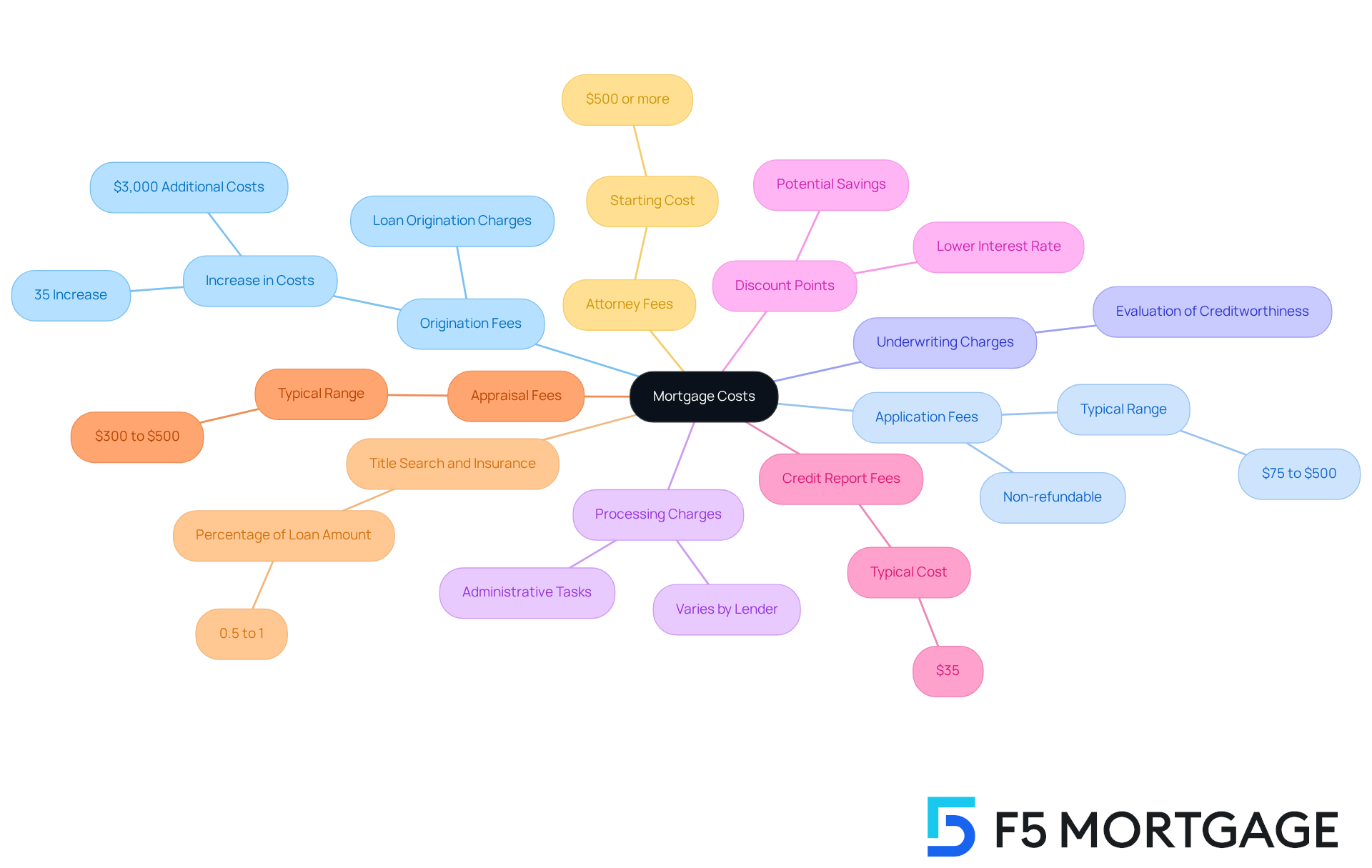

Understanding the costs associated with obtaining a mortgage can feel overwhelming. are just one part of the bigger picture, but understanding the is essential for you as a borrower. This knowledge helps you accurately assess your financial obligations. Here are some key components of to consider:

- Application Fees: Charged by lenders to process your application, these fees are typically non-refundable, reflecting the initial administrative effort involved.

- Underwriting Charges: These cover the evaluation of your loan application, assessing both your creditworthiness and financial stability.

- Processing Charges: Imposed for the administrative tasks needed to prepare your loan for closing, these costs can vary significantly among lenders.

- Discount Points: Optional fees that you can pay upfront to lower your interest rate, potentially leading to substantial savings over the life of your loan.

- Credit Report Fees: Usually around $35, these are the costs associated with obtaining your credit report.

- Appraisal Fees: Typically ranging from $300 to $500, depending on your location and property type.

- Title Search and Title Insurance: Generally between 0.5% and 1% of the loan amount.

- Attorney Fees: These can start at $500 or more, depending on the complexity of the transaction.

In California, finalizing a mortgage refinance usually costs between 2% and 5% of the loan amount. For instance, if your new loan amount is $300,000, you might pay between $6,000 and $15,000 in fees. This total includes application charges ranging from $75 to $500, starting costs between 0.5% and 1.5% of the loan amount, and appraisal costs, which generally range from $300 to $500, depending on location and property type.

Recently, many loan recipients have faced rising expenses, with loan initiation charges increasing by about 35%, adding an extra $3,000 to their costs. This trend highlights the importance of . that when seeking loans, it’s crucial to consider all associated expenses, as and complicate your journey to homeownership. By familiarizing yourself with these various charges, including those related to refinancing, you can and more effectively.

Determining your break-even point can help you understand how long it will take to recover the costs of refinancing through savings in monthly payments or interest rates. To calculate this, follow these three steps:

- Assess your . This includes all closing charges and costs related to refinancing, such as the origination fee mortgage, appraisal expenses, and any discount points.

- Calculate your monthly savings by subtracting your new monthly payment from your current monthly payment.

- Divide your refinancing expenses by your monthly savings. The result will show how many months it takes to reach your break-even point. For example, if your refinancing costs are $4,000 and your monthly savings are $100, your break-even point would be 40 months ($4,000 / $100 = 40 months). To make your refinance worthwhile, you would need to stay in your home long enough to reach this break-even point.

At F5 Mortgage, we know how challenging this can be. We’re committed to transparency and using technology to ensure without the pressure of hard sales tactics. Our goal is to empower you to make the best choices for your financial future, and we’re here to support you every step of the way.

Conclusion

Understanding loan origination fees is crucial for anyone looking to navigate the mortgage process effectively. These fees, which typically range from 0.5% to 1% of the total loan amount, can significantly impact the overall cost of securing a mortgage. Recognizing their purpose and how they fit into the broader picture of mortgage expenses empowers borrowers to make informed decisions and negotiate better terms.

Throughout this article, we’ve shared key insights on the nature of origination fees, typical costs associated with them, and effective negotiation strategies. We know how challenging this can be, so it’s emphasized that borrowers should:

- Compare offers from multiple lenders

- Carefully review Loan Estimates

- Leverage their credit scores to negotiate lower fees

Additionally, understanding the difference between origination fees and other costs, such as application and processing charges, is essential for a comprehensive grasp of total mortgage expenses.

Mastering origination fees is not just about saving money; it plays a vital role in achieving financial stability and making informed choices about homeownership. By applying the strategies we’ve discussed, you can reduce your mortgage costs and enhance your purchasing power. Remember, staying informed and proactive in the mortgage process can lead to more favorable outcomes and a smoother path to achieving your dream of homeownership.

Frequently Asked Questions

What are loan origination fees?

Loan origination fees are initial charges applied by lenders to cover the expenses related to handling a mortgage application, including services such as application processing, underwriting, and financing the loan.

How much do loan origination fees typically cost?

Loan origination fees usually range from 0.5% to 1% of the total loan amount. For example, on a $500,000 mortgage, this could result in costs between $2,500 and $5,000.

Why is it important to understand loan origination fees?

Understanding loan origination fees is essential because they directly impact the total expense of securing a mortgage. Additionally, costs can vary greatly among lenders, making it important for applicants to compare proposals and negotiate terms.

How can I effectively compare loan origination fees from different lenders?

You can effectively compare loan origination fees by requesting multiple loan estimates from different lenders. This allows you to see the details needed to compare rates and expenses.

Are there ways to manage loan origination fees?

Yes, you can manage loan origination fees by seeking assistance from family and friends, negotiating seller concessions, or considering the trade-offs between setup charges and interest rates.

What should I consider when choosing a lender regarding origination fees?

When choosing a lender, consider the competitiveness of their rates, the personalized service they offer, and how their origination fees fit into your overall mortgage cost.