Overview

This article addresses the essential factors and calculations necessary for mastering a $400,000 mortgage payment. We understand how challenging this can be, and it is crucial to grasp components like principal, interest, property taxes, and homeowners insurance for effective budgeting. Through a detailed example, we illustrate how these elements combine to influence your total monthly payment. We’re here to support you every step of the way as you navigate this important financial decision.

Introduction

Understanding the intricacies of a $400,000 mortgage payment can feel overwhelming. We know how challenging this can be, especially when you consider the various components that contribute to the overall cost. From principal and interest to property taxes and homeowners insurance, each element plays a crucial role in shaping your monthly obligations.

This article delves into the essential factors influencing mortgage payments. We’re here to support you every step of the way, offering insights and calculations that empower you to make informed financial decisions. However, with fluctuating interest rates and varying loan terms, navigating the complexities of mortgage payments can be daunting.

How can you ensure a sustainable financial future? Let’s explore this together, so you can feel confident in your choices.

Explore the Basics of a $400,000 Mortgage Payment

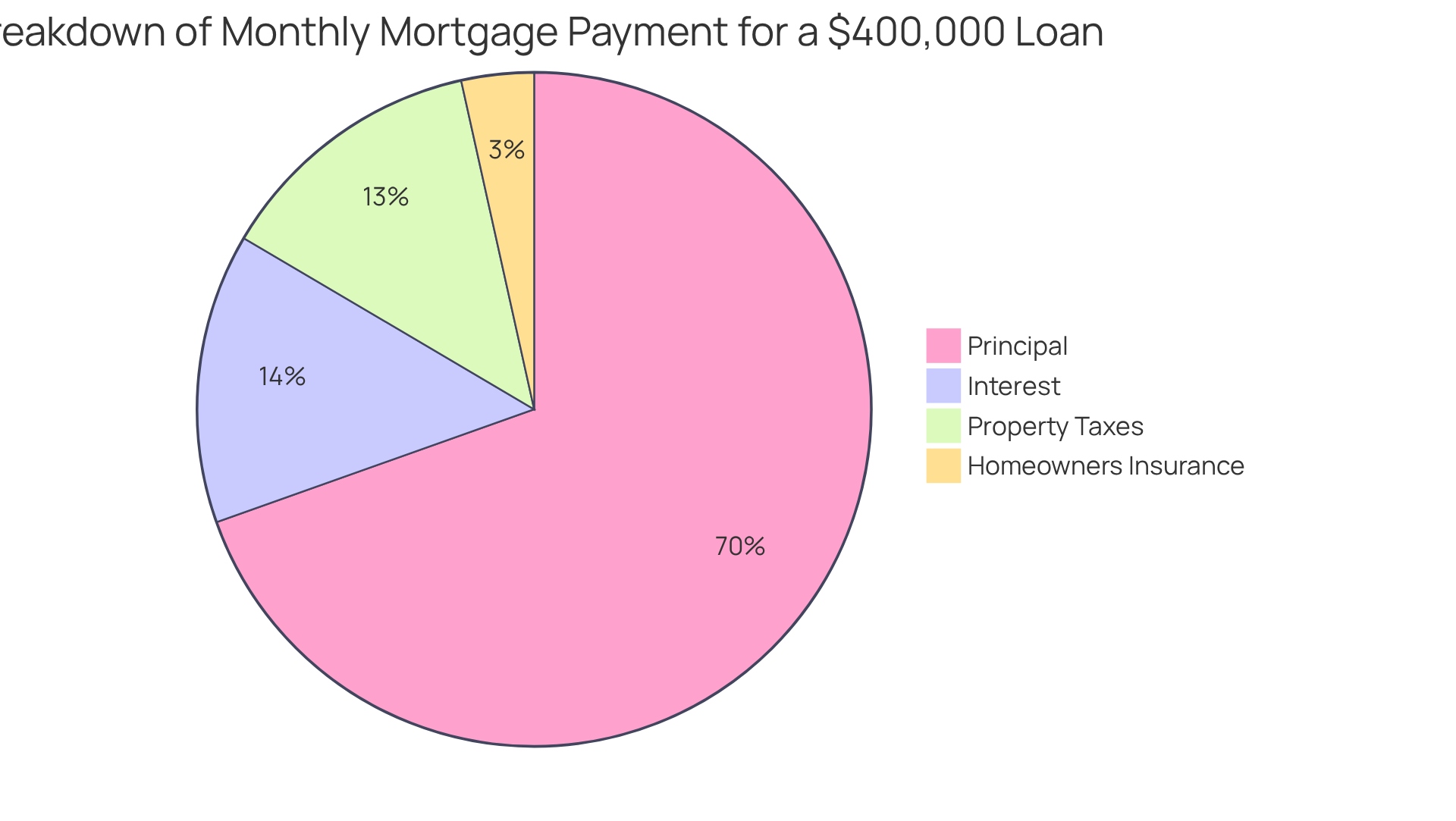

When considering a $400,000 loan, it’s important to understand the four key elements involved in a 400k mortgage payment: principal, interest, property taxes, and homeowners insurance. The principal is simply the amount borrowed, while the interest represents the cost of borrowing that money. Property taxes, assessed by local governments, can vary significantly based on your location, and homeowners insurance serves to protect your valuable investment. We know how challenging this can be, and understanding these components is essential for effective budgeting and financial planning as you take on a mortgage of this size. Moreover, it’s crucial to recognize that these factors can change over time, impacting your overall financial structure.

For instance, in 2025, the average property tax percentage in the U.S. is around 1.1%. This can significantly influence your monthly costs. Let’s take a look at a real-world budgeting example for a $400,000 loan: assuming a 30-year fixed-rate loan at an interest rate of 4%, your monthly obligation for the 400k mortgage payment would be approximately $1,909. By adding an estimated $367 for property taxes and $100 for homeowners insurance, your total monthly payment, including the 400k mortgage payment, would amount to around $2,376. This example illustrates the when preparing for a loan, ensuring that you are well-prepared for your financial obligations.

At F5 Mortgage LLC, we are dedicated to enriching your experience with our commitment to client satisfaction, boasting a customer satisfaction level of 94%. Our streamlined application process allows you to apply for home purchases or refinancing quickly, with the promise of pre-approval in under an hour. Additionally, our customized loan consultations empower you to navigate the intricacies of loan obligations with professional advice, ensuring you feel knowledgeable and supported throughout your financing journey.

Analyze Key Factors Affecting Your Monthly Payment

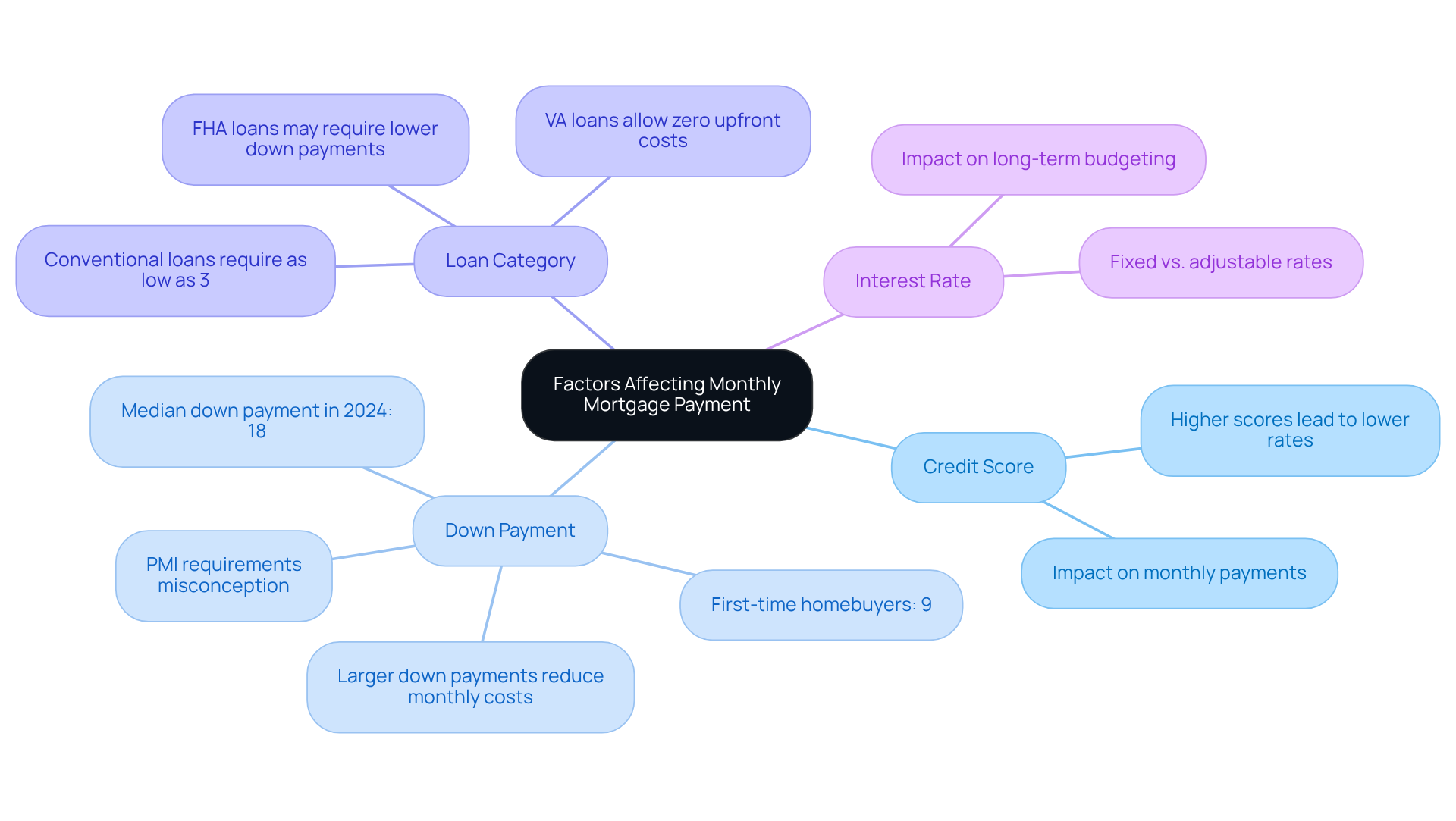

Understanding the factors that influence your 400k mortgage payment on a $400,000 loan can feel overwhelming, but we’re here to support you every step of the way. Here are several key elements to consider:

- Credit Score: We know how challenging it can be to manage your credit score. A higher score typically leads to lower interest rates, which can significantly reduce your monthly payment. In 2025, borrowers with excellent credit may find offers that are much more favorable than those available to individuals with weaker credit histories.

- Down Payment: The upfront amount you contribute is crucial. It affects your loan-to-value ratio, which in turn determines your interest rate and whether you’ll need to pay private mortgage insurance (PMI). In 2024, the median down payment was 18%, but first-time homebuyers often succeeded with as little as 9%. This flexibility allows many to enter the market sooner. However, larger initial contributions can lead to lower monthly expenses, potentially reducing the cost of a 400k mortgage payment and decreasing overall interest fees. It’s important to recognize that many consumers mistakenly believe a 20% down payment is necessary due to PMI requirements for traditional financing.

- Loan Category: Different borrowing categories, such as FHA, VA, and conventional loans, come with unique terms that can impact your financial situation. For instance, FHA loans may require a lower initial contribution but could involve higher insurance costs. On the other hand, VA loans often allow for zero upfront costs, making them an attractive option for qualified veterans.

- Interest Rate: The choice between fixed and adjustable-rate loans can greatly influence your repayment structure. Fixed rates offer stability, while adjustable rates may provide lower initial payments but can increase over time, affecting your long-term budgeting.

By comprehending these factors, you can tailor your financing strategy, ensuring you make informed choices that align with your financial goals. With a of 94%, F5 Mortgage is committed to delivering exceptional service, and most agreements finalize in under three weeks, making the process efficient and reliable.

Calculate Your Monthly Payment: A Step-by-Step Guide

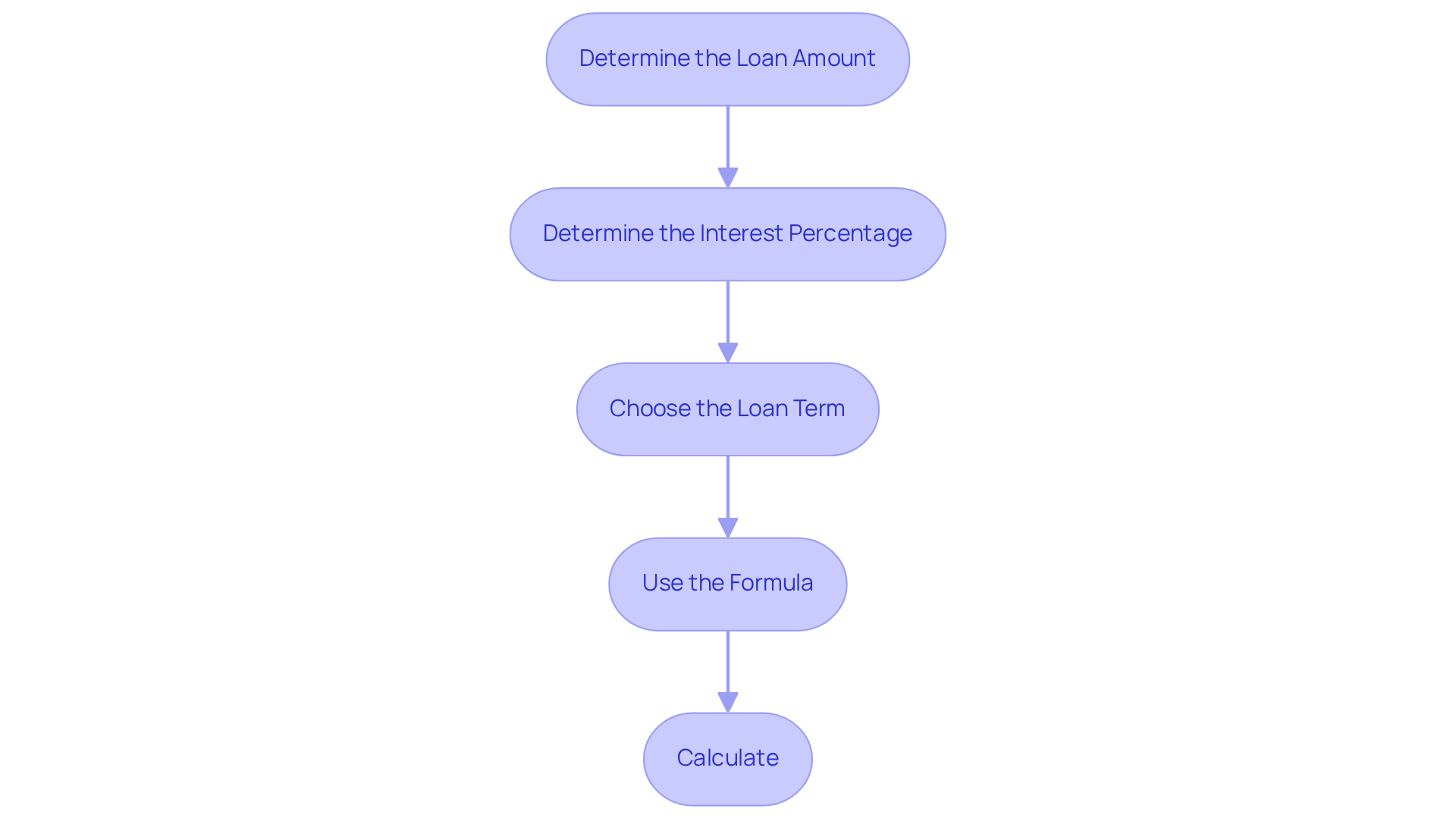

Calculating your monthly mortgage payment for a 400k mortgage payment can feel overwhelming, but we’re here to guide you through it step by step.

- Determine the Loan Amount: Start with the total loan amount you’re considering.

- Determine the Interest Percentage: Look for the current market rate for your type of financing. This can significantly impact your monthly payments.

- Choose the Loan Term: Common terms are 15 or 30 years. Think about what works best for your financial situation.

- Use the Formula: To calculate your monthly payments, use this formula:

M = P[r(1 + r)^n] / [(1 + r)^n - 1]

Where:

- M = total monthly mortgage payment

- P = the principal loan amount

- r = monthly interest rate (annual rate divided by 12)

- n = number of payments (loan term in months)

- Calculate: Now, plug in your numbers to find M. This will give you a clear picture of your monthly obligation. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Evaluate Loan Terms and Interest Rates: Making Informed Choices

When evaluating loan terms and interest rates, we know how challenging this can be. Several critical factors deserve your attention:

- Fixed vs. Adjustable Rates: Fixed-rate mortgages provide stability, ensuring your interest rate remains constant throughout the loan term. This predictability not only assists in budgeting but also safeguards you against rising costs. Conversely, adjustable-rate mortgages (ARMs) may present lower initial costs, yet they carry the risk of increased expenses over time due to periodic rate changes, as highlighted in the case study ‘Understanding Adjustable Rate Mortgages (ARMs).’

- Borrowing Period: The length of your borrowing period significantly influences your financial responsibilities. Shorter borrowing terms typically result in higher monthly payments but lower overall interest expenses. For instance, a home financing option may amortize over a period of 25 or 30 years, allowing you to choose based on your financial strategy. A 25-year loan may present a different financial profile compared to a 30-year loan.

- Prepayment Penalties: Some financing agreements may include prepayment penalties, fees charged for settling the debt early. Understanding these penalties is crucial, as they can impact your long-term financial strategy, especially if you anticipate refinancing or selling your home before the loan matures. It’s important to be aware that some mortgage agreements might include these penalties, significantly affecting your financial planning.

- Discount Points: Paying discount points upfront can effectively lower your interest rate, making this option beneficial for those planning to stay in their home long-term. Approximately 65% of FHA borrowers, 62% of VA borrowers, and 57% of homebuyers with conventional loans chose to pay discount points, reflecting a trend among families seeking to reduce their monthly payments.

By carefully evaluating these factors, you can make informed choices that align with your financial goals. Remember, we’re here to support you every step of the way, ensuring that your mortgage strategy is both effective and sustainable.

Conclusion

Understanding the complexities of a $400,000 mortgage payment is essential for anyone looking to navigate the housing market effectively. We know how challenging this can be. By grasping the key components—principal, interest, property taxes, and homeowners insurance—borrowers can make informed decisions that align with their financial goals. This knowledge not only aids in budgeting but also empowers individuals to take control of their mortgage journey.

Throughout the article, we’ve discussed various factors influencing a $400,000 mortgage payment, including:

- The impact of credit scores

- Down payments

- Loan categories

- Interest rates

Each of these elements plays a significant role in determining monthly obligations and overall financial health. Additionally, the step-by-step guide to calculating monthly payments provides a practical framework for prospective homeowners to assess their financial commitments accurately.

Ultimately, being well-informed about mortgage payments is crucial for securing a sustainable financial future. As interest rates fluctuate and loan options evolve, staying educated on these factors can lead to better financial decisions. Taking proactive steps—such as consulting with mortgage professionals and evaluating loan terms—can significantly enhance the home-buying experience. Remember, we’re here to support you every step of the way, ensuring that each choice made is a step toward long-term financial stability.

Frequently Asked Questions

What are the four key elements involved in a $400,000 mortgage payment?

The four key elements are principal, interest, property taxes, and homeowners insurance. The principal is the amount borrowed, interest is the cost of borrowing that money, property taxes are assessed by local governments, and homeowners insurance protects your investment.

How can property taxes affect my monthly mortgage payment?

Property taxes can vary significantly based on your location. For instance, in 2025, the average property tax percentage in the U.S. is around 1.1%, which can significantly influence your monthly costs.

What would be an example of a monthly payment for a $400,000 mortgage?

Assuming a 30-year fixed-rate loan at an interest rate of 4%, the monthly obligation for the mortgage payment would be approximately $1,909. When adding an estimated $367 for property taxes and $100 for homeowners insurance, the total monthly payment would be around $2,376.

How does F5 Mortgage LLC support clients in the mortgage process?

F5 Mortgage LLC is committed to client satisfaction, with a customer satisfaction level of 94%. They offer a streamlined application process for home purchases or refinancing, with pre-approval in under an hour. Additionally, they provide customized loan consultations to help clients navigate loan obligations with professional advice.