Introduction

Navigating the world of home financing can feel overwhelming, especially for veterans and service members eager to make the most of their hard-earned benefits. We understand how challenging this can be. The VA loan cash-out refinance offers a unique opportunity to tap into your home equity, providing families with the financial flexibility they need for renovations, debt consolidation, or educational expenses.

But you might be asking yourself: what are the essential steps and potential pitfalls in this process? This guide is here to help. We’ll delve into the intricacies of VA cash-out refinancing, empowering you to make informed decisions that can maximize your financial well-being. Together, we can navigate this journey and ensure you feel supported every step of the way.

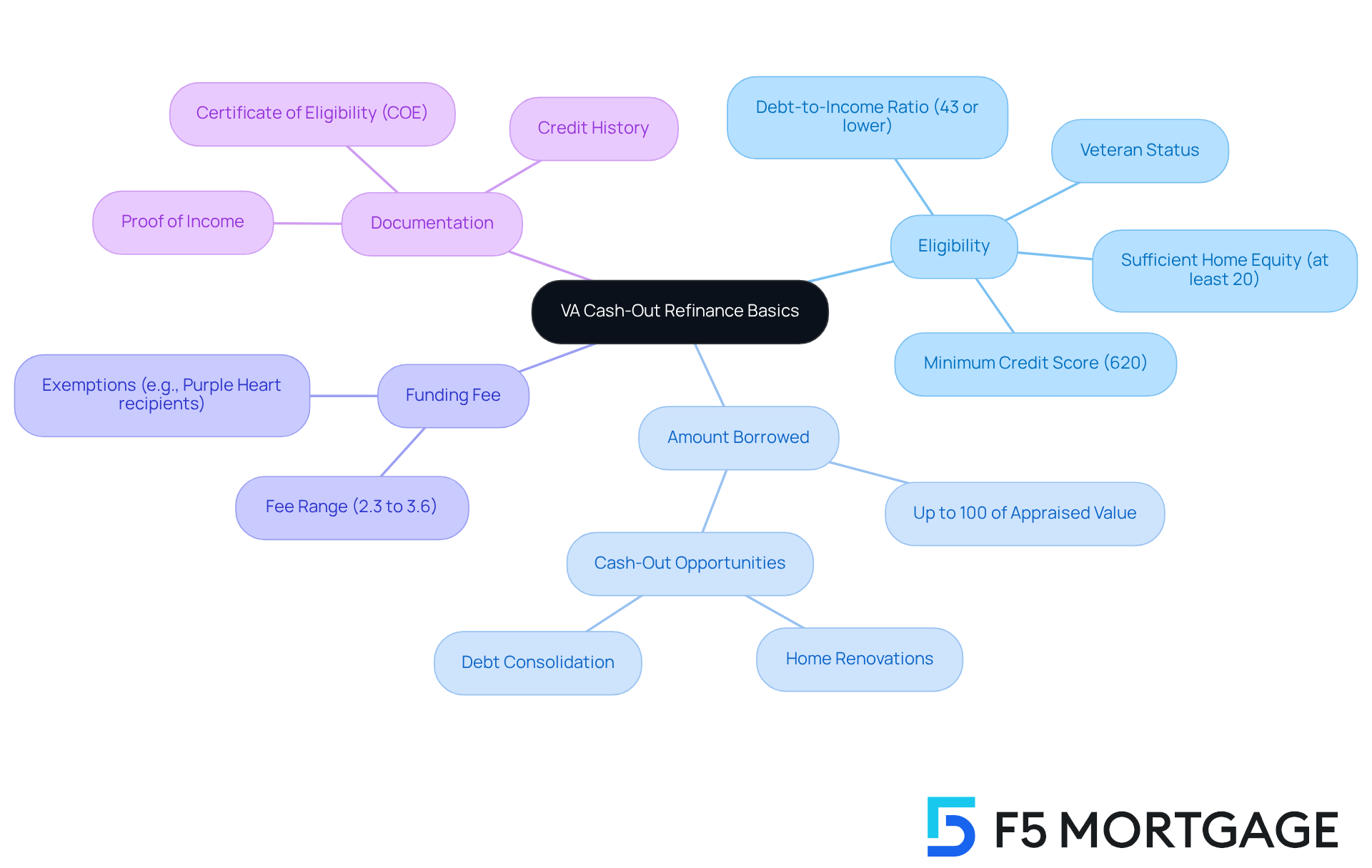

Understand VA Cash-Out Refinance Basics

A VA loan cash out refinance can be a valuable opportunity for qualified veterans and service members, allowing them to replace their current mortgage with a larger amount and tap into the equity they’ve built in their homes. Let’s explore the key components you should consider:

Eligibility: To qualify, you need to be a veteran, an active-duty service member, or a qualifying surviving spouse. One of the most significant benefits of VA financing is that it doesn’t require a down payment. You’ll need to have sufficient equity in your property, typically at least 20%. A minimum credit score of around 620 is also necessary, along with a debt-to-income (DTI) ratio of 43% or lower.

Amount Borrowed: With this new financing, you can borrow up to 100% of your property’s appraised value, minus any outstanding mortgage balance. This opens up substantial cash-out opportunities, which can be incredibly helpful for various financial needs, like home renovations or consolidating debt.

Funding Fee: Keep in mind that a VA funding fee usually applies, which can be included in the amount borrowed. This fee varies based on your service history and whether it’s your first VA financing, ranging from 2.3% to 3.6%. Some veterans, such as Purple Heart recipients, may be exempt from this fee, making the VA loan an appealing option for many.

Documentation: Important documents include your Certificate of Eligibility (COE), proof of income, and credit history. Understanding these requirements is crucial for a smooth application process, ensuring you can navigate the loan modification journey effectively.

By grasping these fundamentals, families can approach the refinancing process with confidence, maximizing the benefits of the VA loan cash out refinance option. The funds from this refinance can be used for various purposes, including renovations, debt repayment, or even education. We know how challenging this can be, but we’re here to support you every step of the way.

Follow the Step-by-Step Refinancing Process

Completing a VA loan cash out refinance can feel overwhelming, but we’re here to support you every step of the way. By following these steps, you can navigate the process with confidence and ease:

Check Your Eligibility: First, ensure you meet the VA’s eligibility criteria. This includes your service history and a credit score typically starting at 620. It’s also important to confirm that you have enough equity in your home.

Gather Necessary Documentation: Next, collect essential documents like your Certificate of Eligibility (COE), recent pay stubs, W-2s, tax returns, and any other financial records your lender may need. This preparation is crucial for a smooth application process.

Choose a Lender: Take the time to research and select a VA-approved lender. Create a shortlist of potential lenders, comparing rates, terms, and customer reviews. Remember, shopping around can help you secure the most favorable terms for your situation.

Submit Your Application: Once you’ve chosen a lender, complete the application and provide all required documentation. Be prepared to answer questions about your financial history, as this will help the lender evaluate your application accurately.

Home Appraisal: The lender will order an appraisal to determine your home’s current market value. This step is vital for assessing how much equity you can access through the VA loan cash out refinance option.

Underwriting Process: After the appraisal, your application will go through underwriting. Here, the lender evaluates your financial situation alongside the appraisal results. This process typically takes 30 to 45 days, depending on various factors.

Finalization: If approved, you’ll receive a closing disclosure detailing the final terms of your financing. Review this document carefully before signing. After signing, you will obtain your cash-out total through a VA loan cash out refinance, which can be utilized for various purposes, such as debt consolidation or home improvements.

By following these steps, families can simplify their loan modification process and minimize potential delays, ensuring a smoother transition to their new loan. We know how challenging this can be, but with the right guidance, you can achieve your financial goals.

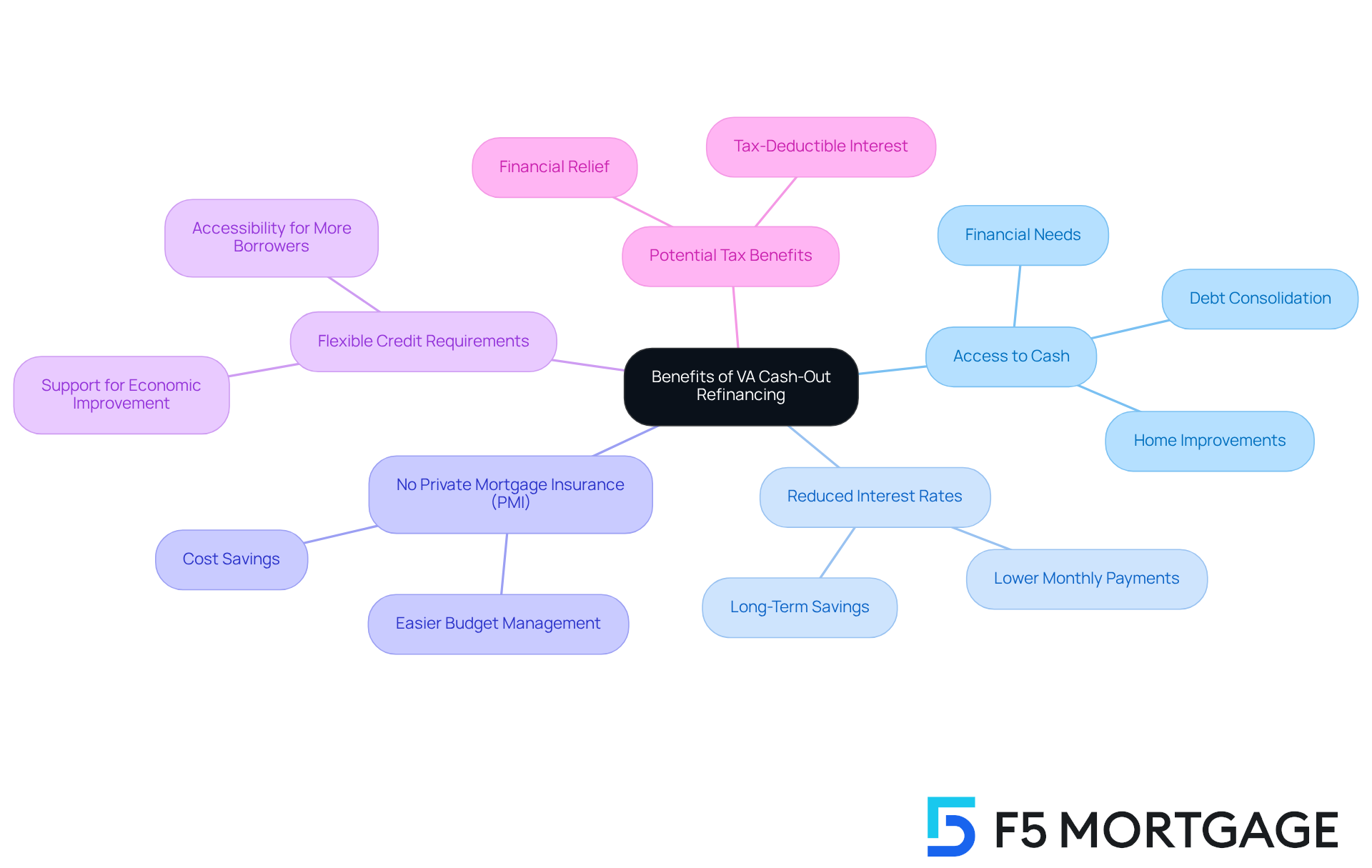

Explore Benefits of VA Cash-Out Refinancing

VA cash-out refinancing offers several compelling advantages for eligible borrowers, and we know how important it is to make informed financial decisions.

Access to Cash: This option allows homeowners to tap into their home equity, providing funds for essential home improvements, debt consolidation, or other financial needs. For instance, veterans can access up to 100% of their home’s appraised value, making it a powerful tool for financial management. Imagine being able to finally tackle those home projects you’ve been putting off or consolidating debt to ease your monthly budget.

Reduced Interest Rates: VA mortgages typically provide lower interest rates than traditional mortgages, leading to significant savings throughout the duration of the mortgage. In 2025, VA rates remain competitive, often lower than those of conventional mortgage products, enhancing affordability for families. This means more money in your pocket for what truly matters.

No Private Mortgage Insurance (PMI): Unlike traditional financing options, VA programs do not require PMI, which can save borrowers hundreds of dollars each month. This feature significantly reduces the overall cost of homeownership, making it easier for families to manage their budgets. Think about how much easier it would be to save for your family’s future without that extra expense.

Flexible Credit Requirements: VA loans typically have more lenient credit requirements, allowing families with less-than-perfect credit histories to qualify. This flexibility can be essential for those aiming to enhance their economic status without the burden of stringent credit checks. We understand that life can throw challenges your way, and we’re here to support you every step of the way.

Potential Tax Benefits: The interest paid on a VA mortgage may be tax-deductible, providing extra monetary relief. This possible advantage can further improve the appeal of VA cash-out loan options for families aiming to optimize their economic situation. Every little bit helps, right?

However, it’s essential to understand that a seasoning period of at least six months of consecutive payments on the current mortgage is typically necessary before obtaining a new loan. While cash-out loan restructuring can offer considerable advantages, it’s vital to refrain from utilizing the funds for unnecessary expenditures, as this can lead to economic instability. Additionally, borrowers should be aware of the VA funding fee related to cash-out loans, which can increase the total expense.

These benefits, combined with a careful approach to utilizing home equity, make a VA loan cash out refinance a strategic option for families looking to improve their financial well-being and invest in their properties. Take the time to explore your options and see how this could work for you!

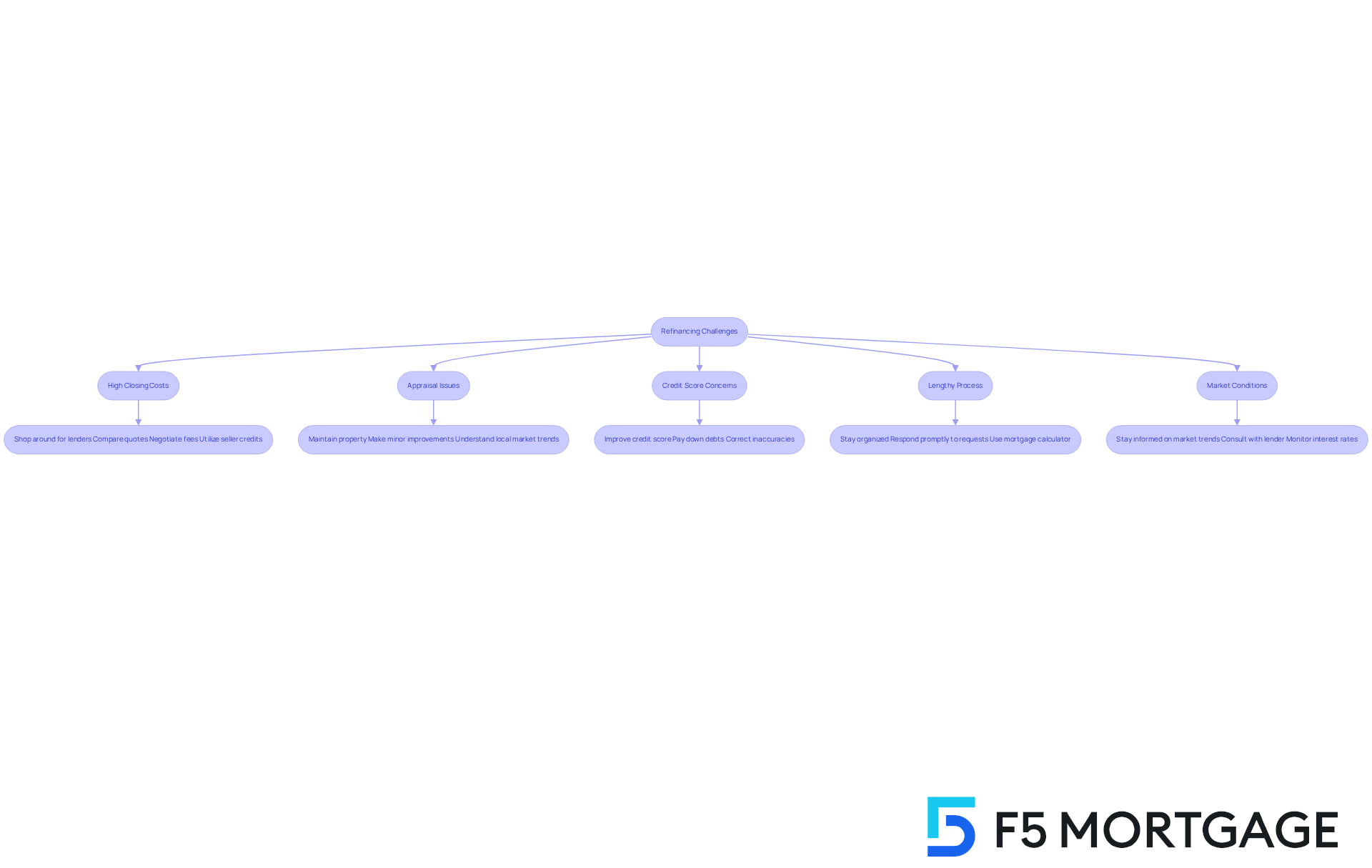

Overcome Common Refinancing Challenges

Families looking to utilize a VA loan cash out refinance option often face several challenges. We know how overwhelming this process can be, but with the right strategies, you can navigate these hurdles effectively:

High Closing Costs: Cash-out refinancing usually comes with higher closing costs, typically between 2% to 5% of the loan amount. To ease this burden, it’s wise to shop around for lenders, compare quotes, and negotiate fees. You might also consider utilizing seller credits to help cover some of these costs, reducing your out-of-pocket expenses. With the current favorable mortgage rates in Colorado, families can find competitive offers that help mitigate these costs.

Appraisal Issues: One significant concern is the risk of appraisals coming in lower than expected, which can limit the cash available for withdrawal. Statistics show that a notable percentage of appraisals for a VA loan cash out refinance may fall short of expectations. To prepare, ensure your property is well-maintained and consider making minor improvements that could boost its value before the appraisal. Understanding local market trends, like the 3.4% increase in appraised values in Colorado, can also help you set realistic expectations.

Credit Score Concerns: A strong credit score is crucial for securing favorable loan terms. If your score is below the typical threshold of 620, take proactive steps to improve it before applying. This might include paying down existing debts and correcting any inaccuracies on your credit report, which can significantly enhance your borrowing potential.

Lengthy Process: The loan modification process can take anywhere from 30 to 45 days, influenced by factors like appraisal scheduling and lender responsiveness. Staying organized and promptly responding to your lender’s requests can help streamline this timeline, ensuring a smoother experience. Tools like the F5 Mortgage calculator can assist families in comparing rates and finding the best options for loan restructuring.

Market Conditions: Interest rates can fluctuate, impacting the overall cost of restructuring debt. Staying informed about market trends and consulting with your lender can help you pinpoint the best time to refinance, potentially leading to significant savings. Present mortgage rates for 30-year and 15-year fixed loans in Colorado have decreased, creating a favorable moment for adjusting loans compared to the national average. Additionally, families should be mindful of rising property taxes and insurance costs in Colorado, which can affect their overall financial situation.

By anticipating these challenges and preparing accordingly, families can navigate the refinancing process with greater ease and confidence. Remember, we’re here to support you every step of the way, helping you achieve your financial goals.

Conclusion

Navigating the VA loan cash-out refinance process can be a significant opportunity for veterans and service members. We understand how important it is to access the equity in your home to meet various financial needs. By grasping the eligibility criteria, necessary documentation, and the step-by-step process, families can effectively leverage this financial tool.

Key insights from the guide reveal the benefits of VA cash-out refinancing. Imagine having access to cash for home improvements, enjoying lower interest rates, and not having to worry about private mortgage insurance. However, we know that challenges can arise, such as high closing costs, appraisal issues, and credit score concerns. But don’t worry—there are practical strategies to help you overcome these obstacles. By following the outlined steps and staying informed, families can simplify their refinancing journey and truly maximize the advantages of their VA loan.

Ultimately, the VA loan cash-out refinance isn’t just a financial transaction; it’s a strategic move towards enhancing your economic stability and achieving long-term goals. It’s crucial for eligible borrowers to explore their options, understand the implications of their decisions, and take action to secure a brighter financial future. Embracing this opportunity can lead to significant benefits, making it a worthwhile consideration for families looking to improve their financial well-being. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a VA cash-out refinance?

A VA cash-out refinance allows qualified veterans and service members to replace their current mortgage with a larger amount and access the equity built in their homes.

Who is eligible for a VA cash-out refinance?

Eligibility includes veterans, active-duty service members, or qualifying surviving spouses. Applicants must have sufficient equity in their property, typically at least 20%, a minimum credit score of around 620, and a debt-to-income (DTI) ratio of 43% or lower.

How much can I borrow with a VA cash-out refinance?

You can borrow up to 100% of your property’s appraised value, minus any outstanding mortgage balance, allowing for significant cash-out opportunities.

Is there a funding fee associated with a VA cash-out refinance?

Yes, a VA funding fee usually applies and can be included in the amount borrowed. This fee ranges from 2.3% to 3.6% depending on your service history and whether it’s your first VA financing. Some veterans, like Purple Heart recipients, may be exempt from this fee.

What documentation is required for a VA cash-out refinance?

Important documents include your Certificate of Eligibility (COE), proof of income, and credit history. Understanding these requirements is essential for a smooth application process.

What can the funds from a VA cash-out refinance be used for?

The funds can be used for various purposes, including home renovations, debt repayment, or education.