Overview

Navigating the journey of paying off your home loan can feel overwhelming, but we’re here to support you every step of the way. This article serves as a compassionate guide on how to effectively use a Paying Off Home Loan Early Calculator. By doing so, you can save on interest and expedite your loan repayment, ultimately easing your financial burden.

To get started, gather your loan information. We know how challenging this can be, but having the right details at hand will empower you. Next, input your data into the calculator. This step is crucial as it allows you to visualize potential savings and repayment timelines.

As you evaluate the outcomes, consider the challenges that may arise. Prepayment penalties and budget constraints are important factors to keep in mind. By acknowledging these hurdles, you can make informed decisions that best suit your financial situation.

Remember, the goal is to empower you as a homeowner. With the right tools and knowledge, you can take control of your mortgage journey and work towards a more secure financial future.

Introduction

Navigating the complexities of home loan repayment can often feel daunting. We understand how challenging this can be. However, the right tools can transform this challenge into an opportunity for significant financial savings. A paying off home loan early calculator serves as a powerful ally for homeowners, revealing potential interest savings and strategies for quicker repayment through additional contributions.

As you explore this valuable resource, you might wonder: what hidden challenges could undermine your efforts to achieve financial independence sooner? Understanding the nuances of this calculator is essential for making informed decisions that align with your long-term financial goals. We’re here to support you every step of the way.

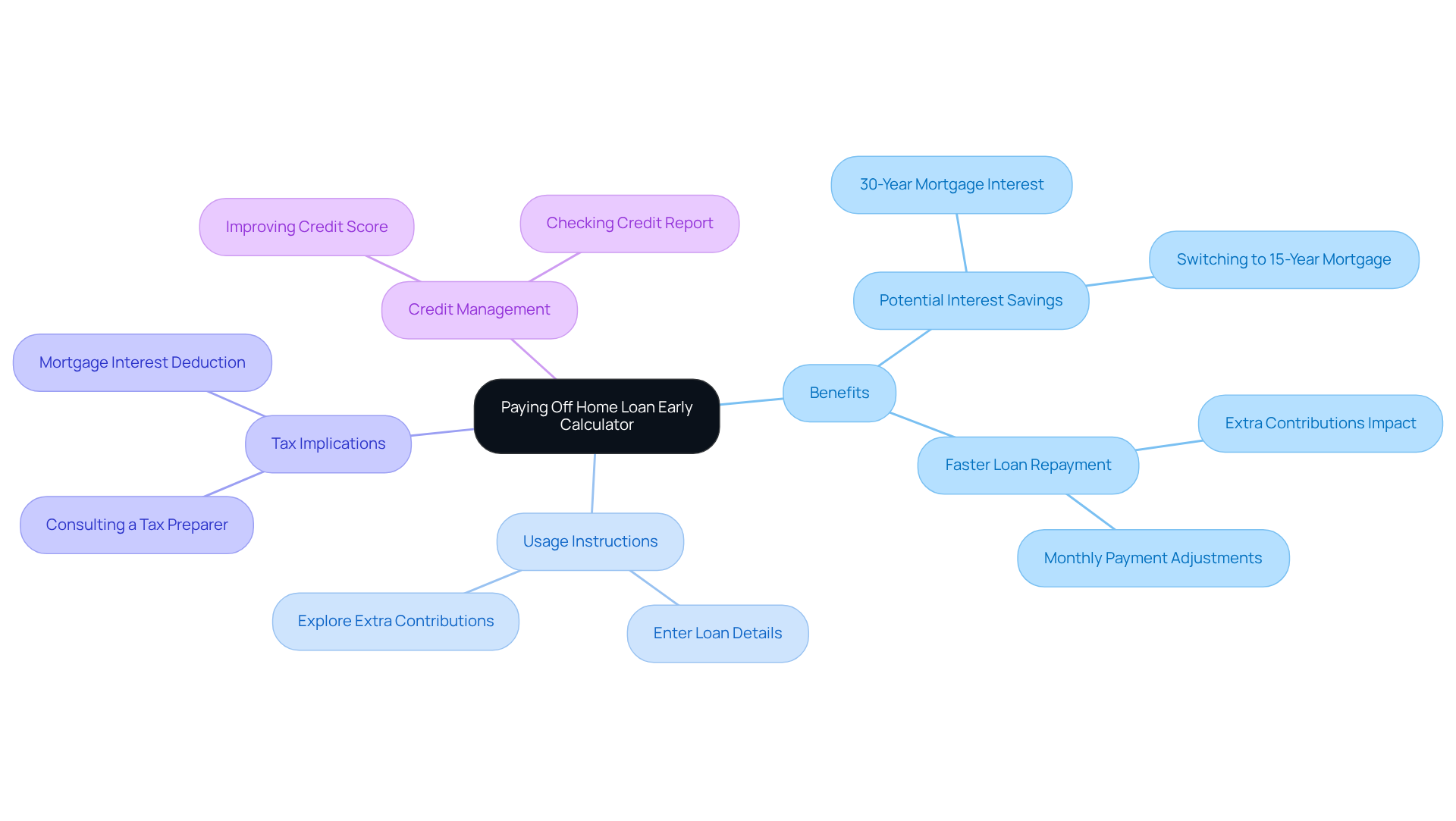

Understand the Purpose of a Paying Off Home Loan Early Calculator

A paying off home loan early calculator can be an essential resource for homeowners, assisting you in discovering potential interest savings and developing a strategy for quicker loan repayment through extra contributions. By entering important details like your current loan balance, interest rate, and the extra amounts you wish to contribute, you can truly see how your financial decisions can make a difference. This calculator not only sheds light on possible savings but also empowers you to take control of your loan repayment strategy, bringing you closer to financial independence sooner than you might think.

Most importantly, many loans do not have prepayment penalties, which means you can make extra payments without incurring any fees. We understand that navigating these options can feel overwhelming, so consulting with a tax preparer can help you understand the tax implications of paying off your loan. To make the most of homeownership, it’s often advised to hold onto your home for at least five years, as this allows for better equity growth and market stability.

Additionally, improving your credit score is essential for expanding your borrowing options. Consider obtaining a copy of your credit report to check for errors, reduce any existing debts, and manage your credit wisely. Understanding these aspects is crucial for effectively using the paying off home loan early calculator to reach your financial goals. Remember, we’re here to support you every step of the way as you work towards a more secure financial future.

Step-by-Step Instructions for Using the Calculator

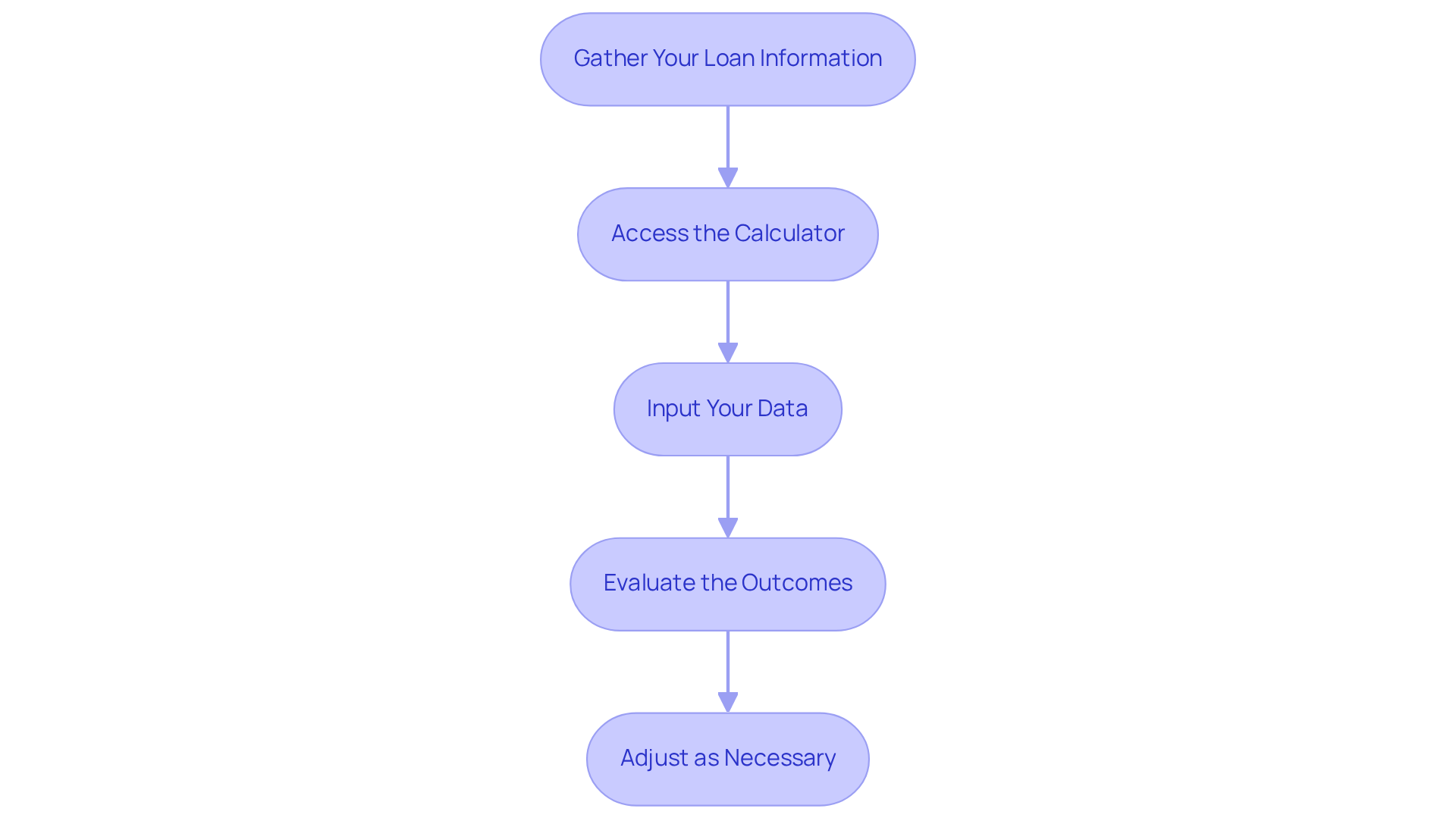

To effectively utilize a Paying Off Home Loan Early Calculator, let’s walk through these streamlined steps together:

-

Gather Your Loan Information: Begin by collecting essential details such as your current loan balance, interest rate, and remaining term. We know how challenging this can be, but having this information is crucial for accurate calculations and will help you understand your monetary position better.

-

Access the Calculator: Visit a reputable loan calculator website. You can find these on financial institution platforms or specialized loan sites. These tools, such as the paying off home loan early calculator, are designed to provide precise insights into your loan repayment options, making the process easier for you.

-

Input Your Data: Enter your current mortgage balance, interest rate, and the number of months remaining on your loan. Don’t forget to include any extra monthly contribution you plan to make. This data will empower the calculator to generate tailored results just for you.

-

Evaluate the Outcomes: Click the ‘Calculate’ button to discover how much interest you can save and how many months you can shorten your loan duration by making additional contributions. Understanding these results can greatly influence your budgeting strategies and help you feel more in control.

-

Adjust as Necessary: Feel free to experiment with various extra payment amounts to see their effects on your overall savings and payoff timeline. This flexibility allows you to customize a strategy that fits your budget and aligns with your long-term financial goals.

By following these steps, property owners can gain valuable insights into their loan repayment strategies with the help of a paying off home loan early calculator. We’re here to support you every step of the way, ultimately leading to more informed financial decisions.

Identify Common Challenges and Considerations in Early Payoff Calculations

When utilizing a Paying Off Home Loan Early Calculator, it’s important to consider several challenges and factors that may arise:

-

Prepayment Penalties: Many loan agreements include terms that impose penalties for early repayment. For instance, a homeowner might consider using a paying off home loan early calculator to see that they could face a charge of 2% of the outstanding amount if they pay off their loan ahead of schedule. We know how challenging this can be, so it’s essential to review your loan paperwork carefully to avoid unexpected costs that could diminish the benefits of settling your debt earlier.

-

Budget Constraints: While making extra payments can lead to significant savings over time—potentially saving a homeowner $184,000 in interest over the life of a $240,000 mortgage—it’s crucial to ensure your budget can handle these additional expenses. We understand that many homeowners face financial limitations, and prioritizing loan obligations should not compromise your overall economic stability.

-

Interest Rate Variability: For those with adjustable-rate loans, fluctuations in interest rates can significantly impact repayment calculations. Being mindful of potential rate changes is vital, as they can alter the anticipated savings from early repayment. As money specialist Rachel Cruze wisely points out, “A biweekly installment plan can be a good idea—but never pay extra charges to enroll in one.”

-

Opportunity Cost: Think about whether the funds you allocate for extra loan payments might yield better returns if invested elsewhere, like in retirement accounts or other investment opportunities. For example, investing in a retirement account might provide greater returns than the interest saved by paying off the home loan early. We encourage you to weigh these options carefully to determine the most effective use of your resources.

-

Emotional Factors: The desire to achieve a debt-free status can sometimes lead to impulsive decisions. Did you know the average millionaire pays off their house in just 10.2 years? This can serve as a motivational benchmark. However, it’s important to evaluate your financial situation comprehensively before committing to an early payoff strategy, ensuring it aligns with your long-term economic goals.

By addressing these considerations, homeowners can make informed decisions using a paying off home loan early calculator to maximize their financial outcomes while minimizing potential pitfalls. Remember, we’re here to support you every step of the way.

Conclusion

Using a paying off home loan early calculator is a powerful strategy for homeowners who want to take charge of their financial future. This tool not only offers insights into potential interest savings but also empowers individuals to create a tailored repayment plan that aligns with their financial goals. By understanding how to effectively use this calculator, homeowners can make informed decisions that may lead to significant savings and a quicker path to financial independence.

We know how challenging it can be to navigate this process. Throughout the article, we emphasized the importance of gathering accurate loan information, being aware of potential prepayment penalties, and considering the impact of budget constraints and interest rate variability. Additionally, we highlighted the emotional factors that can influence decisions around early repayment. It’s crucial for homeowners to evaluate their overall financial situation before committing to an early payoff strategy. By addressing these challenges, individuals can maximize the benefits of the calculator while avoiding common pitfalls.

The journey towards paying off a home loan early is not just about crunching numbers; it’s about making strategic financial decisions that can lead to long-term stability and peace of mind. As homeowners explore the advantages of using a paying off home loan early calculator, we encourage them to weigh their options carefully, consult with financial professionals when necessary, and remain focused on their broader financial objectives. Taking proactive steps today can pave the way for a more secure and debt-free tomorrow.

Frequently Asked Questions

What is the purpose of a paying off home loan early calculator?

A paying off home loan early calculator helps homeowners discover potential interest savings and develop a strategy for quicker loan repayment through extra contributions.

What information do I need to use the calculator?

You need to enter your current loan balance, interest rate, and the extra amounts you wish to contribute.

What benefits does using the calculator provide?

The calculator shows possible savings and empowers you to take control of your loan repayment strategy, helping you work towards financial independence sooner.

Are there any penalties for making extra payments on my loan?

Many loans do not have prepayment penalties, allowing you to make extra payments without incurring any fees.

Should I consult a professional when considering paying off my loan early?

Yes, consulting with a tax preparer can help you understand the tax implications of paying off your loan.

How long should I ideally hold onto my home?

It’s often advised to hold onto your home for at least five years to allow for better equity growth and market stability.

Why is it important to improve my credit score?

Improving your credit score is essential for expanding your borrowing options and managing your finances effectively.

What steps can I take to manage my credit wisely?

Consider obtaining a copy of your credit report to check for errors, reduce any existing debts, and manage your credit effectively.