Overview

Navigating the no appraisal home equity loan process can feel overwhelming for families. We understand how challenging this can be, and we’re here to support you every step of the way. This option allows you to access your home equity without the need for a formal property evaluation, which can be a significant relief.

One of the key benefits is the potential for faster approval and cost savings. Imagine being able to tap into your home’s value quickly, providing financial flexibility when you need it most. However, it’s important to be aware of the potential drawbacks. Higher interest rates and stricter qualification criteria may come into play, so it’s essential to weigh these factors carefully.

In conclusion, this financial option offers a comprehensive way to access your home equity. By understanding both the benefits and potential challenges, you can make an informed decision that best suits your family’s needs.

Introduction

Homeowners today are increasingly seeking efficient ways to access their home equity. No appraisal home equity loans present a compelling solution that can truly make a difference. This innovative financial product allows families to bypass the traditional appraisal process, offering quicker access to funds for home improvements or unexpected expenses.

However, we know how challenging this can be. With the benefits come potential hurdles, such as stricter qualification criteria and higher interest rates. How can families navigate this process effectively to ensure they make the best financial decision for their future?

We’re here to support you every step of the way as you explore your options.

Define No Appraisal Home Equity Loans

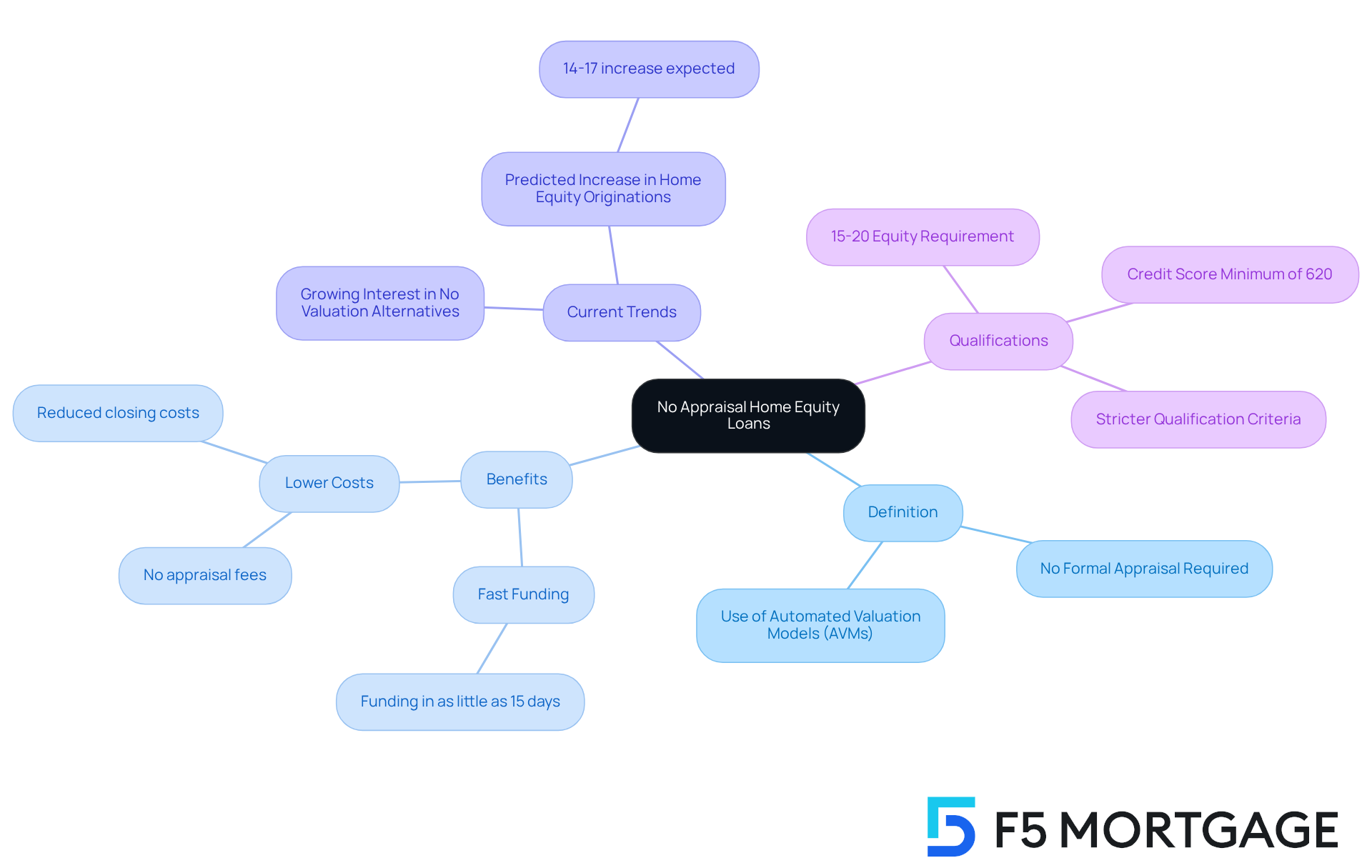

No appraisal home equity loans offer a wonderful opportunity for homeowners to tap into their home equity without the need for a formal evaluation. Instead of relying on traditional methods, lenders often use automated valuation models (AVMs) or previous evaluations to determine property value. This streamlined approach is particularly beneficial for families seeking quick access to funds, as it bypasses the lengthy and costly evaluation process. Generally, these financial agreements require borrowers to have a minimum of 15-20% stake in their properties, making them accessible to many homeowners.

Current trends indicate a growing interest in no valuation alternatives. Experts observe that these financial products can significantly reduce closing times and upfront costs. For example, homeowners can often secure funding in as little as 15 days, which is crucial in today’s fast-paced real estate market. Furthermore, the average homeowner holds approximately $213,000 in equity, providing a substantial financial cushion for those looking to fund home improvements or other expenses.

We understand how challenging navigating these options can be, which is why seeking advice from a mortgage expert is so important. While these loans offer convenience, they may come with stricter qualification criteria and potentially higher interest rates. Case studies reveal that families have successfully used no assessment property financing to support new property acquisitions or renovations, showcasing their practical advantages in real-life situations. Overall, the no appraisal home equity loan presents a compelling option for families aiming to access their home equity efficiently and effectively, and we’re here to support you every step of the way.

Evaluate Pros and Cons of No Appraisal Loans

Evaluate Pros and Cons of No Appraisal Loans

Pros:

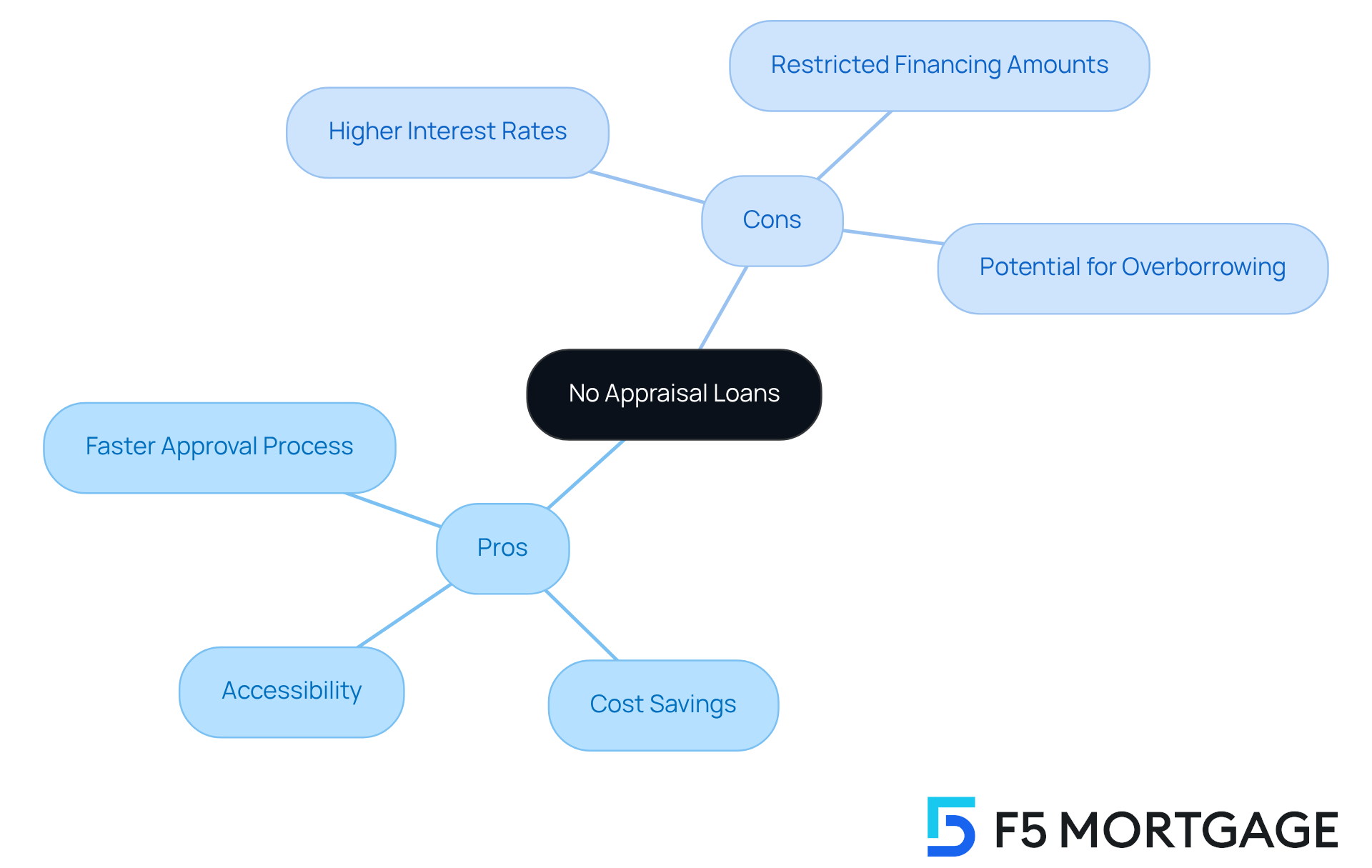

- Faster Approval Process: We understand that time is often of the essence, especially for families needing quick access to funds. A no appraisal home equity loan can significantly speed up the approval process, often reducing it to just a few days.

- Cost Savings: For those on a budget, avoiding appraisal fees—which typically range from $200 to $700—can lead to meaningful savings. By skipping this step, families looking to manage their finances wisely find a no appraisal home equity loan to be an attractive option.

- Accessibility: Families with limited assets or those who have recently acquired their properties may find it easier to qualify for no-appraisal financing. These options often come with less stringent requirements, providing a more accessible pathway to funding.

Cons:

- Higher Interest Rates: It’s important to be aware that no-appraisal loans generally carry higher interest rates compared to traditional home equity loans. This is due to the increased risk lenders face when they lack a thorough evaluation of the property’s value.

- Restricted Financing Amounts: Without an official evaluation, lenders may limit financing amounts. This can restrict your financial choices, making it essential to understand the implications of this limitation.

- Potential for Overborrowing: We know how challenging it can be to navigate financial decisions. The absence of a formal evaluation raises the risk of borrowing more than the property is worth, which can lead to financial strain, especially if property values decline. It’s crucial for borrowers to carefully assess their financial situation before proceeding.

Understand Qualification Requirements and Application Process

Borrowers typically need to meet several key requirements to qualify for a no appraisal home equity loan, which can feel overwhelming. We understand how challenging this can be, so let’s break it down together:

- Sufficient Home Equity: Most lenders require at least 15-20% equity in your home. This is calculated by subtracting your mortgage balance from the home’s current value. For example, if your property is assessed at $250,000 with a $200,000 loan, you would possess $50,000 in ownership stake, which equals 20%. Knowing your equity can empower you in this process.

- Good Credit Score: A credit score of 620 or higher is often necessary, although some lenders may accept lower scores based on other financial strengths. In 2025, borrowers with scores in the low- to mid-600 range may face challenges, but demonstrating strong income stability can improve your chances.

- Stable Income: Evidence of consistent income and employment is essential. Lenders look for reliable income sources to ensure you can meet your repayment obligations. We’re here to support you in showcasing your financial stability.

- Low Debt-to-Income Ratio: Lenders usually prefer a debt-to-income ratio of 43% or less. This indicates that you are not over-leveraged and can manage additional debt responsibly, helping you feel more secure in your financial decisions.

Application Process:

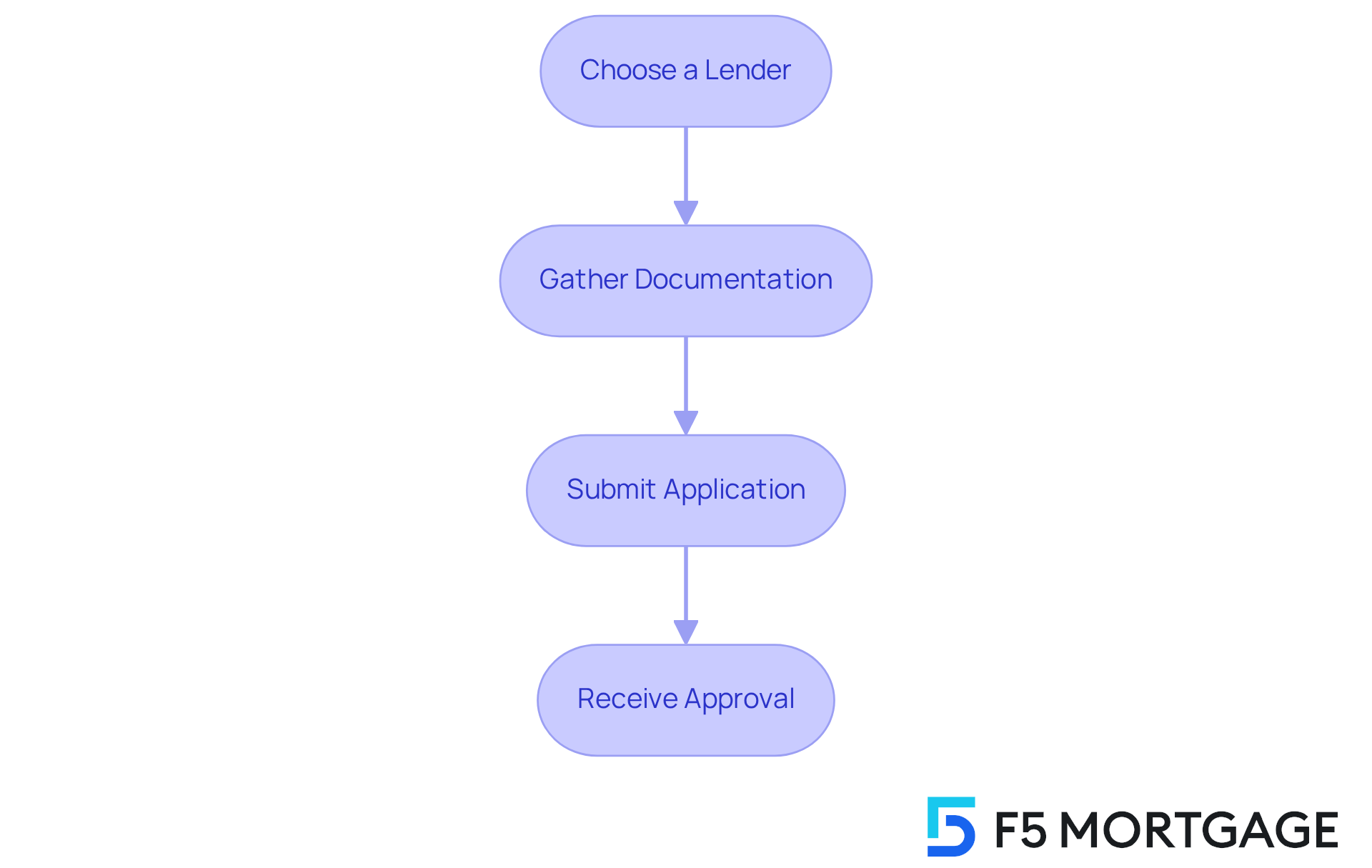

- Choose a Lender: Investigate and pick a lender that provides no assessment home equity financing. Focus on the no appraisal home equity loan options available through F5 Mortgage; we’re here to guide you through your alternatives.

- Gather Documentation: Prepare necessary documents, including proof of income, tax returns, and information about your property. This step is essential for a smooth application process, and we’re here to help you every step of the way.

- Submit Application: Complete the application online or in-person, ensuring all information is accurate. Some lenders may allow for a streamlined application process, skipping certain requirements like full in-person appraisals.

- Receive Approval: If authorized, examine the terms and conditions thoroughly before signing the contract. Approval times can differ, but choosing a no appraisal home equity loan can greatly shorten the timeline, often reducing two weeks or more from the typical approval process.

Grasping these criteria and the application procedure can enable you to make knowledgeable choices about utilizing your property value without the expense of conventional valuation fees. Remember, we’re here to support you throughout this journey.

Explore Alternatives to No Appraisal Home Equity Loans

If a no appraisal home equity loan isn’t the right fit, consider these alternatives:

-

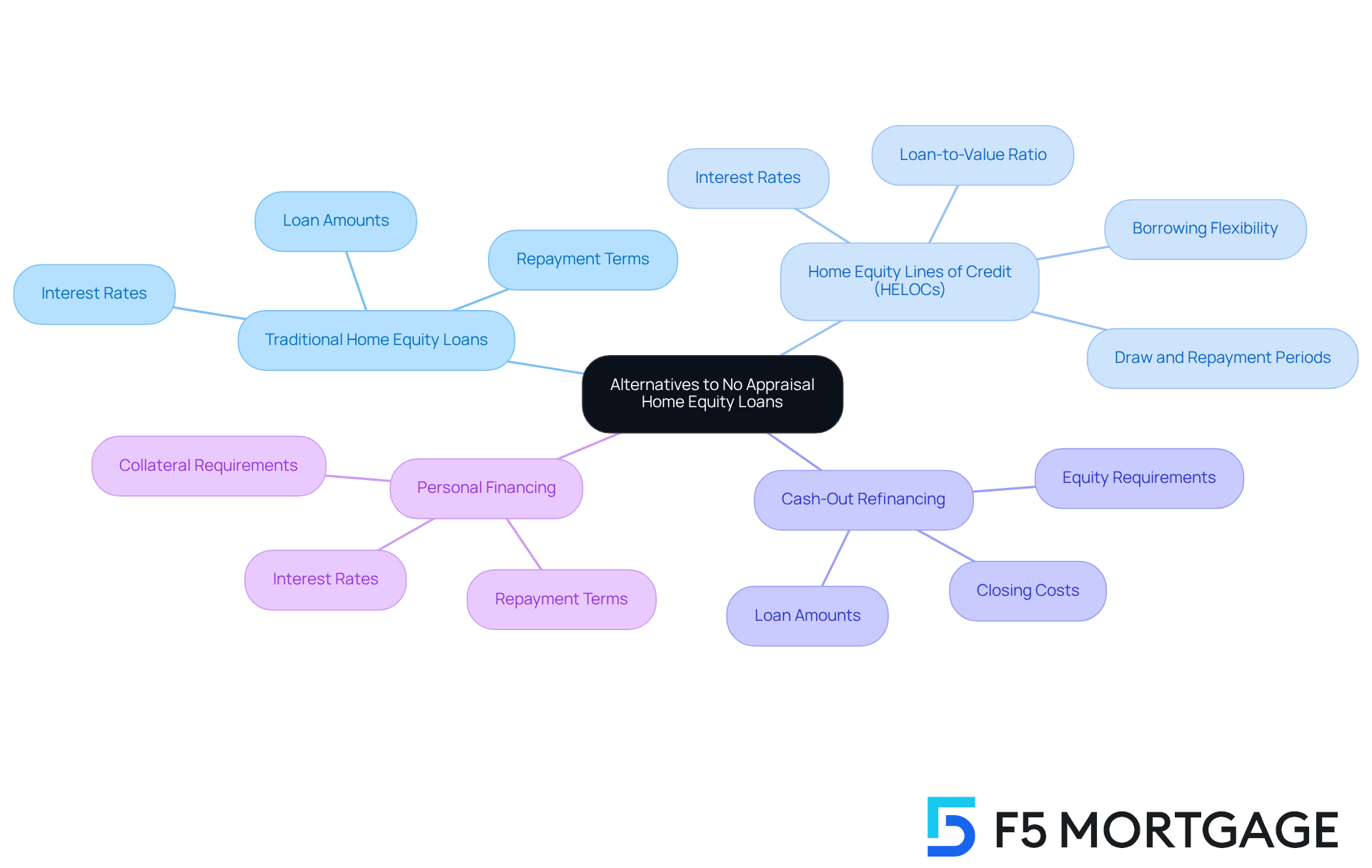

Traditional Home Equity Loans: These loans typically require a formal appraisal, which can take time and add to costs. However, they often offer lower interest rates and higher loan amounts. Home value loans provide a lump sum with fixed payments, simplifying budgeting for homeowners who know exactly how much they need.

-

Home Equity Lines of Credit (HELOCs): HELOCs allow homeowners to borrow against their equity as needed, offering flexibility in accessing funds. While they usually necessitate an evaluation, they function like a credit card with a revolving line of credit. This makes them suitable for ongoing expenses or projects. Borrowing limits are typically set at 80-85% of the home’s value, calculated through a combined loan-to-value ratio.

-

Cash-Out Refinancing: This option involves refinancing your existing mortgage for more than you owe, allowing you to take the difference in cash. Although it often requires an appraisal, cash-out refinancing can provide a larger sum of money, making it ideal for significant expenses or debt consolidation. Just remember, closing costs can vary from 2% to 6% of the borrowed amount.

-

Personal Financing: Unsecured personal financing does not require collateral, making it a quick way to obtain funds without putting your home at risk. However, these typically come with higher interest rates and shorter repayment terms, which can affect long-term financial planning. Personal loans are particularly useful for smaller projects or emergencies when home equity is insufficient.

In evaluating these options, we know how challenging this can be. Homeowners should consider their financial goals, the urgency of their funding needs, and the potential impact on their overall financial health. We’re here to support you every step of the way.

Conclusion

No appraisal home equity loans offer a valuable opportunity for families seeking to leverage their home equity without the stress of formal property evaluations. This streamlined approach not only speeds up the approval process but also reduces costs, making it an appealing option for those in need of quick financial relief. By understanding the nuances of these loans, families can navigate their choices effectively and make informed decisions that align with their financial goals.

Throughout this article, we have shared key insights regarding the benefits and drawbacks of no appraisal loans. The advantages include faster access to funds and significant cost savings, especially for families with limited resources. However, it is crucial to consider potential downsides, such as higher interest rates and the risk of overborrowing. We have also outlined the qualification requirements and application process to empower homeowners to approach this financing option with confidence.

Ultimately, the decision to pursue a no appraisal home equity loan should be made with careful consideration of your unique financial circumstances and goals. Exploring alternatives like traditional home equity loans, HELOCs, or personal financing can also provide valuable options. By staying informed and seeking expert guidance, families can maximize their home equity potential and effectively achieve their financial aspirations. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What are no appraisal home equity loans?

No appraisal home equity loans allow homeowners to access their home equity without a formal property evaluation. Lenders typically use automated valuation models (AVMs) or previous evaluations to determine property value.

What are the benefits of no appraisal home equity loans?

These loans provide quick access to funds, bypassing the lengthy and costly evaluation process. Homeowners can often secure funding in as little as 15 days, making them advantageous in a fast-paced real estate market.

What is the minimum equity stake required for these loans?

Generally, borrowers need to have a minimum of 15-20% stake in their properties to qualify for no appraisal home equity loans.

How much equity do homeowners typically have?

The average homeowner holds approximately $213,000 in equity, which can be a substantial financial resource for home improvements or other expenses.

Are there any drawbacks to no appraisal home equity loans?

While these loans offer convenience, they may come with stricter qualification criteria and potentially higher interest rates compared to traditional loans.

How can families benefit from no appraisal home equity loans?

Families have successfully used these loans to support new property acquisitions or renovations, demonstrating their practical advantages in real-life situations.

Why is it important to seek advice from a mortgage expert when considering these loans?

Navigating the options for no appraisal home equity loans can be challenging, and a mortgage expert can provide valuable advice to help homeowners make informed decisions.