Overview

This article aims to support you in navigating the refinancing process with confidence, focusing on how to effectively use a mortgage rate calculator. We understand how challenging this can be, and we want to emphasize the importance of accurate data input—such as your current mortgage balance, interest rates, and closing costs.

By providing a step-by-step guide along with common troubleshooting tips, we hope to empower you to make informed decisions.

Informed choices can lead to significant financial savings and better loan management. We’re here to support you every step of the way, ensuring that you feel equipped to tackle this process.

Let’s explore how you can leverage a mortgage rate calculator to achieve your refinancing goals.

Introduction

Understanding the intricacies of mortgage refinancing can feel overwhelming. We know how challenging this can be, especially when faced with fluctuating interest rates and complex financial jargon. That’s where mortgage rate calculators come in. These essential tools empower homeowners, helping to demystify their options and visualize potential savings.

However, with so many variables at play, how can you ensure you’re using these calculators effectively? This guide is here to support you every step of the way. We’ll delve into the art of mastering mortgage rate calculators, offering insights that will empower you to navigate refinancing with confidence and clarity.

Understand Mortgage Rate Calculators

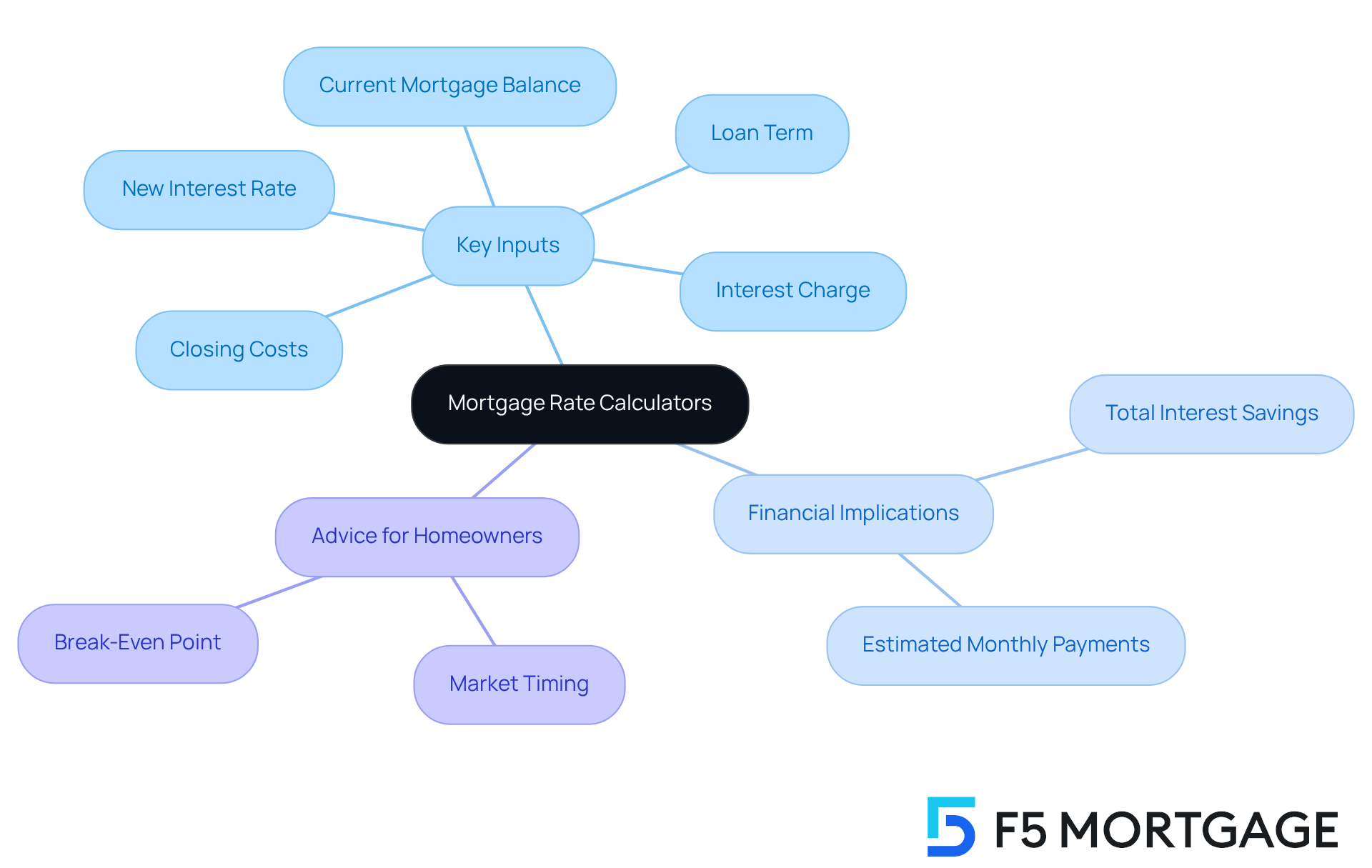

Loan interest estimators, such as the mortgage rate calculator refinance, serve as invaluable online tools, helping homeowners like you assess potential monthly payments and savings when considering loan restructuring. We understand that navigating this process can be overwhelming, so it’s essential to input accurate data to get the most out of these calculators. Here are the key inputs to consider:

- Current mortgage balance: This is the remaining amount owed on your existing mortgage.

- Interest charge: The current interest charge applicable to your existing mortgage.

- New interest rate: The rate you hope to secure through restructuring.

- Loan term: The length of the new loan, typically 15 or 30 years.

- Closing costs: These are the fees associated with refinancing, which can significantly impact your overall savings.

Understanding these inputs is crucial, as they directly influence the output of the mortgage rate calculator refinance, which usually includes estimated monthly payments and total interest savings over the life of the loan. For instance, even a slight reduction in the interest rate—from 6.19% to 6%—can save you hundreds of dollars each month. It’s vital to keep a close eye on these numbers.

Additionally, think about how long you plan to stay in your home before it pays off. Generally, owning your home for at least five years is recommended to ensure that the investment is worthwhile, though this can vary depending on market conditions and your personal situation.

Recent surveys indicate that around 74% of property owners utilize loan estimators when exploring financing options. This trend highlights the growing recognition of the importance of making informed decisions in today’s market, particularly as many feel constrained by high loan rates. Financial advisors emphasize that using a mortgage rate calculator refinance effectively can lead to better financial choices, ultimately enhancing stability and satisfaction in homeownership. As Loan Planner James Sahnger notes, “Understanding your loan options and using resources like calculators can empower homeowners to make informed decisions that align with their financial goals.”

By familiarizing yourself with these elements, including a detailed analysis of mortgage closing costs and how to determine your break-even point, you can approach the process with greater confidence and clarity. Remember, calculating your break-even point involves assessing your loan adjustment costs and comparing them to your monthly savings to see how long it will take to recoup those costs. Moreover, it’s essential to remember that trying to ‘time the market’ can lead to missed opportunities; instead, focus on your financial situation and the benefits of restructuring when the timing feels right.

Steps to Use a Mortgage Rate Calculator for Refinancing

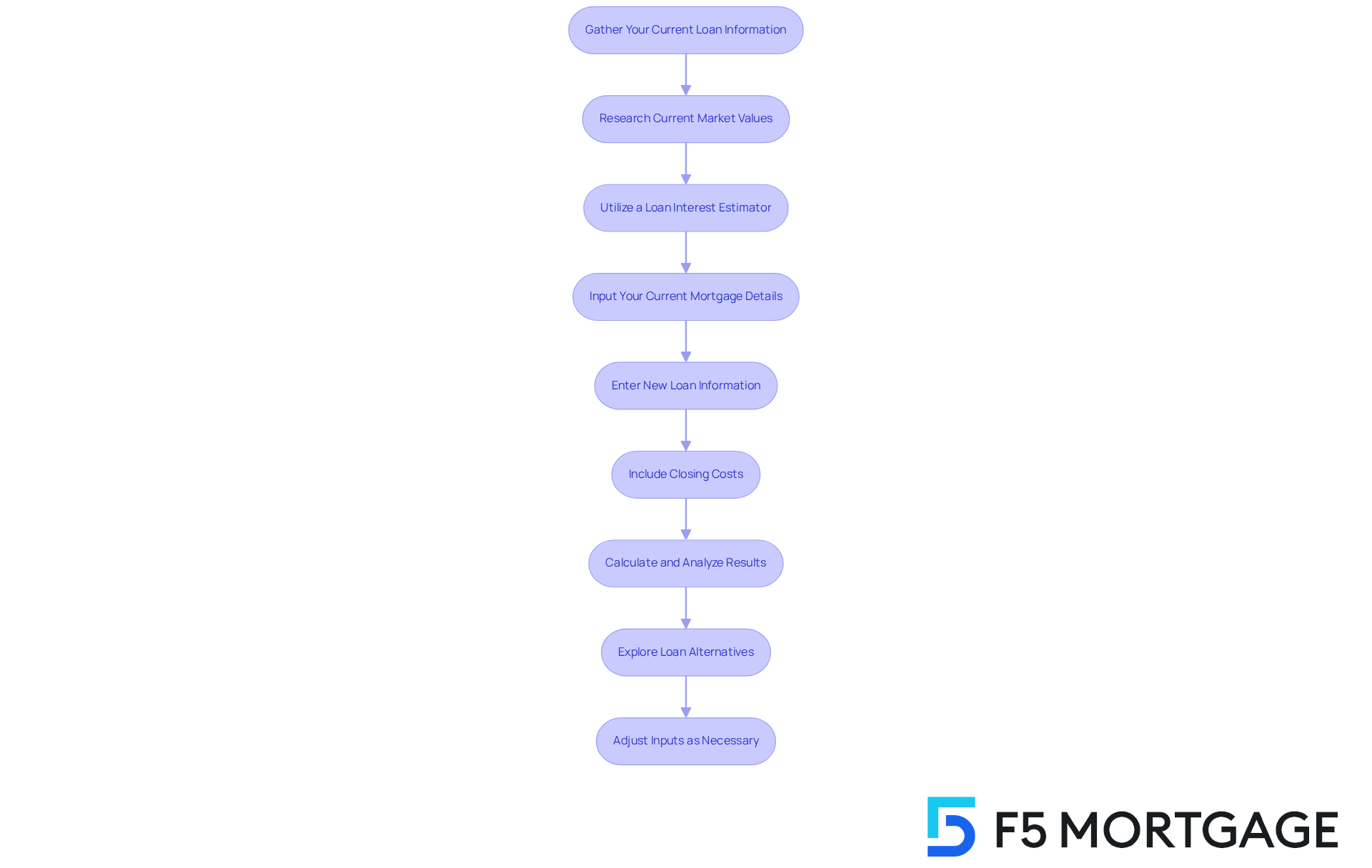

To effectively utilize a mortgage rate calculator for refinancing, we understand how important it is to follow these steps:

-

Gather Your Current Loan Information: Start by collecting essential details about your existing loan, including the current balance, interest percentage, and remaining term. We know how challenging this can be, but having this information at hand is crucial.

-

Research Current Market Values: Explore current loan costs to find competitive alternatives for refinancing. Resources such as Bankrate and Zillow can offer valuable insights into available prices.

-

Utilize a Loan Interest Estimator: Discover a trustworthy online loan interest estimator. Many banks and financial institutions provide these tools at no cost, making it easier for you to assess your options.

-

Input Your Current Mortgage Details: Enter your current mortgage balance, interest percentage, and remaining term into the calculator. This will set the stage for your refinancing journey.

-

Enter New Loan Information: Input the new interest percentage you anticipate securing and the desired loan term for the refinance. This is where you can start to visualize your potential savings.

-

Include Closing Costs: Consider estimated closing expenses, which generally consist of:

- Application fees ($75 to $500)

- Origination fees (0.5% to 1.5% of the loan amount)

- Credit report fees (around $35)

- Appraisal fees ($300 to $500)

- Title search and insurance (0.5% to 1% of the loan amount)

- Discount points (1% of the loan amount for a 0.25% interest decrease)

- Attorney fees ($500 or more)

- Survey fees ($150 to $400)

This will provide you with a clearer understanding of the total expenses related to loan restructuring.

-

Calculate and Analyze Results: Click the calculate button to view your estimated monthly payment and total savings. Take a moment to carefully review the results, noting how variations in rates and terms influence your payments. To identify your break-even point, divide your total restructuring costs by your monthly savings. For instance, if your loan restructuring expenses are $4,000 and your monthly savings are $100, your break-even point would be 40 months.

-

Explore Loan Alternatives: Consider the different loan alternatives available, such as conventional loans, FHA loans, and VA loans. Each option may provide various benefits depending on your unique financial situation.

-

Adjust Inputs as Necessary: Experiment with different scenarios by modifying the interest rate or loan term. See how these changes affect your monthly payment and overall savings. This flexibility can assist you in recognizing the most beneficial loan modification choice for your financial situation.

Statistics suggest that around 50% of homeowners refinance their loans each year, frequently aiming to reduce their monthly payments or tap into home equity. For example, a household moving to a bigger residence may utilize a loan interest tool to assess possible savings through restructuring, enabling them to direct additional resources toward their new home acquisition. Loan brokers suggest utilizing these tools as a best practice, with one expert stating, ‘Using a loan interest estimator helps borrowers comprehend their choices and possible savings, making the refinancing process less intimidating.’ By utilizing loan cost estimators, families improving their residences can make educated choices that correspond with their financial objectives.

Troubleshoot Common Issues with Mortgage Rate Calculators

When utilizing loan interest tools, various typical concerns may arise. Here’s how to troubleshoot them effectively:

-

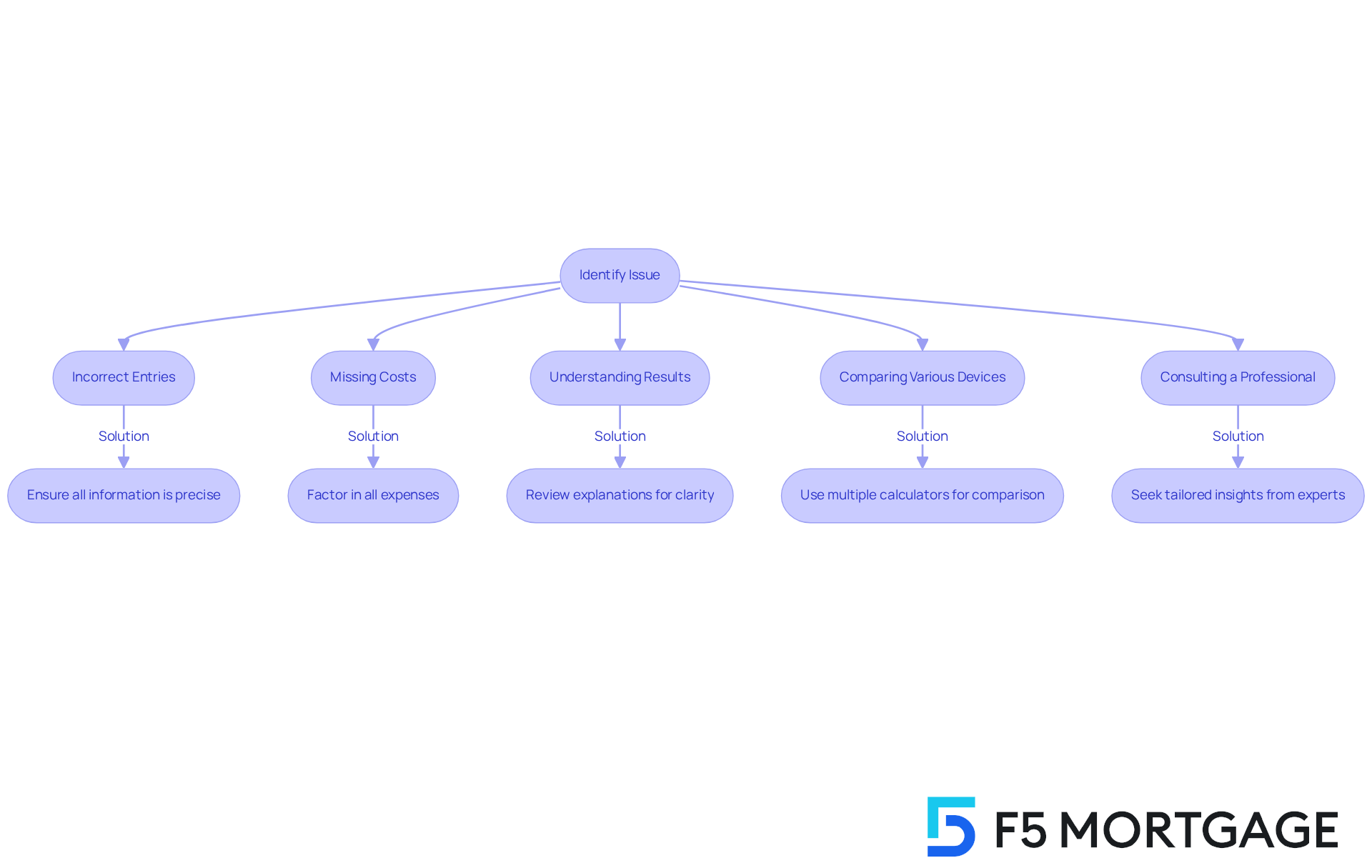

Incorrect Entries: We know how frustrating it can be when things don’t add up. Ensure that all information inputted into the device is precise. Double-check your current mortgage balance, interest rate, and other relevant figures. Even minor errors can lead to significant discrepancies in the results.

-

Missing Costs: Many tools neglect to automatically account for all expenses related to mortgage restructuring, such as closing fees, property taxes, and insurance. It’s crucial to factor these into your calculations when using a mortgage rate calculator refinance to gain a comprehensive view of your financial situation. For instance, property taxes can add hundreds of dollars to your monthly payment, while homeowners insurance premiums may also significantly impact your budget. Understanding the typical closing costs associated with refinancing—such as application fees (between $75 and $500), origination fees (0.5% to 1.5% of the loan amount), and appraisal fees (usually between $300 and $500)—can be facilitated by using a mortgage rate calculator refinance to help you prepare for the overall financial commitment.

-

Understanding Results: If the results appear confusing, take a moment to review what each figure represents. Look for explanations or guides offered by the device to clarify the outputs. This comprehension is crucial, as many computing devices do not consider factors such as credit history or job stability, which can influence your loan conditions. As financial specialists advise, “Many online tools only include three input fields: mortgage amount, interest rate, and number of years, which can lead to unrealistic expectations.” It’s also important to consider how different refinancing options—such as conventional loans, FHA loans, VA loans, or utilizing a mortgage rate calculator refinance—may impact your results.

-

Comparing Various Devices: Remember, not all devices are created equal. If you obtain inconsistent outcomes, try utilizing various computation tools from different sources to compare results and ensure precision. For instance, some calculators may only incorporate basic inputs such as loan amount and interest rate, while others offer a more comprehensive breakdown, including taxes and insurance. This comparison can help identify outliers and provide a more accurate estimate.

-

Consulting a Professional: If uncertainties persist regarding the results or their interpretation, consider reaching out to a loan broker or financial advisor who can help you understand how to use a mortgage rate calculator refinance. They can provide tailored insights and assist you in grasping the consequences of restructuring based on your distinct financial circumstances. Seeking advice from an expert is crucial, as they can elucidate the complete financial landscape and help you navigate the intricacies of loan restructuring. As one expert stated, “Consulting with a mortgage professional can offer personalized and precise information tailored to your financial situation.”

F5 Mortgage is here to support you every step of the way in navigating these challenges and finding the best refinancing options available in Colorado.

Conclusion

Mastering the use of a mortgage rate calculator is essential for homeowners seeking to refine their financial strategies through refinancing. We know how challenging this can be, but by understanding the inputs and processes involved, you can make informed decisions that align with your financial goals. The ability to accurately estimate potential savings and monthly payments can significantly impact your financial stability and satisfaction in homeownership.

Key insights discussed include:

- The importance of accurate data entry

- Considering closing costs

- Understanding your break-even point

Additionally, we’re seeing a growing trend of homeowners utilizing loan estimators to navigate the complexities of refinancing. These tools empower you to explore various loan options and make educated choices that suit your needs.

Ultimately, leveraging a mortgage rate calculator not only simplifies the refinancing process but also opens the door to potential savings and better financial outcomes. As you engage with these tools, remember to stay proactive in your financial planning. Consult with professionals when needed; we’re here to support you every step of the way. Embracing this approach can lead to smarter refinancing decisions, ultimately enhancing both your financial security and peace of mind.

Frequently Asked Questions

What is a mortgage rate calculator?

A mortgage rate calculator is an online tool that helps homeowners estimate potential monthly payments and savings when considering loan restructuring.

What key inputs should I provide when using a mortgage rate calculator?

The key inputs to consider are: current mortgage balance, interest charge on the existing mortgage, new interest rate, loan term (typically 15 or 30 years), and closing costs associated with refinancing.

Why is it important to input accurate data into the mortgage rate calculator?

Accurate data is crucial because it directly influences the output of the calculator, including estimated monthly payments and total interest savings over the life of the loan.

How can a slight reduction in interest rate affect monthly payments?

Even a slight reduction in the interest rate—from 6.19% to 6%—can save homeowners hundreds of dollars each month.

How long should I plan to stay in my home to ensure refinancing is worthwhile?

It is generally recommended to own your home for at least five years to ensure that the investment in refinancing is worthwhile, although this can vary based on market conditions and personal situations.

What percentage of property owners use loan estimators when exploring financing options?

Recent surveys indicate that around 74% of property owners utilize loan estimators.

How can using a mortgage rate calculator benefit homeowners?

Using a mortgage rate calculator can lead to better financial choices, enhancing stability and satisfaction in homeownership by empowering homeowners to make informed decisions that align with their financial goals.

What is the break-even point in mortgage refinancing?

The break-even point is calculated by assessing your loan adjustment costs and comparing them to your monthly savings to determine how long it will take to recoup those costs.

Should I try to time the market when considering refinancing?

It is essential to focus on your financial situation and the benefits of restructuring rather than trying to time the market, as doing so can lead to missed opportunities.