Overview

Navigating the mortgage process when purchasing a $400,000 home can feel overwhelming for many families. We know how challenging this can be, and that’s why it’s essential to understand the different types of mortgages available. By taking the time to calculate total costs and prepare for the application process, families can feel more confident and informed.

Key concepts such as:

- loan terms

- down payments

- the importance of comparing lenders

are crucial in this journey. Each of these elements plays a significant role in securing the best mortgage for your family’s needs. Remember, we’re here to support you every step of the way as you explore your options.

Ultimately, this article equips families with the knowledge they need to navigate the complexities of securing a mortgage effectively. By understanding these essential steps, you can approach the mortgage process with clarity and assurance, turning what may seem like a daunting task into a manageable and empowering experience.

Introduction

Navigating the complex world of mortgages can feel overwhelming, especially for families aiming to upgrade to a $400,000 home. We understand how challenging this can be. Grasping the nuances of various loan types, interest rates, and monthly payment calculations is essential for making informed decisions that align with your financial goals. With so much information available, how can families streamline the mortgage process and steer clear of common pitfalls? This guide delves into essential steps and strategies designed to empower families like yours to master the mortgage journey, ensuring you secure the best financing options for your dream home. We’re here to support you every step of the way.

Understand Mortgage Basics for a $400,000 Home

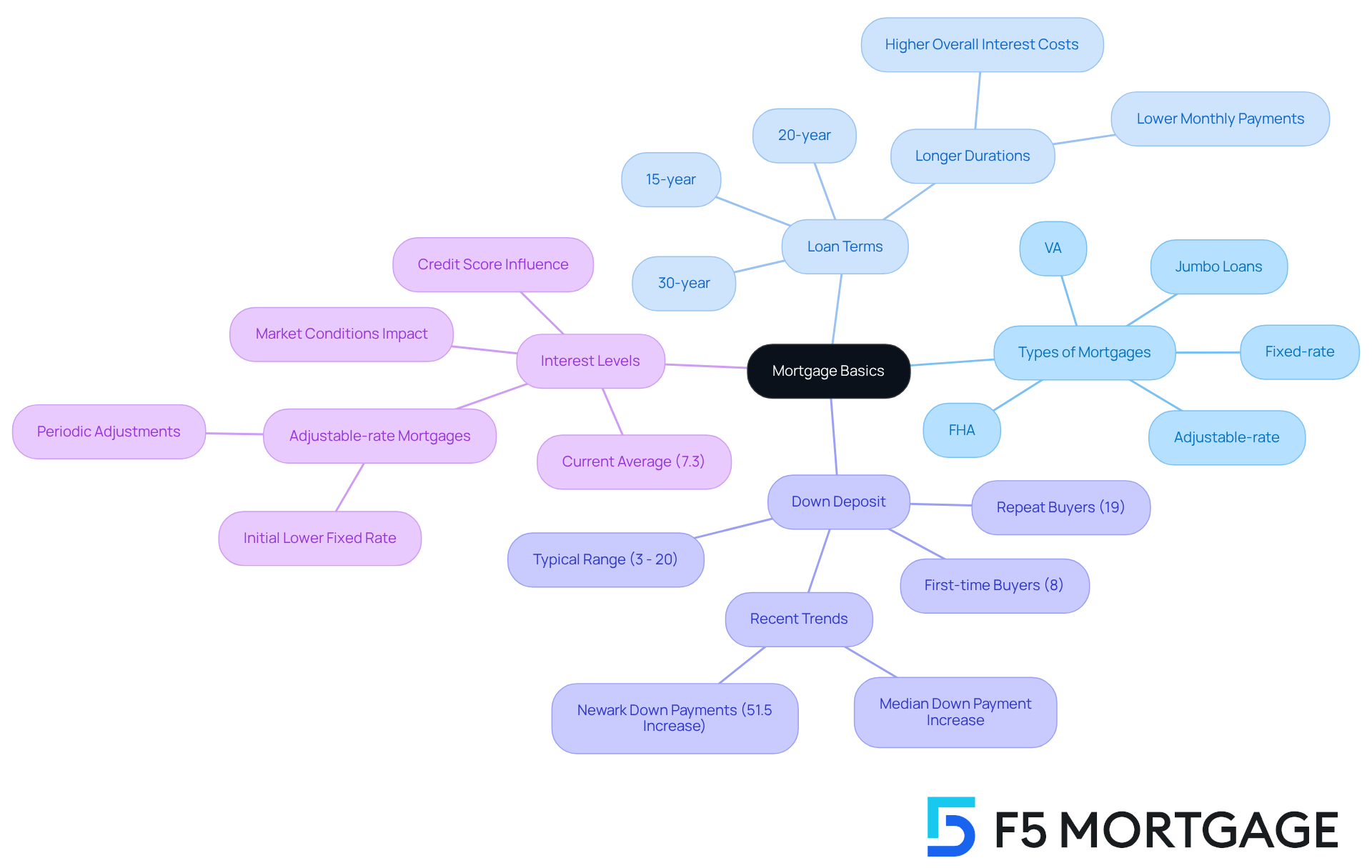

Understanding the loan process is essential for families who aspire to buy a home. This financial agreement is specifically designed for real estate transactions, with the property itself serving as security. Let’s explore some key concepts together:

- Types of Mortgages: It’s important to familiarize yourself with various mortgage options, including fixed-rate, adjustable-rate, FHA, VA, and jumbo loans. Each type presents distinct advantages and disadvantages based on your financial situation. For instance, fixed-interest mortgages offer stability with consistent monthly payments, while adjustable-interest mortgages (ARMs) may start with lower rates that change over time. ARMs generally feature an initial phase with a reduced interest rate, after which the interest adjusts according to market conditions, typically every six months. Interest adjustment caps are in place to help protect borrowers from significant rate increases.

- Loan Terms: Mortgages usually come in 15, 20, or 30-year terms. While longer durations typically lead to , they also mean higher overall interest costs throughout the life of the loan. For many families, a 30-year fixed-rate mortgage is often recommended due to its balance of affordability and predictability.

- Down Deposit: Most lenders require a down deposit, which can range from 3% to 20% of the home’s purchase price. For a mortgage on 400k, this means an initial contribution ranging from $12,000 to $80,000. Recent trends show that first-time buyers are making median down payments of around 8%, while repeat buyers are putting down approximately 19%.

- Interest Levels: Mortgage costs fluctuate based on market conditions, credit scores, and the type of loan. Currently, the typical interest for a 30-year fixed loan is around 7.3%, significantly higher than the lows seen in previous years. Understanding how these factors influence your loan is vital for making informed decisions. Furthermore, F5 Mortgage offers attractive pricing and exceptional service, helping families navigate these challenges with ease. As one satisfied customer shared, “The F5 Mortgage team made the process smooth and stress-free!”

By grasping these fundamentals, families can approach the loan process with greater confidence and clarity, ensuring they select the best financing options tailored to their needs.

Calculate Monthly Payments and Total Costs

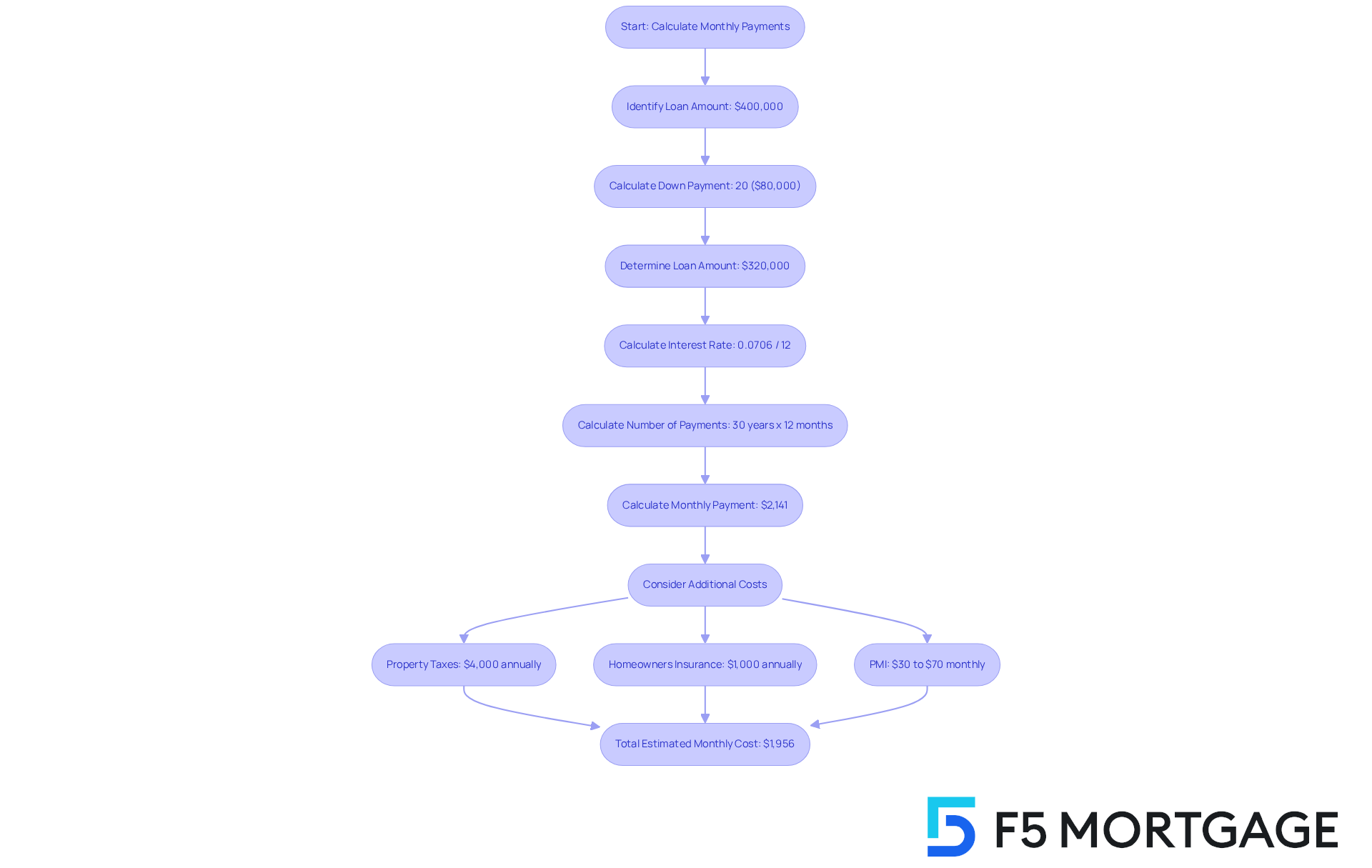

To determine your affordability, let’s start by calculating your estimated monthly mortgage on 400k. You can use this formula:

Monthly Payment = [Loan Amount x Interest Rate] / [1 – (1 + Interest Rate)^-Number of Payments]

For a $400,000 home with a 30-year fixed mortgage at a 7.06% interest rate, here’s how it breaks down:

- Loan Amount: $400,000 – Down Payment (20% down equals $80,000, resulting in a loan of $320,000)

- Interest Rate: 0.0706 / 12 (monthly)

- Number of Payments: 30 x 12 = 360 months

This results in a monthly principal and interest payment of approximately $2,141. However, we know how important it is to consider additional costs:

- Property Taxes: Typically around 1% of the home value annually, which would be about $4,000 for a $400,000 home.

- Homeowners Insurance: Costs vary by location and coverage, averaging around $1,000 annually.

- Private Mortgage Insurance (PMI): Necessary if your deposit is below 20%, costing between $30 and $70 monthly for every $100,000 borrowed.

When you include these expenses, the estimated total monthly housing cost with a mortgage on 400k increases to around $1,956. This covers principal, interest, property taxes, homeowners insurance, and PMI.

Using a loan calculator can simplify this process. By inputting your loan amount, interest percentage, and term, you can effortlessly see your projected monthly payment and overall expenses throughout the duration of the loan. This tool can assist you in budgeting efficiently for your home acquisition. Remember, we’re here to support you every step of the way.

Prepare for the Mortgage Application Process

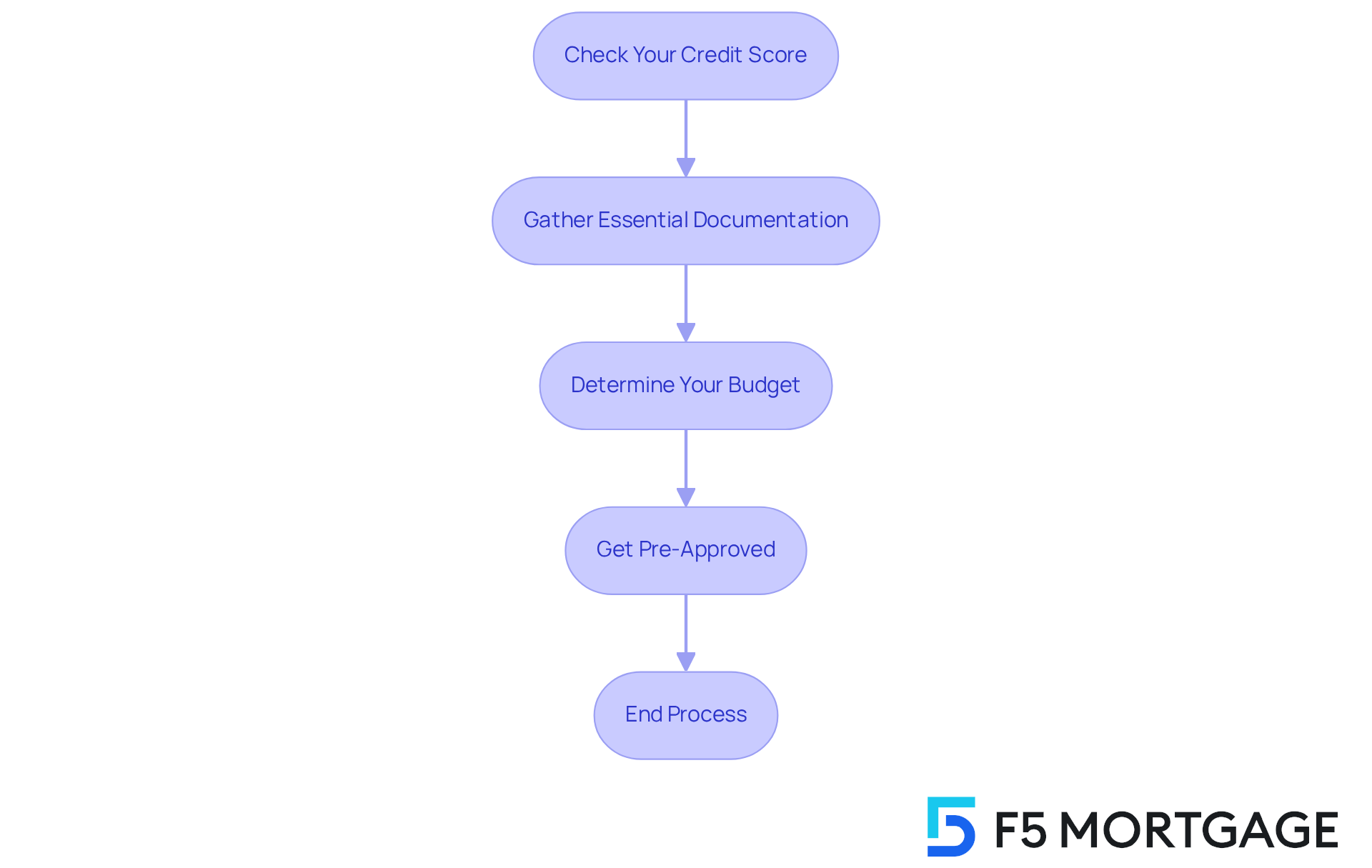

Preparing for your mortgage on 400k application can feel overwhelming, but we’re here to support you every step of the way. Consider these steps to make the process smoother:

Check Your Credit Score: Begin by obtaining your credit report to identify any errors. A strong credit score not only increases your chances of loan approval but also opens the door to better interest rates. We know how challenging this can be, and experts suggest that maintaining a can significantly boost your borrowing power.

Gather Essential Documentation: Have the following documents ready to streamline your application:

- Proof of income, including recent pay stubs and tax returns for the last two years.

- Employment verification to confirm your job status.

- Recent bank statements to demonstrate your financial stability.

- Identification, such as a driver’s license and Social Security number.

Organizing these documents can help expedite the application process, especially in a competitive market.

Determine Your Budget: Take a moment to assess your financial situation and establish a realistic budget. This means calculating your monthly expenses and understanding how much you can afford, especially when considering a mortgage on 400k based on your income and existing debts.

Get Pre-Approved: Seek pre-approval from lenders. This not only provides a clearer picture of your budget but also signals to sellers that you are a serious buyer. Remember, pre-approval is generally more reliable than pre-qualification, as it involves a thorough review of your financial situation.

By being organized and proactive, families can navigate the loan application process more efficiently. This reduces the likelihood of delays and enhances your chances of securing your dream home.

Compare Mortgage Options and Rates

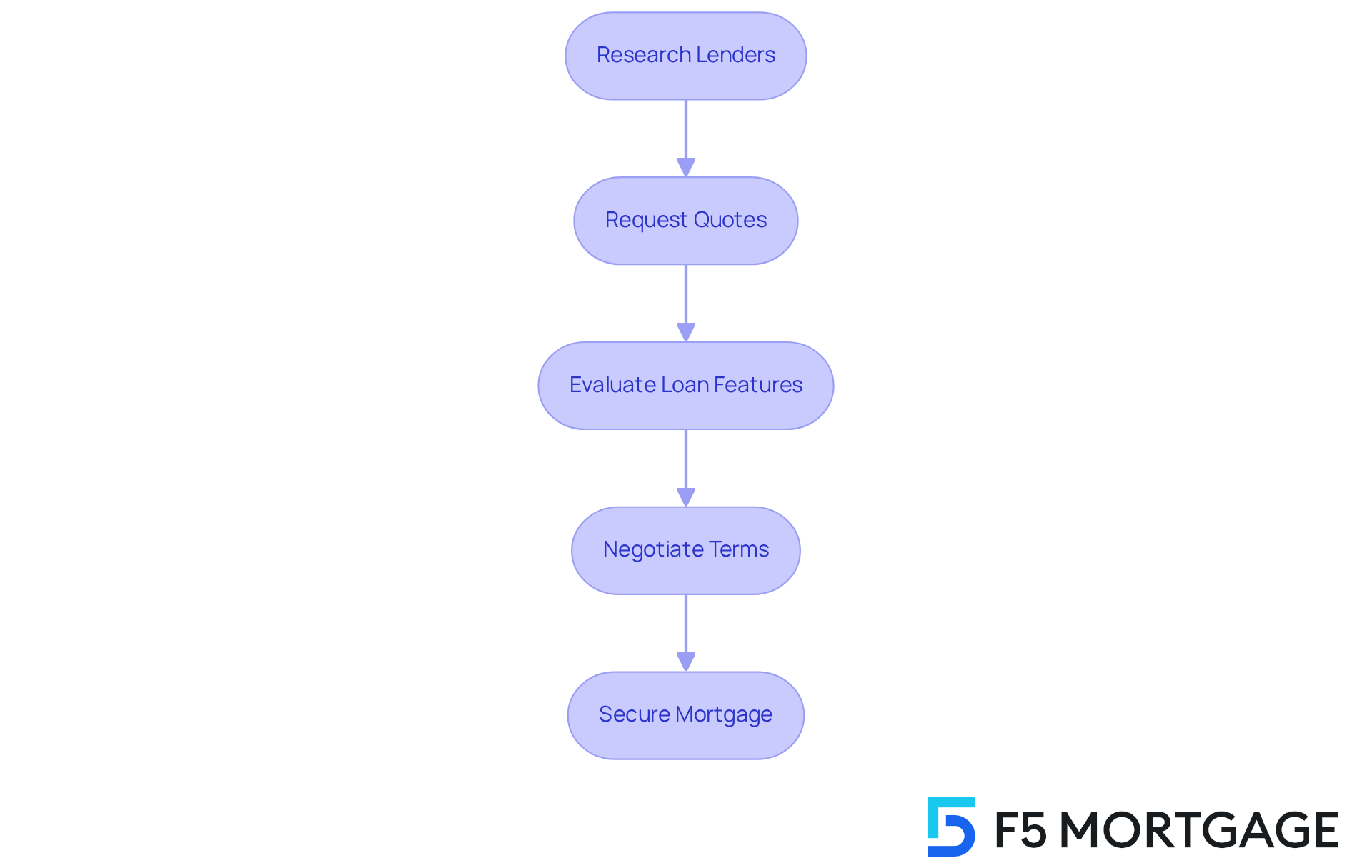

Once your documentation is prepared and you have a budget in mind, we know how essential it is to effectively compare options, such as a mortgage on 400k. Here’s how you can navigate this process with confidence:

- Research Lenders: Begin by identifying reputable lenders, including banks, credit unions, and independent brokers like F5 Mortgage. Look for reviews and ratings to gauge their reliability, as this can help you feel more secure in your choices.

- Request Quotes: Reach out to various lenders to acquire estimates on interest charges, fees, and conditions. It’s important to ensure that you are comparing similar types of credit to make informed decisions that suit your needs.

- Evaluate Loan Features: Consider critical factors such as fixed versus adjustable rates, prepayment penalties, and closing costs, which typically range from 2% to 5% of the loan amount. Understanding these elements can empower you to make the best choice for your family.

- Negotiate Terms: Don’t hesitate to negotiate with lenders. Many are willing to modify rates or fees to secure your business, especially in a competitive market where loan rates have recently stabilized. Remember, advocating for yourself can lead to more favorable terms.

By diligently comparing options and leveraging negotiation, families can secure the most advantageous mortgage on 400k for their new home, potentially saving thousands over the life of the loan. We’re here to in this important journey.

Conclusion

Understanding the intricacies of securing a mortgage on a $400,000 home is crucial for families looking to upgrade their living situation. We know how challenging this can be. This journey involves comprehending various mortgage types, calculating monthly payments, and preparing adequately for the application process. By grasping these essential concepts, families can approach home buying with confidence and make informed financial decisions that align with their goals.

Throughout the article, we’ve highlighted key points such as the importance of mortgage types, the calculations involved in determining monthly payments, and the steps necessary to prepare for a mortgage application. Families learned about the significance of credit scores, the necessity of gathering documentation, and the value of comparing different mortgage options to find the best fit. Each of these elements plays a vital role in navigating the complexities of the mortgage landscape effectively.

Ultimately, mastering the mortgage process on a $400,000 home is not merely about securing financing; it is about empowering families to achieve their dreams of homeownership. By utilizing the strategies outlined, families can take proactive steps to ensure a smooth and successful mortgage experience. Embracing this knowledge will not only facilitate the purchase of a new home but also pave the way for long-term financial stability and satisfaction. We’re here to support you every step of the way.

Frequently Asked Questions

What is the purpose of a mortgage?

A mortgage is a financial agreement specifically designed for real estate transactions, with the property itself serving as security for the loan.

What are the different types of mortgages available?

The main types of mortgages include fixed-rate, adjustable-rate, FHA, VA, and jumbo loans. Each type has its own advantages and disadvantages depending on your financial situation.

How do fixed-rate and adjustable-rate mortgages differ?

Fixed-rate mortgages offer stability with consistent monthly payments, while adjustable-rate mortgages (ARMs) may start with lower rates that can change over time based on market conditions.

What are the typical loan terms for mortgages?

Mortgages usually come in 15, 20, or 30-year terms. Longer durations typically lead to lower monthly payments but higher overall interest costs throughout the life of the loan.

What is a down deposit, and how much is typically required?

A down deposit is an initial contribution required by lenders, usually ranging from 3% to 20% of the home’s purchase price. For a $400,000 home, this means a down payment between $12,000 and $80,000.

What are the current interest levels for mortgages?

The typical interest rate for a 30-year fixed mortgage is around 7.3%, which is significantly higher than the lows seen in previous years. Interest rates can fluctuate based on market conditions and credit scores.

How can understanding mortgage basics help families?

By grasping mortgage fundamentals, families can approach the loan process with greater confidence and clarity, ensuring they select the best financing options tailored to their needs.