Overview

The mortgage interest tax deduction is a valuable benefit for homeowners, enabling them to deduct the interest paid on home loans from their taxable income. This can significantly reduce their overall tax obligation. We understand how important this can be for families, especially during the early years of a mortgage when interest payments tend to be higher.

In this article, we will explore the eligibility requirements, the steps to claim this deduction, and discuss both its advantages and disadvantages. By addressing these aspects, we aim to empower you in your financial planning journey.

Navigating the complexities of homeownership can be challenging, but knowing how to utilize tax deductions can provide some relief. We’re here to support you every step of the way, ensuring you have the information needed to make informed decisions. Let’s delve into the details together.

Introduction

The mortgage interest tax deduction is a vital financial resource for homeowners, enabling them to lower their taxable income by deducting the interest paid on home loans. We know how significant these tax savings can be, especially as they influence homeownership decisions in an ever-changing financial landscape. However, many property owners may find themselves wondering if they can fully take advantage of this benefit due to eligibility criteria and potential limitations.

What are the key factors that determine eligibility? How can homeowners navigate the complexities of claiming this deduction to maximize their financial advantage? Understanding these elements is crucial, and we’re here to support you every step of the way.

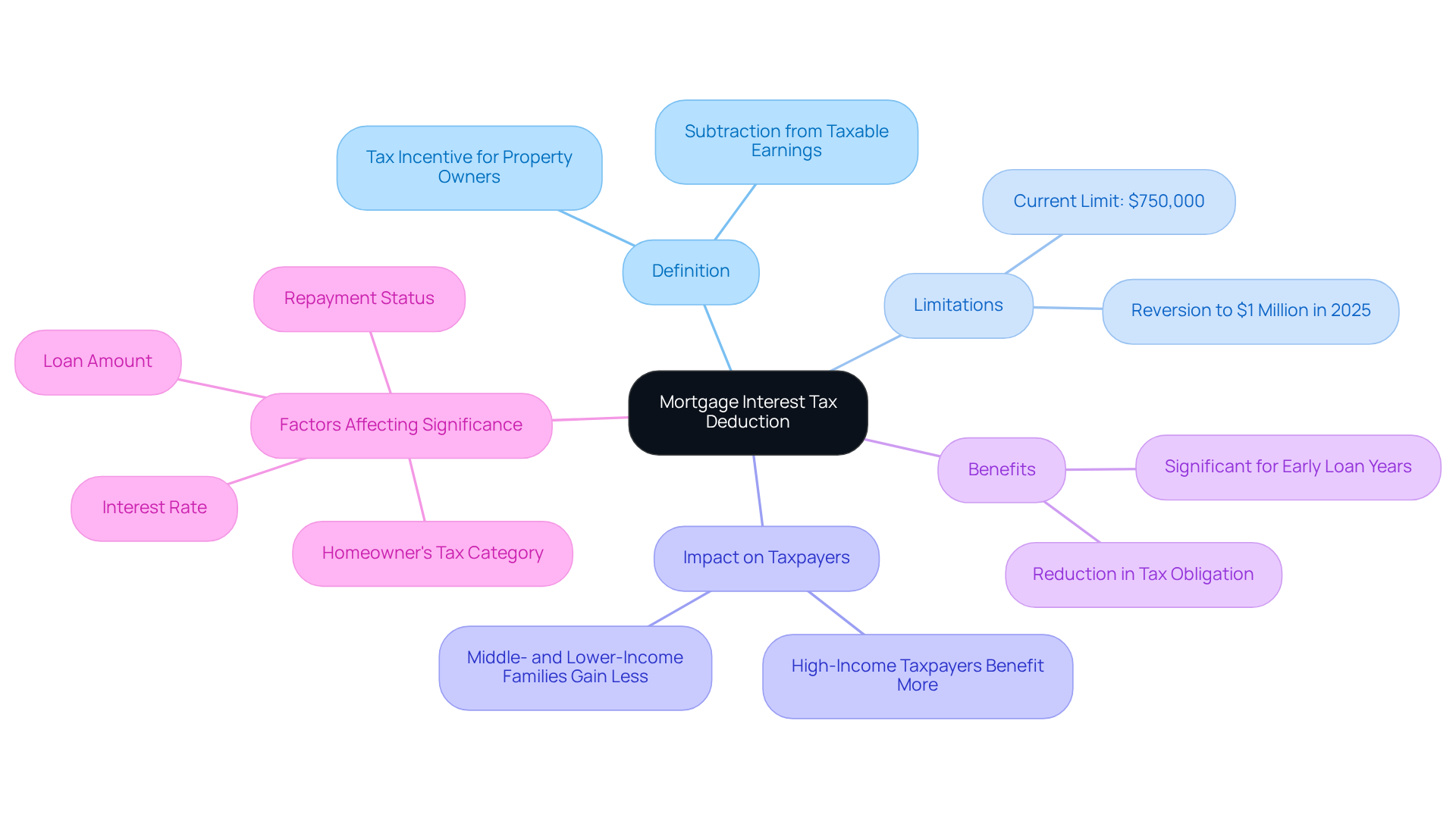

Define the Mortgage Interest Tax Deduction

The mortgage interest tax deduction acts as a valuable tax incentive for property owners, enabling them to subtract the fees paid on their home loan from their taxable earnings. This reduction applies to earnings on loans backed by a primary residence or a secondary home, effectively decreasing taxable income. For loans initiated after December 15, 2017, the allowance is limited to the cost on the first $750,000 of loan debt. This limitation is set to revert to $1 million after December 31, 2025, unless further legislative action is taken.

In practical terms, this reduction can significantly lessen a homeowner’s tax obligation, especially during the early years of a loan when interest payments tend to be greater than principal payments. In 2025, it is estimated that a substantial percentage of homeowners will continue to assert this benefit, reflecting its importance in financial planning. However, we know how challenging this can be for middle- and lower-income families, who may gain less from this tax break due to smaller home loans or the lack of loans entirely. On the other hand, high-income taxpayers often benefit more, as they are more inclined to itemize expenses on their tax returns.

Understanding the mortgage interest tax deduction is essential for property owners who want to optimize their financial advantages. As tax experts highlight, the significance of this allowance depends on several factors, including the loan amount, repayment status, rate of return, and the homeowner’s tax category. With the right guidance, we’re here to support you every step of the way, helping homeowners take advantage of this benefit to improve their overall financial strategy.

Identify Eligibility Requirements for the Deduction

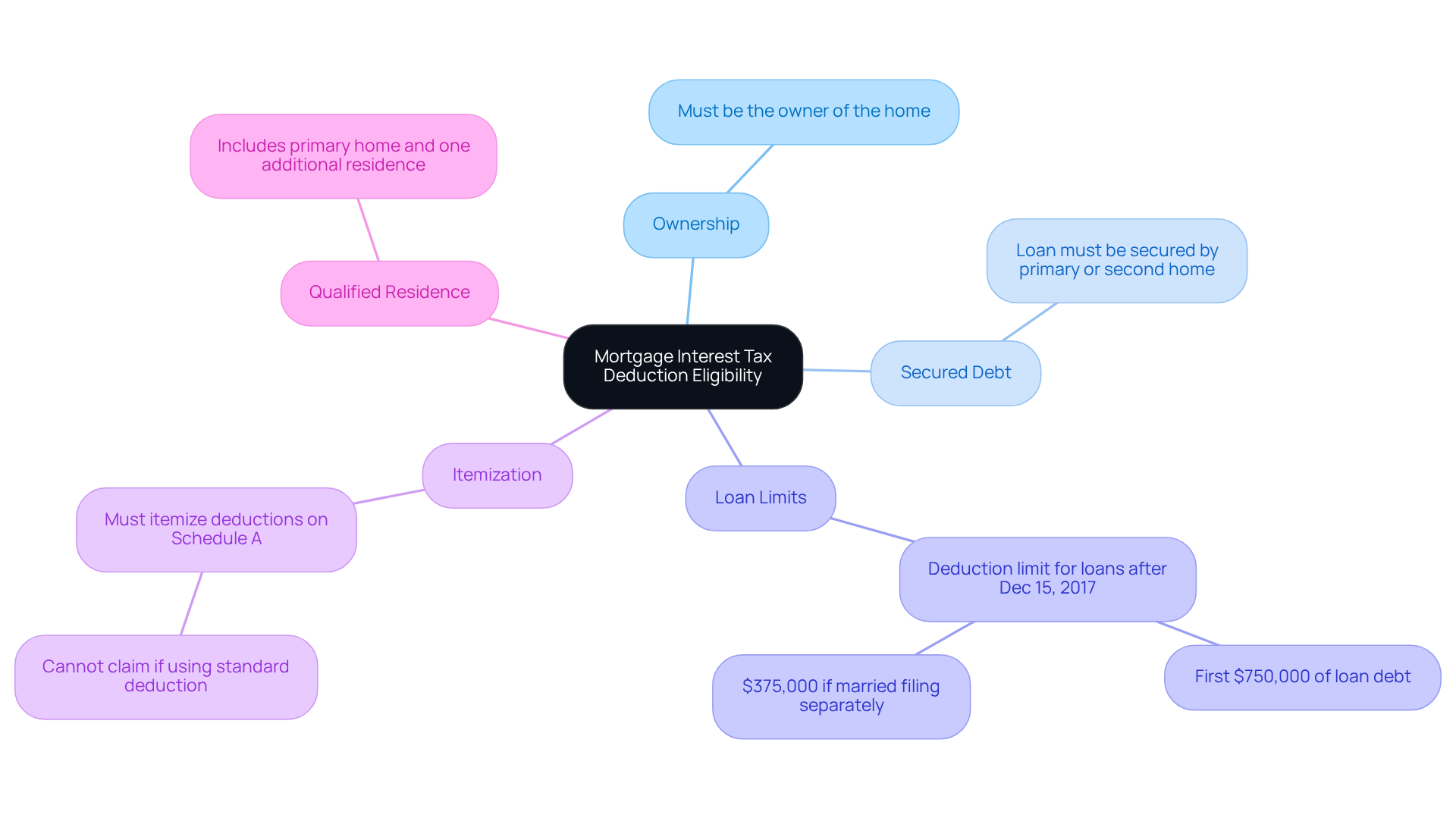

We understand how challenging navigating the mortgage process can be, especially when it comes to tax deductions. Homeowners need to meet certain eligibility requirements that can seem daunting at first to qualify for the mortgage interest tax deduction.

- Ownership: It’s essential that you are the owner of the home for which you’re seeking this tax benefit. This ensures you’re directly benefiting from the mortgage interest tax deduction.

- Secured Debt: The loan must be secured by your primary residence or a second home. This connection is vital for claiming the mortgage interest tax deduction.

- Loan Limits: For home loans obtained after December 15, 2017, there are specific limits. You can deduct interest on the first $750,000 of loan debt, or $375,000 if you’re married and filing separately.

- Itemization: To claim this deduction, you’ll need to detail your subtractions on Schedule A of Form 1040. Remember, the mortgage interest tax deduction cannot be claimed if you choose the standard deduction.

- Qualified Residence: Lastly, your home must be classified as a qualified residence, which includes your primary home and one additional residence.

We’re here to support you every step of the way as you work through these requirements. Understanding these criteria can empower you to take full advantage of the benefits available to you.

Explain How to Claim the Mortgage Interest Deduction

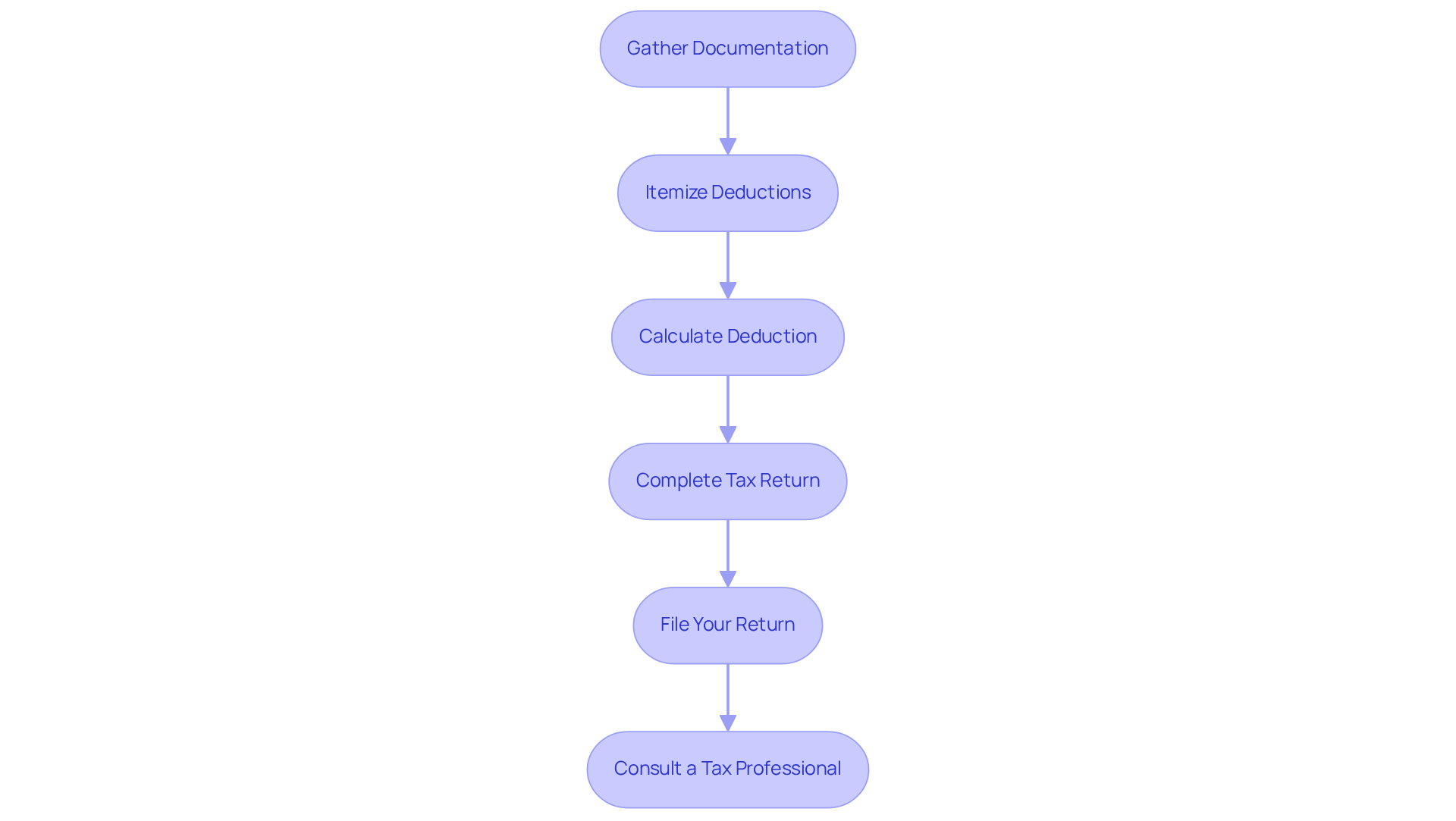

To claim the mortgage interest deduction for 2025, let’s walk through these steps together:

- Gather Documentation: Start by collecting your Form 1098 from your lender. This document outlines the total loan expenses you’ve paid during the tax year, which is crucial for your claim.

- Itemize Deductions: You’ll want to choose to itemize your expenses on your tax return instead of opting for the standard allowance. This process is done on Schedule A of Form 1040, and it can make a significant difference.

- Calculate Deduction: Next, enter the total mortgage interest amount from Form 1098 on the designated line of Schedule A. This is where your hard work begins to pay off.

- Complete Tax Return: Be sure to accurately report all other expenses and credits before finalizing your tax return. Every detail matters, and we know how challenging this can be.

- File Your Return: Finally, submit your tax return by the deadline. Remember to keep copies of all documentation for your records. If you have questions about the process, consulting a tax professional can provide valuable guidance.

Tax experts emphasize that the mortgage interest tax deduction and itemizing expenses can significantly affect your tax obligation. For instance, the mortgage interest tax deduction allows property owners to lower their taxable income, which can greatly support home acquisitions. As Adam Brewer, a tax dispute lawyer, notes, ‘The government is supporting the acquisition of your residence by permitting you to subtract your loan payment fees.’

Additionally, understanding how to calculate your break-even point when refinancing can further enhance your financial flexibility. By determining your refinancing costs and monthly savings, you can assess how long it will take to recoup those costs through savings. For example, if your refinancing costs are $4,000 and your monthly savings are $100, your break-even point would be 40 months. This insight can assist you in making informed choices regarding your loan and maximizing the advantages of homeownership.

We know that gathering the required paperwork for loan tax claims can take several hours, depending on the intricacy of your financial circumstances. But remember, you’re not alone in this process; we’re here to support you every step of the way.

Assess the Advantages and Disadvantages of the Deduction

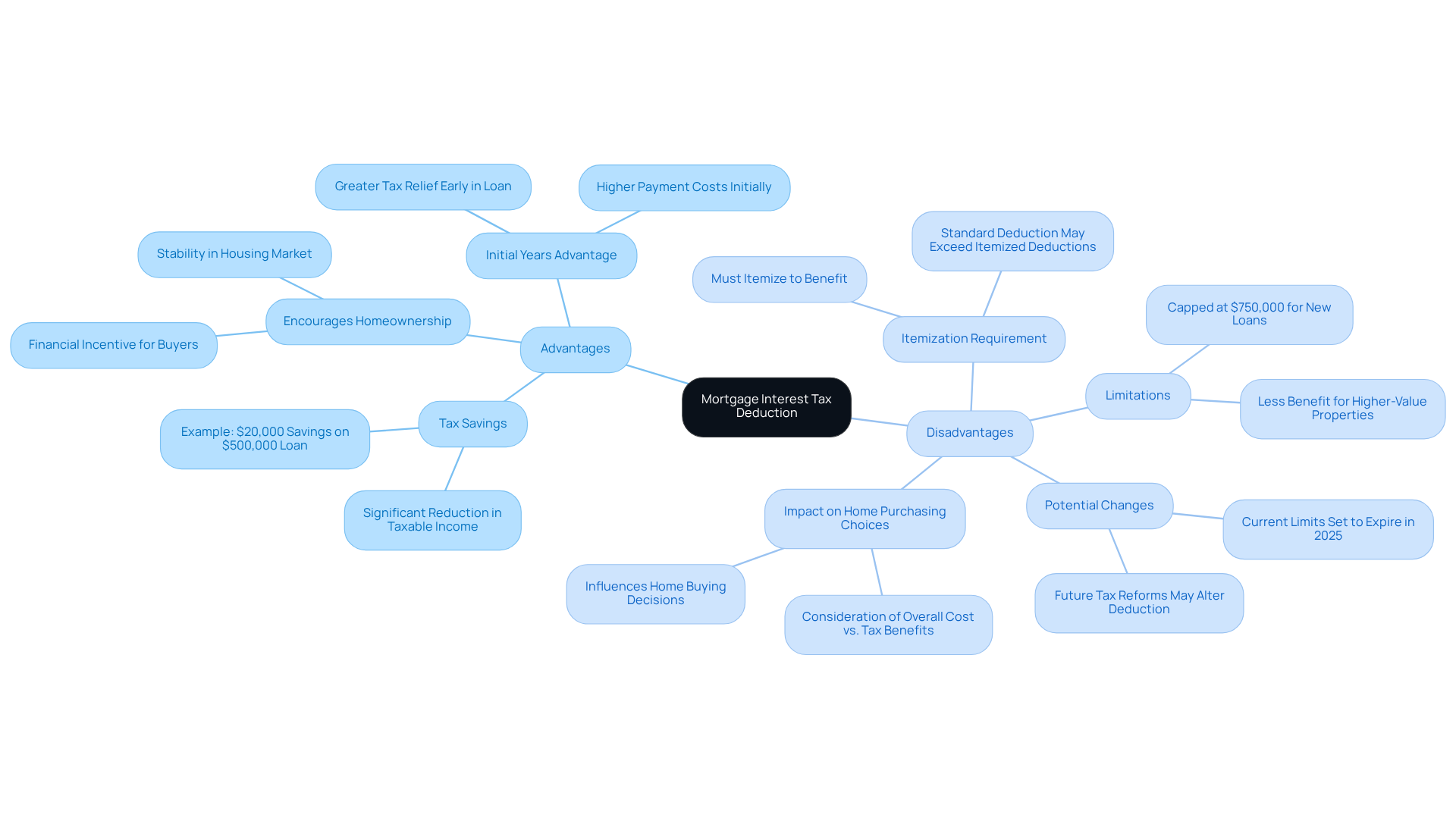

Homeowners should thoughtfully consider the blend of benefits and drawbacks that the mortgage interest tax deduction offers.

Advantages:

- Tax Savings: This deduction can significantly lower your taxable income, potentially reducing your overall tax bill. For instance, a property owner with a $500,000 loan at a 4% interest rate could save around $20,000 annually in payments, leading to substantial tax savings.

- Encourages Homeownership: By making homeownership more financially attractive, this tax benefit acts as an incentive for individuals to buy homes, fostering stability in the housing market.

- Initial Years Advantage: Homeowners typically enjoy the most significant benefits in the early years of their loan, when payment costs are highest. This period allows for greater tax relief, which can be quite helpful.

Disadvantages:

- Itemization Requirement: To benefit from the mortgage interest deduction, taxpayers must itemize their deductions. This may not be advantageous for everyone, especially if the standard deduction exceeds the total of itemized expenses. For example, the standard deduction for married couples filing jointly is $27,700 for the 2023 tax year, which might discourage some from itemizing.

- Limitations: The deduction is capped at $750,000 for new loans, which may not help homeowners with larger loans. This limitation can restrict tax savings for those purchasing higher-value properties.

- Potential Changes: Future tax reforms could alter or eliminate the home loan expense deduction, creating uncertainty for homeowners who rely on it for tax savings. With current limits set to expire in 2025, there’s a possibility of returning to higher thresholds, like $1 million for individual filers for loans taken out before December 16, 2017, which could impact financial planning.

- Impact on Home Purchasing Choices: The complexities surrounding the mortgage interest tax deduction can influence home buying decisions. Homebuyers might weigh the potential tax benefits against the overall cost of homeownership, especially in a market where mortgage rates exceed 6%. As homeowners navigate these financial considerations, understanding the implications of the deduction becomes vital.

We know how challenging this can be, and we’re here to support you every step of the way as you explore your options.

Conclusion

The mortgage interest tax deduction is an essential financial tool for homeowners. It allows them to reduce their taxable income by deducting the interest paid on their home loans. This incentive not only eases tax burdens but also encourages homeownership, especially during the early years of a mortgage when interest payments are at their highest. Understanding this deduction is crucial for property owners who want to optimize their financial strategies and navigate the complexities of tax regulations effectively.

Throughout this article, we’ve examined key aspects such as eligibility requirements, the claiming process, and the advantages and disadvantages of the mortgage interest deduction. To benefit from this deduction, homeowners must meet specific criteria, including property ownership, secured debt, and the necessity to itemize deductions. Moreover, we’ve highlighted the significant savings potential for taxpayers while also addressing the limitations and uncertainties that may arise due to potential changes in tax laws.

In light of these insights, it’s essential for homeowners to stay informed and proactive regarding the mortgage interest tax deduction. By understanding its implications and requirements, individuals can make informed decisions that enhance their financial well-being. As the landscape of tax benefits continues to evolve, taking advantage of the mortgage interest tax deduction can play a pivotal role in achieving financial stability and success in homeownership. Remember, we’re here to support you every step of the way as you navigate this journey.

Frequently Asked Questions

What is the mortgage interest tax deduction?

The mortgage interest tax deduction is a tax incentive for property owners that allows them to subtract the interest paid on their home loan from their taxable income, thereby reducing their tax obligation.

Which loans qualify for the mortgage interest tax deduction?

The deduction applies to loans backed by a primary residence or a secondary home.

What is the limit on the mortgage interest tax deduction for loans initiated after December 15, 2017?

For loans initiated after December 15, 2017, the deduction is limited to the interest on the first $750,000 of loan debt.

When will the limit on the mortgage interest tax deduction revert to $1 million?

The limit is set to revert to $1 million after December 31, 2025, unless further legislative action is taken.

How does the mortgage interest tax deduction impact homeowners financially?

This deduction can significantly reduce a homeowner’s tax obligation, especially in the early years of a loan when interest payments are higher than principal payments.

Who benefits the most from the mortgage interest tax deduction?

High-income taxpayers often benefit more from this deduction, as they are more likely to itemize expenses on their tax returns. In contrast, middle- and lower-income families may gain less due to smaller home loans or the absence of loans.

Why is it important for property owners to understand the mortgage interest tax deduction?

Understanding this deduction is essential for property owners to optimize their financial advantages and improve their overall financial strategy.

What factors influence the significance of the mortgage interest tax deduction for homeowners?

The significance of the deduction depends on several factors, including the loan amount, repayment status, rate of return, and the homeowner’s tax category.