Overview

Navigating the home equity loan process can feel overwhelming for families, but we’re here to support you every step of the way. This article serves as a caring, step-by-step guide that helps you understand the differences between home equity loans and HELOCs, along with the qualification criteria, application steps, and common challenges you might face.

We know how challenging this can be, which is why we provide practical advice on documentation and lender comparisons. Our goal is to empower you to make informed decisions that improve your chances of securing favorable financing options.

By addressing your needs and concerns, we aim to build your confidence in this process. You’ll find that understanding these key elements can make a significant difference in your financial journey. Let’s explore this together!

Introduction

Understanding the nuances of home equity loans and Home Equity Lines of Credit (HELOCs) can truly be a game-changer for families looking to leverage their property’s value. We know how challenging this can be, and this comprehensive guide is designed to clarify the steps involved in the home equity loan process. It also highlights the essential qualifications and potential challenges that homeowners may face along the way.

As families embark on this financial journey, the question looms: how can they effectively navigate the complexities of borrowing against their home? We’re here to support you every step of the way, ensuring you make the best choices for your future. Let’s explore this together, so you can feel empowered and confident in your decisions.

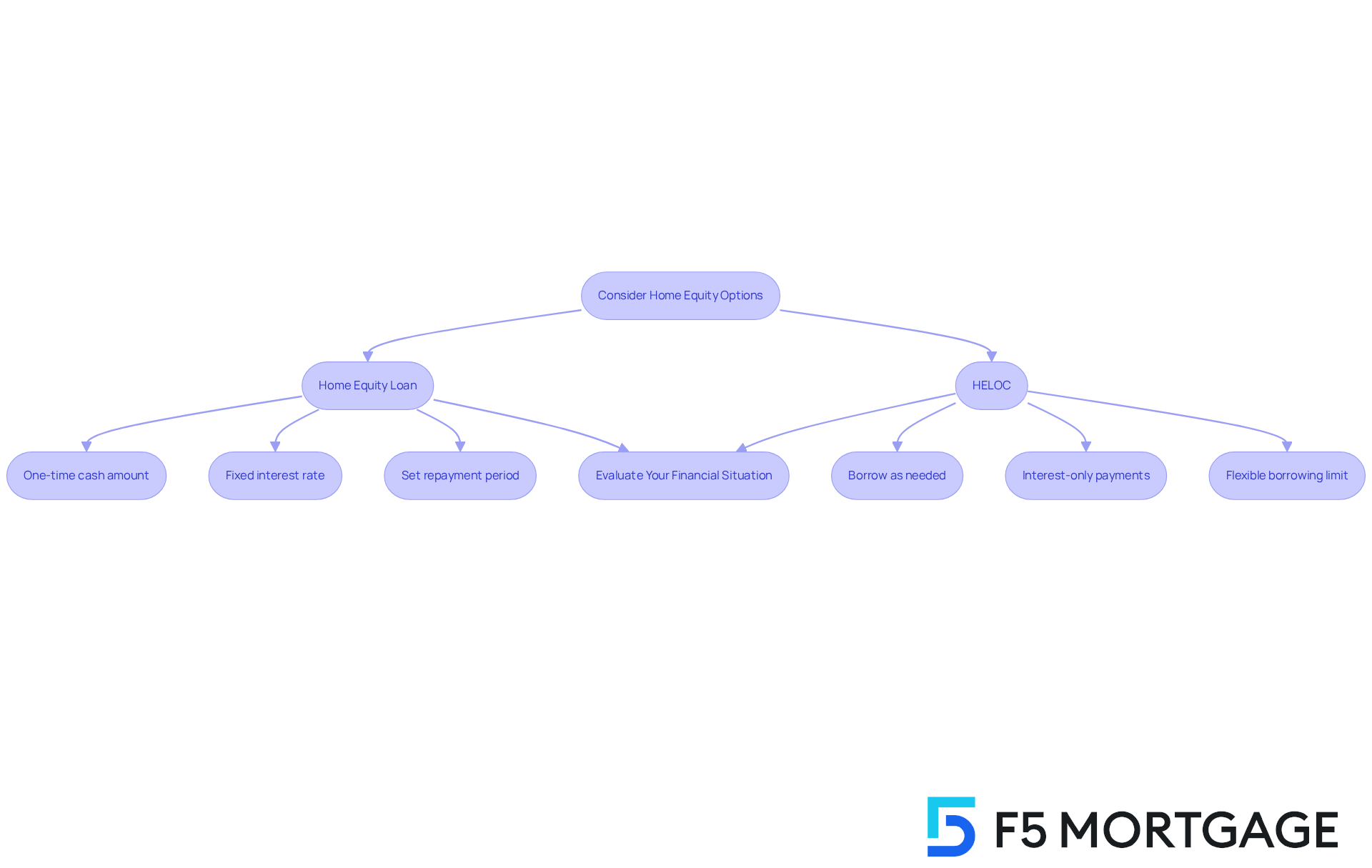

Understand Home Equity Loans and HELOCs

Home value financing and Home Value Lines of Credit (HELOCs) offer homeowners valuable ways to tap into the equity they’ve built in their properties. If you’re considering borrowing against your home’s value, it’s important to understand the home equity loan process and your options. A property value-based loan provides a one-time cash amount, typically at a fixed interest rate, to be repaid over a set period. This option is particularly helpful for families needing a specific sum for significant expenses, like home renovations or educational costs. Many families have successfully used property loans to finance major renovations, transforming their living spaces while managing steady monthly payments.

Conversely, a HELOC operates similarly to a credit card, allowing homeowners to borrow against their home’s value as needed, up to a predetermined limit. This flexibility can be a lifesaver for ongoing projects or unexpected expenses, such as gradual renovations or emergency repairs. During the draw period, borrowers often have the option to make interest-only payments, which can alleviate some financial strain.

When deciding between these two choices, it’s crucial to consider factors like the home equity loan process, including current interest rates—averaging around 8.10% for HELOCs and 8.19% for residential property financing as of late October 2025—and repayment terms. We know how challenging this can be, so financial advisors frequently recommend evaluating your overall financial situation and long-term goals. As one specialist wisely noted, “Before applying, it is wise to compare proposals from various lenders and think about whether a fixed-rate mortgage or variable-rate HELOC is more suitable for your circumstances.” Understanding these differences empowers you to make the right choice that aligns with your financial needs and aspirations.

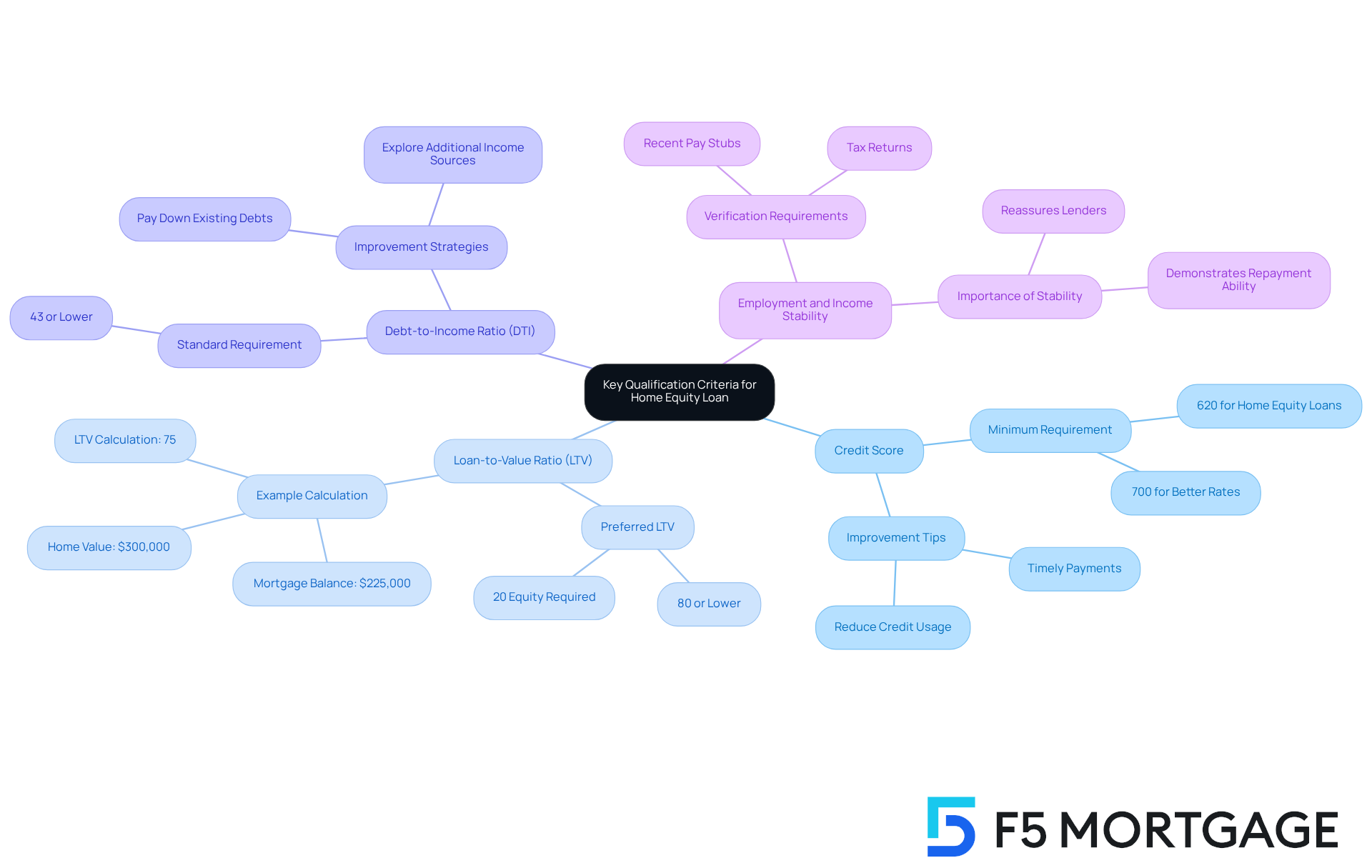

Identify Key Qualification Criteria

To qualify for a home equity loan process or HELOC, we understand that navigating the requirements can feel overwhelming. Lenders typically evaluate several key criteria that are important to grasp:

-

Rating: Most lenders ask for a minimum credit score of around 620. However, if you can achieve a score of 700 or higher, it can significantly enhance your chances of securing better rates. A strong credit profile, characterized by timely payments and minimal credit usage, is essential for favorable financing conditions.

-

Loan-to-Value Ratio (LTV): This ratio compares the loan amount to the assessed value of your property. Lenders generally prefer an LTV of 80% or lower, which means you should aim to maintain at least 20% equity in your home. For instance, if your residence is valued at $300,000 and your mortgage balance is $225,000, your LTV would be 75%, comfortably within the preferred range.

-

Debt-to-Income Ratio (DTI): Lenders look at your monthly debt payments in relation to your gross monthly income. A DTI of 43% or lower is often the standard. If you’re feeling stretched, consider ways to improve your DTI by paying down existing debts or exploring additional income sources.

-

Employment and Income Stability: Demonstrating stable income and a solid employment history is crucial. Lenders typically require recent pay stubs or tax returns to verify your income. Showing consistent income helps reassure lenders of your ability to manage repayments over time.

By understanding these standards, you can take proactive steps to enhance your financial position before engaging in the home equity loan process or applying for a HELOC. For example, improving your credit score through timely payments and reducing debt can significantly impact your chances of approval. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

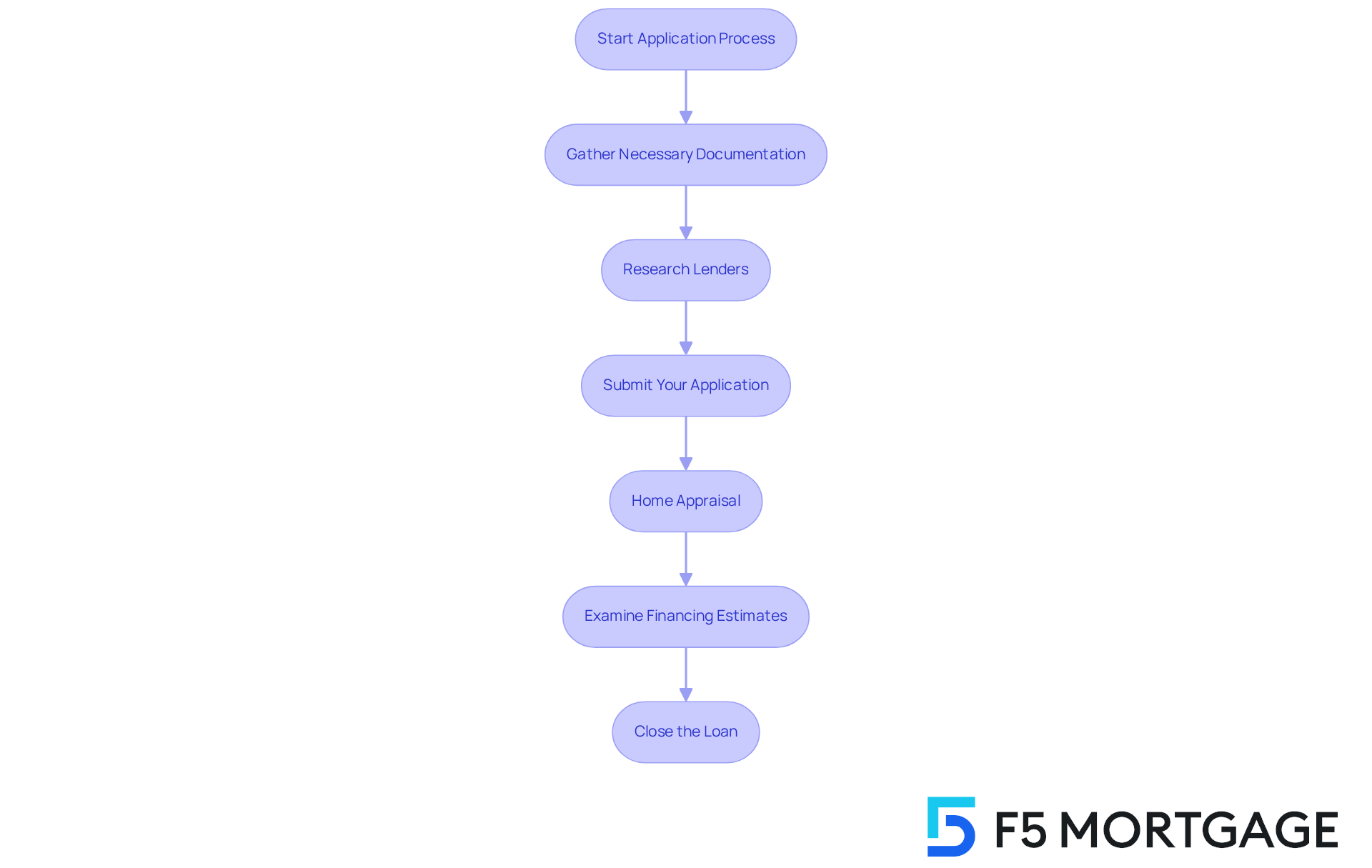

Follow the Home Equity Loan Application Steps

Navigating the home equity loan process or HELOC application can feel overwhelming, but understanding the key steps can significantly enhance your chances of approval. We know how challenging this can be, and we’re here to support you every step of the way.

-

Gather Necessary Documentation: Start by collecting essential documents such as proof of income, tax returns, and details about your current mortgage. Most lenders require these to assess your financial stability and eligibility. Being prepared can ease your worries and streamline the home equity loan process.

-

Research Lenders: It’s crucial to compare various lenders to secure the best rates and terms. Explore options from both traditional banks and independent brokers like F5 Mortgage, which can offer personalized service and competitive deals. Finding the right lender can make a world of difference.

-

Submit Your Application: Complete the application form with accuracy, ensuring all required information and documentation are included. This attention to detail can prevent delays in the home equity loan process, enabling you to move forward with confidence.

-

Home Appraisal: Expect the lender to require an appraisal to establish your home’s current market value. Be mindful that appraisers might be cautious, particularly in changing markets, which can influence your funding amount. Understanding this can help set realistic expectations.

-

Examine Financing Estimates: After approval, carefully examine the financing estimate. Pay close attention to interest rates, fees, and terms to ensure they align with your financial goals. This is your opportunity to make informed decisions that benefit your family.

-

Close the Loan: If you agree to the terms, proceed to closing, where you will sign the final paperwork and receive your funds. This step typically takes two to six weeks, depending on the lender’s efficiency. Knowing what to expect can alleviate some stress during this final stage.

By following these steps and being well-prepared, families can simplify the home equity loan process and improve their chances of obtaining a property-backed line of credit or HELOC in 2025.

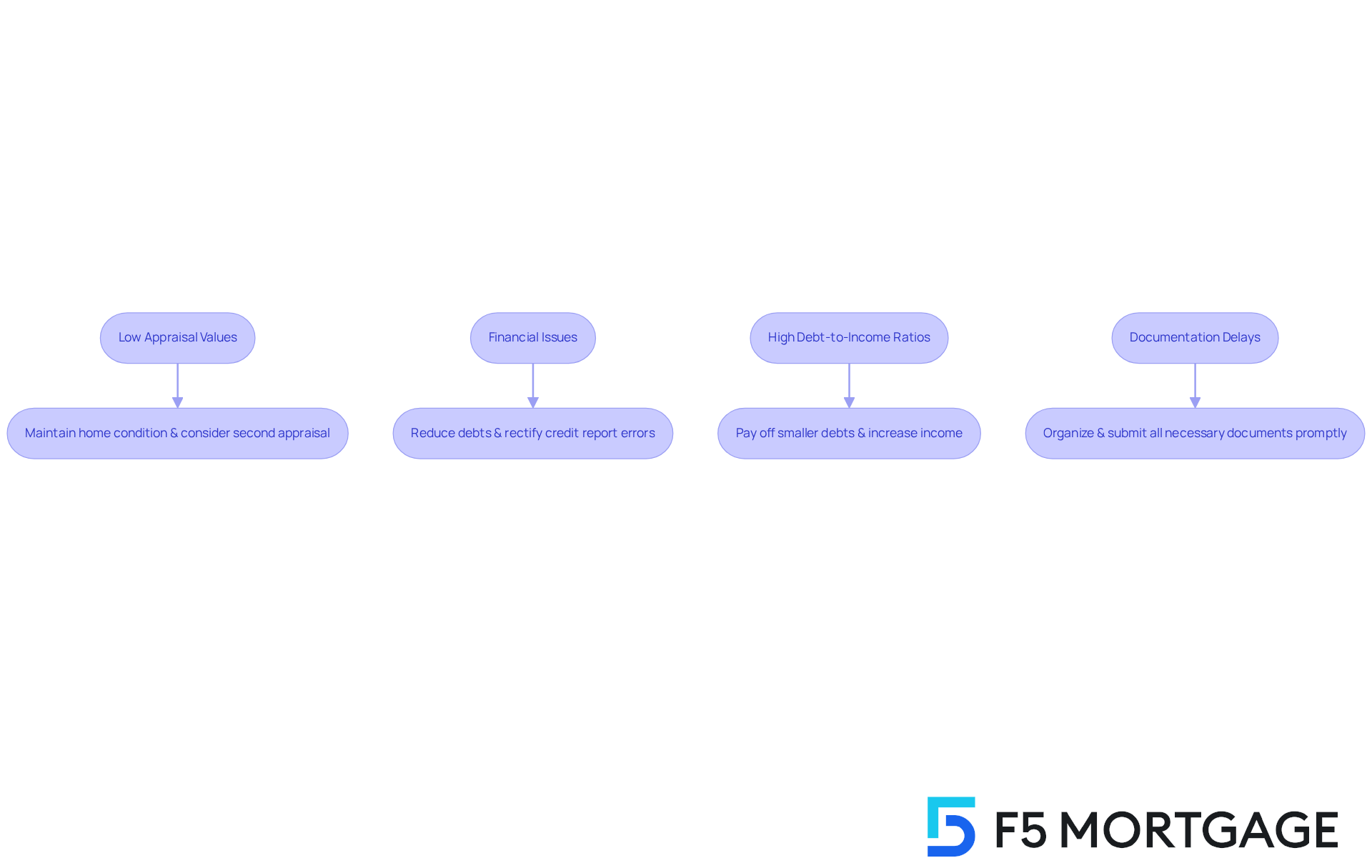

Troubleshoot Common Challenges in the Process

Families often encounter several challenges that can impact their ability to secure financing during the home equity loan process. We know how challenging this can be, and understanding these hurdles is the first step toward overcoming them.

-

Low Appraisal Values: A lower-than-expected appraisal can significantly affect your loan-to-value (LTV) ratio. For instance, if your residence appraises for $375,000 while your mortgage balance is $300,000, your combined LTV is 80%. To address this, maintain your home in good condition and consider obtaining a second appraisal if the initial value seems inaccurate. Gathering evidence of any improvements made to the property can support a higher valuation during a reconsideration request.

-

Financial Issues: A low credit score can hinder your chances of approval. Families can enhance their scores by reducing current debts and rectifying any errors on their reports. Real-life examples show that families who actively manage their credit—like lowering credit card balances and ensuring timely payments—often experience significant score improvements, averaging around 50 points, before applying for mortgage financing.

-

High Debt-to-Income Ratios: Many lenders have tightened their maximum DTI ratios, often capping them at 43%. If your DTI exceeds this threshold, consider strategies to lower it, such as paying off smaller debts or increasing your income through side jobs. Financial advisors recommend focusing on reducing non-essential expenses to improve your financial standing before applying.

-

Documentation Delays: Delays in processing applications can arise from incomplete or disorganized documentation. To avoid this, ensure that all necessary documents—such as income verification, tax returns, and property records—are organized and submitted promptly. This proactive approach can help streamline the application process and reduce waiting times.

By understanding these challenges and preparing accordingly, families can more effectively navigate the home equity loan process. Remember, we’re here to support you every step of the way, increasing your chances of securing favorable terms.

Conclusion

Understanding the home equity loan process is vital for families looking to leverage the value of their homes for financial needs. We know how challenging this can be, but by mastering this process, homeowners can make informed decisions that align with their financial goals. Whether you choose a traditional home equity loan or a more flexible HELOC, each option presents unique advantages. It’s essential to weigh these against your personal circumstances and future aspirations.

Throughout this guide, we’ve explored key aspects of home equity loans and HELOCs, including:

- Qualification criteria

- Application steps

- Common challenges

Families are encouraged to familiarize themselves with the necessary documentation, lender comparisons, and potential hurdles such as low appraisals or high debt-to-income ratios. By proactively addressing these factors, you can position yourself for success in securing financing.

Ultimately, the journey through the home equity loan process can be navigated with confidence and clarity. Families should take actionable steps, from enhancing their credit scores to meticulously preparing documentation, to ensure a smooth application experience. Embracing this knowledge empowers you to make sound financial decisions and opens doors to new opportunities for home improvement, education, and more. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What are home equity loans and HELOCs?

Home equity loans provide a one-time cash amount at a fixed interest rate, repaid over a set period. HELOCs (Home Equity Lines of Credit) allow homeowners to borrow against their home’s value as needed, similar to a credit card, up to a predetermined limit.

When is a home equity loan beneficial?

A home equity loan is particularly beneficial for families needing a specific sum for significant expenses, such as home renovations or educational costs, allowing for steady monthly payments.

How does a HELOC work?

A HELOC allows homeowners to borrow against their home’s value as needed, offering flexibility for ongoing projects or unexpected expenses. Borrowers often have the option to make interest-only payments during the draw period.

What factors should be considered when choosing between a home equity loan and a HELOC?

Important factors include the home equity loan process, current interest rates, repayment terms, and your overall financial situation and long-term goals.

What are the current average interest rates for home equity loans and HELOCs?

As of late October 2025, the average interest rate for HELOCs is around 8.10%, while for residential property financing (home equity loans) it is approximately 8.19%.

What advice do financial advisors give regarding home equity loans and HELOCs?

Financial advisors recommend evaluating your overall financial situation, long-term goals, and comparing proposals from various lenders before applying. They also suggest considering whether a fixed-rate mortgage or a variable-rate HELOC is more suitable for your circumstances.