Overview

This article presents four simple steps to help you effectively use a mortgage calculator when considering extra payments on your mortgage. We understand how overwhelming this process can feel, so let’s break it down together.

- First, it’s essential to grasp the calculator’s purpose; this will empower you to make informed choices.

- Next, accurately inputting your mortgage details is crucial, as it sets the foundation for reliable results.

- As you explore extra payment options, remember that every little bit counts.

- Finally, take the time to analyze the results carefully.

This will not only help you understand your options better but also guide you in making decisions that align with your financial goals.

By following these steps, you can navigate your mortgage payments with confidence. We’re here to support you every step of the way, ensuring that you feel informed and empowered in your financial journey.

Introduction

Understanding the intricacies of mortgage payments can often feel overwhelming. We know how challenging this can be, especially for first-time homebuyers or those considering refinancing. A mortgage calculator is an essential tool that can help you demystify your financial commitments. It provides valuable insights into monthly payments and potential savings, making the process a bit easier.

However, the real challenge lies in effectively utilizing this calculator. It’s important to explore various payment options that could significantly impact the overall cost of homeownership. How can you master the art of using a mortgage calculator? By grasping your current financial obligations, you can strategically reduce your long-term expenses.

Understand the Purpose of a Mortgage Calculator

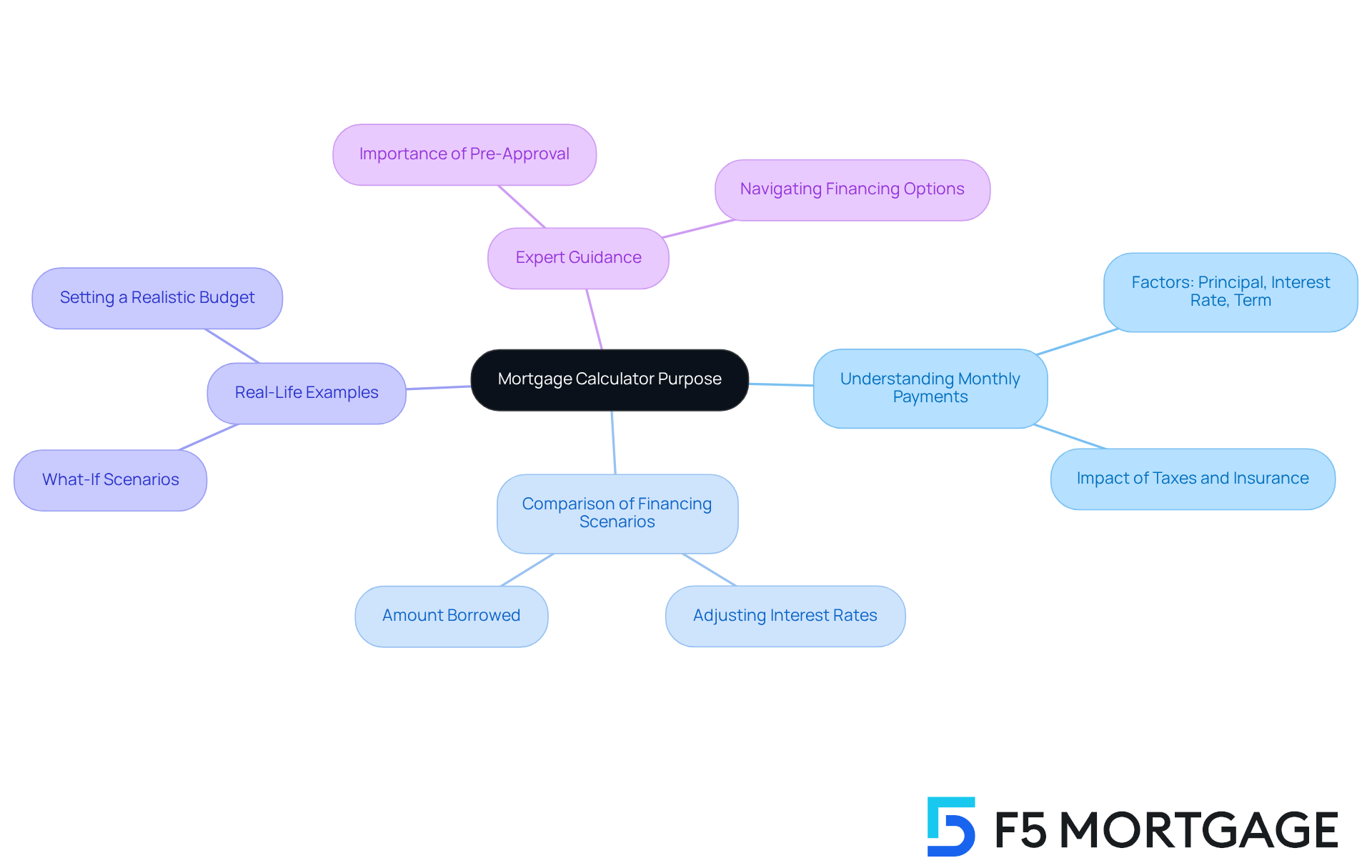

A loan calculator, particularly one for paying extra on mortgage calculator, is a vital resource for those considering home purchases or refinancing. This tool helps you understand your monthly payments, especially when considering paying extra on mortgage calculator by factoring in the principal amount, interest rate, term duration, and even estimates for taxes and insurance. By utilizing a paying extra on mortgage calculator, you can gain clarity on your financial obligations, empowering you to make informed decisions about your financing options.

The benefits of utilizing a mortgage calculator, especially when considering paying extra on mortgage calculator, extend beyond simple projections; it allows you to compare various financing scenarios. For example, paying extra on mortgage calculator by adjusting the interest rate or the amount borrowed can significantly influence your monthly payments. This feature is particularly useful when exploring refinancing options with F5 Mortgage, where our dedicated team is here to help you assess potential savings and the overall costs associated with different financing structures.

Real-life examples highlight the effectiveness of home loan calculators. Buyers often run ‘what if’ scenarios using a paying extra on mortgage calculator to see how different down payment amounts or loan terms affect their monthly commitments. This method not only helps in setting a realistic budget but also empowers you to navigate the complexities of home financing with confidence. As one expert noted, using a loan calculator, particularly when paying extra on mortgage calculator, is one of the smartest first steps in the home purchasing journey, ensuring you are prepared for the financial responsibilities ahead.

Ultimately, while a loan calculator is an essential planning tool, it should be complemented by an official pre-approval from a financing expert at F5 Mortgage for the most accurate financial picture. This combination of tools and expert guidance can streamline your home search and enhance your overall financing experience, especially as you explore refinancing options to maximize your home equity and reduce costs.

Input Your Mortgage Details Accurately

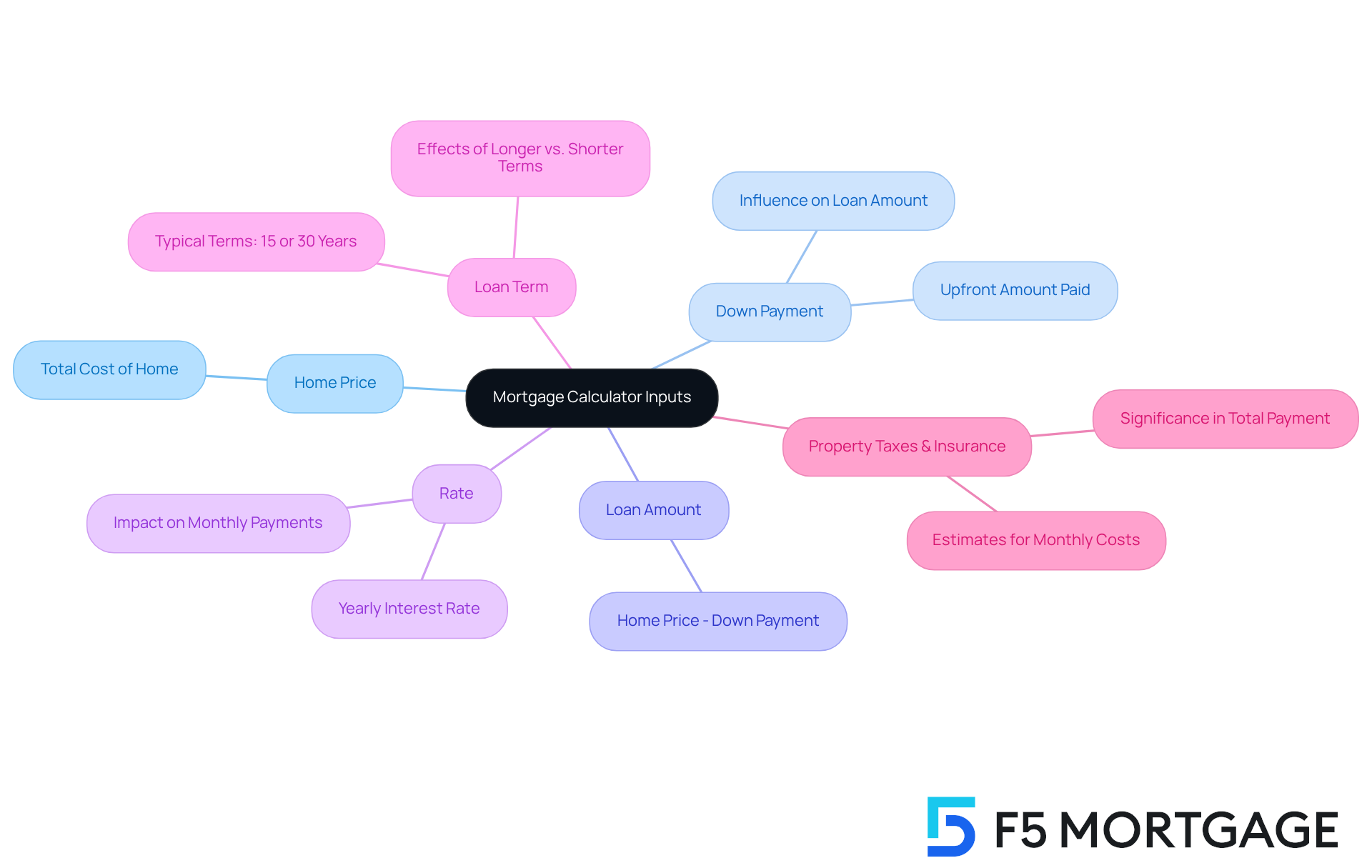

To maximize the effectiveness of a mortgage calculator, we know how challenging it can be to gather accurate information before inputting your details. Here are the key components to consider:

- Home Price: This is the total cost of the home you intend to purchase.

- Down Payment: The upfront amount you plan to pay, which directly reduces the loan amount.

- Loan Amount: Determined as the home price less the down deposit, this figure indicates the sum you will borrow.

- Rate: The yearly rate offered by your lender greatly influences your monthly dues. It’s essential to secure your loan rate once your application is approved to safeguard yourself from market changes during the processing period.

- Loan Term: The repayment duration, typically set at 15 or 30 years. An extended term can assist in maintaining lower monthly costs, freeing up funds for home renovation projects or increasing your savings. Conversely, a shorter term indicates you’ll settle your loan sooner, incur less interest, and accumulate equity in your residence more quickly.

- Property Taxes and Insurance: Estimates for property taxes and homeowners insurance are essential, as they can significantly affect your total monthly costs.

Correct input of these details will produce a more exact calculation of your monthly loan payment. Common mistakes include neglecting to factor in property taxes and insurance, which can lead to underestimating total costs. Authorities such as Taylor Leonhard highlight that utilizing a loan calculator, especially when paying extra on mortgage calculator, is one of the wisest initial actions in the home purchasing process. It is advisable to double-check your inputs and consult with mortgage professionals to ensure accuracy.

Furthermore, grasping how various deposit amounts influence your financing calculations can assist you in making informed choices. For example, a larger initial contribution decreases the loan total and may decrease your monthly expenses, making homeownership more attainable. According to current statistics, the average down deposit percentage varies by state, which can influence your budgeting. By being diligent in your calculations, you can avoid costly errors and better prepare for your loan journey.

Explore Extra Payment Options and Scenarios

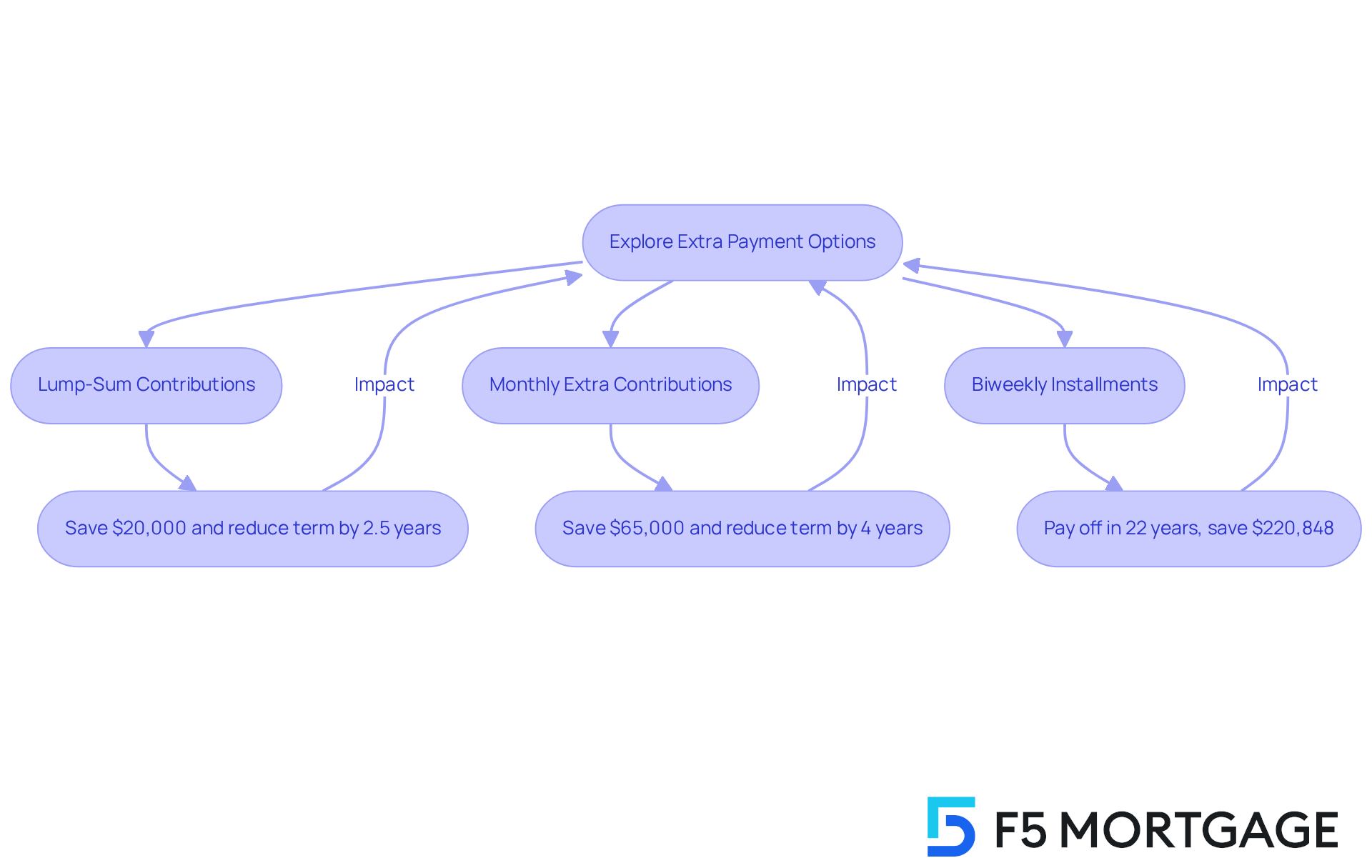

After you have entered your loan information, we know how important it is to explore different scenarios that can enhance your savings. Here’s how you can take charge:

-

Lump-Sum Contributions: Consider entering a single additional amount to see how it impacts your loan balance and saves you on fees. For instance, if you make a one-time contribution of $10,000 on a $300,000 mortgage at a 6.75% rate, you could save over $20,000 in charges and reduce your repayment period by about 2.5 years.

-

Monthly Extra Contributions: Think about adding a specific sum to your monthly payment. By contributing an extra $100 each month, you can reduce your repayment term by more than four years and save nearly $65,000 in interest over the life of the loan.

-

Biweekly Installments: Instead of sticking to monthly payments, consider a biweekly installment plan. This approach allows you to make 26 half payments or 13 full payments each year, effectively making one additional contribution annually. For a $500,000 loan at a 7.73% rate, switching to biweekly installments can shorten your payoff duration from 30 years to just 22 years, saving you roughly $220,848 in costs.

By examining these options, including using a paying extra on mortgage calculator, you can make informed decisions about managing your mortgage effectively and potentially save substantial amounts in costs. Remember, we’re here to support you every step of the way.

Analyze the Results and Make Informed Decisions

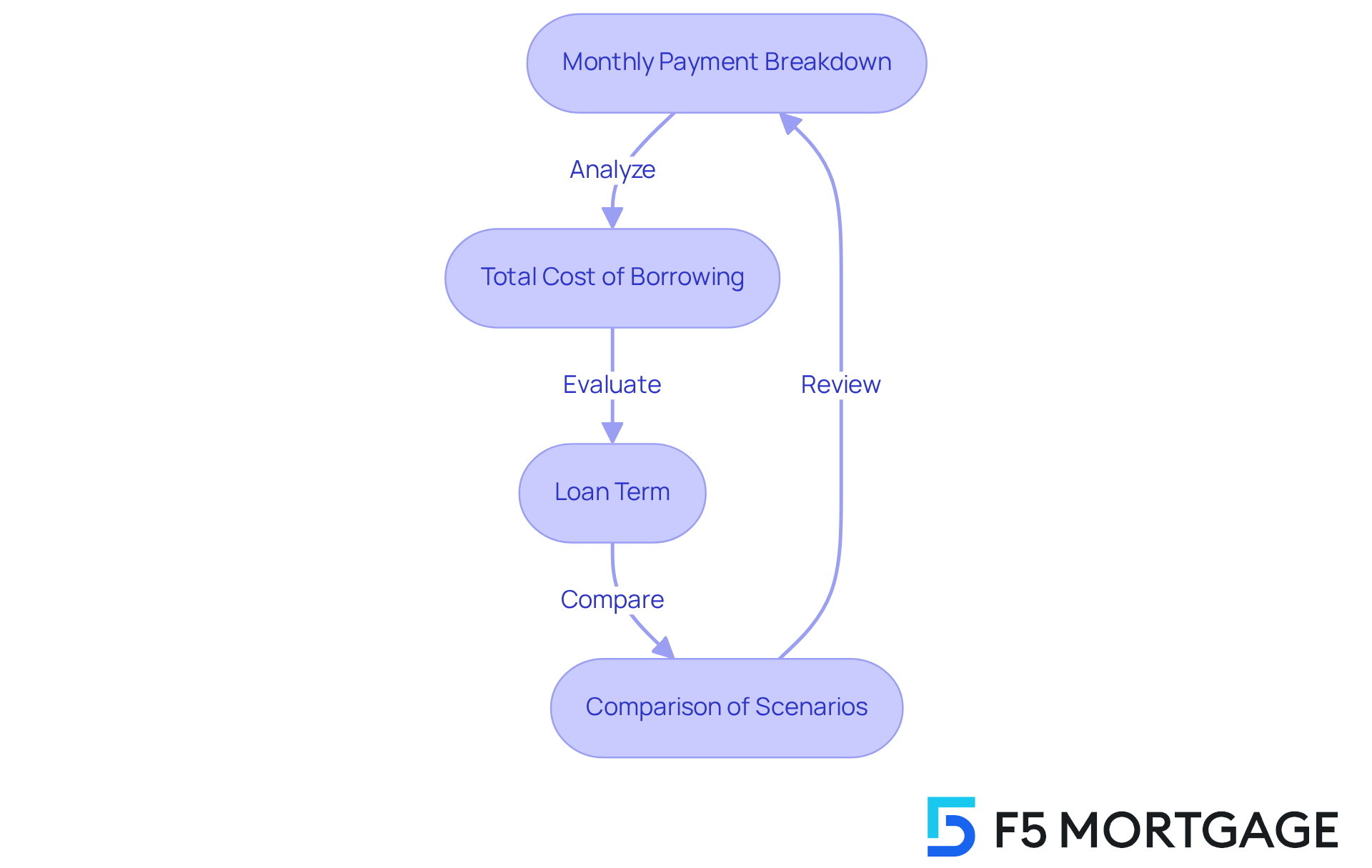

After inputting your details and exploring extra payment options, it’s essential to analyze the results thoroughly:

-

Monthly Payment Breakdown: We understand how important it is to manage your finances effectively. Review the estimated monthly payment, which includes principal, fees, taxes, and insurance—collectively referred to as PITI. Understanding this breakdown is crucial for effective budgeting, as it allows you to see where your money is going each month.

-

Total Cost of Borrowing: Take a moment to reflect on the total amount you will pay over the duration of the loan. This figure can be quite revealing; for instance, homeowners refinancing at today’s average rate of 6.13% could save nearly $100,000 in interest compared to earlier rates. Such insights may inspire you to consider paying extra on mortgage calculator to lower this total.

-

Loan Term: Assess how long it will take to pay off your mortgage. If you’re considering paying extra on mortgage calculator, evaluate how those contributions can reduce this term. For instance, paying extra on mortgage calculator can significantly reduce the duration of your loan, leading to substantial interest savings.

-

Comparison of Scenarios: If you’ve explored various payment options, compare the results to identify which scenario yields the best financial outcome. This comparison can help you understand the long-term implications of your choices, ensuring you make informed decisions that align with your financial goals.

By carefully analyzing these results, you empower yourself to make strategic decisions about your mortgage, paving the way for a more secure financial future. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Utilizing a mortgage calculator, especially when considering extra payments, is a vital step in navigating the complexities of home financing. This tool not only clarifies your monthly obligations but also empowers you to make informed decisions about your financial commitments. By leveraging the insights gained from a paying extra on mortgage calculator, you can approach your mortgage strategically, ensuring you are prepared for the responsibilities that lie ahead.

We understand how challenging this can be, and the key insights from this article emphasize the importance of accurately inputting your mortgage details. Exploring various payment scenarios and thoroughly analyzing the results can make a significant difference. By understanding the impact of factors such as home price, down payment, and interest rates, you can optimize your financing options. Additionally, experimenting with different payment strategies—like lump-sum contributions or biweekly installments—can yield substantial savings and shorten loan durations, making homeownership more attainable.

Ultimately, the journey toward effective mortgage management hinges on informed decision-making. Embracing the capabilities of a mortgage calculator, combined with expert guidance, can lead to substantial financial benefits. We’re here to support you every step of the way. By taking proactive steps today, you can pave the way for a more secure and prosperous future, maximizing your investment and minimizing costs.

Frequently Asked Questions

What is the purpose of a mortgage calculator?

A mortgage calculator helps individuals understand their monthly payments when considering home purchases or refinancing by factoring in the principal amount, interest rate, term duration, and estimates for taxes and insurance.

How does a mortgage calculator assist in financial decision-making?

By using a mortgage calculator, particularly one for paying extra on mortgage, individuals can gain clarity on their financial obligations, empowering them to make informed decisions about their financing options.

What are the benefits of using a mortgage calculator?

The benefits include the ability to compare various financing scenarios, such as adjusting the interest rate or the amount borrowed, which can significantly influence monthly payments.

Can a mortgage calculator help with refinancing options?

Yes, it is particularly useful when exploring refinancing options, allowing users to assess potential savings and the overall costs associated with different financing structures.

How do buyers use a mortgage calculator in real-life scenarios?

Buyers often run ‘what if’ scenarios using a mortgage calculator to see how different down payment amounts or loan terms affect their monthly commitments, helping them set a realistic budget.

What is the significance of combining a mortgage calculator with expert guidance?

While a mortgage calculator is an essential planning tool, it should be complemented by an official pre-approval from a financing expert to provide the most accurate financial picture and enhance the overall financing experience.

Why is using a mortgage calculator considered a smart first step in home purchasing?

It ensures individuals are prepared for the financial responsibilities ahead by helping them navigate the complexities of home financing with confidence.