Overview

Navigating mobile home mortgage rates can feel overwhelming, especially when considering the various factors at play. We understand how challenging this can be. Credit scores, loan types, and market conditions significantly influence the financing options available to families like yours.

Typically, higher credit scores lead to lower rates, which can ease some financial burdens. However, it’s crucial to understand the distinctions between financing options such as FHA, VA, and chattel loans. This knowledge empowers families to make informed decisions, ensuring you secure competitive mortgage rates that fit your needs.

We’re here to support you every step of the way. By acknowledging these factors and taking proactive steps, you can navigate the mortgage process with confidence and peace of mind.

Introduction

Navigating the world of mobile home mortgage rates can feel overwhelming for families. We understand how challenging this can be, and that’s why it’s crucial to grasp the unique landscape of mobile home financing. These specialized loans come with distinct characteristics and challenges that can significantly impact the affordability of homeownership.

As families seek to secure the best rates, they often grapple with important questions about:

- Credit scores

- Loan types

- Market conditions

What strategies can you employ to ensure you’re making informed decisions in this complex and often confusing market? We’re here to support you every step of the way as you explore your options and work towards your dream of homeownership.

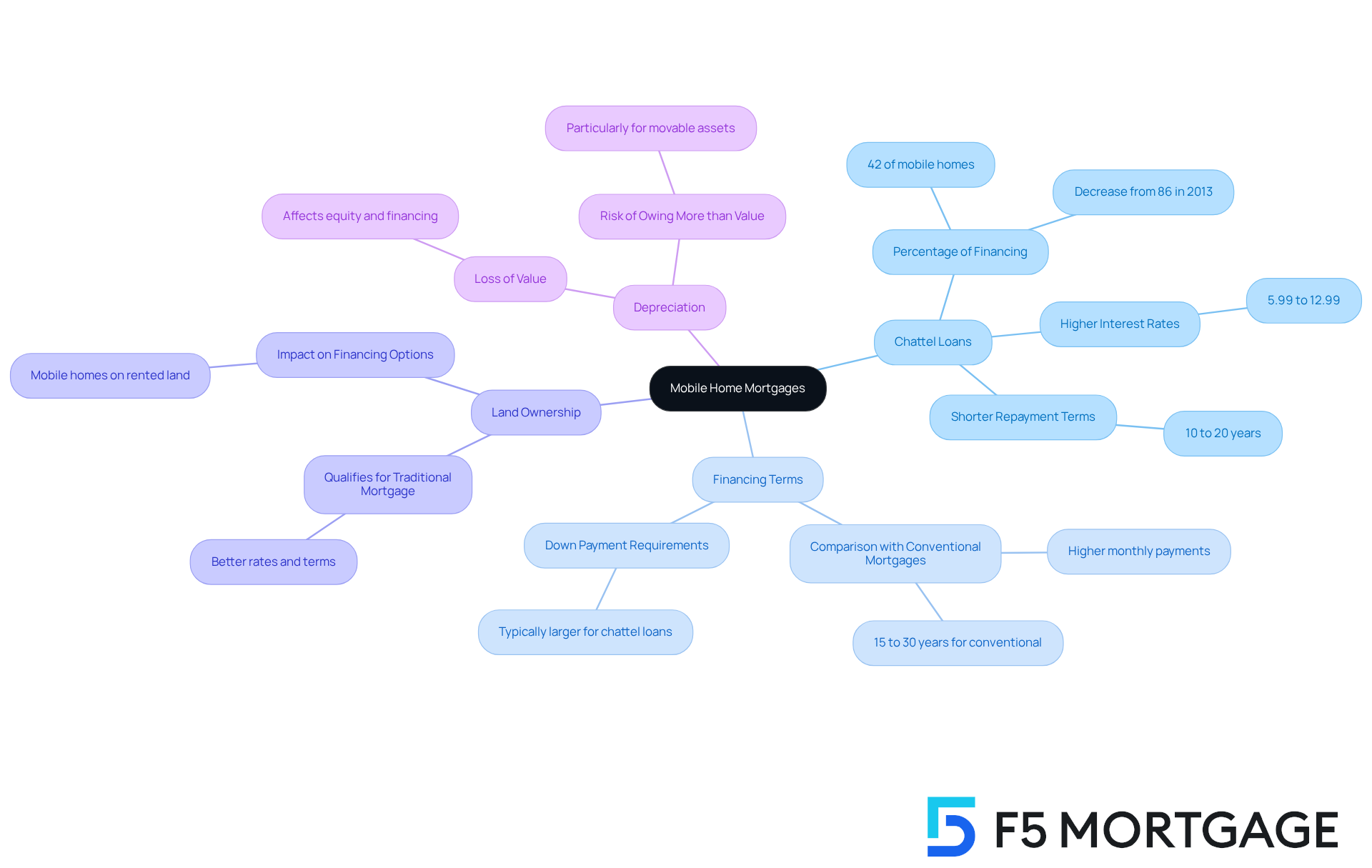

Define Mobile Home Mortgages and Their Unique Characteristics

Mobile home mortgage rates are specialized financing options designed to help families acquire mobile or manufactured residences. We understand how challenging this process can be, especially since mobile home mortgage rates differ from conventional financing options that typically support real estate. Financing mobile units can be more complex due to mobile home mortgage rates, as these structures are classified as personal property rather than real estate. Here are some key characteristics to consider:

- Chattel Loans: Many mobile homes are financed through chattel loans, secured by the home itself rather than the land it sits on. Interestingly, around 42% of mobile residences are funded through chattel financing, a significant decrease from 86% in 2013. This shift suggests a growing trend towards more traditional borrowing options like mobile home mortgage rates.

- Financing Terms: Mobile home mortgage rates often reflect shorter financing durations, usually ranging from 10 to 20 years, and may come with higher interest rates compared to conventional financing, which typically extends from 15 to 30 years. Mobile home mortgage rates usually vary from 5.99% to 12.99%, indicating the increased risk associated with these loans.

- Land Ownership: If your mobile residence is situated on owned land, it may qualify for a traditional mortgage, which can provide better mobile home mortgage rates and terms. This distinction is crucial for families looking to maximize their options regarding mobile home mortgage rates.

- Depreciation: It’s important to note that mobile residences can lose value, which affects the equity and financing alternatives available to property owners. This depreciation can lead to situations where owners owe more on their debts than the property’s value, particularly if the residence is considered a movable asset.

Understanding these characteristics is essential for families to make informed decisions about mobile home mortgage rates when financing their mobile home purchase. Chattel financing can be a practical solution for those with limited access to conventional funding, but it often results in higher expenses compared to mobile home mortgage rates and comes with fewer safeguards. Consulting with a financing expert can help you effectively navigate mobile home mortgage rates. As Kacie Goff wisely suggests, obtaining quotes from a minimum of three lenders is essential to ensure you’re receiving the most favorable mobile home mortgage rates and conditions on your chattel financing.

Additionally, consider potential tax advantages, as interest paid on a chattel financing arrangement may be deductible if it serves as your primary residence. However, families should also be aware of the risks associated with chattel loans, including a faster repossession process in case of default. Sebastian Frey emphasizes that chattel agreements carry a greater risk for loss, so it’s vital to approach this financing option with caution. We’re here to support you every step of the way as you explore your financing options.

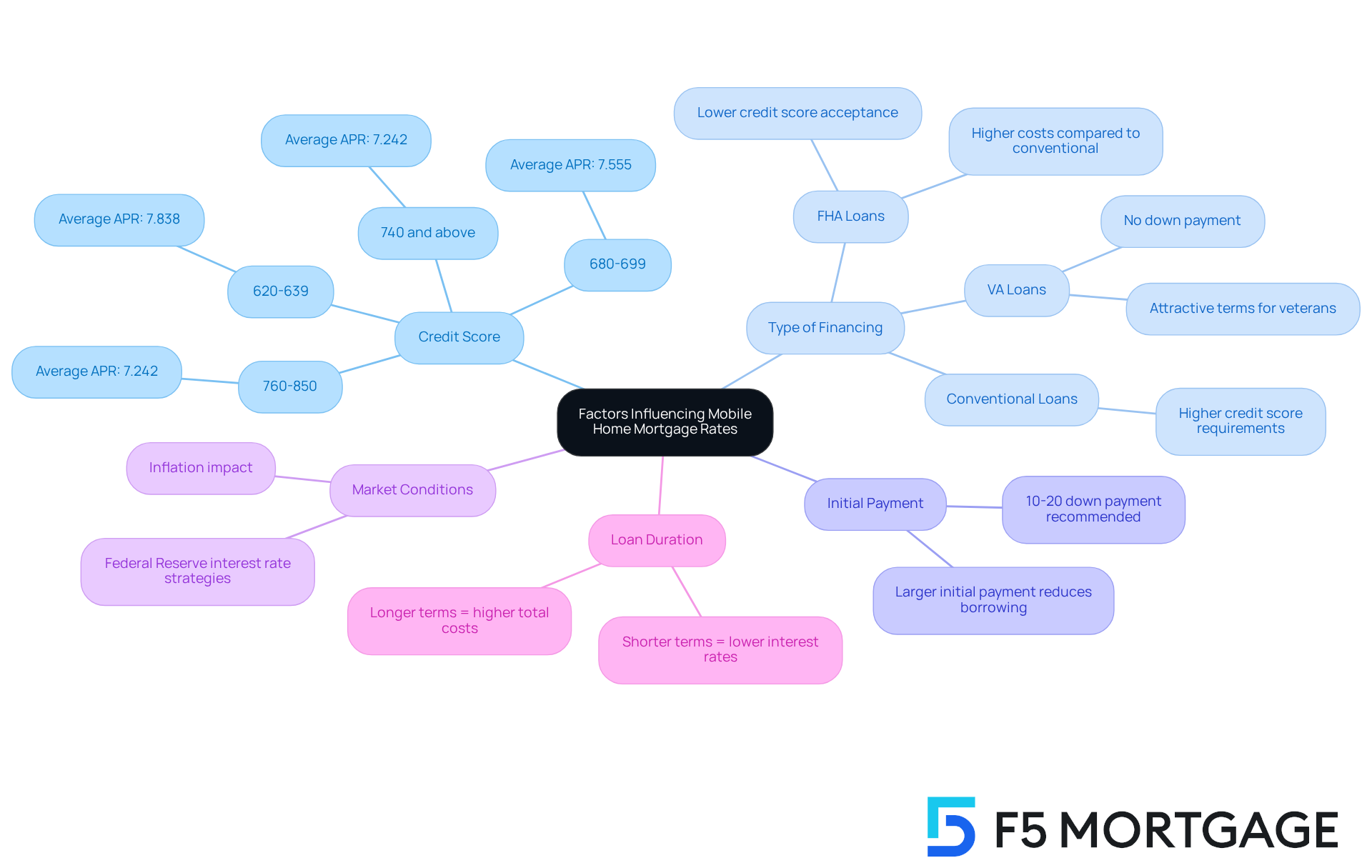

Explore Factors Influencing Mobile Home Mortgage Rates

Understanding several key factors that significantly influence mobile home mortgage rates can make a world of difference in your journey.

We know how crucial a higher credit score is; it typically leads to lower mobile home mortgage rates. Lenders often view borrowers with scores exceeding 740 as lower risk, allowing them to secure the most advantageous terms. For instance, if you have a FICO score ranging from 760 to 850, you might anticipate an average mortgage APR of approximately 7.242%. In contrast, those with scores from 620 to 639 might encounter rates as high as 7.838%.

The type of financing you choose—whether it’s FHA, VA, or conventional—can greatly impact your mobile home mortgage rates and terms. FHA financing may allow lower credit scores but often comes with higher costs compared to traditional options. On the other hand, VA financing offers substantial benefits, including no down payment and attractive terms specifically for veterans.

- Initial Payment: Making a larger initial payment can significantly reduce the amount you need to borrow and lower your overall interest costs. A down payment of 10-20% is often recommended, as it demonstrates financial stability and reduces lender risk, which can lead to better loan terms.

Market conditions, including economic factors like inflation and Federal Reserve interest rate strategies, significantly influence mobile home mortgage rates. Staying informed about these trends can empower families to time their mortgage applications effectively.

- Loan Duration: The length of your borrowing period also affects your costs. Shorter terms typically come with lower interest rates but higher monthly payments, while longer terms may offer smaller payments at the expense of increased total costs.

By understanding these factors, you can navigate the loan application process more effectively. Remember, we’re here to support you every step of the way, helping you negotiate terms that align with your financial objectives.

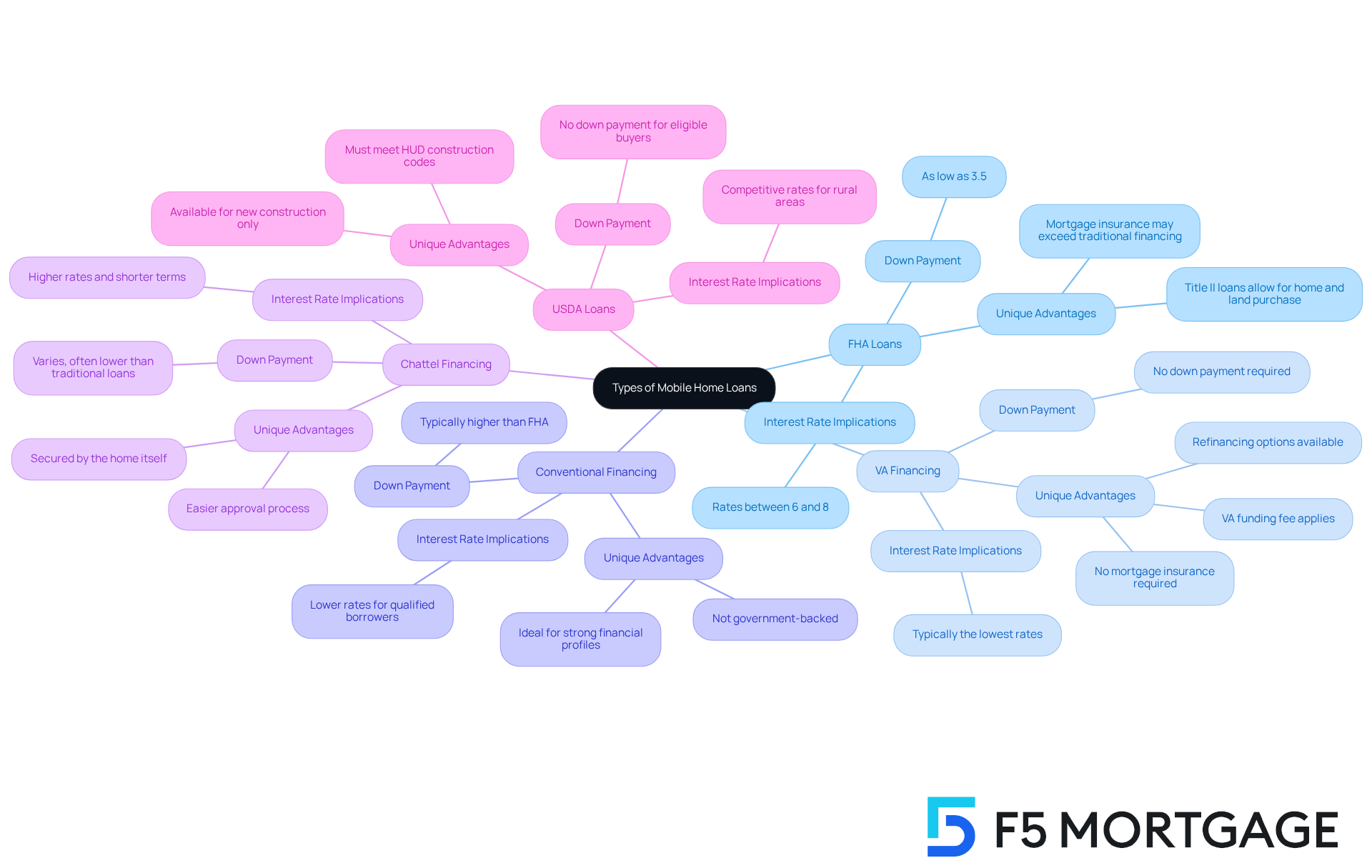

Identify Types of Mobile Home Loans and Their Rate Implications

When considering mobile home mortgage rates, we understand how challenging this can be. It’s essential to understand the various loan types available, each with unique characteristics and implications for interest rates:

-

FHA Loans: Insured by the Federal Housing Administration, FHA loans are designed to assist borrowers with lower credit scores and require a down payment as low as 3.5%. While they provide attractive prices, borrowers should be mindful of the related mortgage insurance expenses, which may exceed those of traditional financing. FHA Title II financing, particularly for mobile residences categorized as real estate on a permanent foundation, allows for the acquisition of both the manufactured structure and the land, offering advantageous conditions for qualified purchasers.

-

VA Financing: Designed for veterans and active-duty military members, VA financing stands out with its competitive rates and the considerable advantage of no down payment necessity. This makes them an appealing option for eligible borrowers looking to purchase manufactured homes. VA programs also do not require mortgage insurance, further enhancing their affordability. However, it’s important to be aware of the VA funding fee, an upfront expense associated with these financial products. For instance, a $553,100 VA mortgage would require a down payment of only $25,000, showcasing the financial benefits accessible to veterans. Additionally, refinancing options such as the VA Interest Rate Reduction Refinance Loan (IRRRL) and VA cash-out refinance are available, providing further financial flexibility. F5 Mortgage is here to assist in navigating these benefits, ensuring that eligible service members make the most of their options.

-

Conventional Financing: Unlike government-backed options, conventional financing is not insured by any government entity. They typically require higher credit scores and down payments, but they can offer lower rates for qualified borrowers. These financial products are ideal for individuals with robust financial profiles who can meet the stricter requirements.

-

Chattel Financing: Specifically designed for mobile homes, chattel financing is secured by the home itself rather than real estate. While they provide easier approval processes, they often come with higher interest rates and shorter repayment terms, making them a less favorable long-term option.

By understanding mobile home mortgage rates and other financing options, families can make informed choices that align with their financial situations and homeownership goals. For instance, FHA mortgages can be especially beneficial for first-time purchasers, while VA programs provide unmatched advantages for veterans, making them an appealing option for qualified service members. Additionally, families in rural areas should consider USDA loans, which offer financing options without a down payment for eligible buyers. We’re here to support you every step of the way.

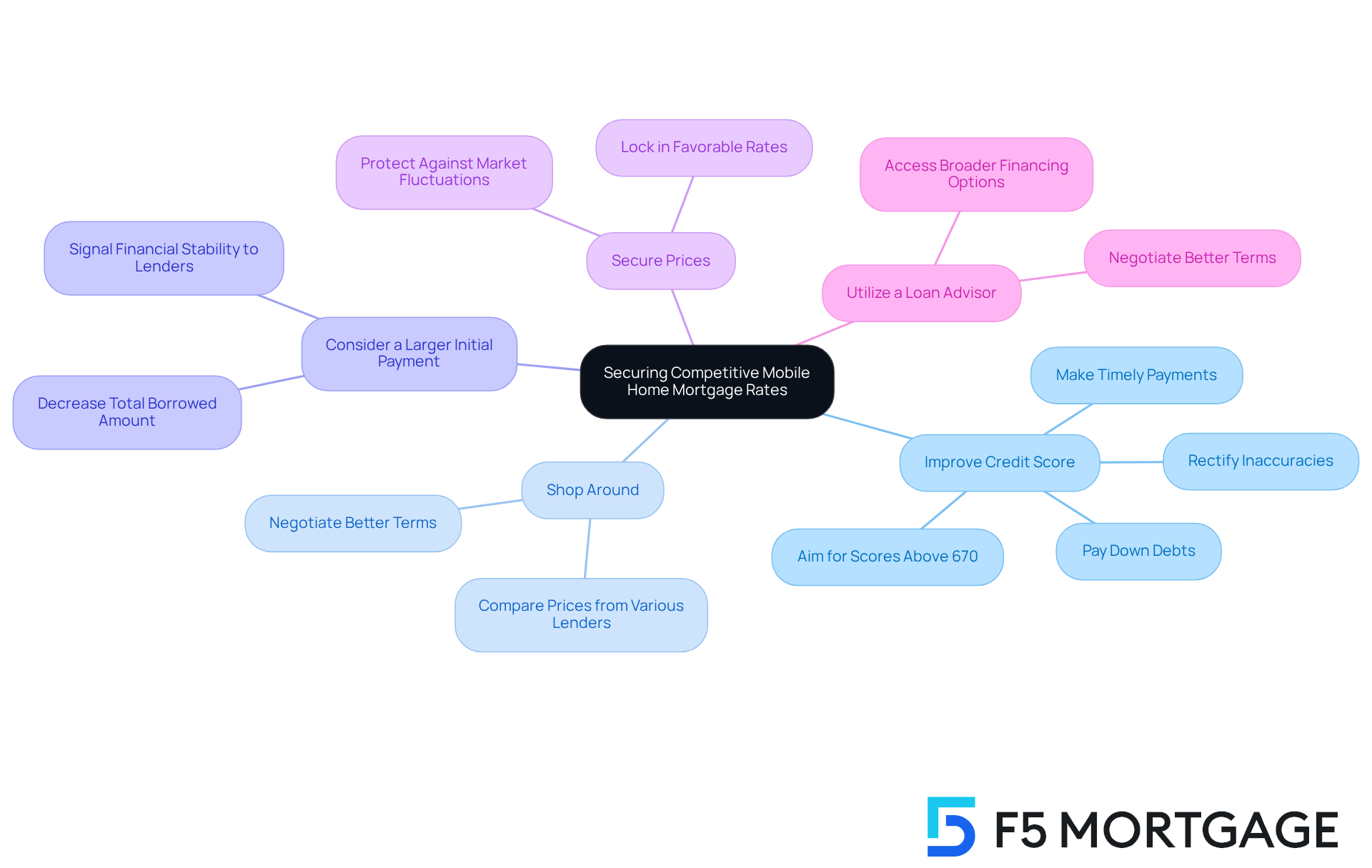

Implement Strategies to Secure Competitive Mobile Home Mortgage Rates

To secure competitive mobile home mortgage rates, families can adopt several effective strategies that truly make a difference:

- Improve Credit Score: We understand how important it is to enhance your credit score. By consistently paying down debts, making timely payments, and rectifying any inaccuracies on your credit report, you can elevate your score. An improved credit score can significantly reduce interest costs, with scores exceeding 670 generally accessing the most favorable deals.

- Shop Around: It’s essential to compare prices from various lenders. Different institutions may offer varying costs and terms, and this practice not only helps in finding the best deal but also empowers you to negotiate better terms.

- Consider a Larger Initial Payment: Setting aside funds for a more substantial initial payment can decrease the total borrowed amount, possibly leading to reduced interest costs. A larger down payment signals financial stability to lenders, enhancing your attractiveness as a borrower.

- Secure Prices: Once you identify a favorable price, consider securing it to protect against potential increases before closing. This can provide peace of mind in a fluctuating market.

- Utilize a Loan Advisor: Working with a knowledgeable loan advisor can open doors to a broader range of financing options and assist in negotiating better terms. Brokers often have insights into lender-specific criteria that can lead to more favorable financing.

By implementing these strategies, families can significantly improve their chances of securing competitive mobile home mortgage rates. We know how challenging this can be, but with the right approach, the journey to homeownership becomes more attainable and affordable.

Conclusion

Understanding mobile home mortgage rates is crucial for families navigating the complexities of financing mobile or manufactured homes. We know how challenging this can be. This article highlights the unique characteristics of these loans, the factors influencing rates, and the various types of financing options available, equipping readers with the knowledge needed to make informed decisions.

Key insights include:

- The importance of credit scores

- The implications of different loan types such as FHA, VA, and chattel financing

- Strategies to secure competitive rates

Families are encouraged to improve their credit scores, shop around for the best deals, and consider larger down payments to enhance their borrowing position. Each of these elements plays a vital role in determining the overall cost of homeownership.

Ultimately, the journey to securing a mobile home should be approached with careful consideration and planning. By leveraging the insights and strategies discussed, families can navigate the mortgage landscape more effectively. Remember, we’re here to support you every step of the way, ensuring you find the best financing options to suit your needs. Empowered with this knowledge, families can confidently pursue their dreams of homeownership while minimizing financial risks and maximizing potential benefits.

Frequently Asked Questions

What are mobile home mortgages?

Mobile home mortgages are specialized financing options designed to help families acquire mobile or manufactured residences. They differ from conventional financing options that typically support real estate.

What are chattel loans?

Chattel loans are a type of financing used for mobile homes, secured by the home itself rather than the land it sits on. Approximately 42% of mobile residences are financed through chattel loans.

How do mobile home mortgage rates compare to conventional financing?

Mobile home mortgage rates generally have shorter financing terms, typically ranging from 10 to 20 years, and come with higher interest rates, usually between 5.99% and 12.99%, compared to conventional financing which often extends from 15 to 30 years.

How does land ownership affect mobile home mortgage options?

If a mobile home is situated on owned land, it may qualify for a traditional mortgage, which can offer better mobile home mortgage rates and terms.

What is the impact of depreciation on mobile homes?

Mobile residences can lose value, affecting the equity and financing options available to owners. This depreciation can lead to situations where owners owe more on their debts than the property’s value.

What are the risks associated with chattel loans?

Chattel loans carry a greater risk for loss, including a faster repossession process in case of default. They often result in higher expenses and fewer safeguards compared to traditional mortgages.

What should families consider when seeking mobile home mortgage rates?

Families should consult with financing experts and obtain quotes from at least three lenders to ensure they receive the most favorable rates and conditions. Additionally, they should consider potential tax advantages and the risks associated with chattel loans.