Introduction

Homeownership is more than just a roof over your head; it’s a significant financial investment. Yet, many homeowners may not realize the potential to tap into their property’s equity for essential upgrades. We know how challenging this can be, but by leveraging this equity through home equity loans, you can access funds for renovations, debt consolidation, or other major expenses. Plus, you can enjoy the predictability of fixed interest rates, which can bring peace of mind.

Navigating the requirements and processes can feel overwhelming. What are the key factors that determine eligibility? How can you secure the best rates? This guide is here to support you every step of the way. We’ll explore the intricacies of securing a loan against your house, empowering you to make informed decisions that enhance both your living space and financial well-being.

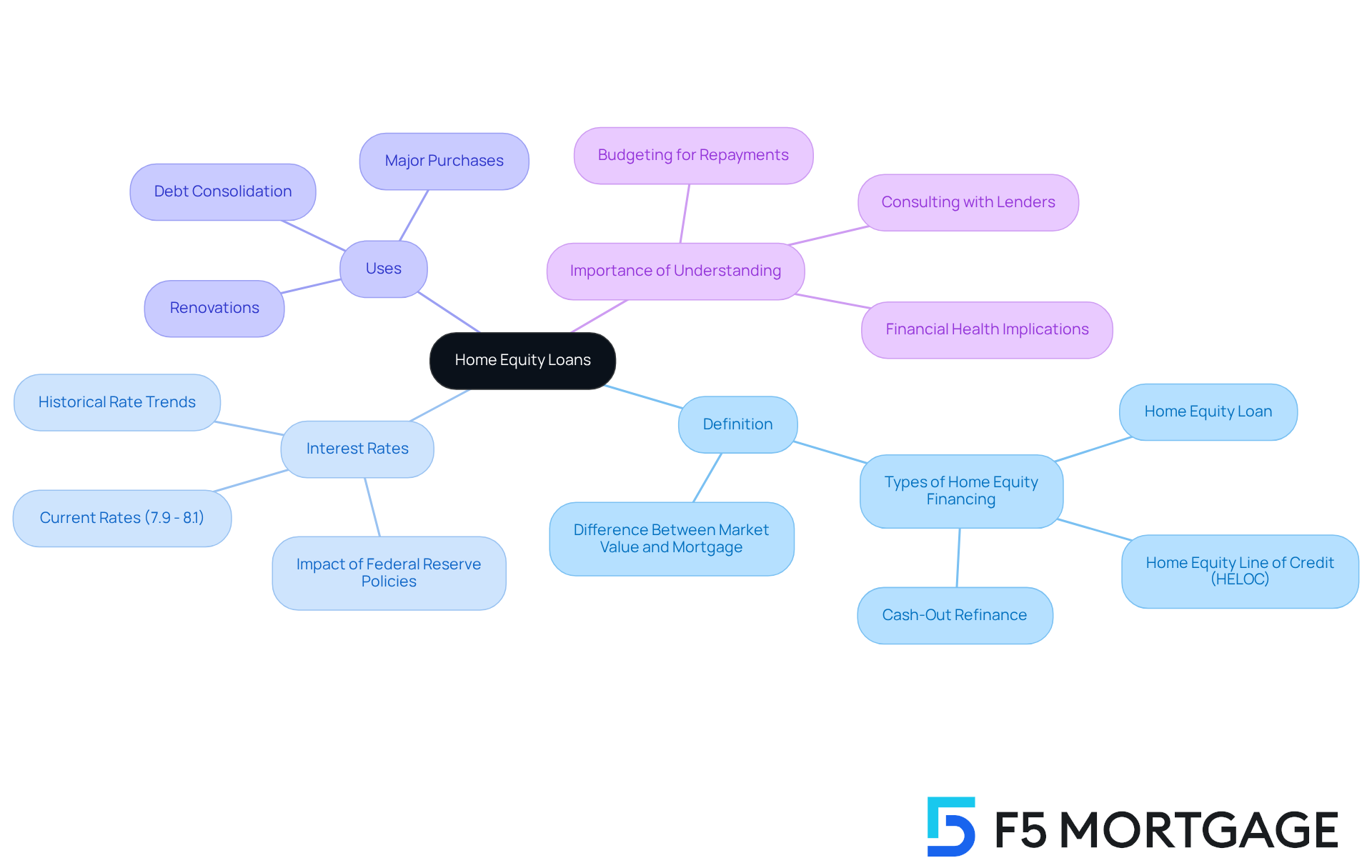

Understand Home Equity Loans

Home equity financing offers a way for homeowners to tap into the equity they’ve built in their properties. This equity is simply the difference between your home’s current market value and what you still owe on your mortgage. In 2025, interest rates for these financial products typically range from 7.9% to 8.1%. This makes them an attractive option for many families looking to improve their financial situation.

These agreements often come with fixed interest rates, which means you can count on predictable monthly payments throughout the term. Homeowners frequently turn to a loan against house for significant expenses, like renovations, debt consolidation, or major purchases. For example, many families have successfully funded kitchen remodels or consolidated high-interest debts using this financing method, showcasing its flexibility and usefulness.

Understanding how residential loans work is crucial for homeowners. It helps you determine if this option aligns with your financial goals. We know how challenging this can be, and financial consultants emphasize the importance of grasping the implications of a loan against house value. This decision can significantly impact your long-term financial health.

By carefully evaluating your ownership status and financial needs, you can make informed choices that enhance your living space and overall financial stability. Remember, we’re here to support you every step of the way.

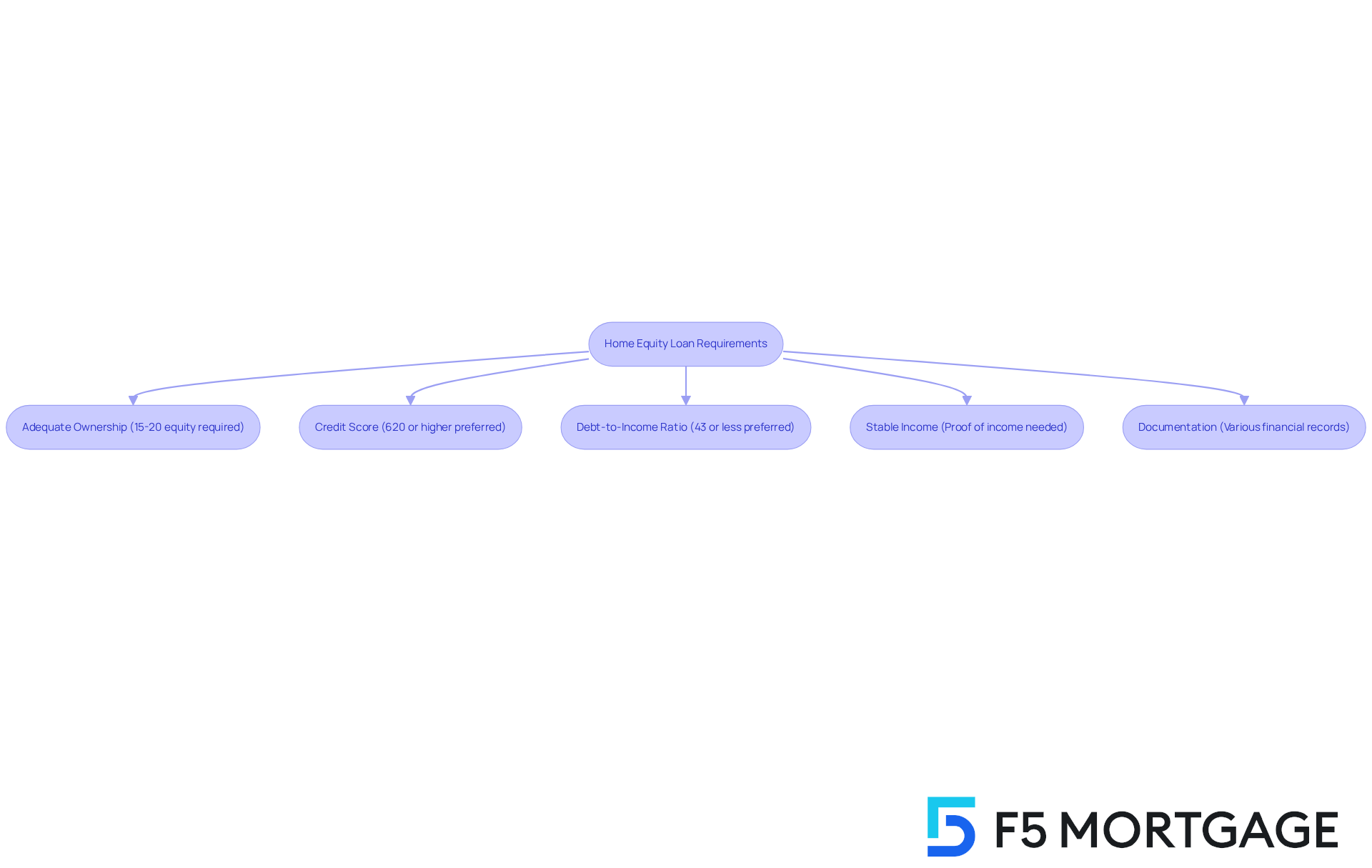

Identify Home Equity Loan Requirements

If you’re considering a loan against house, it’s important to understand the key criteria that can help you navigate this process with confidence. We know how challenging this can be, but being informed can make a significant difference.

Adequate Ownership: Most lenders typically look for homeowners to have at least a 15-20% ownership stake in their property. This means that the total amount borrowed, which includes your primary mortgage and the property loan, should not exceed 80% of your home’s value. For instance, if your home is valued at $400,000 and you owe $200,000, you could potentially borrow up to $120,000, keeping a 20% ownership cushion. Alternatively, you might explore a cash-out refinance, which allows you to refinance your existing mortgage for a higher amount and receive the difference in cash. This can be a great way to access home equity for important expenses like renovations or debt consolidation.

Credit Score: A strong credit score is crucial for securing favorable borrowing terms. Generally, a score of 620 or higher is needed, but aiming for 740 or above can unlock lower interest rates and better conditions. If your score is below 620, you might find it more difficult to get approved, as lenders often see this as a higher risk.

Debt-to-Income Ratio (DTI): Lenders usually prefer a DTI ratio of 43% or less. This ratio is calculated by dividing your total monthly debt payments by your gross monthly income. For example, if your monthly income is $3,000 and your total debt payments are $1,200, your DTI would be 40%, which is acceptable for most lenders.

Stable Income: Showing a consistent income stream is essential. You should be ready to provide proof of steady income, such as pay stubs, W-2 forms, or tax returns. This reassures lenders that you can handle additional payment obligations.

Documentation: Be prepared to submit various documents, including mortgage statements, property tax bills, and other financial records. This thorough documentation helps lenders accurately assess your financial situation. Additionally, the lender will arrange a property appraisal to determine the current market value of your asset, which will influence your rates and show how much ownership you have.

By understanding these criteria, you can enhance your readiness for the application process and increase your chances of securing a loan against house for essential improvements. Moreover, exploring options like property value lines of credit can provide you with extra flexibility in utilizing your home’s equity. Remember, we’re here to support you every step of the way.

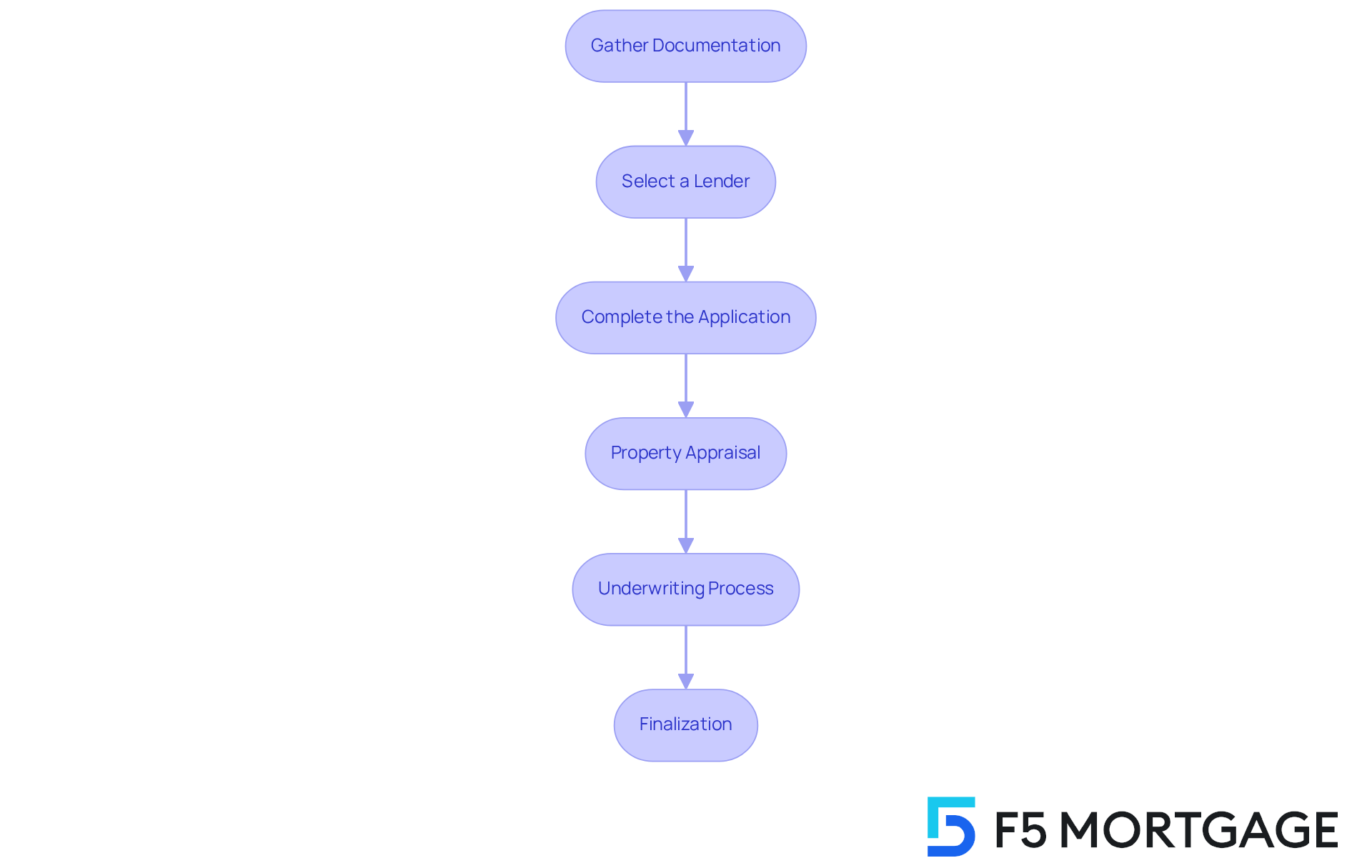

Apply for a Home Equity Loan

Applying for a loan against house can feel overwhelming, but we are here to support you every step of the way. By following these essential steps, you can navigate this process with confidence and set yourself up for a brighter financial future:

Gather Documentation: Start by collecting necessary documents like proof of income, tax returns, and details about existing debts. Having these ready can really speed things up, as lenders typically want a clear picture of your financial situation.

Select a Lender: Take the time to investigate and evaluate different lenders. Look for the most attractive prices and favorable conditions. With property equity, a loan against house percentages currently averaging below 8%, comparing your options can lead to significant savings. Focus on lenders that offer low-interest rates and fees, as these can greatly impact your overall borrowing costs.

Complete the Application: When filling out the lender’s application form, be sure to provide accurate and detailed information about your financial situation. This includes your credit score, which ideally should be in the mid-600s or higher to boost your chances of approval.

Property Appraisal: Most lenders will require a property appraisal to determine the current market value of your home. This step is crucial, as it directly affects the amount of capital you can secure through a loan against house. For instance, if your property is assessed at $400,000 and you owe $320,000, you have 20% equity, which is typically the minimum needed for most mortgage financing options.

Underwriting Process: After submitting your application, the lender will conduct a thorough review of your financial information, including your credit history, income, and assets. It’s important to understand that a high debt-to-income ratio-usually above 43%-can hinder your approval chances.

Finalization: If your application is approved, you’ll move on to the finalization stage, where you’ll sign the financing documents and receive the funds. This process usually takes a few weeks, so be prepared for potential delays due to document verification or appraisal timelines.

By following these steps and ensuring you have all the required documents, you can navigate the application process for a loan against house more efficiently. Remember, we’re here to help you obtain the resources you need for your renovations.

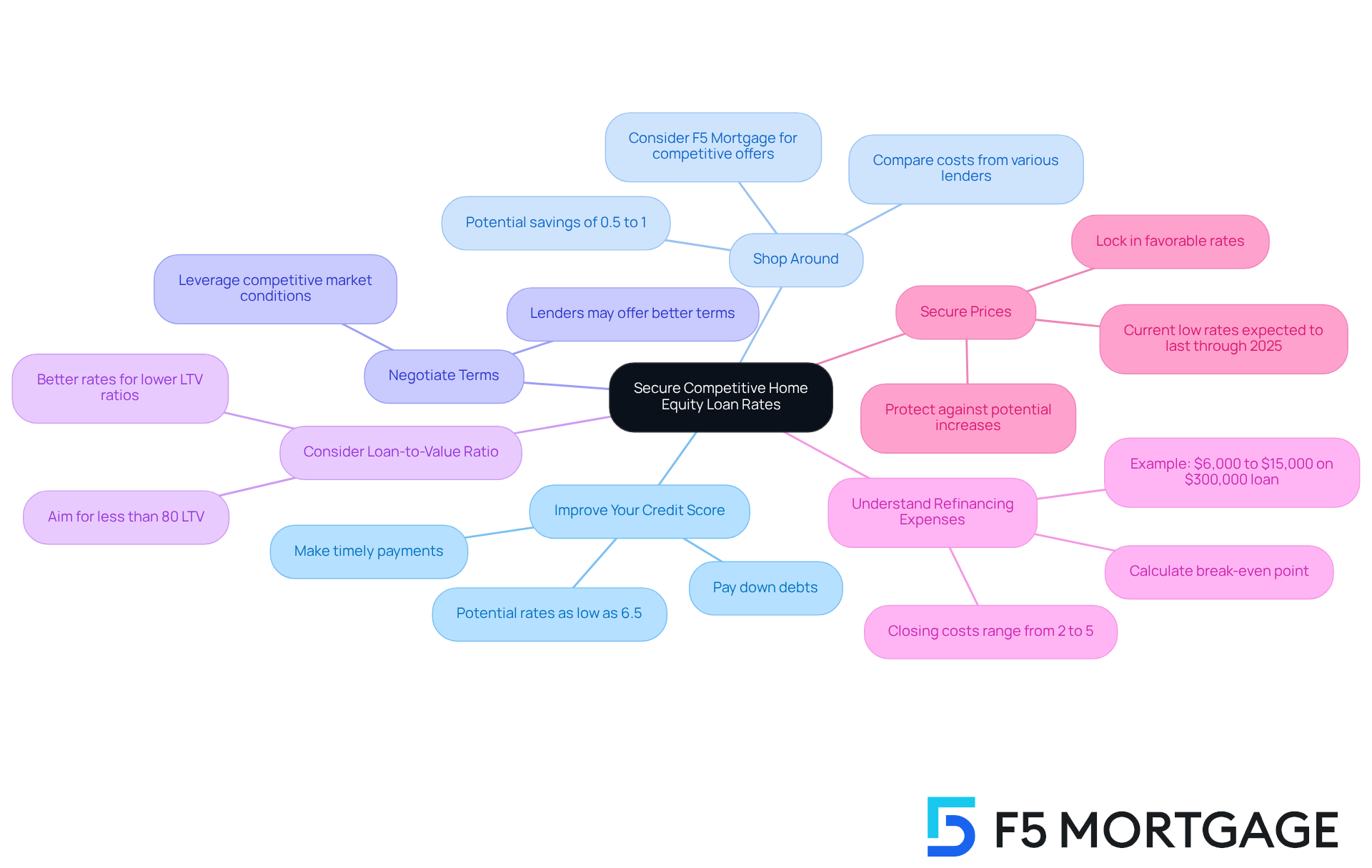

Secure Competitive Home Equity Loan Rates

Securing competitive rates for a loan against house can feel overwhelming, but we’re here to support you every step of the way. Here are some strategies to help you navigate this process with confidence:

Improve Your Credit Score: We know how challenging it can be to manage debts, but paying them down and making timely payments can significantly enhance your credit score. Many homeowners who took this step found themselves enjoying better borrowing terms, with some even securing rates as low as 6.5%.

Shop Around: Don’t settle for the first offer you see. Comparing costs from various lenders – like banks, credit unions, and online platforms – can lead to substantial savings. Homeowners who explored different options reported saving between 0.5% to 1% in costs, which adds up over the life of the loan against house. Consider partnering with F5 Mortgage for competitive offers and personalized service, ensuring you find the best fit for your financial needs.

Negotiate Terms: Remember, it’s okay to negotiate! Many lenders are willing to offer better terms or lower fees to earn your business, especially in a competitive market where they feel confident due to favorable economic conditions.

Consider the loan against house: a lower loan-to-value (LTV) ratio can lead to better rates. Aim to borrow less than 80% of your home’s equity. Borrowers with LTV ratios under this threshold often receive the best deals available.

Understand Refinancing Expenses: If you’re thinking about refinancing, be aware that closing costs in California typically range from 2% to 5% of the borrowed amount. For instance, on a $300,000 loan, you might pay between $6,000 and $15,000 in closing costs. Knowing these fees can help you calculate your break-even point, ensuring that refinancing is the right choice for you.

Secure Prices: If you find a favorable price, consider locking it in. With recent reductions from the Federal Reserve leading to lower property values, securing a price now can protect you from potential increases before finalizing. This is especially important as prices are expected to remain low through 2025, though uncertainty about future changes lingers.

Compare Home Equity Loans with Other Financing Options

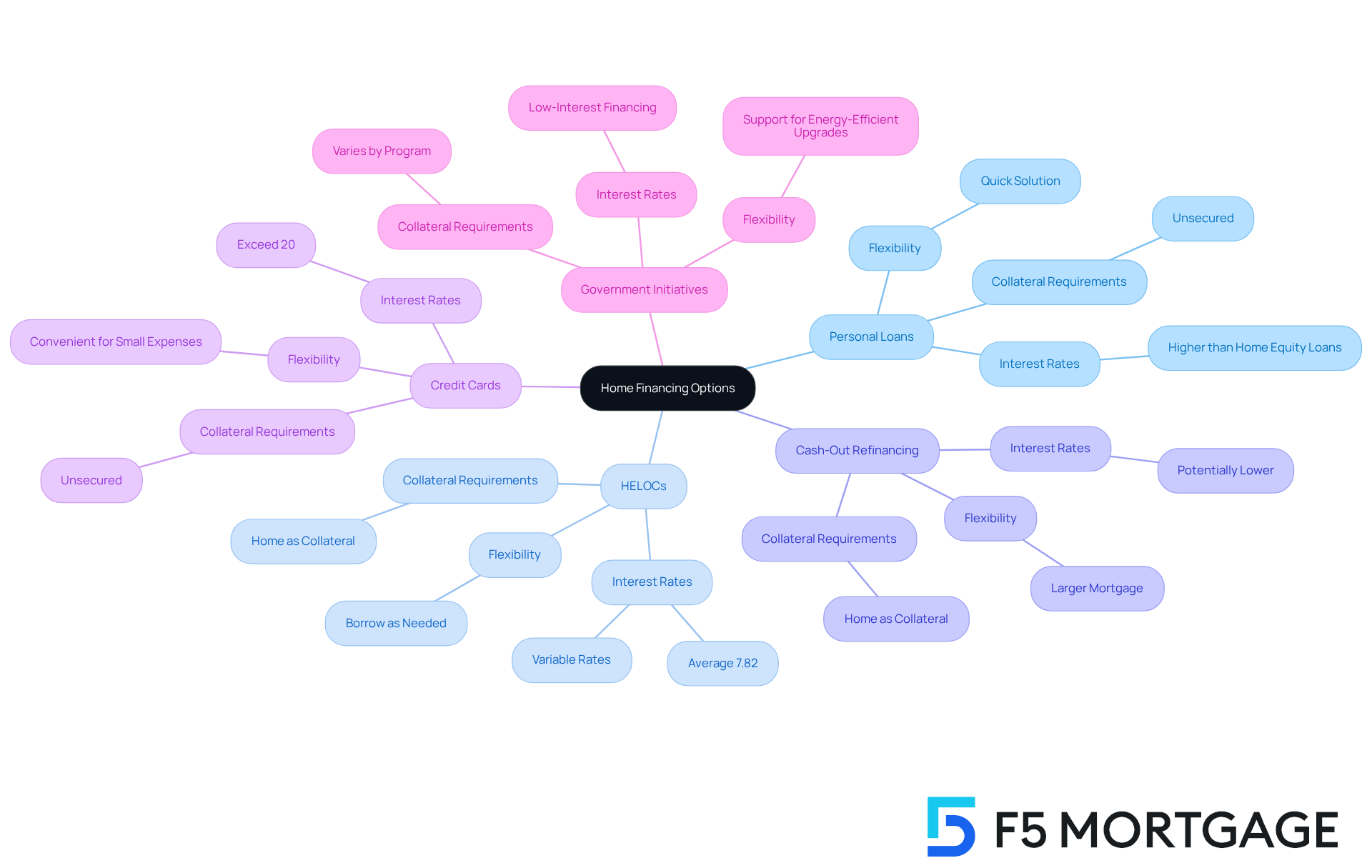

When it comes to financing home upgrades, we know how challenging it can be to navigate your options. It’s essential to evaluate home equity loans alongside other possibilities that might suit your needs better:

Personal Loans: These unsecured loans can be a quick solution, but they often come with higher interest rates than home equity loans. They don’t require you to use your home as collateral, which can be a relief for many homeowners.

Home Equity Lines of Credit (HELOCs): HELOCs offer flexibility, allowing you to borrow as needed up to a certain limit. However, keep in mind that they usually have variable interest rates, which can lead to fluctuating monthly payments. Currently, the average HELOC rate is around 7.82%, making it a competitive choice for many. Plus, if you use a HELOC for home-related expenses, the interest may be tax-deductible, which is a significant factor to consider.

Cash-Out Refinancing: This option replaces your existing mortgage with a larger one, letting you withdraw cash for upgrades. While it can lower your interest charges, be aware that it might involve higher closing costs and a longer approval process.

Credit Cards: They can be convenient for smaller expenses, but credit cards typically carry much higher interest rates. For example, average credit card rates can exceed 20%, which can add up quickly if you’re planning substantial renovations.

Government Initiatives: Don’t forget to explore local or national programs that may offer low-interest financing or funds for home improvements, especially for energy-efficient upgrades. These initiatives can significantly ease the financial burden of renovations.

As we look ahead to 2025, many homeowners are leaning towards HELOCs due to their flexibility and lower average costs compared to traditional home equity financing, which is currently about 8.20% for a 10-year term. Financial advisors stress the importance of evaluating your unique financial situation when deciding between these options. For instance, if you have a steady income and a clear renovation budget, a loan against house might be the right fit for you, offering fixed terms and predictable payments. On the other hand, if you anticipate needing funds over time, a HELOC could be more beneficial. Just remember to weigh the risks associated with HELOCs, such as the chance of owing more than your home’s value if property prices drop.

Ultimately, your decision should reflect your personal financial goals, the nature of the upgrades you’re considering, and the current interest rate landscape. We’re here to support you every step of the way as you make this important choice.

Conclusion

Securing a loan against your home for upgrades can be a smart move, especially if you’re looking to tap into your property’s equity. We understand how important it is to make informed financial decisions that align with your renovation goals. By grasping the ins and outs of home equity loans – like their benefits, requirements, and application processes – you can feel more confident in your choices.

This article emphasizes the need to assess your home equity and understand the loan requirements. Key factors to consider include:

- Your ownership status

- Credit scores

- Debt-to-income ratios

These elements can significantly impact your loan approval and terms. Plus, exploring competitive rates and comparing home equity loans with other financing options can help you maximize your investment while keeping costs down.

Ultimately, deciding to secure a home equity loan should reflect your personal financial goals and the specific upgrades you have in mind. With the right information and support, you can confidently embark on your renovation journey. Imagine transforming your living space while enhancing your overall financial health. Taking proactive steps today can lead to a more beautiful and functional home tomorrow. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a home equity loan?

A home equity loan allows homeowners to borrow against the equity they have built in their property, which is the difference between the home’s current market value and the remaining mortgage balance.

What are the typical interest rates for home equity loans in 2025?

In 2025, interest rates for home equity loans typically range from 7.9% to 8.1%.

What are common uses for home equity loans?

Homeowners often use home equity loans for significant expenses such as renovations, debt consolidation, or major purchases.

What percentage of ownership do lenders typically require for a home equity loan?

Most lenders require homeowners to have at least a 15-20% ownership stake in their property, meaning the total amount borrowed should not exceed 80% of the home’s value.

What credit score is needed to secure a home equity loan?

A credit score of 620 or higher is generally needed, but aiming for a score of 740 or above can lead to better borrowing terms and lower interest rates.

What is the preferred debt-to-income (DTI) ratio for lenders?

Lenders usually prefer a DTI ratio of 43% or less, which is calculated by dividing total monthly debt payments by gross monthly income.

What documentation is required when applying for a home equity loan?

Applicants should be prepared to submit various documents, including mortgage statements, property tax bills, proof of income, and other financial records.

How does a property appraisal factor into the home equity loan process?

A property appraisal is arranged by the lender to determine the current market value of the property, which influences the loan rates and the amount of equity available for borrowing.