Introduction

Navigating the world of mobile home financing can feel overwhelming. We know how challenging this can be, especially with the many options and requirements that prospective buyers must understand. This guide is designed to break down the essential steps to secure a loan while highlighting the distinct advantages of different financing options available in 2025.

However, many borrowers remain unaware of critical details, like how their credit score impacts loan eligibility. This lack of knowledge can make the journey even more complex. So, what are the best strategies to overcome these challenges and secure the financing needed for a mobile home? We’re here to support you every step of the way.

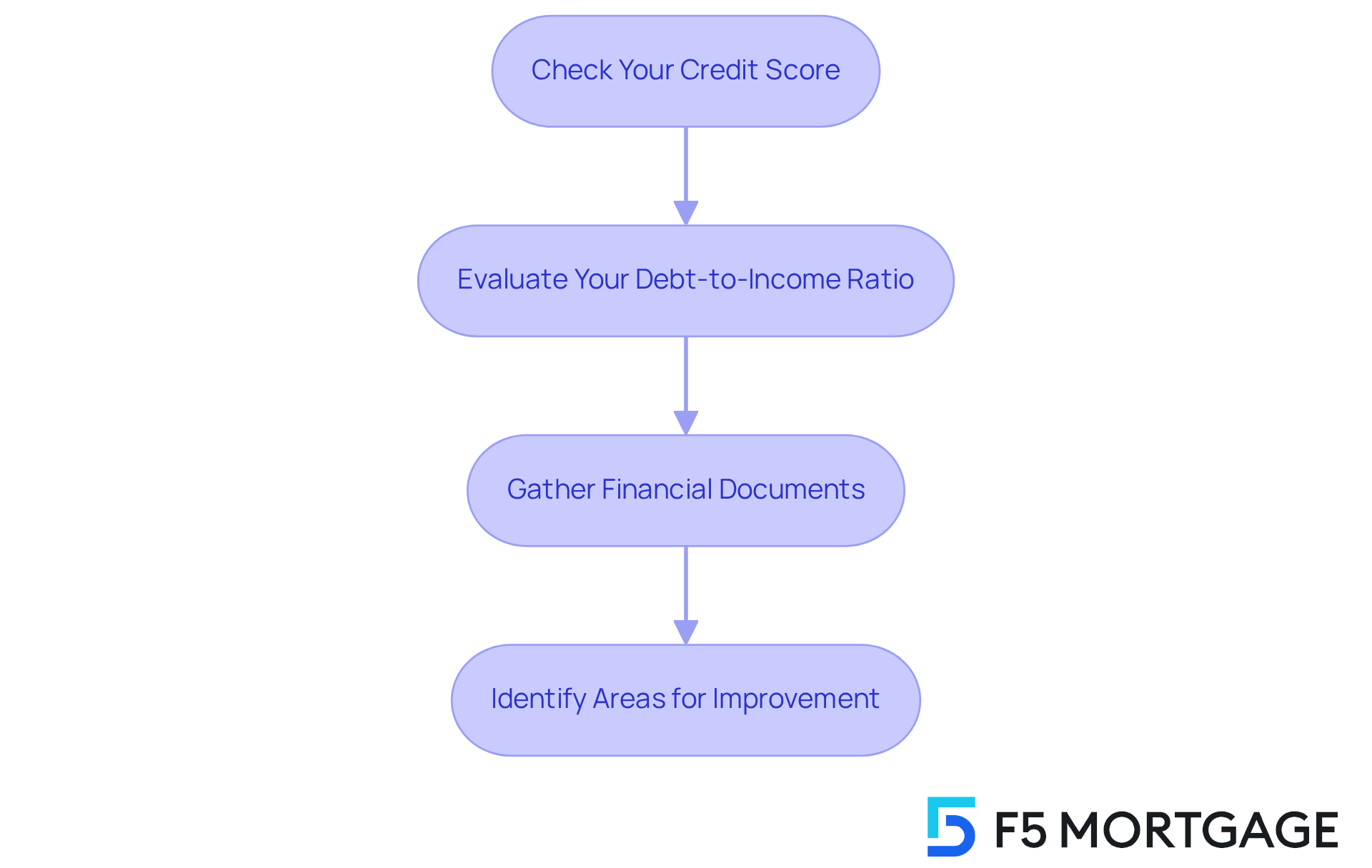

Assess Your Financial Situation and Creditworthiness

Check Your Credit Score: We know how challenging it can be to navigate your financial standing. Start by obtaining your credit report from major credit bureaus like Equifax, Experian, and TransUnion. Aiming for a score of at least 620 can significantly enhance your financing options. Many lenders favor this benchmark for favorable terms, so it’s worth striving for.

Evaluate Your Debt-to-Income Ratio: Understanding your debt-to-income (DTI) ratio is crucial. You can calculate it by dividing your total monthly debt payments by your gross monthly income. A DTI below 43% is generally considered favorable, with many lenders preferring ratios of 36% or less. However, don’t lose hope if your DTI is higher; some programs, like FHA loans, may allow ratios up to 50% if you have compensating factors.

Gather Financial Documents: Preparing essential documents is a vital step in this process. Collect pay stubs, tax returns, and bank statements. Lenders require these to evaluate your financial situation comprehensively, and having them ready can ease your stress.

Identify Areas for Improvement: If your score is below the desired threshold, don’t worry; there are strategies to enhance it. Consider reducing high-interest debts, fixing mistakes on your financial report, and boosting your income. As financial consultants recommend, improving your DTI by decreasing current debt can also lead to a better credit score, making you a more appealing candidate for approval. Remember, we’re here to support you every step of the way.

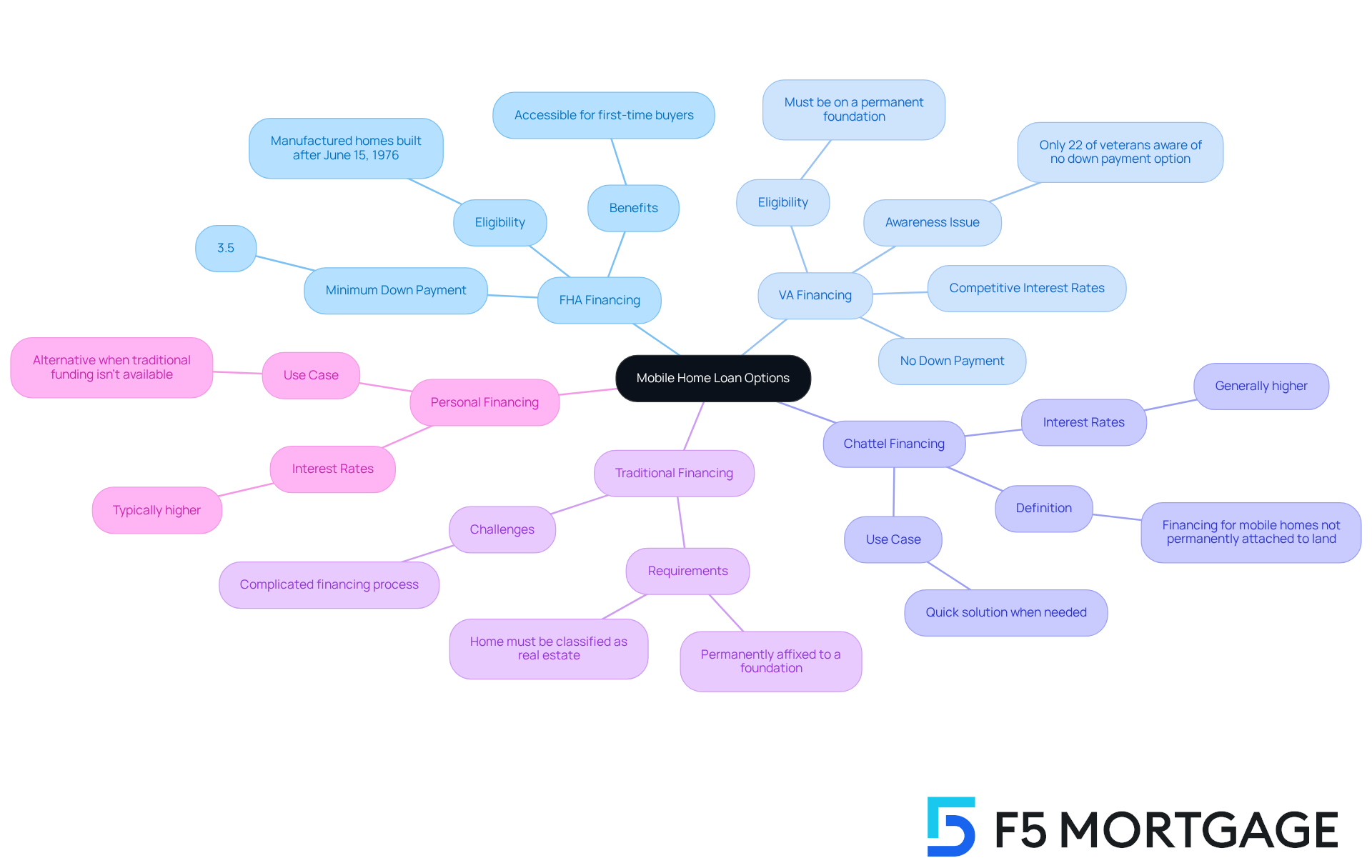

Explore Different Mobile Home Loan Options

FHA Financing: If you’re looking for a way to make homeownership more accessible, FHA financing might be just what you need. Supported by the Federal Housing Administration, this option is available for manufactured homes built after June 15, 1976. With a minimum down payment of just 3.5%, it’s a fantastic choice for first-time buyers seeking affordable financing solutions.

VA Financing: For our veterans and active-duty service members, VA financing offers incredible benefits that can make a real difference. Imagine securing your home with no down payment and enjoying competitive interest rates! Yet, in 2025, only 22% of veterans knew about this no down payment option. This highlights a crucial opportunity for eligible borrowers to take advantage of this benefit when purchasing mobile properties.

Chattel Financing: If your mobile home isn’t permanently attached to land, chattel financing could be a viable option. This type of personal property financing is generally easier to obtain, but it often comes with higher interest rates. While it may not be the most cost-effective choice for long-term financing, it can provide a quick solution when needed.

Traditional Financing: Some lenders do offer traditional financing for mobile homes, but there’s a catch. These agreements usually require the property to be classified as real estate, which means the home must be permanently affixed to a foundation. This can complicate the financing process, so it’s essential to be aware of these requirements.

Personal Financing: If traditional funding isn’t an option for you, personal financing might be worth considering. However, keep in mind that these products typically come with higher interest rates, making them less appealing for long-term solutions.

Understanding how to get a loan for a mobile home is crucial for prospective buyers, especially veterans who can benefit from the unique advantages of VA financing. This includes the ability to finance both the mobile home and the land it sits on, provided the residence meets specific eligibility criteria. We know how challenging this can be, but we’re here to support you every step of the way.

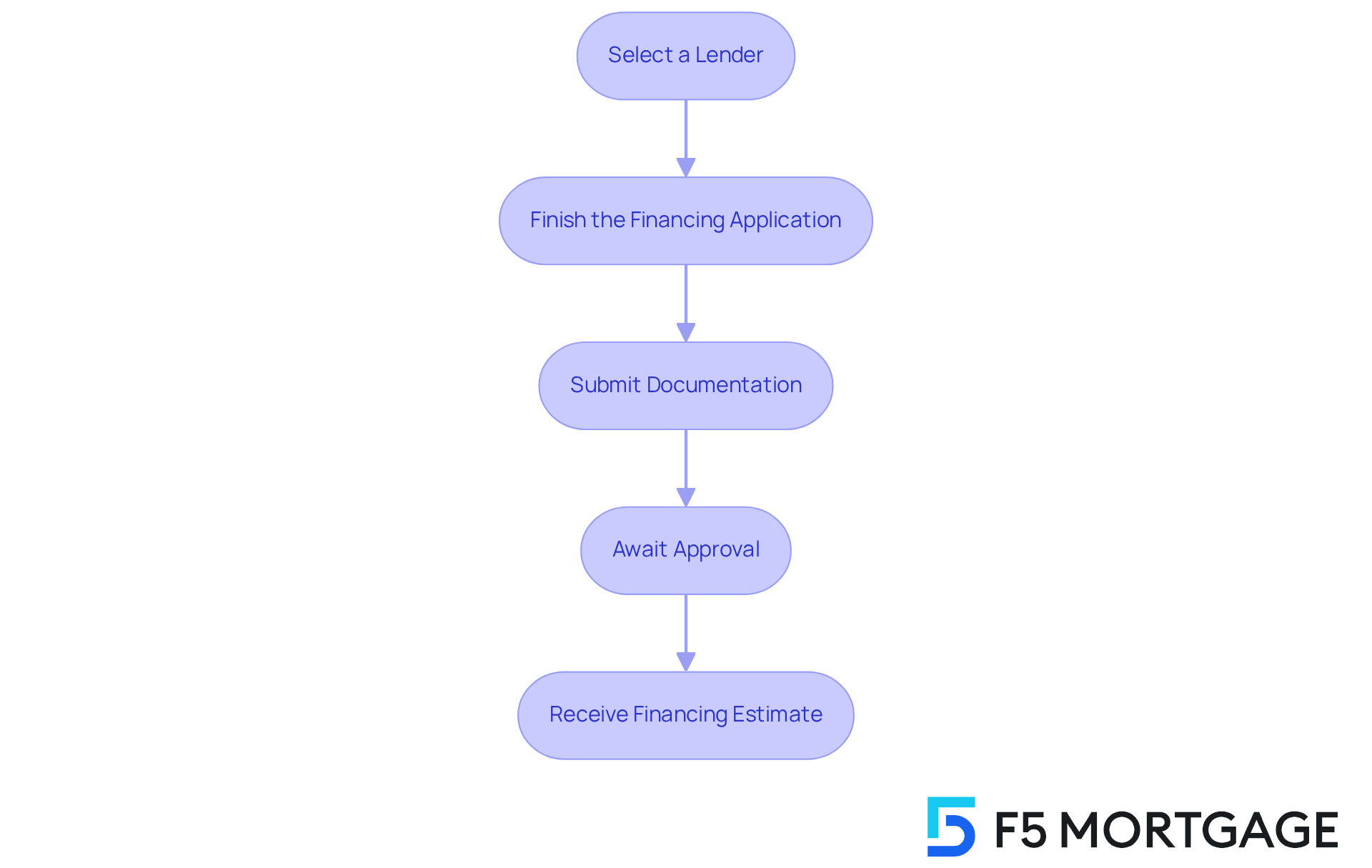

Navigate the Mobile Home Loan Application Process

Select a lender: We know how overwhelming it can be to find the right lender when learning how to get a loan for a mobile home. Start by exploring options that cater specifically to your needs. F5 Mortgage is here for you as a trusted independent brokerage, offering a range of competitive mortgage solutions. Take the time to compare interest rates, terms, and customer reviews to find the best fit for your unique situation.

Finish the Financing Application: Once you’ve chosen a lender, it’s time to fill out the financing application. Make sure to provide detailed information about your financial situation and also understand how to get a loan for a mobile home you wish to acquire. At F5 Mortgage, we make it easy for you to apply online, by phone, or through chat, ensuring you receive customized financial solutions that suit your needs.

Submit Documentation: Along with your application, you’ll need to submit important financial documents. This may include proof of income, credit history, and specific details about the mobile home. Don’t worry – F5 Mortgage’s team is ready to assist you every step of the way, ensuring you have all the necessary documentation to move forward smoothly.

Await Approval: After you submit your application, the lender will review it along with your supporting documents. Be prepared to answer any follow-up questions or provide additional information, as this can help speed up the approval process. At F5 Mortgage, we pride ourselves on exceptional customer service, guiding you through each step with care and support.

Receive Financing Estimate: Once approved, you’ll receive a financing estimate that outlines the terms, interest rates, and closing costs associated with your financing. Take the time to review this estimate carefully to ensure it meets your expectations before proceeding. F5 Mortgage offers a comprehensive overview of various loan programs, including conventional, FHA, and VA loans, so you can fully understand your options and make an informed decision.

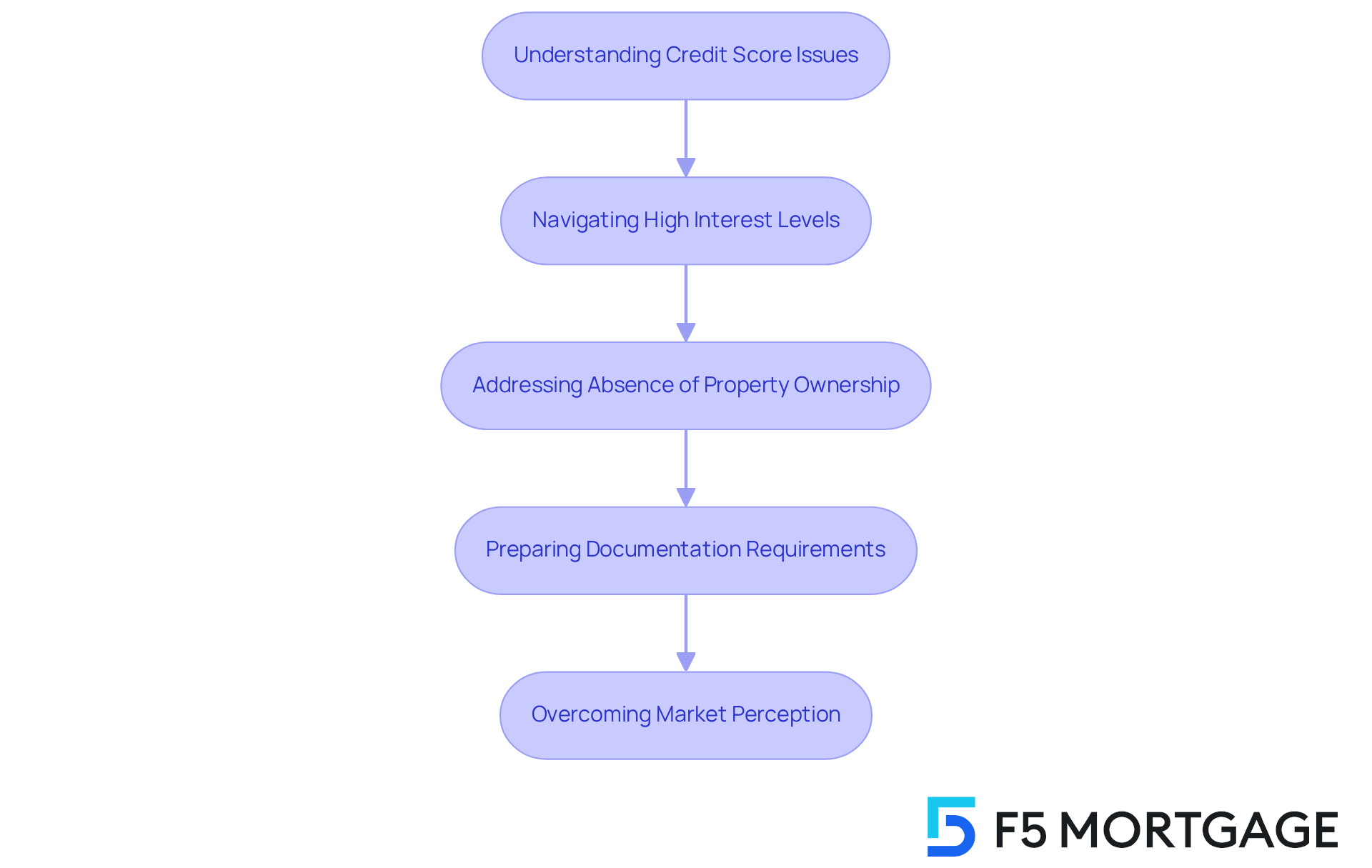

Overcome Challenges in Mobile Home Financing

Understanding Credit Score Issues: We know how challenging it can be when your credit score falls below the required threshold. Collaborating with a credit counselor can be a great first step to enhance your score. Focus on paying down existing debts and making timely payments; these actions can significantly improve your creditworthiness.

Navigating High Interest Levels: With the median interest level for manufactured home mortgages hovering around 7.88%, it’s crucial to explore various lenders. Government-supported financing options, like FHA or VA loans, often provide more favorable conditions and lower costs. These could be practical choices for many families seeking information on how to get a loan for a mobile home.

Addressing Absence of Property Ownership: If you don’t own property, consider chattel financing or personal financing. These options don’t require land as collateral, but they do come with their own implications, such as potentially higher interest rates and shorter repayment periods. Understanding how to get a loan for a mobile home is essential for making informed decisions that suit your needs.

Preparing Documentation Requirements: To avoid delays in the loan process, it’s helpful to have all necessary documentation ready in advance. If you run into any issues, keep the lines of communication open with your lender. Clarifying what’s required can help expedite the approval process, making it smoother for you.

Overcoming Market Perception: Be ready to address any stigma associated with mobile units. Educating yourself on the benefits of mobile home ownership-like affordability and flexibility-can empower you to present a strong case to lenders. Sharing successful stories of borrowers who secured lower interest rates can also strengthen your position.

Conclusion

Securing a loan for a mobile home can feel overwhelming, but we know how challenging this can be. Understanding the steps involved can significantly simplify your journey. This guide has outlined essential strategies to help you assess your financial health, explore various loan options, navigate the application process, and overcome common challenges. By taking the time to prepare and educate yourself, you can enhance your chances of obtaining favorable financing.

Key insights discussed include:

- The importance of evaluating your credit score and debt-to-income ratio.

- Various financing options available, such as FHA, VA, and chattel loans.

- Gathering the required documentation and selecting the right lender is crucial for ensuring a smooth application process.

- Addressing potential challenges, like high-interest rates and credit score issues, is vital for making informed decisions.

Ultimately, the journey to obtaining a mobile home loan is about empowerment through knowledge. By leveraging the information provided, you can confidently approach lenders and advocate for your financing needs. Taking proactive steps not only enhances your likelihood of approval but also paves the way for achieving your dream of mobile home ownership. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

How can I check my credit score?

You can check your credit score by obtaining your credit report from major credit bureaus such as Equifax, Experian, and TransUnion.

What credit score should I aim for to improve my financing options?

Aiming for a credit score of at least 620 can significantly enhance your financing options, as many lenders favor this benchmark for favorable terms.

What is a debt-to-income (DTI) ratio and why is it important?

The debt-to-income (DTI) ratio is calculated by dividing your total monthly debt payments by your gross monthly income. It is crucial because a DTI below 43% is generally considered favorable by lenders, with many preferring ratios of 36% or less.

What if my DTI ratio is higher than 43%?

If your DTI is higher than 43%, don’t lose hope; some programs, like FHA loans, may allow ratios up to 50% if you have compensating factors.

What financial documents should I gather before applying for financing?

You should collect essential documents such as pay stubs, tax returns, and bank statements, as lenders require these to evaluate your financial situation comprehensively.

How can I improve my credit score if it’s below the desired threshold?

You can improve your credit score by reducing high-interest debts, fixing mistakes on your financial report, and boosting your income. Additionally, improving your DTI by decreasing current debt can also lead to a better credit score.