Overview

Calculating a monthly mortgage payment can feel overwhelming, but we’re here to help you through it. It’s important to consider several key components:

- Principal

- Interest

- Property taxes

- Homeowners insurance

- Private mortgage insurance (PMI)

Each of these elements plays a crucial role in your total payment.

Understanding how these components fit into the mortgage payment formula is essential. This article outlines each part’s significance, providing you with a structured formula and clear steps for accurate calculation. By doing so, we aim to empower you to manage your financial commitments effectively.

We know how challenging this can be, but with the right tools and knowledge, you can navigate this process with confidence. Take a moment to review the information provided, and don’t hesitate to reach out if you have any questions. We’re here to support you every step of the way.

Introduction

Navigating the intricacies of monthly mortgage payments can often feel like wandering through a maze of numbers and terms. We understand how challenging this can be. Demystifying this process is essential for anyone aiming to make informed financial decisions about homeownership. This guide is designed to break down the key components of mortgage payments and provide practical steps for accurate calculations, ensuring clarity in your budgeting.

But what happens when unexpected costs arise, or interest rates fluctuate? We’re here to support you every step of the way in managing these variables effectively, helping you maintain financial stability.

Understand Mortgage Payment Components

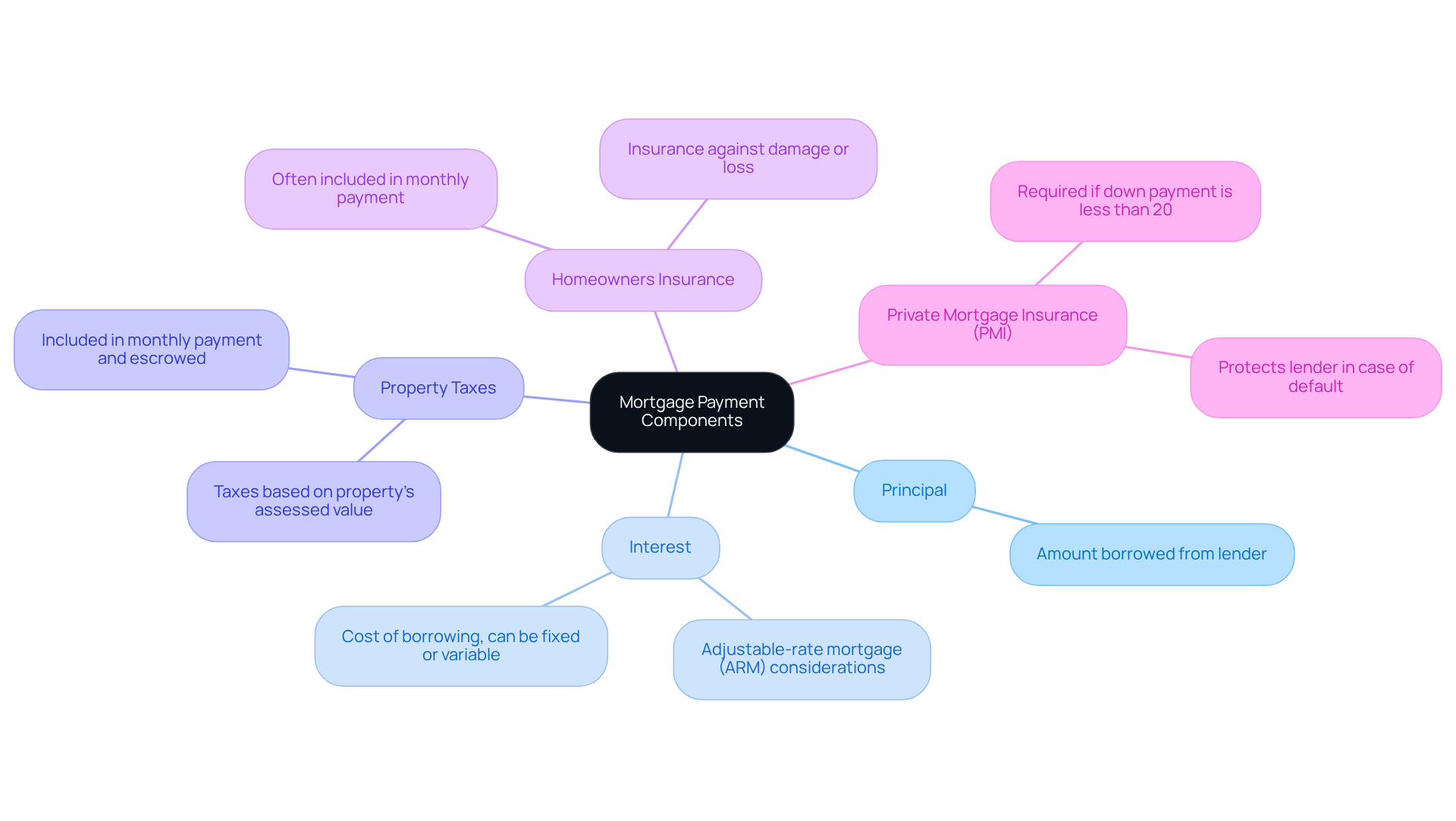

Understanding how to calculate monthly mortgage payment can feel overwhelming, but it’s essential to break it down into its key components. Let’s explore these together, so you can feel more confident in your financial decisions.

- Principal: This is the amount of money you borrow from the lender. It serves as the base amount that you will repay throughout the life of the loan. Knowing this helps you understand your financial commitment.

- Interest: This represents the cost of borrowing that principal amount, expressed as a percentage. The interest can be fixed or variable, which significantly impacts your monthly payment. For instance, with an adjustable-rate mortgage (ARM), you might start with a lower introductory interest rate. However, it’s important to remember that this can change based on market conditions, typically every six months. Understanding these potential adjustments is crucial for effective budgeting.

- Property Taxes: These are taxes imposed by your local government based on your property’s assessed value. They are usually included in your regular payment and kept in an escrow account until they are due. Being aware of this can help you plan for future expenses.

- Homeowners Insurance: This insurance safeguards your home and belongings against damage or loss. Like property taxes, it is often included in your monthly payment, providing you with peace of mind.

- Private Mortgage Insurance (PMI): If your down payment is less than 20%, you may need to pay PMI, which protects the lender in case of default. This cost is also factored into your regular payment.

By grasping these elements, you’ll better understand how to calculate monthly mortgage payment and how they connect and contribute to your overall total cost. Whether you choose a for stability or an ARM for potentially lower initial costs, we know how challenging this can be. Remember, we’re here to support you every step of the way as you navigate this important financial decision.

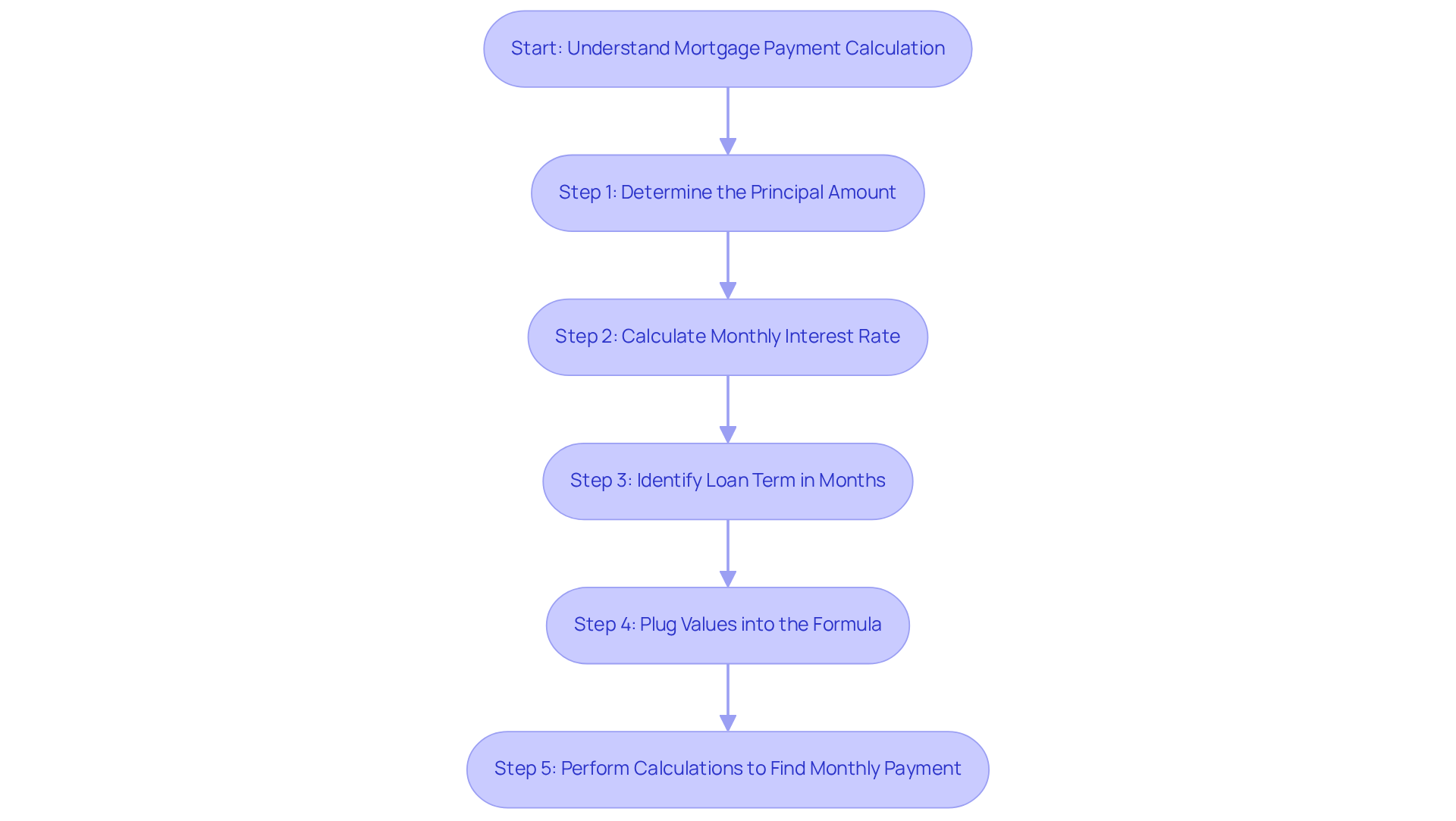

Apply the Mortgage Payment Formula

Understanding how to calculate monthly mortgage payment can feel overwhelming, but we’re here to guide you through it. To help you understand this process, use the following formula:

M = P[r(1 + r)^n] / [(1 + r)^n – 1]

Where:

- M = Total monthly mortgage payment

- P = Principal loan amount

- r = Monthly interest rate (annual rate divided by 12)

- n = Number of payments (loan term in months)

Steps to Apply the Formula:

-

Determine the Principal: Start by identifying the total amount you plan to borrow. For instance, if you’re looking to purchase a home for $300,000, that will be your principal.

-

Determine the Monthly Interest Percentage: If your yearly interest percentage is 6.75%, convert it to a decimal (0.0675) and then divide by 12 to find the periodic figure (approximately 0.005625).

-

Identify the Loan Term: For a 30-year mortgage, multiply 30 by 12 to get 360 months.

-

Plug Values into the Formula: Substitute your values into the formula. If you have a principal of $300,000, a monthly interest rate of 0.005625, and a loan term of 360 months, your equation will look like this:

M = 300000[0.005625(1 + 0.005625)^360] / [(1 + 0.005625)^360 – 1]

-

Compute: Carry out the calculations sequentially to determine your regular installment. Using the example values, your monthly payment would be approximately $1,948.10.

Understanding how to provides clarity on your recurring mortgage obligation, helping you manage your finances effectively. Many home purchasers find this formula invaluable in understanding how to calculate monthly mortgage payment, ensuring their budget aligns with their financial goals. At F5 Mortgage, we recognize how challenging this process can be, and we emphasize the importance of property inspections and their impact on refinancing eligibility. A thorough inspection can help ensure that your property is in good condition, which is crucial for qualifying for refinance loans. By leveraging our technology-driven approach, we provide competitive rates and a stress-free service, empowering you to navigate the complexities of home financing confidently. Remember, we’re here to support you every step of the way.

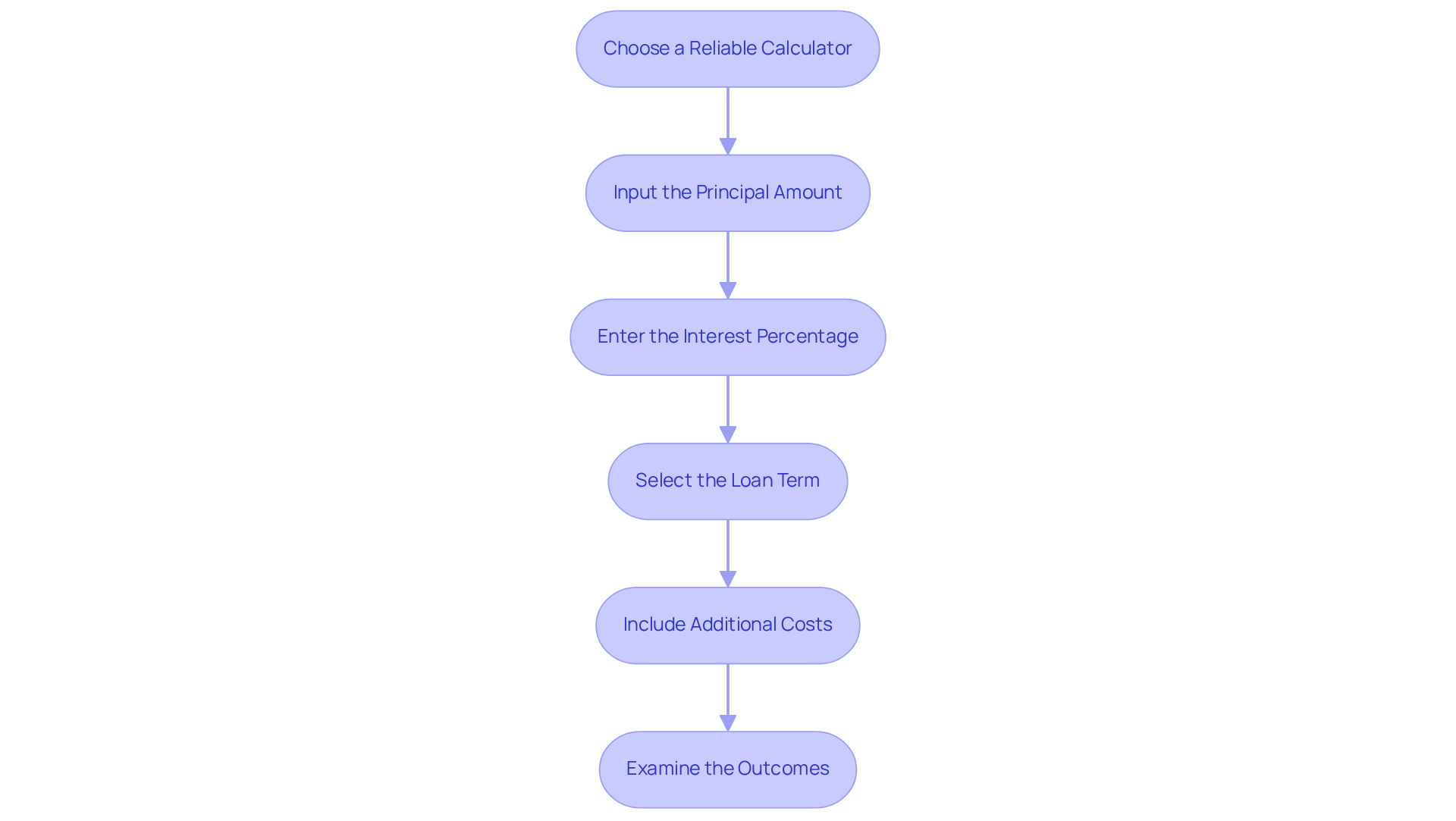

Utilize a Mortgage Calculator Effectively

Home loan calculators are essential tools for quickly and accurately demonstrating how to calculate monthly mortgage payment. We know how overwhelming this process can be, so here’s how to use one effectively:

- Choose a Reliable Calculator: Opt for a reputable online mortgage calculator. F5 Mortgage provides a user-friendly option that delivers precise estimates tailored to your needs.

- Input the Principal Amount: Enter the total loan sum you plan to borrow; this is crucial for determining your monthly dues.

- Enter the Interest Percentage: Input your annual interest percentage, as this significantly affects your amount due. F5 Mortgage is committed to offering ultra-competitive rates, empowering you to make informed financial decisions.

- Select the Loan Term: Choose the duration of your loan, typically 15 or 30 years, to see how it impacts your payments.

- Include Additional Costs: To obtain a thorough estimate, add property taxes, homeowners insurance, and private mortgage insurance (PMI) if applicable. Remember, closing expenses typically vary from 2% to 5% of the loan, so take these into account as well.

- Examine the Outcomes: The calculator will produce an estimated recurring charge, enabling you to evaluate various loan alternatives and make knowledgeable choices.

Utilizing a can help you understand how to calculate monthly mortgage payment, saving time and allowing you to visualize your financial obligations. It’s important to ensure you remain within the suggested 28% of your gross income for housing expenses. For example, if your total income each month is $5,000, strive to keep your loan installment around $1,400. This approach can prevent you from becoming ‘house poor’ and allows for better financial planning.

Additionally, F5 Mortgage’s approach stands out from traditional lenders by prioritizing transparency and client empowerment. We’re here to support you every step of the way, ensuring you have all the information needed to make the best financial decisions. Remember, enhancing your credit score can also improve your loan opportunities, so consider reviewing your credit report for mistakes and managing your debts wisely.

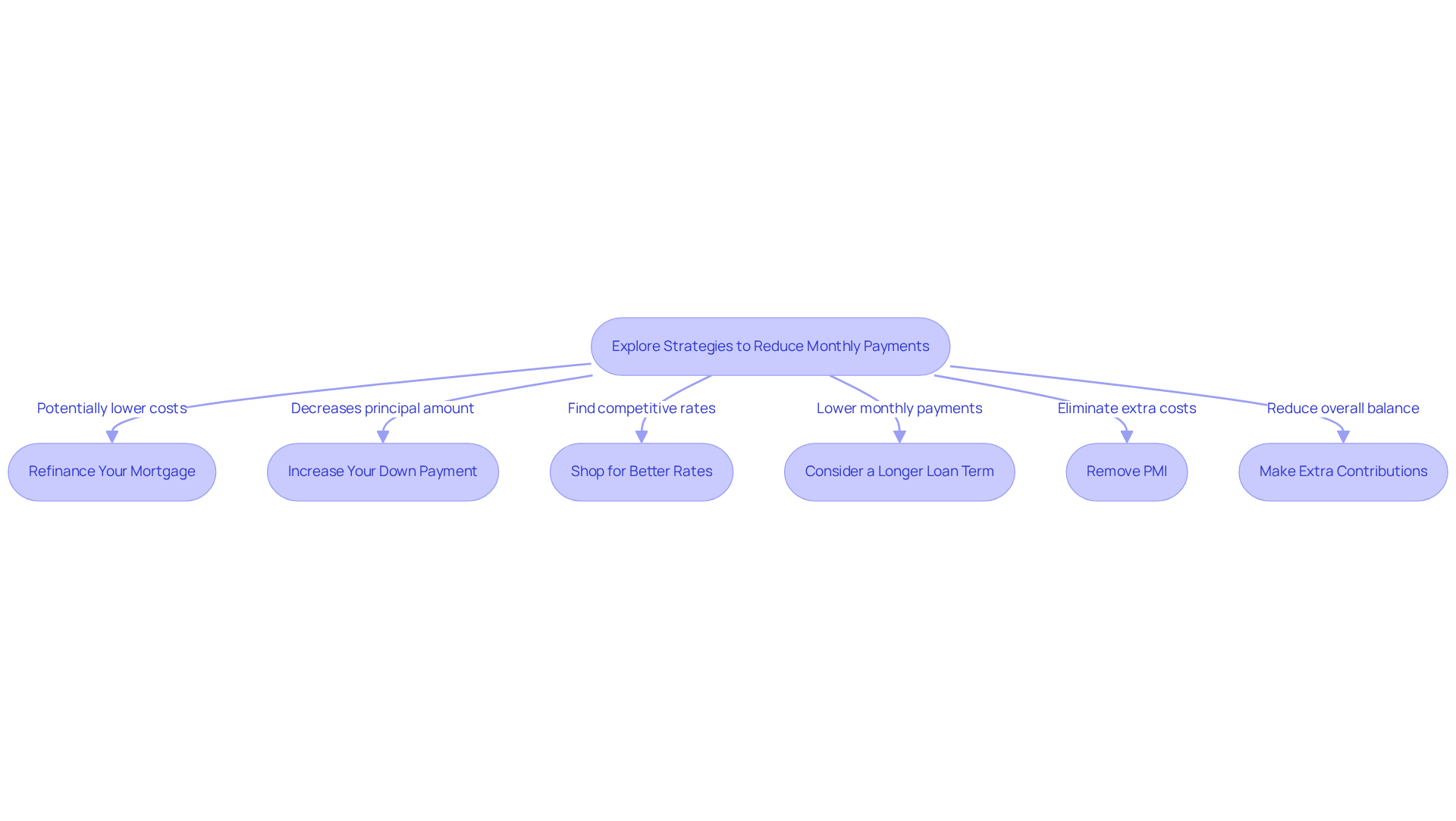

Explore Strategies to Reduce Monthly Payments

Lowering your regular mortgage cost can significantly ease financial pressure. We understand how challenging this can be, and we’re here to support you every step of the way. Here are several effective strategies to consider:

- Refinance Your Mortgage: If interest levels have declined since you obtained your loan, refinancing may reduce your regular costs. Many homeowners are exploring refinancing options, especially with projections indicating potential rate drops by the end of 2025.

- Increase Your Down Payment: A larger down payment decreases the principal sum borrowed, which can lead to lower monthly charges. In 2025, a significant portion of homebuyers are anticipated to raise their upfront contributions, indicating a movement towards more considerable initial investments.

- Shop for Better Rates: Comparing offers from various lenders can help you find the most competitive interest rate available. This simple step could save you money over the life of your loan.

- Consider a Longer Loan Term: Extending the duration of your loan can lower your installments, although it may raise the total interest paid over time. This option can be advantageous for those prioritizing reduced regular obligations.

- Remove PMI: If your equity reaches 20%, you can ask for the (PMI) from your loan expenses. This can lead to considerable savings.

- Make Extra Contributions: If possible, providing extra funds towards the principal can reduce the overall loan balance and future monthly installments. Regular overpayments can substantially shorten the loan term and reduce total interest costs.

Implementing these strategies can help you learn how to calculate monthly mortgage payment more effectively, leading to greater financial stability and peace of mind.

Conclusion

Understanding how to calculate a monthly mortgage payment is crucial for anyone looking to navigate the complexities of home financing. We know how challenging this can be, but by breaking down the components—such as principal, interest, property taxes, homeowners insurance, and private mortgage insurance (PMI)—you can gain clarity on your financial commitments. This knowledge empowers you to make informed decisions that align with your long-term financial goals.

This article outlines a step-by-step approach to applying the mortgage payment formula, emphasizing the importance of each calculation to determine a manageable monthly payment. Additionally, utilizing a mortgage calculator effectively can streamline this process, allowing potential homeowners to explore various scenarios and make educated choices regarding their financing options. Strategies to reduce monthly payments, such as refinancing, increasing down payments, and shopping for better rates, further enhance your financial flexibility and security.

Ultimately, mastering the calculation of monthly mortgage payments not only aids in budgeting but also fosters confidence in making significant financial decisions. By leveraging the insights and tools provided, you can take proactive steps toward achieving your homeownership dreams while maintaining a healthy financial outlook. Embracing these strategies and understanding the underlying components will pave the way for a more secure and sustainable financial future.

Frequently Asked Questions

What are the main components of a monthly mortgage payment?

The main components of a monthly mortgage payment are principal, interest, property taxes, homeowners insurance, and private mortgage insurance (PMI).

What is the principal in a mortgage payment?

The principal is the amount of money you borrow from the lender, which serves as the base amount that you will repay throughout the life of the loan.

How does interest affect my mortgage payment?

Interest represents the cost of borrowing the principal amount, expressed as a percentage. It can be fixed or variable, impacting your monthly payment. For example, with an adjustable-rate mortgage (ARM), the interest rate may start lower but can change based on market conditions.

What are property taxes in relation to mortgage payments?

Property taxes are taxes imposed by your local government based on your property’s assessed value. They are usually included in your regular mortgage payment and kept in an escrow account until they are due.

Why is homeowners insurance important in a mortgage payment?

Homeowners insurance protects your home and belongings against damage or loss. It is often included in your monthly mortgage payment, providing you with peace of mind.

What is private mortgage insurance (PMI) and when is it required?

PMI is insurance that protects the lender in case of default. It is typically required if your down payment is less than 20% of the home’s purchase price and is included in your regular mortgage payment.

How can understanding these components help me with my mortgage?

By understanding the components of a mortgage payment, you can better calculate your monthly payment and plan for future expenses, leading to more informed financial decisions.