Overview

Applying for a home equity loan can feel overwhelming, but we’re here to support you every step of the way. Start by assessing your property value and credit score—this is essential for understanding your financial standing. Next, take the time to shop around for the best financing options available to you. Gathering the necessary documentation will help streamline the application process and make it less stressful.

It’s important to understand equity and maintain a good credit score, as these factors can significantly impact your loan terms. By comparing different lenders, you can secure favorable terms that suit your needs. However, it’s also crucial to be aware of the associated risks and costs involved. Remember, we know how challenging this can be, but with careful planning and informed decisions, you can navigate this journey successfully.

Introduction

Understanding the intricacies of home equity loans can truly open doors to significant financial opportunities for homeowners. We know how challenging this can be, but this powerful financial tool allows individuals to leverage the value of their property. Whether it’s transforming your living space or consolidating debt, the possibilities are exciting. However, navigating the application process can seem daunting, especially with so many factors at play.

What essential steps must you take to ensure a successful application?

How can homeowners minimize risks while maximizing benefits?

We’re here to support you every step of the way.

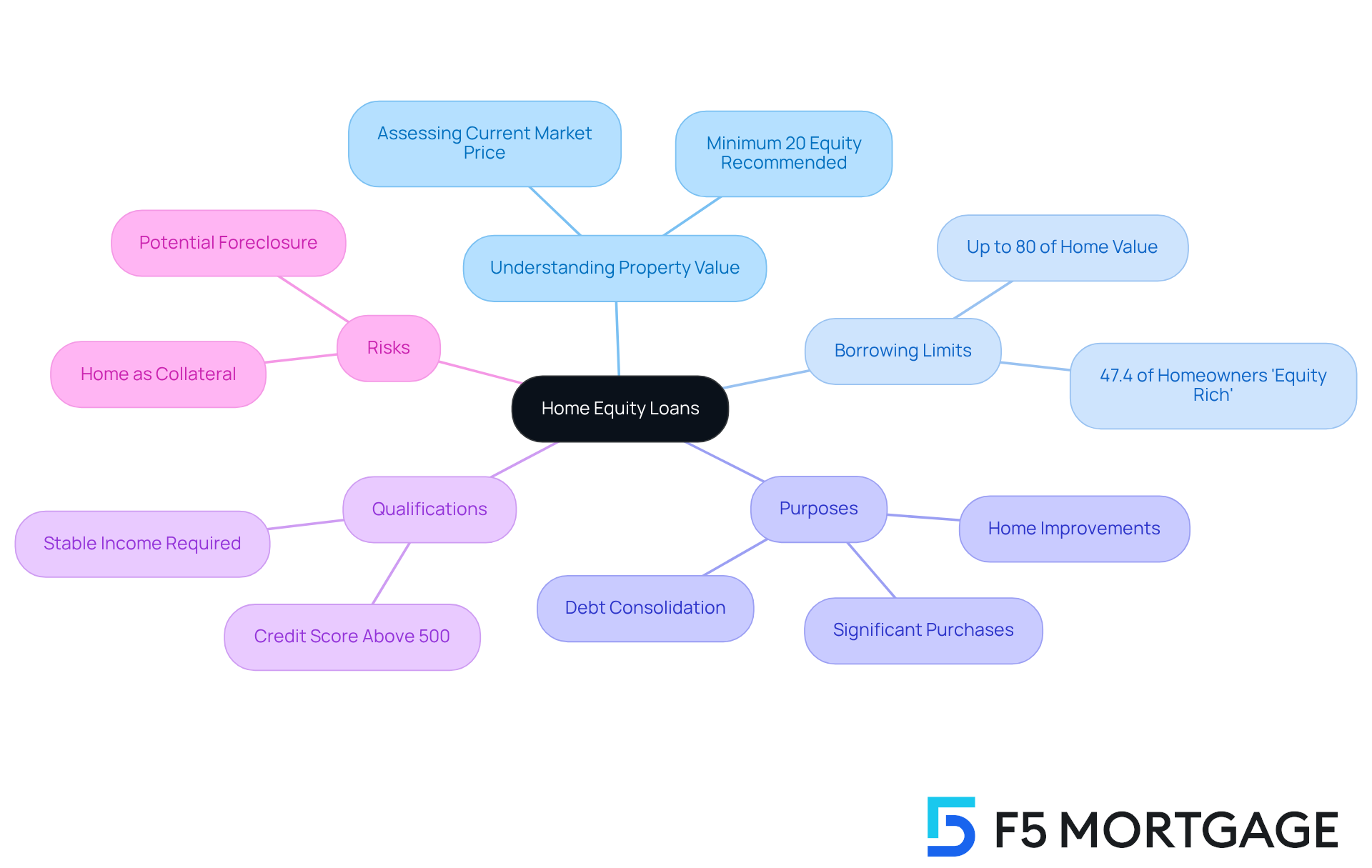

Understand Home Equity Loans

Understanding property value advancement can be a significant step for homeowners looking to leverage their assets. This financial tool allows you to tap into the difference between your home’s current market price and what you still owe on your mortgage. Typically, these agreements provide a lump sum that you repay over a set term at a fixed interest rate. As we look ahead to 2025, many homeowners can borrow up to 80% of their residential value, reflecting a growing trend of using property equity for larger financial needs. For instance, financing $50,000 at a 10% APR over 30 years would result in monthly payments of about $439.

Equity financing can serve various purposes, whether it’s for home improvements, consolidating debt, or making significant purchases. Financial advisors often highlight that these options are particularly suitable for homeowners with stable incomes who plan to stay in their homes for an extended period. However, it’s crucial to remember that your home acts as collateral; failing to repay the loan could lead to foreclosure.

Before you think about how to apply for a home equity loan, it’s wise to assess your property value. Generally, a minimum of 20% equity is recommended to qualify for financing. As of mid-2025, nearly half of U.S. homeowners with mortgages are classified as ‘equity rich,’ which can provide you with enhanced financial flexibility.

Many homeowners use these financial options to make improvements that not only enhance their living conditions but also potentially increase their property’s market value, such as kitchen renovations or energy-efficient upgrades. We understand how important it is to grasp both the associated with borrowing against your home’s equity. This knowledge is vital for making informed financial decisions, and we’re here to support you every step of the way.

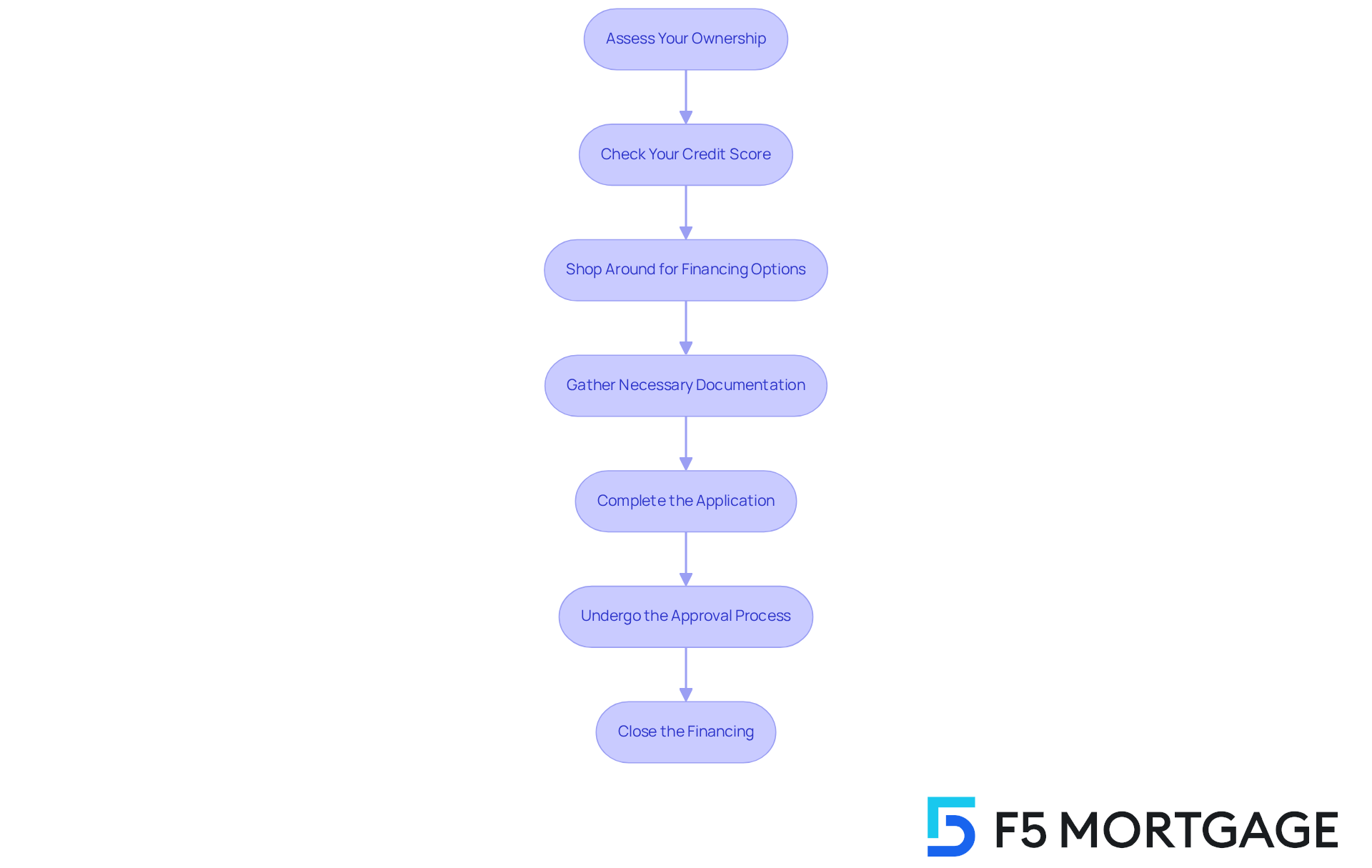

Steps to Apply for a Home Equity Loan

- Assess Your Ownership: Begin by determining your property value. This is calculated as the difference between your home’s current market worth and your remaining mortgage balance. To qualify for a property value advance, you typically need at least 20% ownership in your home. We know how important this step is in understanding your financial standing.

- Check Your Credit Score: It’s essential to check your credit score, as most financial institutions require a minimum score of 620 for home equity loans. Obtain your credit report to spot any discrepancies that might negatively impact your score. Remember, a higher score—ideally above 700—can greatly enhance your chances of approval and help you secure lower interest rates.

- Shop Around for Financing Options: Take the time to explore different financial institutions. Comparing interest rates, fees, and terms is crucial. This includes both traditional banks and online lenders. The mortgage marketplace is competitive, which means you have the opportunity to find the best offer that suits your needs.

- Gather Necessary Documentation: Prepare the essential documents you’ll need, such as proof of income (like pay stubs and tax returns), a list of your debts, and details about your home, including your property tax bill and mortgage statement. Being organized can make this process smoother.

- Complete the Application: When you’re ready, fill out the application form from your chosen financial institution. When discussing your financial situation and the purpose of the loan, also consider how to . We’re here to support you every step of the way.

- Undergo the Approval Process: After submitting your application, the financial institution will review your financial information, conduct a home appraisal, and evaluate your creditworthiness. This process may take several weeks, so it’s important to be prepared for potential delays. Maintaining a low debt-to-income (DTI) ratio, typically 43% or less, is crucial, as lenders prefer this for approval.

- Close the Financing: If your application is approved, you will receive a closing disclosure that outlines the financing terms. Take the time to review this document carefully before signing. Once you close, the funds will be disbursed, and you will begin repayment according to the agreed-upon schedule. Remember, this is a significant step, and we’re here to help you navigate it.

Consider Key Factors and Risks

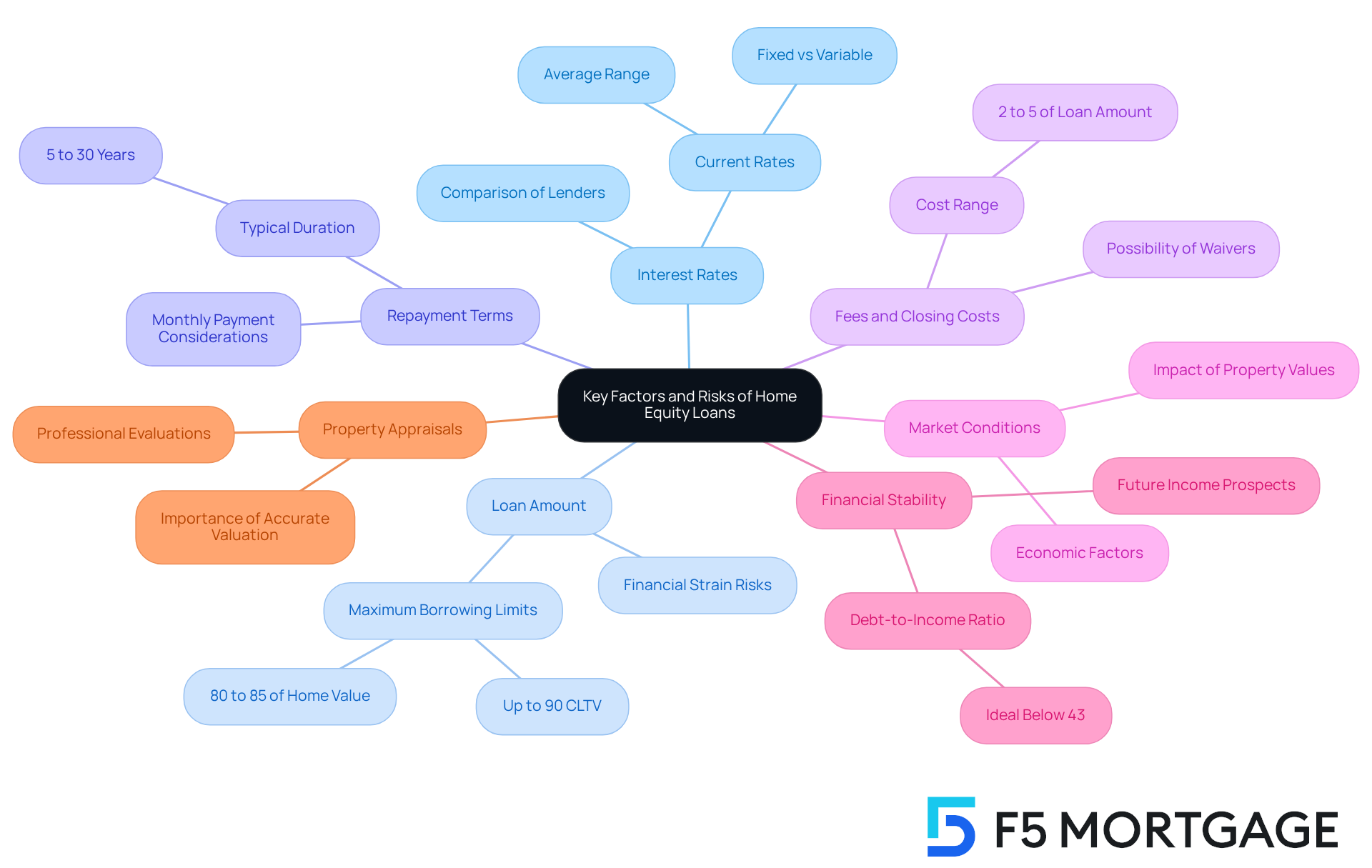

When considering a home equity loan, we understand how important it is to keep certain factors in mind:

- Interest Rates: Home equity loans generally offer lower interest rates compared to unsecured loans, with current rates averaging between 8.01% and 8.31%. These rates can vary significantly among financial institutions and are influenced by the Federal Reserve’s decisions. Therefore, it’s essential to determine if the rate is fixed or variable and to from at least three to five providers to secure the best deal. Consider working with F5 Mortgage for competitive rates and personalized service that can help you navigate these comparisons effectively.

- Loan Amount: Determine the amount you need to borrow, ensuring it aligns with your available equity. Most lenders allow borrowing up to 80% or even 85% of your property’s value, and some may permit borrowing up to 90% of the combined loan-to-value (CLTV) ratio. Borrowing excessively can lead to financial strain, especially if your financial situation changes.

- Repayment Terms: Familiarize yourself with the repayment schedule, which typically ranges from five to thirty years. Ensure that the monthly payments fit within your budget, as missing payments can lead to foreclosure, given that your home serves as collateral.

- Fees and Closing Costs: Be aware of various fees associated with the loan, including origination fees, appraisal fees, and closing costs, which can range from 2% to 5% of the total loan amount. Some lenders may waive these costs, so it’s important to inquire about this possibility. These costs can significantly impact the overall expense of borrowing.

- Market Conditions: Monitor the real estate market closely. A decrease in property values could lead to owing more than your residence is worth, complicating future financial choices and possibly restricting your borrowing ability.

- Financial Stability: Assess your current financial situation and future income prospects. It is vital to ensure that you can manage the additional debt comfortably without jeopardizing your financial health. Experts emphasize that maintaining a low debt-to-income ratio, ideally below 43%, is crucial for securing favorable loan terms and ensuring repayment capability.

- Property Appraisals: Grasping the significance of property appraisals is vital, as they establish your asset’s worth and stake, which directly influences the sum you can borrow. A professional evaluation can offer a clear understanding of your property’s value, ensuring you make informed borrowing choices.

By carefully considering these factors and comparing lenders, including F5 Mortgage, you can understand how to apply for a home equity loan while minimizing risks. Remember, we’re here to support you every step of the way.

Conclusion

Understanding how to apply for a home equity loan is crucial for homeowners who want to tap into their property’s value for financial needs. We know how challenging this can be, and this guide outlines the process in a clear, step-by-step manner. Our aim is to ensure that you feel well-equipped to navigate the complexities of home equity financing.

Key steps discussed include:

- Assessing ownership

- Checking credit scores

- Shopping around for the best financing options

Additionally, gathering necessary documentation and understanding the associated risks, such as interest rates and repayment terms, are vital for making informed decisions. By being prepared and knowledgeable, you can enhance your chances of securing favorable loan terms while minimizing potential pitfalls.

Ultimately, tapping into home equity can provide significant financial advantages, whether for home improvements, debt consolidation, or other major expenses. However, it is essential to approach this financial tool with caution and awareness of the risks involved. We encourage you to conduct thorough research and consider your financial stability before proceeding. Taking these steps can lead to a rewarding experience in leveraging home equity effectively.

Frequently Asked Questions

What is a home equity loan?

A home equity loan allows homeowners to borrow against the difference between their home’s current market value and what they owe on their mortgage. It typically provides a lump sum that is repaid over a set term at a fixed interest rate.

How much can homeowners borrow against their home equity?

As of 2025, many homeowners can borrow up to 80% of their home’s residential value, reflecting a trend of utilizing property equity for larger financial needs.

What are some common uses for home equity loans?

Home equity loans can be used for various purposes, including home improvements, consolidating debt, or making significant purchases.

Who should consider a home equity loan?

Financial advisors often recommend home equity loans for homeowners with stable incomes who plan to stay in their homes for an extended period.

What is the risk associated with taking out a home equity loan?

The primary risk is that your home acts as collateral; if you fail to repay the loan, it could lead to foreclosure.

What is the minimum equity recommended to qualify for a home equity loan?

Generally, a minimum of 20% equity in the home is recommended to qualify for a home equity loan.

What does it mean to be ‘equity rich’?

As of mid-2025, ‘equity rich’ refers to homeowners who have significant equity in their homes, which can provide enhanced financial flexibility.

How can home improvements financed by a home equity loan affect property value?

Home improvements, such as kitchen renovations or energy-efficient upgrades, can enhance living conditions and potentially increase the property’s market value.