Overview

Home equity is an important concept for homeowners, calculated by subtracting the outstanding mortgage balance from the current market value of the home. This calculation represents the owner’s stake in the property, and we know how crucial it is to understand this aspect of homeownership. The article provides a step-by-step guide to help you navigate this process with confidence.

Accurate property valuation is essential, as it can significantly influence your equity calculation. We’re here to support you every step of the way, ensuring you consider any additional liens that may affect your equity. By addressing these factors, you can gain a clearer picture of your financial standing and make informed decisions regarding your home.

Introduction

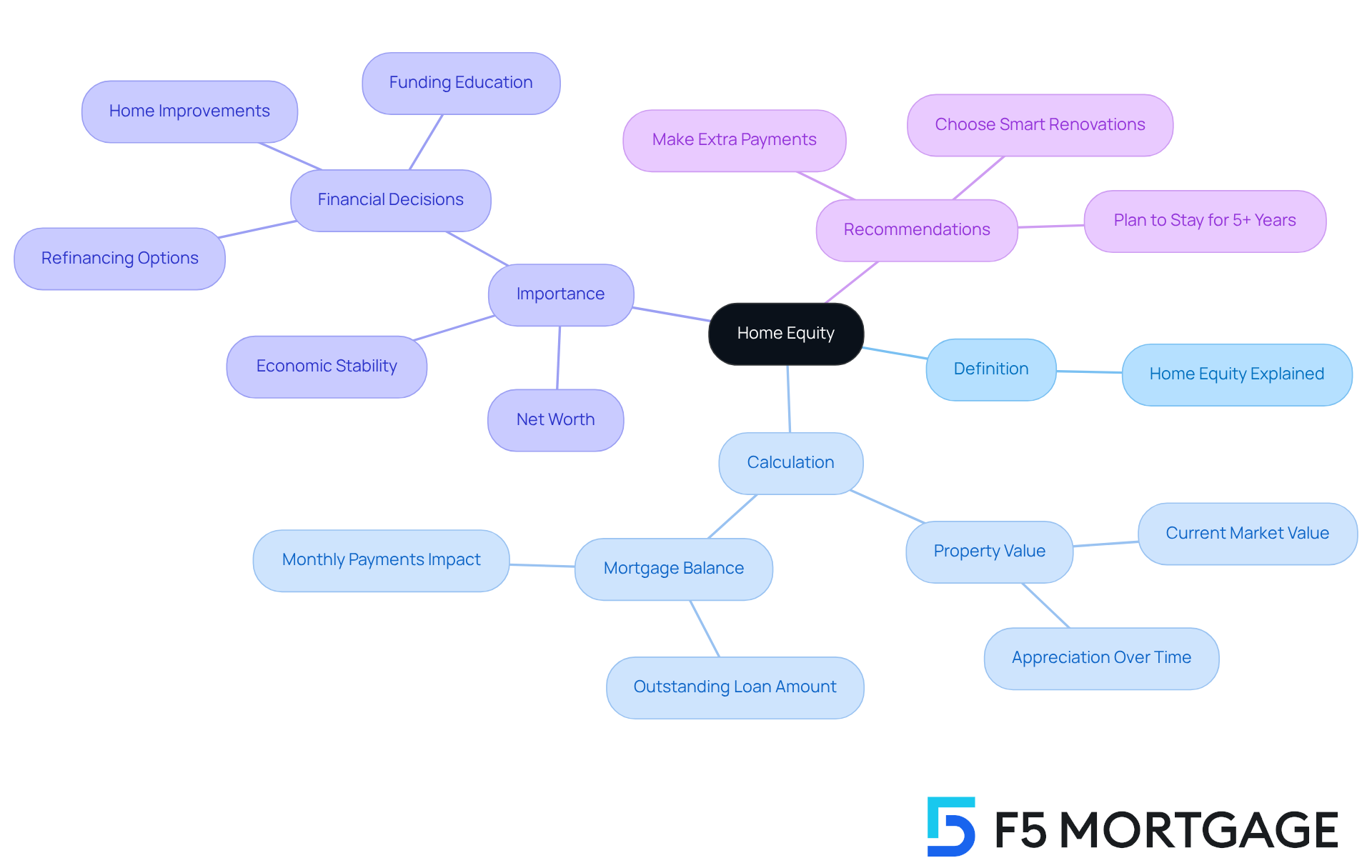

Understanding home equity is crucial for families who want to make informed financial decisions about their property. This concept—defined as the difference between a home’s current market value and the outstanding mortgage balance—can significantly impact various aspects of financial planning, from refinancing to funding education.

However, we know how challenging this can be. Many homeowners struggle with accurately calculating their home equity, which can lead to potential missteps that affect their financial stability.

What challenges do families face in navigating this essential calculation? And how can they ensure they are making the most of their home investment?

We’re here to support you every step of the way as you explore these important questions.

Define Home Equity and Its Importance

Understanding the value of your property is essential. It’s defined as the difference between what your home is currently worth and what you owe on your loan, which is essential for understanding how home equity is calculated. For example, if your home is valued at $300,000 and you have a mortgage balance of $200,000, this helps explain how home equity is calculated, as your property value minus liabilities is $100,000. This amount is significant because it represents your ownership stake in the home and can be used for loans or lines of credit.

We know how challenging this can be for families. Comprehending residential value is crucial, as it influences important financial decisions—whether it’s refinancing, making home improvements, or even funding education. It also plays a key role in determining your net worth and overall economic stability.

Typically, we recommend that homeowners plan to stay in their residences for at least five years. This timeframe allows you to fully appreciate the financial benefits of ownership, as it gives your property value time to grow and market conditions a chance to stabilize.

At F5 Mortgage, we’re here to support you every step of the way. Our commitment is to educate borrowers about these vital aspects, ensuring a smoother mortgage experience. We leverage advanced technology and provide personalized service to help families make informed decisions.

Calculate Your Home’s Value and Outstanding Debts

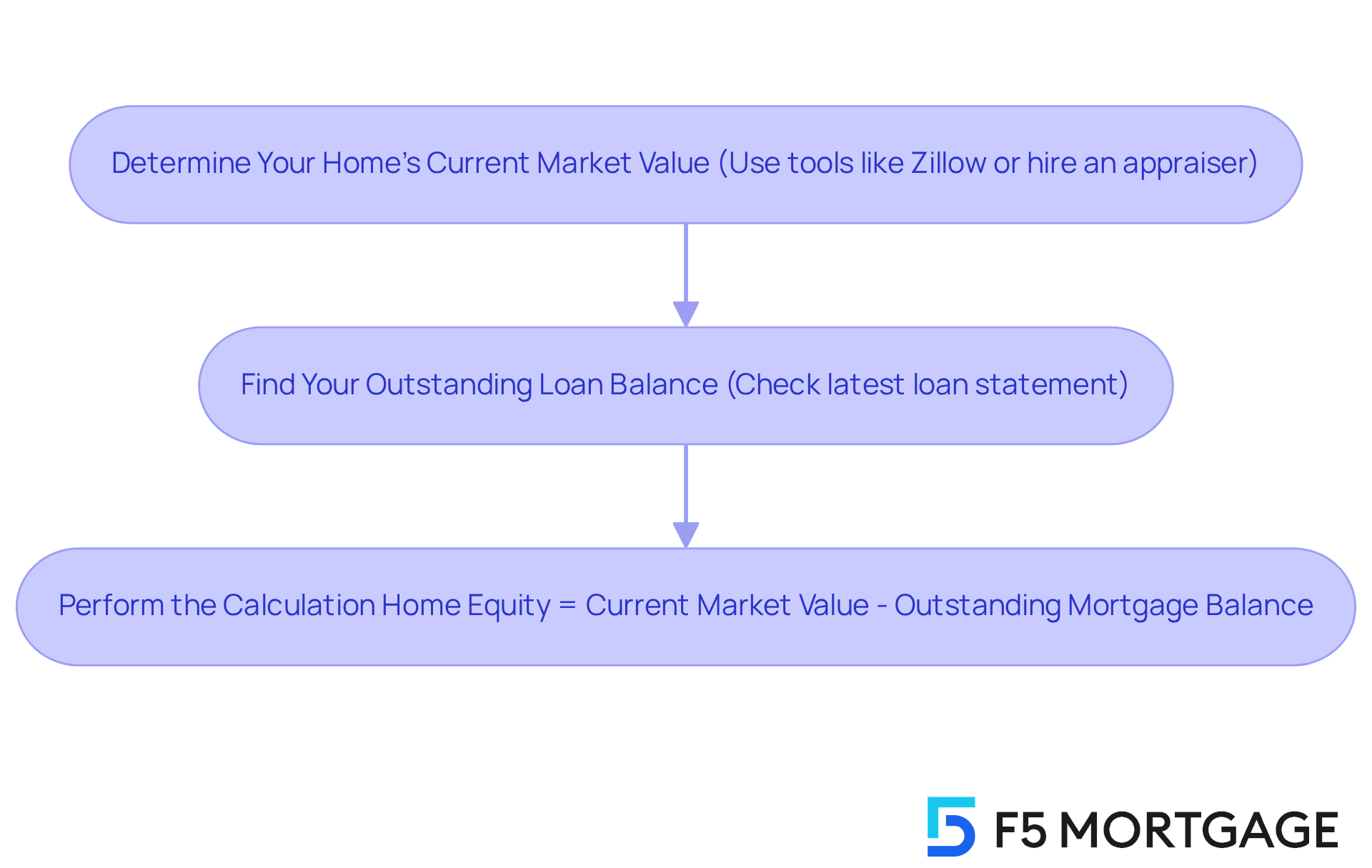

Calculating your home equity can feel daunting, but we’re here to support you as you learn how home equity is calculated every step of the way. Let’s break it down into manageable steps:

-

Determine Your Home’s Current Market Value: Start by utilizing online tools like Zillow or Redfin for a quick estimate. If you want a precise valuation, consider hiring a professional appraiser. You might also find it helpful to examine recent sales of similar properties in your neighborhood, as this can provide valuable insights into the market.

-

Find Your Outstanding Loan Balance: Take a moment to access your latest loan statement or contact your lender to find out the remaining amount owed on your loan.

-

Perform the Calculation: Use this simple formula:

Home Equity = Current Market Value – Outstanding Mortgage Balance

For example, if your home is valued at $350,000 and your outstanding mortgage balance is $150,000, your home equity would be:

$350,000 – $150,000 = $200,000

This figure represents the equity you hold in your home, which can be leveraged for various financial needs, such as home renovations or debt consolidation through options like cash-out refinancing.

Understanding your property equity is essential, especially considering that the average mortgage liability per individual with a mortgage is around $149,266. Many households are turning to online resources to evaluate their property values, which can significantly assist in financial planning. For instance, families have reported using these tools to gauge their home’s worth before making important decisions about refinancing or selling.

Additionally, many lenders, such as F5 Mortgage, require homeowners to maintain a minimum 80% home-to-value loan ratio to effectively utilize their assets. It’s also crucial to understand your debt-to-income (DTI) ratio; a lower DTI can lead to more competitive mortgage rates. As appraisers emphasize, obtaining a professional valuation can provide a clearer picture of your property’s worth, ensuring you make informed decisions regarding your assets.

Identify Common Mistakes and Key Considerations

When it comes to calculating home equity, we understand how is home equity calculated can be overwhelming. Here are some common mistakes and key considerations to keep in mind:

-

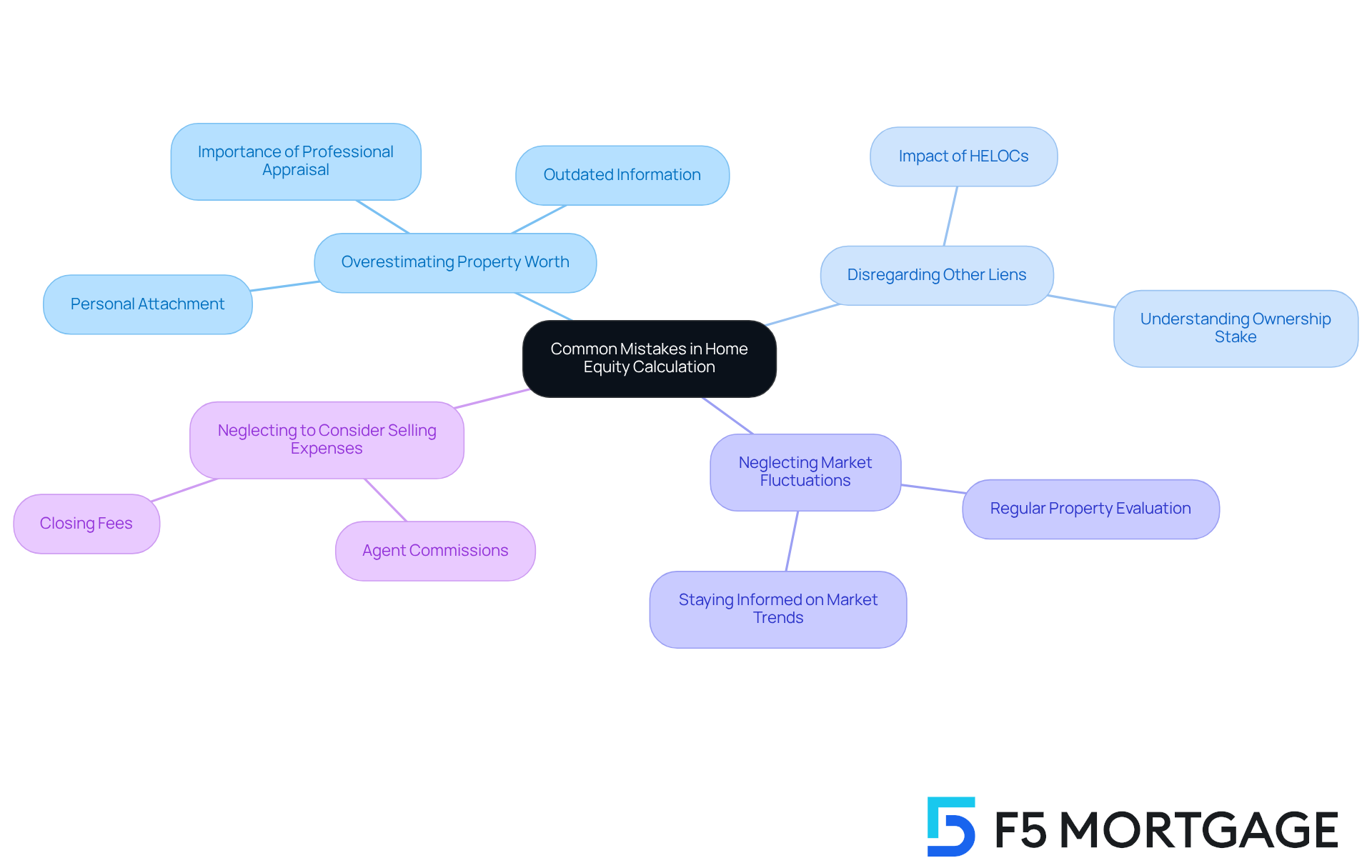

Overestimating Property Worth: Many homeowners may unintentionally inflate their property’s value due to personal attachment or outdated information. To ensure accuracy, always refer to current market data and comparable sales. Engaging with a professional appraisal can provide a more objective evaluation of your property’s market value, which is essential for understanding how is home equity calculated.

-

Disregarding Other Liens: If you have additional loans secured against your property, such as a home equity line of credit (HELOC), it’s important to factor these into your calculations. These can significantly influence your ownership stake, and recognizing them is crucial for an accurate assessment.

-

Neglecting Market Fluctuations: Real estate markets can change rapidly, and we know how important it is to stay informed. Regularly evaluate your property’s worth to ensure your ownership calculations remain precise. At F5 Mortgage, we encourage homeowners to stay updated on market trends, empowering you to make informed economic decisions.

-

Neglecting to Consider Selling Expenses: If selling your property is on the horizon, remember that selling expenses—like agent commissions and closing fees—will impact your true value. It’s essential to take these into account when strategizing your financial actions based on your assets.

By being mindful of these factors, families can navigate their property equity with greater confidence and make informed decisions that will positively impact their financial future. At F5 Mortgage, we’re here to provide personalized support and guidance throughout this process, ensuring you have the tools needed to navigate your home financing options effectively.

Conclusion

Understanding how to calculate home equity is crucial for homeowners, as it directly impacts financial decisions and long-term economic stability. Home equity represents the ownership stake in a property and can be leveraged for various financial needs. By grasping the calculation process, families can better navigate their financial landscape and make informed choices regarding refinancing, home improvements, or even funding education.

The steps for calculating home equity are straightforward, yet they require careful consideration. It’s essential to determine the current market value and outstanding debts accurately. We know how challenging this can be; common pitfalls, such as overestimating property worth or neglecting additional liens, can lead to misinformation and misguided financial decisions. Staying informed about market fluctuations and considering selling expenses are also vital for a precise assessment of home equity.

Ultimately, understanding home equity is not just about numbers; it is about empowering families to make sound financial choices that contribute to their overall well-being. By taking the time to educate themselves and utilizing the resources available, homeowners can unlock the potential of their properties and secure a brighter financial future. Embracing this knowledge fosters confidence and enables families to navigate their home financing options with clarity and purpose.

Frequently Asked Questions

What is home equity?

Home equity is defined as the difference between the current value of your home and the amount you owe on your mortgage. For example, if your home is valued at $300,000 and you have a mortgage balance of $200,000, your home equity would be $100,000.

Why is home equity important?

Home equity is important because it represents your ownership stake in the home and can be used for loans or lines of credit. It also influences significant financial decisions such as refinancing, making home improvements, or funding education.

How does home equity affect net worth?

Home equity plays a key role in determining your net worth and overall economic stability, as it reflects the value of your owned asset in relation to your liabilities.

How long should homeowners plan to stay in their residences to benefit from home equity?

Homeowners are typically recommended to plan to stay in their residences for at least five years to fully appreciate the financial benefits of ownership, allowing property values to grow and market conditions to stabilize.

How does F5 Mortgage assist homeowners in understanding home equity?

F5 Mortgage is committed to educating borrowers about vital aspects of home equity and the mortgage process, leveraging advanced technology and providing personalized service to help families make informed decisions.