Overview

A Home Equity Line of Credit (HELOC) can be a valuable resource for homeowners, allowing them to borrow against their property’s equity. This flexible, revolving line of credit can help meet various financial needs, and we understand how important it is to navigate this process carefully.

During the draw period, you can access funds as needed, paying interest only on the amount you’ve drawn. This can provide a sense of relief in times of financial need. However, as you transition to the repayment phase, it’s crucial to remember that you’ll need to pay back both the principal and interest. We know how challenging this can be, so understanding the associated costs and risks is essential.

Variable interest rates can add uncertainty, and it’s vital to consider the potential for foreclosure if payments become unmanageable. We’re here to support you every step of the way, ensuring you feel informed and empowered to make the best decisions for your financial future.

Introduction

Understanding the mechanics of a Home Equity Line of Credit (HELOC) can open doors to significant financial opportunities for homeowners. We know how challenging it can be to navigate your options, but this flexible borrowing solution allows you to convert your home’s equity into accessible funds. Whether you’re considering home improvements or looking to consolidate debt, a HELOC can be an appealing choice.

However, we also recognize that the intricacies of how HELOCs function can raise important questions about their benefits and risks. What should you consider before tapping into this valuable resource? How can you navigate the potential pitfalls associated with variable interest rates and repayment terms? We’re here to support you every step of the way as you explore your options.

Define HELOC: Understanding Home Equity Lines of Credit

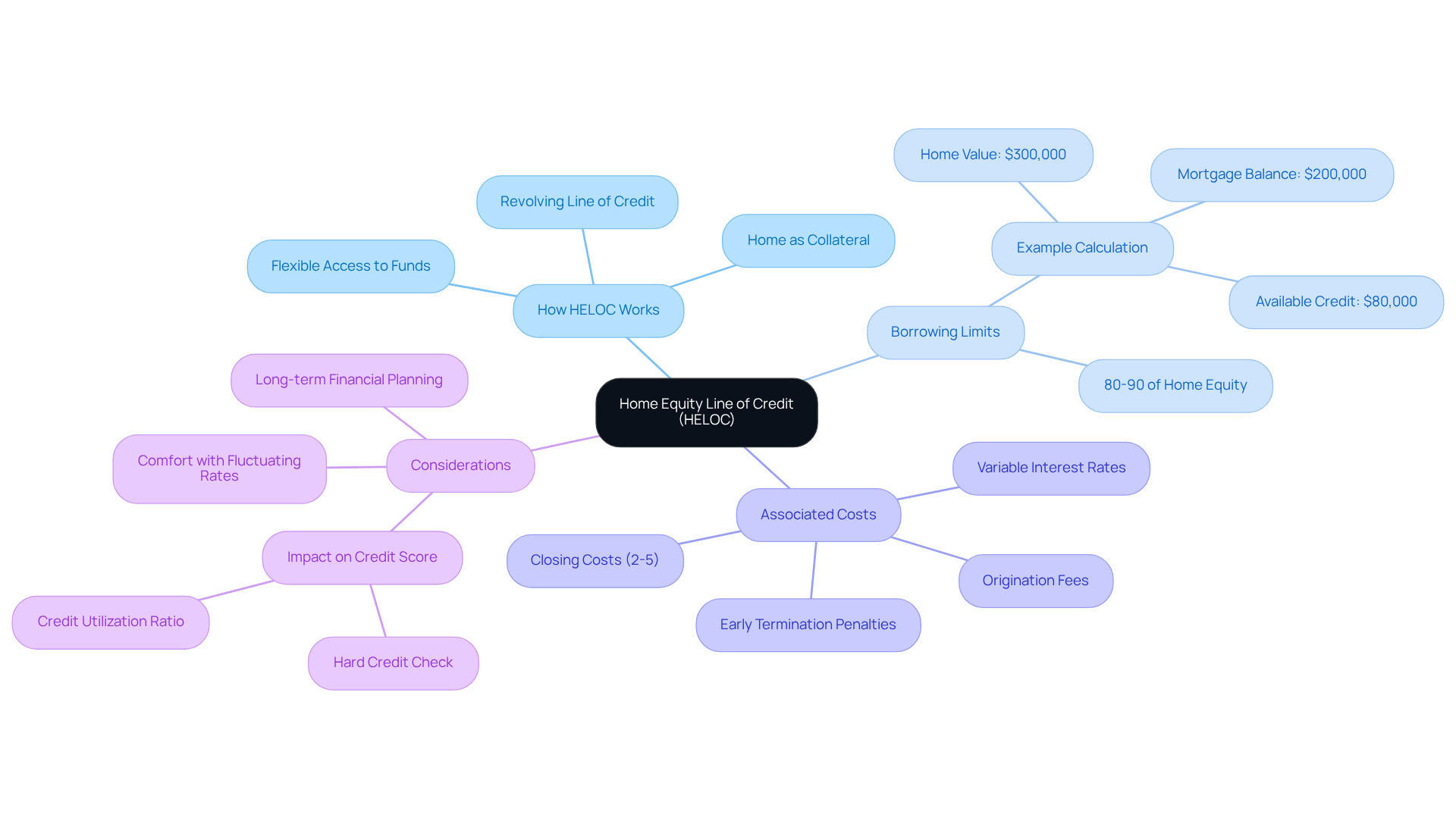

For property owners looking to tap into their home’s equity, understanding how does HELOC work can make a Home Equity Line of Credit (HELOC) a wonderful solution. This flexible, revolving line of credit illustrates how does HELOC work by allowing you to transform a portion of your property’s value into available cash for various needs—whether it’s for renovations, consolidating debt, or managing unexpected expenses. Unlike traditional loans, you may wonder how does HELOC work, as it lets you access funds as needed, much like a credit card, with your home serving as collateral.

The borrowing limit is typically based on the difference between your home’s current market value and the outstanding mortgage balance, often allowing you to access 80 to 90 percent of your home equity. However, it’s important to be aware of associated costs, such as origination fees and early termination penalties. In California, the cost of closing on a mortgage refinance generally ranges from 2% to 5% of the loan amount. Understanding these costs can empower you to make informed decisions about accessing your equity.

HELOCs can be especially appealing for those looking to manage significant yet unpredictable expenses. We know how challenging this can be, but as long as you are comfortable with fluctuating interest rates and the associated risks, this option may be worth considering. Additionally, adjustable-rate mortgages (ARMs) offer lower introductory rates and borrower protections, making them a viable choice if you plan to refinance or sell in the near future. Remember, we’re here to support you every step of the way as you navigate these important financial decisions.

Explain How HELOC Works: Mechanics of Borrowing Against Home Equity

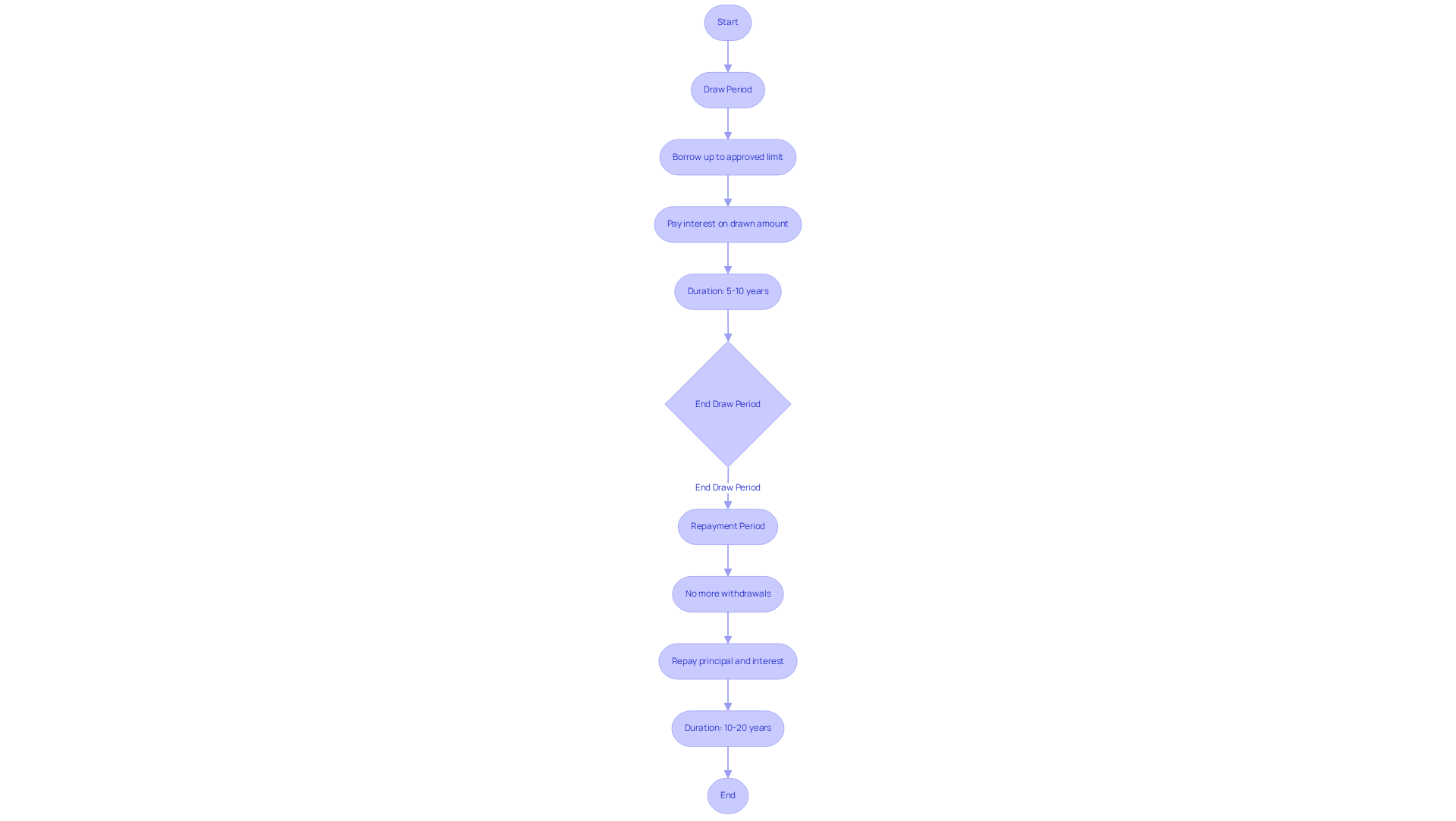

To understand how does HELOC work, it’s important to know that a Home Equity Line of Credit (HELOC) consists of two main phases: the draw period and the repayment period. We know how challenging it can be to navigate these options, so let’s break it down together.

Understanding how does HELOC work, the draw period typically lasts between 5 to 10 years, allowing you to borrow from your line of credit as needed, up to your approved limit. During this time, you only pay interest on the amount you draw, which illustrates how does HELOC work, making it a flexible and cost-effective option for managing cash flow.

It’s important to understand that some HELOCs may have application, annual, or closing fees, while others may waive these costs. This can impact the overall expense of obtaining a HELOC, so it’s essential to explore your options carefully. Furthermore, the Loan-to-Value (LTV) ratio clarifies how much equity you can access, which is essential to understand how does HELOC work, as it enables you to borrow up to 80% of your property’s value minus what you still owe. Many lenders require homeowners to maintain at least an 80% home-to-value loan ratio, meaning you should have paid down at least 20% of your original loan amount or your home must have appreciated in value.

Once the draw period concludes, to understand how does HELOC work, the repayment phase begins. During this time, you can no longer withdraw funds and must start repaying both the principal and interest. The repayment period, based on how does HELOC work, can last from 10 to 20 years, depending on the specific conditions of your home equity line of credit. It’s crucial to be aware of how does HELOC work, particularly since interest charges on HELOCs are frequently variable and can change according to market conditions. This is an essential aspect to consider when planning for your payments.

As of mid-2025, average home equity line rates are around 8.27%, a significant increase from below 4 percent three years ago. This provides homeowners with competitive options for accessing their equity. If you need swift access to funds, learning how does HELOC work can help you obtain funding for a home equity line of credit in as little as two weeks after applying, making it an attractive option for many families.

Lastly, comprehending the expenses linked to refinancing, which typically vary from 2% to 5% of the loan total, can assist you in assessing the overall financial consequences of employing a home equity line of credit. We’re here to support you every step of the way as you explore these options.

Evaluate Pros and Cons: Benefits and Risks of Using a HELOC

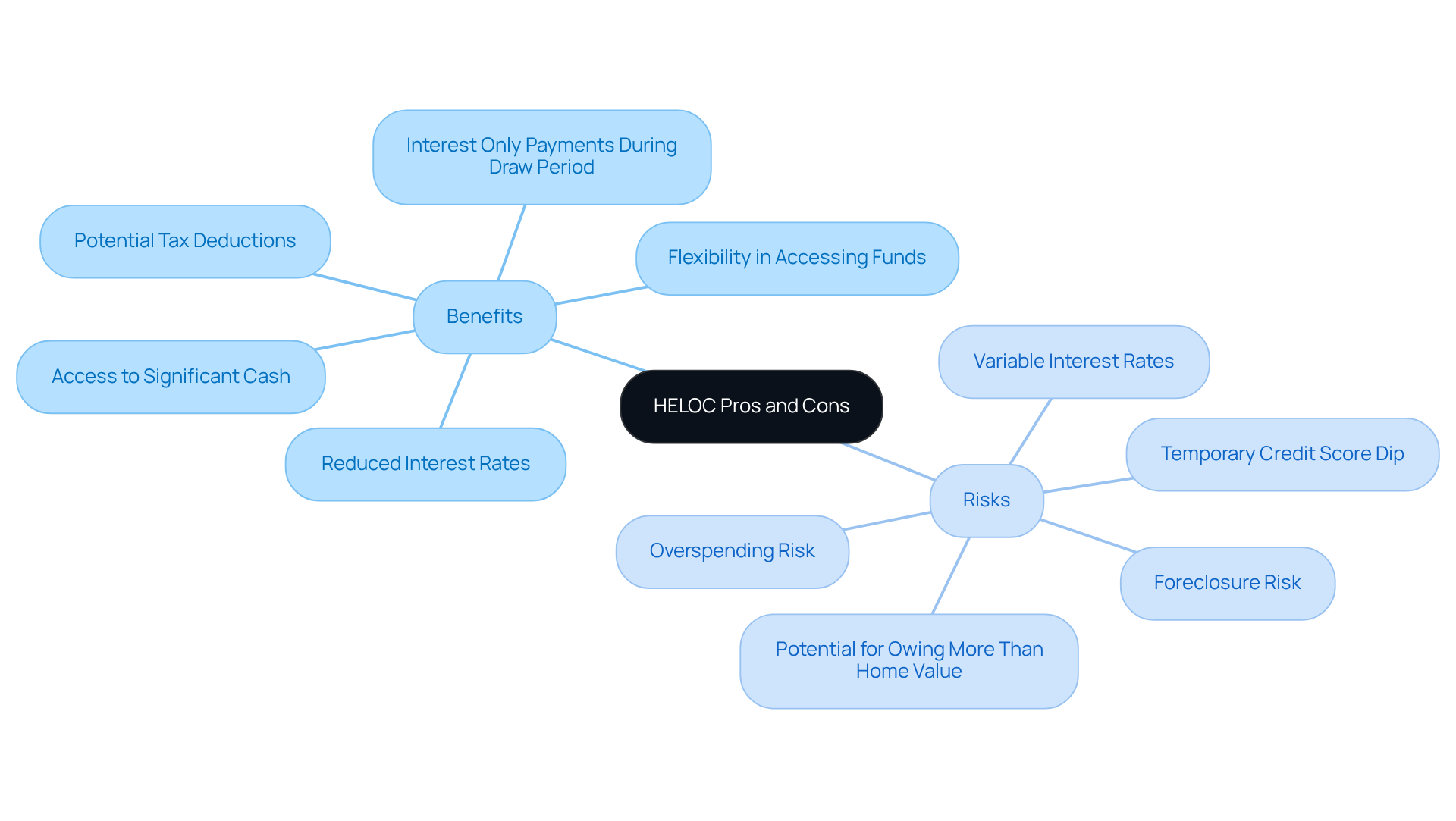

Are you wondering how does HELOC work when considering a Home Equity Line of Credit (HELOC)? You’re not alone in exploring this financial option, and we understand how important it is to make informed decisions. One of the significant benefits of a HELOC is the reduced interest rates compared to unsecured loans, which can lead to substantial savings for you as a borrower. This financial product offers you the flexibility to access funds when needed, whether for home renovations or educational expenses. Plus, if you use the funds for property enhancements, the interest paid on a HELOC might even be tax-deductible, making it an even more attractive option.

However, it’s essential to be aware of the risks that come with HELOCs. Your home serves as collateral, meaning that failing to make timely repayments could result in foreclosure, a serious concern for any homeowner. Additionally, the variable interest rates typical of HELOCs can lead to fluctuating monthly payments, complicating your budgeting efforts. For instance, interest rates can rise significantly, with potential increases of up to 18%, which may place additional pressure on your finances. Most HELOC interest rates are variable and can change based on economic conditions. If property values decline, you might find yourself in a situation where you owe more than your home is worth, limiting your financial options. Some lenders may also have minimum withdrawal requirements that could exceed your actual needs.

It’s crucial to weigh these benefits and risks carefully. Practicing financial discipline is vital when managing a home equity line of credit, especially during the draw phase, where you may only need to make interest payments. Seeking advice from a financial consultant can provide you with tailored support, helping you make informed choices about using a HELOC effectively. Additionally, be aware that requesting a HELOC might lead to a temporary decline in your credit score due to a hard credit inquiry. Understanding these dynamics can empower you to navigate the complexities of HELOCs and grasp how does HELOC work to make sound financial decisions. Remember, we’re here to support you every step of the way.

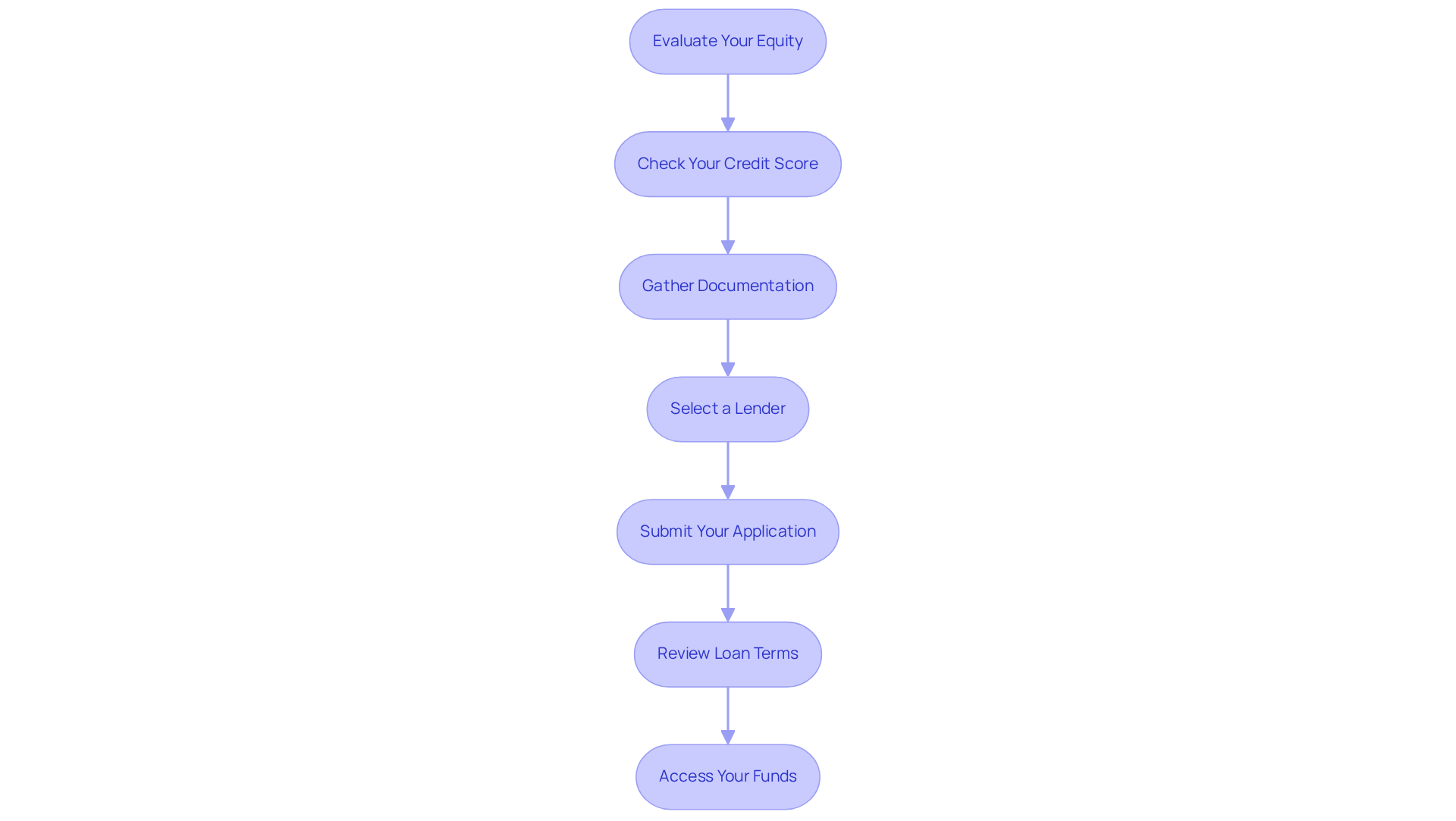

Outline HELOC Application Process: Requirements and Steps to Apply

Applying for a Home Equity Line of Credit (HELOC) can feel overwhelming, but we’re here to support you every step of the way. By following these key steps, you can ensure you meet the necessary requirements and secure favorable terms.

-

Evaluate Your Equity: Start by determining your property equity. Subtract your current mortgage balance from your property’s market value. For example, if your home is valued at $500,000 and you owe $400,000, you have $100,000 in equity, which is 20%. Remember, lenders typically require at least 20% equity in your property, with a loan-to-value (LTV) ratio cap of around 80%.

-

Check Your Credit Score: A credit score of at least 620 is usually necessary. However, aiming for a score of 680 or above can significantly enhance your chances of obtaining improved terms.

-

Gather Documentation: Prepare essential documents, such as proof of income, tax returns, and details about your existing debts. This information is crucial for lenders to assess your financial stability and understand your unique situation.

-

Select a Lender: Take the time to investigate different lenders to evaluate their prices and conditions. This step is vital, as different lenders can offer diverse terms. Consider collaborating with F5 Mortgage, where you can find attractive offers and tailored assistance. It’s important to discover a solution that aligns with your needs. Keep in mind that home equity line of credit rates can vary significantly by location, with some areas like Chicago offering rates as low as 6.32% and New York Metro rates reaching up to 9.92%. F5 Mortgage is available Monday to Friday from 8:30 am to 11:00 pm (EST) and Saturday from 8:30 am to 5:00 pm (EST).

-

Submit Your Application: Complete the application, which typically includes a credit check and may require a home appraisal to verify your property’s value.

-

Review Loan Terms: After approval, carefully examine the terms of your HELOC. Understanding the interest rates, repayment structure, and any fees involved is vital before signing, ensuring you feel confident in your decision.

-

Access Your Funds: Once the closing procedure is finished, you can start utilizing your line of credit as needed, offering you the flexibility for renovations or other costs.

By following these steps, you can navigate the HELOC application process with confidence and learn how does HELOC work, empowering yourself to leverage your home equity effectively. Many customers have shared positive experiences with F5 Mortgage, reinforcing their reputation as a trusted partner in your mortgage journey. We know how challenging this can be, and we’re here to assist you throughout the process.

Conclusion

Understanding how a Home Equity Line of Credit (HELOC) works is crucial for homeowners seeking to leverage their property’s equity effectively. This financial tool provides flexibility and access to funds when needed, making it a viable option for various expenses, whether for renovations, debt consolidation, or unexpected costs. By turning a portion of home equity into a revolving line of credit, homeowners can manage their finances more adeptly. However, it’s important to be aware of the associated risks and costs.

This article outlines the mechanics of HELOCs, including:

- The draw and repayment phases

- The significance of understanding loan-to-value ratios

- The potential costs involved

It emphasizes the benefits of:

- Lower interest rates compared to unsecured loans

- The flexibility of borrowing only what is necessary

Yet, it also highlights the risks, such as:

- The possibility of foreclosure if repayments are missed

- The variability of interest rates that can complicate budgeting

Additionally, the application process is broken down into manageable steps, ensuring that potential borrowers feel well-prepared to navigate their options.

In conclusion, a HELOC can be a powerful financial tool when used thoughtfully and responsibly. We know how challenging this can be, and we encourage homeowners to weigh the benefits against the risks. Seeking professional advice and fully understanding the terms before committing to this form of credit is essential. By making informed decisions, individuals can utilize their home equity to enhance their financial well-being while minimizing potential pitfalls. We’re here to support you every step of the way.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A HELOC is a flexible, revolving line of credit that allows property owners to access a portion of their home’s equity as cash for various needs, such as renovations, debt consolidation, or managing unexpected expenses.

How does a HELOC work?

A HELOC functions similarly to a credit card, allowing you to borrow funds as needed with your home serving as collateral. The borrowing limit is typically based on the difference between your home’s current market value and the outstanding mortgage balance.

What percentage of home equity can I access through a HELOC?

Homeowners can generally access 80 to 90 percent of their home equity through a HELOC.

What costs are associated with obtaining a HELOC?

Associated costs may include origination fees and early termination penalties. In California, closing costs on a mortgage refinance typically range from 2% to 5% of the loan amount.

Who might benefit from a HELOC?

HELOCs can be particularly appealing for those looking to manage significant and unpredictable expenses, as they provide flexible access to funds.

What should I consider regarding interest rates with a HELOC?

It is important to be comfortable with fluctuating interest rates and the associated risks, as HELOCs often have adjustable rates.

Are there any advantages to using adjustable-rate mortgages (ARMs) with a HELOC?

Yes, ARMs can offer lower introductory rates and borrower protections, making them a viable choice for those planning to refinance or sell in the near future.