Overview

A Home Equity Line of Credit (HELOC) can be a helpful financial tool for homeowners. It offers a flexible, revolving credit line that allows you to borrow against your home equity for various needs, with your property serving as collateral.

We understand that while HELOCs provide benefits like flexibility and lower interest rates compared to credit cards, they also come with risks. These risks include variable interest rates and the potential for foreclosure if payments are missed. This underscores the importance of careful financial planning.

As you consider your options, remember that we’re here to support you every step of the way. It’s essential to weigh these factors thoughtfully and make a decision that aligns with your financial goals.

Introduction

Understanding the intricacies of a Home Equity Line of Credit (HELOC) can unlock significant financial opportunities for homeowners. We know how challenging it can be to navigate these options, but this flexible borrowing solution allows individuals to tap into their home’s equity for various purposes—whether it’s for renovations, debt consolidation, or other needs.

However, as with any financial tool, there are benefits and risks associated with HELOCs that can feel daunting.

- What challenges might arise when leveraging this line of credit?

- How can homeowners ensure they make informed decisions about their financial futures?

We’re here to support you every step of the way.

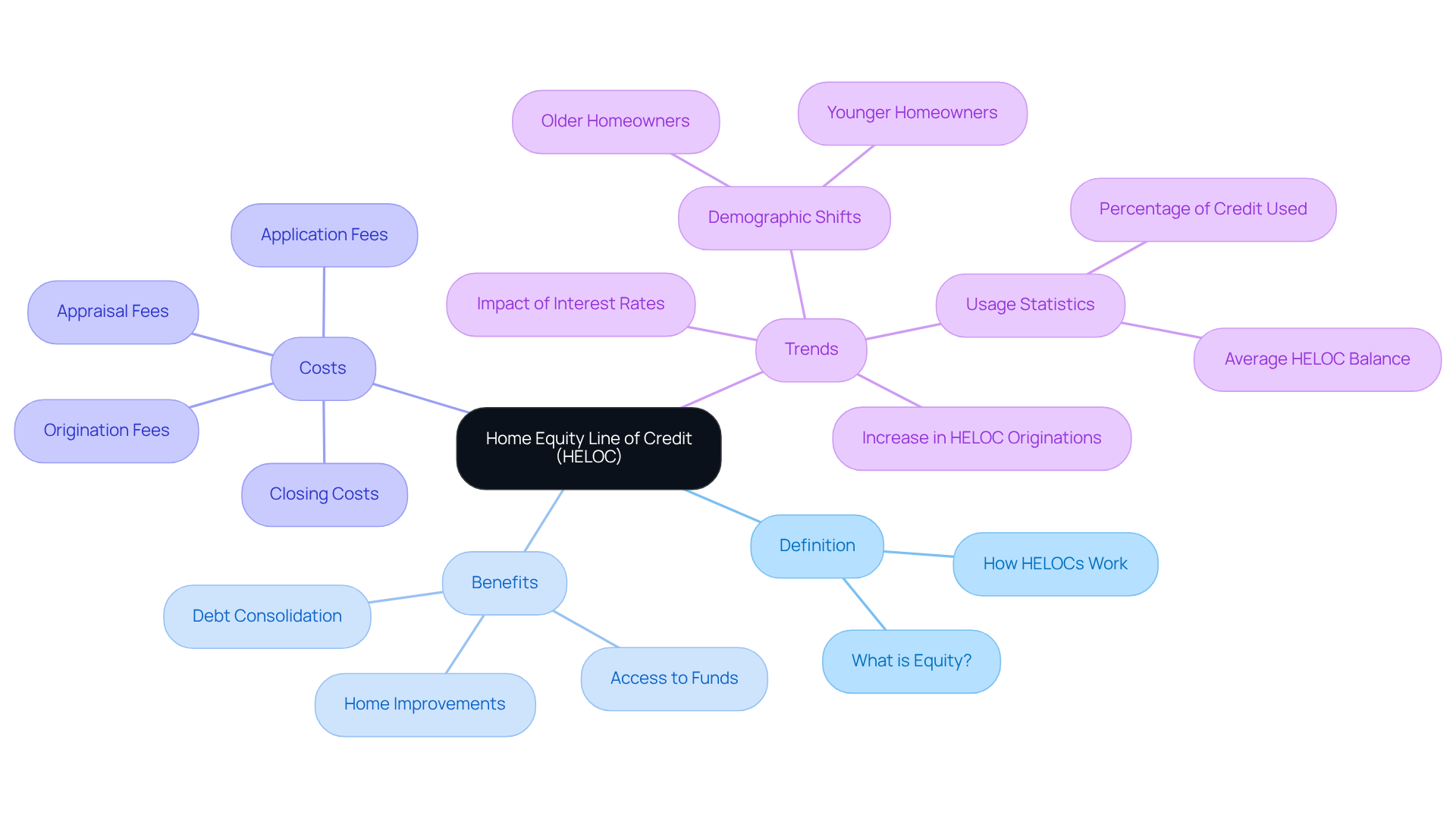

Define Home Equity Line of Credit (HELOC)

A (HELOC) is a that demonstrates by allowing property owners to borrow against the equity in their homes. We understand that equity can be a complex concept, defined as the difference between your property’s current market value and the outstanding mortgage balance. This financial tool helps homeowners by explaining how does a HELOC loan work, providing them with the opportunity to access funds for various needs, such as , debt consolidation, or significant purchases, with their residence serving as collateral. Unlike traditional loans, a HELOC offers the advantage of flexibility, allowing you to withdraw funds as needed, up to a predetermined credit limit, which raises the question of how does a HELOC loan work, much like using a credit card.

Recent trends reveal that HELOCs are increasingly favored among homeowners, particularly for funding renovations. Many property owners are that enhance property value. In fact, reports indicate that nearly 1.3 million HELOCs were established in 2023 alone. This resurgence in HELOC usage highlights their appeal as a practical alternative to cash-out refinancing, especially in a climate where existing mortgage rates are lower than current market values.

during times of rising interest rates. They allow homeowners to retain their lower-rate first mortgages while accessing necessary funds. This strategic approach not only facilitates home improvements but also .

When considering how does a HELOC loan work, it’s crucial to understand the , particularly in California, where can range from 2% to 5% of the loan amount. For instance, if your new loan amount is $300,000, you might expect to pay between $6,000 and $15,000 in closing costs. This includes:

- Application fees (ranging from $75 to $500)

- Origination fees (between 0.5% and 1.5% of the loan amount)

- Appraisal fees (typically between $300 and $500)

- More

Knowing your break-even point can help you determine how long it will take to recoup these expenses through savings in monthly payments or interest. Additionally, once your application is approved, locking in your mortgage rates is essential to safeguard against market fluctuations during the processing period.

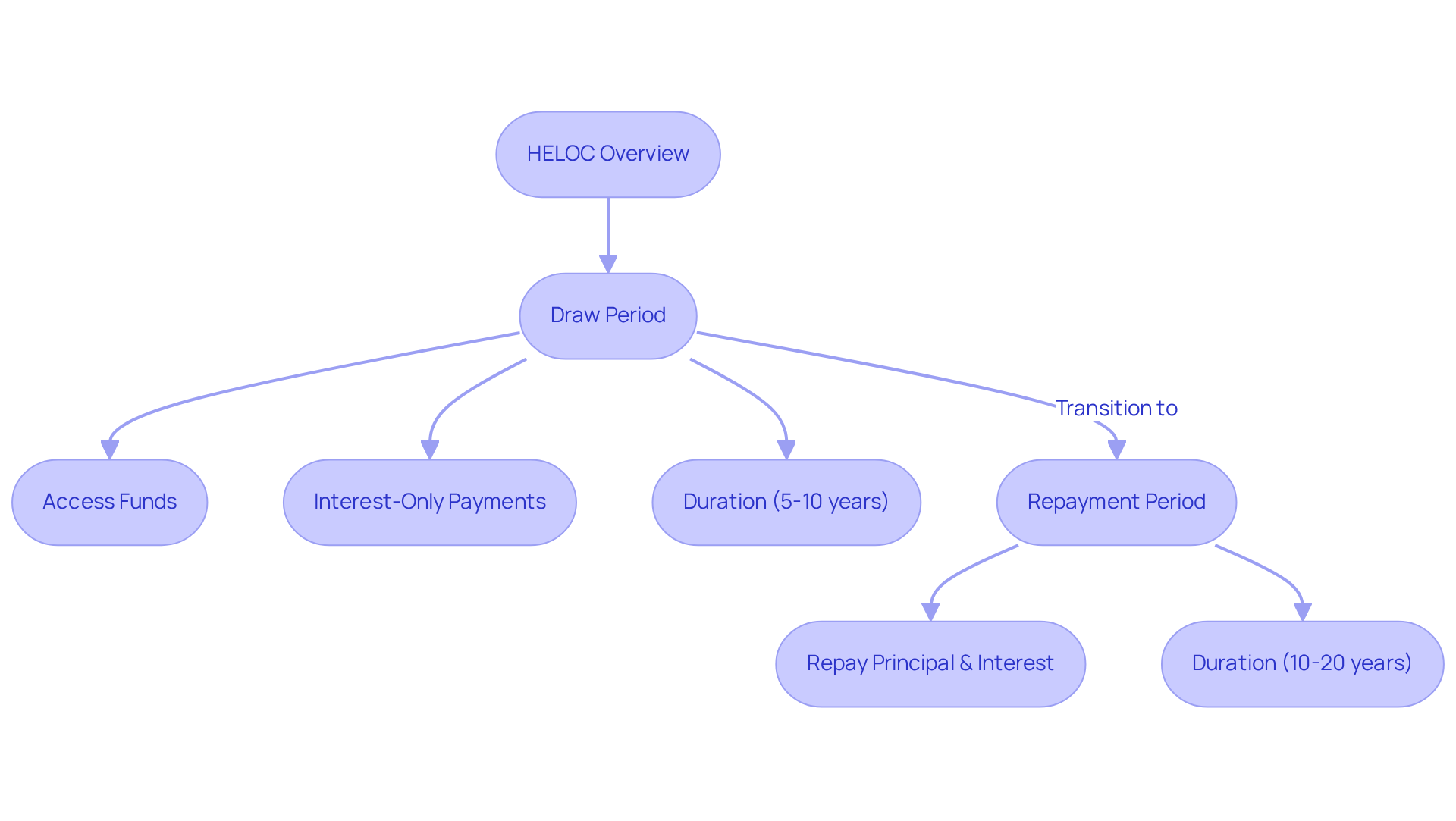

Explain How a HELOC Works

Navigating a can feel overwhelming, but understanding how does a work can empower you. This financial tool operates in two distinct phases, which raises the question of [how does a heloc loan work](https://f5mortgage.com/home-equity-loan-vs-home-equity-line-of-credit-key-differences-explained) during the draw period and the repayment period. The , allowing you to access funds up to your established credit limit. During this time, many borrowers opt for interest-only payments, providing the without the pressure of a lump sum commitment.

Once the draw period concludes, the . Here, you’ll need to repay both the principal and interest. It’s important to recognize that . This means that fluctuations can affect your , which can be particularly concerning in an unpredictable economic climate.

We know how challenging this can be. Comprehending how does a heloc loan work and its implications is crucial for effective financial planning. If you’re considering using a or other significant expenses, take the time to weigh the potential risks and rewards. Remember, we’re here to support you every step of the way as you make these important decisions.

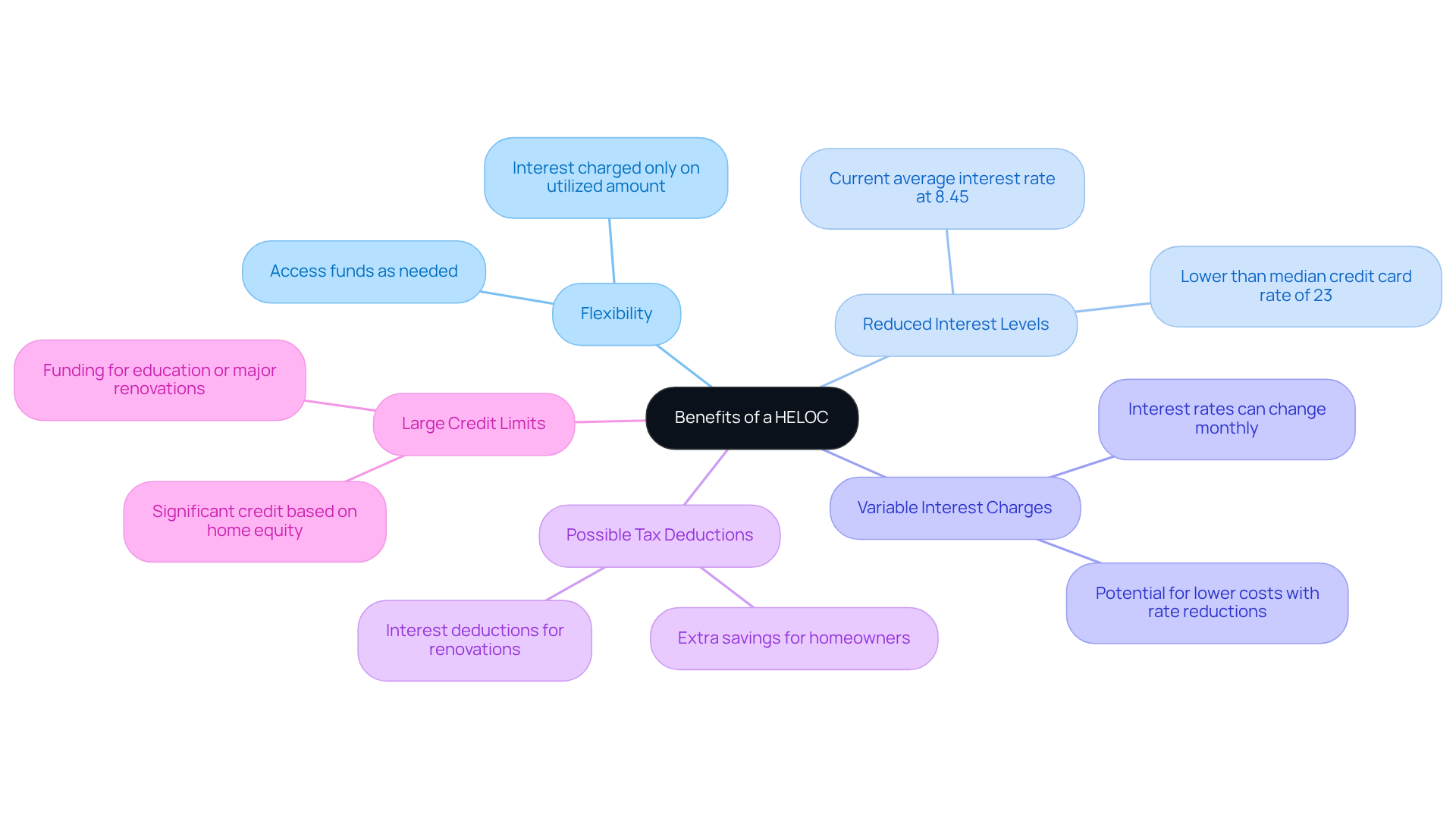

Outline Benefits of a HELOC

Understanding reveals that the benefits of a (HELOC) are substantial and can significantly enhance .

- Flexibility: We know how challenging can be. To understand how does a heloc loan work, it’s important to note that HELOCs allow you to access funds as needed, with interest only charged on the amount utilized. This feature is particularly advantageous for , enabling you to manage your finances more effectively.

- Reduced Interest Levels: Currently, borrowing costs for home equity lines of credit have hit an 18-month minimum, making them a more economical option than unsecured loans or credit cards. The typical interest percentage for HELOCs is around 8.45%, which is considerably lower than the median credit card percentage of nearly 23%. This emphasizes the financial benefits of selecting a HELOC.

- : It’s important to note that HELOCs have variable interest charges that can change monthly. While this poses a risk in a rising interest rate environment, it can also be , potentially leading to lower costs by summer.

- : Property owners may benefit from tax deductions on the interest paid on a home equity line of credit, provided the funds are used for renovations. This can result in extra savings, making a home equity line of credit an even more appealing choice.

- Large Credit Limits: Depending on your home equity, you can often obtain significant credit limits through a home equity line of credit. This access allows for , such as funding education or undertaking major renovations, which can enhance the value of your property.

In general, knowing how does a HELOC loan work can provide you with the financial adaptability you need while benefiting from and possible tax advantages. As Matt Richardson notes, “Both HELOCs and reverse mortgages have unique features homeowners may want to explore this year,” making it essential to consider all options carefully. We’re here to support you every step of the way.

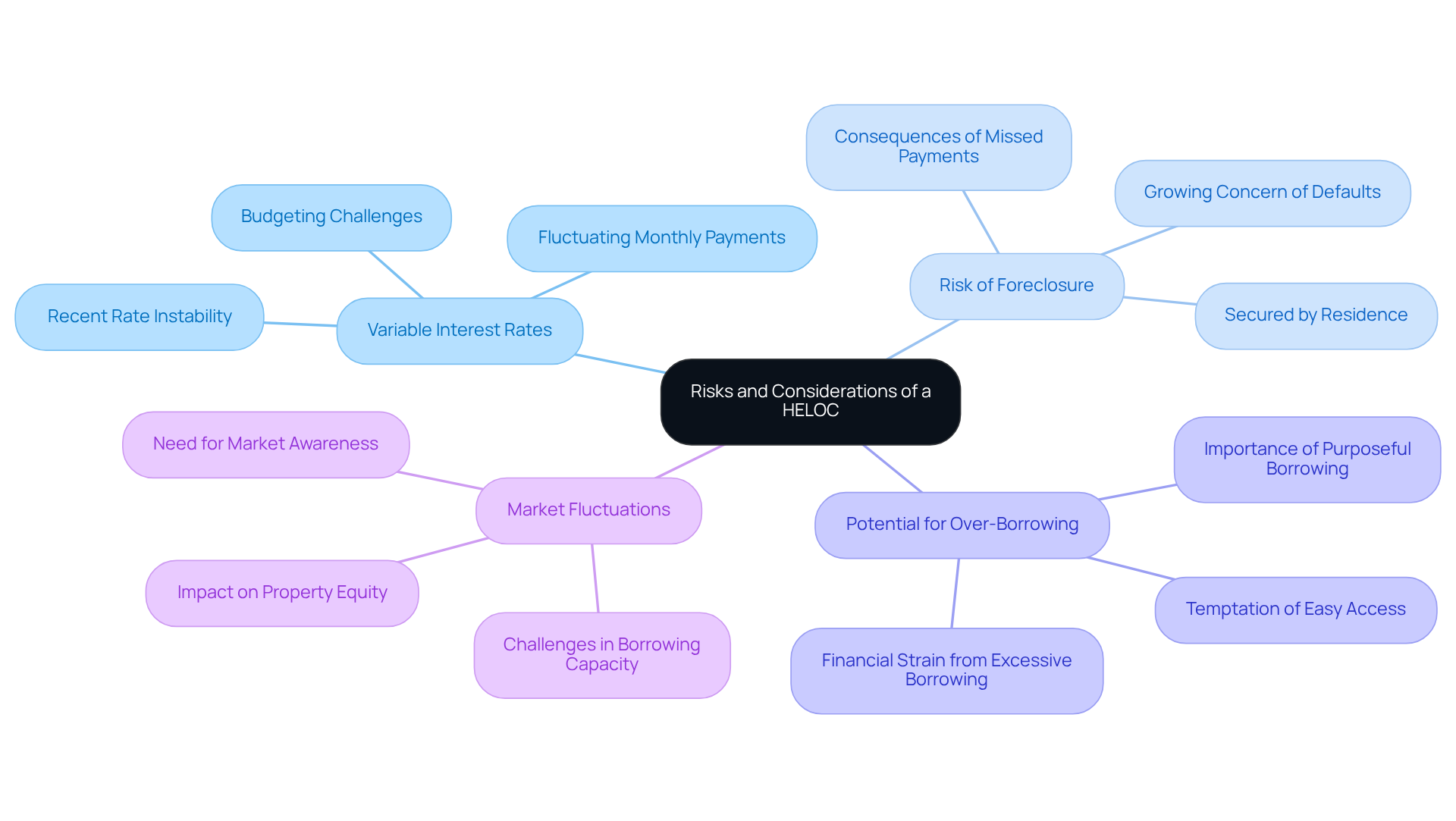

Discuss Risks and Considerations of a HELOC

While HELOCs offer numerous benefits, they also come with that borrowers should carefully consider.

- : We understand how challenging it can be to manage finances with the uncertainty of variable interest rates. Most HELOCs feature these rates, leading to fluctuating monthly payments. This variability complicates budgeting, especially for those on fixed incomes or with long-term financial plans. Recent trends suggest that rates have been unstable, prompting borrowers to assess their in light of potential rate increases. It’s important to recognize that these fluctuations can significantly impact your monthly obligations and overall financial health.

- : The thought of foreclosure can be daunting, especially since a home equity line of credit is secured by your residence. Failure to make can lead to this unfortunate situation, endangering your most valuable asset. Foreclosure rates associated with equity line defaults are a growing concern, with some research suggesting that property owners who miss payments face a greater risk of losing their homes. This highlights the importance of maintaining consistent payment schedules to protect your investment.

- : We know how tempting the flexibility of a home equity line of credit can be, but it can also lead to excessive borrowing. Homeowners may find themselves drawing more than they can afford to repay, resulting in financial strain. Experts caution that easy access to funds can encourage spending beyond your means, which may lead to long-term debt issues. It is crucial to understand the purpose of your borrowing and to limit your draws to essential expenses.

- : Changes in the housing market can significantly affect your property equity, potentially lowering your available credit limit. This fluctuation can create challenges for those who depend on their line of credit for financial stability, as a decrease in property value may limit borrowing capacity and affect overall financial situations. Homeowners should stay informed about current market conditions and how they may influence equity and borrowing options.

is crucial for homeowners considering a HELOC. We’re here to support you every step of the way as you navigate the complexities of borrowing against your home equity.

Conclusion

A Home Equity Line of Credit (HELOC) is more than just a financial tool; it’s a way for homeowners to unlock the potential of their property’s equity to meet various needs. We understand how important it is to make informed financial choices, and by grasping how a HELOC works, you can effectively finance home improvements, consolidate debt, or handle unexpected expenses. The unique structure of a HELOC combines the flexibility of a credit card with the possibility of lower interest rates, making it an attractive option for many families looking to optimize their financial resources.

As you explore this option, it’s essential to recognize the key phases of a HELOC, including the draw and repayment periods. These phases come with benefits such as:

- Flexibility

- Lower borrowing costs

- Potential tax deductions

However, we also want to remind you of the risks involved, including:

- Variable interest rates

- Possibility of foreclosure

- Temptation to over-borrow

These insights underline the importance of careful financial planning and consideration before deciding on a HELOC.

Ultimately, understanding the intricacies of a HELOC is vital for homeowners like you who are contemplating this choice. By weighing the benefits against the risks, you can make informed decisions that align with your financial goals. As the landscape of home equity borrowing continues to change, staying informed about the advantages and potential pitfalls of HELOCs will empower you to navigate your financial future with confidence. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A Home Equity Line of Credit (HELOC) is a flexible, revolving line of credit that allows property owners to borrow against the equity in their homes, which is the difference between the property’s current market value and the outstanding mortgage balance.

How does a HELOC work?

A HELOC works similarly to a credit card, allowing homeowners to withdraw funds as needed, up to a predetermined credit limit, using their residence as collateral. This provides access to funds for various needs, such as home improvements, debt consolidation, or significant purchases.

Why are HELOCs becoming more popular among homeowners?

HELOCs are increasingly favored for funding renovations and enhancing property value. In 2023, nearly 1.3 million HELOCs were established, highlighting their appeal as a practical alternative to cash-out refinancing, especially when existing mortgage rates are lower than current market values.

What are the advantages of a HELOC during rising interest rates?

HELOCs allow homeowners to retain their lower-rate first mortgages while accessing necessary funds, which helps manage financial needs effectively and facilitates home improvements.

What costs are associated with obtaining a HELOC in California?

In California, closing costs for a HELOC can range from 2% to 5% of the loan amount. For a $300,000 loan, this could mean paying between $6,000 and $15,000 in closing costs, which may include application fees, origination fees, and appraisal fees.

How can I determine my break-even point for a HELOC?

Knowing your break-even point helps you determine how long it will take to recoup closing costs through savings in monthly payments or interest. This calculation is essential for understanding the financial implications of your HELOC.

What should I do once my HELOC application is approved?

Once your HELOC application is approved, it is important to lock in your mortgage rates to protect against market fluctuations during the processing period.