Overview

Home Equity Lines of Credit (HELOCs) offer a way for homeowners to tap into the equity in their homes, providing a flexible source of funds for family upgrades and improvements. We understand how challenging it can be to manage home renovations, and HELOCs can be a helpful solution.

These lines of credit operate in two phases—draw and repayment. One of their main advantages is the lower interest rates compared to credit cards, which can ease financial burdens. By strategically using a HELOC for renovations, you can enhance your property value, making it a wise investment for your family’s future.

Statistics show that a significant percentage of homeowners are considering this financial option. We’re here to support you every step of the way as you explore how a HELOC can meet your family’s needs.

Introduction

Homeowners are increasingly turning to Home Equity Lines of Credit (HELOCs) as a versatile financial tool. This option allows families to fund renovations and upgrades that can enhance their living spaces and property values. By borrowing against the equity built in their homes, they can access flexible financing options for everything from kitchen remodels to emergency repairs.

However, we know how challenging navigating the intricacies of HELOCs can be. This process raises critical questions about:

- How they work

- The costs involved

- The qualifications needed to secure one

Understanding these elements is essential for homeowners looking to make informed decisions about leveraging their home equity for family upgrades. We’re here to support you every step of the way as you explore these opportunities.

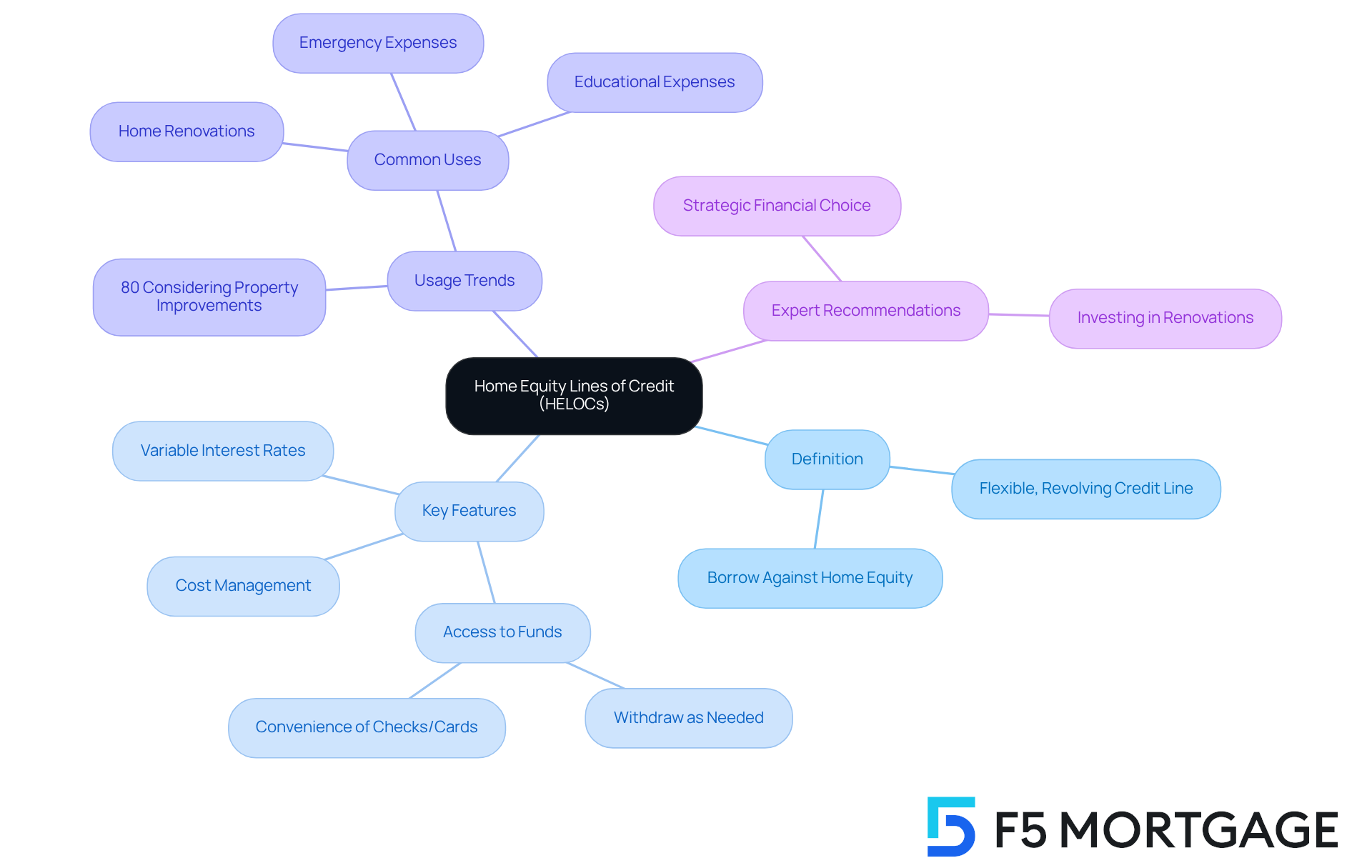

Define Home Equity Lines of Credit (HELOCs)

A Home Equity Line of Credit (HELOC) is a flexible, revolving credit line that illustrates how home equity lines of credit work, allowing property owners to borrow against the equity in their homes. This equity represents the difference between the property’s current market value and the outstanding mortgage balance. Much like a credit card, a HELOC enables homeowners to withdraw funds as needed, up to a predetermined limit. This makes it a suitable financing option for various expenses, especially home enhancements and upgrades.

We understand that many homeowners are exploring their options for property improvements. In fact, surveys indicate that around 80% of property owners with active lines of credit are considering using their equity for such projects. This trend highlights the growing popularity of HELOCs as a means to finance endeavors that can enhance a home’s value and functionality.

Key features of HELOCs include:

- Variable interest rates that fluctuate with market conditions, typically lower than those of credit cards.

- Borrowers can access only what they need, which can help manage costs effectively.

- Homeowners can often access their HELOC funds through checks or a credit card linked to the account, offering both convenience and simplicity.

Experts suggest that using a HELOC for property improvements can be a strategic financial choice, particularly in a market where property values are on the rise. By investing in renovations, homeowners not only improve their living spaces but also potentially increase their property’s market value, creating a win-win situation. As the housing market continues to evolve, understanding how home equity lines of credit work will be essential for homeowners looking to optimize their investments in their residences.

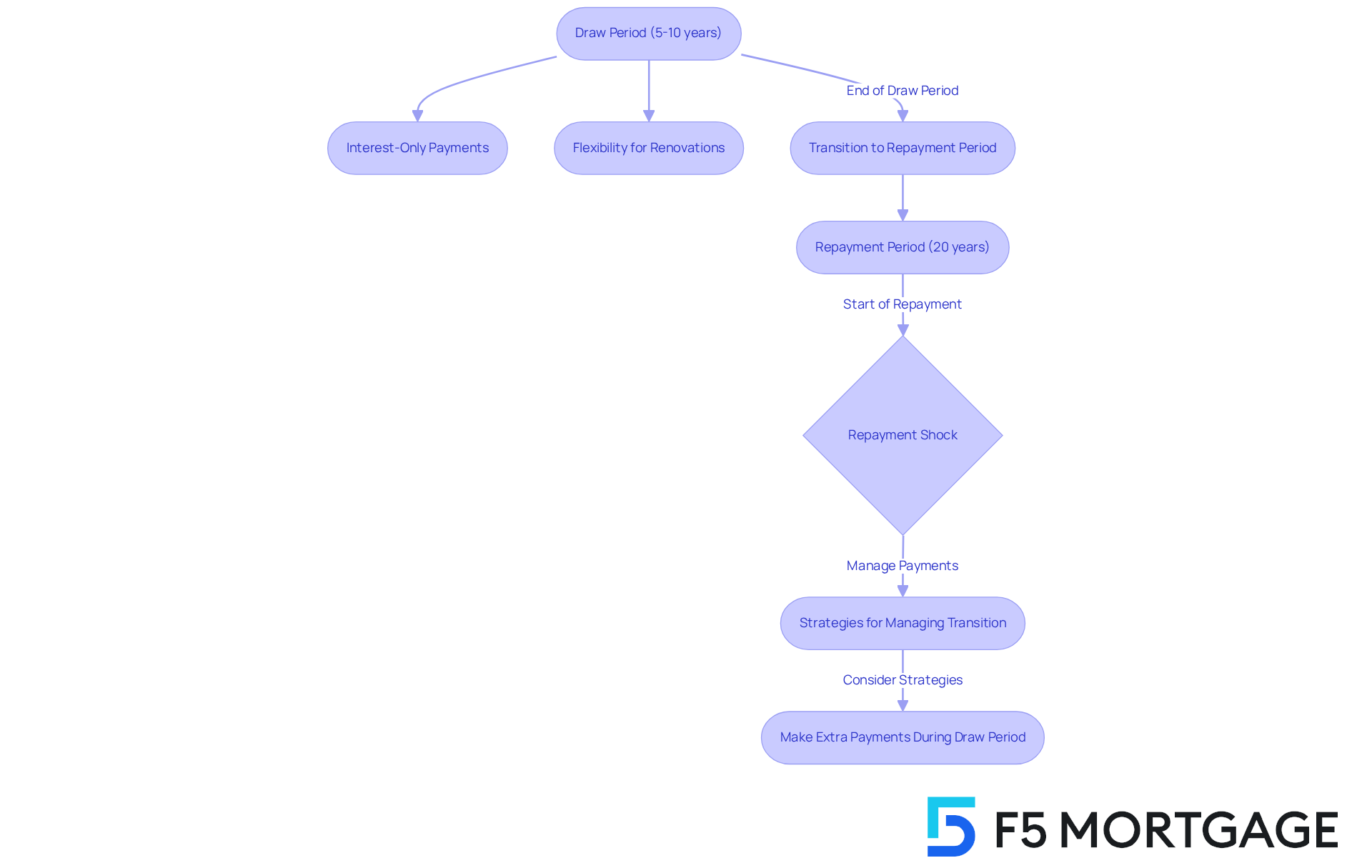

Explain How HELOCs Work

To understand how home equity lines of credit work, it’s essential to note that they are structured in two main phases: the draw period and the repayment period. We understand how important it is for property owners to navigate these phases effectively. The draw period typically lasts between 5 to 10 years, allowing you to withdraw funds as needed while only paying interest on the amount borrowed. This flexibility makes HELOCs an appealing choice for those interested in understanding how home equity lines of credit work for funding renovations or upgrades.

As the draw period comes to a close, you transition into the repayment phase, which generally spans 20 years. During this time, you must begin repaying both the principal and interest, often leading to significantly higher monthly payments—sometimes more than double the interest-only payments made during the draw period. This shift can create what is known as ‘repayment shock,’ where your budget may feel strained by the increased financial obligation.

Recent trends show that many lenders are adjusting their repayment structures, with some offering longer draw periods of up to 20 years. This change provides property owners with extended access to funds, allowing for better financial planning. For instance, if you withdraw $10,000 from a HELOC at an interest rate of 8%, you would only pay interest on that amount during the draw period. However, once the repayment phase begins, understanding how home equity lines of credit work is crucial, as you must account for both principal and interest, which can significantly impact your monthly budget.

To manage these transitions effectively, we encourage you to consider strategies such as making additional payments toward the principal during the draw period. This proactive approach can help reduce the total amount owed when the repayment phase starts, easing your financial burden. Additionally, seeking guidance from a mortgage expert can provide personalized advice on how home equity lines of credit work, helping you manage the intricacies and ensuring you are well-prepared for the changes ahead. Remember, we’re here to support you every step of the way.

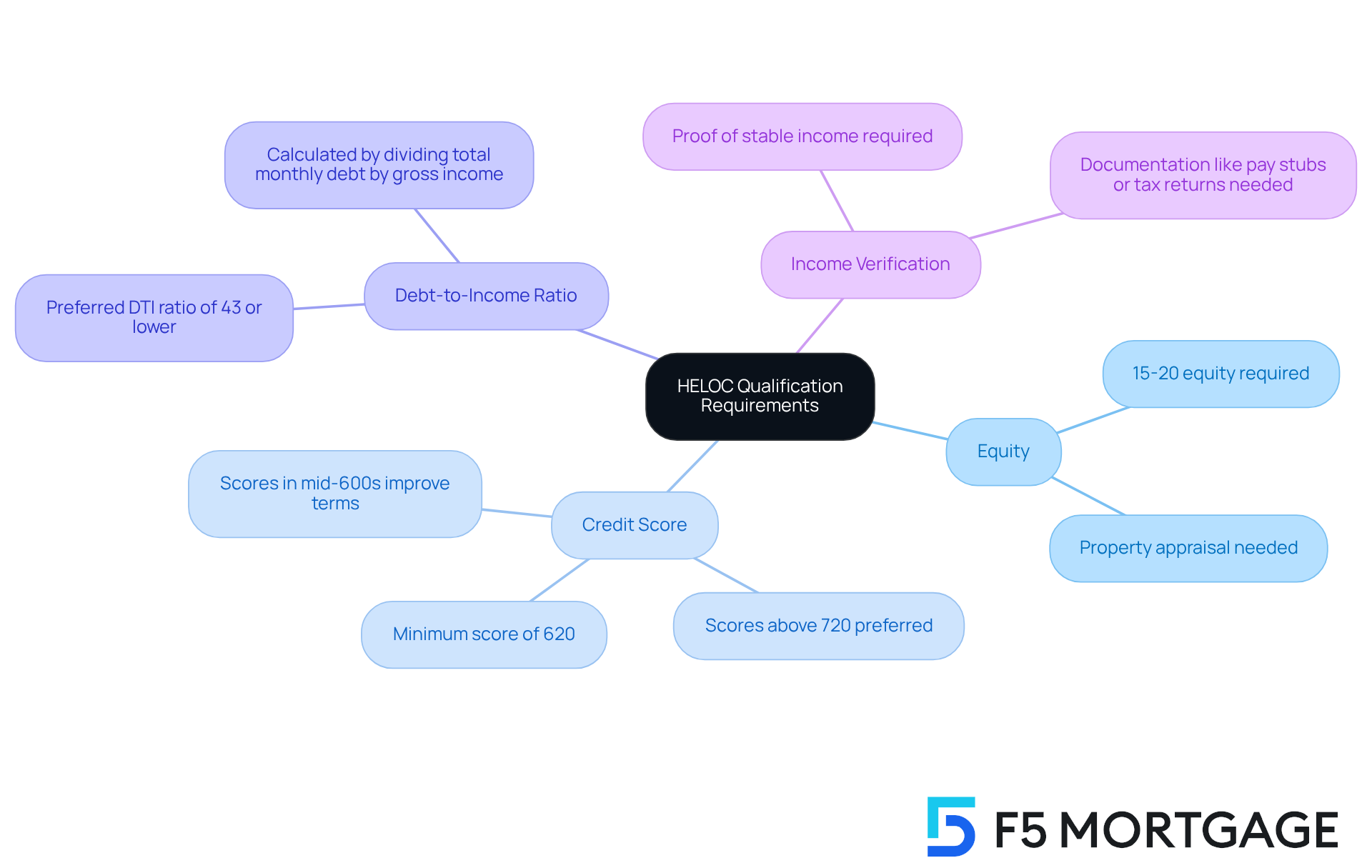

Outline Qualification Requirements for a HELOC

Homeowners often feel overwhelmed by the several key criteria they must meet to qualify, raising the question of how do home equity lines of credit work. Here’s what you need to know:

-

Equity: Most lenders require at least 15-20% equity in your property. This equity is the difference between your property’s market value and the outstanding mortgage balance. A property appraisal will be arranged by the lender to determine the current market value of your asset. This assessment not only identifies how much equity you have but also influences your rates.

-

Credit Score: A minimum credit score of approximately 620 is frequently required. However, some lenders may prefer a score of 720 or higher for HELOC qualification. Scores in the mid-600s to 700s can significantly improve your terms and interest rates, with borrowers above 740 potentially securing even better rates.

-

Debt-to-Income Ratio: Lenders generally prefer a debt-to-income (DTI) ratio of 43% or lower. This ratio measures your monthly debt payments against your gross monthly income and helps lenders assess your ability to manage additional debt.

-

Income Verification: Proof of stable income is essential to demonstrate your capacity to handle repayments. Lenders will typically require documentation such as pay stubs or tax returns.

We understand how challenging navigating these requirements can be, especially regarding property appraisals and their role in assessing equity. By grasping these criteria and preparing effectively, you can improve your chances of obtaining a HELOC and understanding how do home equity lines of credit work for property enhancements. Remember, we’re here to support you every step of the way.

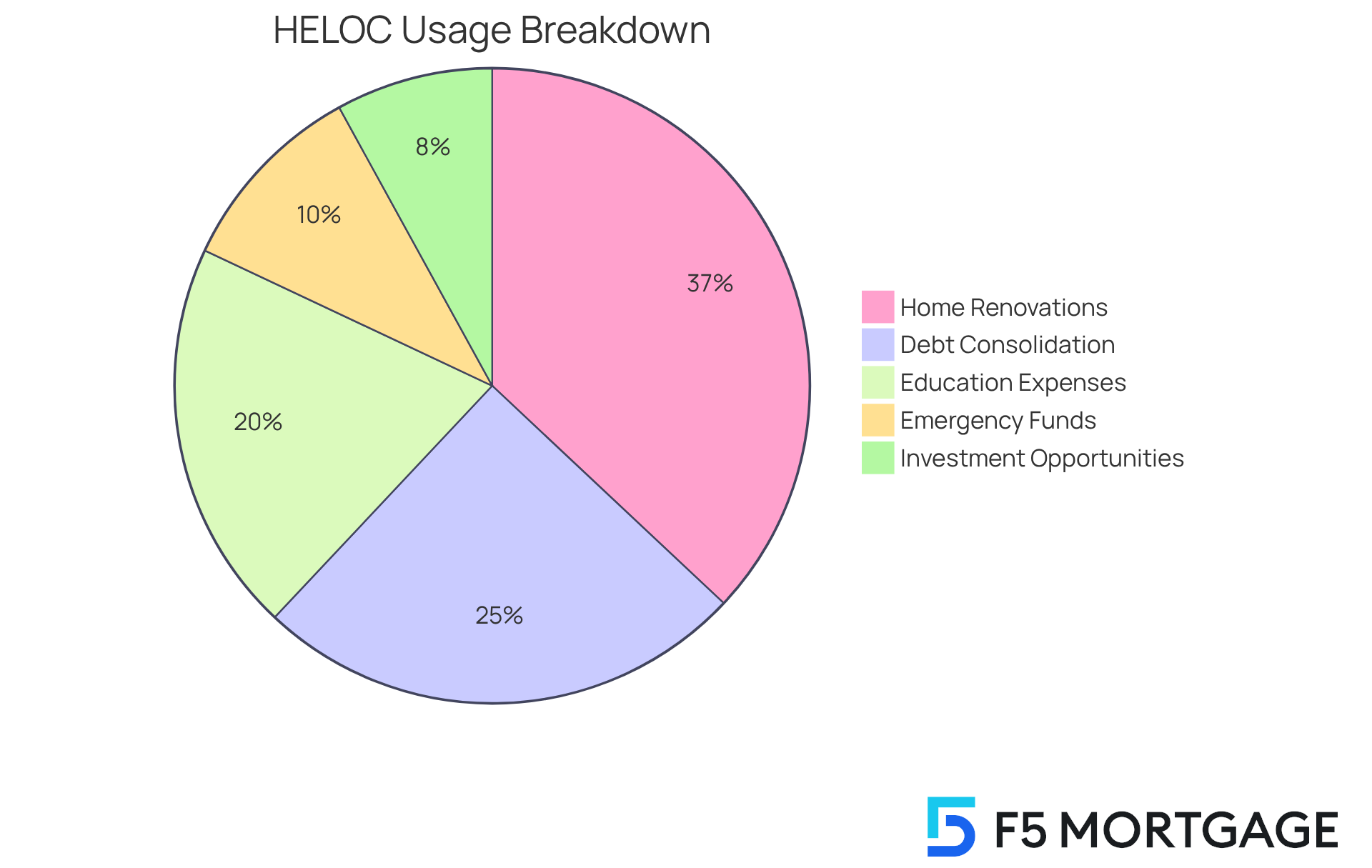

Identify Common Uses for Home Equity Lines of Credit

Home Equity Lines of Credit offer a variety of flexible uses, allowing families to understand how do home equity lines of credit work in significantly assisting them to improve their financial situations and property values. We understand how important it is to make informed decisions, so let’s explore some common uses:

-

Home Renovations: Many families turn to home equity lines of credit to finance home improvement projects, like kitchen or bathroom remodels. These enhancements can substantially boost a property’s market value. In fact, 80% of homeowners with existing home equity lines of credit consider using their equity for renovations, raising the question of how do home equity lines of credit work as a popular choice. In 2024, homeowners are collectively using about 37% of their home equity lines of credit for such improvements, showcasing a strong trend in utilizing this financial tool.

-

Debt Consolidation: If you’re feeling overwhelmed by high-interest debts, such as credit cards with an average interest rate of 18%, a home equity line of credit can help. By consolidating these debts into a HELOC, families can reduce their overall interest payments and simplify their financial obligations, making it easier to manage.

-

Education Expenses: Home equity lines of credit can also cover tuition and other educational costs for family members. This option allows families to invest in education without the burden of high-interest student loans, providing a more manageable alternative.

-

Emergency Funds: Life can be unpredictable, and home equity lines of credit serve as a financial cushion for unexpected expenses, such as medical bills or urgent home repairs. This flexibility can be crucial for families facing sudden financial challenges. However, it’s important to be aware of the risks associated with HELOCs, including how do home equity lines of credit work regarding variable interest rates and the potential for foreclosure if repayments are not managed properly.

-

Investment Opportunities: Homeowners can utilize funds from their home equity lines of credit for real estate investments or to start a business. This enables families to capitalize on potential growth opportunities without having to liquidate other assets. In 2024, the average HELOC balance was $121,613, providing families with a substantial amount of equity to work with.

These applications illustrate how home equity lines of credit work, offering financial flexibility that makes them a valuable resource for families looking to enhance their living conditions and manage their finances effectively. As you consider these options, keep in mind the prepayment penalties often linked to home equity lines of credit, typically within the first 36 months of the draw period. We’re here to support you every step of the way, ensuring you make informed financial decisions.

Evaluate Costs Associated with HELOCs

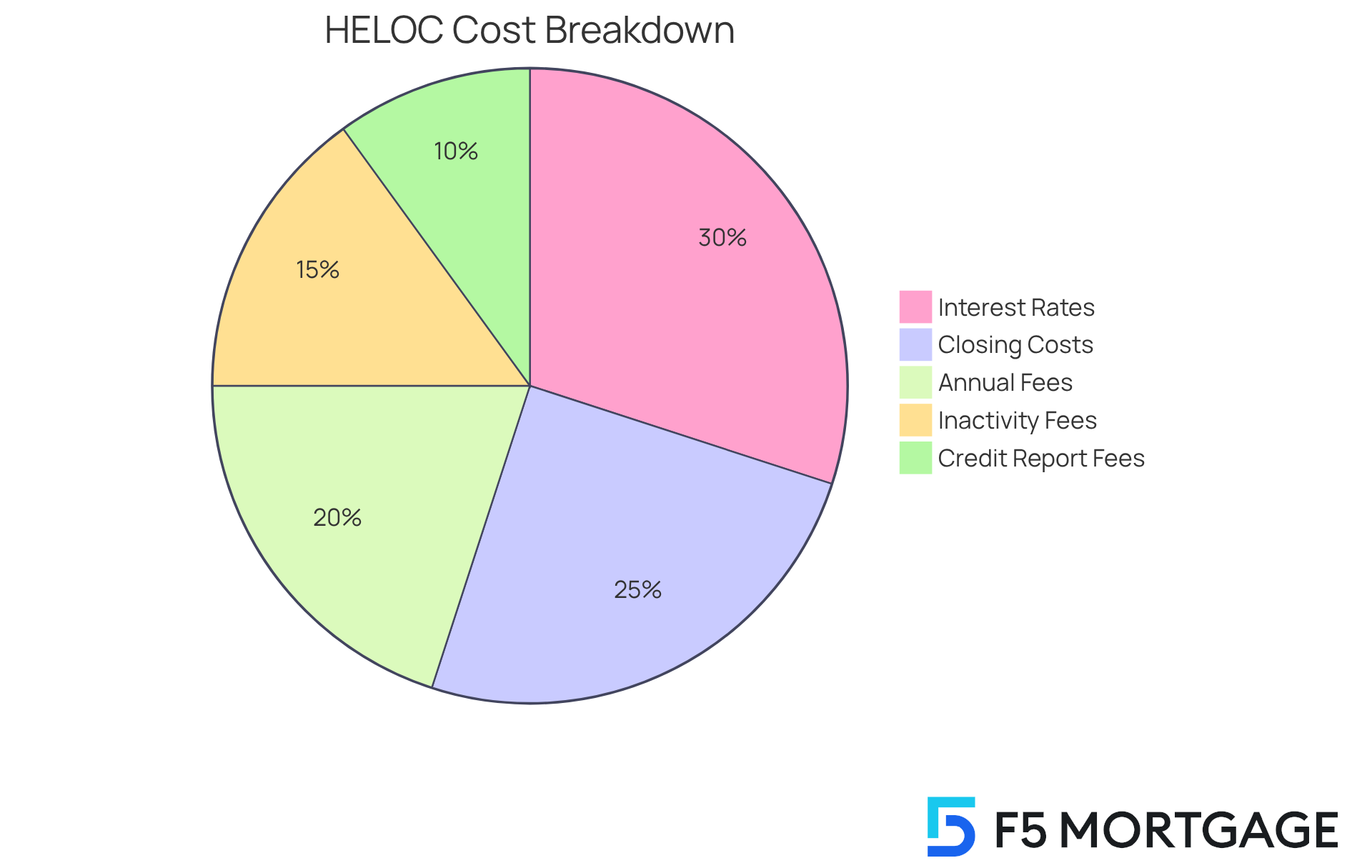

When considering a Home Equity Line of Credit (HELOC), we understand how home equity lines of credit work and how essential it is to assess the related expenses for efficient budgeting. Let’s explore some key costs together:

-

Interest Rates: HELOCs generally feature variable interest rates that fluctuate based on market conditions, often tied to the prime rate. This means that as the Federal Reserve modifies rates, your home equity line of credit interest rate may also change, affecting your monthly payments.

-

Closing Costs: These costs typically range from 2% to 5% of the credit limit and can include various fees such as appraisal fees, which average around $350, title search fees ranging from $75 to $250, and origination fees that may be between 0.5% and 1% of the loan amount. Some lenders may charge application fees instead of origination fees. Understanding these costs upfront can help you avoid unexpected financial burdens.

-

Annual Fees: Some lenders impose an annual fee for maintaining the line of credit, which can vary from $5 to $250. This fee is often considered a membership cost for accessing the credit line.

-

Inactivity Fees: If the home equity line of credit remains unused for an extended period, lenders may charge inactivity fees, typically ranging from $5 to $50. Being aware of these potential charges can help you avoid unnecessary expenses.

-

Credit Report Fees: It’s also important to consider the costs for checking a credit report, which can range from $30 to $50. This fee is essential for the loan approval process and may influence the interest rate offered.

By comprehensively understanding these costs, you can better prepare for the financial implications of how home equity lines of credit work. We’re here to support you every step of the way as you make informed decisions that align with your home upgrade goals.

Conclusion

Home Equity Lines of Credit (HELOCs) offer a valuable financial resource for homeowners eager to improve their properties and manage their finances wisely. By enabling individuals to borrow against their home equity, HELOCs bring flexibility and accessibility for various needs, from home renovations to debt consolidation. We understand that navigating these options can be daunting, but grasping how HELOCs work is essential for making decisions that align with your financial aspirations.

In this guide, we have explored the key aspects of HELOCs, including their operational phases, qualification requirements, common uses, and associated costs. We encourage homeowners to consider the advantages of a HELOC for family improvements, as it not only enhances living spaces but can also boost property value. By being aware of the financial implications and the importance of strategic planning, you can approach the complexities of HELOCs with confidence.

Ultimately, utilizing a HELOC can unlock a world of possibilities, whether it’s funding a dream renovation, consolidating debt, or preparing for unexpected expenses. As you weigh your options, staying informed about the mechanics and potential risks of HELOCs is crucial. We know how challenging this can be, but embracing this knowledge can lead to smarter financial choices that improve your living conditions and optimize your home investments. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A Home Equity Line of Credit (HELOC) is a flexible, revolving credit line that allows property owners to borrow against the equity in their homes, which is the difference between the property’s current market value and the outstanding mortgage balance.

How does a HELOC work?

A HELOC is structured in two main phases: the draw period and the repayment period. During the draw period, which lasts between 5 to 10 years, borrowers can withdraw funds as needed and only pay interest on the amount borrowed. After this period, the repayment phase begins, typically lasting 20 years, where borrowers must repay both the principal and interest.

What are the key features of HELOCs?

Key features of HELOCs include variable interest rates that are generally lower than credit card rates, the ability to access only the funds needed, and convenient access through checks or a credit card linked to the account.

What should homeowners consider when using a HELOC for property improvements?

Homeowners should consider that using a HELOC for property improvements can potentially increase their home’s market value. It is also important to be aware of the transition from the draw period to the repayment phase, as this can lead to higher monthly payments.

What is ‘repayment shock’ in relation to HELOCs?

‘Repayment shock’ refers to the financial strain that can occur when homeowners transition from the draw period, where they only pay interest, to the repayment phase, where they must pay both principal and interest, often resulting in significantly higher monthly payments.

Are there any recent trends in HELOC repayment structures?

Yes, many lenders are now offering longer draw periods of up to 20 years, providing property owners with extended access to funds for better financial planning.

How can homeowners manage the transition from the draw period to the repayment phase?

Homeowners can manage this transition by making additional payments toward the principal during the draw period to reduce the total amount owed when the repayment phase starts. Seeking guidance from a mortgage expert can also provide personalized advice.