Overview

Home Equity Lines of Credit, or HELOCs, offer a flexible way for homeowners to tap into their home’s equity as needed. This revolving line of credit can be a lifeline for expenses like home improvements or debt consolidation. We understand how important it is to have options when managing finances, especially during challenging times.

In this article, we will explore:

- How HELOCs work

- The application process

- Eligibility requirements

- The pros and cons

It’s crucial to recognize both the benefits and the risks involved, as making informed decisions can empower you on your financial journey.

By the end, we hope you’ll feel more equipped to consider whether a HELOC is the right choice for you and your family. We’re here to support you every step of the way, guiding you through the process with care and understanding.

Introduction

Navigating the financial landscape can feel overwhelming, especially for homeowners in search of flexible funding solutions. We understand how challenging this can be. A Home Equity Line of Credit (HELOC) emerges as a versatile option, enabling individuals to access their home’s equity for various needs—from renovations to unexpected expenses. Yet, the complexities of how HELOCs operate can lead to confusion and uncertainty.

What are the key steps to effectively leveraging this financial tool?

How can homeowners ensure they are making informed decisions?

We’re here to support you every step of the way.

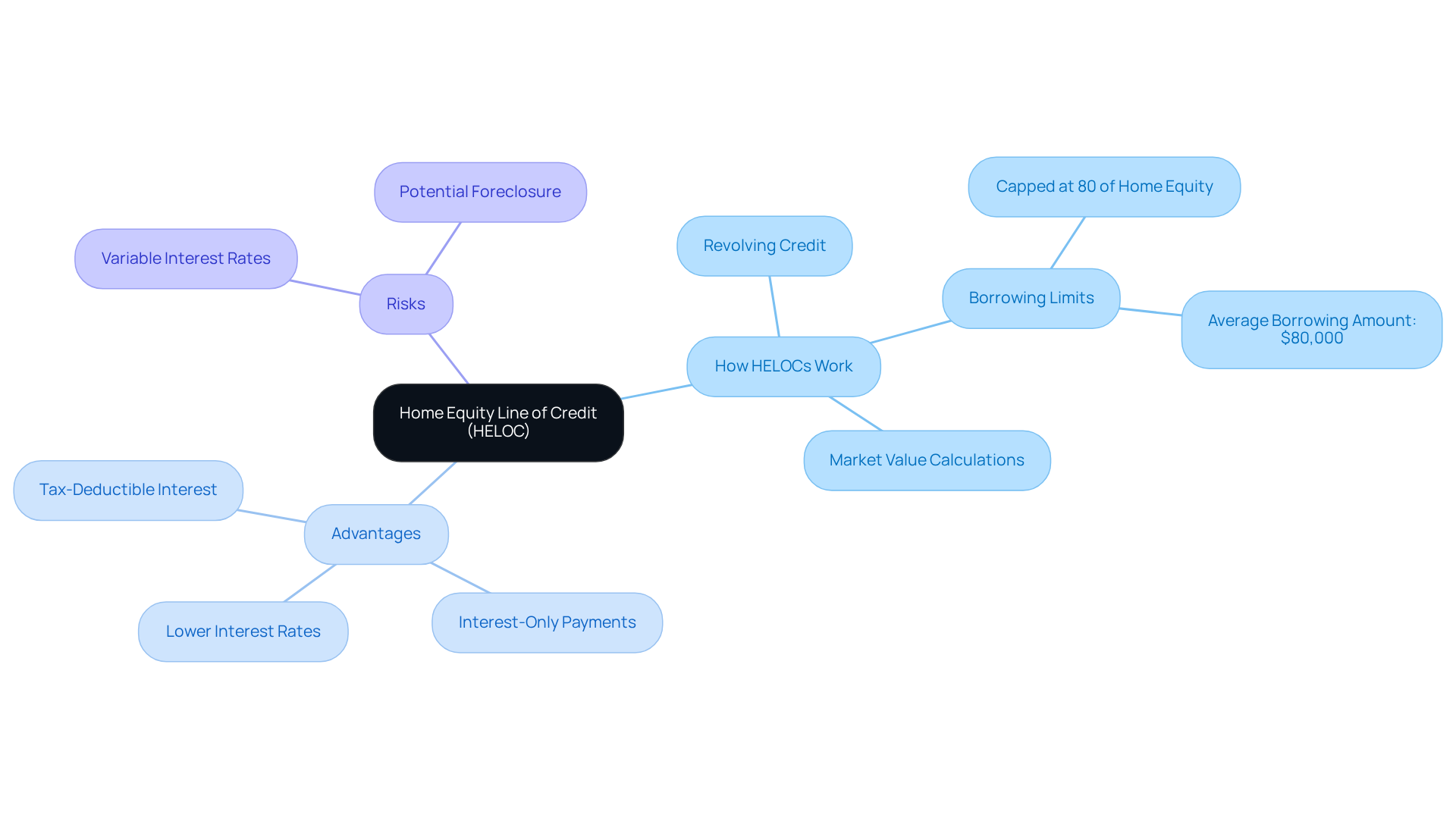

Define HELOC: Understanding Home Equity Lines of Credit

A Home Value Line of Credit, or HELOC, is a revolving line of credit, which illustrates how do HELOCs work, as it is backed by the value in your home. We understand how challenging it can be to manage finances, and unlike conventional loans that offer a one-time amount, a HELOC illustrates how do HELOCs work by allowing homeowners to borrow against their property’s value as needed, up to a set limit. This flexibility can be a lifeline for financing home improvements, consolidating debt, or addressing unexpected expenses.

Typically, the borrowing limit is determined by the difference between your home’s current market value and your outstanding mortgage balance. Most lenders cap borrowing at 80% of total assets, which provides a safety net while allowing you to access funds. In 2025, homeowners are borrowing an average of $80,000 through HELOCs, prompting interest in how do HELOCs work as a supportive financial tool.

The advantages of HELOCs are significant. They often come with lower interest rates compared to unsecured loans, offer interest-only payment options during the draw period, and may even provide tax-deductible interest when used for home improvements. However, it’s important to manage your borrowing wisely. We know that variable interest rates can be daunting, and it’s essential to be aware of the risks, including potential foreclosure. Remember, we’re here to support you every step of the way as you navigate these financial decisions.

Explain How HELOCs Work: Mechanics and Processes

Homeowners often face the challenge of managing finances, and a Home Equity Line of Credit (HELOC) can be a helpful solution. Much like credit cards, HELOCs provide a revolving line of financing based on your home equity, allowing for flexibility in cash flow. Understanding how HELOCs work is crucial for making informed decisions about responsibly utilizing your property.

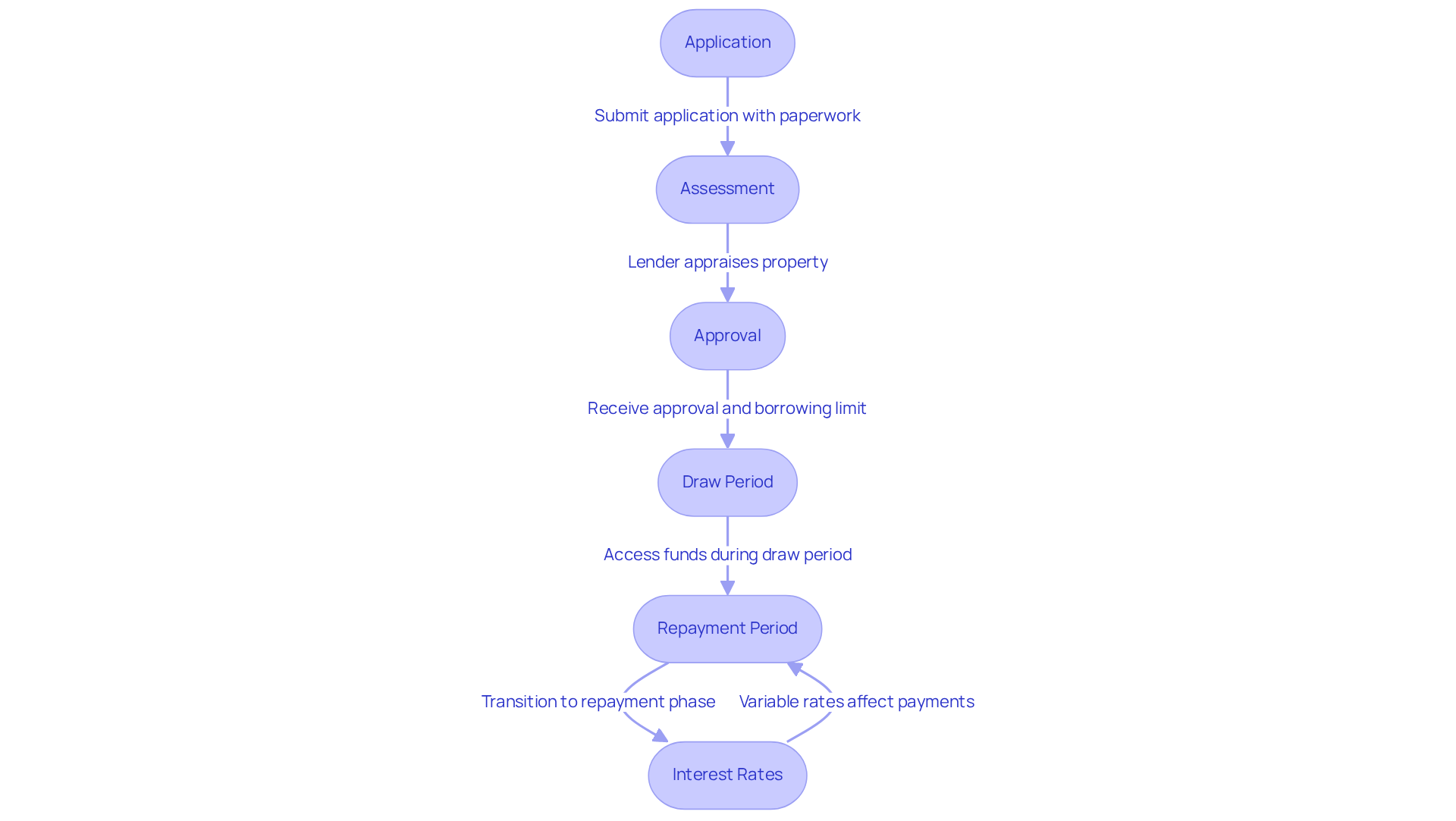

Application: To begin, homeowners initiate the process by applying for a HELOC with a lender. This step involves providing necessary paperwork, including income verification and financial history, which can feel overwhelming.

Assessment: Next, the lender will request a property appraisal to determine the current market value of your home. This assessment reveals how much equity you possess and influences your borrowing rates, so it’s important to be aware of this process.

Approval: After the appraisal, the lender examines your application and evaluates the property’s value. They will then set a borrowing limit based on your financial profile and the available equity. This step is crucial, as it shapes your financial options moving forward.

Draw Period: Once approved, you can access funds during a designated draw period, typically lasting between 5 to 10 years. During this time, many homeowners make interest-only payments on the borrowed amount, providing some breathing room in their budget.

Repayment Period: However, after the draw period concludes, you will transition into the repayment phase, where you must pay back both the principal and interest. This shift can lead to significantly higher monthly payments, so careful financial planning is essential.

Interest Rates: It’s also important to note that most HELOCs feature variable interest rates. These rates can fluctuate based on market conditions, potentially impacting your monthly payments and overall financial stability.

As Tim Maxwell wisely notes, “A home equity line of credit is a valuable option if you need to access money for large or unexpected expenses.” We know how challenging this can be, and it’s vital to be aware of the risks associated with HELOCs, including the potential for foreclosure if payments are not made. Therefore, reviewing all loan disclosures carefully is advisable to fully understand the terms and conditions of your home equity line of credit. Remember, we’re here to support you every step of the way.

Outline HELOC Eligibility: Requirements and Qualifications

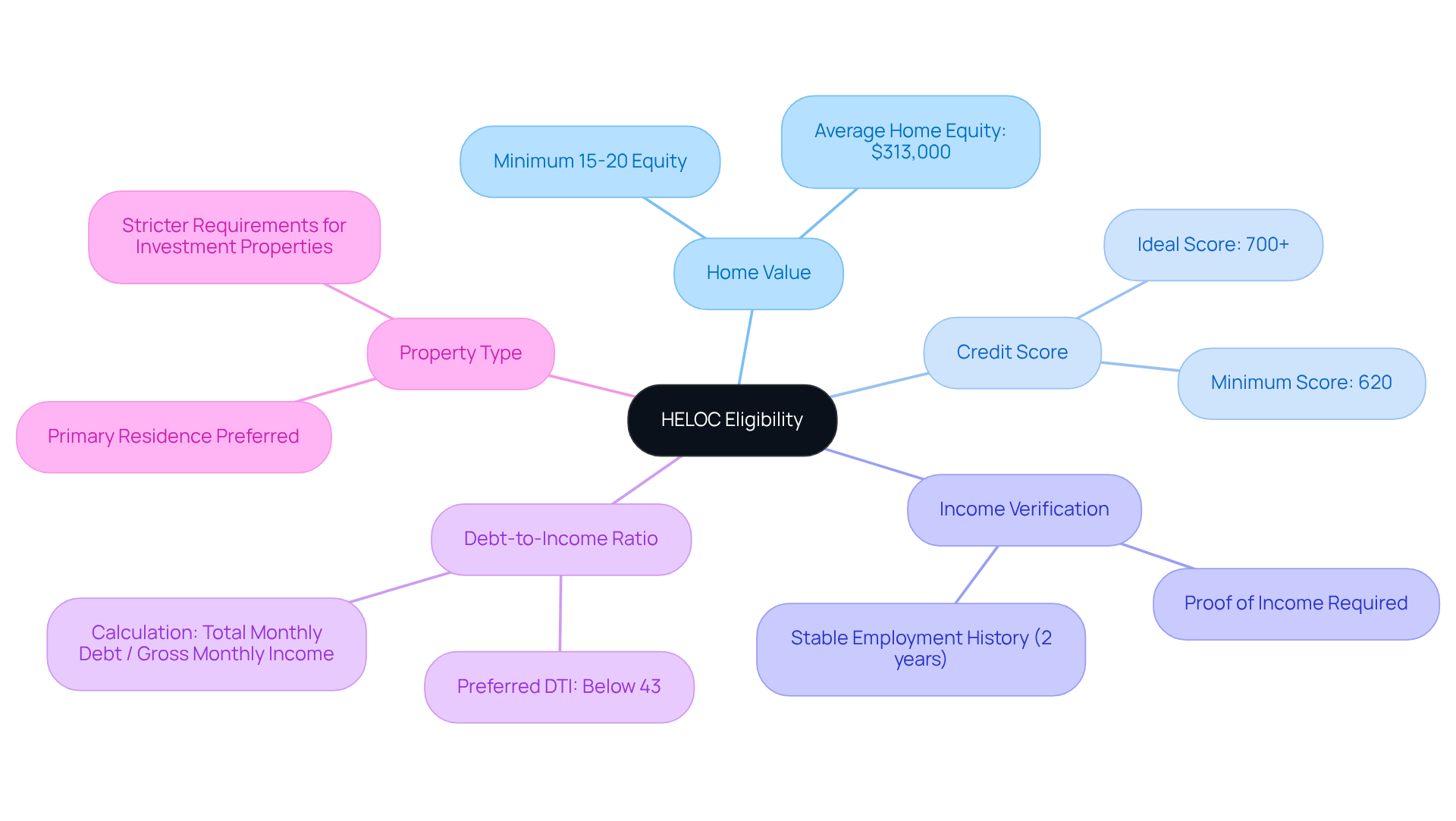

If you’re considering a Home Equity Line of Credit (HELOC), it’s important to understand how do HELOCs work and the key criteria that can help you qualify. We know how challenging this can be, but with the right preparation, you can navigate this process more easily.

-

Home Value: Most lenders look for homeowners to have at least 15-20% ownership in their property. This value is calculated by subtracting any remaining mortgage balance from your home’s current market worth. With the average homeowner holding over $313,000 in equity, many borrowers have a solid foundation for qualification.

-

Credit Score: A solid credit score is essential. Most lenders seek a minimum score of 620, but aiming for 700 or higher can secure you more favorable terms and rates. Remember, higher credit scores can significantly enhance your approval odds and lead to better interest rates.

-

Income Verification: Lenders will require proof of income to ensure you can manage the payments. This typically includes documentation such as pay stubs, tax returns, or bank statements. A stable income history, often requiring at least two years of steady employment, is essential for approval.

-

Debt-to-Income Ratio: A lower debt-to-income (DTI) ratio is preferred. Most lenders favor ratios below 43%. This ratio is calculated by dividing your total monthly debt payments by your gross monthly income, indicating your ability to manage additional debt.

-

Property Type: The type of property can influence your eligibility. Primary residences are generally viewed more favorably compared to investment properties, which may come with stricter requirements.

Grasping these criteria can empower you to prepare efficiently for the credit line application process, which is essential for understanding how do HELOCs work and boosting your likelihood of approval. We’re here to support you every step of the way.

Evaluate Pros and Cons of HELOCs: Weighing Your Options

When considering a home equity line of credit (HELOC), it is essential to understand how do HELOCs work by evaluating both the benefits and drawbacks. Let’s take a closer look at how do HELOCs work and what this option can mean for you and your family.

Pros:

- Flexibility: One of the greatest advantages of a HELOC is the flexibility it offers. You can access funds as needed, making it ideal for ongoing expenses like home renovations, which can truly enhance your living space.

- Interest Rates: Typically, HELOCs come with lower interest rates compared to credit cards or personal loans. This can make it a more cost-effective borrowing option, allowing you to manage your finances better.

- Tax Advantages: If you utilize the funds for renovations, the interest paid on a home equity line of credit may be tax-deductible. However, it’s always wise to consult a tax advisor to understand how this applies to your situation.

Cons:

- Variable Interest Rates: It’s essential to be aware that HELOCs often have variable interest rates. If rates rise, your payments could increase, leading to potential financial strain. We understand how concerning this can be.

- Risk of Foreclosure: Since a HELOC is secured by your property, failure to repay could result in losing your home. This is a significant risk that requires careful consideration.

- Fees and Closing Costs: Some lenders may impose charges for establishing a home equity line of credit, which can increase the total expense. It’s crucial to factor these costs into your decision-making process.

By weighing these pros and cons, you can make a more informed choice about how do HELOCs work in a way that aligns with your family’s needs. We’re here to support you every step of the way in navigating this important financial decision.

Guide to Applying for a HELOC: Step-by-Step Process

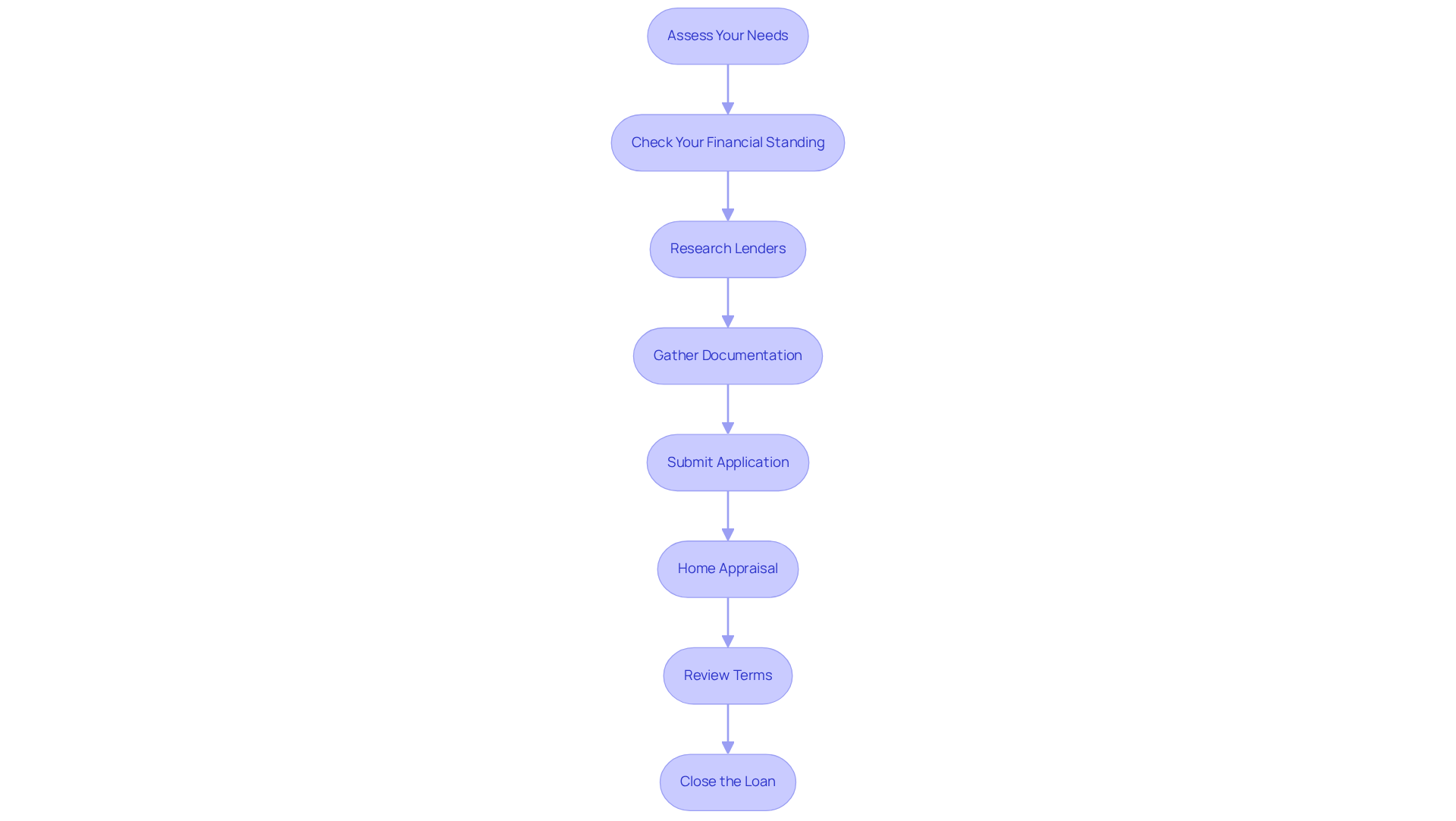

Applying for a Home Equity Line of Credit (HELOC) can feel overwhelming, but we’re here to support you in learning how do helocs work every step of the way. Let’s break down the essential steps to ensure a smooth process:

- Assess Your Needs: Start by clearly defining how much you need to borrow and the purpose behind it, whether it’s for home improvements, debt consolidation, or other expenses. We know how challenging it can be to navigate these decisions.

- Check Your Financial Standing: Take a moment to review your credit report and score. Confirm that you meet lender requirements. A strong credit profile can significantly enhance your chances of securing better rates, giving you peace of mind.

- Research Lenders: Don’t hesitate to compare various lenders to find the most competitive rates and terms. Shopping around is crucial, as rates can vary significantly. This step empowers you to make the best choice for your situation.

- Gather Documentation: Prepare the necessary documents, including proof of income, tax returns, and information about your residence. This preparation will help streamline the application process, making it less stressful.

- Submit Application: Complete the application with your chosen lender, ensuring all required information is accurate and complete. Taking this step is a major milestone!

- Home Appraisal: Be ready for a home appraisal, which the lender may require to assess your home’s current value. This is a standard part of the process and can provide valuable insights.

- Review Terms: Once approved, carefully examine the terms of the home equity line of credit. Pay close attention to interest rates, repayment options, and any related fees. Understanding how do helocs work is vital for your financial planning.

- Close the Loan: Finally, sign the necessary documents to complete the home equity line of credit. This allows you to draw funds as needed, giving you flexibility and control over your finances.

In 2025, common fees associated with HELOCs may include application fees, appraisal fees, and potential annual fees. Understanding these costs upfront is essential for effective budgeting. As Timothy Manni, a mortgage consultant, emphasizes, having a strong financial profile and addressing any inaccuracies in your credit report can significantly enhance your chances of securing favorable terms. With the right preparation, homeowners can navigate the HELOC application process confidently and effectively.

Conclusion

A Home Equity Line of Credit (HELOC) offers homeowners a flexible financial tool that leverages the equity in their property. We understand how important it is for you to make informed decisions about accessing funds for various needs, from home improvements to unexpected expenses. This guide has illuminated the mechanics of HELOCs, emphasizing the importance of responsible borrowing and awareness of potential risks.

Throughout the article, we’ve explored key aspects of HELOCs, including the application process, eligibility requirements, and the advantages and disadvantages of this financial option. You’ve learned about the steps involved in securing a HELOC, from assessing your personal financial standing to navigating the approval process. Additionally, our discussion on interest rates and repayment periods highlighted the need for diligent financial planning to avoid pitfalls.

Ultimately, understanding how HELOCs function empowers you to utilize your property’s equity wisely. As financial landscapes evolve, being equipped with knowledge about home equity lines of credit can lead to better financial decisions. We encourage you to weigh your options carefully, consult financial advisors, and explore the potential of HELOCs as a means to achieve your financial goals while safeguarding your home investment.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A HELOC is a revolving line of credit backed by the value of your home, allowing homeowners to borrow against their property’s value as needed, up to a set limit.

How does a HELOC work?

Homeowners apply for a HELOC with a lender, who assesses the property’s value through an appraisal. The lender then determines a borrowing limit based on the home’s equity and the homeowner’s financial profile. During the draw period, homeowners can access funds and often make interest-only payments.

What is the typical borrowing limit for a HELOC?

The borrowing limit is typically determined by the difference between the home’s current market value and the outstanding mortgage balance, with most lenders capping borrowing at 80% of total assets.

What are the advantages of using a HELOC?

Advantages include lower interest rates compared to unsecured loans, interest-only payment options during the draw period, and potential tax-deductible interest when used for home improvements.

What is the draw period in a HELOC?

The draw period is a designated time, usually lasting between 5 to 10 years, during which homeowners can access funds and often make interest-only payments.

What happens after the draw period ends?

After the draw period, homeowners enter the repayment phase, where they must pay back both the principal and interest, which can lead to significantly higher monthly payments.

What type of interest rates do HELOCs typically have?

Most HELOCs feature variable interest rates, which can fluctuate based on market conditions and may impact monthly payments.

What risks are associated with HELOCs?

Risks include variable interest rates that can increase payments and the potential for foreclosure if payments are not made. It is essential to review all loan disclosures carefully to understand the terms and conditions.