Overview

Securing home loans for nurses can be a daunting task, but there are specialized programs designed with your needs in mind. Programs like the Nurse Next Door Program and VA loans offer unique benefits, including down payment assistance, to help make homeownership a reality. We know how challenging this can be, and understanding eligibility criteria is crucial to navigating this journey.

As you explore your options, comparing mortgage rates becomes essential. This step not only empowers you but also enhances your chances of obtaining favorable financing. Preparing for the home buying process can feel overwhelming, but we’re here to support you every step of the way. By taking these actionable steps, you can move closer to your dream home.

Introduction

Navigating the world of home loans can feel overwhelming, especially for nurses who balance demanding schedules with their financial dreams. We understand how challenging this can be, but there is good news: specialized loan programs are designed to meet the unique needs of nursing professionals.

These programs offer opportunities for favorable terms and down payment assistance, making homeownership more attainable. Yet, with so many options available, how can you be sure you’re making the best choice for your financial future?

This article will guide you through essential steps for securing home financing tailored specifically for nurses. We’ll highlight key programs, eligibility requirements, and strategies to simplify the mortgage process, ensuring you feel supported every step of the way.

Identify Suitable Loan Programs for Nurses

If you’re a nurse seeking financial support, consider exploring that are specifically designed for your needs. Programs like the following can provide valuable assistance:

Each of these options comes with unique benefits, including and . Evaluating these features can help you find the best fit for your needs.

Additionally, don’t overlook local and state-specific initiatives that may offer even more support. We understand how challenging navigating these options can be, and we’re here to .

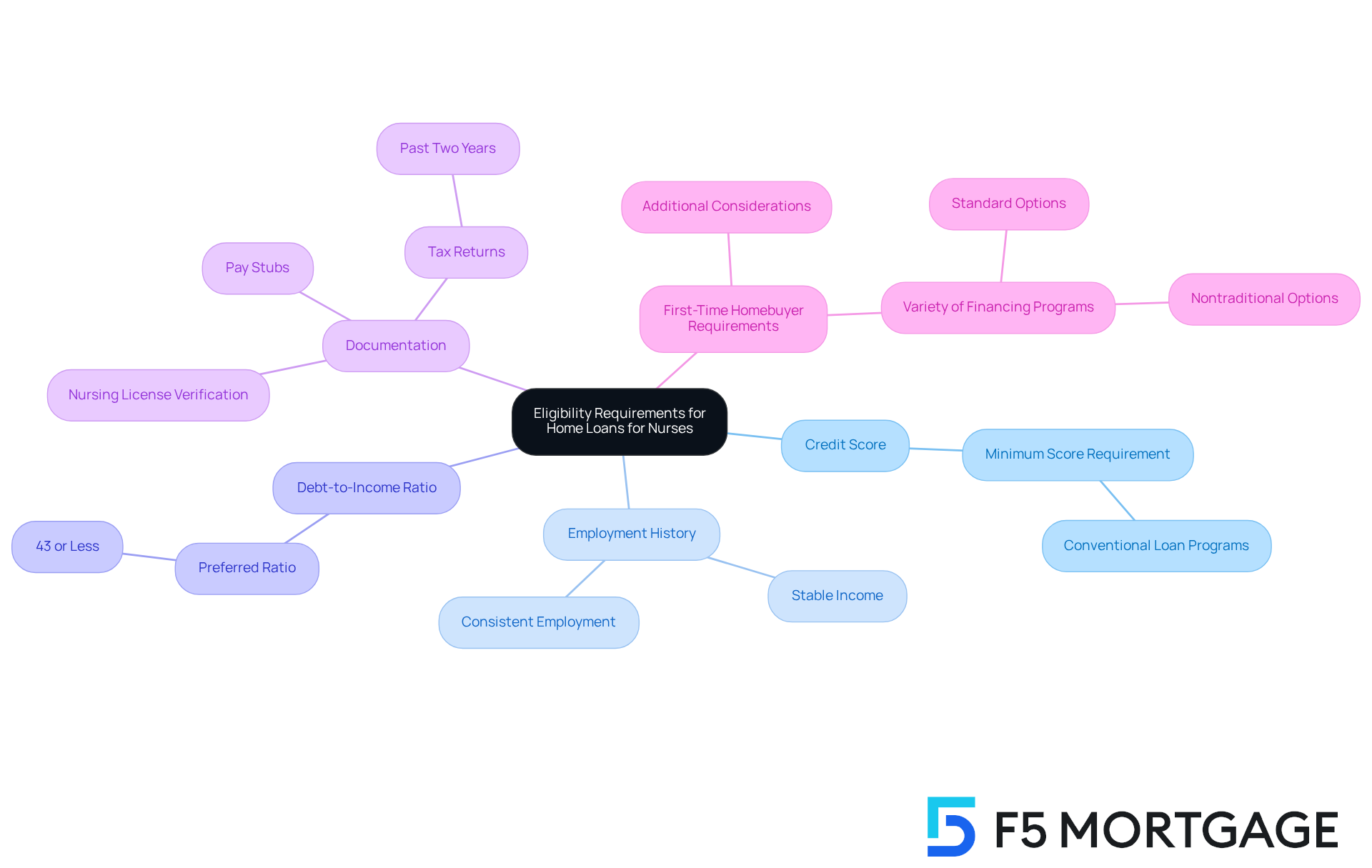

Verify Eligibility Requirements for Nursing Professionals

If you’re a nursing professional looking to secure , we recognize the importance of knowing what you need to qualify. Here are some key criteria to consider:

-

: Generally, a minimum credit score of 620 is needed for conventional loan programs. This score is crucial for determining your eligibility and the terms of your financial assistance.

-

Employment History and Income Verification: A stable income and consistent employment history are vital. Be ready to provide documentation that confirms your income, such as pay stubs and tax returns.

-

: Most lenders prefer a debt-to-income ratio of 43% or less. This ratio helps evaluate your ability to manage monthly expenses alongside your existing debts.

-

: To make the process smoother, ensure you have all required documents ready, including:

- Pay stubs to confirm your income.

- Tax returns for the past two years.

- Verification of your is essential for establishing your professional credentials to qualify for home loans for nurses.

-

: If you’re a first-time homebuyer, there may be additional requirements to consider. At F5 Mortgage, we offer a , including both standard and nontraditional options, to cater to diverse borrower needs. This means that even if one lender says no, you still have alternatives available.

By familiarizing yourself with these eligibility criteria and gathering the necessary documentation, you can significantly enhance your chances of securing a favorable mortgage through F5 Mortgage. Remember, we’re here to support you every step of the way.

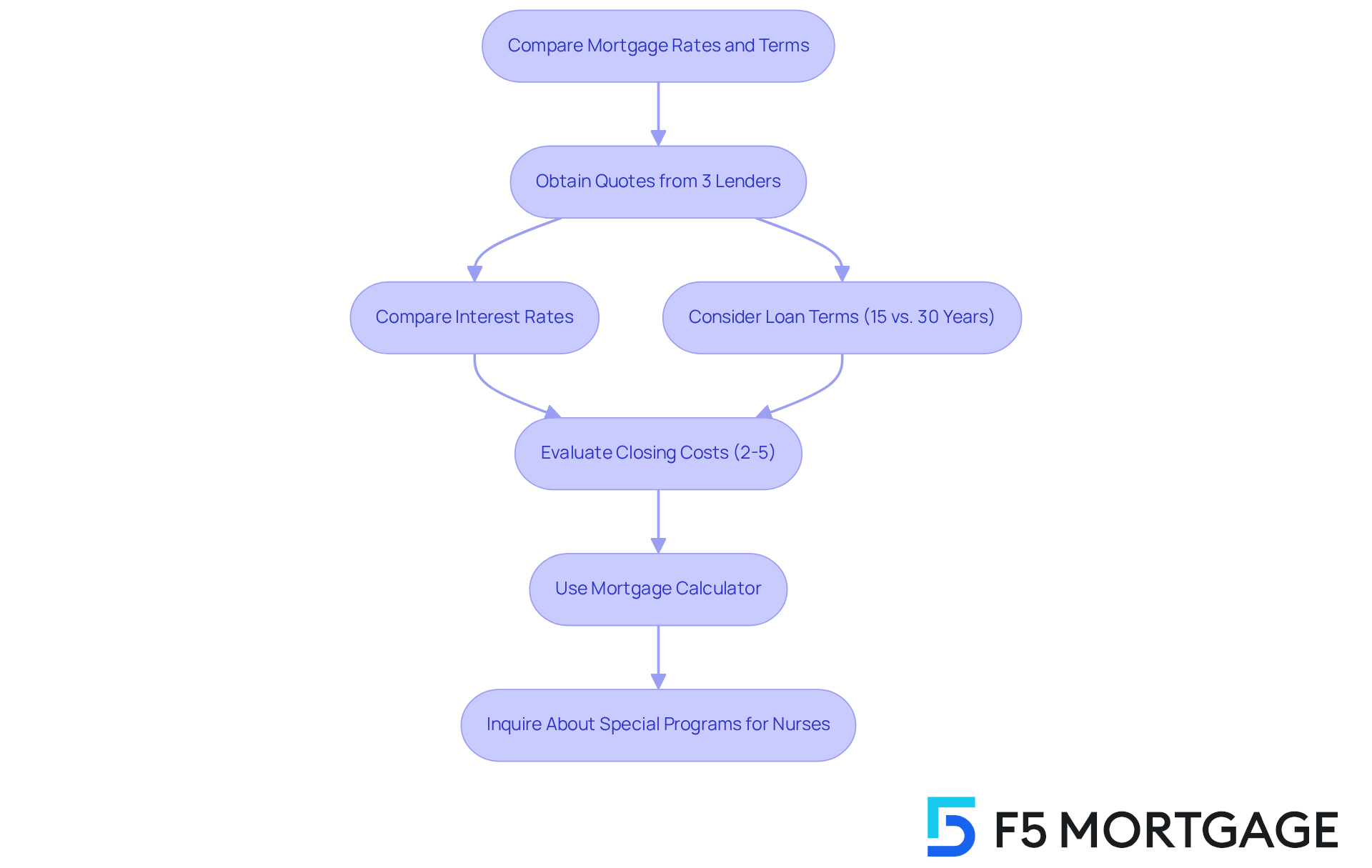

Compare Mortgage Rates and Terms from Multiple Lenders

When navigating the mortgage process, obtaining quotes from at least three different lenders is essential to ensure you’re making the best choice. Start by comparing interest rates. Remember, , so you have access to the .

Next, consider the loan conditions. Whether you choose a can significantly impact your monthly payments and total expenses. It’s important to understand how these varying terms affect your financial situation.

Don’t forget to look into , which typically range from 2% to 5% of the total loan amount in Colorado. For example, refinancing a $500,000 residence could result in as much as $25,000 in closing costs. However, support initiatives may help lessen this burden, making it easier for you.

Using a can be a helpful tool to estimate monthly payments based on different rates and terms. This will assist you in understanding the financial implications of your choices.

Lastly, be sure to ask lenders about any special programs or discounts available for . F5 Mortgage is dedicated to finding the best options tailored to your unique needs. We know how challenging this process can be, and we’re here to .

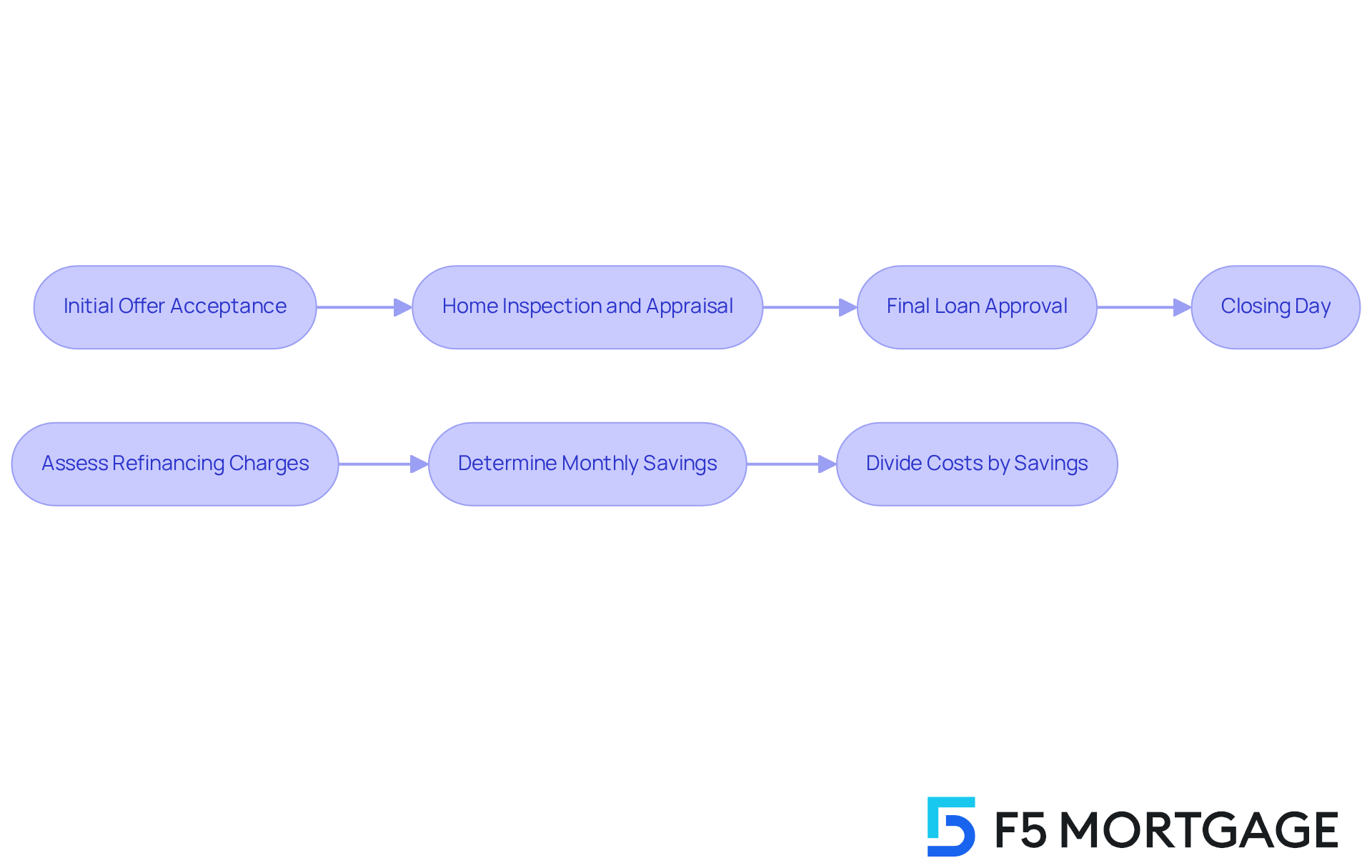

Understand the Closing Process and Timeline

Familiarize yourself with the typical , which can range from 30 to 60 days. This process includes:

- Initial offer acceptance

- Home inspection and appraisal

- Closing day

Preparing for closing can feel overwhelming, but we’re here to support you every step of the way. Start by reviewing all closing documents in advance. Understanding the involved is crucial. These typically include:

- Application fees (between $75 and $500)

- Origination fees (between 0.5% and 1.5% of the loan amount)

- Appraisal fees (usually between $300 and $500)

- Title search and title insurance (between 0.5% and 1% of the loan amount)

- Any potential discount points that may affect your interest rate.

We know how challenging this can be, but will assist you in budgeting efficiently. Also, confirm the final amount needed for closing, including any potential discount points that may influence your interest rate.

To calculate your break-even point, follow these three simple steps:

- Assess , including all closing fees and expenses related to refinancing.

- Determine your monthly savings by deducting your new monthly charge from your existing monthly charge.

- Divide your refinancing costs by your monthly savings to find out how many months it will take to break even.

Lastly, schedule a before closing. This is your opportunity to ensure everything is in order and meets your expectations.

Explore Down Payment Assistance Programs

When exploring options available for nurses, it’s important to consider choices like:

- YourChoice!

- Grant for Grads

- Ohio Heroes

- Nurse Next Door grants

- State-specific aid

- Federal Housing Administration (FHA) assistance

We understand how challenging this can be, and we want to help you find the .

Start by determining your eligibility for these programs and gathering the necessary documentation, such as proof of income, tax returns, and employment verification. This step is crucial in enhancing your likelihood of qualifying. Additionally, calculate how much assistance you may qualify for and how it impacts your overall budget.

Partnering with an like can provide valuable guidance throughout the . We’re here to support you every step of the way, ensuring you have all the to confidently submit your application and secure the help you need.

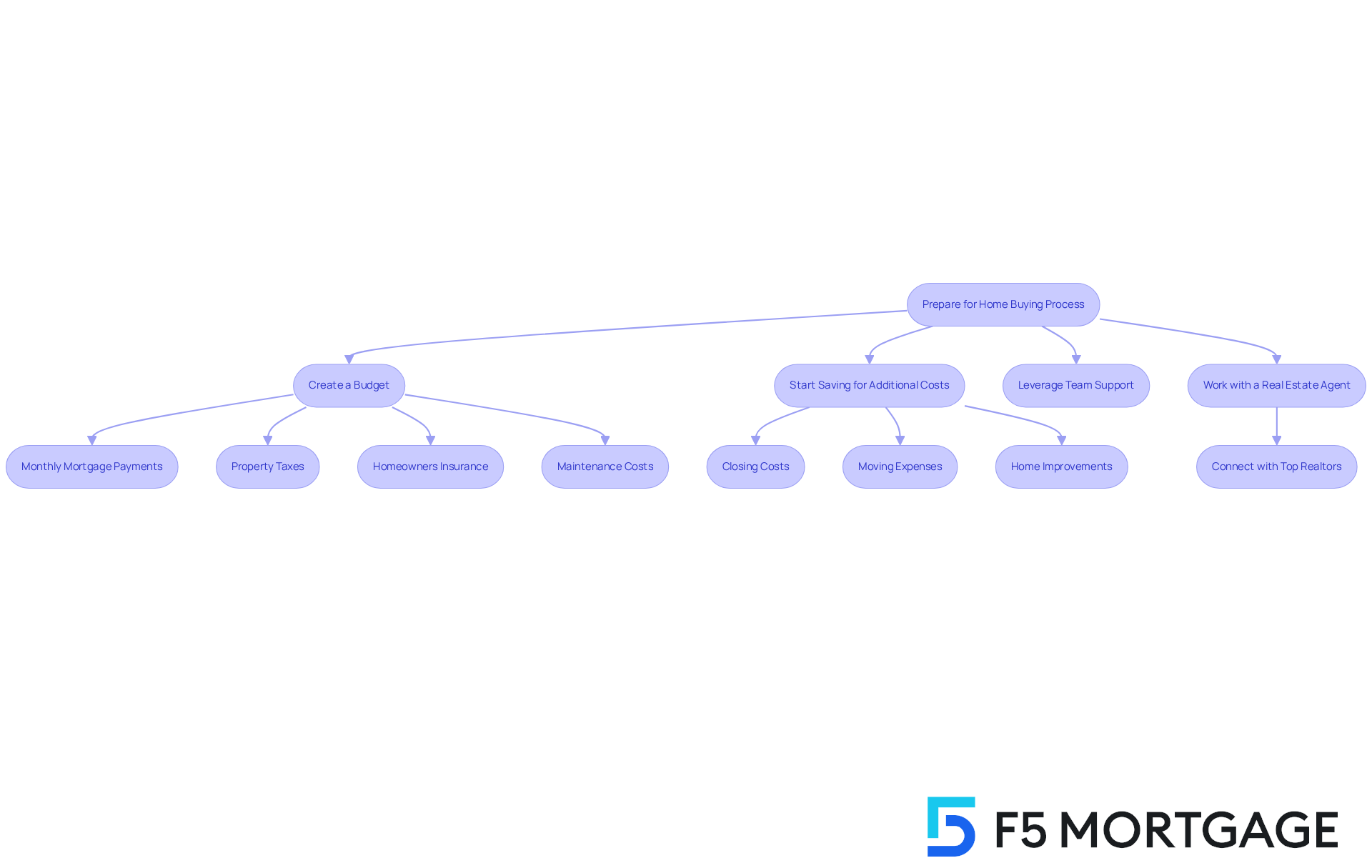

Prepare for the Home Buying Process

To effectively prepare for the , we know how important it is to consider the following steps:

-

Create a budget that includes:

- Monthly mortgage payments

- Property taxes

- Homeowners insurance

- Maintenance costs

-

Start saving for additional costs, such as:

- Closing costs

- Moving expenses

- Home improvements

-

Leverage the . Your loan officer and Account Manager will work alongside you and your realtor, helping you find your and secure your offer. This teamwork is essential in navigating the home buying process efficiently.

-

Consider working with a real estate agent who understands the , particularly regarding . F5 Mortgage can connect you with top realtors in your area, ensuring you have the . We’re here to support you every step of the way.

Conclusion

Navigating the world of home loans can feel overwhelming for nurses, but there are financing options specifically designed to make this journey easier. It’s essential to understand the loan programs available for nursing professionals, like the Nurse Next Door Program and various down payment assistance initiatives. By leveraging these resources, nurses can discover financial solutions that truly fit their unique situations, ultimately making homeownership more attainable.

Key aspects of the home loan process include:

- Verifying eligibility requirements

- Comparing mortgage rates from multiple lenders

- Understanding the closing process

We know how challenging this can be, so it’s vital to stay informed about:

- Credit score necessities

- Income documentation

- Debt-to-income ratios

These factors can enhance your chances of approval. Additionally, comparing offers from different lenders can help uncover the best mortgage rates and terms, ensuring your financial commitment aligns with your long-term goals.

Ultimately, the journey to homeownership for nurses is not just about securing financing; it’s about empowering you to take the necessary steps toward stability and investing in your future. By utilizing available resources and support from experienced lenders like F5 Mortgage, you can confidently navigate the complexities of home loans. The time to explore these options is now—take that first step towards making your dream of homeownership a reality.

Frequently Asked Questions

What loan programs are available for nurses seeking financial support?

Nurses can explore several loan programs, including the Nurse Next Door Program, home loans specifically for nurses, VA loans for eligible veterans, and conventional loans with favorable terms.

What benefits do these loan programs offer?

These loan programs may provide valuable benefits such as down payment assistance and competitive interest rates, helping nurses find the best fit for their financial needs.

Are there local or state-specific initiatives available for nurses?

Yes, there may be local and state-specific initiatives that offer additional support for nurses seeking financial assistance.

What are the minimum credit score requirements for securing home loans for nurses?

Generally, a minimum credit score of 620 is needed for conventional loan programs, which is important for determining eligibility and loan terms.

What documentation is needed to verify employment history and income?

Nurses should be prepared to provide documentation such as pay stubs and tax returns to confirm stable income and consistent employment history.

What is the preferred debt-to-income ratio for lenders?

Most lenders prefer a debt-to-income ratio of 43% or less to evaluate a borrower’s ability to manage monthly expenses alongside existing debts.

What specific documentation should nurses gather before applying for a loan?

Nurses should gather necessary documents including pay stubs, tax returns for the past two years, and verification of their nursing license.

Are there additional requirements for first-time homebuyers?

Yes, first-time homebuyers may face additional requirements, but there are a variety of financing programs available, including standard and nontraditional options.

How can understanding eligibility criteria improve chances of securing a mortgage?

Familiarizing yourself with eligibility criteria and gathering the necessary documentation can significantly enhance your chances of securing a favorable mortgage.