Overview

Understanding your financial options is essential, especially when it comes to your home. The key differences between a Home Equity Line of Credit (HELOC) and a home equity loan can significantly impact your choices. HELOCs provide flexibility with variable interest rates, perfect for ongoing expenses. In contrast, home equity loans offer a lump sum with fixed payments, ideal for larger, immediate needs.

We know how challenging these decisions can be. HELOCs are designed for those who may need access to funds over time, allowing you to borrow as needed. On the other hand, home equity loans can be a great solution for significant one-time expenses. This empowers you to choose the option that best aligns with your financial situation and goals.

Ultimately, we’re here to support you every step of the way. By understanding the differences between these two options, you can make informed decisions that suit your family’s needs.

Introduction

Understanding the nuances of home equity can truly empower homeowners to make informed financial decisions. We know how challenging it can be to navigate the world of borrowing, especially as property values fluctuate and options evolve. The choice between a Home Equity Line of Credit (HELOC) and a home equity loan is significant, and it’s natural to wonder which option provides the best balance of flexibility and security. This article delves into the key differences, benefits, and potential pitfalls of each choice, guiding you through the complexities of leveraging your property for financial gain. We’re here to support you every step of the way.

Understanding Home Equity: The Foundation of Borrowing Options

Understanding the value of your property is essential. It is determined by the current market worth of your home, minus any remaining mortgage amounts. This value can be a powerful tool for obtaining additional financing, which is crucial for homeowners like you who are exploring borrowing options.

We recognize that many families plan to stay in their homes for at least five years. This timeframe can significantly impact your asset accumulation and overall investment return. By grasping the concept of property equity, you can better understand how it affects what you can borrow through Home Equity Lines of Credit (HELOCs) and the comparison of [HELOC vs home equity loan](https://f5mortgage.com/?p=10282).

It’s important to note that many lenders require homeowners to maintain at least an 80% value-to-price ratio. This means you should have paid down at least 20% of your initial mortgage, or your property must have appreciated in value. Additionally, a maximum debt-to-income (DTI) ratio of 43% is typically necessary for housing loans, which can influence your mortgage rates.

Accessing can serve various purposes, such as:

- Funding renovations

- Merging debts

- Covering significant expenses

This flexibility makes it a valuable financial resource for your family’s needs. We’re here to support you every step of the way as you navigate these options.

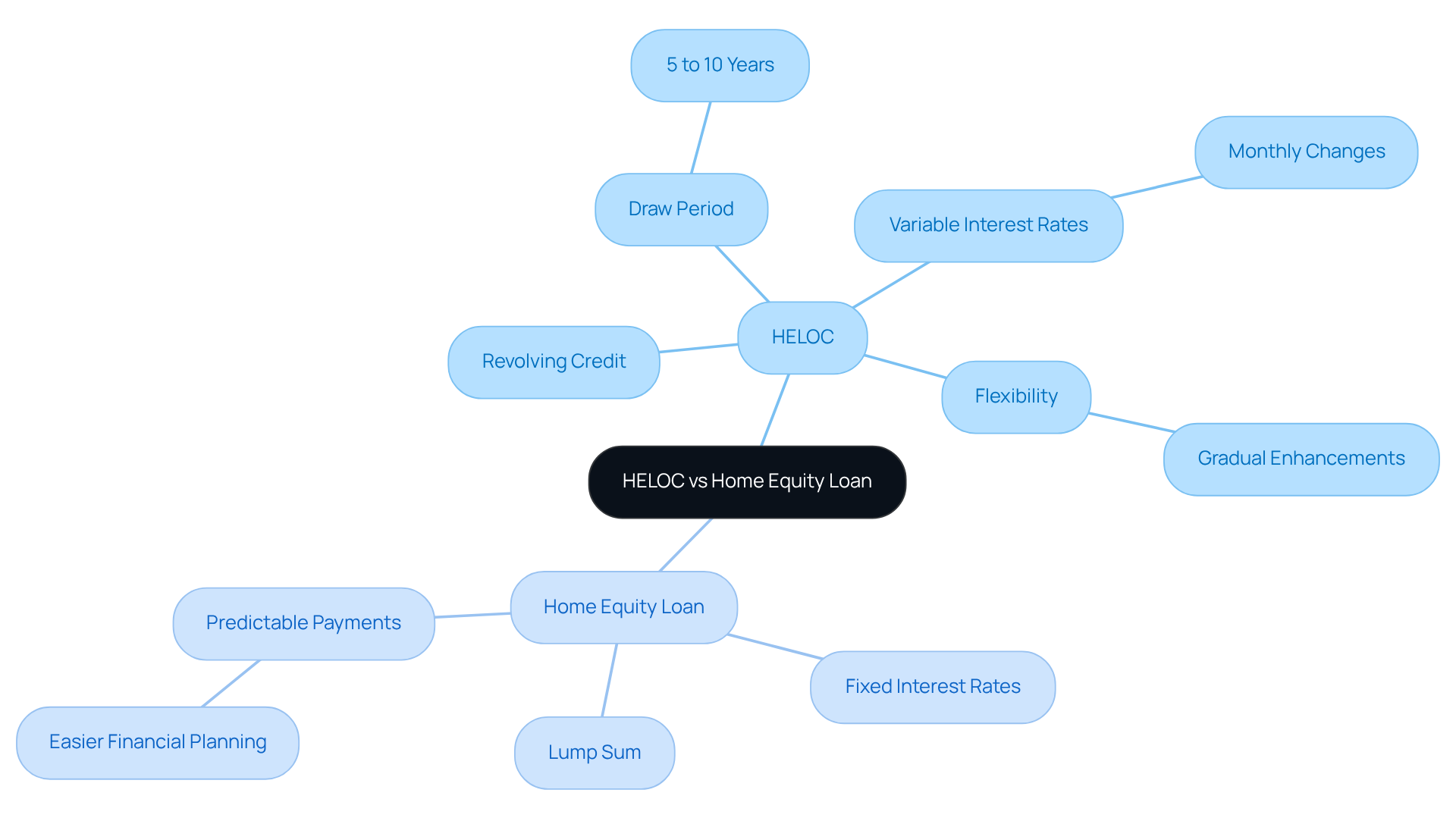

Defining HELOC and Home Equity Loans: Key Features and Structures

A Property Value Line of Credit (HELOC) functions like a revolving credit line, offering homeowners the flexibility to borrow against their property value as needed, much like a credit card. During a specified draw period, typically lasting between 5 to 10 years, borrowers can access funds up to a predetermined limit. After this period, they transition into a repayment phase. However, it’s important to note that HELOC interest rates are variable, which can lead to changing monthly payments. This variability may complicate financial planning for some homeowners, and we know how challenging this can be.

On the other hand, property value borrowing provides a lump sum based on the owner’s stake, which is repaid over a set term at a fixed interest rate. This structure allows for predictable monthly payments, making financial planning easier. While both options leverage residential value as collateral, the differences in repayment frameworks and flexibility in the discussion of HELOC vs home equity loan offer unique benefits for borrowers to consider.

As we look ahead to 2025, the typical initial percentage for second lien HELOCs has fallen below 7.5%. Meanwhile, have shown slight variations, decreasing from 8.98% in January to 8.41% by the end of the year. This trend suggests a potential shift in borrowing costs, emphasizing the need for homeowners to evaluate their options carefully. Mortgage professionals indicate that HELOCs may become more attractive if interest rates continue to decline, especially in light of anticipated Federal Reserve actions.

Real-life examples highlight the practical applications of these products: property owners might opt for a HELOC to fund gradual property enhancements, enjoying the flexibility in withdrawals. Conversely, a property value loan could be preferred for immediate, larger expenses, such as significant renovations or debt consolidation. Understanding the differences in HELOC vs home equity loan is crucial for homeowners who want to make informed financial decisions regarding their home equity. We’re here to support you every step of the way as you navigate these options.

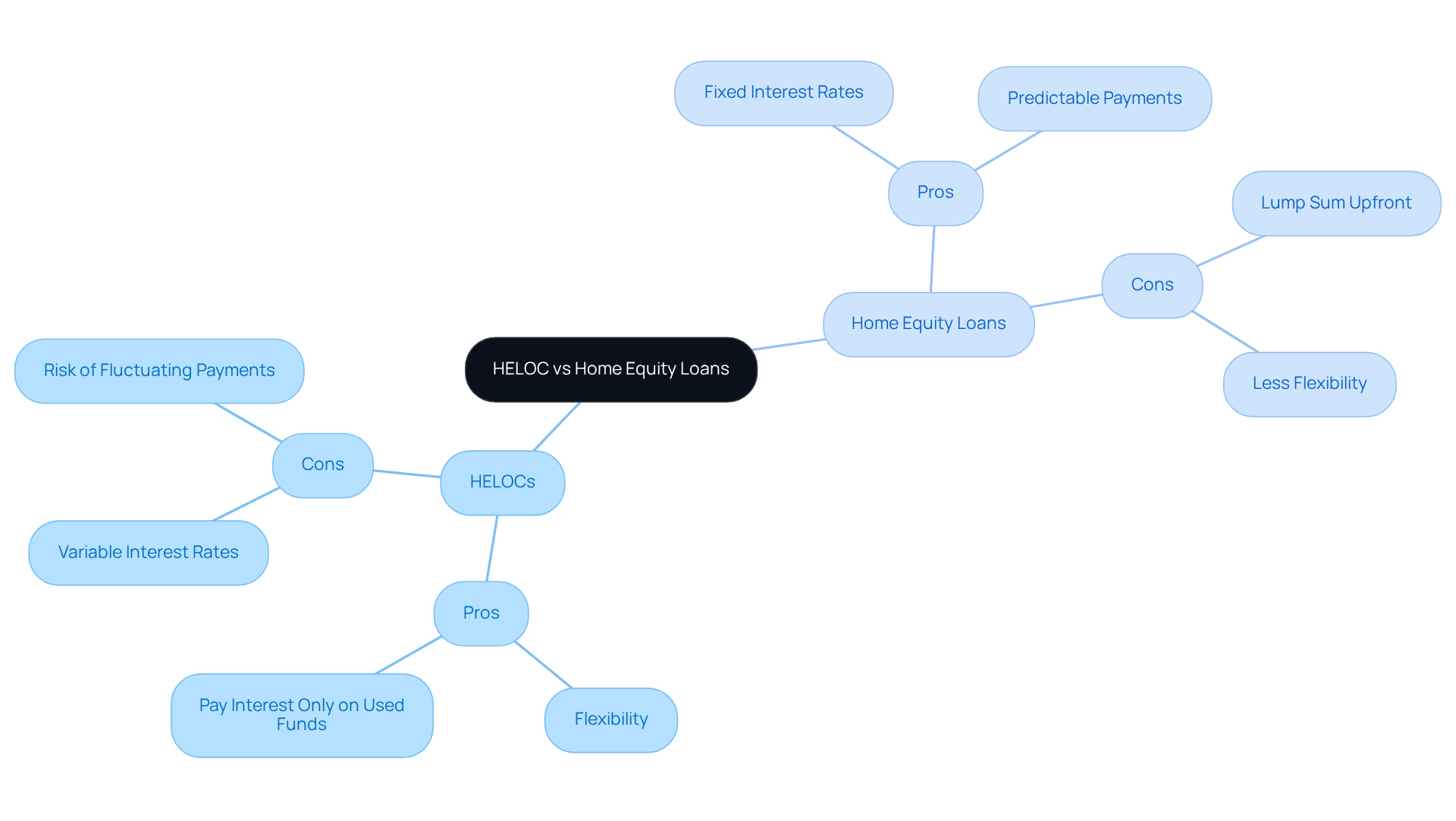

Comparing Pros and Cons: Evaluating HELOCs vs. Home Equity Loans

When considering HELOCs, it’s important to recognize their significant advantage: flexibility. Borrowers can withdraw funds as needed, incurring interest only on the amount utilized. This feature is particularly beneficial for ongoing projects or unexpected expenses, providing a sense of security. However, we understand that the variable interest rates associated with HELOCs can lead to unpredictable payments, which can be concerning if rates increase. As of January 6, 2025, the average HELOC interest rate is around 8.36%. This is notably lower than credit card charges, averaging 20.15%, and personal borrowing costs at 12.65%. Yet, homeowners must remain vigilant regarding that could affect their financial plans.

On the other hand, residential asset financing offers the peace of mind that comes with fixed interest terms and predictable monthly installments. This consistency can make budgeting easier for families. As of January 6, 2025, the average rate for residential value credit is around 8.41%. For those who appreciate a steady payment structure, this predictability can be a relief. However, it’s worth noting that property value loans require borrowers to take a lump sum upfront, which may not align with the needs of individuals who prefer to access funds gradually.

Both financing options come with the risk of foreclosure if payments are missed, as they are secured by the property. In 2025, the default percentages for HELOCs are expected to be somewhat higher than those for property value credits, highlighting the risks associated with fluctuating interest rates. Financial consultants emphasize the importance of having a clear repayment plan when utilizing HELOCs, especially in a changing interest environment. As Linda Bell, a certified HELOC specialist, insightfully notes, ‘With typical property value borrowing and credit line rates in the 8 percent range currently, that’s near the threshold that separates lower- and higher-cost debt.’ Ultimately, the decision regarding HELOC vs home equity loan should reflect your personal financial situation and risk tolerance. We’re here to support you every step of the way in making the best decision for your family’s future.

Choosing the Right Option: Use Cases and Suitability for Homeowners

Lines of credit, specifically HELOCs, are particularly advantageous for property owners who foresee the need for funds over time—whether for ongoing renovations or educational expenses. Their inherent flexibility allows you to borrow as needed, making them ideal for those with changing financial requirements. In 2025, approximately 25% of property owners are considering HELOCs, reflecting a growing trend toward utilizing residential value for gradual financial needs. Additionally, the average monthly payment required to withdraw $50,000 via a HELOC has decreased from $412 in early 2024 to $311 by the end of Q1 2025. This shift illustrates the evolving cost dynamics of this option.

On the other hand, property-backed financing options may be more suitable for individuals who require a significant amount upfront for specific goals, such as consolidating high-interest debt or making major purchases. Property owners can borrow as much as 80% of their home’s worth, provided they have at least 20% equity. With a fixed repayment structure, these financial products offer stability, appealing to homeowners who prefer predictable financial commitments. Financial advisors often recommend property-backed borrowing for singular expenses, as it allows homeowners to access a substantial sum initially, which can be especially beneficial for merging various high-interest debts and potentially reducing overall interest costs.

Ultimately, the decision regarding should be guided by your personal financial goals, risk tolerance, and intended use of the funds. For example, if you’re looking to consolidate debt, home equity loans may prove particularly advantageous, as they can provide a lump sum to pay off multiple high-interest obligations. As you navigate these options, we know how challenging this can be, and understanding your unique financial situation will be crucial in making the right choice. We’re here to support you every step of the way.

Conclusion

Understanding the differences between a Home Equity Line of Credit (HELOC) and a home equity loan is crucial for homeowners looking to leverage their property value for financial needs. Each option presents unique advantages and structures that cater to different borrowing scenarios. By recognizing these distinctions, homeowners can make informed choices that align with their financial goals and circumstances.

The article highlights the fundamental differences between HELOCs and home equity loans, focusing on their structures, benefits, and drawbacks. HELOCs offer flexibility with revolving credit, making them suitable for ongoing expenses. In contrast, home equity loans provide a lump sum with fixed repayment terms, ideal for larger, immediate financial needs. Additionally, the current trends in interest rates and borrowing costs underscore the importance of evaluating these options based on personal financial situations and market conditions.

Ultimately, the decision between a HELOC and a home equity loan should reflect individual financial goals, risk tolerance, and specific funding requirements. We know how challenging this can be, and homeowners are encouraged to assess their unique circumstances. Consulting financial professionals can help navigate these options effectively. By understanding the nuances of each borrowing method, homeowners can maximize their home equity and secure a stable financial future. We’re here to support you every step of the way.

Frequently Asked Questions

What is home equity?

Home equity is the current market worth of your home minus any remaining mortgage amounts. It represents the value you have built up in your property.

Why is understanding home equity important for homeowners?

Understanding home equity is crucial as it can be a powerful tool for obtaining additional financing, which is important for exploring borrowing options.

How long do many families plan to stay in their homes, and why does this matter?

Many families plan to stay in their homes for at least five years, which can significantly impact asset accumulation and overall investment return.

What are Home Equity Lines of Credit (HELOCs)?

HELOCs are borrowing options that allow homeowners to access the equity in their property for various financial needs.

What is the difference between a HELOC and a home equity loan?

A HELOC is a line of credit based on the equity in your home, while a home equity loan provides a lump sum of money based on that equity. Both options have different terms and repayment structures.

What are the lender requirements for accessing home equity?

Many lenders require homeowners to maintain at least an 80% value-to-price ratio, meaning they should have paid down at least 20% of their initial mortgage or their property must have appreciated in value. Additionally, a maximum debt-to-income (DTI) ratio of 43% is typically necessary for housing loans.

What can homeowners use their home equity for?

Homeowners can use their home equity for various purposes, such as funding renovations, merging debts, or covering significant expenses.

How can accessing home equity benefit a family’s financial needs?

Accessing home equity provides flexibility and serves as a valuable financial resource to meet various family needs.