Overview

This article delves into the differences between a Home Equity Line of Credit (HELOC) and cash-out refinancing, aiming to assist homeowners in identifying the best financial option for their unique needs. We understand how challenging financial decisions can be, and we’re here to support you every step of the way.

HELOCs offer flexibility and lower costs, making them an appealing choice for ongoing expenses. On the other hand, cash-out refinancing provides a lump sum that can be invaluable for significant purchases or debt consolidation. It’s essential to consider which option aligns best with your individual financial goals and circumstances.

By recognizing your specific situation, you can make an informed decision that truly supports your financial well-being. Remember, we’re here to help you navigate these choices with care and understanding.

Introduction

Navigating the financial landscape of home equity can feel overwhelming for many homeowners. We understand how challenging it can be to consider options like a Home Equity Line of Credit (HELOC) and cash-out refinancing. Each choice comes with its own set of advantages and potential pitfalls, making it essential for families to grasp how these financial tools can meet their unique needs.

As you weigh the flexibility of a HELOC against the predictability of cash-out refinancing, a pressing question arises: which option truly offers the best path for upgrading your living space while maintaining financial stability?

We’re here to support you every step of the way.

Define HELOC and Cash-Out Refinance

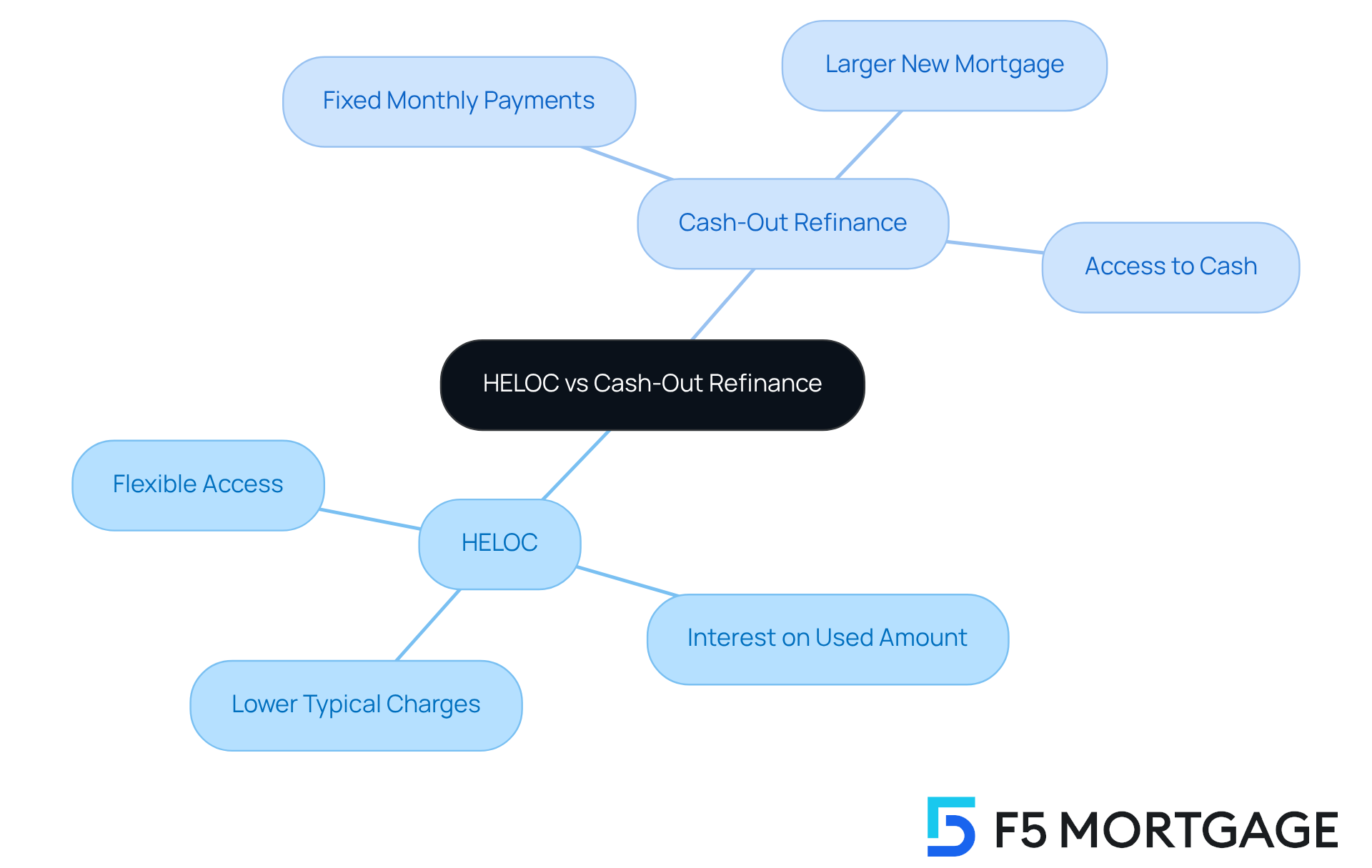

A (HELOC) can be a valuable resource for property owners looking to tap into their home equity. Think of it as a that works much like a credit card. You can withdraw funds as needed, up to a specified limit, and only pay interest on what you actually use. This flexibility makes HELOCs particularly appealing for ongoing expenses, such as home renovations or unexpected costs that life may throw your way.

In contrast, with a new, larger one. This option allows you to in your home. You receive the difference in cash, which can be used for various purposes, including home enhancements or even . With refinancing, you typically have a fixed monthly payment based on the new mortgage terms, providing you with predictability in budgeting.

Starting in 2025, you’ll find that typical charges for HELOCs are usually less than those when comparing HELOC vs . This makes HELOCs a compelling option for many property owners who want to to make the most of their equity. For instance, homeowners in states like Rhode Island and New Jersey have seen . In Rhode Island, homeowners experienced a $37,000 rise as of Q1 2025. This highlights the potential benefits of through these financial products.

We know how challenging navigating these financial decisions can be, but we’re here to support you every step of the way as you explore your options.

Explore the Pros of HELOC and Cash-Out Refinance

The primary advantage of a (HELOC) lies in its flexibility. We understand how important it is for homeowners to manage their finances effectively. With a HELOC, you can borrow only what you need, making it particularly suitable for like home renovations or educational costs. Additionally, HELOCs generally provide lower charges compared to personal loans or credit cards, and the fees may even be tax-deductible when utilized for home enhancements. This can make them an attractive option for many families.

On the other hand, offers a lump sum of money, which can be beneficial for significant expenses or consolidating high-interest debt. This choice enables homeowners to , providing stability in monthly payments over time. If the new mortgage percentage is less than the current one, refinancing can potentially lower the total cost, resulting in considerable savings that can ease financial burdens.

Professional insights emphasize that refinancing is especially efficient for , as it can simplify multiple payments into a single one, often at a reduced interest rate. We know how challenging it can be to juggle various payments, and success stories from property owners illustrate how they have effectively used to manage debt, freeing up cash flow for other necessary expenses.

In 2025, more property owners are recognizing the advantages of both choices. Many are selecting HELOCs to finance renovations that improve their property’s value. On average, homeowners using HELOCs for renovations report , which can lead to increased property value and equity over time. This trend underscores the importance of evaluating the options of to determine which best aligns with your and needs. Remember, we’re here to support you every step of the way as you navigate these important decisions.

Examine the Cons of HELOC and Cash-Out Refinance

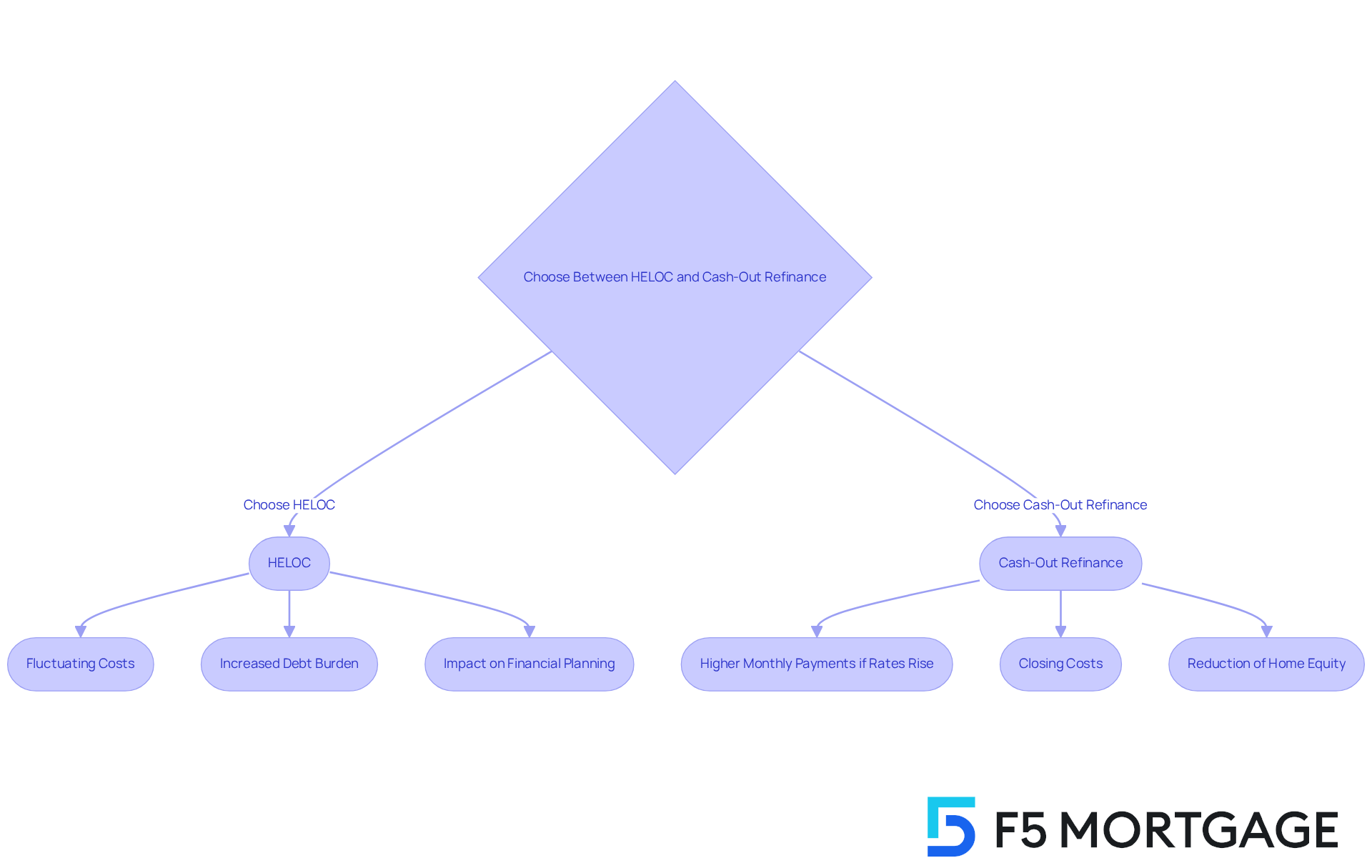

A notable disadvantage of a (HELOC) is its , which can lead to erratic monthly payments. We understand how this variability can create , especially if interest rates rise, potentially resulting in unmanageable debt. Additionally, since a HELOC functions as a second mortgage, it increases the overall debt burden on the homeowner, complicating .

In contrast, the challenges of can be understood better when considering . This option replaces the existing mortgage, which may have a lower interest rate. If the new mortgage rate is significantly elevated, this could lead to . Moreover, when considering HELOC vs cash out refi, equity refinancing usually involves , which increases the total expense of the transaction. As of September 2025, these costs can be substantial, making it essential for property owners to weigh the benefits against the financial implications.

Both options, in the context of HELOC vs cash out refi, also risk reducing home equity, impacting future financial decisions. Homeowners should carefully consider how tapping into their equity might affect their , especially in a fluctuating market. Proactive planning and consultation with mortgage professionals can help navigate these complexities. We’re here to support you every step of the way, ensuring that families make that align with their financial goals.

Determine When to Choose HELOC or Cash-Out Refinance

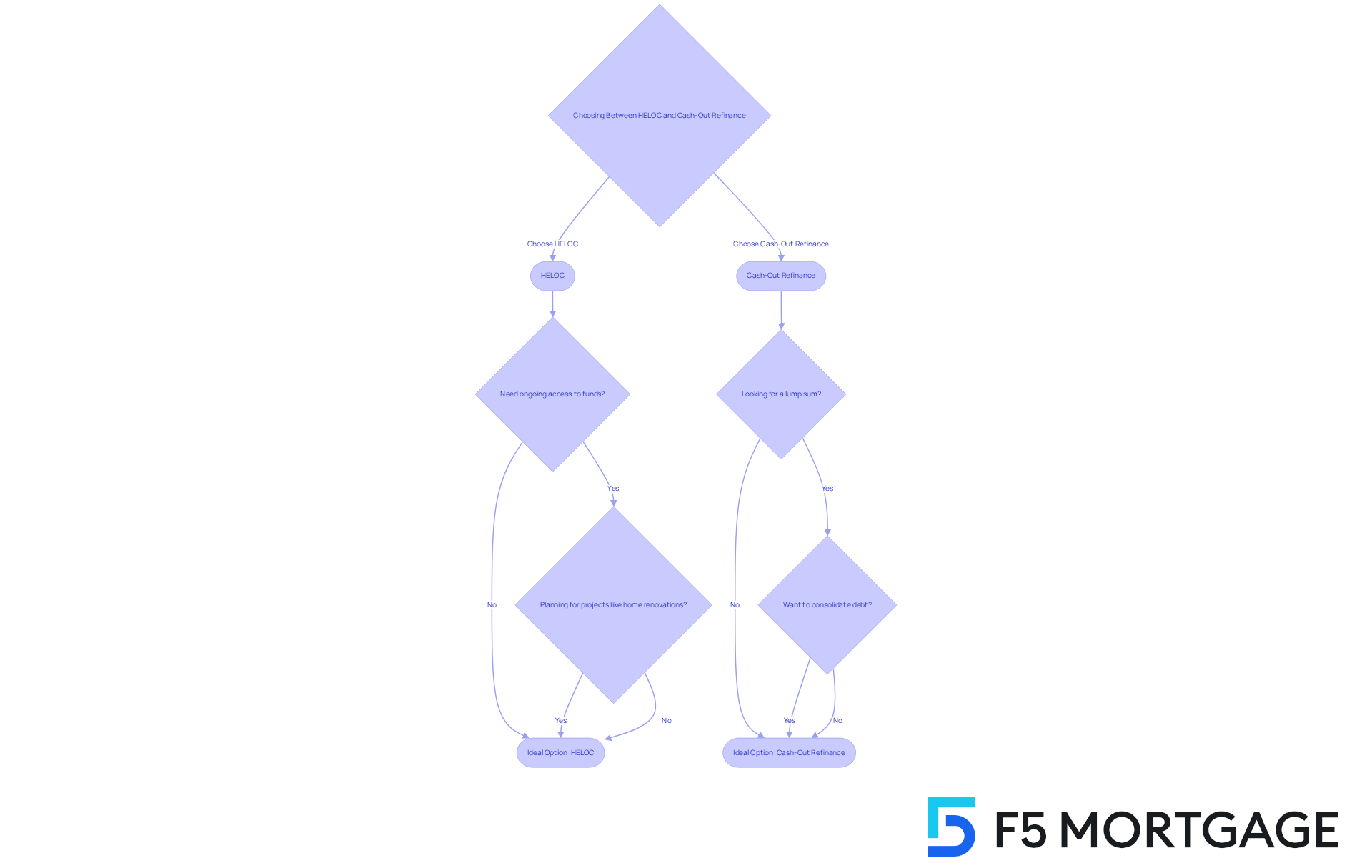

Choosing between a HELOC and a can feel overwhelming when considering the options. We understand how important it is to find the right that meets your unique needs. A HELOC is particularly advantageous for those who require for projects or unexpected expenses that may arise over time, such as . This option provides flexibility, allowing you to access your available credit as needed, which is ideal for individuals who may not require a significant amount of cash upfront.

On the other hand, may be a better fit for homeowners looking to consolidate debt or make , like major home enhancements or investments. This option allows you to replace your existing mortgage with a new loan that exceeds your current balance, providing a lump sum at closing. If you value the stability of a fixed interest rate and are comfortable with potentially higher monthly payments, refinancing with equity withdrawal could be a suitable choice.

Ultimately, the decision regarding HELOC vs cash out refi should reflect your , long-term goals, and risk tolerance. For instance, families planning extensive renovations might find the flexibility of a HELOC beneficial, while those seeking to streamline their finances through may consider the differences between a HELOC vs cash out refi. Understanding these distinctions is crucial for making an that aligns with your financial strategy. Remember, we’re here to support you every step of the way as you navigate these important choices.

Conclusion

Choosing between a Home Equity Line of Credit (HELOC) and a cash-out refinance is a significant decision for homeowners looking to leverage their property’s equity. We understand how challenging this can be, and it’s essential to grasp these two financial products to make informed choices that align with your individual financial goals. While HELOCs offer flexibility and lower initial costs, cash-out refinancing provides a lump sum with predictable payments, catering to different needs and circumstances.

Throughout this article, we’ve highlighted the advantages and disadvantages of both options. HELOCs are ideal for ongoing expenses, allowing homeowners to borrow only what they need. On the other hand, cash-out refinancing can effectively consolidate debt and provide substantial funds for major purchases. However, it’s important to recognize that both options come with risks, such as fluctuating payments for HELOCs and potential higher costs with refinancing. This makes it crucial to weigh these factors carefully.

Ultimately, the decision between HELOC and cash-out refinance should reflect your personal financial situation and long-term objectives. We’re here to support you every step of the way as you assess your needs—whether it’s ongoing access to funds or a fixed payment structure. Consulting with financial professionals can help you navigate these choices effectively. Making an informed decision today can lead to enhanced financial stability and support your future aspirations.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A HELOC is a flexible, revolving line of credit that allows property owners to tap into their home equity. It functions similarly to a credit card, enabling you to withdraw funds as needed up to a specified limit and only pay interest on the amount you use.

How does a cash-out refinance work?

A cash-out refinance replaces your existing mortgage with a new, larger mortgage. This allows you to access the equity built up in your home, and you receive the difference in cash, which can be used for various purposes like home improvements or debt consolidation.

What are the typical charges for HELOCs compared to cash-out refinancing?

Starting in 2025, typical charges for HELOCs are generally less than those for cash-out refinancing, making HELOCs an attractive option for property owners looking to utilize their home equity.

What are the benefits of using a HELOC?

The main benefits of a HELOC include its flexibility in withdrawing funds as needed, the ability to pay interest only on the amount used, and its suitability for ongoing expenses such as home renovations or unexpected costs.

What are the advantages of cash-out refinancing?

Cash-out refinancing provides a fixed monthly payment based on the new mortgage terms, offering predictability in budgeting. It also allows homeowners to access a lump sum of cash for various uses.

How has home equity changed in states like Rhode Island and New Jersey?

Homeowners in Rhode Island have experienced significant equity increases, with a reported rise of $37,000 as of Q1 2025, highlighting the potential benefits of tapping into home equity through HELOCs and cash-out refinancing.

How can I decide between a HELOC and cash-out refinancing?

The decision between a HELOC and cash-out refinancing depends on your financial needs, such as whether you prefer flexible access to funds or a fixed monthly payment structure. Understanding the differences and potential costs can help you make an informed choice.