Overview

Navigating the world of home financing can be challenging, and we understand how important it is to make the right choice for your family. This article highlights the key differences between Home Equity Loans (HELOAN) and Home Equity Lines of Credit (HELOC), guiding you toward the option that best fits your financial needs.

HELOANs provide fixed payments, making them ideal for large, one-time expenses. If you have a significant project in mind, this could be the right choice for you. On the other hand, HELOCs offer flexible access to funds with variable interest rates, which can be more suitable for ongoing expenses. This flexibility allows you to draw funds as needed, adapting to your changing financial situation.

Ultimately, it’s essential to align your choice with your unique financial circumstances. By understanding the differences between these options, you can make an informed decision that supports your family’s goals. Remember, we’re here to support you every step of the way.

Introduction

We know how challenging it can be to navigate the nuances of financing options as a homeowner looking to leverage your property equity. Home Equity Loans (HELOAN) and Home Equity Lines of Credit (HELOC) each come with their own unique advantages and challenges. This makes the decision between them a critical one.

- Will the stability of a HELOAN suit your need for predictable payments?

- Or does the flexibility of a HELOC better align with your fluctuating financial needs?

As you weigh these choices, remember that the implications of your decision can significantly impact your financial future. We’re here to support you every step of the way.

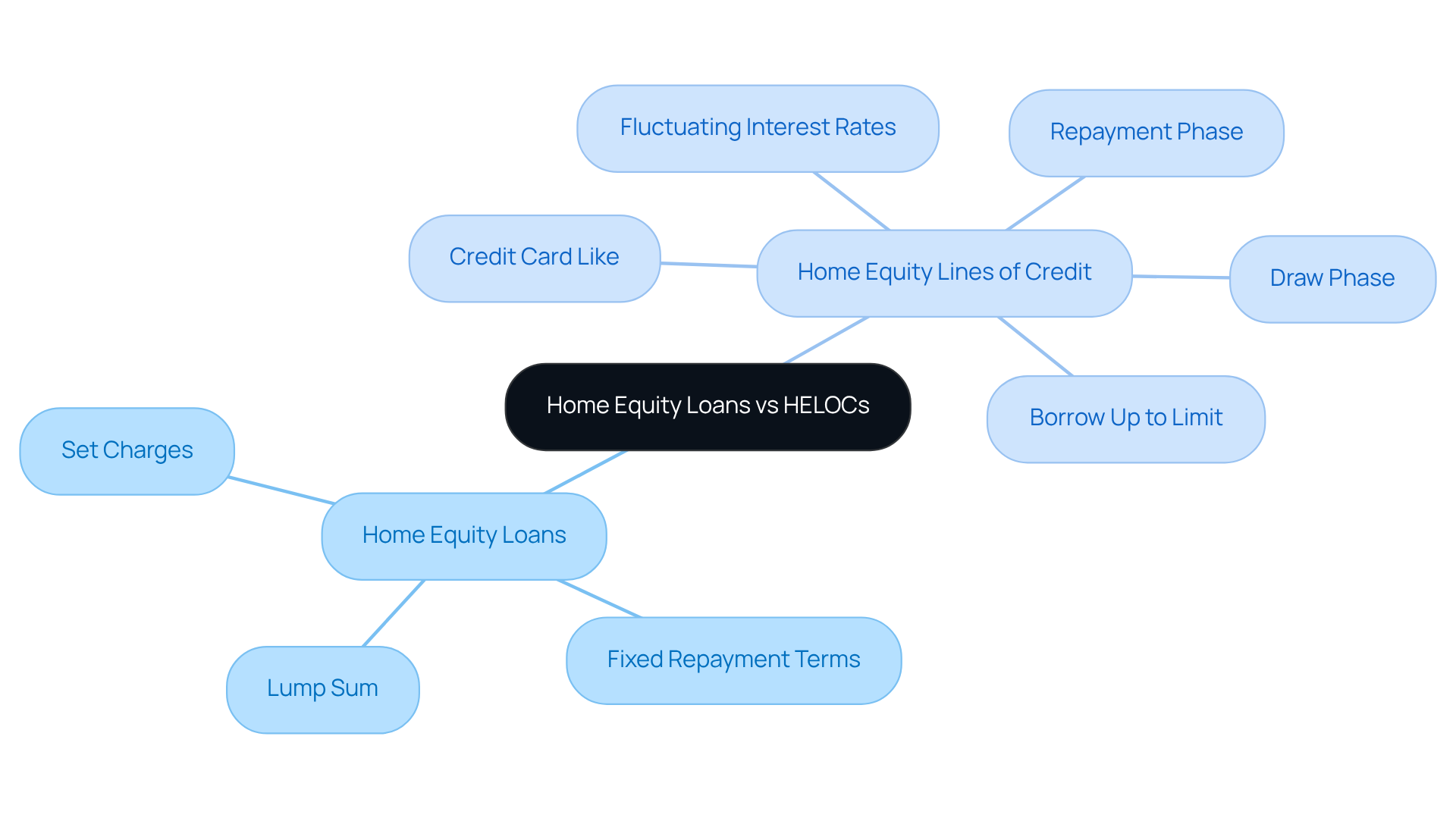

Define Home Equity Loans and HELOCs

Home Equity Loans (HELOAN) offer a way for property owners to tap into the equity they’ve built in their homes, which is often discussed in the context of heloan vs heloc. By borrowing against this equity, you can obtain a lump sum that is repaid over a set term with a fixed charge. On the other hand, in the discussion of heloan vs heloc, Home Equity Lines of Credit (HELOC) function more like a credit card. They allow homeowners to borrow against their equity up to a certain limit, giving you the flexibility to withdraw funds as needed. It’s important to note that HELOCs typically feature fluctuating interest rates and consist of a draw phase followed by a repayment phase.

Understanding heloan vs heloc is crucial for homeowners like you who are considering leveraging your home equity for financial needs. We know how challenging this decision can be, and we’re here to . Once your application receives approval, securing your mortgage terms with F5 Mortgage is essential. This step helps protect you from market changes during the processing period, ensuring that you can move forward with confidence.

Compare Structures and Terms of HELOAN and HELOC

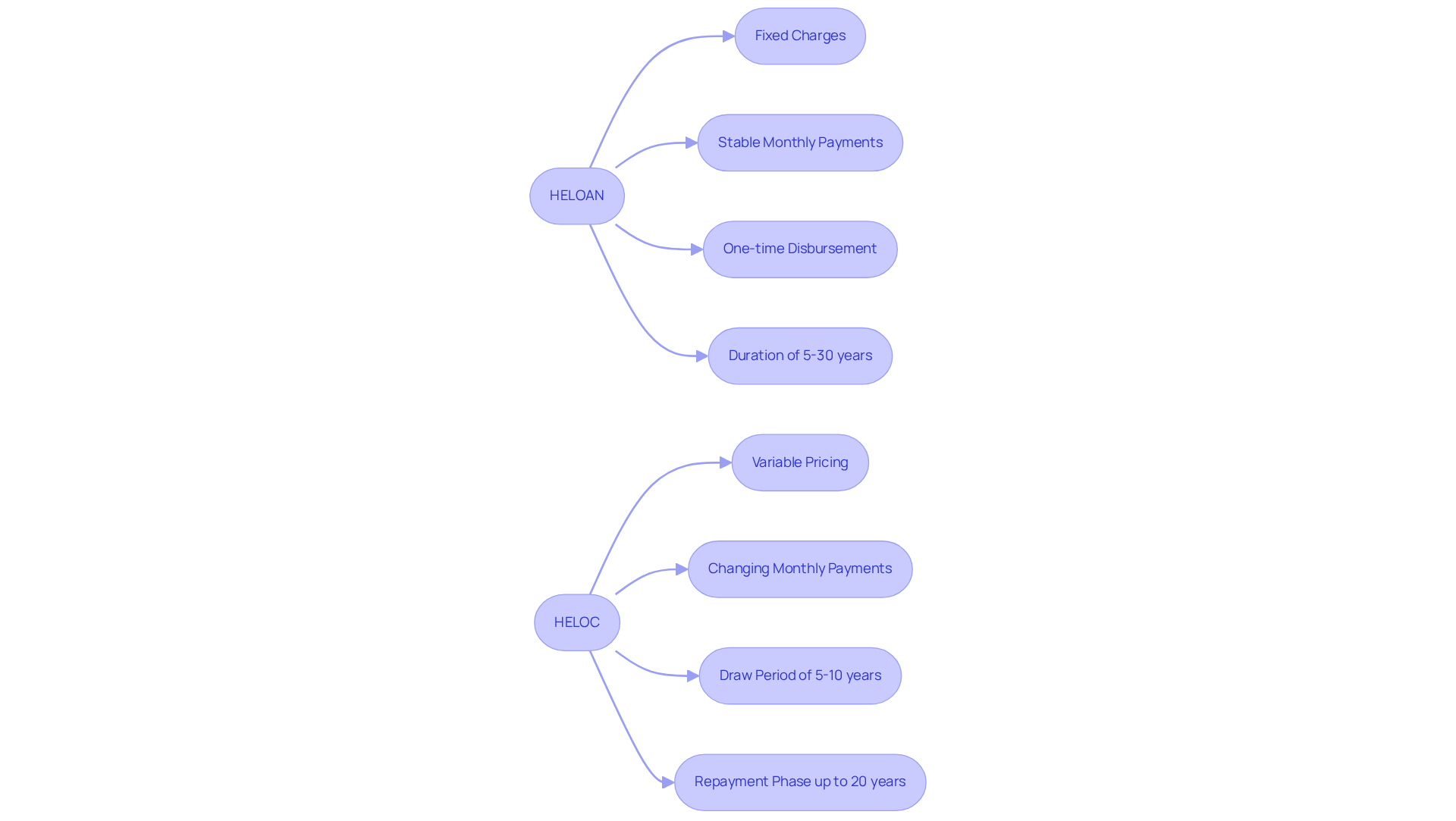

When it comes to financing large expenses, is crucial. HELOANs generally offer fixed charges, meaning your monthly payments will remain stable throughout the loan duration, which can vary from 5 to 30 years. This predictability can be comforting, especially for families planning for significant one-time costs. Borrowers receive a one-time disbursement, making HELOANs particularly suitable for those larger expenses you might be facing.

On the other hand, HELOCs provide a different kind of flexibility. They typically feature variable pricing, which means your monthly payments can change over time. This aspect can introduce a level of uncertainty, but it also allows for adaptability as your financial needs evolve. The draw period for a HELOC often lasts between 5 to 10 years, allowing you to withdraw funds as needed. After this period, you enter a repayment phase that can last up to 20 years.

We understand how challenging it can be to navigate these options. It’s essential to weigh the stability of HELOANs when considering HELOAN vs HELOC and their flexibility. By considering your family’s unique situation, you can make an informed choice that fits your needs. Remember, we’re here to support you every step of the way as you explore these financial pathways.

Evaluate Pros and Cons of Home Equity Loans and HELOCs

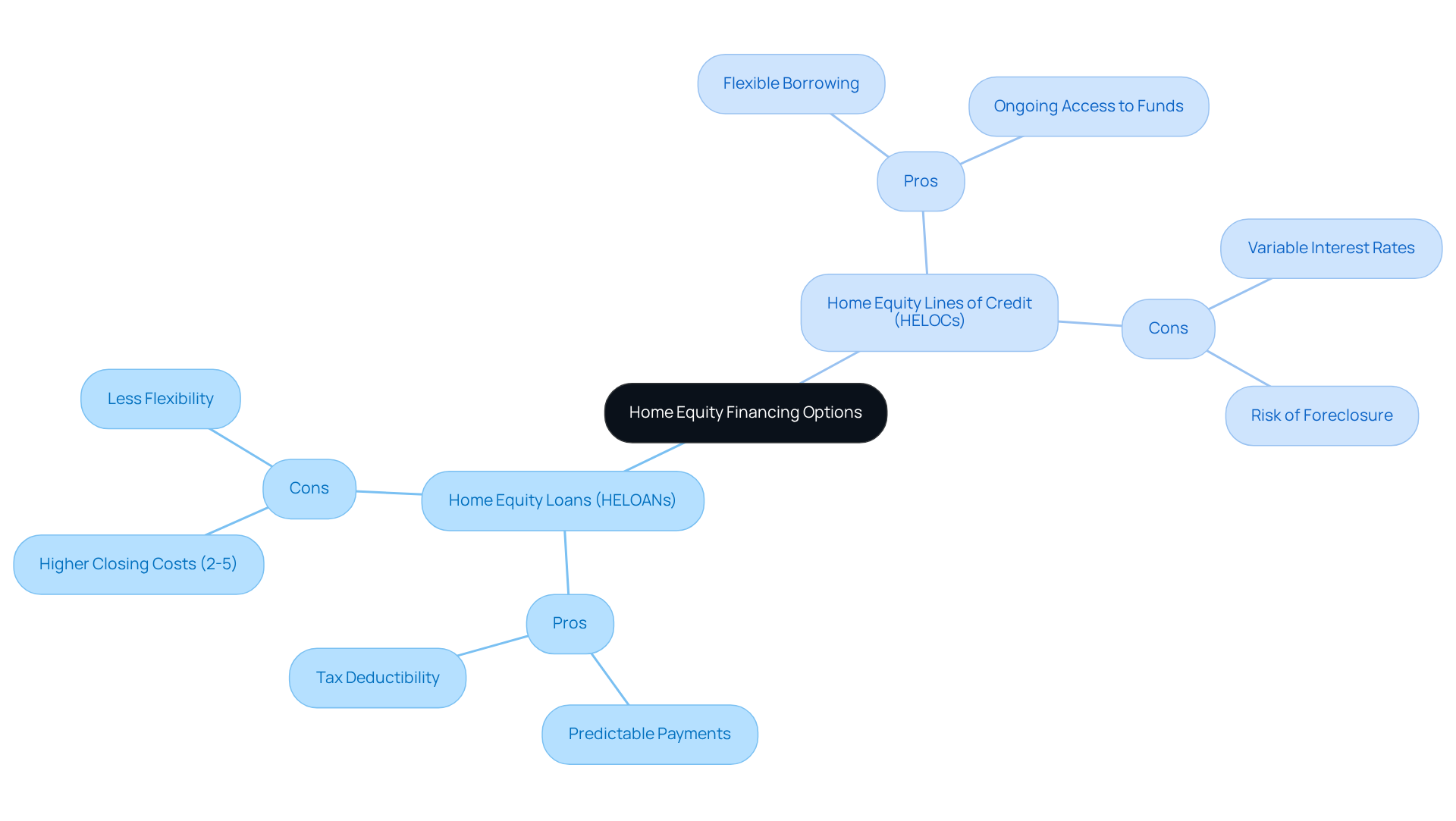

Home Equity Loans (HELOANs) can be a valuable resource for homeowners, especially when comparing heloan vs heloc, as they offer predictable payments and fixed rates that simplify budgeting. If you’re facing significant expenses like renovations or debt consolidation, HELOANs might be just what you need. Plus, if you use the funds for property enhancements, you may find that the charges on HELOANs are tax-deductible, providing an extra financial incentive.

However, it’s essential to be aware that HELOANs often come with higher closing costs, usually between 2% and 5% of the loan amount. Additionally, they offer less flexibility in borrowing when considering the heloan vs heloc options.

On the other hand, when comparing heloan vs heloc, HELOCs can provide you with greater flexibility in both borrowing and repayment. You can access funds whenever you need them, making HELOCs suitable for like education or gradual property improvements. Yet, it’s important to note that HELOCs typically have variable interest rates—currently around 8.25 percent—which can lead to fluctuating payments. This variability can pose a risk for some borrowers, especially if property values decline and you find yourself owing more than your home is worth, increasing the risk of foreclosure if payments are missed.

As you consider your options, understanding the distinctions in heloan vs heloc is crucial for making informed financial decisions. By comparing rates, costs, and terms from various lenders, including F5 Mortgage, you can ensure that you find competitive rates and personalized service that cater to your needs. We know how challenging this can be, and incorporating insights from financial specialists can further assist you in enhancing your home. Remember, we’re here to support you every step of the way as you weigh these important choices.

Guide to Choosing Between HELOAN and HELOC

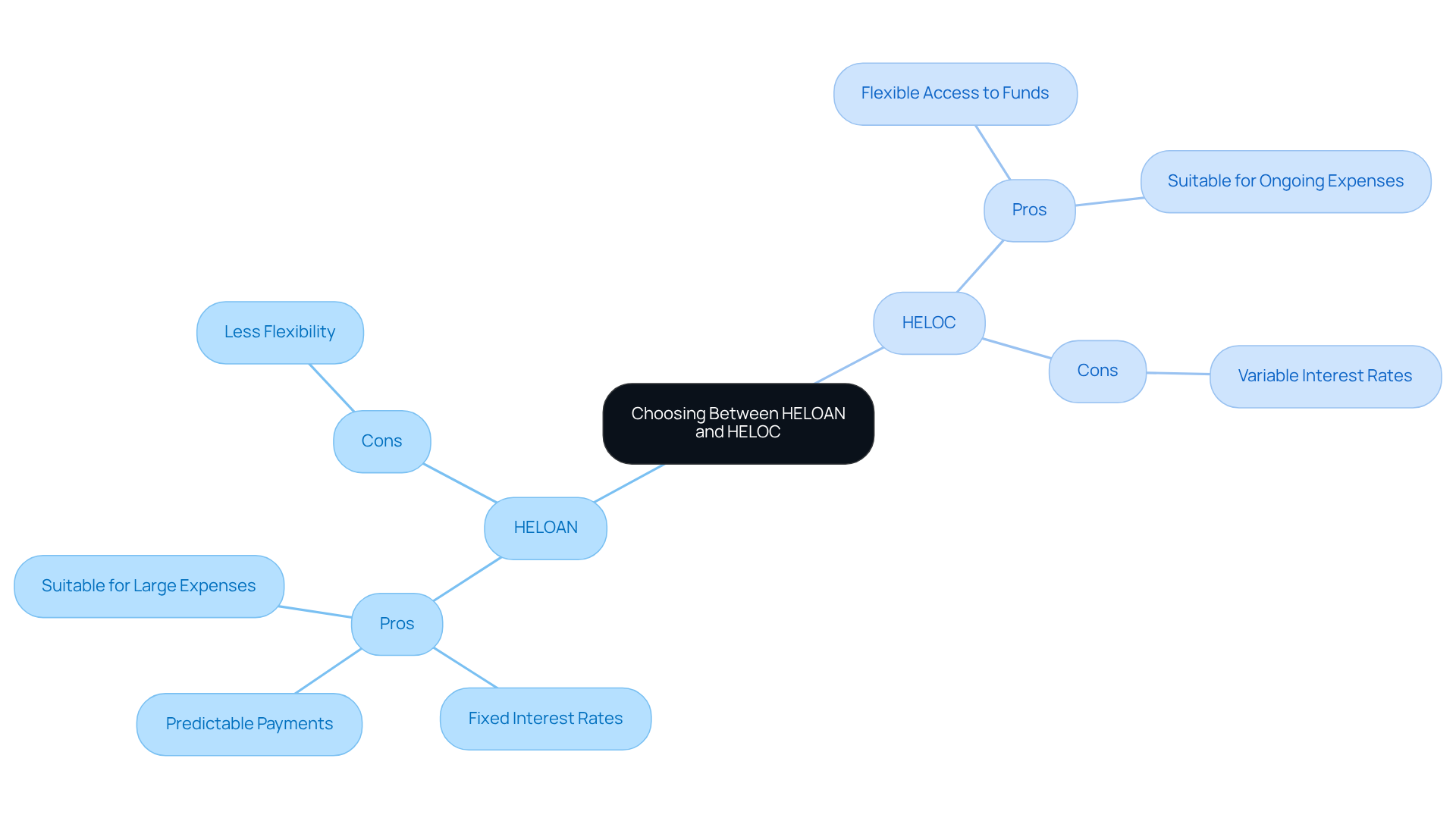

When choosing between a HELOAN vs HELOC, it’s important for property owners to carefully assess their financial needs and repayment capabilities. We understand how overwhelming this decision can feel. A HELOAN is ideal for those who need a substantial amount for a specific purpose, such as home renovations or debt consolidation, and prefer predictable monthly payments. With , borrowers can enjoy the security of a stable interest rate, which is especially appealing in today’s fluctuating market.

On the other hand, a HELOC offers flexibility for homeowners who anticipate needing access to funds over time for various expenses, such as ongoing renovations or unexpected costs. This revolving credit line allows borrowers to withdraw funds as needed, making it a great option for those who appreciate a more adaptable borrowing approach. However, it’s essential to be aware of the implications of variable interest rates, which can result in fluctuating monthly payments.

Understanding property equity criteria is crucial. Many lenders require property owners to maintain a minimum of an 80% loan-to-value ratio. This means you should have paid down at least 20% of your original loan amount or that your property has appreciated in value. Additionally, a maximum debt-to-income (DTI) ratio of 43% is typically necessary for home loans, which reflects the balance between your existing debt and income. A better DTI can lead to more favorable mortgage terms, making it an important factor when comparing HELOAN vs HELOC in your decision-making process.

We encourage you to consult with a mortgage professional who can provide personalized insights tailored to your unique financial situation. For example, a homeowner with a steady income and a specific project in mind may find a HELOAN more beneficial, while someone with variable cash flow might appreciate the flexibility of a HELOC, illustrating the differences in a HELOAN vs HELOC scenario. It’s also vital to understand the current lending environment; with home equity loan and HELOC rates hovering around 8.25 percent, it’s essential to evaluate your comfort with these figures and the potential for future changes.

Pros and Cons Summary:

- HELOAN:

- Pros: Predictable monthly payments, fixed interest rates, suitable for large, specific expenses.

- Cons: Less flexibility in accessing funds over time.

- HELOC:

- Pros: Flexible access to funds, suitable for ongoing expenses.

- Cons: Variable interest rates can lead to fluctuating payments.

Real-life examples can help clarify these choices: one homeowner opted for a HELOAN to finance a kitchen remodel, valuing the fixed payments, while another chose a HELOC to manage ongoing expenses related to a new business venture, appreciating the ability to draw funds as needed. As mortgage consultant Stephen Kates notes, ‘HELOCs have been harder to come by for some borrowers, which may be pushing them towards considering the HELOAN vs HELOC options.’ Ultimately, your decision should take into account your income, existing debts, cash flow, and the intended use of the funds. We’re here to support you every step of the way, ensuring you select the option that aligns best with your financial goals.

Conclusion

Navigating the decision between a Home Equity Loan (HELOAN) and a Home Equity Line of Credit (HELOC) is essential for homeowners looking to leverage their property equity effectively. We know how challenging this can be, and understanding the distinct advantages and drawbacks of each option is crucial for aligning them with your personal financial goals and needs.

- HELOANs provide fixed payments and predictable terms, making them ideal for substantial, one-time expenses.

- On the other hand, HELOCs offer flexibility for ongoing financial needs with variable interest rates.

The choice ultimately depends on your individual circumstances, such as the nature of your expenses, repayment preferences, and financial stability.

In conclusion, evaluating the differences between HELOANs and HELOCs is not just about comparing numbers; it’s about making informed decisions that can significantly impact your financial well-being. We encourage you to assess your unique situation, consult financial professionals, and consider current market conditions.

Whether you opt for the stability of a HELOAN or the adaptability of a HELOC, taking the time to understand these financial tools can lead to more confident and strategic financial planning. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What are Home Equity Loans (HELOAN)?

Home Equity Loans (HELOAN) allow property owners to borrow against the equity they have built in their homes. This type of loan provides a lump sum that is repaid over a set term with a fixed interest rate.

How do Home Equity Lines of Credit (HELOC) work?

Home Equity Lines of Credit (HELOC) function similarly to a credit card, enabling homeowners to borrow against their equity up to a certain limit. They offer the flexibility to withdraw funds as needed and typically have fluctuating interest rates, consisting of a draw phase followed by a repayment phase.

What is the main difference between HELOAN and HELOC?

The main difference is that HELOAN provides a lump sum with a fixed repayment term, while HELOC allows for borrowing up to a limit with variable withdrawals and fluctuating interest rates.

Why is it important to understand the differences between HELOAN and HELOC?

Understanding the differences is crucial for homeowners considering leveraging their home equity for financial needs, as it helps them make informed decisions based on their financial circumstances.

What should I do after my application is approved?

After your application receives approval, it is essential to secure your mortgage terms with F5 Mortgage to protect yourself from market changes during the processing period. This ensures you can move forward with confidence.