Overview

This article highlights the essential steps families should consider during the FHA home inspection process as they look to upgrade their homes. We understand how overwhelming this journey can feel, and that’s why it’s crucial to grasp the FHA appraisal guidelines and the appraisal process. These elements play a significant role in determining financing options and ultimately influence the success of securing a home loan.

By familiarizing yourself with these guidelines, you can navigate the complexities of the mortgage process with greater confidence. We know how challenging this can be, but taking these steps can empower you to make informed decisions. Remember, we’re here to support you every step of the way as you work towards your dream home.

Introduction

Navigating the world of home buying can feel overwhelming, especially for families eager to enhance their living situation. One crucial aspect of this journey is the FHA home inspection. This process not only protects lenders but also ensures that homes meet vital safety and livability standards. As families prepare for this significant step, they might find themselves wondering:

- What if the appraisal doesn’t meet expectations?

- What if repairs are necessary before proceeding?

Understanding the complexities of FHA appraisals can empower families to make informed decisions, guiding them toward successfully securing their dream home. We know how challenging this can be, and we’re here to support you every step of the way.

Define FHA Appraisals and Their Importance in Home Buying

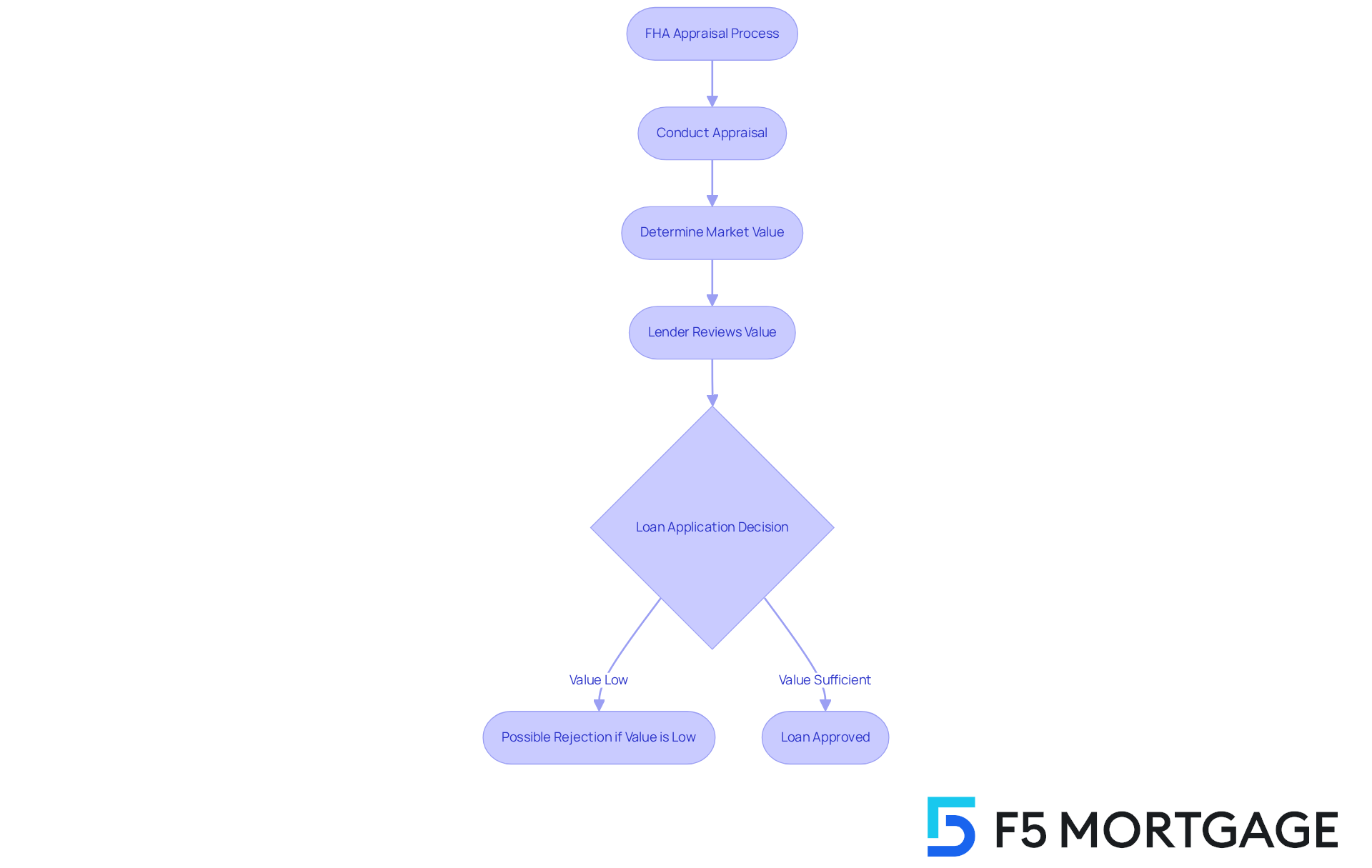

FHA evaluations are essential examinations conducted by authorized evaluators to determine the market worth of a property and ensure it meets the Federal Housing Administration’s (FHA) minimum standards. When families pursue FHA loans, the financier will request a home evaluation to establish the current market value. This step is crucial, as it helps financial institutions assess the risk of the loan and confirm that the asset is valued appropriately for the amount being financed.

We understand how important this process can be for families. In Colorado, some lenders require homeowners to maintain their current loan for a specific duration before they qualify to refinance. This is where an evaluation becomes particularly significant. If the property does not appraise for the loan amount, or even a portion of it, the financial institution may have to reject the loan application.

Therefore, an FHA home inspection not only protects the lender’s investment but also ensures that the home is safe, sound, and secure for the family moving in. Understanding this process is vital for families, as it can greatly influence their ability to secure financing and affect the overall cost of their mortgage. We know how challenging this can be, and we’re here to support you every step of the way.

Explore FHA Appraisal Guidelines and HUD’s Minimum Property Standards

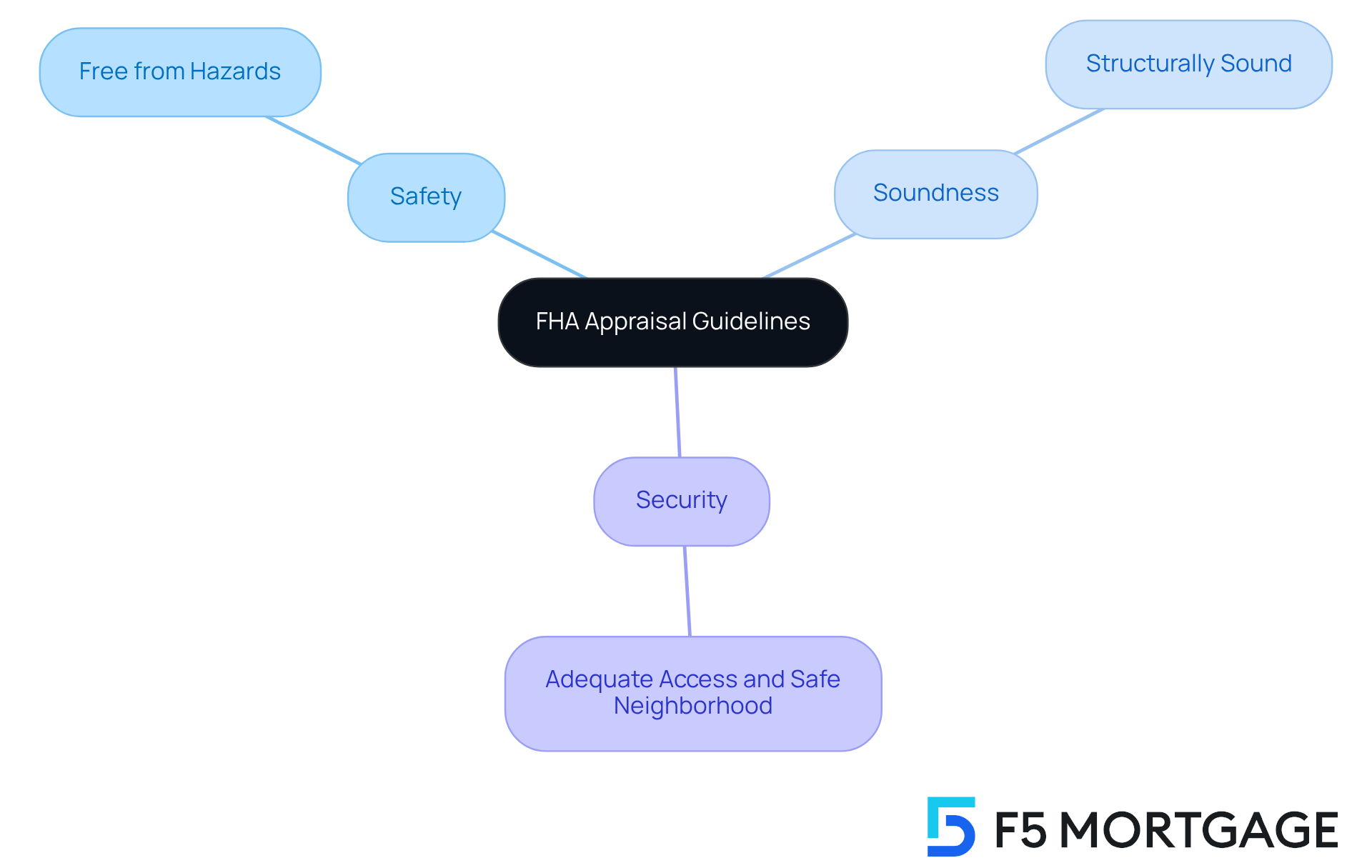

Understanding FHA appraisal standards can feel overwhelming, but we’re here to support you every step of the way. Set by the Department of Housing and Urban Development (HUD), these standards encompass key criteria that homes must meet to ensure they are safe and habitable. Let’s explore these guidelines together:

- Safety: It’s crucial that the property is free from hazards that could pose risks to you and your loved ones, such as structural issues or environmental dangers.

- Soundness: The home should be structurally sound, with no significant defects that could compromise its integrity.

- Security: Adequate access and a safe neighborhood are essential for your peace of mind.

By grasping these guidelines, families can prepare their homes for evaluation and proactively address any potential concerns. We know how challenging this can be, but taking these steps can empower you on your journey to homeownership.

Understand the FHA Appraisal Process: Steps and Expectations

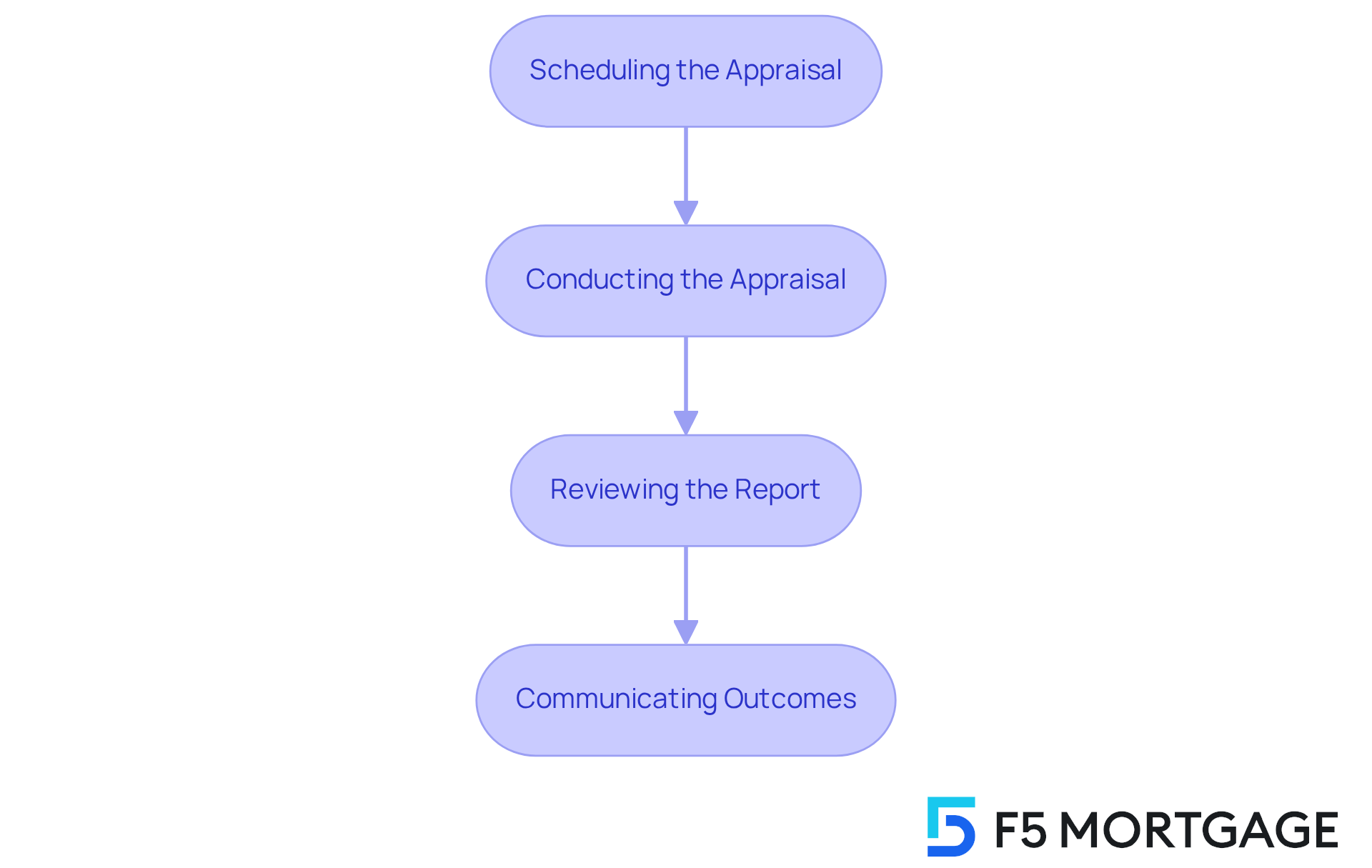

The FHA appraisal process typically involves several key steps that can feel overwhelming, but we’re here to support you every step of the way:

-

Scheduling the Appraisal: Once you submit your loan application, the lender will order the appraisal. It’s important for families to ensure that the appraiser has access to the property, as this is the first step in the journey.

-

Conducting the Appraisal: The appraiser will visit your home to assess its condition, measure its size, and compare it to similar properties in the area. This step is crucial, as it helps determine the current market value of your home, which directly impacts mortgage rates and refinancing eligibility. Additionally, the lender may request an FHA home inspection to ensure the property is in good condition, as a home needing significant repairs may not qualify for refinance loans.

-

Reviewing the Report: After the evaluation, the appraiser will prepare a report outlining their findings, including the property’s value and any issues that need attention. Understanding this report is vital for families, as it can help you navigate your next steps.

-

Communicating Outcomes: The lender will share the appraisal results with you, detailing any necessary repairs or adjustments. This communication is essential for families to grasp how the appraisal affects their refinancing options and overall investment.

By understanding these steps, families can better prepare for the appraisal and proactively address any concerns. We know how challenging this can be, but being informed can make all the difference.

Address Outcomes of FHA Appraisals: Handling Issues and Next Steps

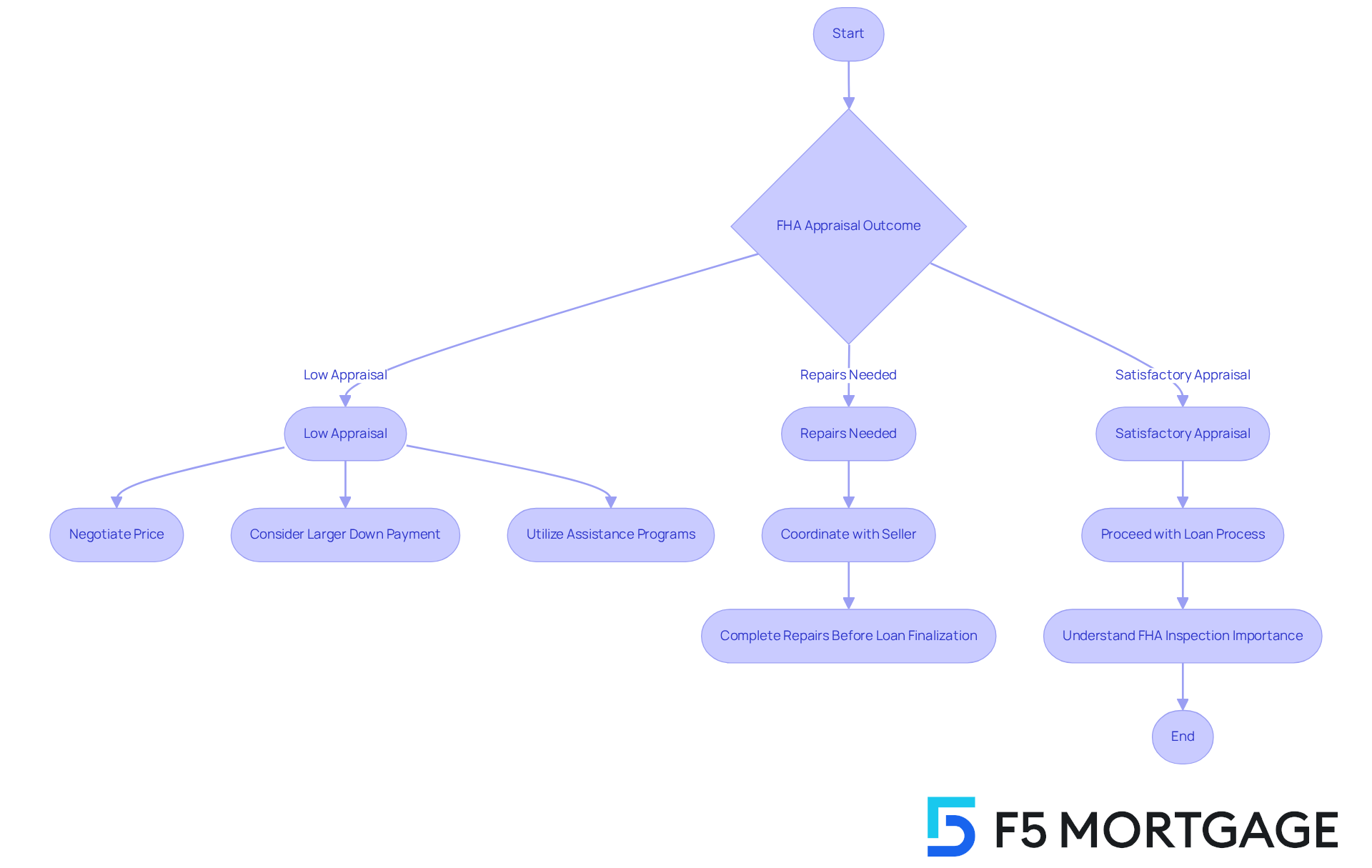

After the FHA appraisal, families may encounter different outcomes. We understand how challenging this can be, so here’s how to handle them:

-

If the Appraisal Comes in Low: Families may need to negotiate with the seller to lower the price or consider making a larger down payment to cover the difference. Utilizing down payment assistance programs can help alleviate some of this financial burden. For instance, the MyHome Assistance Program in California offers up to 3% of the home’s purchase price. In Texas, the My Choice Texas Home program provides up to 5% for down payment and closing assistance. Meanwhile, in Florida, programs like the Florida Assist Second Mortgage Program offer up to $10,000 for upfront costs.

-

If Repairs Are Needed: The lender may require specific repairs identified during the FHA home inspection to be completed before finalizing the loan. Families should work with the seller to address these issues promptly, ensuring a smoother process.

-

If the Appraisal is Satisfactory: Families can proceed with the loan process, confident that their asset meets FHA standards. It’s essential to comprehend the significance of the FHA home inspection and other home evaluations in assessing property value and equity, as this directly influences mortgage rates and overall financing choices. A greater evaluation can lead to improved mortgage rates, while a lesser evaluation may require additional financial adjustments.

Being prepared for these outcomes allows families to navigate the appraisal process smoothly and make informed decisions about their home purchase. Remember, we’re here to support you every step of the way.

Conclusion

Understanding the FHA home inspection process is crucial for families looking to upgrade their homes and secure financing. This process not only involves evaluating the property’s market value but also ensuring it meets the safety, soundness, and security standards set by the Federal Housing Administration. We know how challenging this can be, but by familiarizing themselves with the FHA appraisal and inspection guidelines, families can navigate potential challenges and make informed decisions that impact their homeownership journey.

Throughout this article, we’ve shared key insights regarding the various steps involved in the FHA appraisal process, from scheduling the appraisal to addressing potential outcomes. Families learned about the importance of being proactive in preparing their homes for evaluation, understanding the significance of the appraisal report, and knowing how to handle issues that may arise, such as low appraisals or necessary repairs. Each step is designed to empower families with the knowledge needed to enhance their home-buying experience.

Ultimately, being well-informed about the FHA home inspection and appraisal process can greatly influence a family’s ability to secure financing and ensure a safe living environment. We’re here to support you every step of the way. Families are encouraged to take action by preparing their homes accordingly, seeking assistance when needed, and remaining engaged throughout the appraisal journey. This proactive approach not only fosters confidence but also lays the foundation for a successful transition into homeownership, making it a rewarding and fulfilling experience.

Frequently Asked Questions

What are FHA appraisals?

FHA appraisals are evaluations conducted by authorized evaluators to determine the market worth of a property and ensure it meets the Federal Housing Administration’s (FHA) minimum standards.

Why are FHA appraisals important in home buying?

FHA appraisals are important because they help financial institutions assess the risk of the loan and confirm that the property is valued appropriately for the amount being financed.

How does an FHA appraisal affect loan applications?

If a property does not appraise for the loan amount, or even a portion of it, the financial institution may have to reject the loan application.

What role does an FHA appraisal play in refinancing?

In Colorado, some lenders require homeowners to maintain their current loan for a specific duration before qualifying to refinance, making an appraisal significant in determining eligibility.

How does an FHA appraisal protect families?

An FHA appraisal ensures that the home is safe, sound, and secure for the family moving in, which is crucial for their well-being.

What should families understand about the FHA appraisal process?

Families should understand that the FHA appraisal process can greatly influence their ability to secure financing and affect the overall cost of their mortgage.