Overview

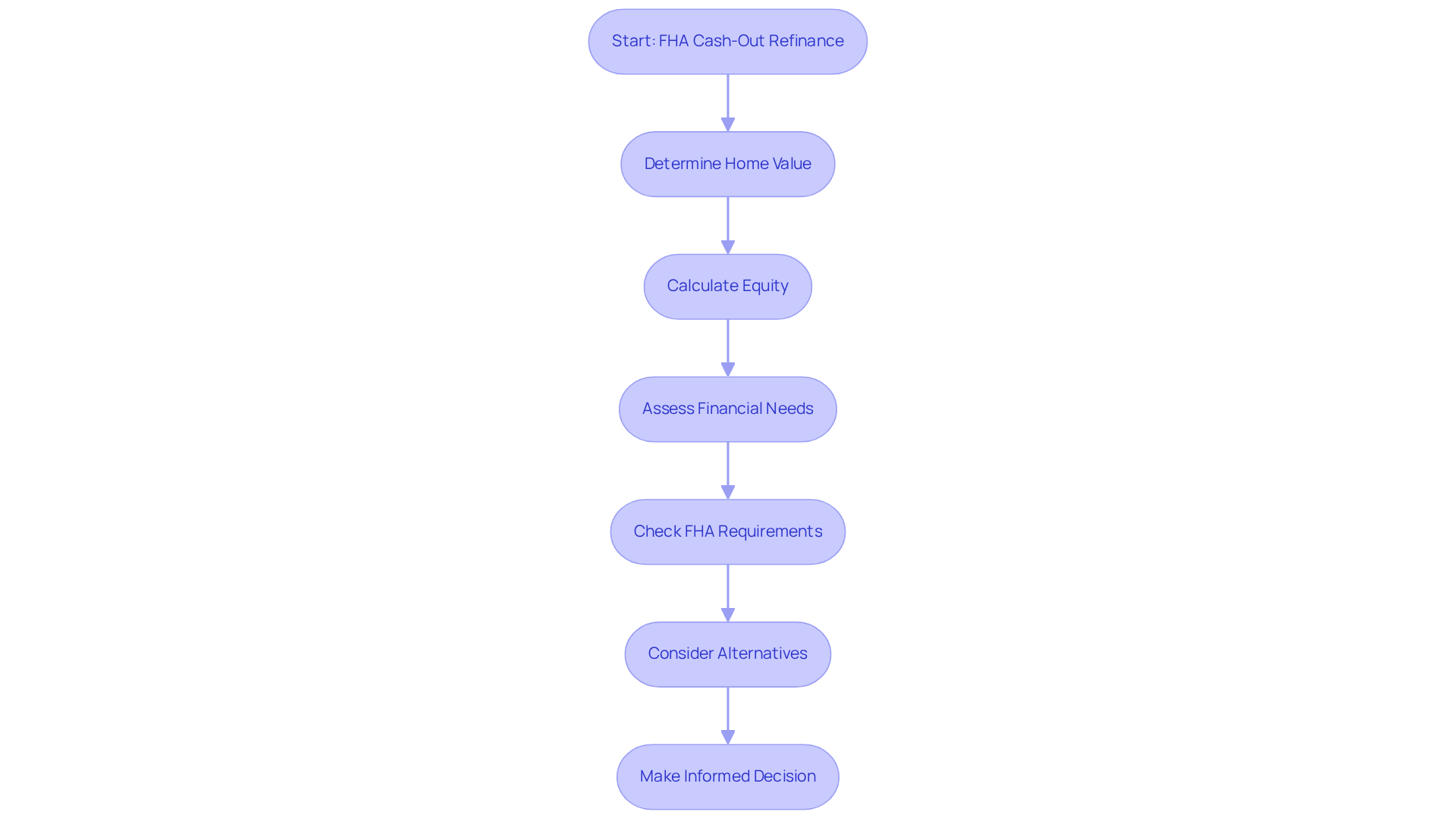

Navigating financial challenges can be tough, and the FHA cash-out refinance might just be the solution you need. This option allows homeowners to replace their existing mortgage with a larger FHA-backed loan, unlocking access to home equity for various financial needs.

We understand that many families face hurdles in achieving their financial goals. The good news is that this refinancing option is accessible, thanks to lower credit score requirements and competitive interest rates. By tapping into your home equity, you can address pressing financial needs, whether it’s for home improvements, debt consolidation, or other expenses.

It’s essential to consider the criteria involved in this process. Factors like your equity, debt-to-income ratios, and costs such as mortgage insurance premiums and closing fees play a significant role. We know how challenging this can be, but understanding these elements can empower you to make informed decisions.

If you’re ready to explore this opportunity, remember that we’re here to support you every step of the way. Take the first step towards financial freedom by learning more about the FHA cash-out refinance today!

Introduction

Homeownership often brings the challenge of maximizing the value of your investment, especially when financial needs arise. We know how challenging this can be. The FHA cash-out refinance presents a strategic opportunity for homeowners to tap into their home equity. This option allows you to fund renovations, consolidate debt, or cover unexpected expenses.

However, as you consider this option, questions about eligibility, costs, and the potential impact on long-term financial health may loom large.

How can you navigate these complexities to make an informed decision that aligns with your financial goals? We’re here to support you every step of the way.

Understand FHA Cash-Out Refinancing

The FHA cash out refinance is a valuable financial option that allows homeowners to replace their existing mortgage with a new, larger FHA-backed loan. This process enables you to you’ve built in your home, providing cash for various needs, such as property improvements, debt consolidation, or other financial requirements. In California, you can refinance your existing mortgage for an amount higher than what you currently owe, allowing you to receive the difference in cash.

We understand how important it is to make the most of your home’s value. According to FHA regulations, homeowners can refinance up to 80% of their residence’s assessed worth. This is especially beneficial for those whose property values have increased since their initial purchase. For example, if your home is valued at $300,000 and you have an existing mortgage of $200,000, you could potentially access up to $40,000 in cash through this refinancing option.

However, it’s important to consider all your options for accessing home equity. Alternatives like home equity financing and home equity lines of credit might also suit your needs. Current trends show that the FHA cash out refinance remains a popular choice, especially since it typically offers lower interest rates compared to traditional financing. This makes it an attractive solution for homeowners looking to utilize their equity effectively.

Moreover, the flexibility of FHA cash out refinance, which has credit score requirements as low as 580, makes it accessible for a wider range of borrowers, including those with less-than-perfect credit histories. As you explore this option, keep in mind that your debt-to-income ratio must be 43% or less.

It’s also crucial to understand the costs associated with refinancing. You’ll need to consider annual mortgage insurance premiums, which generally range from 0.45% to 1.05% of the borrowed amount each year, along with closing costs that can vary from 2% to 6% of the total amount. By fully understanding the refinancing process in California, you can make informed decisions about accessing your home equity, and we’re here to support you every step of the way.

Explore FHA Cash-Out Refinance Requirements

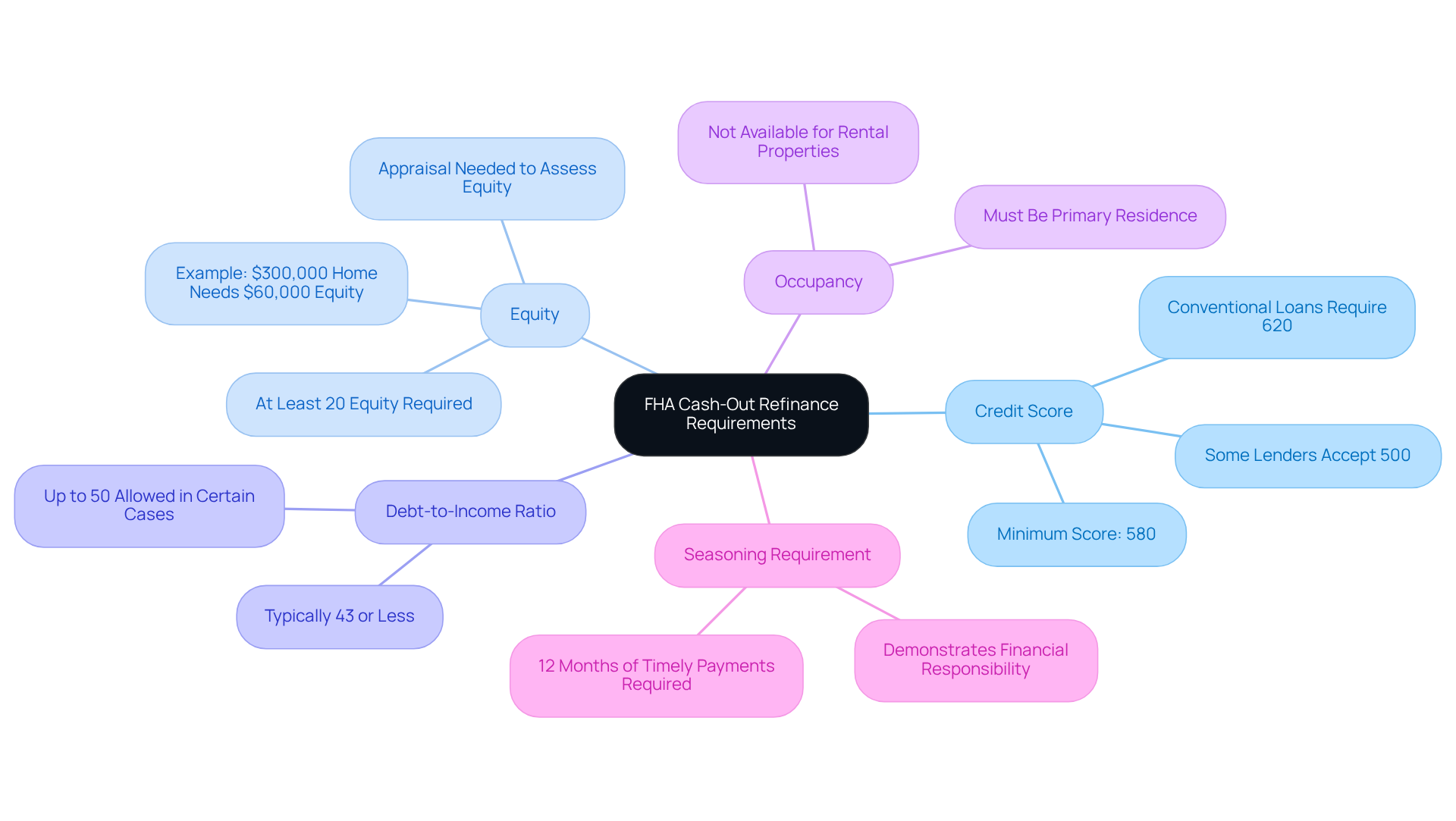

To qualify for an FHA cash-out refinance, borrowers must navigate several essential criteria, as we understand. Here’s what you need to know:

- Credit Score: Generally, a minimum credit score of 580 is required for FHA loans. However, some lenders may accept scores as low as 500, making this option accessible for those with less-than-perfect credit. In contrast, conventional loans typically expect a minimum credit score of 620.

- Equity: It’s important for property owners to have at least 20% equity in their asset, assessed through a new appraisal. This means that if your home is valued at $300,000, you would need to possess at least $60,000 in equity. Understanding is vital, as they directly influence your equity assessment and the mortgage rates available to you.

- Debt-to-Income Ratio: A debt-to-income (DTI) ratio of 43% or less is usually expected. However, certain lenders may permit a DTI of up to 50% under specific circumstances.

- Occupancy: The property must serve as your main residence, ensuring that the financing supports your personal housing needs.

- Seasoning Requirement: You should have made timely payments on your existing mortgage for at least 12 months, demonstrating your financial responsibility and stability.

Additionally, it’s essential to know that the FHA does not limit the applications for withdrawal funds. This means you can use these funds for various purposes, including debt consolidation and home enhancements. It’s also important to be aware of the closing expenses related to FHA refinancing, which typically range from 2% to 6% of the mortgage amount. These requirements are designed to ensure that you are financially equipped to manage the new loan, facilitating an FHA cash-out refinance for homeowners to access cash from their equity while maintaining manageable debt levels. Remember, we’re here to support you every step of the way.

Evaluate Costs and Benefits of FHA Cash-Out Refinancing

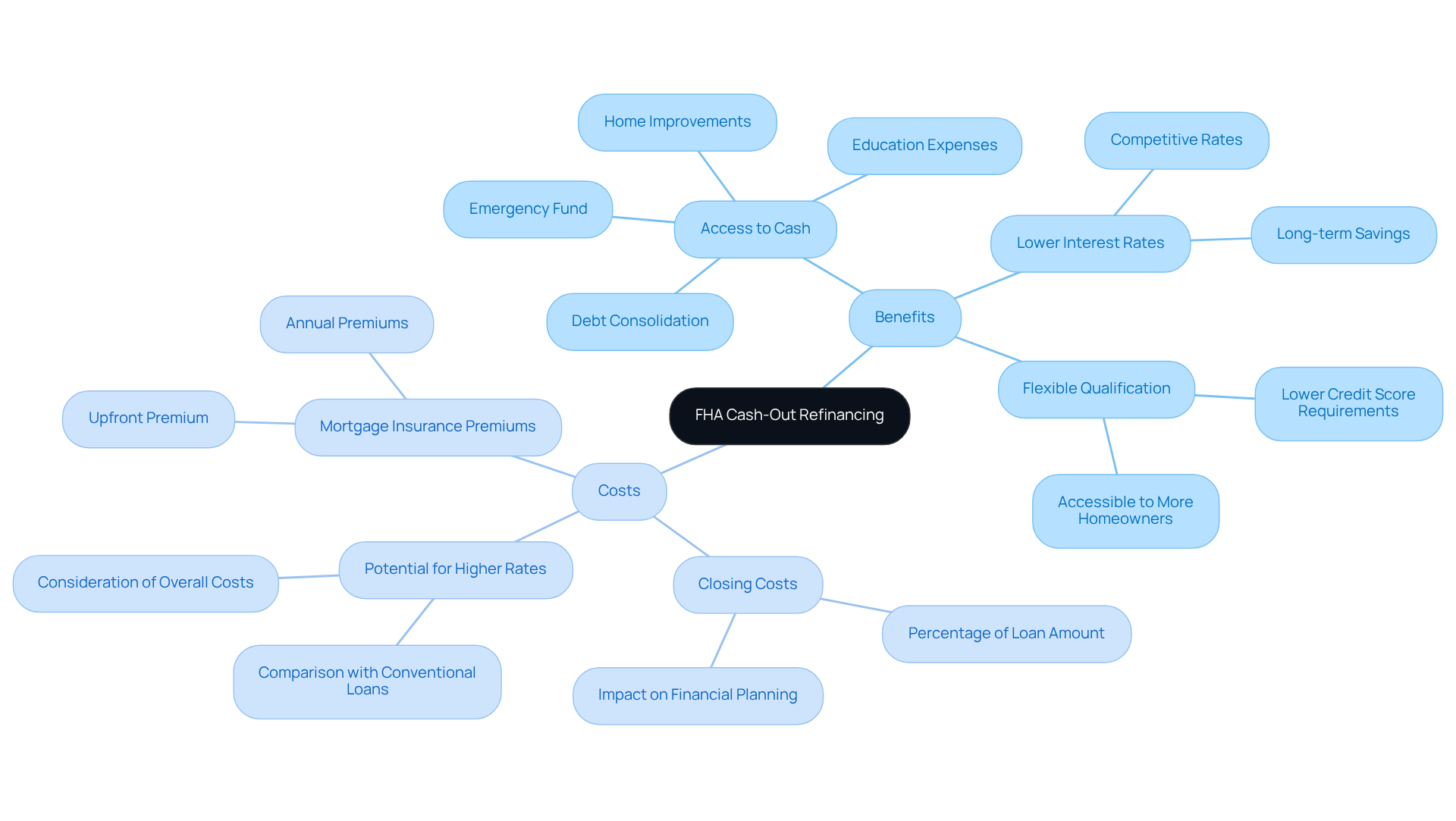

When considering an FHA cash-out refinance, it’s essential to evaluate both the costs and benefits with care:

- Access to Cash: Homeowners have the opportunity to access substantial cash reserves. This cash can be used for important needs such as home improvements, debt consolidation, education expenses, or even building an emergency fund. For instance, if a home is appraised at $400,000 with a current mortgage of $200,000, homeowners could potentially access up to $40,000 through a refinance, depending on their equity.

- Lower Interest Rates: FHA mortgages often provide reduced interest rates compared to traditional financing, currently averaging around 6.58%. This reduction can lead to significant savings over the life of the mortgage, making FHA refinancing an appealing option for many families.

- Flexible Qualification: FHA financing is designed with more lenient qualification standards. Borrowers with credit scores as low as 500 can qualify for FHA cash out refinance, making it accessible to a broader range of homeowners, including those facing unique financial challenges.

Costs:

- Closing Costs: It’s important to anticipate closing costs, which generally range from 2% to 6% of the loan amount. For example, on a $300,000 refinance, closing costs could be between $6,000 and $18,000, which can significantly impact your overall financial planning.

- Mortgage Insurance Premiums: FHA mortgages require both upfront and annual mortgage insurance premiums. These can add considerable costs, with the upfront premium currently set at 1.75% of the loan amount, and annual premiums ranging from 0.45% to 1.05% of the loan balance.

- Potential for Higher Rates: While FHA refinance rates are competitive, they may be slightly higher than those for conventional refinancing options. It’s crucial for homeowners to consider this when evaluating their choices.

By thoughtfully considering these factors, we can help you make informed decisions about whether an FHA refinance aligns with your financial goals. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Compare FHA Cash-Out Refinance with Other Options

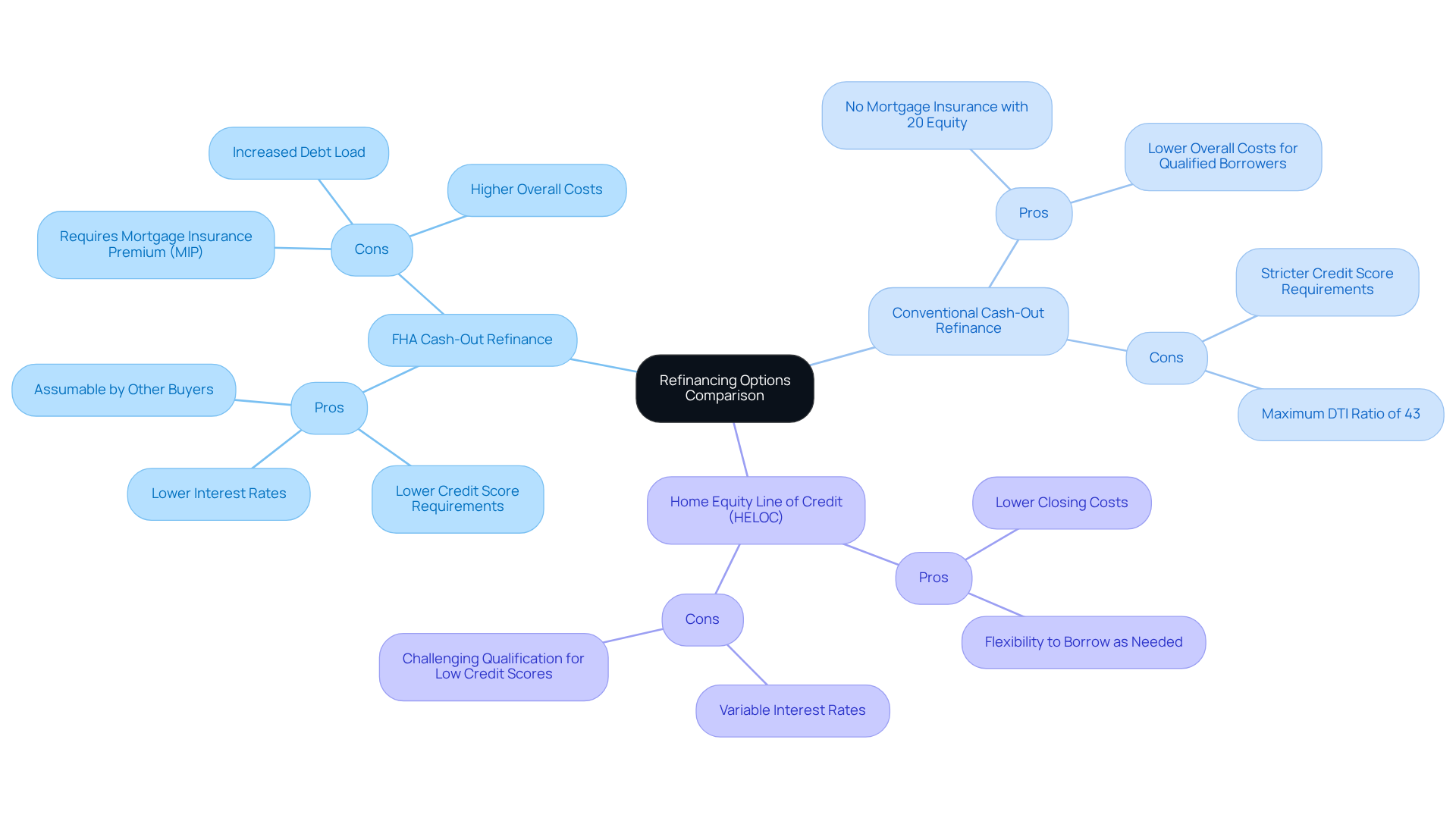

When evaluating refinancing options, we understand how important it is to compare the with alternatives like conventional cash-out refinancing and home equity lines of credit (HELOCs). This knowledge can empower you to make the best choice for your family’s financial future.

-

FHA Cash-Out Refinance:

- Pros: With lower credit score requirements (as low as 580), you can access cash for various needs, often at lower interest rates—typically averaging 10-15 basis points lower than conventional loans. Plus, FHA refinances can be assumed by other buyers, enhancing the marketability of your property.

- Cons: However, keep in mind that this option requires mortgage insurance premiums (MIP) of 0.55% annually, along with a one-time upfront premium of 1.75%, which can increase overall costs. To qualify for an FHA cash-out refinance, homeowners must also have lived in their home for at least 12 months. Additionally, an increased debt load may lead to larger monthly payments, which is something to consider.

-

Conventional Cash-Out Refinance:

- Pros: This option doesn’t require mortgage insurance if you have at least 20% equity, which can lead to lower overall costs for you.

- Cons: On the flip side, it comes with stricter credit score requirements (typically a minimum of 620) and a maximum debt-to-income (DTI) ratio of 43%, making it less accessible for some families.

-

Home Equity Line of Credit (HELOC):

- Pros: A HELOC offers flexibility to borrow as needed, often with lower closing costs compared to traditional refinancing options, which can be a great advantage for your budget.

- Cons: However, be aware that variable interest rates can lead to higher payments over time, and qualifying may be more challenging for those with lower credit scores.

By understanding these comparisons, we hope you feel more equipped to make informed decisions about which refinancing option aligns best with your family’s financial goals and circumstances. Remember, we’re here to support you every step of the way.

Conclusion

The FHA cash-out refinance is a valuable resource for homeowners eager to tap into their home equity. By replacing an existing mortgage with a new, larger FHA-backed loan, you can access funds for various needs—whether it’s for home improvements or debt consolidation. This option not only provides cash but also offers competitive interest rates and flexible qualification criteria, making it an appealing choice for many families.

Throughout this article, we’ve highlighted key aspects of the FHA cash-out refinance. The eligibility requirements, such as credit score thresholds and debt-to-income ratios, are designed to ensure that more homeowners can benefit from this financing option. Additionally, it’s important to consider the costs associated with refinancing, including mortgage insurance premiums and closing costs, as these can significantly impact your overall financial planning. By thoughtfully comparing this option with alternatives like conventional cash-out refinancing and HELOCs, you can make informed decisions that best suit your needs.

Ultimately, understanding the intricacies of the FHA cash-out refinance is essential for those looking to maximize their home’s value and secure necessary funds. As you navigate your financial options, remember to assess not only the immediate benefits but also the long-term implications of your choices. Engaging with financial advisors or mortgage professionals can provide tailored insights, ensuring that your selected refinancing path aligns with your unique financial goals. We know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What is FHA cash-out refinancing?

FHA cash-out refinancing allows homeowners to replace their existing mortgage with a new, larger FHA-backed loan, enabling them to access the equity built in their home for cash needs like property improvements or debt consolidation.

How much equity can homeowners access through FHA cash-out refinancing?

Homeowners can refinance up to 80% of their residence’s assessed worth according to FHA regulations. For example, if a home is valued at $300,000 with an existing mortgage of $200,000, a homeowner could potentially access up to $40,000 in cash.

What are the advantages of FHA cash-out refinancing compared to other options?

FHA cash-out refinancing typically offers lower interest rates compared to traditional financing and is more accessible to a wider range of borrowers due to its lower credit score requirements.

What are the credit score requirements for FHA cash-out refinancing?

The credit score requirements for FHA cash-out refinancing can be as low as 580, making it accessible for borrowers with less-than-perfect credit histories.

What is the maximum debt-to-income ratio allowed for FHA cash-out refinancing?

The maximum debt-to-income ratio allowed for FHA cash-out refinancing is 43%.

What costs should homeowners consider when refinancing?

Homeowners should consider annual mortgage insurance premiums, which typically range from 0.45% to 1.05% of the borrowed amount each year, as well as closing costs that can vary from 2% to 6% of the total amount.

Why is it important to understand the refinancing process in California?

Understanding the refinancing process in California helps homeowners make informed decisions about accessing their home equity, ensuring they choose the best financial options for their needs.