Overview

Navigating home refinance options can feel overwhelming, but we’re here to support you every step of the way. By evaluating different refinancing methods—like rate-and-term, cash-out, and streamline refinances—you can find the best fit for your family’s financial goals. Each option is tailored to meet specific needs, whether you’re looking to lower monthly payments or access your home equity.

Key factors such as:

- loan-to-value ratios

- closing costs

- the break-even point

are essential in this process. Understanding these elements provides a comprehensive view that empowers homeowners to make informed decisions aligned with their financial objectives. We know how challenging this can be, but with the right information, you can confidently choose the path that suits your family’s needs.

Introduction

Navigating the world of mortgage refinancing can be daunting. We know how challenging this can be, yet it presents a unique opportunity for families to enhance their financial well-being.

With various home refinance options available, homeowners can tailor their choices to meet specific goals. This might mean:

- Reducing monthly payments

- Accessing cash for renovations

- Simplifying the loan process

However, with so many alternatives to consider, the question remains: how can families effectively evaluate and select the right refinancing option that aligns with their financial aspirations and circumstances?

We’re here to support you every step of the way.

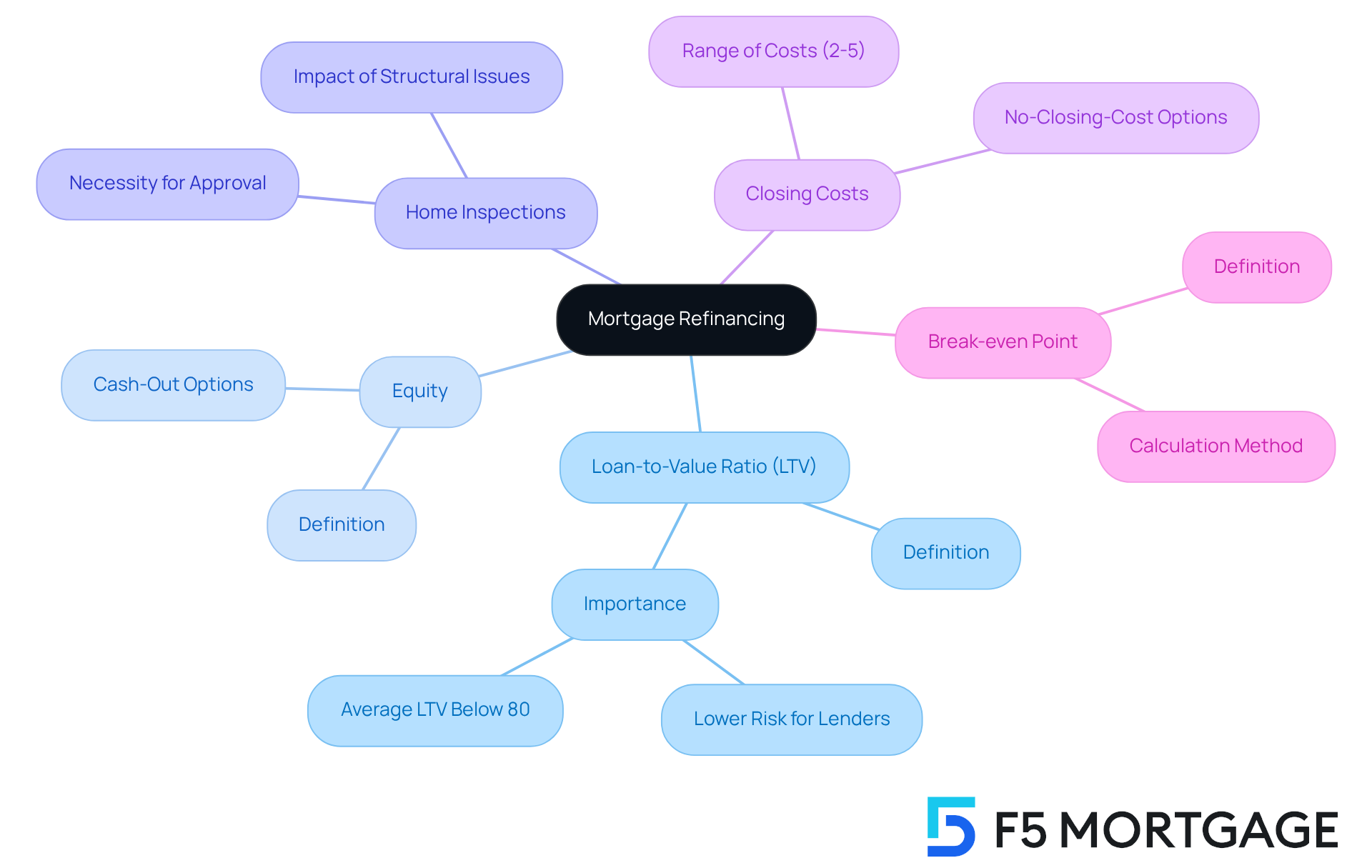

Understanding Mortgage Refinancing: Key Concepts and Definitions

Mortgage restructuring can feel overwhelming, but it offers a chance to improve your financial situation. By using home refinance options to substitute your existing mortgage with a new financial arrangement, you can often secure better conditions, like a lower interest rate or a more manageable repayment period. Understanding key concepts is essential for making informed decisions:

Loan-to-Value Ratio (LTV): This ratio compares your loan amount to the appraised value of your property. A lower LTV often leads to more favorable refinancing options, as it indicates less risk to lenders. As of 2025, the average LTV ratio for refinanced loans is below 80%, showcasing strong borrower equity and lending quality.

Equity: This is the difference between your home’s market value and the outstanding mortgage balance. You can utilize your equity for cash-out options, allowing you to access funds for other investments or expenses.

Home Inspections: Before fully approving a refinance, an inspection is necessary to ensure your home is in good condition. Significant structural issues can complicate approval. Thankfully, you have various home refinance options available for restructuring your mortgage, including conventional types, FHA options, and VA types, each with different eligibility criteria and advantages.

Closing Costs: These charges related to obtaining a new mortgage can range from 2% to 5% of the principal amount. They may include appraisal fees, title insurance, and origination fees. Understanding these expenses is crucial for assessing the total advantage of restructuring your loan. Some lenders even offer home refinance options, including no-closing-cost loan restructuring, where costs are rolled into the loan principal or covered through a higher interest rate.

Break-even Point: This metric indicates the time it takes for the savings from a lower interest rate to offset the closing expenses of the loan adjustment. It’s important to calculate this point to see if restructuring your mortgage aligns with your financial goals. To find your break-even point, determine your loan costs, calculate your monthly savings, and divide your loan costs by your monthly savings.

Real-world examples can illustrate the impact of LTV on loan restructuring. For instance, consider a couple with a property valued at £3,000,000 and an existing mortgage of £1,000,000. Their favorable LTV allowed them to secure a new mortgage with better terms. This shows how maintaining a low LTV can significantly enhance your home refinance options.

In summary, understanding these concepts—LTV, equity, home inspections, closing costs, and the break-even point—empowers homeowners to navigate the loan modification process effectively. We know how challenging this can be, so it’s recommended to review your credit score and take steps to enhance it before submitting an application for a loan modification. We’re here to support you every step of the way.

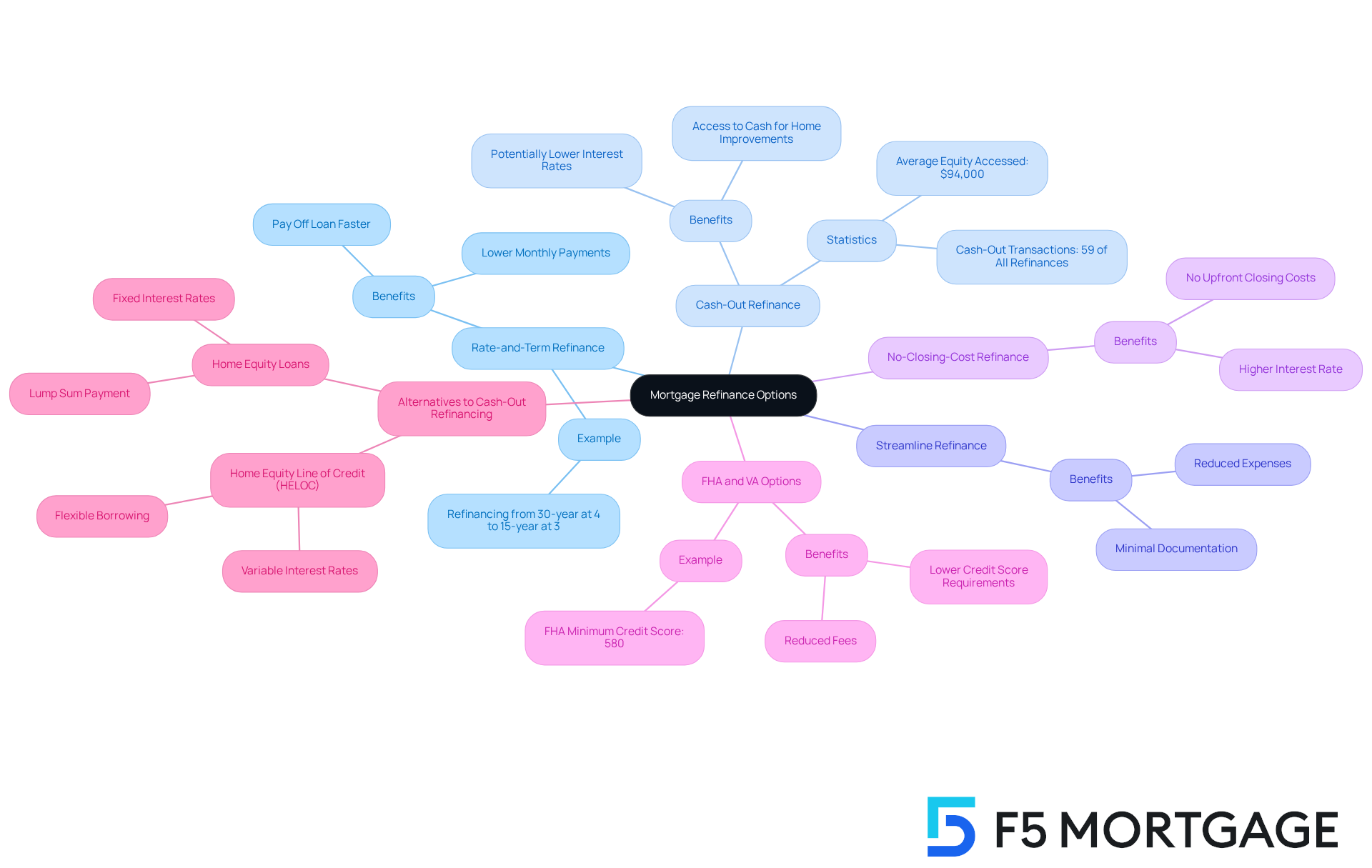

Exploring Different Types of Mortgage Refinance Options

Mortgage refinancing provides several home refinance options tailored to meet your unique financial needs.

- Home refinance options such as Rate-and-Term Refinance allow you to adjust your interest rate and/or the term of your existing mortgage without extracting additional cash. It’s particularly beneficial for those wanting to reduce monthly payments or pay off their loan faster. For instance, if you refinance from a 30-year loan at 4% to a 15-year loan at 3%, you could save significantly on interest over the life of the loan.

One of the home refinance options is Cash-Out Refinance, which allows you to refinance for an amount greater than your existing loan balance, receiving the difference in cash. This is ideal for funding home improvements that can enhance your property’s value and equity. In recent years, cash-out refinances have made up a significant portion of all refinance transactions, with borrowers accessing an average of $94,000 in equity. For example, if your home is valued at $350,000 and you have a $200,000 loan, you could refinance to a new loan of $250,000, allowing you to use $50,000 for renovations. Additionally, if you purchased your home with a traditional financing method and put down less than 20%, you might be able to eliminate private mortgage insurance (PMI) by securing a new mortgage, especially with the high home appreciation rates in California. However, it’s essential to consider potential risks, such as an increased debt burden and the obligation to pay closing costs, which could impact your overall financial stability.

Home refinance options, such as the Streamline Refinance specifically designed for FHA and VA mortgages, simplify the refinancing process with minimal documentation and often reduced expenses. It’s perfect for borrowers seeking to lower their interest rates without the hassle of extensive paperwork.

One of the home refinance options is the no-closing-cost refinance, which allows you to refinance without upfront closing costs, although it may result in a higher interest rate. It’s advantageous if you wish to avoid immediate expenses while still benefiting from a refinance.

FHA and VA home refinance options provide unique benefits, such as lower credit score criteria (minimum credit score of 580 for FHA programs) and reduced fees, making them accessible to a wider range of borrowers. FHA mortgages also require two insurance premiums: an upfront premium of 1.75% of the mortgage amount and an annual premium ranging from 0.45% to 0.85%. Residents of Colorado can particularly benefit from these options, which often have less strict eligibility requirements compared to traditional financing.

- Alternatives to Cash-Out Refinancing: It’s also wise to consider alternatives like Home Equity Lines of Credit (HELOCs) and home equity loans, which may provide faster and more affordable ways to access your home equity.

Choosing the right loan modification method should align with your personal financial goals, whether it’s exploring home refinance options to reduce monthly payments, obtaining cash for home improvements, or simplifying the refinancing process. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

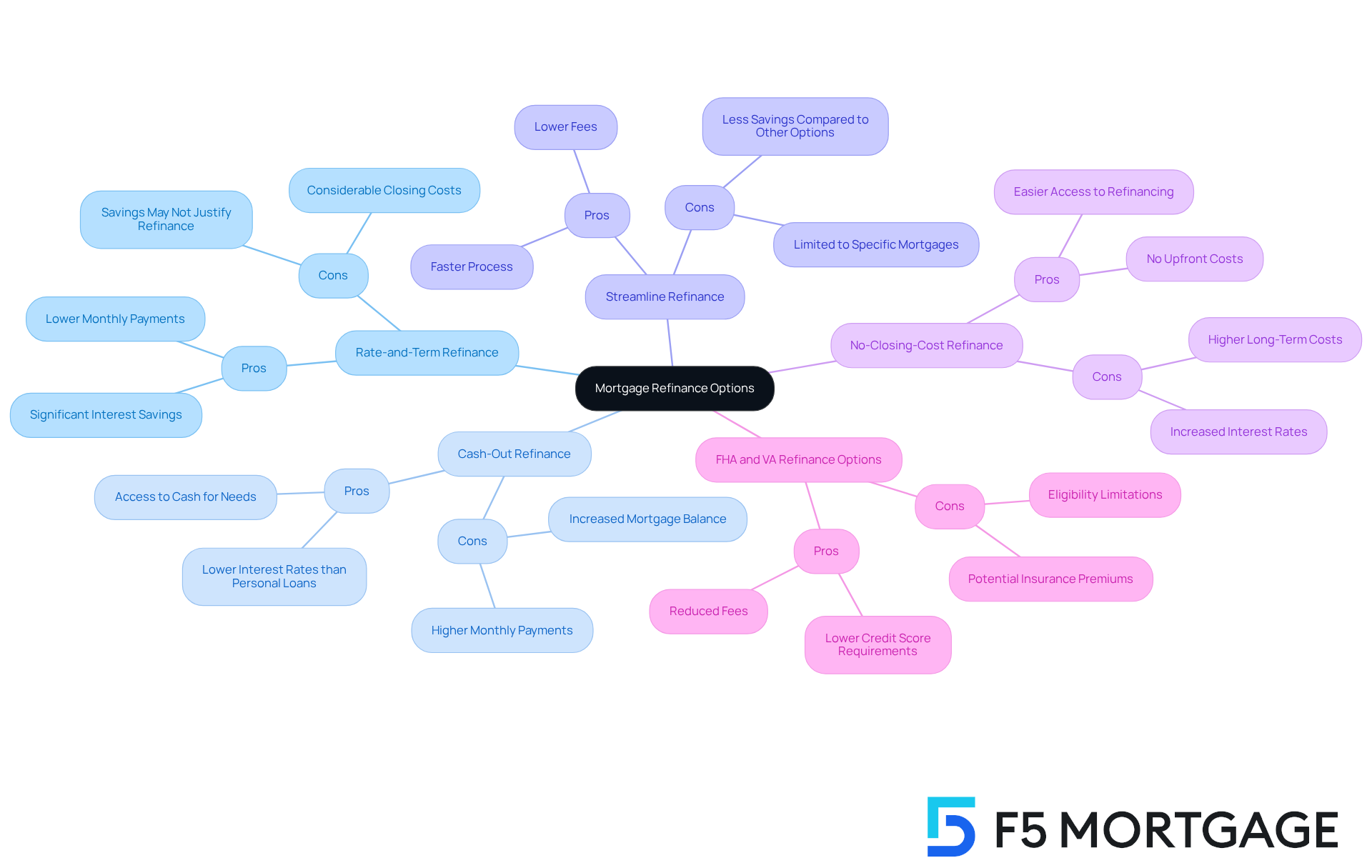

Evaluating the Pros and Cons of Each Refinance Option

Refinancing your mortgage can feel overwhelming, but understanding your options can help ease your concerns. Each refinancing choice comes with its own set of advantages and disadvantages that we want to share with you.

Rate-and-Term Refinance: This option can lead to lower monthly payments and significant interest savings, especially if you’re moving from an adjustable-rate to a fixed-rate mortgage. However, it’s important to consider that closing costs can still be considerable. If the new rate isn’t significantly lower, the potential savings may not justify the refinance.

Cash-Out Refinance: This option allows homeowners to access cash for important needs like home improvements or debt consolidation, often at lower interest rates than personal loans. Given the rise in home values, leveraging your home equity can be a wise choice. On the flip side, this option does raise your mortgage balance, which could lead to higher monthly payments and an extended repayment period. Additionally, closing costs typically range from 2% to 5% of the mortgage amount, contributing to overall expenses.

Streamline Refinance: If you’re looking for a faster process, this option requires less documentation and often results in lower fees. However, keep in mind that it’s limited to specific types of credit, such as FHA or VA mortgages, and may not yield as much savings compared to other restructuring options.

No-Closing-Cost Refinance: This option can save you on upfront costs, making refinancing more accessible without immediate financial strain. Yet, be aware that higher interest rates may lead to increased long-term costs, potentially resulting in you paying more over the life of the loan.

FHA and VA Refinance Options: These options often feature lower credit score requirements, reduced fees, and flexible terms, making them appealing for eligible borrowers. However, there are eligibility limitations, and you may still face insurance premiums that can increase your monthly payments.

We know how challenging this can be, but understanding these options is the first step toward making a decision that feels right for you. We’re here to support you every step of the way as you navigate this process.

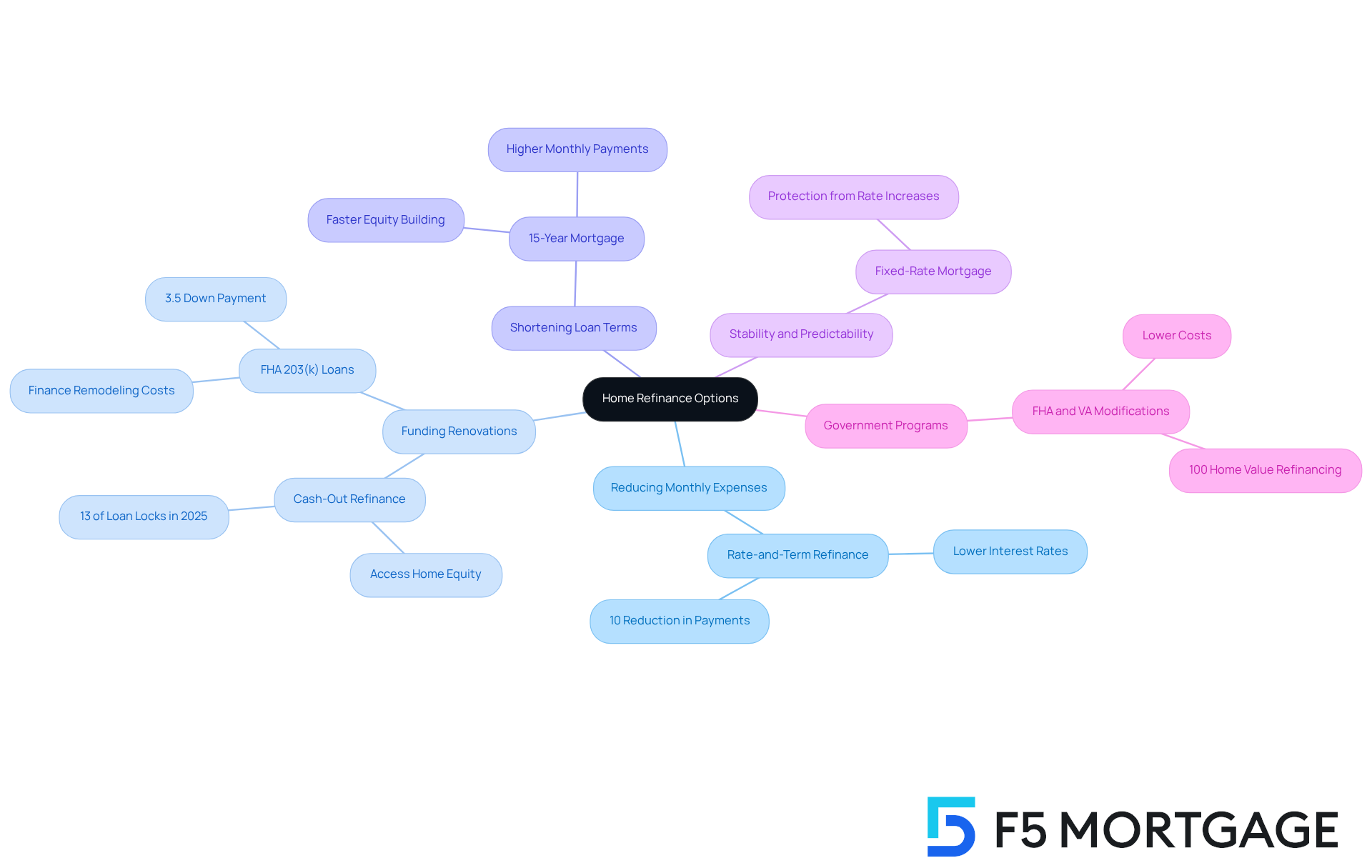

Aligning Refinance Options with Your Financial Goals

Aligning home refinance options with your financial goals requires thoughtful consideration of your unique circumstances.

If you’re focused on reducing monthly expenses, considering home refinance options like a rate-and-term refinance could be a great fit. Securing a significantly lower interest rate can make a real difference. Just a 1 percentage point decline in loan rates can decrease monthly payments by about 10%, making this an appealing choice for many families.

For those seeking funds for renovations or debt consolidation, exploring home refinance options like a cash-out refinance might be beneficial. This option allows you to tap into your home equity while potentially lowering the interest rate on your current loan. In 2025, cash-out refinancing accounted for roughly 13% of all loan locks, highlighting its popularity among homeowners looking to enhance their living spaces. However, keep in mind that the average cost to refinance, which ranges from 2% to 5% of the total amount borrowed, can significantly impact your financial planning when considering home refinance options.

Shortening Loan Terms: If your goal is to pay off your home loan more quickly, considering home refinance options such as a rate-and-term refinance that reduces the loan term can help you build equity faster and lower overall interest costs. For instance, switching from a 30-year to a 15-year loan can greatly improve equity accumulation, although it may come with higher monthly payments.

Stability and Predictability: If you’re worried about fluctuating interest rates, opting for a fixed-rate mortgage through an adjustment might bring you peace of mind. This choice provides stability in your monthly payments, protecting you from potential rate increases in the future.

Government Programs: If you’re eligible, consider exploring FHA and VA loan modification options. These programs often offer unique advantages, like lower costs and more lenient qualification criteria. For example, VA programs can allow for restructuring up to 100% of your home’s worth without needing equity, making them an attractive option for many.

Ultimately, it’s essential to assess your current financial situation, future objectives, and how exploring home refinance options could impact your overall financial health before making a decision. As Bryan Dornan, Chief Editor of RefiGuide.org, wisely notes, “The best time to refinance is when it aligns with your goals and financial situation.” Additionally, remember to factor in typical closing costs associated with refinancing, which can range from 2-6% of the loan amount, as these can significantly influence the overall implications of your refinancing decision. We’re here to support you every step of the way.

Conclusion

Exploring home refinance options is a thoughtful way to enhance your financial stability and align your mortgage terms with your family’s goals. We understand how overwhelming this process can be. By grasping the various refinancing methods available, homeowners like you can make informed choices that best suit your unique financial situation. It’s important to consider key concepts such as Loan-to-Value Ratio, equity, and closing costs, as these play a critical role in determining the most beneficial refinancing path.

Consider the benefits of different refinancing options:

- Rate-and-Term Refinance can help you achieve lower monthly payments

- Cash-Out Refinance allows you to access your home equity

- Streamline Refinance offers a simplified process

Each option has its own set of pros and cons, so it’s essential to evaluate how these choices align with your long-term financial objectives. Additionally, exploring government programs like FHA and VA loans can reveal accessible paths for many borrowers.

Ultimately, the decision to refinance should be guided by a clear understanding of your personal financial goals and the implications of each option. We encourage you to assess your current situation and future aspirations carefully. This ensures that your refinancing choice not only meets your immediate needs but also supports your overall financial health. Embracing the right refinancing strategy can lead to significant savings and a more secure financial future for your family. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is mortgage refinancing?

Mortgage refinancing involves substituting your existing mortgage with a new financial arrangement, often to secure better conditions such as a lower interest rate or a more manageable repayment period.

What does Loan-to-Value Ratio (LTV) mean?

LTV compares your loan amount to the appraised value of your property. A lower LTV indicates less risk to lenders and can lead to more favorable refinancing options. As of 2025, the average LTV ratio for refinanced loans is below 80%.

What is equity in the context of mortgage refinancing?

Equity is the difference between your home’s market value and the outstanding mortgage balance. It can be utilized for cash-out options, providing access to funds for other investments or expenses.

Why are home inspections necessary before refinancing?

Home inspections ensure that your home is in good condition before fully approving a refinance. Significant structural issues can complicate the approval process.

What are closing costs associated with refinancing?

Closing costs are charges related to obtaining a new mortgage, typically ranging from 2% to 5% of the principal amount. They may include appraisal fees, title insurance, and origination fees.

What is the break-even point in mortgage refinancing?

The break-even point indicates the time it takes for the savings from a lower interest rate to offset the closing expenses of the loan adjustment. It helps determine if restructuring aligns with your financial goals.

How can LTV impact loan restructuring?

A favorable LTV can enhance your home refinance options. For example, a couple with a property valued at £3,000,000 and an existing mortgage of £1,000,000 secured better mortgage terms due to their low LTV.

What steps should I take before applying for a loan modification?

It is recommended to review your credit score and take steps to enhance it before submitting an application for a loan modification.