Overview

Calculating your $400,000 mortgage payment can feel overwhelming, but we’re here to support you every step of the way. It’s important to consider key components such as:

- The principal loan amount

- Interest rate

- Loan term

- Property taxes

- Homeowners insurance

- Possibly private mortgage insurance (PMI)

By understanding these elements, you can avoid underestimating your financial obligations.

This article provides a step-by-step formula to help you accurately determine your monthly payment. We know how challenging this can be, but including all relevant costs ensures you have a clear picture of your financial responsibilities. Let’s take this journey together and empower you to make informed decisions about your mortgage.

Introduction

Understanding the intricacies of mortgage payments can feel overwhelming, especially when considering significant amounts like a $400,000 mortgage. We know how challenging this can be. This guide aims to simplify the process by breaking down the key components—principal, interest, taxes, and insurance—so that you can confidently calculate your monthly payments.

With rising interest rates and various calculation pitfalls, you may wonder: how can you ensure you are accurately assessing your financial commitments? We’re here to support you every step of the way.

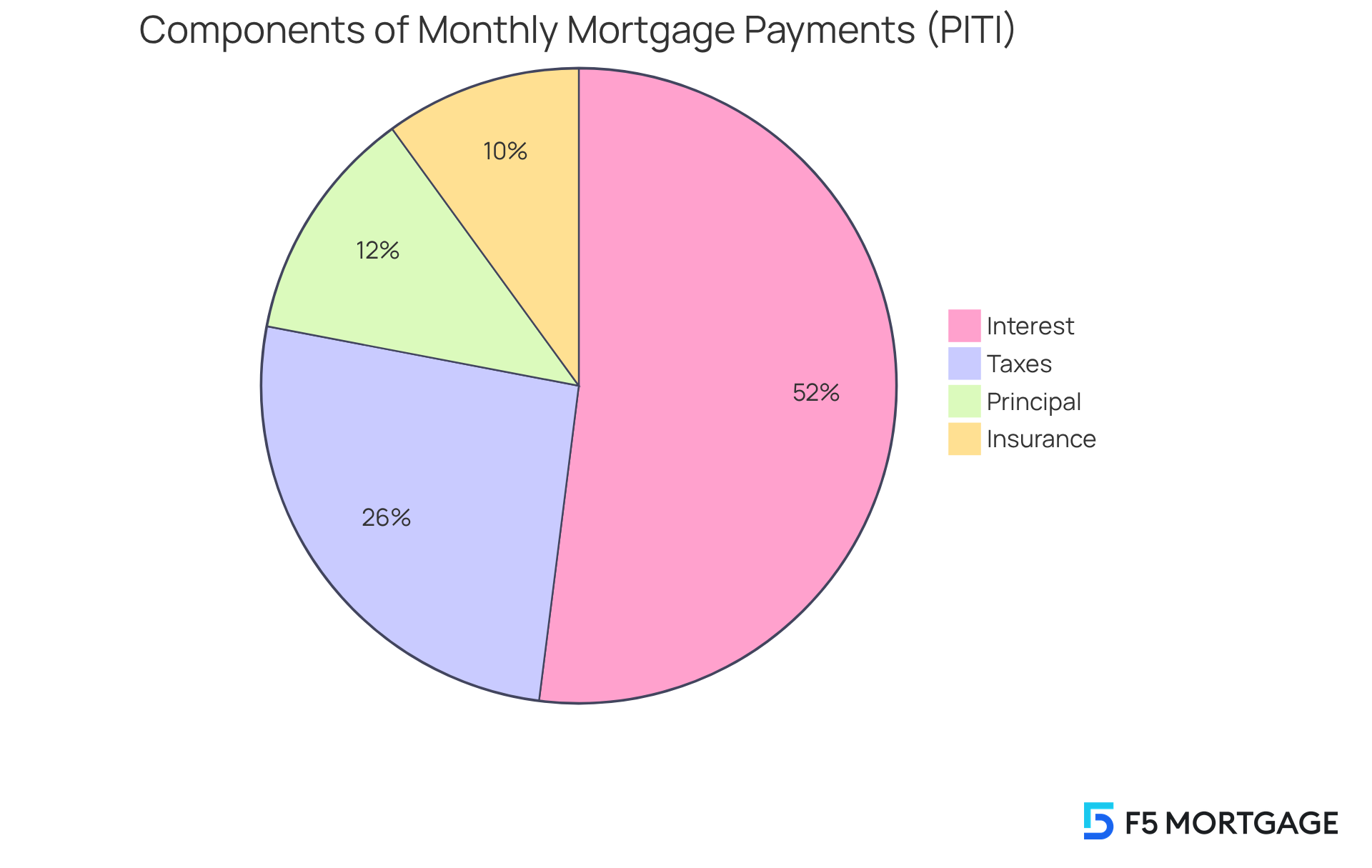

Understand Mortgage Payment Basics

Mortgage installments generally consist of four key components: principal, interest, taxes, and insurance—collectively referred to as PITI. Understanding these elements is crucial for your journey:

- Principal: This is the amount you borrow from the lender to purchase your home.

- Interest: This represents the cost of borrowing that principal, expressed as a percentage of the loan amount.

- Taxes: Property taxes are often included in your monthly payments and can vary based on your location.

- Insurance: Homeowners insurance safeguards against damages to your property and is frequently required by lenders.

We know how challenging this can be, but by familiarizing yourself with these terms, you will feel more empowered to calculate your loan installment accurately. Remember, we’re here to support you every step of the way.

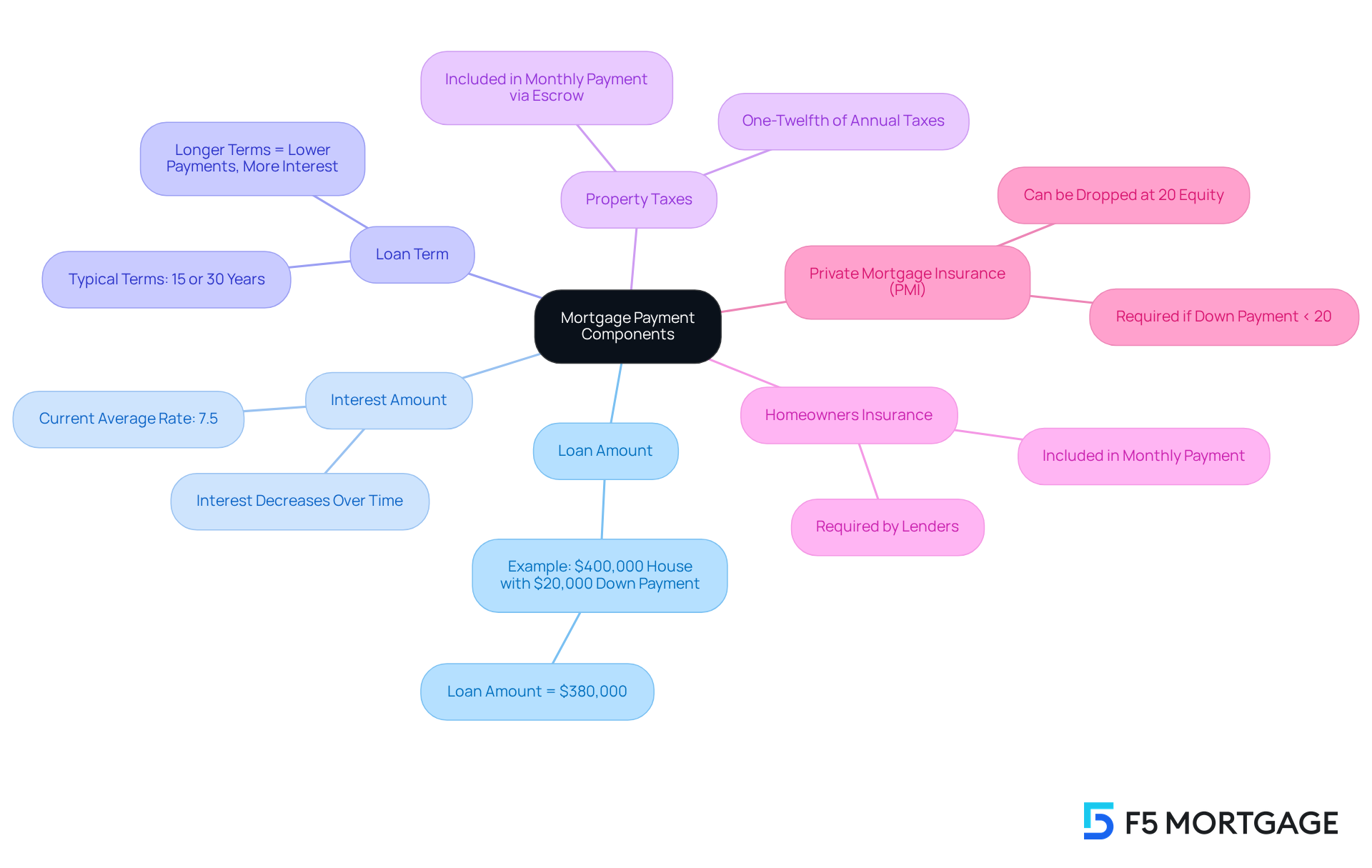

Identify Key Components of Your Mortgage Payment

To accurately calculate your mortgage payment, we know how essential it is to identify a few key components that can feel overwhelming at first:

- Loan Amount (Principal): This is the total amount you are borrowing. For instance, if you’re looking at a house that involves a 400,000 mortgage payment with a $20,000 down payment, your loan amount would be $380,000.

- Interest Amount: This refers to the annual percentage rate (APR) that the lender applies for borrowing the funds. As of July 2025, the average interest rate for a 30-year fixed loan is approximately 7.5%, reflecting current market trends. It’s important to note that the interest component of your loan installment decreases over time as you pay down the principal.

- Loan Term: This is the duration over which you will repay the loan, typically 15 or 30 years. While longer terms can lead to lower monthly payments, they also result in more interest paid over time.

- Property Taxes: These are assessed annually and can be divided into regular installments, often included in your mortgage payment via an escrow account. An escrow account helps manage these expenses, ensuring that property taxes and homeowners insurance premiums are paid on time, which can prevent unexpected large costs.

- Homeowners Insurance: This protects your home and belongings and is frequently required by lenders. A portion of the yearly premium is included in your monthly payment.

- Private Mortgage Insurance (PMI): If your down payment is less than 20%, PMI may be necessary to protect the lender in case of default. This cost is also part of your monthly payment.

Understanding these elements provides a clearer picture of your home financing costs, empowering you to make informed financial decisions as you navigate the home buying journey. As AGCU states, “Comprehending the elements of your loan, how contributions are calculated, and strategies for managing them can assist you in making informed choices.” Remember, homeownership is often seen as a powerful tool for securing financial futures, making it crucial to grasp these components.

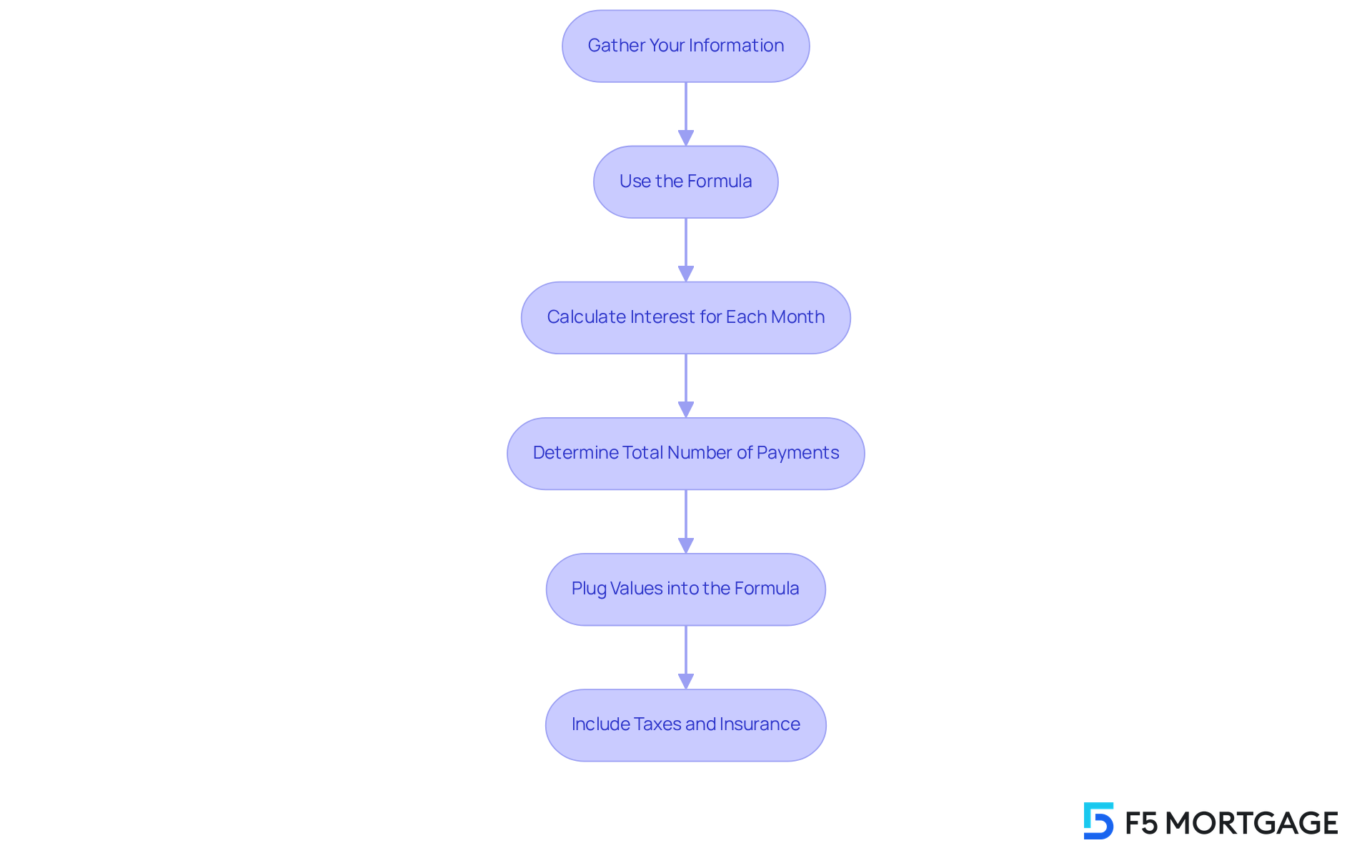

Calculate Your Monthly Payment: A Step-by-Step Guide

Calculating your monthly mortgage payment can feel overwhelming, but we’re here to help you through it. Let’s break it down into manageable steps:

-

Gather Your Information: Start by collecting essential details such as the loan amount, interest percentage, loan term, property taxes, homeowners insurance, and PMI if applicable. Knowing this information is the first step toward clarity.

-

Use the Formula: The formula for calculating your monthly mortgage payment (M) is:

M = P[r(1 + r)^n] / [(1 + r)^n - 1]Where:

- M = total monthly mortgage payment

- P = the principal loan amount

- r = monthly interest rate (annual rate divided by 12)

- n = number of payments (loan term in years multiplied by 12)

-

Calculate Interest for Each Month: Convert your annual interest percentage to a monthly percentage by dividing by 100 and then by 12. For instance, if your annual rate is 6%, your monthly rate would be 0.005 (6/100/12). This step is crucial for understanding your costs.

-

Determine Total Number of Payments: Multiply the number of years in your loan term by 12. For a 30-year mortgage, this means you’ll have 360 payments to consider.

-

Plug Values into the Formula: Substitute your values into the formula to calculate M. This gives you the base charge, which is a key figure in your budgeting.

-

Include Taxes and Insurance: Don’t forget to factor in property taxes and insurance. Divide their yearly amounts by 12 and add them to your monthly payment. For example, if your yearly property tax is $2,400, your monthly tax would be $200.

By following these steps, you can accurately determine your 400,000 mortgage payment, which is essential for making informed decisions about your home financing options. With rising interest rates leading to increased costs—over 60% since late 2021—understanding this calculation is more important than ever for prospective homebuyers.

We know how challenging this can be, so also consider assessing your financial readiness, including your credit score and debt-to-income ratio, before making a purchase. Using a loan calculator can further assist you in estimating your monthly costs based on various factors, ensuring you feel well-prepared for your home financing journey. Remember, we’re here to support you every step of the way.

Troubleshoot Common Mortgage Calculation Issues

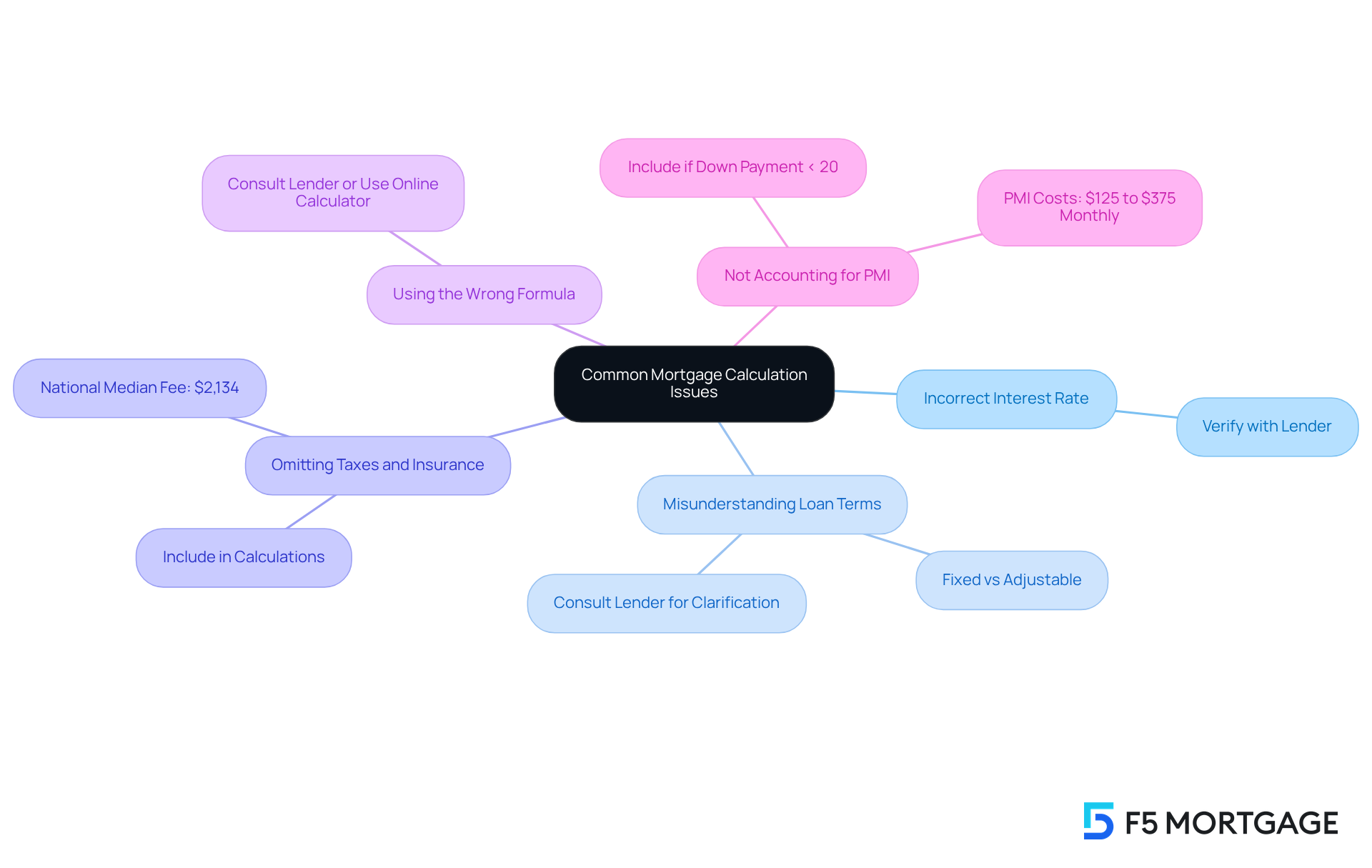

When calculating your mortgage payment, we understand how challenging this can be, and several common issues may arise that can lead to inaccuracies:

- Incorrect Interest Rate: Always verify that you are using the correct annual interest rate. If you’re uncertain, we’re here to support you—consult your lender for clarification.

- Misunderstanding Loan Terms: It’s essential to comprehend whether your loan is fixed or adjustable. This distinction greatly affects your calculation of costs. In fact, a significant percentage of borrowers misunderstand their loan terms, which can lead to costly mistakes.

- Omitting Taxes and Insurance: Ensure you include property taxes and homeowners insurance in your calculations. Neglecting these can lead to an underestimation of your monthly cost. The national median fee for loan applicants rose to $2,134 in January, emphasizing the significance of precise calculations.

- Using the Wrong Formula: Different loan types require specific formulas. If you’re uncertain, consult with your lender or use an online loan calculator to ensure accuracy.

- Not Accounting for PMI: If your down payment is below 20%, remember to include Private Mortgage Insurance (PMI) in your calculations, as this can significantly increase your monthly expense.

As Sam Khater, Chief Economist at Freddie Mac, points out, grasping these calculations is essential in today’s market, where loan rates are expected to stabilize between 6 to 7%. By being mindful of these common pitfalls, you can troubleshoot effectively and ensure that your calculations for the 400,000 mortgage payment are precise. This knowledge empowers you to make informed financial decisions, and we’re here to guide you every step of the way.

Conclusion

Understanding the intricacies of calculating a mortgage payment, especially for a significant amount like $400,000, can feel overwhelming for prospective homeowners. We know how challenging this can be, but by grasping the fundamental components—principal, interest, taxes, and insurance—you can navigate your financial commitments with confidence and clarity.

This guide has provided a comprehensive breakdown of the key elements involved in mortgage payments, emphasizing the importance of accurate calculations. From identifying the loan amount and interest rates to understanding the role of property taxes and insurance, each step plays a crucial role in determining your monthly payment. Additionally, we’ve addressed common pitfalls that can lead to miscalculations, ensuring that you are well-equipped to avoid these mistakes.

Ultimately, being informed about your mortgage payment is not just about crunching numbers; it is about making empowered financial decisions that can impact your future. As the housing market continues to evolve, staying educated on mortgage calculations will help you secure the best possible terms for your home financing. Take the time to utilize mortgage calculators and consult with professionals—we’re here to support you every step of the way—as you make the most informed choices on your path to homeownership.

Frequently Asked Questions

What are the main components of a mortgage payment?

The main components of a mortgage payment are principal, interest, taxes, and insurance, collectively known as PITI.

What does ‘principal’ refer to in a mortgage?

The principal is the amount you borrow from the lender to purchase your home.

What is the role of ‘interest’ in a mortgage payment?

Interest represents the cost of borrowing the principal, expressed as a percentage of the loan amount.

How do property taxes affect mortgage payments?

Property taxes are often included in your monthly payments and can vary based on your location.

Why is homeowners insurance important in a mortgage?

Homeowners insurance safeguards against damages to your property and is frequently required by lenders.