Overview

Buying down an interest rate can be a wise choice for many families. This involves paying upfront fees, known as discount points, to lower your mortgage costs. While it may seem like a significant expense initially, this strategy can lead to substantial savings over the life of your loan.

We know how challenging it can be to navigate these decisions. That’s why it’s essential to assess your financial situation carefully. Start by:

- Calculating potential savings

- Understanding your break-even point

This will empower you to make an informed decision that aligns with your family’s needs.

In this article, we’ll guide you through a step-by-step process to evaluate this strategy effectively. By taking the time to understand your options, you can feel confident in your choices and secure a brighter financial future for your family.

Introduction

Navigating the complexities of mortgage financing can feel overwhelming. We understand how challenging it is to find ways to effectively reduce borrowing costs. One powerful strategy homeowners can consider is buying down their interest rate through upfront payments known as discount points. This approach not only has the potential to lower monthly payments but can also lead to significant savings over the life of the loan.

However, the decision to buy down an interest rate raises important questions:

- Is the initial investment worth it?

- How can homeowners ensure they maximize their financial benefits?

We’re here to support you every step of the way as you explore these options.

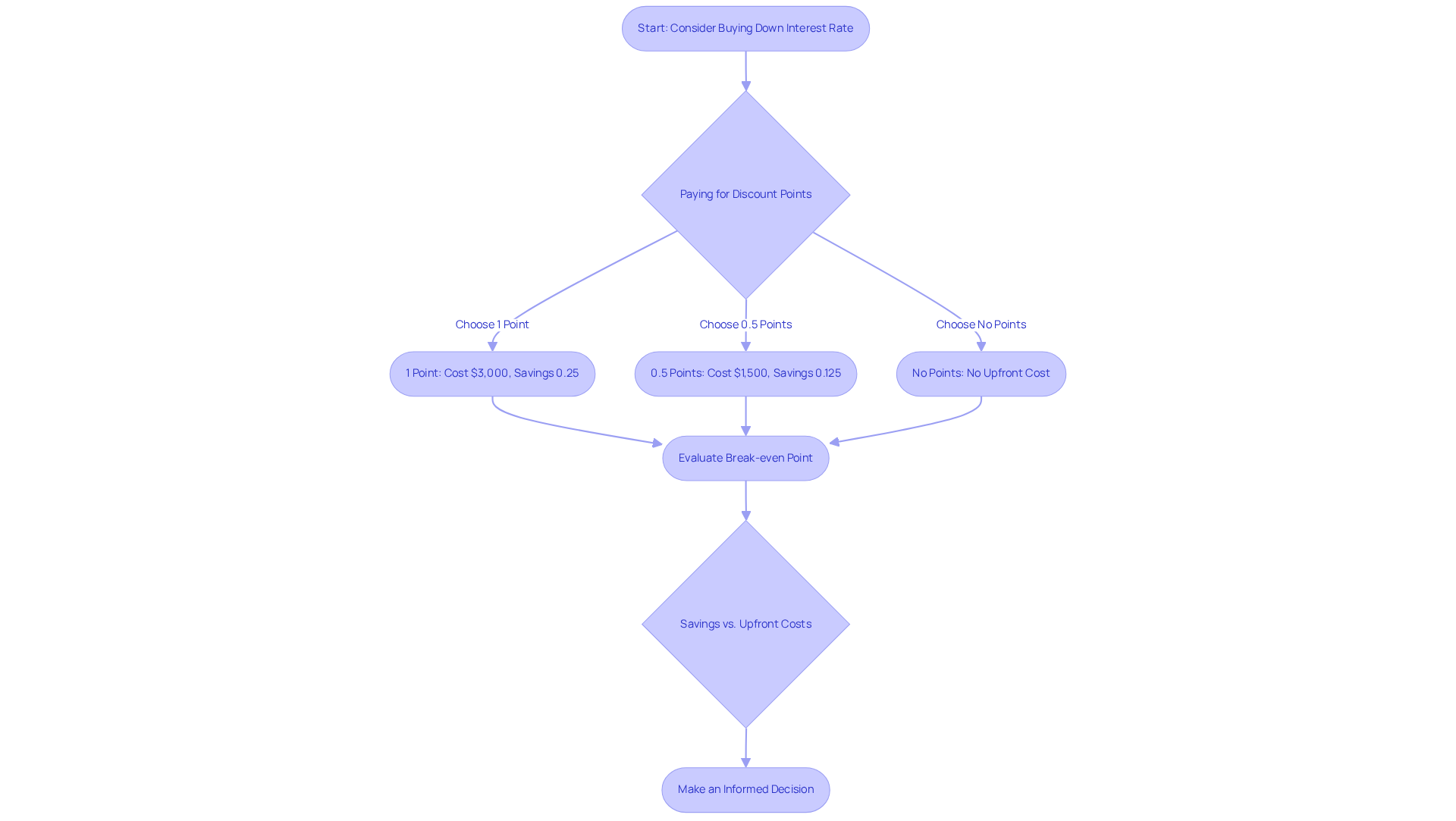

Understand the Concept of Buying Down an Interest Rate

Purchasing a lower cost can often feel overwhelming, but understanding the process can make it easier. By paying upfront fees, known as discount points, you can effectively decrease the cost of your loan. Each point typically costs 1% of the loan amount and can reduce your borrowing costs by about 0.25%. For instance, on a $300,000 mortgage, buying down interest rate by purchasing one point for $3,000 could lower your interest rate from 4.5% to 4.25%.

Additionally, paying half a point (0.5%) usually lowers the cost by 0.125%. This detailed insight helps you see how different amounts of discount points can influence your overall borrowing costs. This strategy can lead to significant savings over the life of your loan, especially if you plan to stay in your home for a long time. It’s essential to weigh the upfront cost against the potential long-term savings on your monthly payments and total interest paid.

Understanding the break-even point—when your savings from the reduced rate surpass the cost of the points—can also assist in your decision-making. For example, if buying down interest rate by purchasing three points costs $9,000 and reduces your rate by 0.75%, the monthly savings could justify this initial investment, particularly if you intend to remain in the home for several years.

Moreover, consider that sellers may be willing to pay for discount points, which can significantly lower your upfront costs, especially in a competitive market. Evaluating your cash situation is crucial when deciding whether to pay for discount points upfront or to include them in your loan. This thoughtful approach not only enhances affordability but also empowers you to make more competitive offers in a tight housing market. We understand how challenging this can be, and we’re here to support you every step of the way.

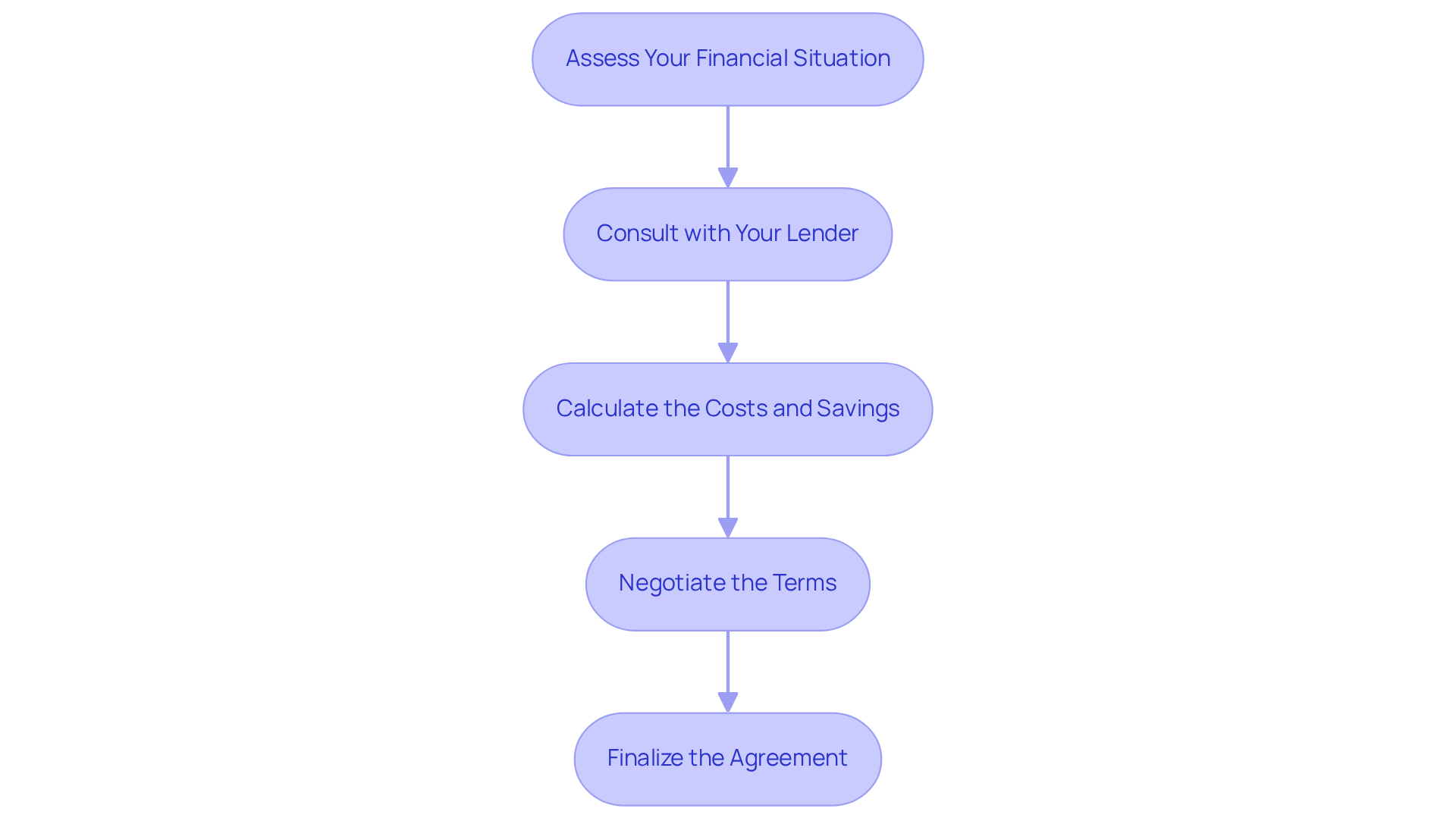

Follow the Step-by-Step Process to Buy Down Your Interest Rate

-

Assess Your Financial Situation: We know how challenging it can be to navigate your financial health. Start by evaluating your credit score, debt-to-income ratio, and how long you plan to own your home. Understanding these factors is crucial in determining if buying down interest rate is a suitable option for your loan.

-

Consult with Your Lender: Engage in a conversation with your mortgage provider about the possibility of reducing your borrowing costs. Inquire about the number of points available for buying down interest rate and how they can help reduce your interest rate. Additionally, explore possible contributions from sellers or builders that could help cover the costs of the reduction.

-

Calculate the Costs and Savings: Utilize a mortgage calculator to compare your monthly payments with and without the reduction. It’s essential to determine the breakeven point, which shows how long it will take to recover the upfront costs through savings. This calculation is key to ensuring that the financial adjustment is worthwhile.

-

Negotiate the Terms: If you decide to move forward, negotiate the terms with your lender. Make sure you fully understand all fees related to the payment reduction and confirm the final interest rate when it comes to buying down interest rate to avoid any surprises. Remember, while reduced rates can lead to lower monthly payments and potential tax benefits, they may also require an initial fee and could result in higher payments once the temporary reduction period ends.

-

Finalize the Agreement: After reaching an agreement on the terms, finalize the mortgage contract, ensuring that the details of the buydown are clearly documented within the loan terms. We’re here to support you every step of the way.

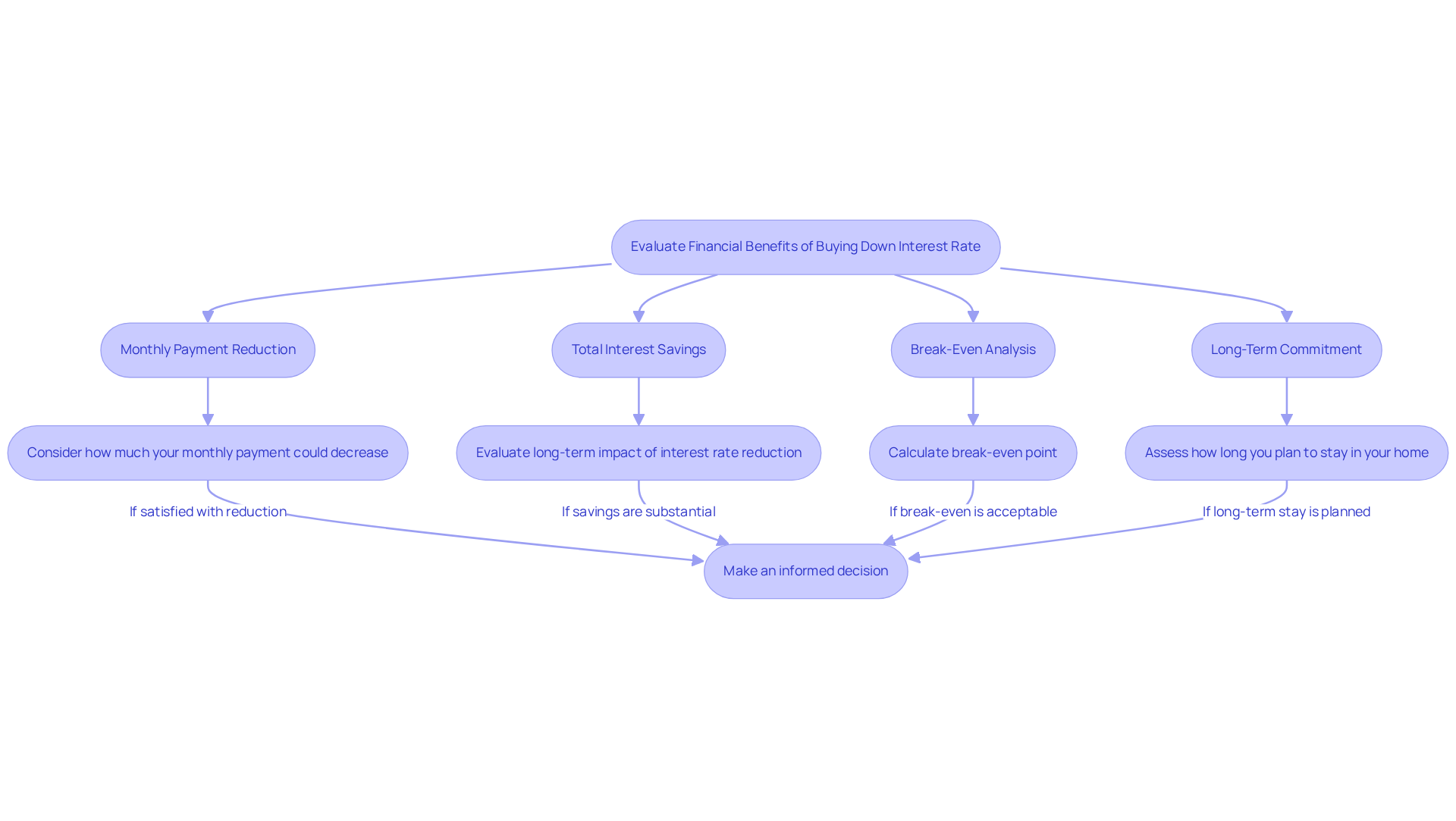

Evaluate the Financial Benefits of Buying Down Your Interest Rate

To evaluate the financial benefits of buying down your interest rate, let’s explore some important aspects together:

-

Monthly Payment Reduction: Have you considered how much your monthly payment could decrease with a lower interest rate? For example, if you lower your interest from 4.5% to 4.0% on a $400,000 loan, you could see a monthly payment reduction of about $117. This can make a significant difference in managing your budget more comfortably.

-

Total Interest Savings: It’s essential to think about the long-term impact of even a small reduction in interest rates. Over the life of a 30-year mortgage, spending $8,000 to lower your rate from 4.5% to 4.0% could lead to total expenses of $84,370 after five years, compared to $86,236 at 4.5%. This highlights the potential for substantial savings over time, which can be quite empowering.

-

Break-Even Analysis: Understanding how long it will take to recover your initial investment through monthly savings is crucial. If the cost of buying down interest rate is $2,000 and you save $50 each month, your break-even point would be 40 months, or just over 3 years. By dividing the total cost of the points by your monthly savings, you can see how this timeline fits into your plans. We know how challenging this can be, so it’s important to have clarity.

-

Long-Term Commitment: Finally, consider how long you plan to stay in your home. If you think you might move before reaching the break-even point, it may not be the best financial decision for you when it comes to buying down interest rate. For instance, if you’re planning to sell within three years, the upfront investment in a buydown may not yield enough savings to justify the cost. We’re here to support you every step of the way as you navigate these decisions.

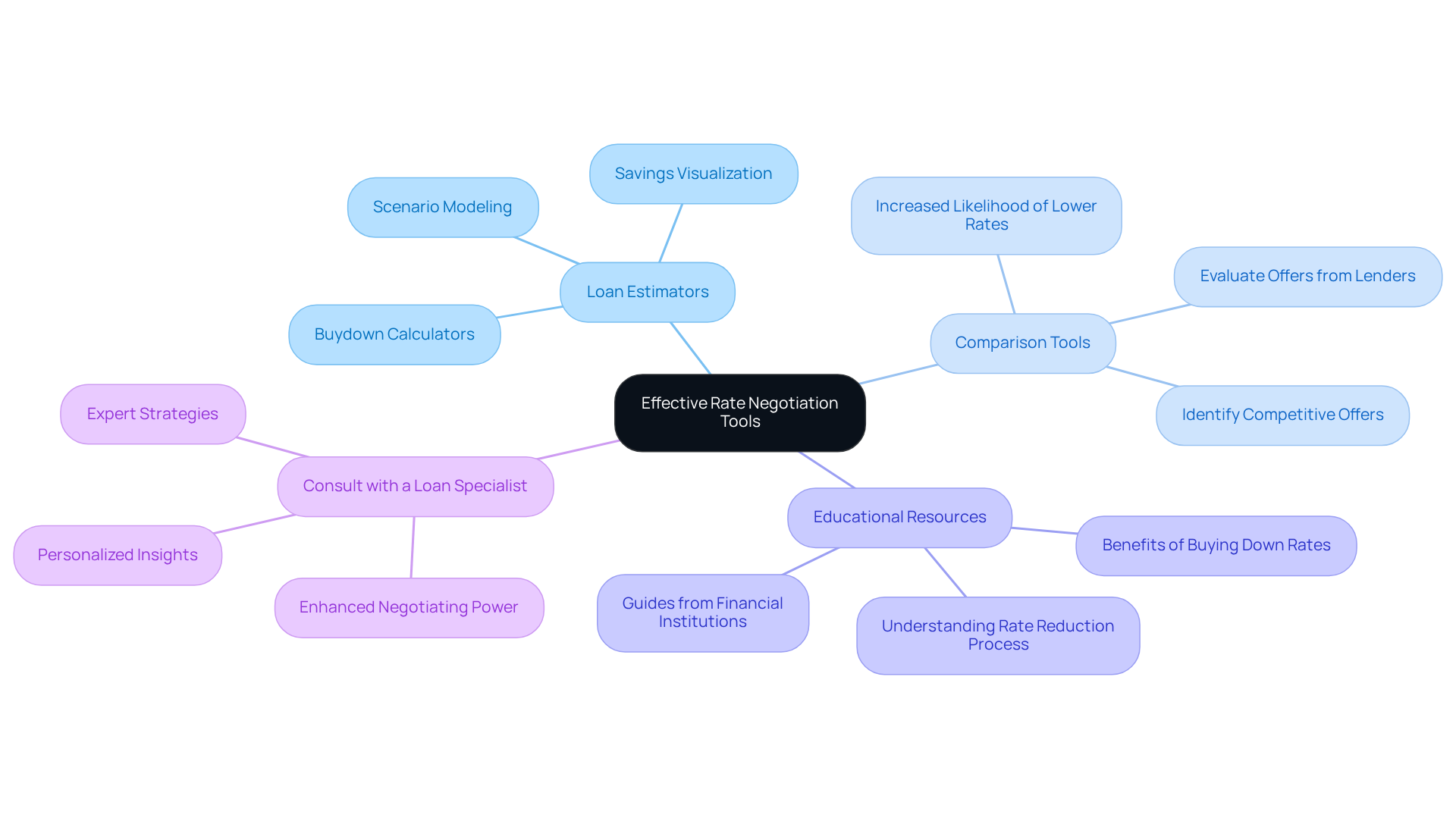

Access Tools and Resources for Effective Rate Negotiation

Navigating the mortgage process can feel overwhelming, but we’re here to support you every step of the way. To effectively negotiate your mortgage rate and explore the option of buying down your interest rate, consider utilizing these helpful tools and resources:

-

Loan Estimators: Internet-based loan estimators are essential for modeling different scenarios, such as the impact of purchasing a lower interest amount. Many platforms provide specific buydown calculators that help visualize potential savings, allowing you to make informed decisions. Research by Zillow shows that utilizing mortgage calculators can assist purchasers in saving an average of $30,000 throughout the duration of their loan by pinpointing improved options.

-

Comparison Tools: Websites that allow you to evaluate offers from various lenders empower you in negotiations and help identify the most competitive offers available in the market. Recent reports indicate that borrowers who use comparison tools are 20% more likely to secure lower rates than those who do not.

-

Educational Resources: Access articles and guides from reputable financial institutions that explain the mortgage rate reduction process and its benefits in detail. For example, PNC Insights offers extensive resources that explain how a buydown can greatly lessen your total loan expenses.

-

Consult with a Loan Specialist: Working with a knowledgeable loan specialist can provide personalized insights and strategies tailored to your financial situation. Their expertise ensures you navigate the complexities of loan financing effectively, making informed decisions throughout the process. As noted by Hal Bundrick, a CFP® Senior Writer, consulting with a broker can provide critical insights that enhance your negotiating power.

By utilizing these tools, you can better understand the impact of buying down interest rate, which will help you secure a more favorable mortgage rate and ease some of the stress that comes with this important decision.

Conclusion

Understanding how to buy down an interest rate can significantly impact your financial decisions related to home financing. We know how challenging this can be, but by leveraging discount points and strategically evaluating options, you can lower your mortgage costs and enhance your overall affordability. This approach not only helps in achieving lower monthly payments but also contributes to substantial long-term savings. It’s a valuable consideration for those planning to stay in their homes for an extended period.

Key insights discussed in this article include:

- The importance of assessing your financial situation

- Consulting with lenders

- Calculating costs versus savings to determine the feasibility of buying down an interest rate

- Understanding the break-even point

- Utilizing available tools for negotiation

These factors can empower you to make informed decisions. By carefully weighing them, you can navigate the complexities of mortgage financing more effectively.

Ultimately, the decision to buy down an interest rate should be guided by your individual financial circumstances and long-term plans. Embracing this strategy not only enhances your potential for savings but also equips you with the knowledge necessary to negotiate better mortgage terms. Taking the time to explore these options and utilize available resources can lead to a more favorable financial outcome, reinforcing the significance of informed decision-making in the homebuying process. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What does it mean to buy down an interest rate?

Buying down an interest rate involves paying upfront fees, known as discount points, to decrease the cost of your loan. Each point typically costs 1% of the loan amount and can reduce your borrowing costs by about 0.25%.

How much does one discount point cost and how does it affect the interest rate?

One discount point costs 1% of the loan amount and can lower your interest rate by approximately 0.25%. For example, on a $300,000 mortgage, purchasing one point for $3,000 could reduce the interest rate from 4.5% to 4.25%.

What is the impact of paying half a point on the interest rate?

Paying half a point (0.5%) typically lowers the interest rate by about 0.125%.

How can buying down the interest rate lead to savings?

Buying down the interest rate can lead to significant savings over the life of your loan, especially if you plan to stay in your home for a long time. It’s important to weigh the upfront cost against the potential long-term savings on monthly payments and total interest paid.

What is the break-even point in this context?

The break-even point is when your savings from the reduced interest rate surpass the cost of the discount points. For instance, if buying down the interest rate by purchasing three points costs $9,000 and reduces your rate by 0.75%, the monthly savings may justify this initial investment if you plan to stay in the home for several years.

Can sellers contribute to the cost of discount points?

Yes, sellers may be willing to pay for discount points, which can significantly lower your upfront costs, especially in a competitive market.

What should you consider when deciding to pay for discount points?

It’s crucial to evaluate your cash situation when deciding whether to pay for discount points upfront or to include them in your loan. This approach can enhance affordability and empower you to make more competitive offers in a tight housing market.