Overview

Deciding between Georgia and Texas for your next home purchase can feel overwhelming, and we understand how challenging this can be. Each state has its own unique advantages and challenges that cater to different needs.

- Georgia is known for its affordability and diverse communities, making it an attractive option for many families.

- On the other hand, Texas boasts a lack of state income tax and a robust job market, which can be incredibly appealing.

As you consider your options, it’s crucial to weigh these factors against your personal preferences and financial situation. What matters most to you? Is it the cost of living, job opportunities, or the type of community you want to be part of? We’re here to support you every step of the way in making this important decision.

Ultimately, the best choice will depend on your individual needs and circumstances. Take your time to reflect on what you truly value in a home and community. By doing so, you’ll find the right place that feels like home for you and your family.

Introduction

As the housing markets in Georgia and Texas continue to evolve, we know how challenging it can be for prospective homeowners to make a pivotal decision in 2025. Both states present distinct advantages and challenges, from affordability and inventory levels to lifestyle and community factors.

With shifting buyer preferences and economic influences at play, you might be wondering which state truly stands out as the best option for homebuyers. This article delves into a comprehensive comparison of Georgia and Texas, exploring key metrics, pros and cons, and the unique offerings of each state to help you navigate this critical choice.

We’re here to support you every step of the way.

Overview of the Housing Markets in Georgia and Texas

As we approach mid-2025, the housing markets in Georgia and Texas are considered the best states to purchase a home, presenting unique characteristics that prospective homeowners should carefully consider, especially with the support of [F5 Mortgage’s tailored loan solutions](https://f5mortgage.com/loan-programs).

In Georgia:

- The average property value is around $335,963, reflecting a slight decline of 1.7% over the past year.

- This market is stabilizing, with urban and suburban areas experiencing different levels of demand.

- Notably, inventory has increased by nearly 15% year-over-year, reaching 49,244 listings.

- This shift indicates a potential move toward a buyer’s market, offering more choices for homebuyers.

We understand how important this process is, and F5 Mortgage is here to help you find the best mortgage rates and terms that fit your budget, along with refinancing options to lower your monthly payments and save money.

In Texas:

- The median property price stands at approximately $306,682, which has seen a decline of 2.2% over the same period.

- The market here is characterized by a significant stock of homes, which has risen by 30.7% from the previous year, particularly in urban areas like Dallas and Houston, where demand remains strong despite recent price fluctuations.

- The state currently has about 4.8 months of property inventory, indicating a balanced market that gives buyers additional time to make decisions.

- Homes in the Lone Star State are available for an average of 72 days, while in Georgia, the median days on the market is 71 days.

Both states are experiencing shifts in buyer preferences, influenced by economic factors and demographic trends. Experts expect that as interest rates stabilize—loan rates for a 30-year fixed mortgage in Georgia are currently around 6.961%, slightly below the national average—and as inventory increases, property prices in both Georgia and Texas are likely to remain stable throughout 2025.

With F5 Mortgage’s and user-friendly technology, families looking to enhance their homes can navigate these markets with confidence, making informed decisions that align with their financial goals. We know how challenging this can be, and understanding the mortgage approval process is essential. F5 Mortgage is here to support you every step of the way.

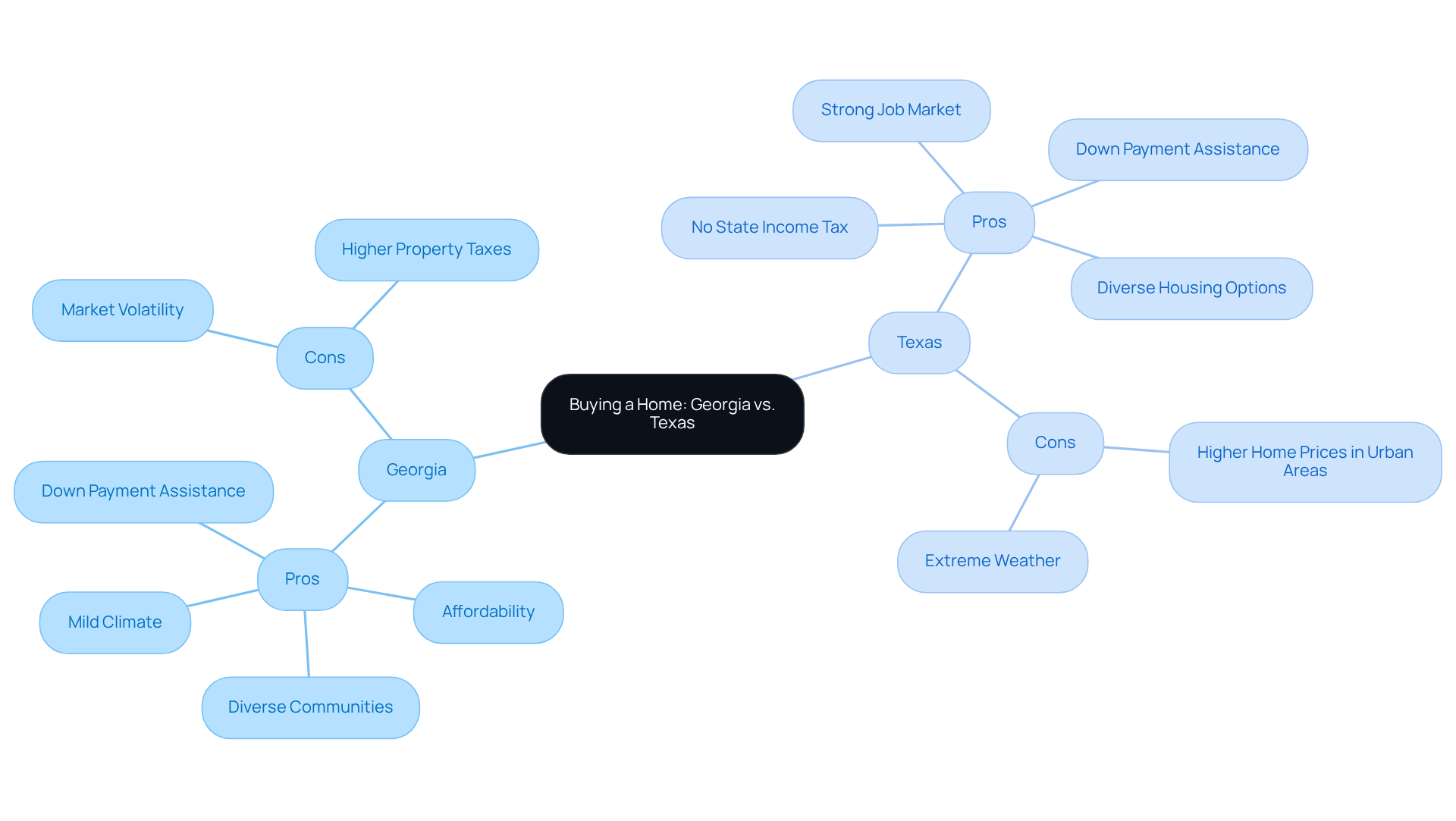

Pros and Cons of Buying a Home in Georgia vs. Texas

When exploring home acquisitions in Texas, it’s essential to recognize both the advantages and challenges that come into play, particularly because Texas is considered the best state to purchase a home, especially with the valuable down payment assistance programs offered by F5 Mortgage.

Georgia:

Pros:

- Affordability: We understand that budget is a significant concern for many families. With home prices in Georgia generally lower than the national average, it is considered one of the for those looking to stretch their dollars further.

- Diverse Communities: Georgia offers a rich mix of urban and rural environments, catering to a variety of lifestyles and preferences, ensuring there’s something for everyone.

- Mild Climate: The state enjoys favorable weather conditions throughout the year, which can enhance your overall living experience and comfort.

- Down Payment Assistance: Programs available can provide crucial support for buyers with little or no cash for down payments, making it the best state to purchase a home by allowing for more competitive offers and reduced mortgage payments, thus making homeownership more attainable for families like yours.

Cons:

- Market Volatility: It’s important to be aware that certain regions are experiencing price declines, which could affect long-term investment potential.

- Higher Property Taxes: Georgia’s property tax rates are generally higher than those in Texas, which may impact overall affordability for you and your family.

Texas:

Pros:

- No State Income Tax: Homeowners in Texas can enjoy significant savings due to the absence of a state income tax, allowing for greater disposable income to support your family’s needs.

- Strong Job Market: With a robust economy attracting new residents, Texas is recognized as the best state to purchase a home, driving demand for housing and contributing to property value stability—a reassuring factor for your investment.

- Diverse Housing Options: This state is considered the best state to purchase a home, offering a wide range of properties, from urban apartments to expansive ranches, ensuring there’s a perfect fit for your family’s needs.

- Down Payment Assistance: Just like in Georgia, assistance programs can help you secure your dream home sooner and with smaller loan amounts, making it easier to navigate the competitive housing market in the best state to purchase a home.

Cons:

- Higher Home Prices in Urban Areas: Major cities like Austin and Dallas can present steep home prices, which may pose a challenge for some buyers.

- Extreme Weather: Texas is susceptible to severe weather events, including hurricanes and tornadoes, which can be concerning for homeowners.

We know how challenging this process can be, but we’re here to support you every step of the way.

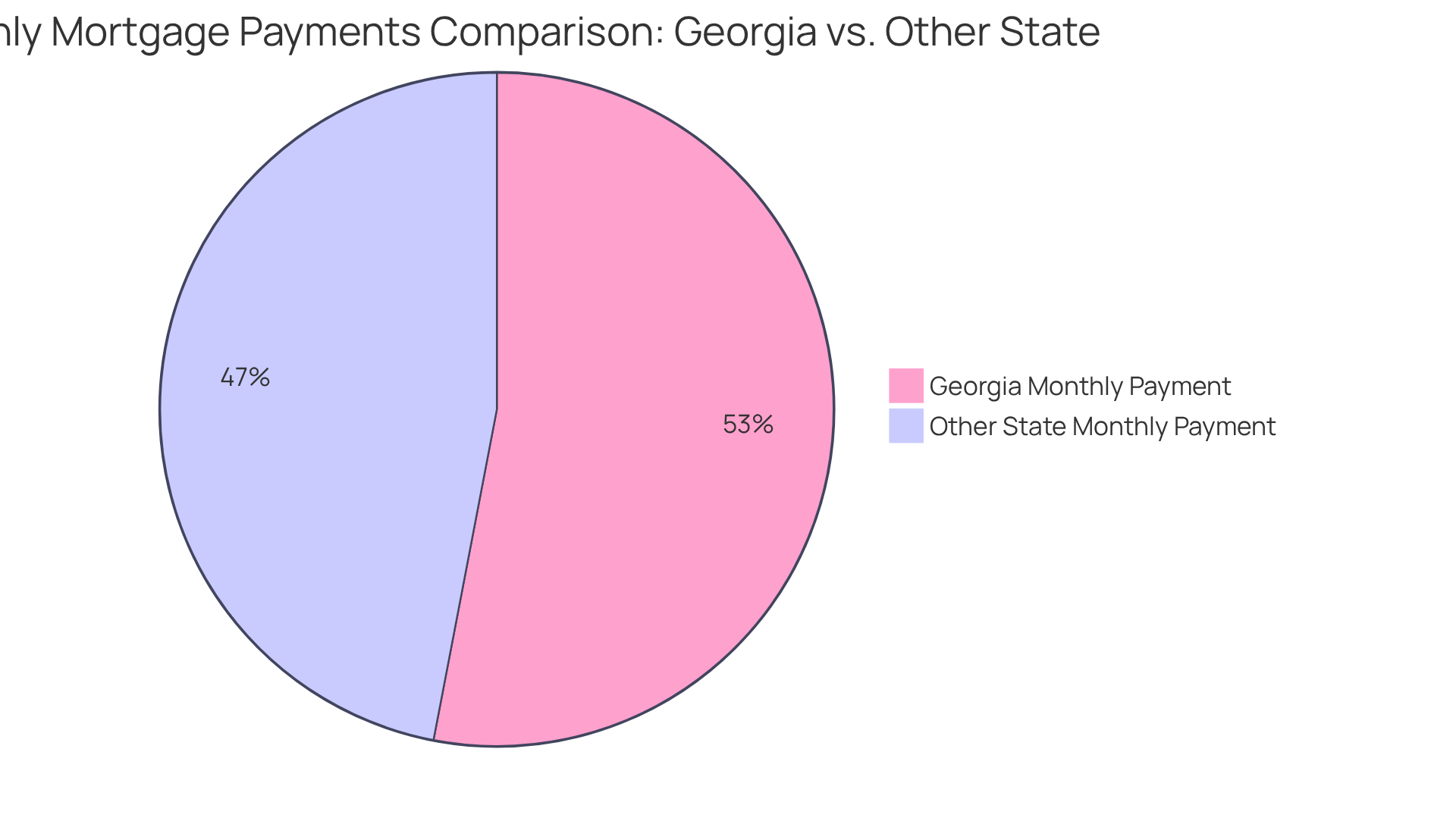

Financial Considerations: Mortgage Rates and Affordability in 2025

In 2025, loan interest rates are pivotal in shaping property purchasing decisions across both states. As of July 2025, the typical loan rate for a 30-year fixed loan in one state is approximately 6.88%, while another state offers slightly lower rates at around 6.75%. We know how challenging it can be to navigate these numbers, and we’re here to support you every step of the way.

Affordability Analysis:

- Georgia: The median home price stands at $335,963, leading to a monthly mortgage payment of about $2,200, assuming a 20% down payment.

- State: With a [lower median housing cost](https://money.usnews.com/loans/rates/mortgages/mortgage-rates-georgia) of $306,682, the monthly payment is roughly $1,950 under similar circumstances.

Although the loan rates in the state are slightly elevated, overall affordability remains competitive due to its reduced property prices. When evaluating their , prospective buyers should consider additional expenses, such as property taxes, insurance, and maintenance, especially in the context of the best state to purchase a home. Remember, understanding these factors can empower you to make informed decisions that suit your family’s needs.

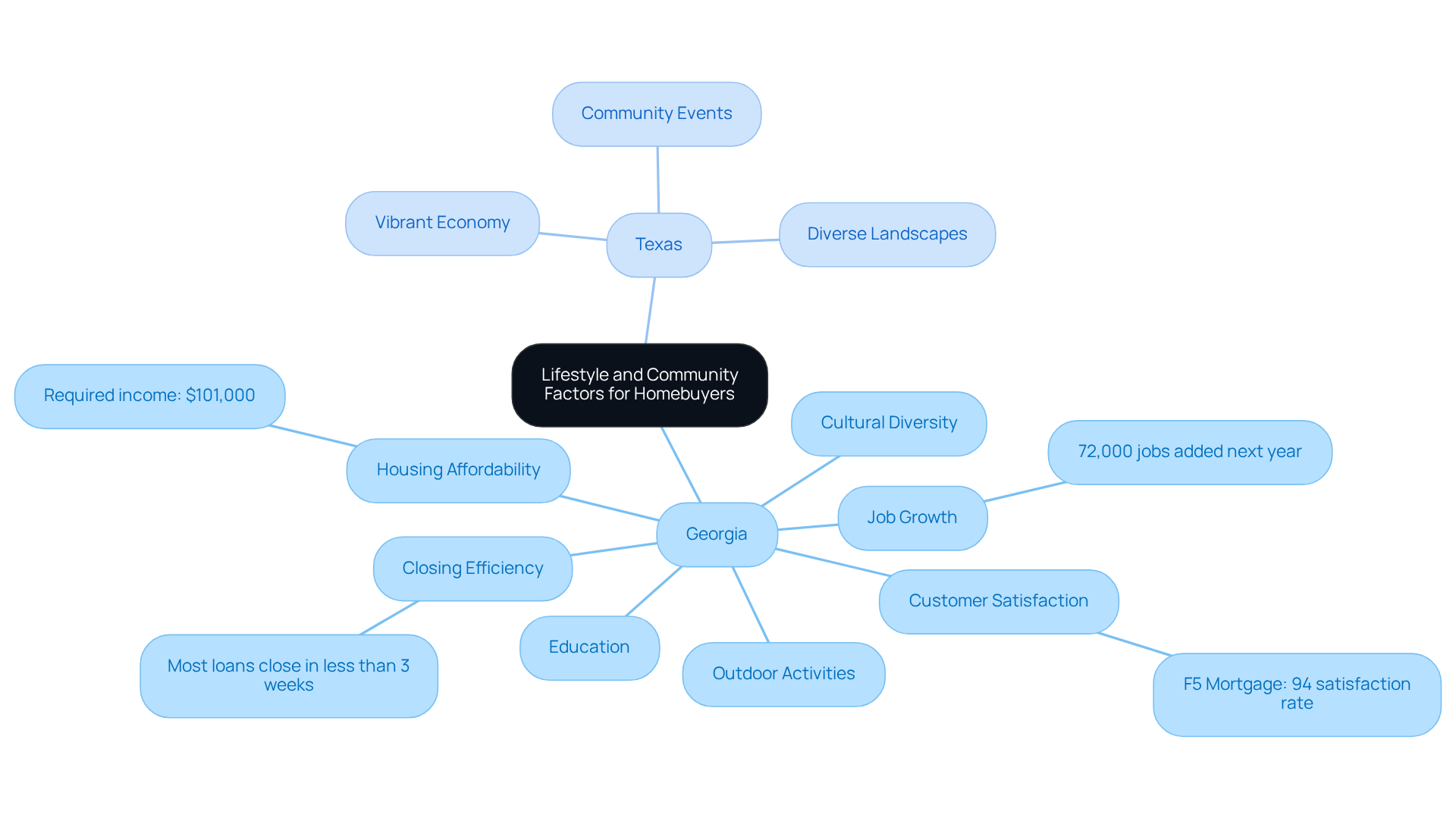

Lifestyle and Community Factors: What Each State Offers Homebuyers

When considering Texas and Georgia as the best state to purchase a home, it’s essential to focus on lifestyle and community aspects, especially when aiming for a smooth mortgage experience with F5 Mortgage.

Georgia:

- Cultural Diversity: We know how important it is for families to feel connected. Georgia, particularly Atlanta, is celebrated for its vibrant cultural scene, featuring a rich tapestry of music, art, and culinary experiences that reflect its diverse population.

- Outdoor Activities: If you love nature, Georgia offers an abundance of parks, hiking trails, and recreational areas, perfect for families seeking outdoor adventures together.

- Education: For families prioritizing quality education for their children, Georgia boasts a variety of educational institutions that can meet those needs.

- Job Growth: With an anticipated addition of almost 72,000 positions next year, Georgia is becoming increasingly attractive for families looking for economic stability.

- Housing Affordability: As of January 2025, an annual income of $101,000 is necessary to purchase a median-priced property in this state, which is considered the best state to purchase a home for potential buyers.

- Customer Satisfaction: F5 Mortgage showcases a customer satisfaction rate of 94%, reinforcing the reliability of the loan process in Georgia.

- Closing Efficiency: The fast closing process at F5 Mortgage, with most loans closing in less than three weeks, emphasizes the efficiency of the mortgage experience for families, allowing them to focus on settling into their new homes without unnecessary stress.

Texas:

- Vibrant Economy: Texas boasts one of the largest economies in the U.S., offering a wealth of job opportunities across multiple sectors, making it an attractive destination for career-oriented individuals.

- Community Events: Cities across Texas organize numerous festivals and events that encourage community involvement, nurturing social ties and a feeling of belonging among residents.

- Diverse Landscapes: From stunning beaches to expansive deserts, Texas offers a wide array of landscapes, appealing to outdoor enthusiasts and those who appreciate natural beauty.

Ultimately, the decision between Georgia and Texas hinges on your personal preferences regarding lifestyle, community involvement, and individual values. It’s essential to consider what each state uniquely offers. With F5 Mortgage’s , we’re here to support you every step of the way toward achieving homeownership with exceptional service and competitive rates, ensuring a smooth transition into your new life.

Conclusion

The comparison between Georgia and Texas as the best states for home purchasing brings to light the unique advantages and challenges each market presents. Both states offer distinct opportunities for prospective homeowners, shaped by varying property values, market conditions, and lifestyle factors. Understanding these differences empowers you to make informed decisions that align with your personal and financial goals.

Key insights into the housing markets reveal that:

- Georgia offers a more stable inventory and affordability.

- Texas attracts buyers with its robust job market and no state income tax.

Each state has its pros and cons—Georgia’s higher property taxes and Texas’s extreme weather events are just a few to consider. Moreover, down payment assistance programs in both states provide crucial support for families looking to secure their dream homes.

Ultimately, the choice between Georgia and Texas depends on your individual preferences regarding community, lifestyle, and financial considerations. As both markets evolve, staying informed about current real estate trends and mortgage rates is essential for navigating these dynamic environments. Embracing the unique offerings of each state can lead to a fulfilling homeownership experience. It’s important for you to assess your priorities and seek guidance from trusted mortgage partners like F5 Mortgage, ensuring a smooth transition into your new life.

Frequently Asked Questions

What are the average property values in Georgia and Texas as of mid-2025?

The average property value in Georgia is around $335,963, while the median property price in Texas stands at approximately $306,682.

How have property values changed in Georgia and Texas over the past year?

In Georgia, property values have declined by 1.7%, and in Texas, they have decreased by 2.2% over the same period.

What is the current state of the housing market in Georgia?

The housing market in Georgia is stabilizing, with an increase in inventory by nearly 15% year-over-year, reaching 49,244 listings, indicating a potential move toward a buyer’s market.

How much has the inventory of homes changed in Texas?

The inventory of homes in Texas has risen by 30.7% from the previous year, contributing to a balanced market.

What is the average time homes are on the market in Georgia and Texas?

Homes in Georgia are available for a median of 71 days, while in Texas, they are on the market for an average of 72 days.

What factors are influencing buyer preferences in these states?

Buyer preferences in both states are being influenced by economic factors and demographic trends, as well as the stabilization of interest rates.

What are the current loan rates for a 30-year fixed mortgage in Georgia?

The loan rates for a 30-year fixed mortgage in Georgia are currently around 6.961%, which is slightly below the national average.

How can F5 Mortgage assist prospective homeowners in Georgia and Texas?

F5 Mortgage offers tailored loan solutions, competitive mortgage rates, refinancing options, and support throughout the mortgage approval process to help families make informed decisions.