Overview

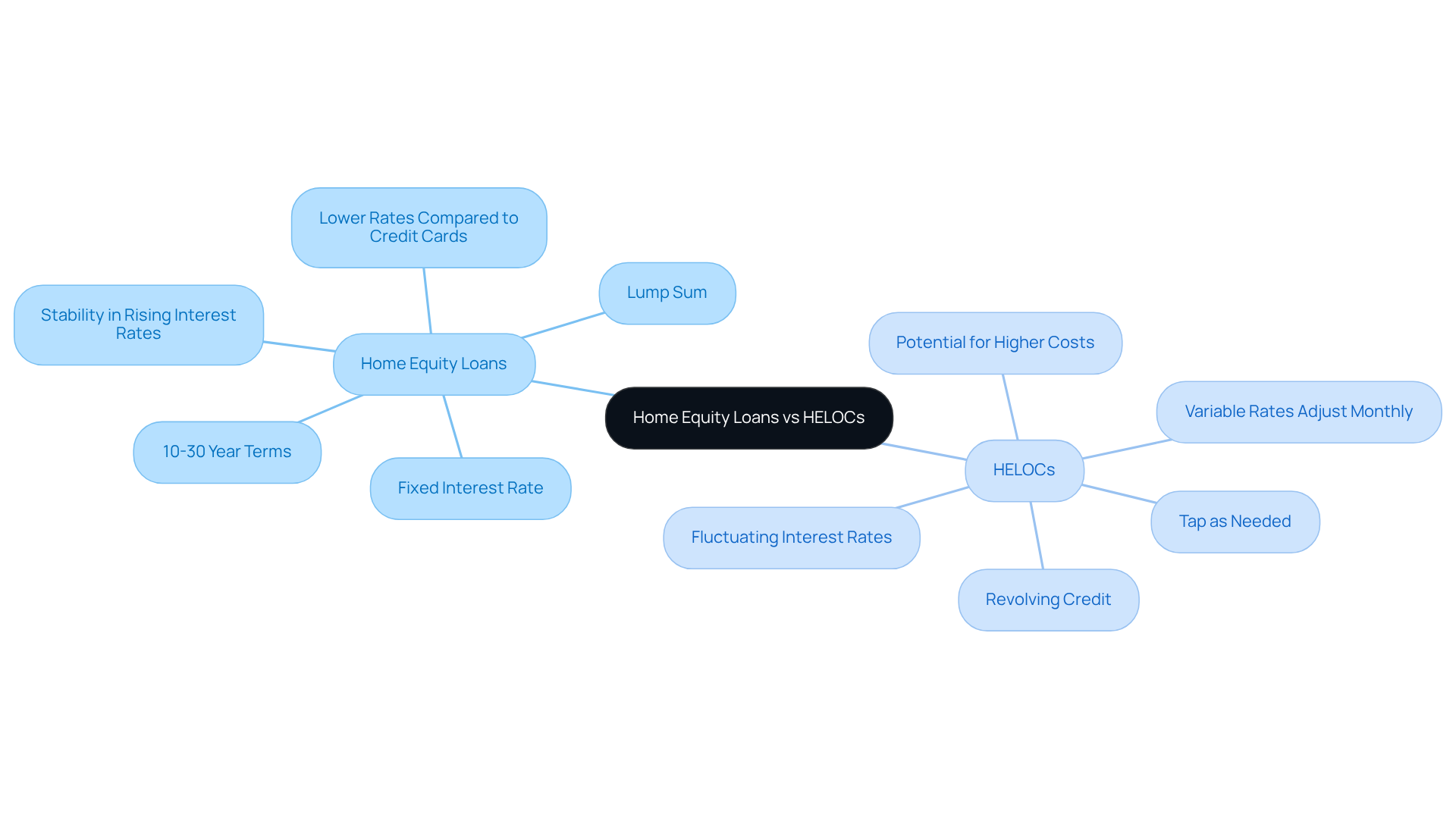

Understanding the differences between home equity loans and HELOCs is essential as you navigate your financial journey. Home equity loans provide a lump sum at a fixed interest rate, making them a great choice for significant, one-time expenses. On the other hand, HELOCs offer a revolving line of credit with variable interest rates, giving you the flexibility needed for ongoing costs.

We know how challenging it can be to decide which option is right for you. These distinctions not only highlight the structural differences but also reflect how they cater to various financial needs. By considering your unique circumstances, you can make a more informed choice that aligns with your goals.

Ultimately, assessing your individual financial situation is crucial. Whether you need a substantial amount for a major purchase or prefer the adaptability of a line of credit, we’re here to support you every step of the way.

Introduction

Navigating the financial landscape of home equity can feel daunting, especially when considering the differences between a home equity loan and a Home Equity Line of Credit (HELOC). We understand how overwhelming this decision can be. Each option offers unique advantages that can profoundly impact your financial strategy, whether you’re looking to consolidate debt or fund renovations.

As you weigh your choices, it’s important to recognize the fluctuating interest rates and varying repayment structures that come into play. What factors should you consider to determine which option aligns best with your financial goals and lifestyle? We’re here to support you every step of the way, helping you make informed decisions that suit your needs.

Understanding Home Equity Loans and HELOCs

Navigating the world of home equity loan vs HELOC can be daunting, but understanding your options is essential. A home equity line functions as a second mortgage, enabling homeowners to borrow against the equity they’ve built up in their property. This type of credit often provides a lump sum at a fixed interest rate, with repayment terms ranging from 10 to 30 years.

On the other hand, a Home Equity Line of Credit (HELOC) operates much like a credit card. It offers a revolving line of credit that homeowners can tap into as needed, up to a specified limit. However, it’s important to note that HELOCs typically have fluctuating interest rates, which may change based on market conditions. Currently, HELOC rates average around 8.20%, while fixed-rate residential value credit options provide stability, even as interest rates rise.

We know how challenging it can be to make these financial decisions. Many homeowners are considering second mortgages to consolidate high-interest debts, especially when comparing home equity loan vs HELOC, as these financial products usually come with terms significantly lower than credit cards—sometimes nearly three times less. As the market evolves, it’s crucial for homeowners to explore their options thoughtfully. Securing a mortgage at today’s low-interest levels could offer a strategic advantage in managing your finances effectively.

Remember, you’re not alone in this journey. We’re here to support you every step of the way as you make informed choices about utilizing your real estate value for your financial needs.

Advantages of Home Equity Loans and HELOCs

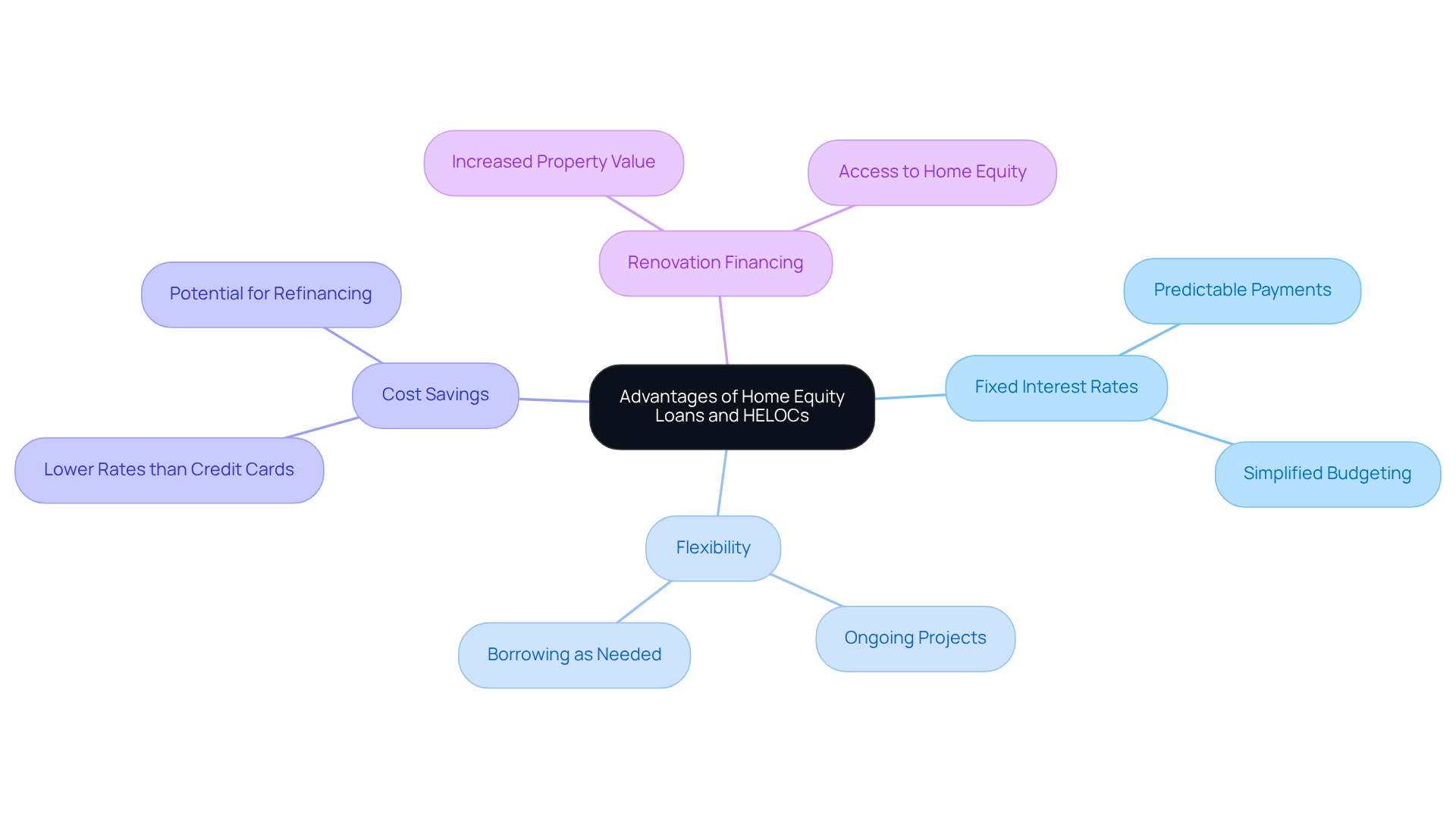

Home financing options come with several key benefits that can truly make a difference for families. One of the most reassuring aspects is their fixed interest rates, which guarantee predictable monthly payments and simplify budgeting. This makes them particularly suitable for significant, one-time costs, like property renovations or debt consolidation. For instance, a household in Vancouver utilized a $75,000 property value line of credit to remodel their kitchen and bathrooms. This decision not only enhanced their living space but also led to a 10% increase in property value, adding $50,000 in assets.

On the other hand, in the discussion of home equity loan vs HELOC, the latter provides remarkable flexibility, allowing homeowners to borrow only what they need, precisely when they need it. This feature is especially beneficial for ongoing projects or fluctuating expenses, such as education costs or medical bills. With the current average interest rates for a home equity loan vs HELOC at 8.27%, HELOCs often present lower initial figures compared to equity financing, making them an appealing choice for short-term borrowing needs. Additionally, homeowners who opened HELOCs in 2023 or earlier might benefit from refinancing due to the recent drop in interest rates, potentially leading to significant savings.

Looking ahead to 2025, financial specialists emphasize that property owners can save considerably by utilizing HELOCs for renovations. These products typically offer lower rates than credit cards or personal loans, providing a more manageable way to fund improvements. As homeowners increasingly turn to their asset value for renovation financing, this trend underscores the importance of these financial tools in helping them achieve their goals. We understand how challenging this can be, and we’re here to support you every step of the way.

Disadvantages of Home Equity Loans and HELOCs

While property-backed financing options and the comparison of home equity loan vs HELOC can offer benefits, it’s essential to recognize their potential drawbacks. When considering home equity loan vs HELOC, it’s important to note that home equity loans can result in significant debt if payments become overwhelming, as your home is used as collateral. Additionally, these loans often come with closing costs and fees that can increase your overall financial burden.

On the other hand, when considering home equity loan vs HELOC, the latter provides flexibility but typically comes with variable interest rates. This means that your monthly payments could rise over time, which may lead to unexpected financial strain. Moreover, the temptation to overspend with a HELOC can be significant, as homeowners might borrow more than necessary, creating further challenges.

As you explore these options, it’s crucial to consider your debt-to-income (DTI) ratio. A DTI ratio exceeding 43% might limit your chances of obtaining favorable mortgage rates or refinancing opportunities. We understand how challenging this can be, and that’s why F5 Mortgage is here to help you navigate these complexities. We can assist you in understanding how your DTI impacts your eligibility for residential financing options and HELOCs, empowering you to make informed financial choices every step of the way.

Choosing the Right Option: Suitability for Different Needs

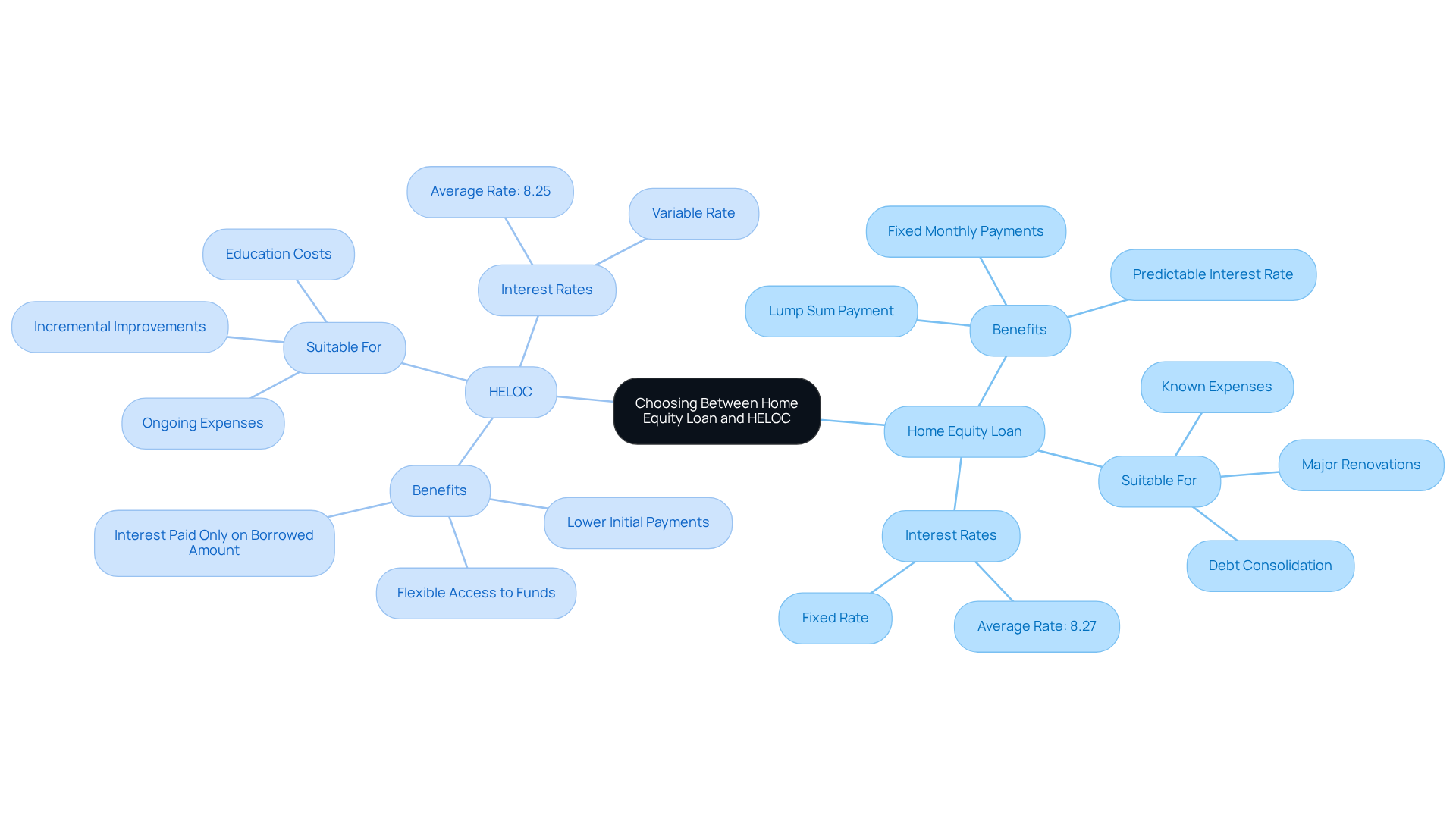

When choosing between a home equity loan vs HELOC, we understand how important it is for property owners to assess their unique financial needs and goals. A property value-based borrowing option can be particularly beneficial for those seeking a lump sum for specific purposes, such as major renovations or debt consolidation. This option offers the peace of mind of fixed monthly payments over a period of 5 to 30 years. Currently, the typical interest rate for property-backed loans stands at 8.27%.

On the other hand, a HELOC is designed for property owners who prefer to access funds gradually for ongoing expenses, like education or incremental property improvements. If you are comfortable with the fluctuations of interest rates, which average around 8.25%, this option provides flexibility. It allows for minimal interest payments during the draw period, making it suitable for those with changing financial needs.

Additionally, we encourage homeowners to explore alternatives such as cash-out refinancing and reverse mortgages, especially in the current economic climate of 2025. Ultimately, your decision between a home equity loan vs HELOC will depend on personal financial circumstances, risk tolerance, and long-term aspirations. We recommend a thorough assessment of these factors, as financial planners often do, to help you determine the best option for leveraging your home equity. Remember, we’re here to support you every step of the way.

Conclusion

Understanding the distinctions between home equity loans and HELOCs is essential for homeowners like you, who are looking to leverage property value for financial needs. We know how challenging this can be, and both options present unique benefits and challenges. It’s crucial to evaluate which aligns best with your individual financial goals and circumstances.

Throughout this article, we’ve outlined key insights that can help you navigate this decision. For instance, home equity loans offer fixed-rate predictability, making them ideal for substantial, one-time expenses. On the other hand, HELOCs provide a flexible, revolving nature that caters to ongoing financial needs with their draw-and-repay structure. Additionally, we’ve emphasized considerations such as interest rates, potential debt risks, and the impact of debt-to-income ratios, highlighting the importance of careful financial planning.

Ultimately, the choice between a home equity loan and a HELOC should be guided by your personal financial situation and long-term objectives. As you navigate these options, staying informed about current trends and potential savings is vital. Engaging with financial advisors or mortgage professionals can provide valuable insights, helping you make well-informed decisions that can significantly impact your financial well-being. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a home equity loan?

A home equity loan functions as a second mortgage, allowing homeowners to borrow against the equity they’ve built up in their property. It typically provides a lump sum at a fixed interest rate, with repayment terms ranging from 10 to 30 years.

How does a Home Equity Line of Credit (HELOC) work?

A HELOC operates like a credit card, offering a revolving line of credit that homeowners can access as needed, up to a specified limit. It generally has fluctuating interest rates that may change based on market conditions.

What are the current average interest rates for HELOCs?

Currently, HELOC rates average around 8.20%.

How do home equity loans and HELOCs compare to credit cards in terms of interest rates?

Home equity loans and HELOCs usually come with terms significantly lower than credit cards, often nearly three times less.

Why might homeowners consider taking out a second mortgage?

Many homeowners consider second mortgages to consolidate high-interest debts, as they can offer more favorable terms compared to credit cards.

What are the advantages of securing a mortgage at today’s low-interest levels?

Securing a mortgage at today’s low-interest levels can provide a strategic advantage in managing finances effectively, especially as interest rates rise.

How can homeowners get support in making financial decisions regarding home equity?

Homeowners can seek support from financial advisors or services that assist them in making informed choices about utilizing their real estate value for financial needs.