Overview

We understand how challenging it can be to determine how much mortgage you can afford. To navigate this process, it’s essential to evaluate your financial profile, which includes your:

- Income

- Current debts

- Credit score

- Interest rates

Aim for a debt-to-income ratio below 36% to keep your finances healthy.

By understanding these factors, you can set realistic expectations. Utilizing resources like mortgage calculators can be incredibly helpful. They empower you to make informed decisions and effectively navigate the home purchasing process. Remember, we’re here to support you every step of the way.

Introduction

Understanding how much mortgage you can afford is a crucial step in your home-buying journey. It directly impacts your financial stability and long-term satisfaction. We know how challenging this can be, and that’s why this guide delves into the essential factors—like your income, credit score, and debt levels—that shape mortgage affordability. Our goal is to equip you with the knowledge needed to make informed decisions.

However, with fluctuating interest rates and varying lender requirements, navigating this complex landscape can feel overwhelming. How can you, as a potential homeowner, ensure that you secure the best possible terms? We’re here to support you every step of the way.

Understand Mortgage Affordability Basics

Understanding how much mortgage can I afford is an essential consideration for many families, as it reflects the sum you can borrow based on your financial profile. This profile includes your income, current debts, credit score, and prevailing interest levels. Understanding how much mortgage can I afford is vital for setting realistic expectations and avoiding financial strain.

A key metric in this assessment is the debt-to-income (DTI) ratio. This ratio measures your monthly debt payments against your gross monthly income. In 2025, the average DTI ratio for homebuyers is around 32%. Lenders typically prefer borrowers with a DTI below this threshold for favorable loan terms, which can significantly influence how much mortgage can I afford in your financial journey.

Familiarizing yourself with terms like ‘loan-to-value (LTV) ratio’ is also essential. The LTV ratio compares the loan amount to the appraised value of the property, helping lenders evaluate risk. For instance, a lower LTV ratio often leads to improved loan rates, as it indicates a reduced risk for the lender.

Real-world examples can illustrate these concepts effectively. In Regina, where the RBC aggregate affordability measure is at 26.1%, buyers benefit from manageable ownership costs. This situation makes it easier to qualify for home loans. Conversely, in Toronto, where homeownership expenses consume over 75% of a median household’s income, understanding how much mortgage can I afford and managing your DTI becomes crucial for navigating this challenging market.

Financial advisors emphasize that maintaining a healthy DTI ratio is vital for obtaining a loan. As one expert notes, ‘A lower DTI not only improves your chances of approval but also positions you for better interest rates.’ By grasping these fundamentals, you can approach the financing process with confidence and clarity. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Identify Key Factors Affecting Affordability

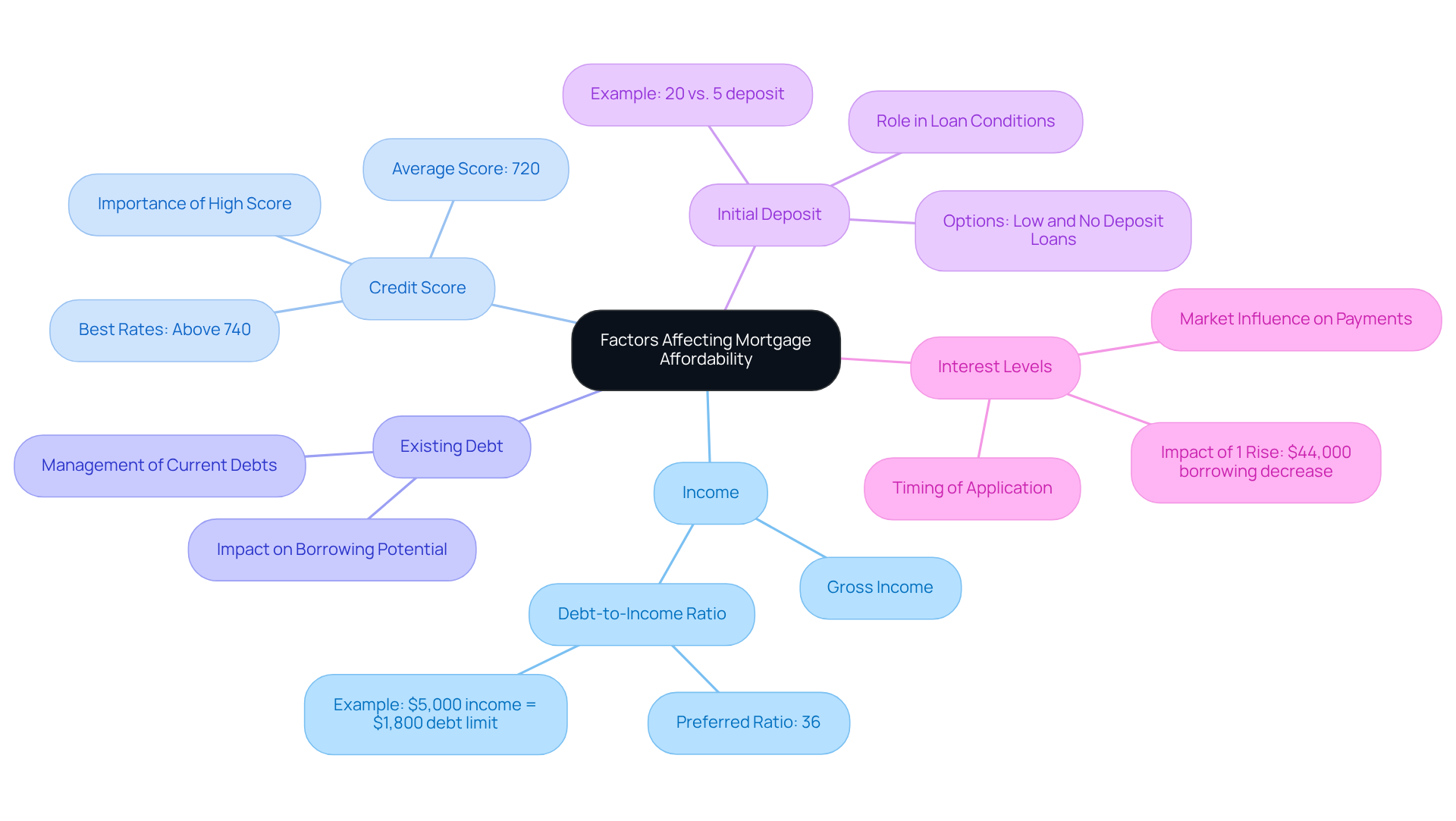

Several key factors significantly influence your mortgage affordability:

-

Income: We know how challenging it can be to navigate your overall gross income, which is the cornerstone of your borrowing capacity. Lenders generally prefer a debt-to-income ratio of 36% or lower. This means your total debts each month should not surpass this percentage of your gross income. For instance, if your income each month is $5,000, your overall debt obligations should preferably be no greater than $1,800.

-

Credit Score: An elevated credit score is essential in obtaining favorable interest terms, which directly affects your monthly payments and overall affordability. As of 2025, the average credit score for loan applicants hovers around 720, a figure that can significantly enhance your borrowing terms. A score above 740 often qualifies borrowers for the best rates available, making it worthwhile to focus on improving your credit.

-

Existing Debt: We understand that current debts, such as student loans or credit card balances, can limit your borrowing potential. Lenders assess your total debt obligations when determining how much mortgage can I afford, so managing existing debts effectively is crucial. Remember, lenders typically prefer a debt-to-income ratio of 36% or less, which can help you secure better loan options.

-

Initial Deposit: The amount of your initial deposit plays a crucial role in your loan conditions. A bigger initial deposit can decrease your loan total and remove the requirement for private insurance, which can increase your regular expenses. For example, putting down 20% instead of 5% can save you thousands over the life of the loan. Furthermore, grasping the different deposit alternatives accessible, including low and no deposit loans, can assist you in making informed choices when funding your home through F5 Financing.

-

Interest Levels: Present market interest levels greatly influence your monthly payments and the overall expense of your loan. With increasing bond yields, home loan costs may rise. It’s essential to keep a close watch on these expenses to optimize your application timing. For example, a 1% rise in interest can diminish a household’s borrowing ability by around $44,000, highlighting the significance of timing in your loan strategy. Additionally, understanding your debt-to-income ratio can result in more competitive loan rates, particularly when exploring refinancing alternatives offered by F5 Mortgage.

At F5 Mortgage, we’re here to support you every step of the way. We offer a completely online application process, backed by real people ready to assist you when needed. Our dedication to customer service persists even after you finalize, ensuring you receive the assistance required during your financing journey.

Calculate Your Mortgage Affordability

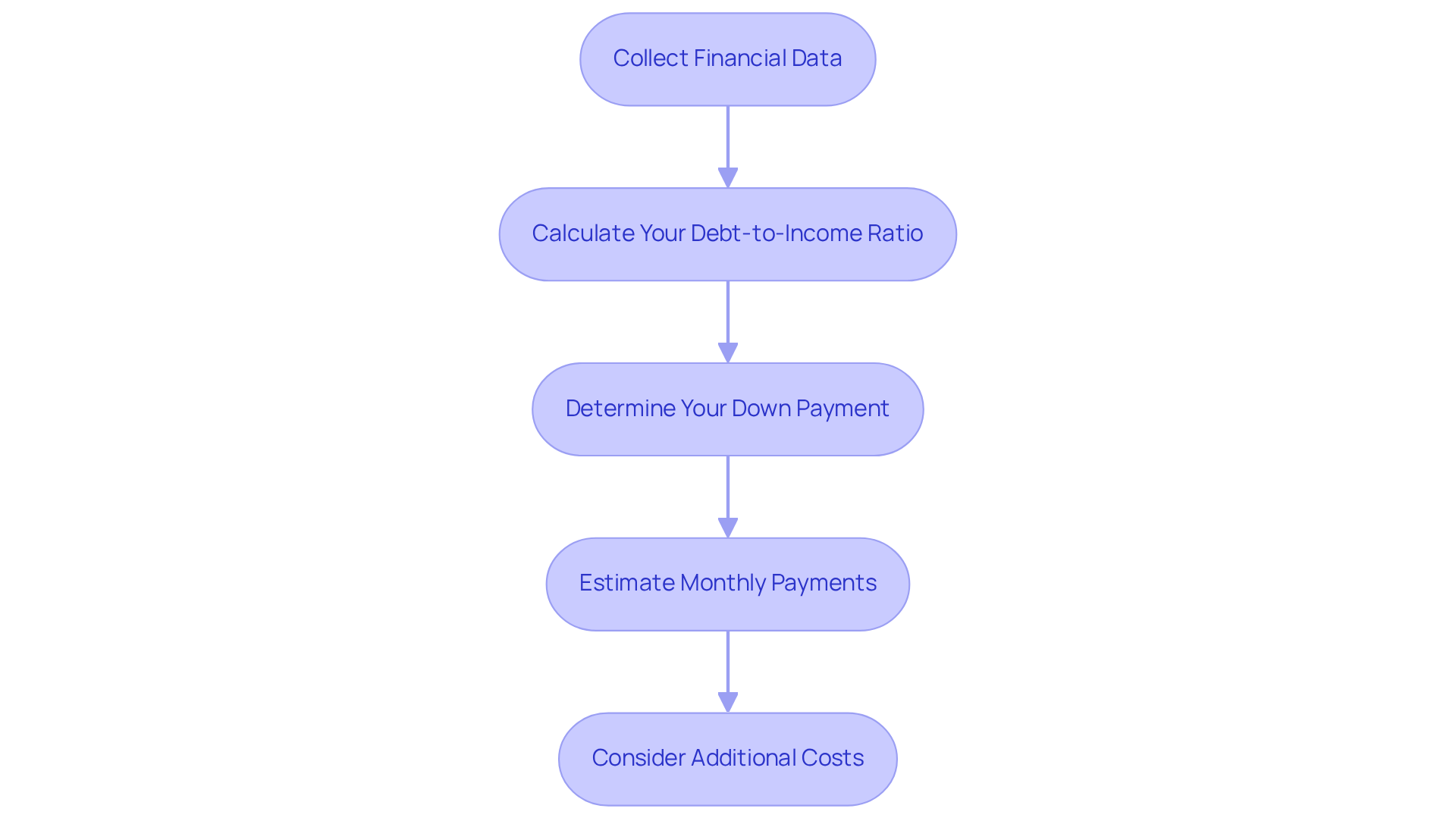

To determine how much mortgage you can afford, let’s walk through these essential steps together:

-

Collect Financial Data: Start by gathering your monthly income, current debts, and any savings you have set aside for a down payment. This foundational information is crucial for accurate calculations, and we know how important it is to get this right.

-

Calculate Your Debt-to-Income Ratio: Next, add up your monthly obligations, including the estimated housing cost, and divide this total by your gross monthly earnings. Ideally, aim for a debt-to-income (DTI) ratio below 36%. This is a common threshold for mortgage approval, and we’re here to support you every step of the way.

-

Determine Your Down Payment: Consider how much you can afford to put down. In 2025, the average initial deposit across the U.S. is roughly 13% of the purchase price. A larger initial deposit not only decreases your loan total but also reduces your recurring charges, making homeownership more affordable.

-

Estimate Monthly Payments: Use a loan calculator to get an idea of your monthly payments based on the loan amount, interest rate, and loan duration. This tool allows you to explore various scenarios and understand how different factors influence your affordability.

-

Consider Additional Costs: Don’t forget to factor in property taxes, homeowners insurance, and maintenance costs. These expenses can significantly affect your overall budget, so it’s essential to have a realistic view of homeownership costs.

By following these steps, you can gain a clearer understanding of your loan affordability and make informed decisions as you navigate the home purchasing process. Remember, we’re here to help you every step of the way.

Utilize Mortgage Calculators and Resources

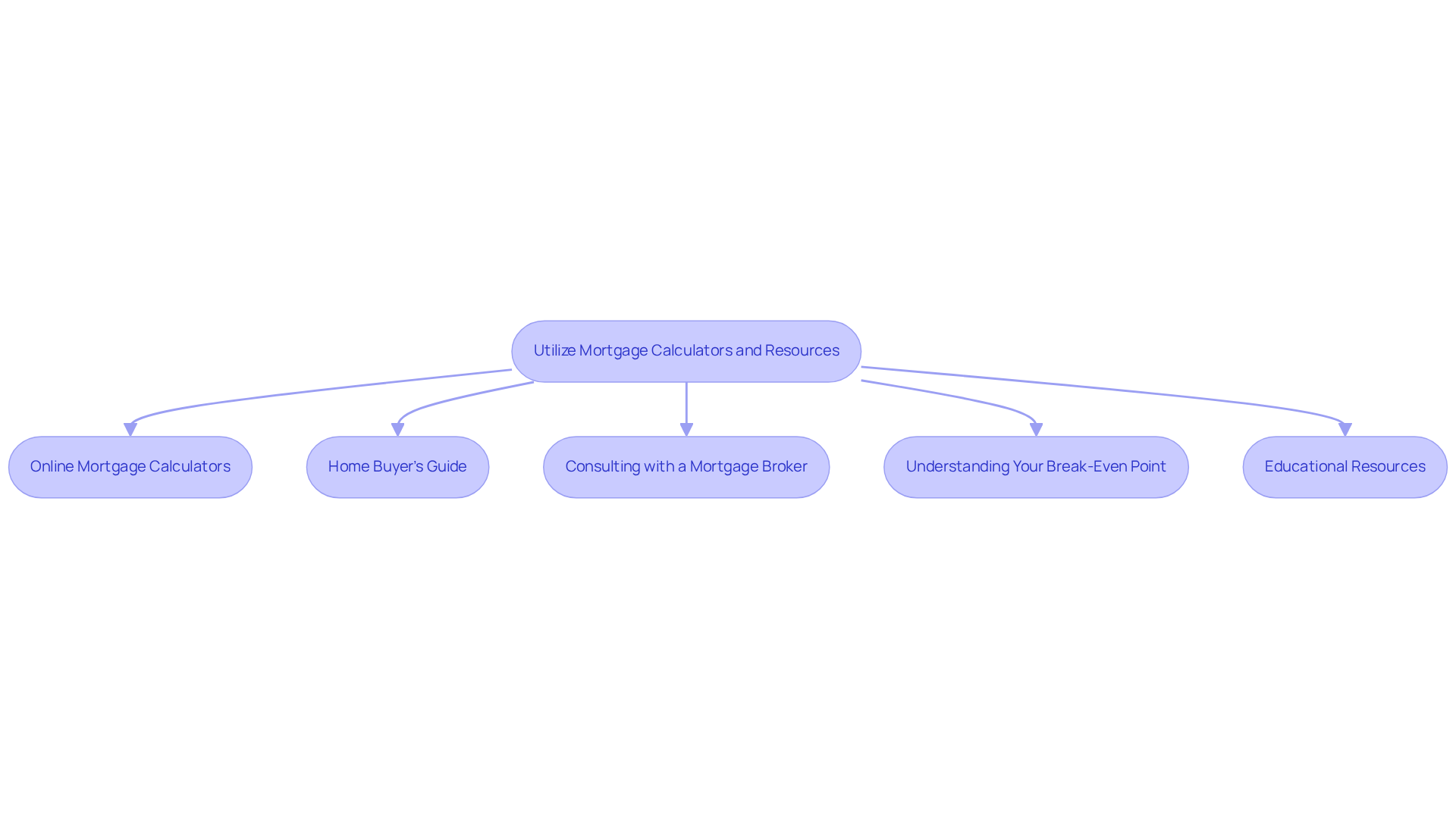

To effectively utilize mortgage calculators and resources, let’s explore some helpful steps together:

-

Online Mortgage Calculators: We understand how overwhelming it can be to navigate your finances. Platforms like F5 Mortgage offer user-friendly tools where you can input your financial data and explore various loan scenarios. These calculators help you determine how much mortgage can I afford by showing how different interest rates and loan durations impact your monthly costs, enabling you to make informed choices that suit your needs.

-

Home Buyer’s Guide: Comprehensive guides are invaluable resources that outline the loan process. They provide essential tips on enhancing your credit score and strategies for saving for a down payment. In 2025, many homebuyers found these guides instrumental in improving their understanding of financing options, and we believe you will too.

-

Consulting with a mortgage broker can provide insights on how much mortgage can I afford, making it feel like having a trusted ally by your side. They can provide tailored insights and guide you through the complexities of mortgage options that align with your financial situation. Brokers help identify the best loan products and terms available, ensuring you make the most informed choice possible.

-

Comprehending Your Break-Even Point: Understanding your break-even point is crucial for making informed refinancing decisions. This knowledge helps you figure out how long it will take to recover the expenses of refinancing through savings in periodic payments or interest rates. To calculate your break-even point, follow these three steps:

- Determine refinancing costs

- Calculate your savings per period

- Divide your refinancing costs by your savings per period

For instance, if your refinancing costs are $4,000 and your monthly savings are $100, your break-even point would be 40 months.

-

Educational Resources: We encourage you to take advantage of webinars, articles, and workshops offered by mortgage companies like F5 Mortgage. These resources deepen your understanding of the mortgage landscape and keep you informed about market trends and changes. Staying informed can significantly enhance your confidence as you approach the home buying process.

Remember, we’re here to support you every step of the way.

Conclusion

Understanding how much mortgage can be afforded is crucial for making informed financial decisions. We know how challenging this can be, and by grasping the basics of mortgage affordability, you can avoid potential pitfalls and ensure you are not overextending your financial commitments. This knowledge empowers you to set realistic expectations and navigate the often complex mortgage landscape with confidence.

Several key factors impact mortgage affordability, including:

- Your income

- Credit score

- Existing debts

- Initial deposits

- Interest rates

Each of these elements plays a significant role in determining how much you can borrow and under what terms. By maintaining a healthy debt-to-income ratio and leveraging online resources such as mortgage calculators and homebuyer guides, you can gain valuable insights into your borrowing capacity and make strategic decisions.

Ultimately, understanding mortgage affordability is not just about crunching numbers; it’s about fostering your financial well-being and making choices that align with your long-term goals. As the housing market continues to evolve, staying informed and utilizing available resources will be essential for anyone looking to secure a mortgage. Taking proactive steps today can lead to a more manageable and rewarding homeownership experience tomorrow.

Frequently Asked Questions

Why is understanding mortgage affordability important?

Understanding mortgage affordability is essential as it reflects the amount you can borrow based on your financial profile, which includes income, current debts, credit score, and interest levels. It helps set realistic expectations and avoid financial strain.

What is the debt-to-income (DTI) ratio?

The DTI ratio measures your monthly debt payments against your gross monthly income. It is a key metric in assessing how much mortgage you can afford, with lenders typically preferring a DTI below 32% for favorable loan terms.

What is the loan-to-value (LTV) ratio?

The LTV ratio compares the loan amount to the appraised value of the property. It helps lenders evaluate risk, and a lower LTV ratio can lead to improved loan rates, indicating reduced risk for the lender.

How do different cities affect mortgage affordability?

In Regina, the RBC aggregate affordability measure is at 26.1%, making it easier for buyers to qualify for home loans. In contrast, Toronto has homeownership expenses that consume over 75% of a median household’s income, making understanding mortgage affordability and managing DTI crucial in this challenging market.

What do financial advisors say about maintaining a healthy DTI ratio?

Financial advisors emphasize that maintaining a healthy DTI ratio is vital for obtaining a loan. A lower DTI not only improves your chances of approval but also positions you for better interest rates.