Overview

Understanding your mortgage can feel overwhelming, especially when considering a significant amount like $400,000. We know how challenging this can be, and it’s essential to grasp the factors that influence your monthly payment. Key elements include:

- The interest rate

- Loan duration

- Down payment

- Property taxes

- Insurance

- The type of loan you choose

Each of these factors plays a crucial role in determining your monthly payment. For instance, a lower interest rate can lead to substantial savings over time. Similarly, the length of the loan and your down payment can significantly impact your financial obligations. By recognizing how these elements interact, you can make informed decisions that align with your financial goals.

We’re here to support you every step of the way. Understanding these factors is not just about numbers; it’s about planning for your family’s future. As you navigate through these options, remember that effective financial planning and budgeting are vital for prospective homeowners. Take the time to explore your choices, and don’t hesitate to seek guidance when needed.

Introduction

Navigating the intricacies of a $400,000 mortgage can feel overwhelming for many prospective homeowners. We know how challenging this can be. Monthly payments aren’t just numbers; they represent a substantial financial commitment that can significantly influence your budgeting and long-term financial strategy.

This article aims to shed light on the key factors that shape these payments, including:

- Interest rates

- Loan terms

- Down payments

- Property taxes

Given the ever-changing market, how can you, as a potential buyer, navigate these complexities? Our goal is to help you make informed decisions that align with your financial aspirations.

Together, we’ll explore the essential elements of the mortgage process, ensuring you feel supported every step of the way.

Defining Monthly Payments on a $400,000 Mortgage

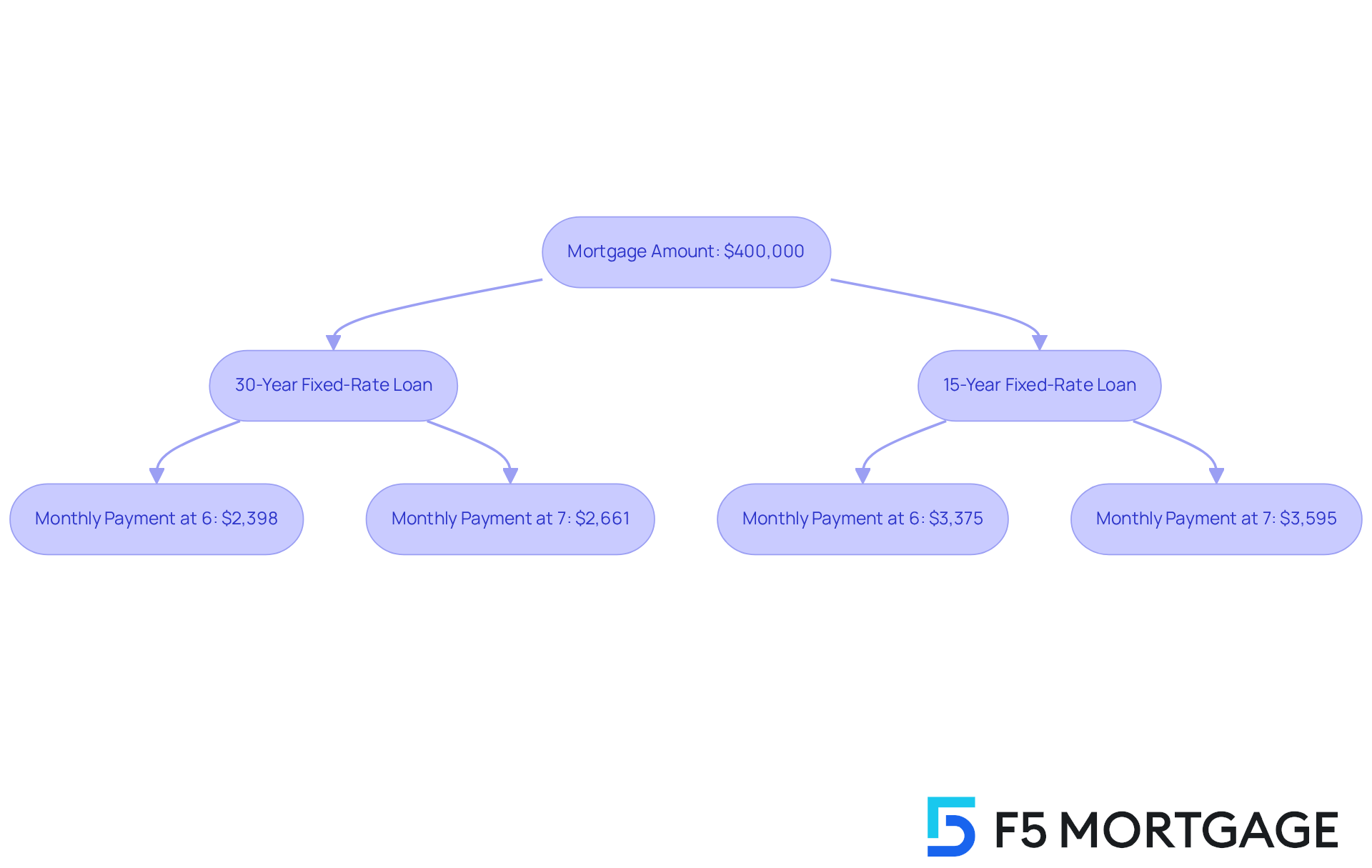

When considering a $400,000 loan, it’s important to understand that the monthly payment on a 400k mortgage consists of the routine contributions you make to your lender, which typically include both principal and interest. These payments are influenced by several key factors: the loan amount, interest rate, and loan term. For example, if you choose a 30-year fixed-rate loan, you’ll be making regular payments over 360 months. Your monthly payment on a 400k mortgage at a 6% interest rate would be roughly $2,398. However, if the interest rate rises to 7%, the monthly payment on a 400k mortgage increases to approximately $2,661.

Understanding these expenses is crucial for prospective homeowners, as they directly impact your budgeting and financial planning. The 28/36 guideline suggests that no more than 28% of your gross income should be allocated for housing costs, including loan obligations, while your total debt should not exceed 36% of your income. For a $400,000 loan, a household income of around $90,000 may suffice under certain conditions, but a more practical recommendation would be $105,000 when factoring in insurance and taxes.

Let’s consider practical examples to illustrate how different borrowing conditions affect the monthly payment on a 400k mortgage. A 15-year loan at 6% results in a monthly payment on a 400k mortgage of about $3,375. This is significantly higher than the 30-year option, yet it offers the benefit of paying off your debt more quickly and accumulating less interest over time. This highlights the importance of understanding loan installments; they are not just numbers but represent your financial commitment and long-term strategy.

As Warren Buffett wisely noted, a home serves as both a financial asset and a space where life unfolds. Therefore, it’s essential to thoroughly grasp the implications of mortgage costs. We know how challenging this can be, and we’re here to support you every step of the way.

Factors Influencing Monthly Payments

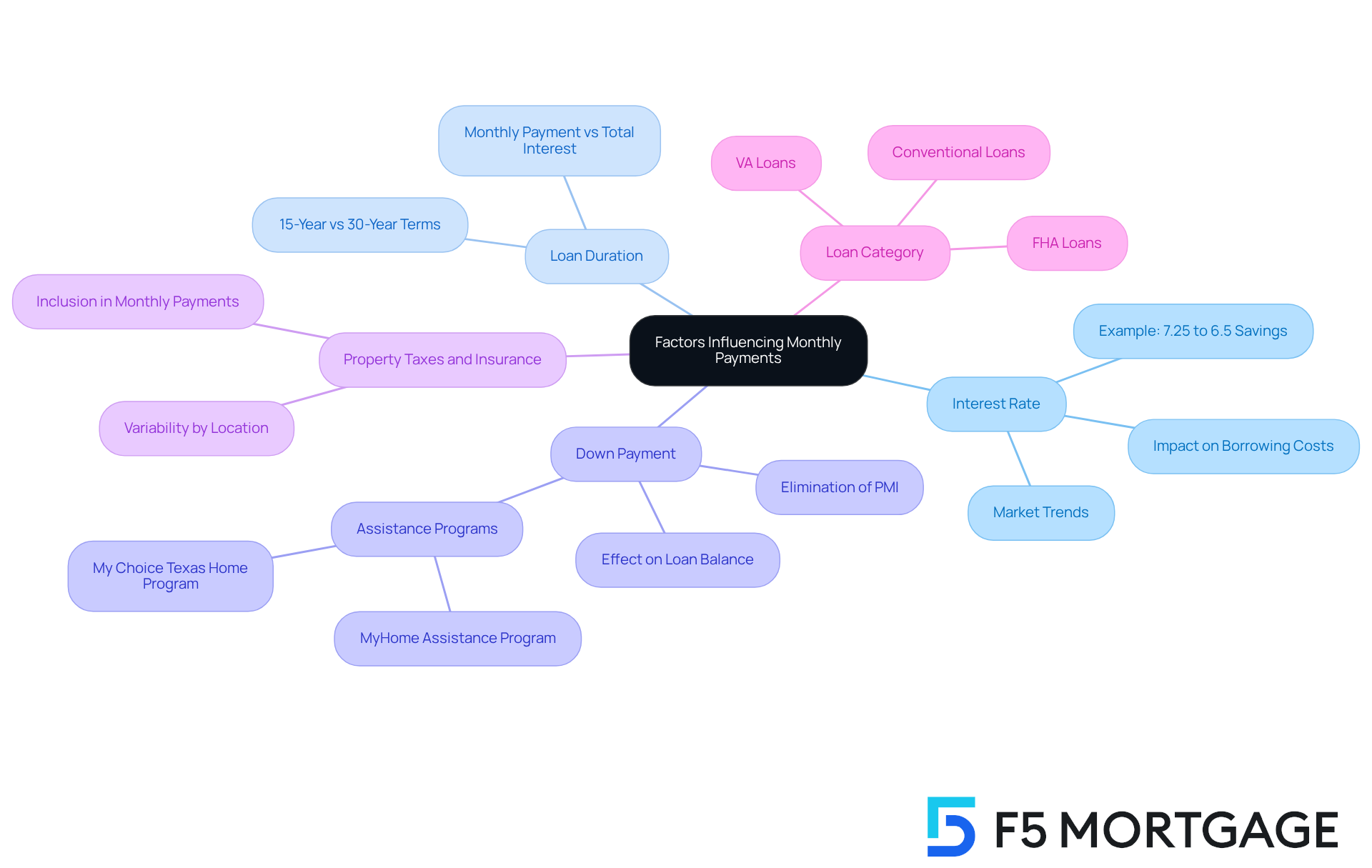

Several key factors influence the monthly payments on a $400,000 mortgage:

-

Interest Rate: We understand that the interest rate can significantly impact your overall borrowing costs. For example, if the interest rate drops from 7.25% to 6.5%, you could save around $200 each month. Lower rates not only ease your monthly budget but also enhance your buying power, allowing you to qualify for larger loans without increasing your expenses. As mortgage rates have been declining throughout 2025, many potential homebuyers are discovering renewed opportunities in the market.

-

Loan Duration: The length of your loan plays a crucial role in determining your monthly payments. Shorter loan terms, such as 15 years, typically result in higher monthly payments but lower total interest over the life of the loan. Conversely, a 30-year term spreads payments over a longer period, reducing your monthly burden but increasing the total interest paid. We know how important it is to choose a term that aligns with your financial goals.

-

Down Payment: The initial amount you pay upfront directly reduces your loan balance, which can lower your monthly payments. A larger down payment can also eliminate the need for private mortgage insurance (PMI), further easing your financial load. Programs like the MyHome Assistance Program in California and the My Choice Texas Home program provide essential support for buyers looking to minimize their initial costs. By making a significant down payment on a $400,000 home, you can greatly reduce your monthly payment on a $400,000 mortgage.

-

Property Taxes and Insurance: These costs are often included in your monthly mortgage payment, impacting the total amount you owe each month. It’s important to factor in these expenses when budgeting, as they can vary widely based on location and property value. We encourage you to consider these elements carefully as you plan your finances.

-

Loan Category: Different loan types, including FHA, VA, and conventional options, come with varying requirements and implications for your monthly payments. For instance, FHA loans may require lower upfront payments but include insurance fees, which can affect your overall affordability.

Understanding these factors is essential for potential homebuyers, especially in a fluctuating market where interest rates can significantly alter payment scenarios. As you navigate the housing market, staying informed about these elements can empower you to make sound financial decisions. Remember, we’re here to support you every step of the way.

Components of a Monthly Mortgage Payment

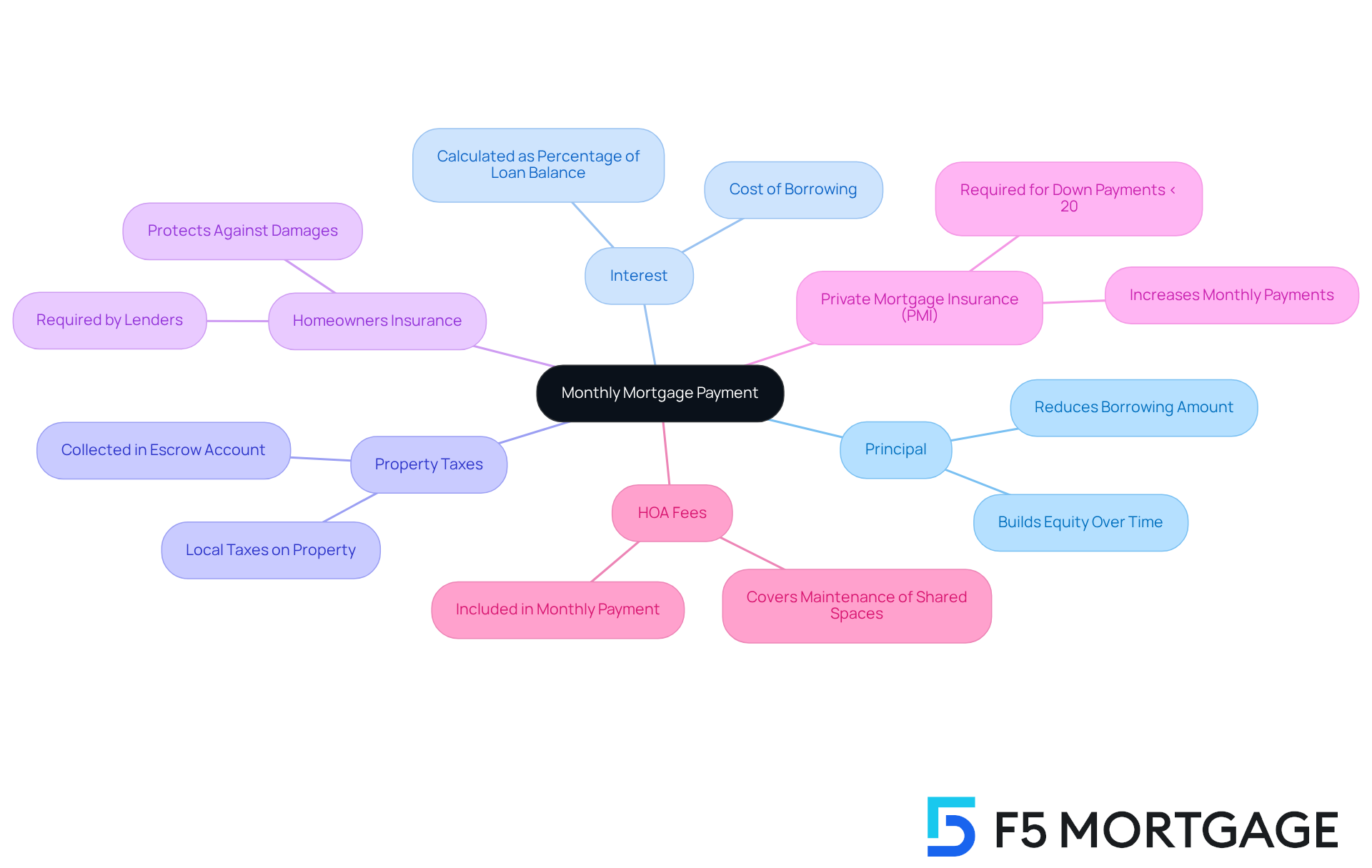

A typical monthly mortgage payment consists of several essential components that can feel overwhelming at first. But understanding these elements is crucial for your financial journey.

- Principal: This part reduces the original borrowing amount, helping you build equity in your home over time.

- Interest: This is the cost of borrowing money, calculated as a percentage of the remaining loan balance. For instance, the monthly payment on a 400k mortgage at a 6% interest rate would mean that the first month’s interest is around $2,000.

- Property Taxes: Local taxes on your property, which lenders often collect and hold in an escrow account until they’re due. Remember, property tax rates vary by state, impacting your monthly expenses.

- Homeowners Insurance: Required by lenders, this insurance protects your home against damages and losses, ensuring your property is safeguarded.

- Private Mortgage Insurance (PMI): If your down payment is less than 20%, PMI is usually necessary to protect lenders in case of default. This can significantly increase your monthly payments.

- Homeowners Association (HOA) Fees: If you live in a community with an HOA, these fees cover the maintenance of shared spaces and may be included in your regular payment.

Grasping these components is essential, as they collectively shape your overall financial responsibility. We know how challenging this can be, but financial specialists emphasize that understanding the principal and interest is vital to the loan repayment framework.

Consider this: a longer loan term can help keep your monthly payment on a 400k mortgage lower, freeing up cash for home improvement projects or increasing your savings. Conversely, a shorter term means you’ll settle your loan sooner, pay less interest, and build equity in your home faster.

This comprehensive view empowers potential buyers to navigate the complexities of financing effectively. We’re here to support you every step of the way.

Examples of Monthly Payments Based on Different Scenarios

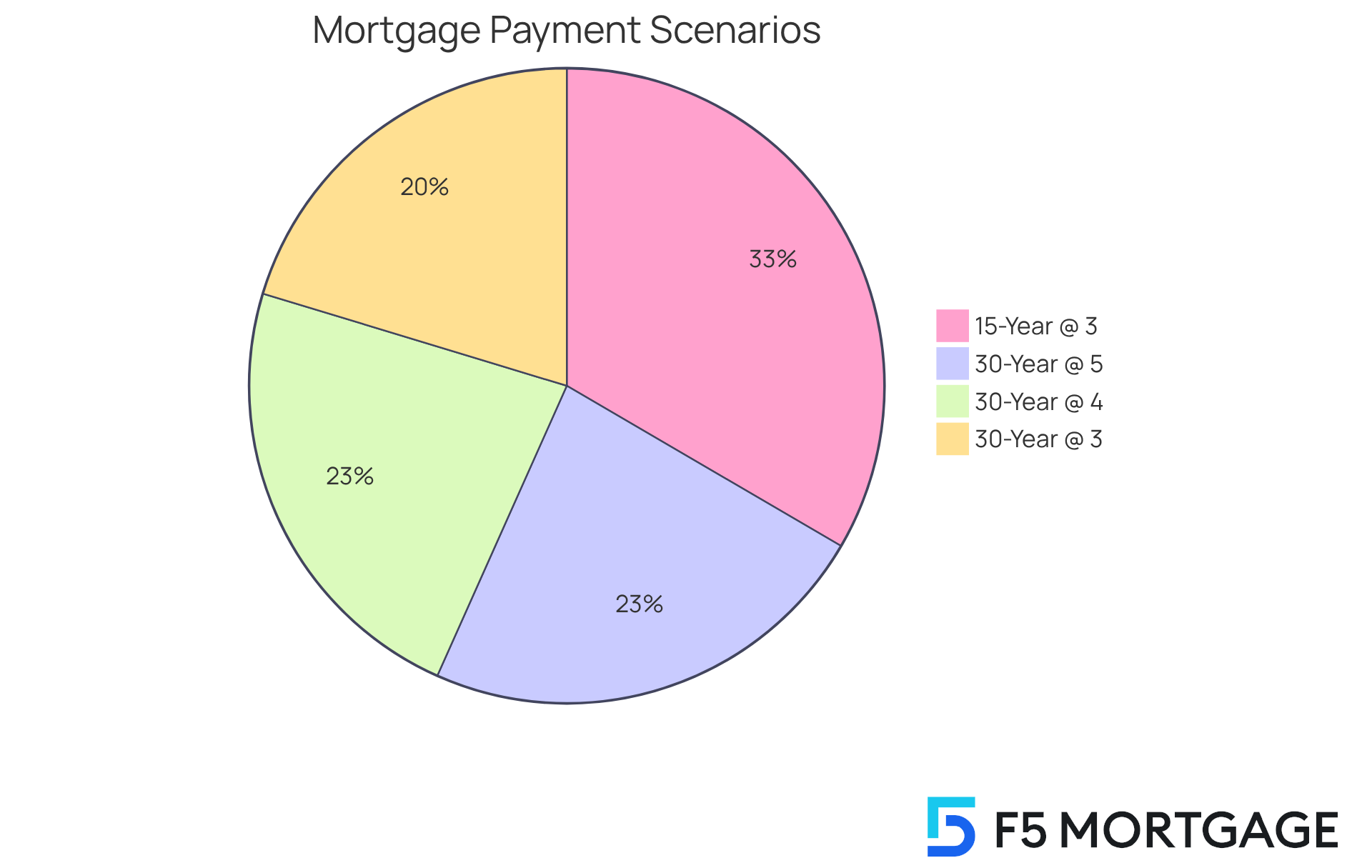

To illustrate the variability of monthly payments for a $400,000 mortgage, let’s consider some scenarios that many families might face:

- 30-Year Fixed Rate at 3%: Approximately $1,686.42.

- 30-Year Fixed Rate at 4%: About $1,909.66.

- 15-Year Fixed Rate at 3%: Around $2,774.

- 30-Year Fixed Rate at 5% with a 10% Down Payment: Assuming a borrowing amount of $360,000, approximately $1,932.

These examples highlight how even slight variations in interest rates or modifications in loan terms can lead to significant changes in the monthly payment on a 400k mortgage. We know how challenging it can be to navigate these options, which is why comprehensive financial planning is so important. Understanding how interest rate fluctuations can impact overall affordability is crucial for making informed decisions.

At F5 Mortgage, we’re here to support you every step of the way. We leverage technology to offer ultra-competitive rates and personalized support, ensuring you feel empowered rather than pressured. As personal finance journalist Aly J. Yale wisely notes, understanding the monthly payment on a 400k mortgage and the factors that influence it is crucial before purchasing a home. With F5 Mortgage, you can achieve homeownership with exceptional service and clarity.

Conclusion

Understanding the intricacies of monthly payments on a $400,000 mortgage is vital for any prospective homeowner. We know how challenging this can be. These payments are not merely numbers; they represent a significant financial commitment influenced by various factors like interest rates, loan duration, and down payments. Grasping these elements allows individuals to make informed decisions that align with their financial goals and homeownership aspirations.

Throughout this article, we’ve discussed key insights, including:

- How interest rates can dramatically alter monthly payments

- The impact of loan terms on overall costs

- The importance of factoring in property taxes and insurance

Real-life examples have illustrated how different scenarios can affect monthly obligations, demonstrating that even slight changes can lead to significant financial differences. Understanding these components empowers buyers to navigate the mortgage landscape with confidence.

Ultimately, the journey toward homeownership requires careful consideration and strategic planning. By leveraging the knowledge of how monthly payments are calculated and the factors that influence them, potential buyers can better prepare for their financial futures. Taking the time to analyze these aspects not only aids in budgeting but also enhances the overall home-buying experience, ensuring that individuals make choices that will benefit them in the long run. We’re here to support you every step of the way.

Frequently Asked Questions

What does the monthly payment on a $400,000 mortgage include?

The monthly payment on a $400,000 mortgage typically includes contributions to both the principal and interest of the loan.

What factors influence the monthly payment on a mortgage?

The monthly payment is influenced by the loan amount, interest rate, and loan term.

How much would the monthly payment be on a $400,000 mortgage at a 6% interest rate?

The monthly payment on a $400,000 mortgage at a 6% interest rate would be roughly $2,398.

What happens to the monthly payment if the interest rate increases to 7%?

If the interest rate rises to 7%, the monthly payment on a $400,000 mortgage increases to approximately $2,661.

What is the 28/36 guideline for housing costs?

The 28/36 guideline suggests that no more than 28% of your gross income should be allocated for housing costs, including loan obligations, while your total debt should not exceed 36% of your income.

What household income is recommended for a $400,000 loan?

A household income of around $90,000 may suffice for a $400,000 loan under certain conditions, but a more practical recommendation would be $105,000 when considering insurance and taxes.

How does the loan term affect the monthly payment on a $400,000 mortgage?

A 15-year loan at 6% results in a monthly payment of about $3,375, which is significantly higher than the 30-year option, but it allows for quicker debt payoff and less interest accumulation over time.

Why is it important to understand mortgage costs?

Understanding mortgage costs is crucial as they directly impact budgeting and financial planning, representing your financial commitment and long-term strategy.