Overview

Understanding the difference between APR and interest rate is essential for homebuyers. The APR, or Annual Percentage Rate, is more than just the interest rate; it includes additional costs associated with borrowing, such as fees and charges. This broader perspective offers a clearer picture of the total loan expense.

We know how challenging navigating these financial choices can be. By grasping this distinction, you empower yourself to evaluate loan options more effectively. This understanding is crucial in making informed financial decisions that align with your unique goals.

Remember, we’re here to support you every step of the way. Take the time to explore your options, and don’t hesitate to seek guidance as you embark on this important journey.

Introduction

Navigating the world of borrowing can feel overwhelming, especially for homebuyers facing the complexities of mortgage rates. The difference between the Annual Percentage Rate (APR) and the interest rate is not just a technical detail; it plays a crucial role in determining the total cost of a loan and, ultimately, the affordability of homeownership. As you consider your options, a vital question emerges: how can you ensure that you are making the most informed financial decision amid the variety of rates and fees?

In this article, we will explore the essential differences between APR and interest rates. Our goal is to equip you with the knowledge necessary to evaluate your mortgage choices effectively. We understand how challenging this process can be, and we’re here to support you every step of the way.

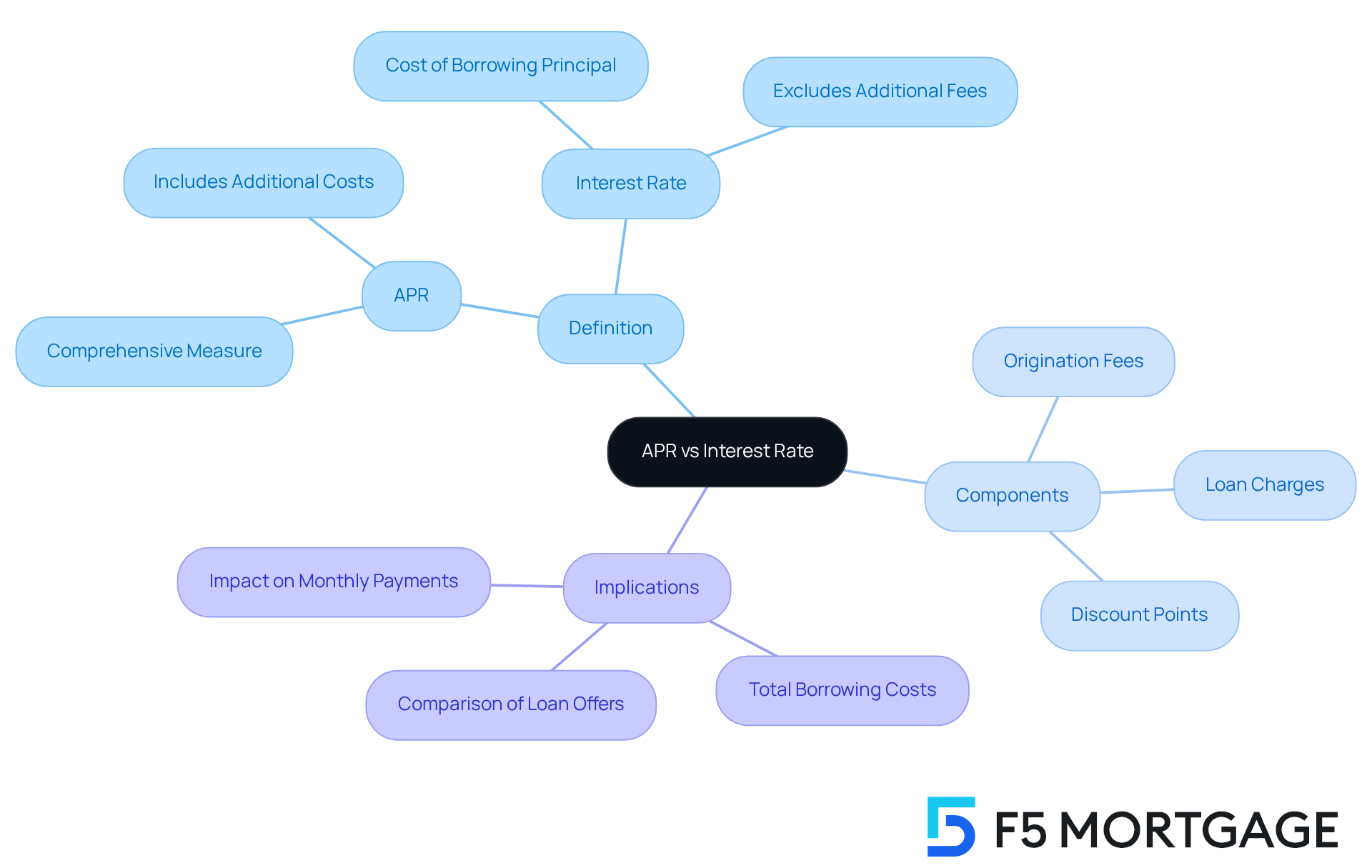

Define APR and Interest Rate

Understanding what is APR vs interest rate is crucial, as the Annual Percentage Rate (APR) is more than just a number; it’s a vital indicator of the total cost of borrowing, expressed as a yearly percentage. We know how challenging it can be to navigate the world of loans, and it’s important to understand what is APR vs interest rate, which indicates that the APR includes not only the borrowing percentage but also extra charges related to the loan, such as origination fees and final expenses. For instance, if you secure a mortgage at 6.65%, the APR might be higher due to these additional costs, providing a clearer picture of your total financial commitment.

In contrast, the borrowing charge only reflects the cost of obtaining the principal amount, shown as a percentage of the loan. While this borrowing cost signifies the basic expense of acquiring funds, knowing what is APR vs interest rate can provide a more comprehensive view of your total loan expense throughout its duration. This is crucial for you to consider when evaluating various loan options.

Recent data shows that the typical 30-year fixed mortgage borrowing cost is currently 6.65%. However, understanding what is APR vs interest rate is important as the average APR can vary based on the specific fees associated with the loan. Understanding these differences is essential for homebuyers like you, as it empowers you to make informed decisions that align with your financial goals. Remember, we’re here to support you every step of the way.

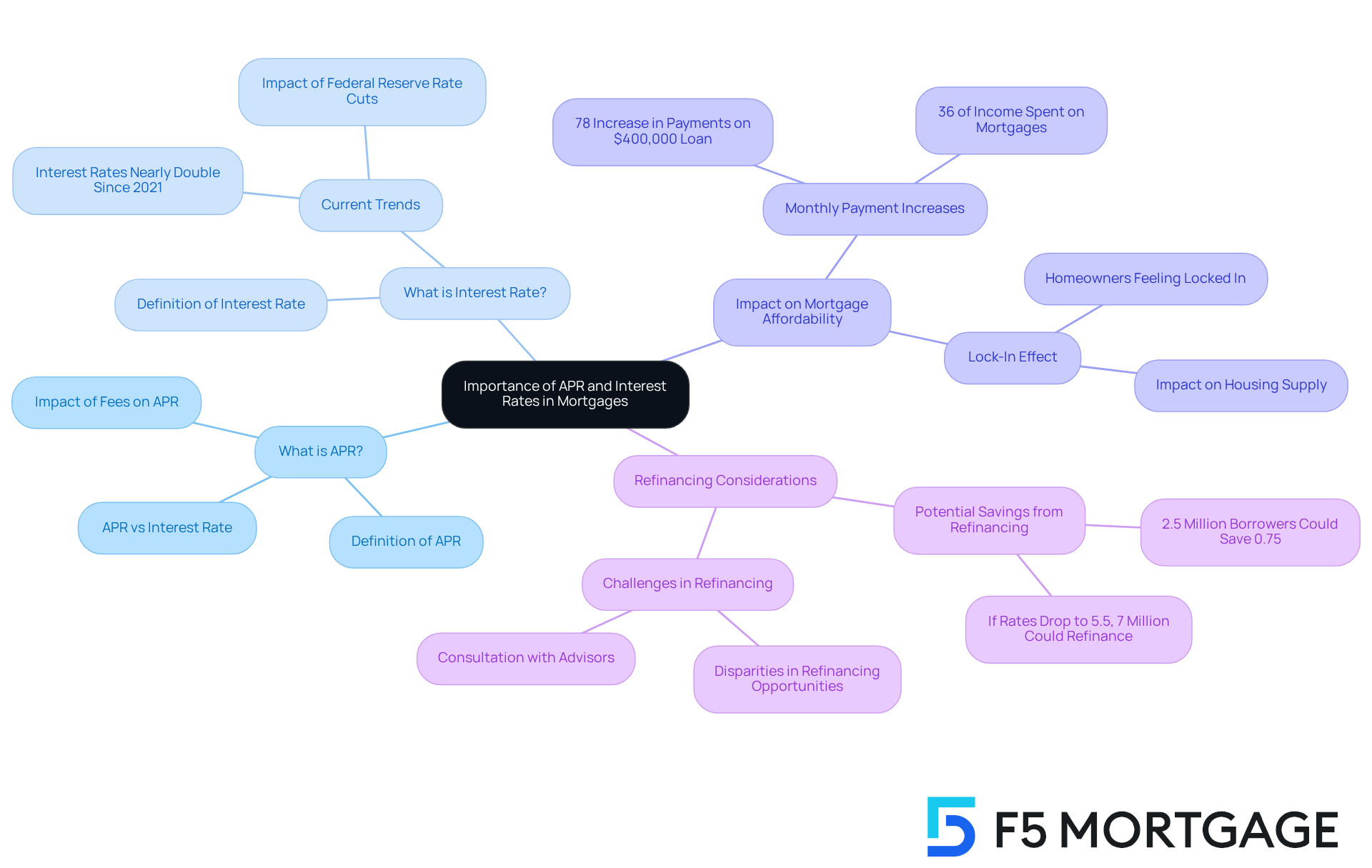

Explain the Importance of APR and Interest Rates in Mortgages

For homebuyers seeking to achieve their dream of homeownership with F5 Mortgage, understanding what is APR vs interest rate and other financial charges is crucial. These elements play a vital role in assessing mortgage affordability. For instance, a decrease in the borrowing cost from 7.25% to 6.5% can save a borrower about $200 each month on a $400,000 loan. This reduction makes homeownership more attainable, especially in a market where a typical household now spends about 36% of their monthly income on mortgage payments, a significant increase from 26% in 2019.

The APR, or Annual Percentage Rate, helps to clarify what is APR vs interest rate by representing the overall cost of borrowing. It includes not just the interest rate but also any related fees. This means that two loans with the same borrowing cost can have very different APRs if one has higher fees. For example, a loan with a lower borrowing cost but a higher APR may ultimately cost the borrower more over time.

At F5 Mortgage, we understand how overwhelming this can be, and we are here to support you every step of the way. With nearly 60% of active mortgages featuring charges below 4%, many homeowners feel ‘locked in’ to their existing loans, especially as borrowing costs have nearly doubled since 2021. This ‘lock-in effect’ can make refinancing seem daunting, even though it may offer potential savings. As borrowing costs decrease, around 2.5 million borrowers might consider refinancing to save at least 0.75% on their charges, highlighting the importance of keeping track of these figures.

We offer a free quote with no commitment or hidden costs, allowing you to explore your options without pressure. Expert insights suggest that as borrowing costs decline, housing demand may rise, which could help ease some affordability challenges. Therefore, understanding what is APR vs interest rate, along with assessing the borrowing cost, is essential for making informed decisions and selecting the most economical mortgage option. With the competitive offers and outstanding service provided by F5 Mortgage, we are dedicated to helping you navigate this journey.

Differentiate Between APR and Interest Rate: Key Characteristics

Understanding what is APR vs interest rate and the differences with loan charges can feel overwhelming, but we’re here to help you navigate this important aspect of borrowing. The loan charge is a straightforward percentage that reflects the cost of borrowing the principal sum. However, to understand what is APR vs interest rate, it is important to note that the APR (Annual Percentage Rate) offers a more comprehensive view, encompassing not just the charge but also additional costs associated with the loan, such as origination fees and discount points.

Typically, what is APR vs interest rate indicates that the APR is higher than the nominal interest rate because it accounts for these extra costs. For instance, imagine a borrower securing a $300,000 mortgage with a 4% charge. Their monthly payment, calculated solely on this interest rate, would be around $1,432. But if the APR is 4.5%, it is important to understand what is apr vs interest rate, as this signals that there are additional expenses to consider, which can significantly impact the total amount paid over the life of the loan.

The APR is determined by adding these costs to the initial loan amount, providing a clearer picture of the total borrowing expenses. In fact, the difference between the borrowing cost and APR can lead to thousands of dollars in extra costs over the loan’s duration. Grasping these nuances, including what is apr vs interest rate, is essential for borrowers to accurately assess the true expense of their mortgage options and make informed financial decisions.

Moreover, the federal Truth in Lending Act (TILA) mandates that lenders disclose both the finance charge and APR. This requirement ensures that borrowers have the necessary information to evaluate loan offers effectively. It’s crucial for borrowers to compare loan charges and understand what is apr vs interest rate, as this allows for a more accurate assessment of borrowing costs. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

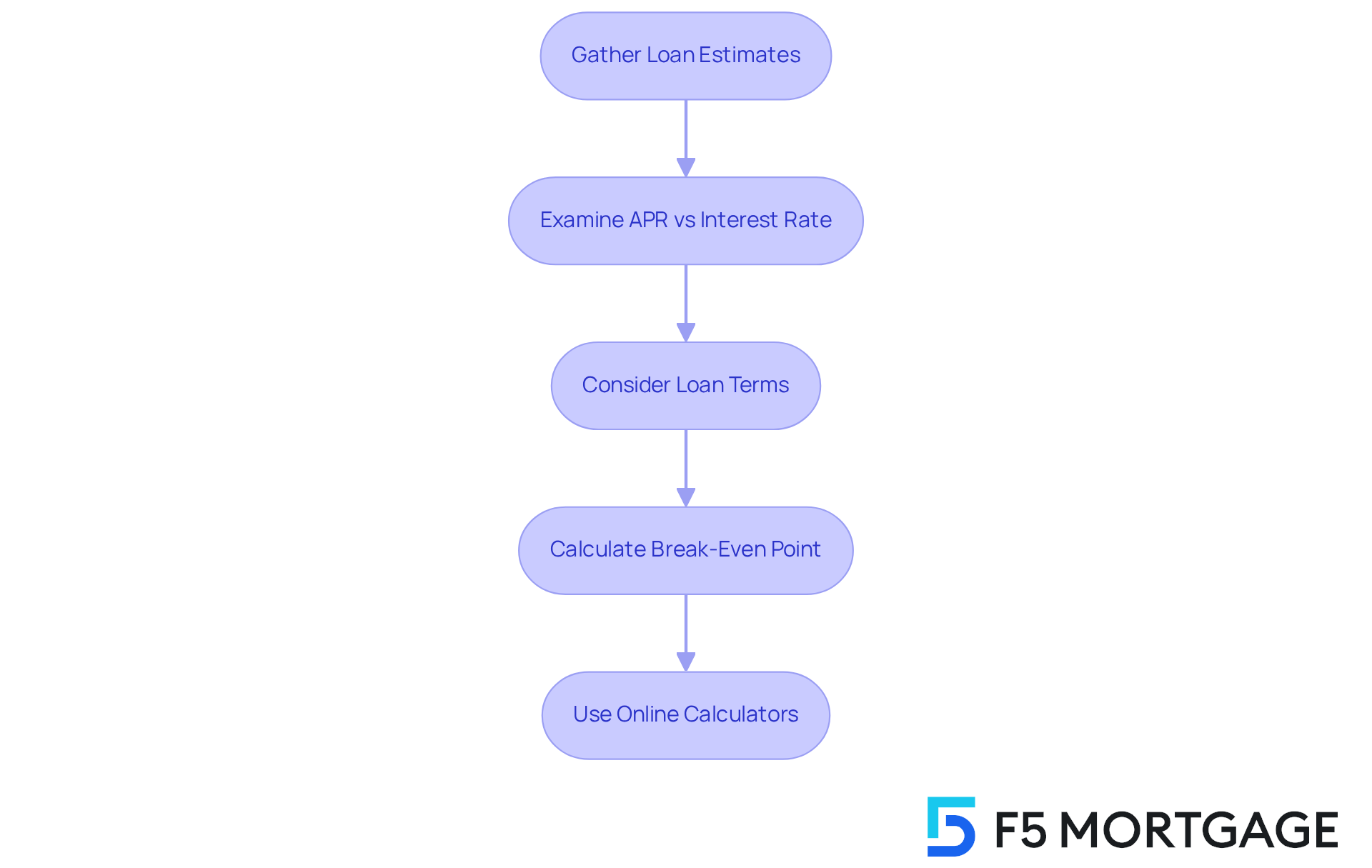

Guide to Comparing APR and Interest Rates for Better Borrowing Decisions

When evaluating mortgage choices, we know how challenging it can be to navigate the complexities of financing. To fully understand the expenses associated with a loan, it’s essential for borrowers to consider both the finance charge and what is APR vs interest rate. Here are some steps to guide you through this process:

-

Gather Loan Estimates: Start by obtaining loan estimates from various lenders. Make sure these estimates include both the cost of borrowing and what is APR vs interest rate, to allow for effective comparison.

-

Examine what is APR vs interest rate: Don’t just focus on the interest rate; look closely at the APR. This figure represents the total cost of borrowing, which raises the question of what is APR vs interest rate, and encompasses fees like application fees, origination fees, and appraisal expenses.

-

Consider Loan Terms: Take a moment to assess the loan conditions. Factors such as the duration of the loan and any prepayment penalties can significantly impact your overall expenses.

-

Calculate Your Break-Even Point: To understand how long it will take to recover refinancing costs through savings in monthly payments, calculate your monthly savings by subtracting your new monthly payment from your current one. Then, divide your total refinancing expenses by this monthly savings amount.

-

Use Online Calculators: Finally, don’t hesitate to utilize mortgage calculators. These tools can help simulate different scenarios based on varying interest rates and explain what is APR vs interest rate, allowing you to visualize potential monthly payments and total costs.

By following these steps, you can make informed borrowing decisions that align with your financial goals. Remember, we’re here to support you every step of the way.

Conclusion

Understanding the differences between APR and interest rates is essential for homebuyers seeking to make informed financial decisions. We know how challenging this can be, and that’s why the Annual Percentage Rate (APR) offers a comprehensive view of the total cost of borrowing. It encompasses not only the interest charged but also additional fees associated with the loan. This holistic perspective is crucial for evaluating various mortgage options and understanding the true financial commitment involved.

Throughout this article, we have highlighted key insights, such as the impact of APR on monthly payments and overall loan affordability. The importance of comparing both the interest rate and APR cannot be overstated. These figures can significantly influence the total amount paid over the life of the loan. Moreover, understanding how these rates are calculated and their implications on loan terms empowers homebuyers to navigate the mortgage landscape effectively.

In light of these insights, it is vital for borrowers to take proactive steps in evaluating their financing options. By gathering loan estimates, examining both APR and interest rates, and utilizing online calculators, homebuyers can better understand their financial choices. This knowledge not only aids in selecting the right mortgage but also fosters a more secure and confident approach to homeownership. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is APR?

The Annual Percentage Rate (APR) is a vital indicator of the total cost of borrowing, expressed as a yearly percentage. It includes the borrowing percentage as well as additional charges related to the loan, such as origination fees and final expenses.

How does APR differ from the interest rate?

The interest rate reflects only the cost of obtaining the principal amount, shown as a percentage of the loan. In contrast, APR provides a more comprehensive view by including extra charges, thus indicating the total financial commitment over the duration of the loan.

Why is understanding APR important for borrowers?

Understanding APR is crucial as it allows borrowers to have a clearer picture of their total loan expenses, empowering them to make informed decisions when evaluating various loan options.

What is the current typical borrowing cost for a 30-year fixed mortgage?

The typical borrowing cost for a 30-year fixed mortgage is currently 6.65%.

How can the average APR vary?

The average APR can vary based on the specific fees associated with the loan, which is why understanding both APR and interest rate is important for homebuyers.