Overview

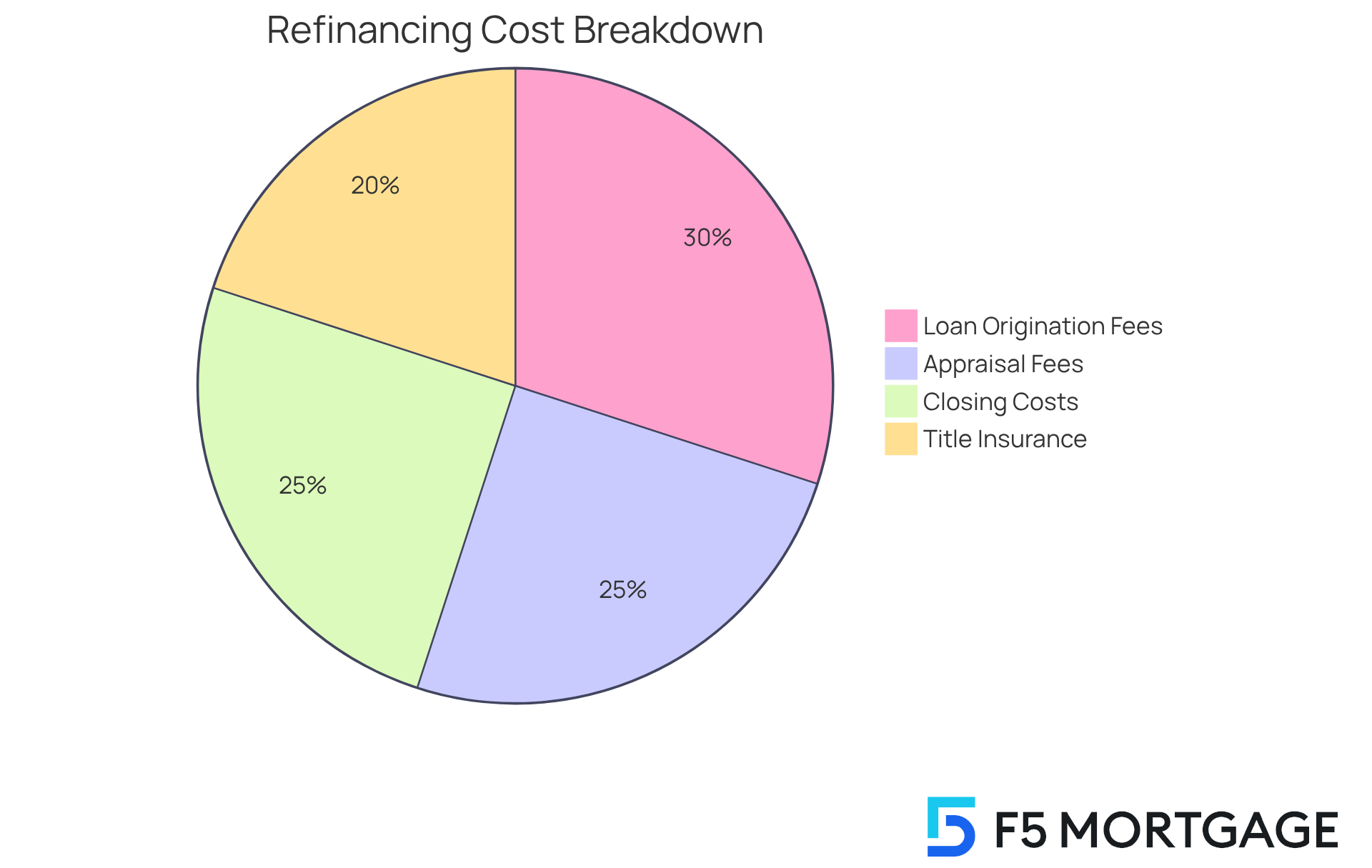

Understanding the costs of refinancing your home is crucial. Typically, these costs range from 2% to 6% of the new loan amount. This includes various fees such as loan origination, appraisal, title insurance, and closing costs.

We know how challenging it can be to navigate these financial decisions. That’s why it’s important to understand these costs fully. They empower you to make informed choices about whether refinancing is the right move for you.

Especially during times of declining interest rates or when your credit score improves, refinancing can offer significant benefits. By being aware of the associated costs, you can determine if this financial step aligns with your goals.

We’re here to support you every step of the way as you consider your options. Take the time to evaluate your situation and consult with professionals who can guide you through this process.

Introduction

Understanding the costs involved in refinancing a house is essential for homeowners looking to make informed financial decisions. We know how challenging this can be, especially with expenses that can range from 2% to 6% of the new loan amount. Navigating through fees such as loan origination, appraisal, and title insurance can feel daunting.

As you weigh the potential savings against these costs, a crucial question arises: when does refinancing truly become a financially sound choice? Exploring this topic can unveil strategies to not only manage these expenses but also maximize the benefits of restructuring a mortgage. We’re here to support you every step of the way in making the best decision for your financial future.

Define Mortgage Refinancing Costs

Mortgage restructuring expenses are the costs associated with replacing an existing mortgage with a new one. These expenses can typically range from 2% to 6% of the new loan amount, encompassing various charges such as loan origination fees, appraisal fees, title insurance, and closing costs. Understanding these expenses is crucial for homeowners as it helps them evaluate how much does it cost to refinance a house and determine if restructuring their mortgage is a financially sound decision.

For example, if you are consolidating a $300,000 mortgage, you could expect to pay between $6,000 and $18,000 in related costs. Grasping these figures allows homeowners to make informed choices regarding their loan options and potential savings.

In California, one popular option for restructuring is the rate-and-term arrangement. This option enables homeowners to reduce their monthly payments by replacing their current mortgage with one that offers a more favorable rate or different term lengths. Such refinancing can be particularly beneficial during times of declining interest rates, prompting homeowners to ask how much does it cost to refinance a house while saving money on their overall debt. Additionally, homeowners have the flexibility to switch between a variable rate and a fixed-rate mortgage, which can provide further financial relief.

It’s also essential to consider how long you plan to stay in your home. Generally, it’s recommended to own a house for at least five years to ensure that the investment pays off effectively. We understand how challenging these decisions can be, and we’re here to support you every step of the way.

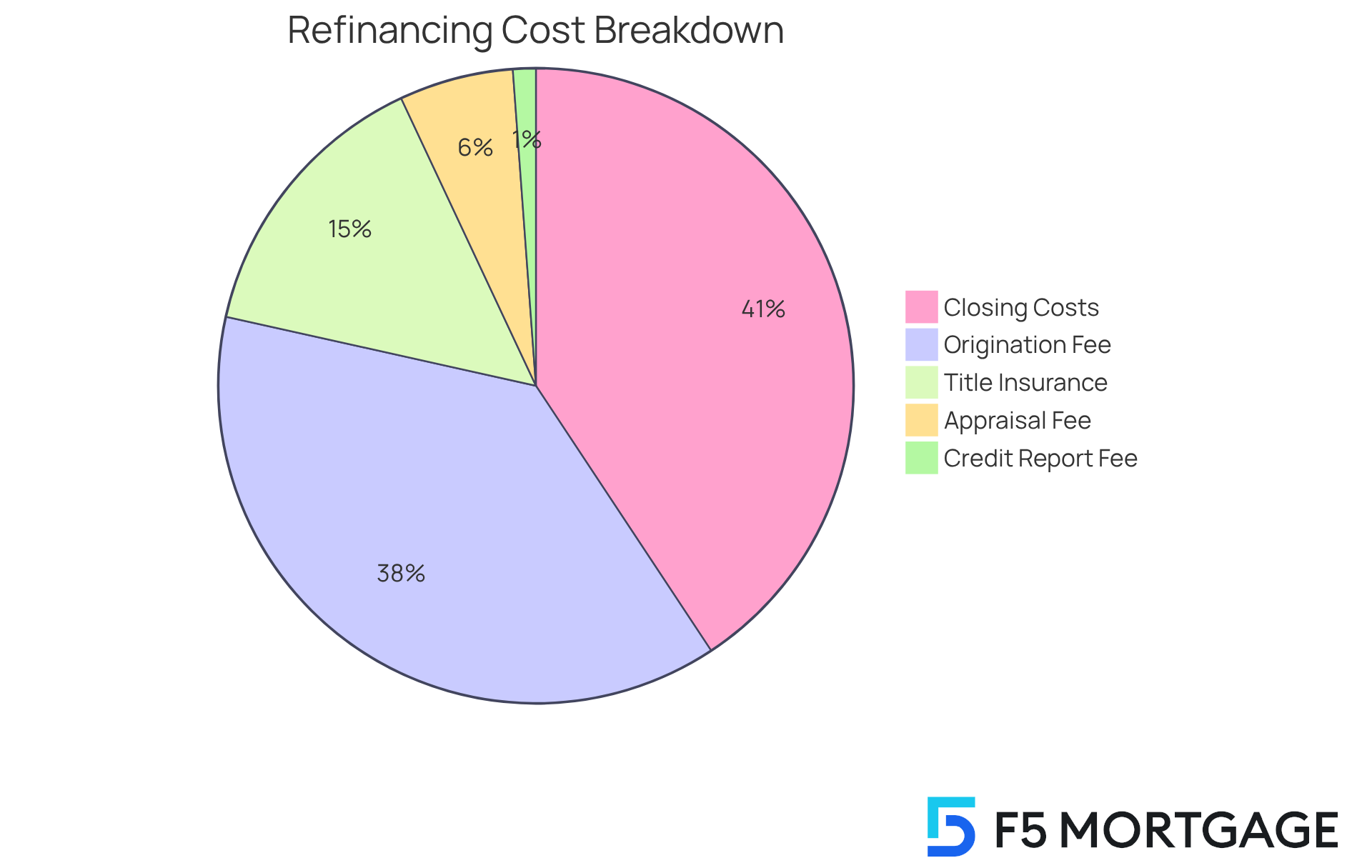

Identify Common Costs Involved in Refinancing

Refinancing your home can feel overwhelming, especially when it comes to understanding how much does it cost to refinance a house. Here are some common expenses you may encounter:

- Financing Origination Fee: Typically ranging from 1% to 1.5% of the financing amount, this fee is charged by the lender for processing your financing. It’s important to know this upfront so you can budget accordingly.

- Appraisal Fee: This can vary between $300 and $1,000. It covers the cost of evaluating your property’s worth, which is essential for determining the equity available for refinancing options like rate-and-term financing.

- Title Insurance: This protects you against potential disputes over property ownership, costing between $1,000 and $2,500. Having this protection can give you peace of mind as you move forward.

- Credit Report Fee: Usually around $30 to $50, this fee is for obtaining your credit report. Understanding your credit status can empower you in the refinancing process.

- Closing Costs: These encompass various fees such as attorney fees, recording fees, and other charges, typically amounting to 2% to 5% of the mortgage sum. Knowing these costs helps you prepare for the final steps.

Additionally, before fully approving a refinance, an inspection is often needed to ensure your home is in good condition. This can impact the approval process and the types of financing options available to you.

We understand how challenging this can be, and knowing how much does it cost to refinance a house is essential for effective budgeting. By being informed, you can make knowledgeable choices regarding the loan options available, including conventional, FHA, and VA loans. We’re here to support you every step of the way.

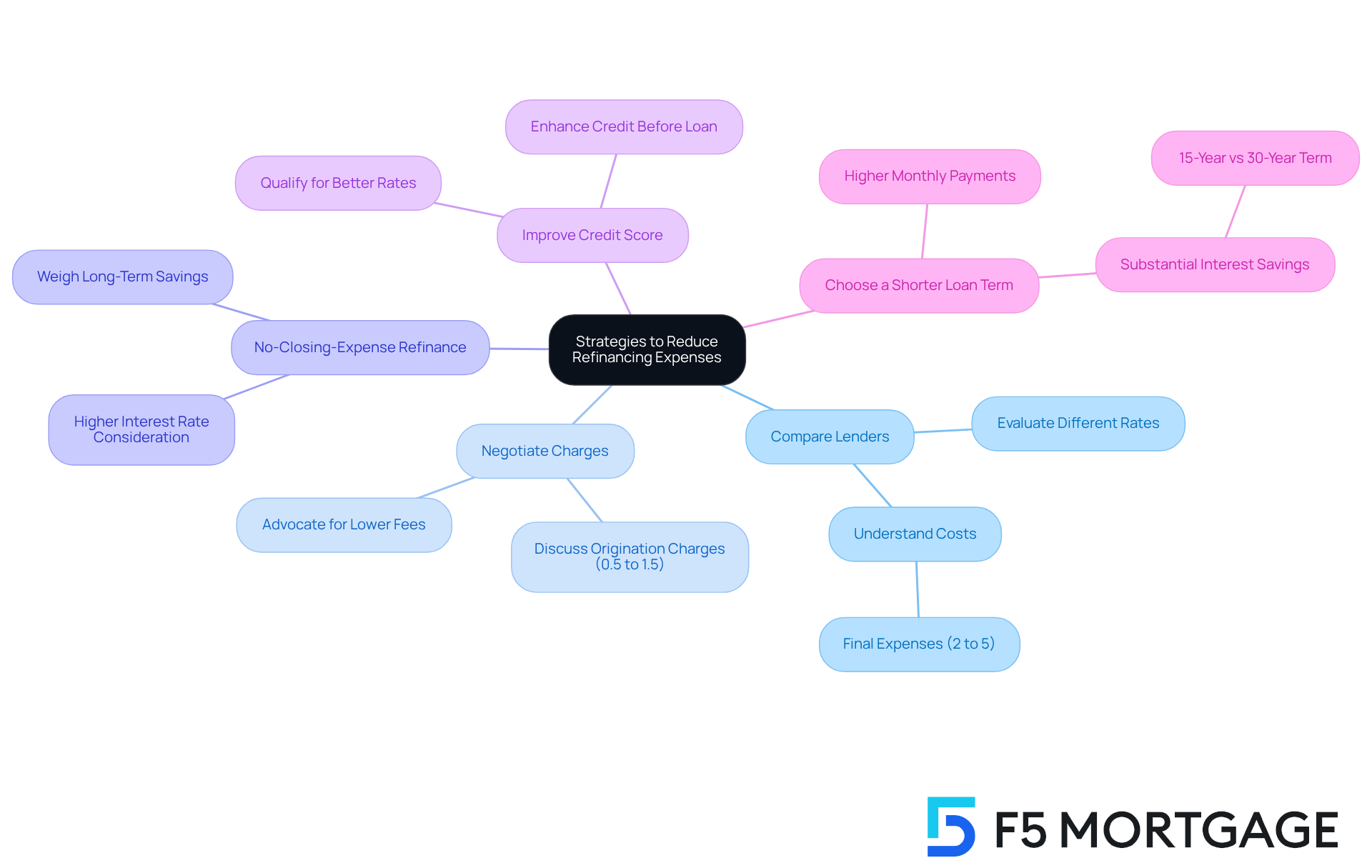

Explore Strategies to Reduce Refinancing Expenses

To reduce refinancing expenses, consider these thoughtful strategies:

-

Compare Lenders: We understand that navigating different lenders can be overwhelming. However, various lenders provide different rates and costs. Evaluating these options can help you discover the best offer and understand how much does it cost to refinance a house, potentially saving you thousands in final expenses, which usually range from 2% to 5% of the borrowing amount.

-

Negotiate Charges: Don’t hesitate to discuss with your lender regarding origination charges, which can range from 0.5% to 1.5% of the loan amount, and additional expenses. Many lenders are willing to lower fees to secure your business, and advocating for yourself can lead to significant savings.

-

Consider a No-Closing-Expense Refinance: This option allows you to refinance without paying upfront closing fees, although it may result in a higher interest rate. It’s essential to weigh this against the potential long-term savings, as it could be a beneficial choice for your financial situation.

-

Improve Your Credit Score: We know how challenging this can be, but a higher credit score can qualify you for better rates, ultimately reducing overall costs. Taking steps to enhance your credit before seeking a new loan can greatly affect your origination fees and interest rates.

-

Choose a Shorter Loan Term: While this may increase monthly payments, it can significantly reduce the total interest paid over the loan’s life, ultimately saving you money. For instance, opting for a 15-year term instead of a 30-year term can lead to substantial interest savings.

Applying these methods can greatly reduce the expenses related to obtaining a new loan, prompting homeowners to consider how much does it cost to refinance a house, thus making it a more appealing choice. Moreover, calculating your break-even point by assessing your loan costs and monthly savings can assist you in understanding how long it will take to recover these expenses through savings in monthly payments. We’re here to support you every step of the way.

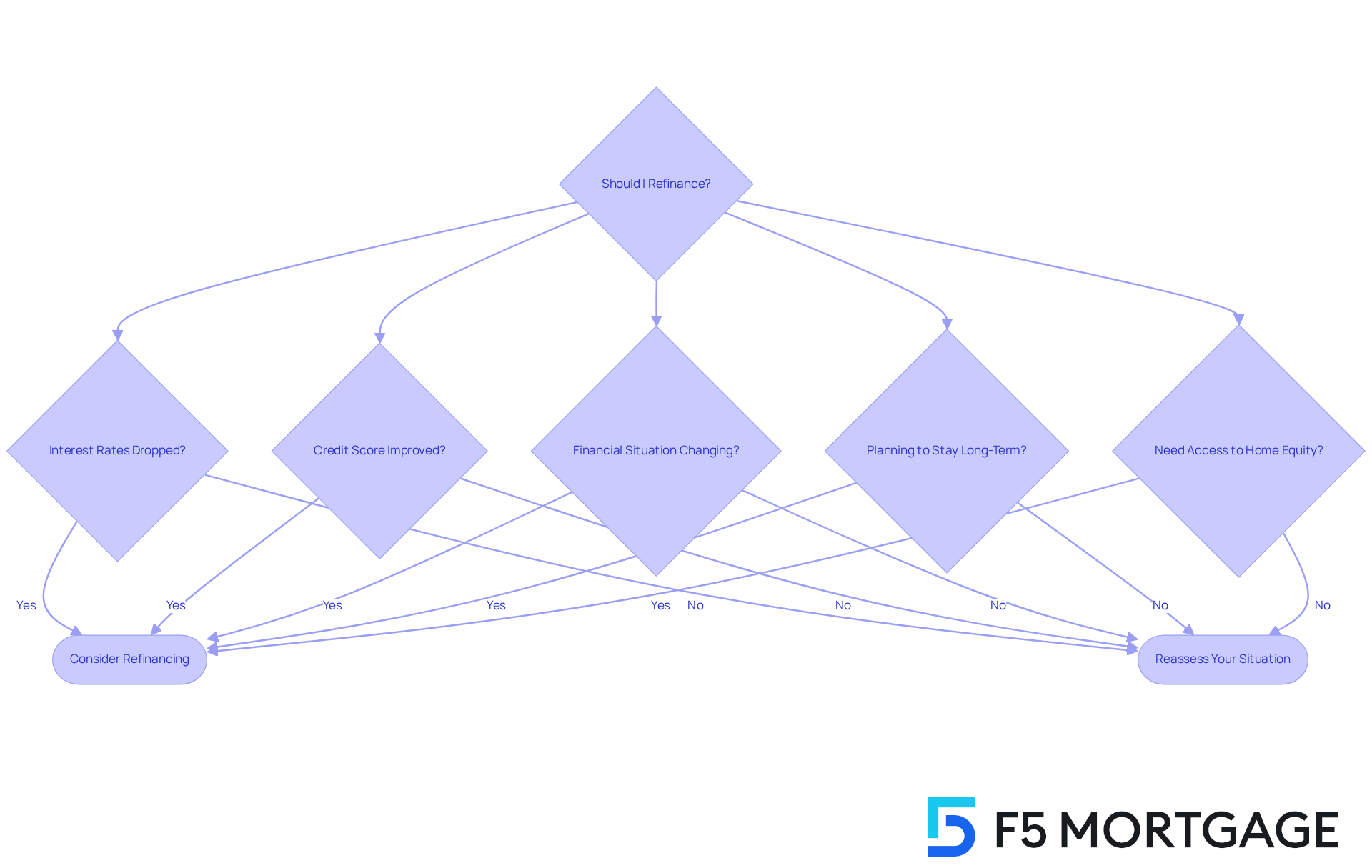

Evaluate When Refinancing Makes Financial Sense

Refinancing can be a wise financial decision, especially when certain conditions align with your needs and goals.

-

Have Interest Rates Dropped? If current mortgage rates are significantly lower than your existing rate—typically by at least 1%—securing a new loan could lead to substantial savings. This shift can ease financial burdens and provide peace of mind.

-

Has Your Credit Score Improved? If your credit score has improved since you took out your original mortgage, you may qualify for better rates. This improvement can open doors to more favorable loan terms, allowing you to save even more.

-

Is Your Financial Situation Changing? If your income has increased or your financial situation has improved, refinancing can help you secure a better loan term or lower monthly payments. We know how important it is to align your mortgage with your current lifestyle.

-

Planning to Stay Long-Term? If you intend to reside in your home for multiple years, the savings from a reduced interest rate can surpass the initial expenses of obtaining a new loan. This long-term perspective can make a significant difference in your financial journey.

-

Need Access to Home Equity? If you require funds for home enhancements or other costs, restructuring your loan can enable you to utilize your home equity at a lower interest rate than other borrowing methods. This option can provide the financial flexibility you need.

By evaluating these factors, you can determine if refinancing is a beneficial move for your financial future. We’re here to support you every step of the way.

Conclusion

Understanding the costs associated with refinancing a house is essential for homeowners like you, who are seeking to make informed financial decisions. We know how challenging this can be. By grasping the various expenses involved—ranging from origination fees to closing costs—you can better evaluate whether refinancing aligns with your financial goals and circumstances.

This article outlines key costs such as:

- Loan origination fees

- Appraisal fees

- Title insurance

- Closing costs

These can significantly impact the overall expense of refinancing. Additionally, we highlight strategies for reducing these costs, including:

- Comparing lenders

- Negotiating fees

- Improving your credit score

By considering factors like interest rate changes and your personal financial situation, you can determine the ideal timing for refinancing.

Ultimately, refinancing can offer substantial financial benefits when approached with careful consideration and planning. We encourage you to assess your unique situation, explore available options, and take action to secure favorable terms that can lead to long-term savings. By being proactive and informed, refinancing can transform into a strategic financial move that enhances your financial stability and future prospects.

Frequently Asked Questions

What are mortgage refinancing costs?

Mortgage refinancing costs are expenses associated with replacing an existing mortgage with a new one, typically ranging from 2% to 6% of the new loan amount. These costs include loan origination fees, appraisal fees, title insurance, and closing costs.

How much can I expect to pay in refinancing costs?

If you are consolidating a $300,000 mortgage, you could expect to pay between $6,000 and $18,000 in related costs.

Why is it important to understand mortgage refinancing costs?

Understanding these expenses is crucial for homeowners as it helps them evaluate the total cost of refinancing and determine if it is a financially sound decision.

What is a rate-and-term refinancing option?

A rate-and-term refinancing option allows homeowners to reduce their monthly payments by replacing their current mortgage with one that offers a more favorable interest rate or different term lengths.

When is refinancing particularly beneficial?

Refinancing can be particularly beneficial during times of declining interest rates, as it may allow homeowners to save money on their overall debt.

Can I switch between variable and fixed-rate mortgages during refinancing?

Yes, homeowners have the flexibility to switch between a variable rate and a fixed-rate mortgage, which can provide further financial relief.

How long should I plan to stay in my home to make refinancing worthwhile?

Generally, it is recommended to own a house for at least five years to ensure that the investment in refinancing pays off effectively.