Overview

Navigating the world of homeownership can be overwhelming, especially for families looking for affordable options. This article provides essential insights about FHA condo loans, specifically designed to support your journey toward homeownership.

We understand how challenging this can be, which is why we want to highlight the benefits of FHA financing. With low down payment requirements and flexible credit criteria, FHA loans can open doors to homeownership that may seem out of reach.

However, it’s important to be aware of the eligibility criteria. Understanding these requirements can make a significant difference in your experience. We’re here to support you every step of the way, ensuring you feel confident in navigating the complexities of the loan process.

Expert guidance is crucial in this journey. By working with knowledgeable professionals, you can gain clarity and direction, making the loan process smoother and more manageable. Remember, you’re not alone in this; we’re here to help you achieve your dream of owning a home.

Introduction

Navigating the complex world of FHA condo loans can feel overwhelming for families eager to achieve homeownership. We understand how challenging this can be, especially with recent updates to loan limits and the increasing interest in affordable housing options. These loans present a unique opportunity for first-time buyers and those looking to upgrade their living situation.

However, misconceptions about eligibility and the application process often create barriers that prevent families from seizing these advantages. It’s important to address these concerns and empower families with the essential insights they need. By understanding the nuances of FHA condo financing, families can confidently explore their options and overcome the challenges they face.

F5 Mortgage: Your Trusted Source for FHA Condo Loans

F5 Financing LLC stands out as a compassionate independent brokerage, specializing in FHA condo financing. At F5 Financial Services, we truly prioritize client satisfaction. Our team provides personalized consultations and a diverse array of financing options tailored to meet the unique needs of families. By leveraging advanced technology, we ensure that our clients enjoy competitive rates and favorable terms, making the home buying process smoother and more accessible. Families can trust F5 Mortgage to help them navigate the complexities of FHA condo financing, providing guidance that fosters confidence and clarity throughout their mortgage journey.

Current trends indicate a growing interest in FHA financing, particularly among first-time homebuyers and families looking to upgrade. With the FHA’s recent updates to loan limits, more families can now access financing options that were once beyond their reach. F5 Financing is well-equipped to assist clients in seizing these opportunities, ensuring they remain competitive in today’s ever-changing housing market.

Moreover, the positive experiences shared by our clients highlight the advantages of working with independent loan brokers like F5. Clients frequently commend our personalized approach and exceptional service, expressing gratitude for how our team guided them through the process with patience and expertise. As one satisfied client shared, “The F5 loan team made the process simple and stress-free, ensuring I grasped each step completely.” This unwavering commitment to excellence and focus on empowering our clients makes F5 Mortgage a trusted partner in realizing homeownership dreams.

Eligibility Criteria for FHA Condo Loans

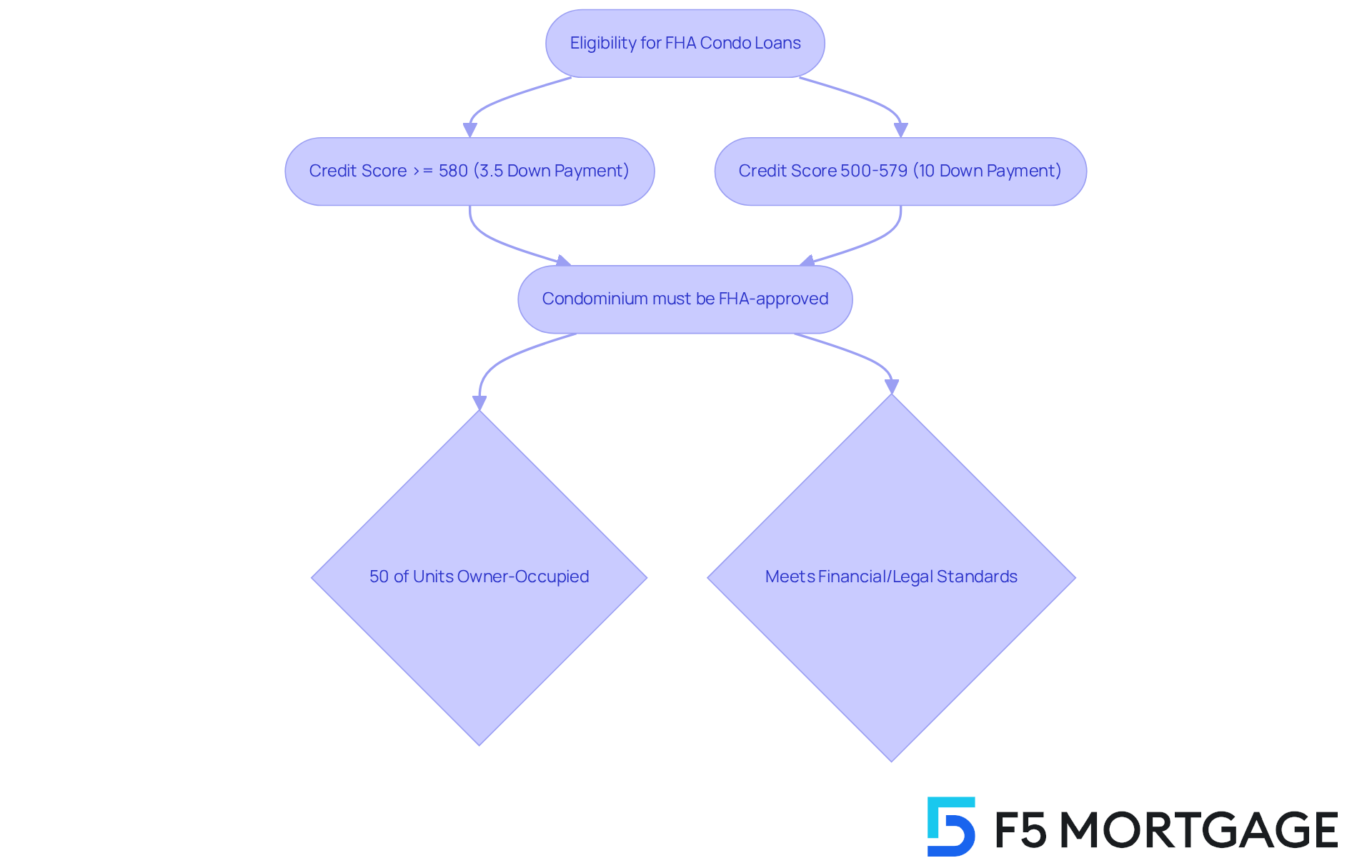

Navigating the world of FHA condo mortgages can feel overwhelming, and we understand how challenging the FHA condo process can be for families. To qualify, borrowers must meet specific eligibility criteria. Typically, a minimum credit score of 580 is required for a 3.5% down payment. However, if your score falls between 500 and 579, you may need to provide a 10% down payment instead.

Additionally, it’s important to know that the condominium must be part of an FHA-approved project. This usually means that:

- At least 50% of the units must be owner-occupied

- Adherence to various financial and legal standards

As we look ahead to 2025, these requirements remain in place, underscoring the importance of understanding them as you evaluate your eligibility.

At F5 Mortgage, we’re here to support you every step of the way. Our mission is to empower households by offering tailored assistance throughout the mortgage journey. Even if you’re facing initial credit difficulties, an FHA condo can still be a viable financing option for you. Our mortgage experts are dedicated to helping families navigate these criteria, making the dream of homeownership more attainable and feasible.

Key Benefits of FHA Condo Loans

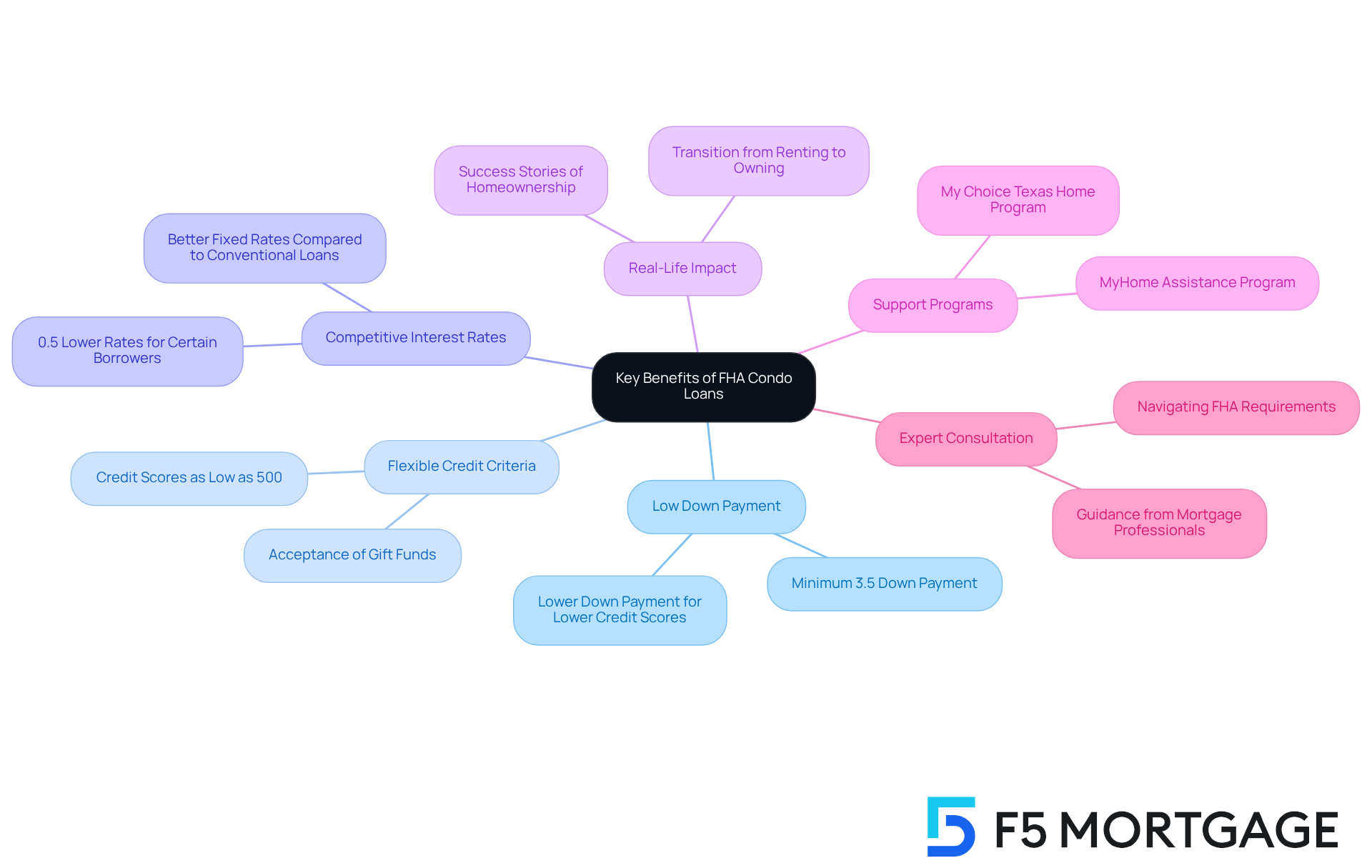

FHA condo financing offers a range of benefits for families seeking to purchase an FHA condo. One of the most appealing aspects is the low down payment requirement, which can be as little as 3.5% for borrowers with a credit score of 580 or higher. We understand how challenging it can be for first-time homebuyers to save for larger down payments, making this accessibility crucial. Additionally, FHA mortgages are known for their flexible credit score criteria, allowing families with less-than-ideal credit to qualify more easily. In fact, some lenders accept scores as low as 500 with a higher down payment, broadening the pool of potential homeowners.

Competitive interest rates further enhance the attractiveness of FHA mortgages, making them a financially sound choice for families. Borrowers with credit scores ranging from 620 to 655 have reported average interest rates that are 0.5% lower than those for similar traditional mortgages, leading to significant savings over the life of the loan.

Real-life stories illustrate the positive impact of FHA financing on families. Many have successfully navigated the home buying process with the support of FHA financing, allowing them to transition from renting to owning. The flexibility of FHA condo mortgages, including the ability to use gift funds for down payments, has empowered families to achieve their homeownership dreams despite financial constraints. Moreover, down payment assistance programs, such as the MyHome Assistance Program from the California Housing Finance Authority and the My Choice Texas Home program, can provide additional support, making homeownership even more attainable.

Current expert opinions highlight the ongoing importance of FHA condo financing in today’s housing market. With the FHA’s Mutual Mortgage Insurance Fund reaching record capital levels, the program remains a viable option for families looking to build long-term wealth through homeownership. As the housing market evolves, FHA financing continues to offer vital pathways for families, especially those entering the market for the first time.

To fully leverage the benefits of FHA financing, families should consider consulting a mortgage expert to navigate the specific requirements and options available. We’re here to support you every step of the way.

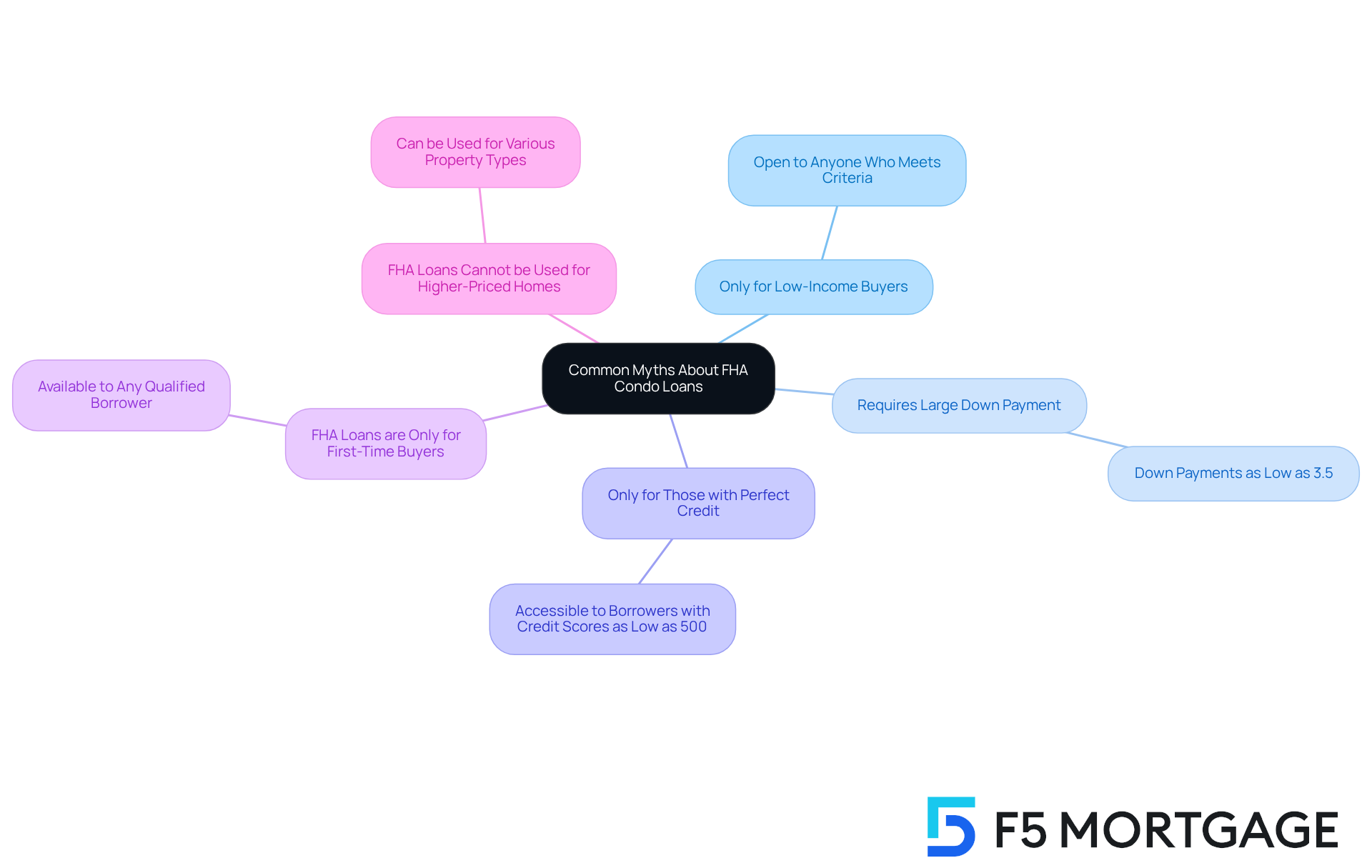

Common Myths About FHA Condo Loans Debunked

Many families face confusion regarding FHA condo financing, which often leads to misunderstandings. One prevalent myth is that FHA financing is only for low-income buyers. In truth, these options are open to anyone who meets the eligibility criteria, regardless of income level.

Another common belief is that FHA mortgages necessitate a large down payment. However, FHA financing allows down payments as low as 3.5%, making homeownership more attainable for many families. Additionally, it’s essential to know that FHA loans are accessible to borrowers with credit scores as low as 500, dispelling the notion that only those with perfect credit can qualify.

Moreover, families should be aware of down payment assistance programs available in Ohio, such as:

- YourChoice!

- Grant for Grads

- Ohio Heroes

These programs can provide crucial funding to support home purchases, particularly for those who may find it challenging to afford a home on their own. Many of these assistance programs have income limits, aimed at helping those who truly need it.

By dispelling these myths and understanding the assistance available, families can gain a clearer picture of FHA condo financing and down payment options. This knowledge empowers them to make informed decisions about their homeownership journey. For more information, we encourage you to consult reliable resources or speak with mortgage professionals. We’re here to support you every step of the way.

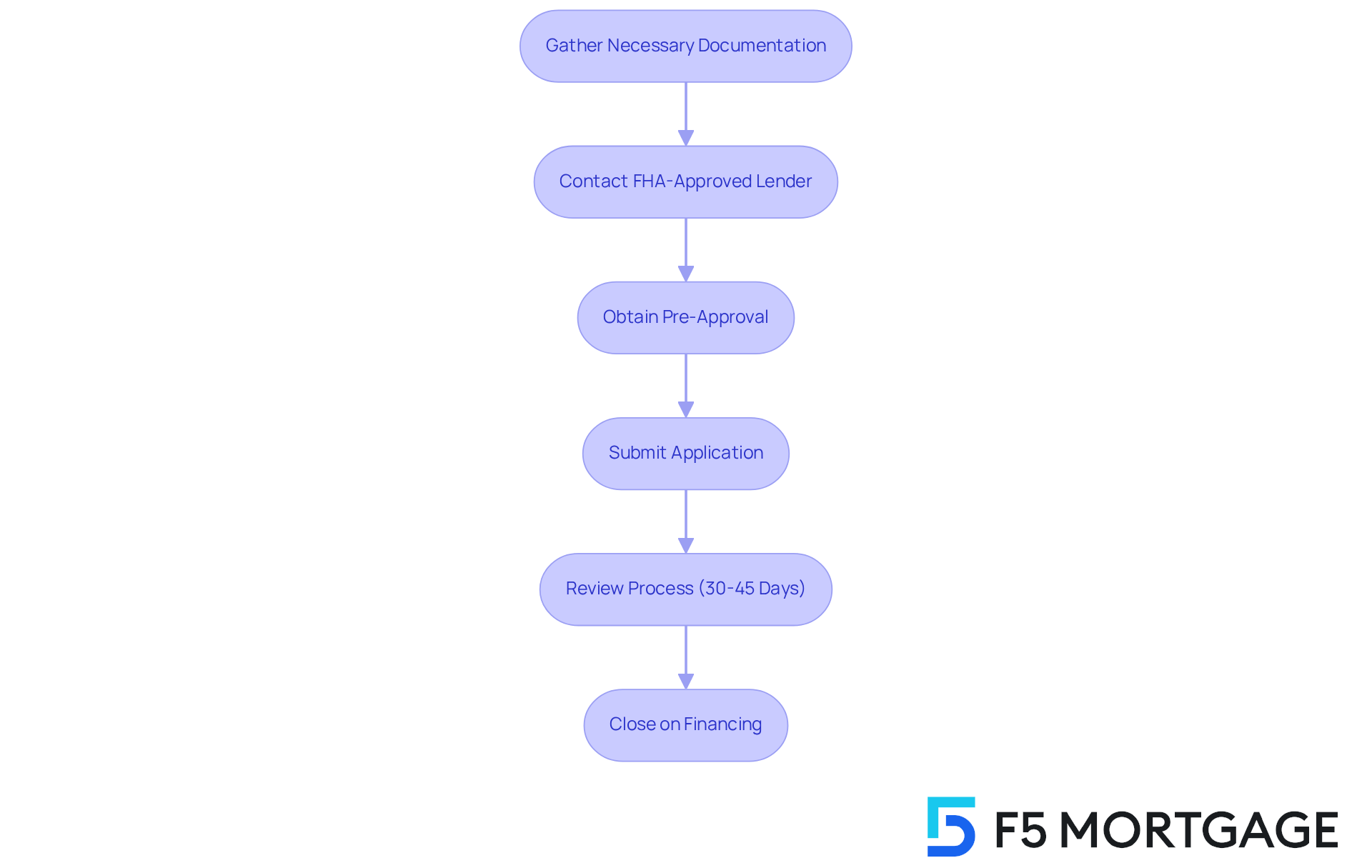

Steps to Apply for FHA Condo Loans

Applying for an FHA condo mortgage can feel overwhelming, but there are several crucial steps that can help simplify the process for families like yours. First, it’s important to gather necessary documentation. This typically includes:

- Proof of income

- Credit history

- Specific details about the condo project

Preparing these documents is essential, as it lays the groundwork for a smoother application experience.

Next, we encourage you to reach out to an FHA-approved lender, such as F5, to explore your financing options and start the pre-approval process. At F5 Mortgage, you can easily apply online, by phone, or through chat. Our financing specialists are here to help you personalize a plan that aligns with your goals. This step is vital, as obtaining pre-approval not only clarifies your budget but also strengthens your position when making an offer on an FHA condo. With FHA condo financing, you can benefit from a low down payment requirement of just 3.5% if you have a credit score of 580 or higher, making FHA condos a compelling choice for many families.

Once you’re pre-approved, you can formally submit your application. The lender will review it, and this process generally takes between 30 to 45 days for approval. It’s important to keep this timeline in mind, as it allows you to plan your move accordingly.

When you receive approval, you can proceed to close on the financing for the FHA condo, finalizing the purchase of your new home. Keep in mind that FHA financing requires mortgage insurance premiums (MIP), which should be factored into your budget. Throughout this journey, understanding the FHA financing process can greatly enhance your chances of approval and successful homeownership. We know how challenging this can be, but we’re here to support you every step of the way in your pursuit of affordable housing.

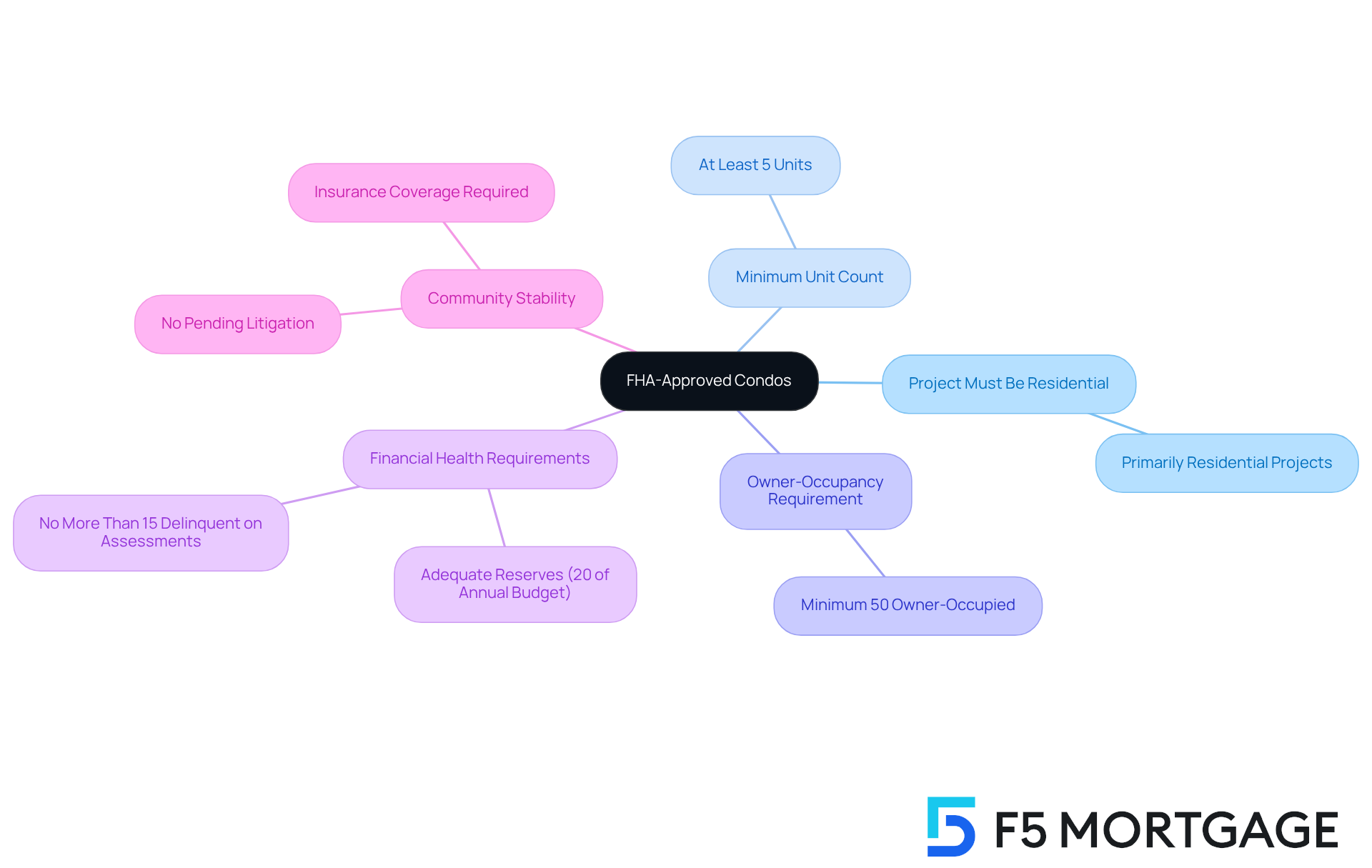

Understanding FHA-Approved Condos

Navigating the world of FHA condos can feel overwhelming, but understanding the specific criteria is essential for families seeking affordable housing options. To qualify for FHA condo financing, these condos must meet the following criteria:

- Be part of a project that is primarily residential.

- Consist of at least five units.

- Ensure that a minimum of 50% of the units are owner-occupied.

We know how challenging this can be, especially when considering the financial implications.

Additionally, the condo association must maintain adequate reserves, typically equal to at least 20% of the annual budget, and comply with various legal and financial standards. It’s crucial to note that no more than 15% of the units can be over 60 days delinquent on assessments. This requirement helps maintain the financial health of the community, ensuring a stable environment for all residents.

Comprehending these criteria not only influences funding possibilities but also shapes the overall experience of homeownership. Real estate experts stress that maneuvering through these requirements can significantly improve a household’s chances of obtaining an FHA condo. By understanding these guidelines, families can take proactive steps toward finding a home that meets their needs.

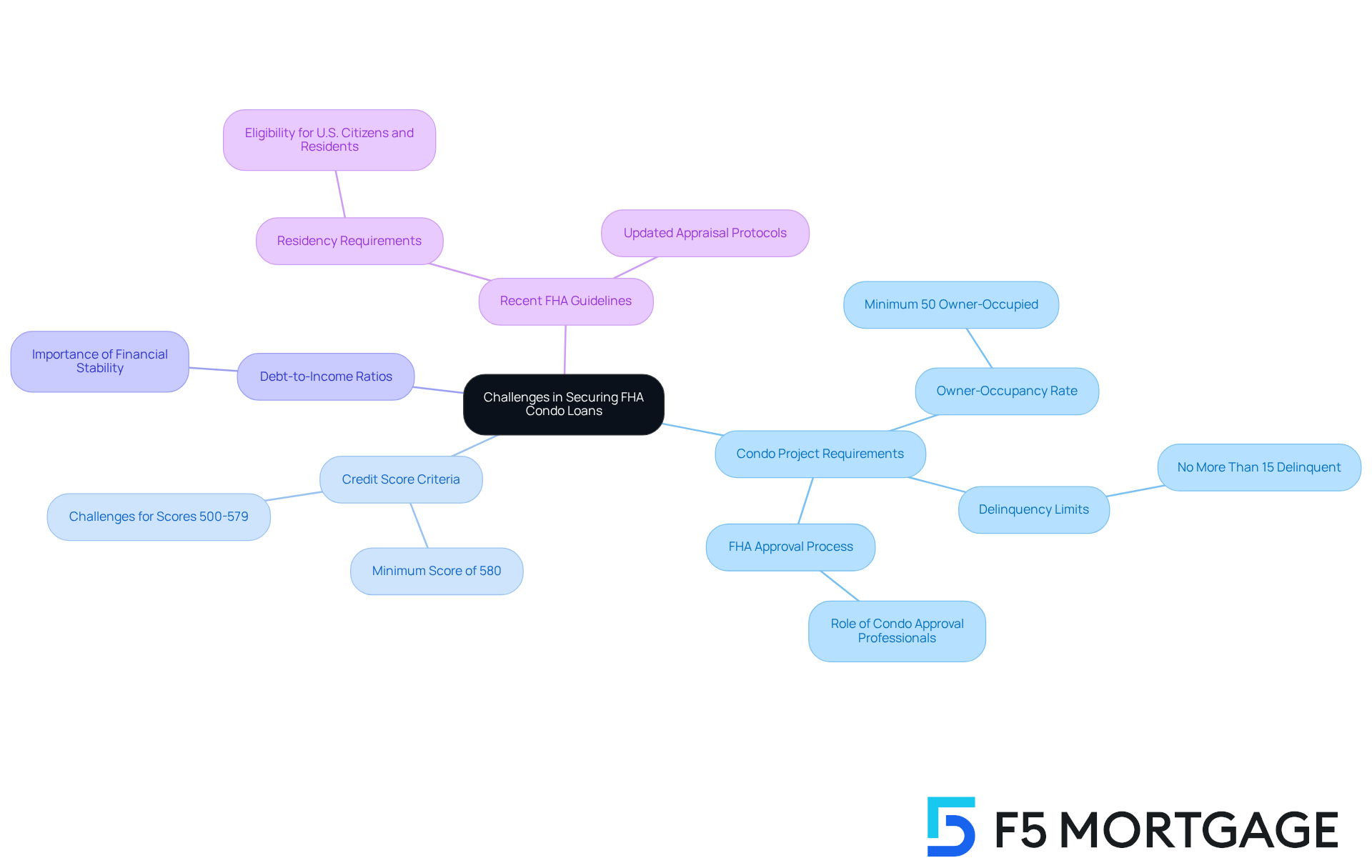

Challenges in Securing FHA Condo Loans

Navigating the process of obtaining an FHA condo mortgage can be challenging for families. One significant hurdle is the requirement for the condo project to be an FHA condo, which can greatly limit options, particularly in areas where many local condos do not meet the stringent criteria. Starting in 2025, the FHA mandates that at least 50% of units in a condo project must be owner-occupied, with no more than 15% of units delinquent on HOA dues for over 60 days. While these requirements aim to promote community stability, they can restrict access to FHA-insured loans for potential buyers.

We understand that families often encounter difficulties regarding credit score criteria. While the minimum score can be as low as 580, those with scores ranging from 500 to 579 may still face obstacles. Additionally, debt-to-income ratios are crucial in determining eligibility, and families need to demonstrate financial stability. By understanding these challenges in advance, families can navigate the process more effectively. Many have successfully overcome these hurdles by seeking assistance from skilled financing experts at F5, who provide personalized advice and support. They can connect families with top realtors in their area and leverage F5’s partnerships with over two dozen premier lenders and investors to secure the best loan agreements available.

Staying informed about the latest FHA financing challenges is essential. Recent updates to FHA guidelines have introduced new residency requirements, limiting eligibility to U.S. citizens and lawful permanent residents, which may impact some applicants. Moreover, the role of Condo Approval Professionals is crucial in facilitating the FHA approval process, helping condo projects meet necessary criteria. By proactively addressing these issues and utilizing available resources, including the expertise of F5, families can enhance their chances of obtaining FHA condo financing and achieving their homeownership goals. To improve your opportunities, consider reaching out to F5 for tailored support and to explore your options. We’re here to support you every step of the way.

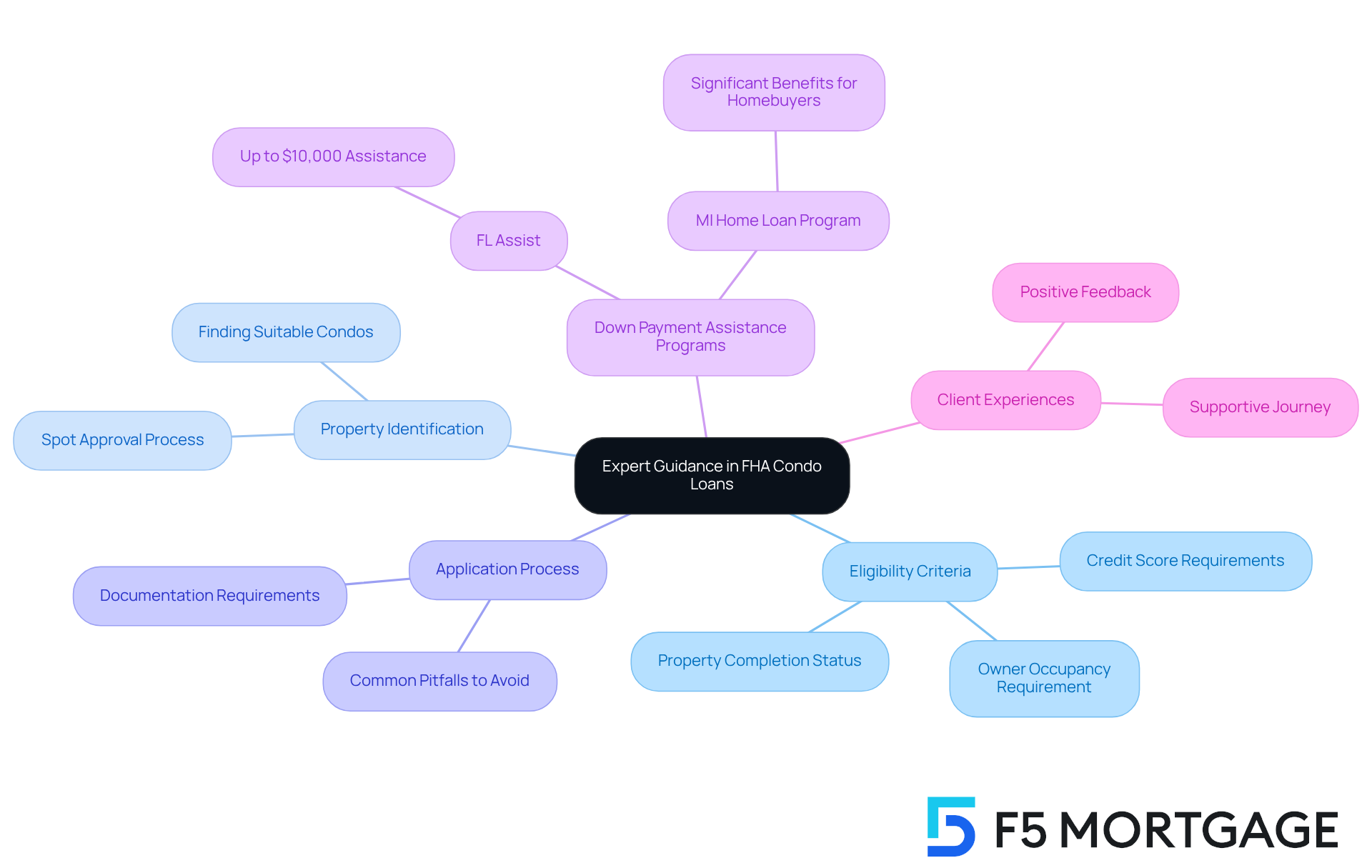

The Importance of Expert Guidance in FHA Condo Loans

Navigating the FHA condo loan process can feel overwhelming, and we understand how challenging this can be for families looking to secure an FHA condo. That’s why having expert guidance is essential. A proficient loan broker, like those at F5, is here to help you comprehend eligibility criteria, identify suitable properties, and simplify the application process.

With our expertise, you can avoid common pitfalls and secure favorable financing options. We also provide access to valuable down payment assistance programs, including Florida’s FL Assist and Michigan’s MI Home Loan program. These programs offer significant benefits for eligible homebuyers, providing up to $10,000 in assistance, making homeownership more attainable.

Our clients consistently share their positive experiences, praising the smooth and supportive journey they receive. This reflects F5 Mortgage’s commitment to a client-centric approach. We’re here to support you every step of the way, ensuring you feel confident and informed throughout the home financing process.

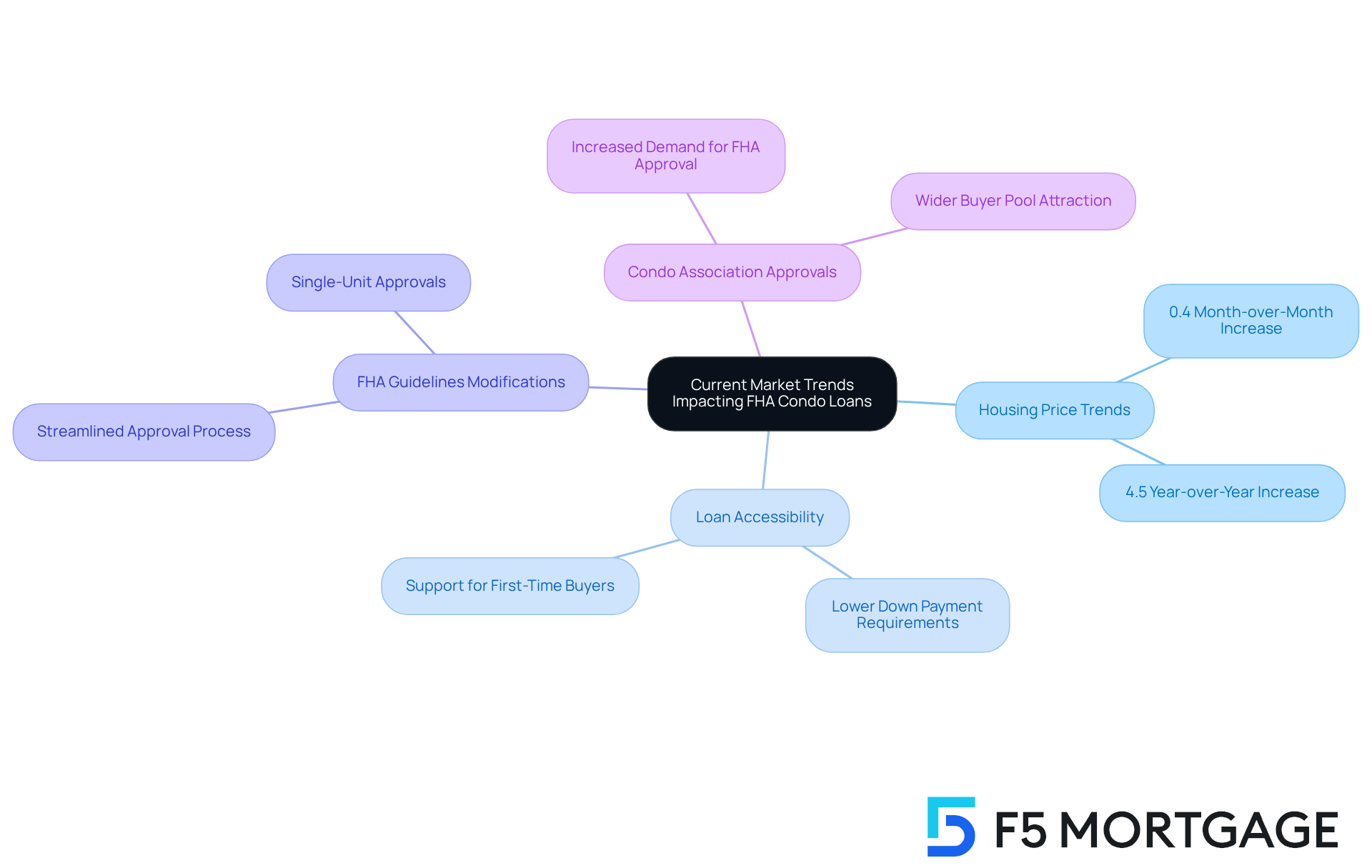

Current Market Trends Impacting FHA Condo Loans

Current market trends are reshaping the landscape of FHA condo financing, and we understand how challenging this can be. With housing prices seeing a significant rise—growing 0.4% month-over-month and 4.5% year-over-year as of October 2024—many households are increasingly considering FHA financing. These loans offer lower down payment requirements, making homeownership more accessible, especially for first-time buyers.

At F5 Financial, we’re here to support you every step of the way with quick and adaptable loan solutions. There are no obligations or concealed expenses, enabling households to acquire their dream residences more swiftly. Recent modifications to FHA condo guidelines have streamlined the approval process for certain condo projects, broadening the selection of FHA condo properties available to buyers.

This shift is particularly significant as more condo associations seek FHA condo approval to attract a wider buyer pool, reflecting the growing demand for affordable housing options in urban areas. By staying updated on these changing trends and securing competitive loan rates with F5, households can make strategic choices regarding their home acquisitions and financing alternatives.

We understand that navigating the intricacies of the current market can feel overwhelming. As one satisfied customer noted, ‘The F5 Mortgage team made the process smooth and stress-free!’

Take the first step towards your homeownership journey today.

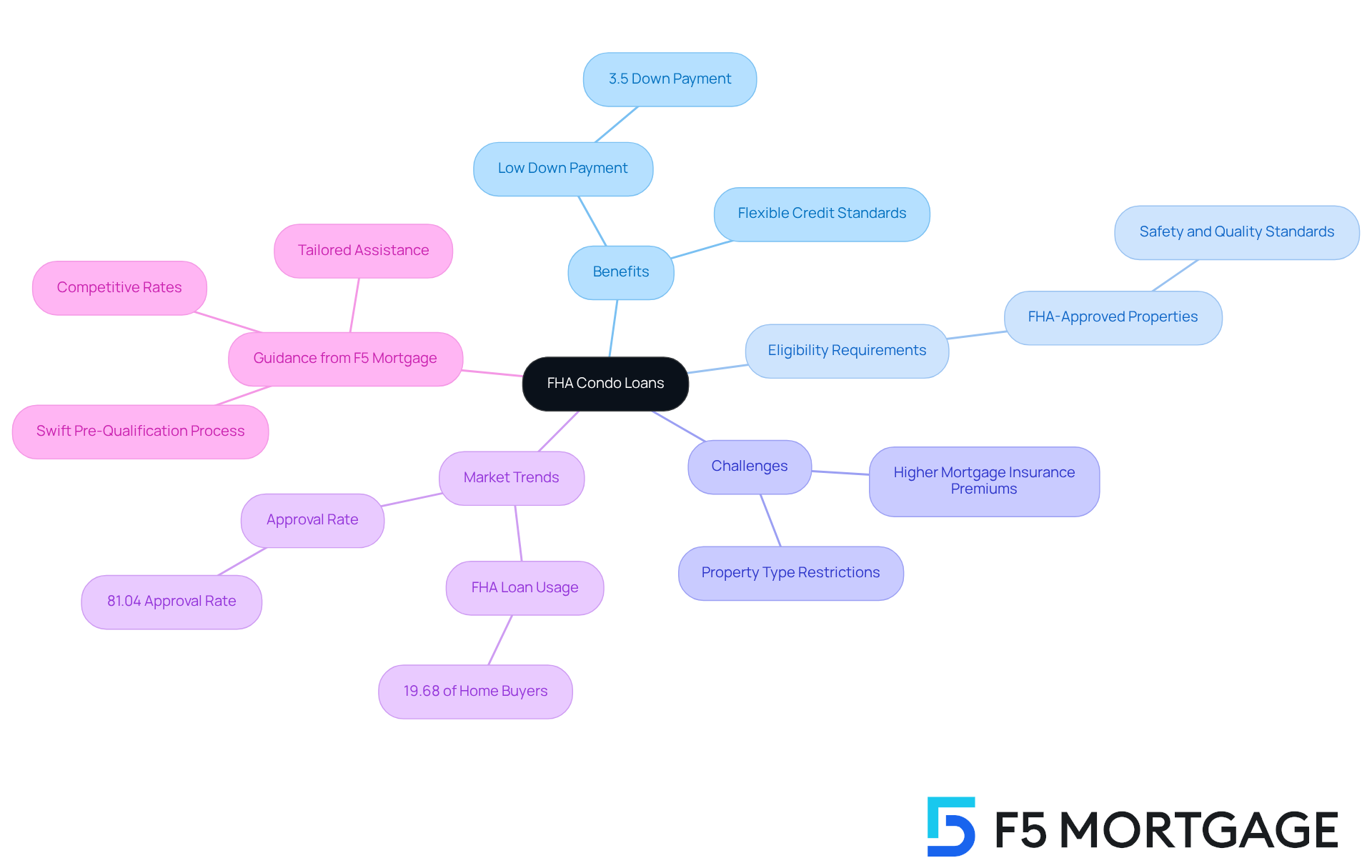

Essential Takeaways on FHA Condo Loans

FHA condo financing provides households with a promising path to homeownership, highlighted by several key benefits. We understand how challenging this journey can be, and these financial agreements generally demand reduced down payments, sometimes as low as 3.5%. This makes them attainable for families eager to enter the housing market. Additionally, FHA financing provides adaptable credit standards, which can be especially helpful for individuals with imperfect credit records.

It’s essential to comprehend the eligibility requirements for FHA financing. Families must ensure that the FHA condo they are interested in is FHA-approved, as this designation confirms that the property meets specific safety and quality standards. This step is crucial because it not only influences the approval process but also impacts the long-term value of the investment.

While there are many advantages, households should also be aware of the challenges associated with FHA loans. These can include higher mortgage insurance premiums and potential restrictions on the types of properties that qualify. However, with the right guidance from F5 Lending, which offers competitive rates and a swift pre-qualification process, families can navigate these hurdles effectively. F5 Mortgage provides quick and adaptable mortgage solutions, ensuring tailored assistance for home purchasing and refinancing, enabling individuals to realize their homeownership aspirations.

Current market trends indicate that FHA condo loans remain a favored option, with around 19.68% of home buyers utilizing them. This demonstrates an increasing awareness of their benefits, especially among families. Success stories abound, with numerous households successfully obtaining FHA financing and achieving their homeownership dreams. In fact, the overall approval rate for mortgage applications stands at 81.04%, contributing to a strong pathway for families seeking to purchase an FHA condo.

By staying informed about the FHA loan process and seeking expert advice from F5 Mortgage, families can enhance their chances of securing financing and making empowered decisions on their journey to homeownership. We’re here to support you every step of the way.

Conclusion

FHA condo loans are a vital resource for families seeking affordable homeownership options. With lower down payment requirements and flexible credit criteria, these loans open doors for many households that might otherwise struggle to secure financing. We know how challenging this can be, so understanding the intricacies of FHA financing—such as eligibility and the importance of choosing FHA-approved properties—is essential for families aiming to navigate this path successfully.

Throughout this article, we’ve explored the numerous advantages of FHA condo loans. From competitive interest rates to accessible down payment assistance programs, these resources can significantly ease the journey to homeownership. Additionally, dispelling common myths surrounding FHA financing empowers families to make informed decisions. Awareness of current market trends further emphasizes the continued relevance of these loans in today’s housing landscape.

Ultimately, we encourage families to leverage the benefits of FHA condo financing and seek expert assistance to enhance their chances of securing a home. By staying informed and proactive, individuals can transform the dream of homeownership into reality. This journey can ensure a stable and prosperous future for their households. Embracing this opportunity can lead to lasting financial growth and community stability, making FHA condo loans a significant consideration for aspiring homeowners.

Frequently Asked Questions

What is F5 Mortgage and what services do they offer?

F5 Mortgage, operated by F5 Financing LLC, is an independent brokerage specializing in FHA condo financing. They prioritize client satisfaction by providing personalized consultations and a variety of financing options tailored to families’ unique needs, ensuring competitive rates and favorable terms.

Who can benefit from FHA condo loans?

FHA condo loans are particularly beneficial for first-time homebuyers and families looking to upgrade. Recent updates to FHA loan limits have made these financing options more accessible to a wider range of families.

What are the eligibility criteria for FHA condo loans?

To qualify for FHA condo loans, borrowers typically need a minimum credit score of 580 for a 3.5% down payment. If the credit score is between 500 and 579, a 10% down payment is required. Additionally, the condominium must be part of an FHA-approved project, which generally requires at least 50% of the units to be owner-occupied.

What are the key benefits of FHA condo loans?

Key benefits of FHA condo loans include a low down payment requirement (as low as 3.5% for those with a credit score of 580 or higher), flexible credit score criteria, competitive interest rates, and the ability to use gift funds for down payments. These features make homeownership more attainable for families.

How do FHA condo loans compare to traditional mortgages in terms of interest rates?

FHA mortgages can offer competitive interest rates, often lower than those for traditional mortgages. Borrowers with credit scores between 620 and 655 have reported average interest rates that are 0.5% lower than similar traditional mortgage rates, leading to potential savings over the loan’s life.

Are there any assistance programs available for FHA condo loans?

Yes, there are down payment assistance programs available, such as the MyHome Assistance Program from the California Housing Finance Authority and the My Choice Texas Home program, which can provide additional support for families looking to purchase an FHA condo.

What should families do to navigate the FHA financing process?

Families are encouraged to consult with mortgage experts to understand the specific requirements and options available for FHA financing. F5 Mortgage offers dedicated support to help families throughout the mortgage journey, making homeownership more feasible.