Overview

Estimating closing costs when paying cash can feel daunting, especially when these expenses range from 2% to 5% of the property’s purchase price. This range can significantly impact your overall financial commitment. We know how challenging this can be, and it’s essential to understand the components involved, such as title insurance and appraisal fees.

To ease your concerns, this article outlines effective strategies for reducing these costs:

- Prepare thoroughly

- Negotiate wisely

By following these strategies, you can avoid unexpected financial strains during the home-buying process. Remember, we’re here to support you every step of the way, empowering you to make informed decisions for your family’s future.

Introduction

Understanding closing costs can feel overwhelming, especially for families paying cash for their new home. These expenses, typically ranging from 2% to 5% of the property’s purchase price, are crucial in shaping the overall financial commitment of a real estate transaction.

We know how challenging this can be, and families often find themselves asking: how can they accurately estimate these costs and avoid unexpected financial strains?

In this guide, we will explore the essential components of closing costs, share strategies for estimation, and provide practical tips for minimizing expenses. Our goal is to ensure a smoother path to homeownership, supporting you every step of the way.

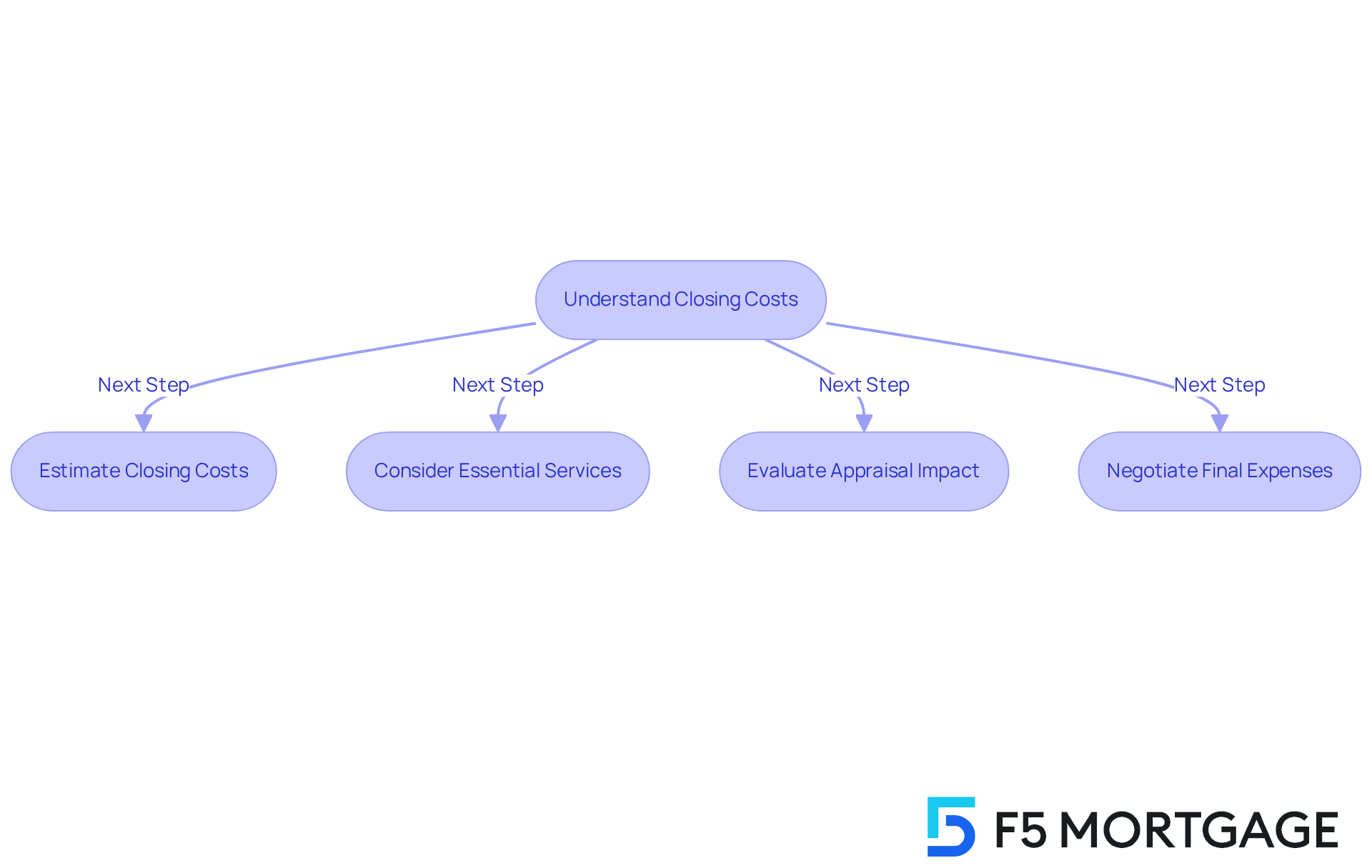

Define Closing Costs and Their Importance

Closing expenses can often feel overwhelming, but understanding them is crucial for your journey in real estate. For cash buyers, understanding how to estimate closing costs when paying cash is crucial, as these charges typically range from 2% to 5% of the property’s purchase price and can significantly influence your overall spending. Essential services like title insurance, which may vary from $300 to $2,500, appraisal fees averaging around $350, and necessary legal fees are all part of finalizing your transaction.

We know how challenging this can be, especially when the lender requests a property appraisal to determine your asset’s current market value. This appraisal not only indicates your equity but can also affect your rates. For instance, on a $300,000 house, understanding how to estimate closing costs when paying cash can show that settlement fees could range from $6,000 to $15,000. This underscores the importance of knowing how to estimate closing costs when paying cash for these expenses.

Moreover, the outcome of the appraisal can impact your final costs, making it vital to consider this element. We’re here to support you every step of the way, and we encourage you to think about negotiating final expenses and seller concessions, as these can greatly lessen your financial burden.

By acknowledging and preparing for these expenses, families can avoid unexpected financial strains at closing, ensuring a more seamless home-buying process. Remember, you’re not alone in this; we’re here to help you navigate through it all.

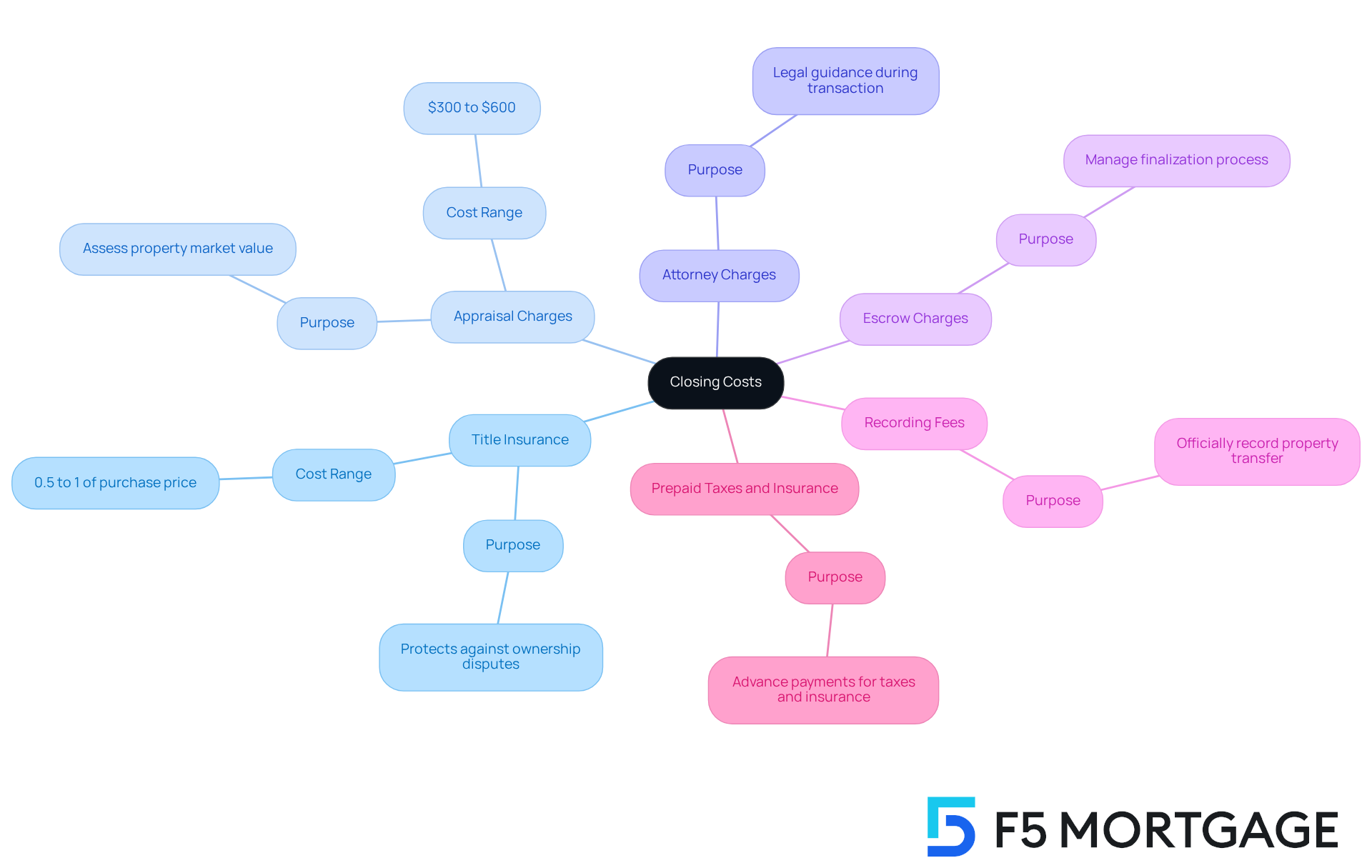

Identify Components of Closing Costs

Closing expenses can feel overwhelming, but understanding them is the first step toward a smoother home-buying journey. These expenses can vary based on your location and the specifics of your transaction. Let’s explore some key components together:

- Title Insurance: This is essential for protecting you against potential disputes regarding property ownership, giving you peace of mind during your purchase.

- Appraisal Charges: These charges cover the cost of assessing your property’s market value. This step is crucial for securing financing and ensuring your investment is sound. In 2025, you can expect typical appraisal costs to range from $300 to $600, depending on the size and complexity of the home.

- Attorney Charges: If you choose to have legal representation, these costs will compensate your attorney for their invaluable guidance throughout the transaction, especially when navigating complex legalities.

- Escrow Charges: These fees, imposed by the escrow firm, are for managing the finalization process, ensuring that all funds and documents are handled properly.

- Recording Fees: These are fees paid to your local government for officially recording the property transfer, and they can vary by jurisdiction.

- Prepaid Taxes and Insurance: Often, buyers need to make advance payments for property taxes and homeowners insurance. This can significantly impact your overall expenses at settlement.

By familiarizing yourself with these components, you can better anticipate your total settlement costs and learn how to estimate closing costs when paying cash, which typically range from 2% to 5% of the property’s purchase price. We know how challenging this can be, but this knowledge empowers you to budget effectively and avoid unexpected costs during your property buying journey. Remember, we’re here to support you every step of the way.

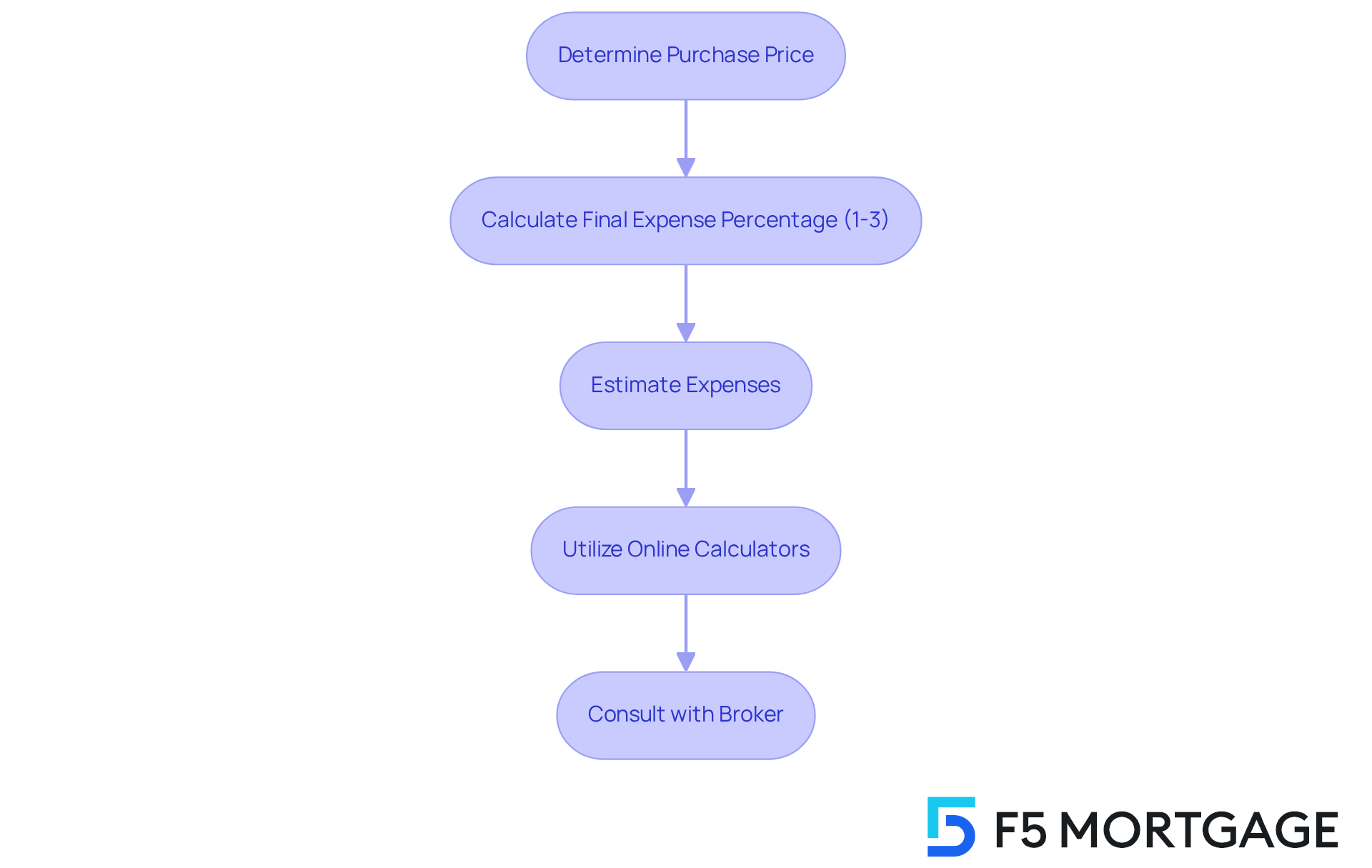

Calculate Your Estimated Closing Costs

Estimating your closing costs when paying cash can feel overwhelming, but we’re here to help you navigate how to estimate closing costs when paying cash with confidence. Start by determining the purchase price, which is simply the total cost of the property you wish to buy.

Next, consider utilizing a final expense percentage. Typically, when considering how to estimate closing costs when paying cash, expenses for cash acquisitions vary from 1% to 3% of the purchase price. For instance, if you’re looking at a residence valued at $300,000, you can expect expenses to range from $3,000 to $9,000. This range can help you plan better.

You might also find it helpful to utilize online calculators. Websites like Zillow and Bank of America offer settlement fee calculators that can provide a more customized estimate based on your specific circumstances. This tool can make the process feel a bit more manageable.

Additionally, consulting with your broker can be invaluable. Engaging with a mortgage broker can yield insights into local fees, helping to refine your estimates based on their expertise.

By following these steps, families can gain a clearer understanding of how to estimate closing costs when paying cash and their anticipated expenses. We know how challenging this can be, and we want to ensure you are well-prepared for the financial aspects of your property acquisition.

Explore Strategies to Reduce Closing Costs

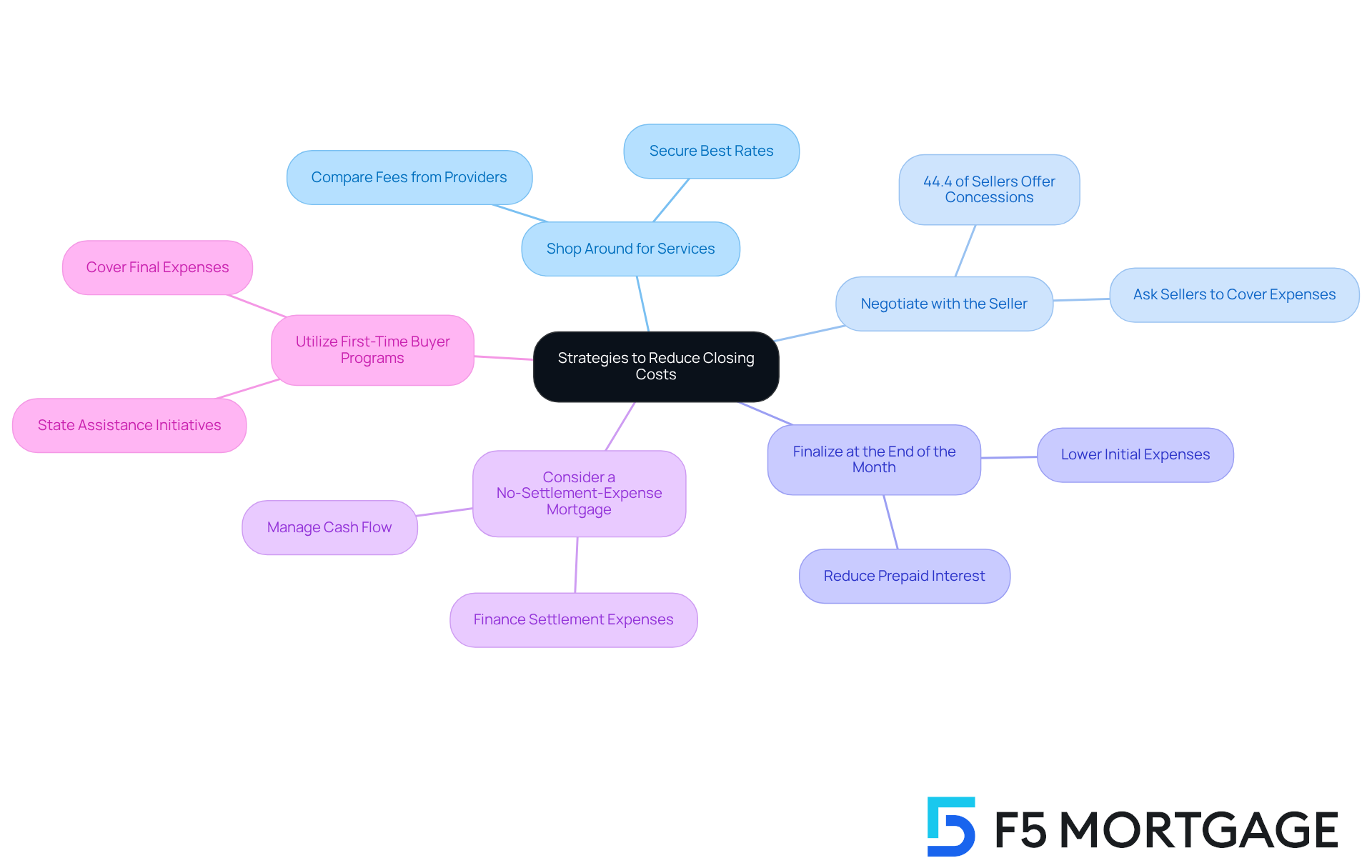

Minimizing final expenses is crucial for families looking to make home purchasing more manageable and affordable. Here are some effective strategies to consider:

- Shop Around for Services: We know how overwhelming it can be to compare fees from various service providers, such as title companies and inspectors. By taking the time to secure the best rates, you can lead your family to substantial savings.

- Negotiate with the Seller: With 44.4% of sellers providing concessions in early 2025, this is an advantageous moment to ask sellers to cover part of your final expenses. This can be a vital component of your negotiation strategy, helping ease your financial burden.

- Finalize at the End of the Month: Timing your closing date toward the end of the month can significantly reduce the amount of prepaid interest you owe, further lowering your initial expenses. Every little bit helps!

- Consider a No-Settlement-Expense Mortgage: Some lenders offer options that allow you to finance settlement expenses into your mortgage. This can facilitate better management of your cash flow, making the process feel less daunting.

- Utilize First-Time Buyer Programs: Many states provide assistance initiatives designed to help cover final expenses, which can be especially beneficial for families navigating the property purchasing process.

By implementing these strategies, families can effectively understand how to estimate closing costs when paying cash, making the journey to homeownership more affordable and within reach. We’re here to support you every step of the way.

Conclusion

Understanding how to estimate closing costs when paying cash is essential for any family embarking on the home-buying journey. We know how challenging this can be, and grasping the significance of these expenses—typically ranging from 2% to 5% of the property’s purchase price—can help families prepare for the financial implications of their investment. A clear comprehension of closing costs not only aids in budgeting but also ensures a smoother transaction process.

This article delves into various components of closing costs, including:

- Title insurance

- Appraisal fees

- Attorney charges

- More

Each of these elements plays a crucial role in the overall expenses incurred during a property purchase. Additionally, we offer practical strategies for estimating and reducing these costs. By shopping around for services, negotiating with sellers, and utilizing first-time buyer programs, families can make informed decisions that align with their financial goals.

Ultimately, being proactive in understanding and estimating closing costs can significantly alleviate the stress associated with home buying. Families are encouraged to take advantage of available resources, consult with professionals, and apply the strategies discussed to navigate the complexities of closing expenses effectively. This knowledge not only fosters confidence but also helps families achieve their dream of homeownership without unexpected financial burdens.

Frequently Asked Questions

What are closing costs in real estate?

Closing costs are expenses that buyers must pay when finalizing a real estate transaction, typically ranging from 2% to 5% of the property’s purchase price.

Why is it important to understand closing costs?

Understanding closing costs is crucial because they can significantly influence your overall spending and help you prepare for the financial aspects of buying a property.

What are some common components of closing costs?

Common components of closing costs include title insurance, appraisal fees, and legal fees. Title insurance can range from $300 to $2,500, while appraisal fees average around $350.

How can the appraisal affect closing costs?

The appraisal can impact the final costs by determining the property’s current market value, which can influence your equity and rates.

How can I estimate closing costs when paying cash?

When paying cash for a property, you can estimate closing costs by calculating 2% to 5% of the purchase price. For example, on a $300,000 house, closing costs could range from $6,000 to $15,000.

What strategies can help reduce closing costs?

Negotiating final expenses and seller concessions can help lessen your financial burden related to closing costs.

How can I prepare for closing costs to avoid financial strain?

By acknowledging and preparing for closing costs in advance, families can avoid unexpected financial strains at closing and ensure a smoother home-buying process.