Overview

Veterans mortgage assistance offers essential financial support to our brave former military personnel and their families. This support plays a vital role in helping them achieve the dream of homeownership. Programs like VA home loans are particularly beneficial, as they often require no down payment and do not include private mortgage insurance.

We understand how overwhelming the home-buying process can feel, which is why it’s important to highlight the key benefits of these programs:

- Reduced interest rates

- Flexible credit requirements

These are designed to ease the financial burden on veterans. Additionally, eligibility criteria ensure that assistance is directed toward those who have served honorably.

By taking advantage of these resources, veterans can enhance their overall financial stability. We’re here to support you every step of the way, empowering you to make informed decisions about your homeownership journey.

Introduction

Navigating the path to homeownership can be especially challenging for veterans and active service members. We understand the unique financial hurdles you may face. Fortunately, veterans mortgage assistance programs offer a lifeline, providing crucial support through low-interest loans, grants, and specialized refinancing options tailored to meet your needs.

Yet, amidst these opportunities, many potential beneficiaries remain unaware of the eligibility criteria and specific benefits available to them. How can you ensure that you are taking full advantage of these resources designed to facilitate your journey toward owning a home? We’re here to support you every step of the way.

Define Veterans Mortgage Assistance

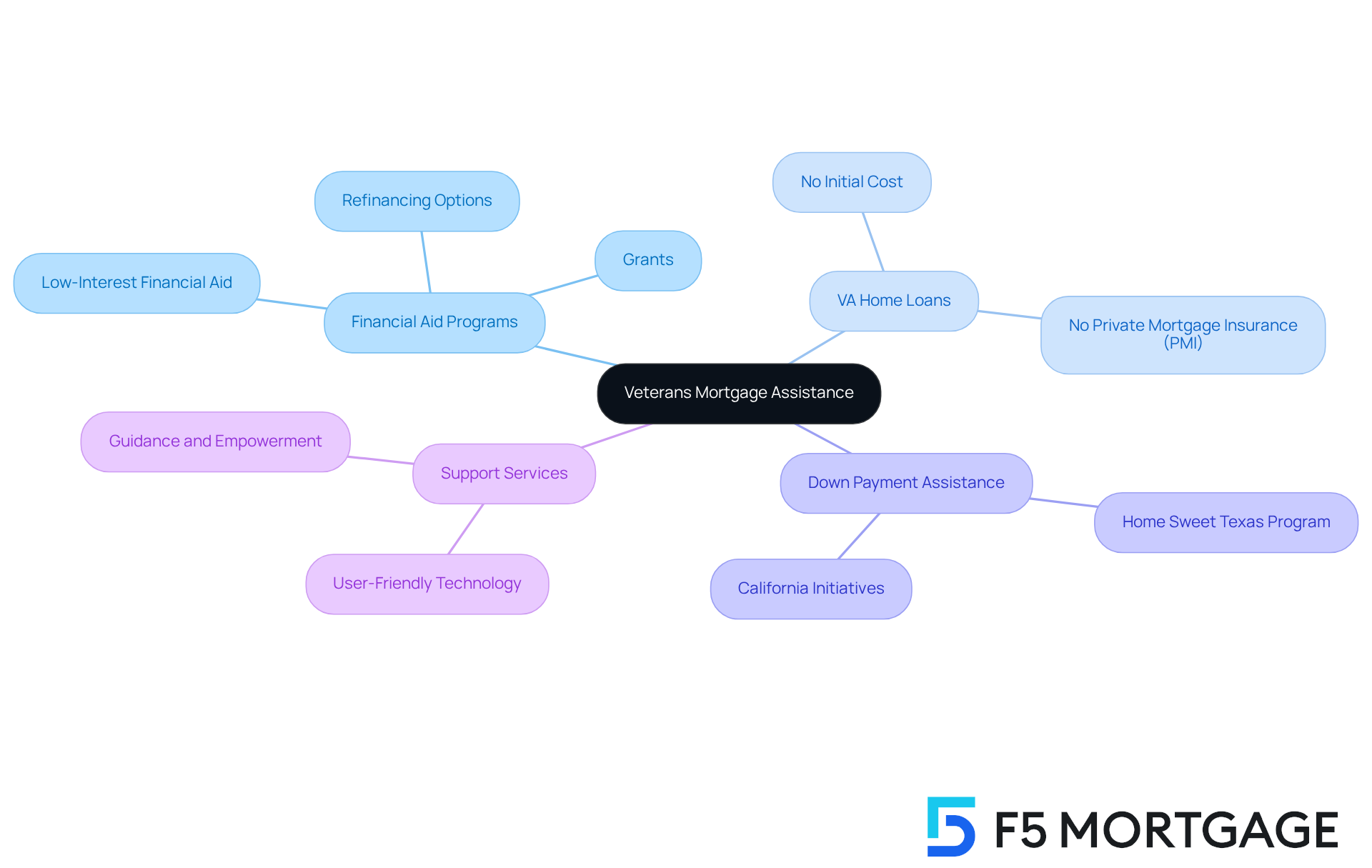

A range of financial aid programs, known as veterans mortgage assistance, is thoughtfully designed to support former military personnel, active service members, and their families in fostering homeownership. We understand how challenging this can be, and we want to assure you that support is available. This assistance, known as veterans mortgage assistance, can manifest in various forms, such as low-interest financial aid, grants, and specialized refinancing options. At F5 Mortgage, we are here to support you every step of the way. Our user-friendly technology simplifies the mortgage process, allowing service members to navigate its complexities with confidence.

Our primary goal is to guide, not to push, empowering you to make choices that feel right for you. Programs like VA home loans and veterans mortgage assistance exemplify this support, enabling qualified individuals to acquire homes under advantageous conditions, including no initial cost and no private mortgage insurance (PMI). Additionally, we provide detailed information on down assistance initiatives in California and explore alternatives such as the ‘Home Sweet Texas’ program. Together, we can improve your options and open the door to homeownership possibilities for military personnel.

Explore Benefits of Veterans Mortgage Assistance

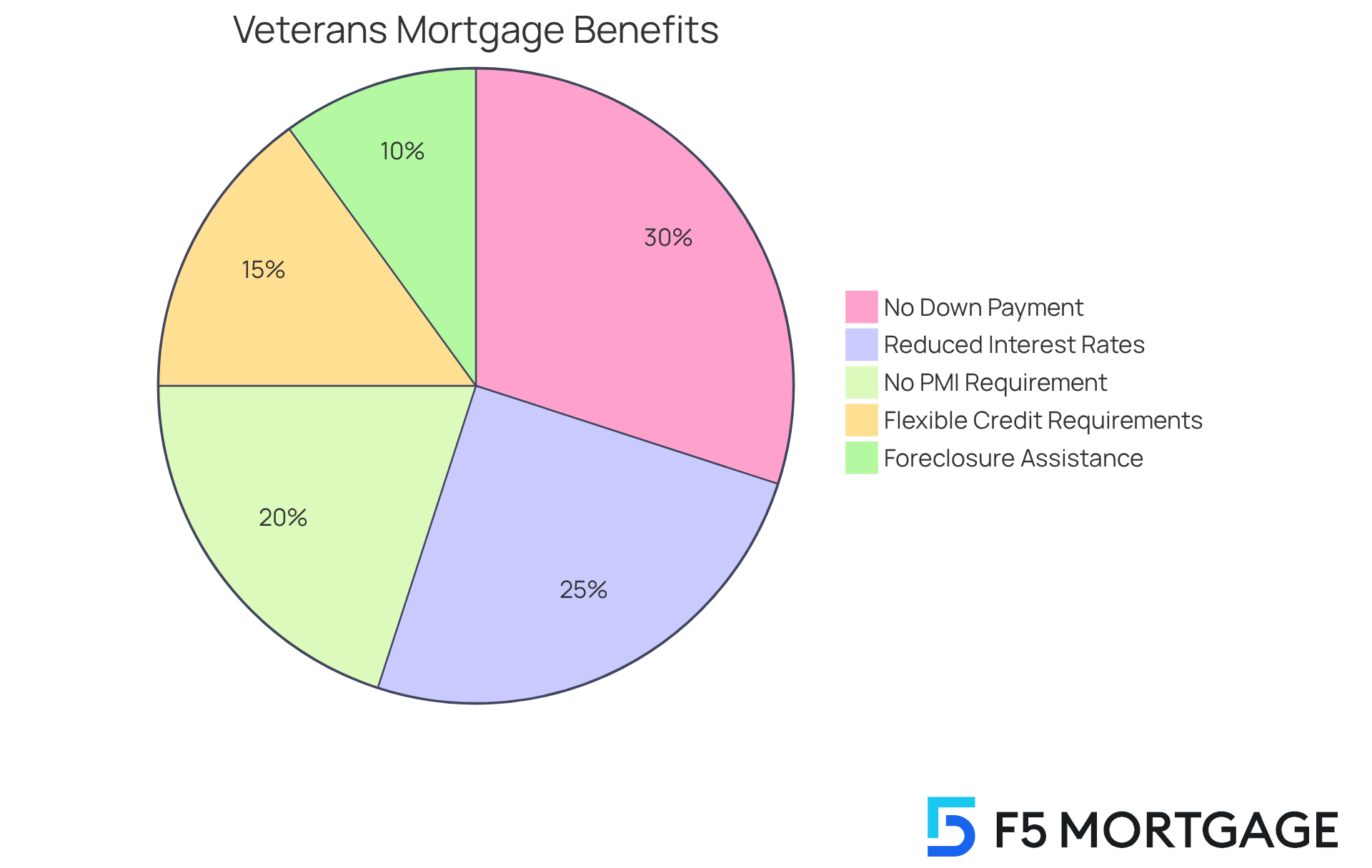

The advantages of veterans mortgage assistance are numerous and significant, greatly enhancing homeownership opportunities for those who have served. We understand how challenging the path to homeownership can be, and these key benefits can truly make a difference:

- No Down Payment: Many VA loans empower veterans to purchase homes without the burden of a down payment. This accessibility is especially crucial in today’s market, where typical down payments often exceed 20% for standard financing.

- Reduced Interest Rates: In 2025, veterans often qualify for interest rates that are approximately 0.5% to 1% lower than those available for standard financing. This difference can lead to substantial savings over the life of the loan, particularly as mortgage rates hover around 7% for traditional options.

- No PMI Requirement: Unlike conventional financing, VA options do not require private mortgage insurance (PMI). This absence can significantly reduce monthly payments and overall costs, easing the financial burden.

- Flexible Credit Requirements: VA financing generally features more lenient credit score criteria, making it easier for individuals from diverse financial backgrounds to qualify. This flexibility is vital for many former service members who may face challenges in conventional lending environments.

- Assistance with Foreclosure Prevention: Recent legislative efforts have bolstered support for service members at risk of foreclosure. These measures allow them to restructure loans or access financial counseling, aiming to prevent the loss of homes. This proactive approach is particularly important for the nearly 70,000 former service members currently facing mortgage delinquency.

Collectively, these advantages, including veterans mortgage assistance, empower former service members to achieve and maintain homeownership, contributing to their overall financial stability. Real-life stories illustrate this impact: many former service members have successfully utilized VA financing without any down payment to secure their homes. This initiative not only promotes homeownership but also fosters long-term financial well-being. We’re here to support you every step of the way as you navigate this journey.

Clarify Eligibility Requirements for Assistance

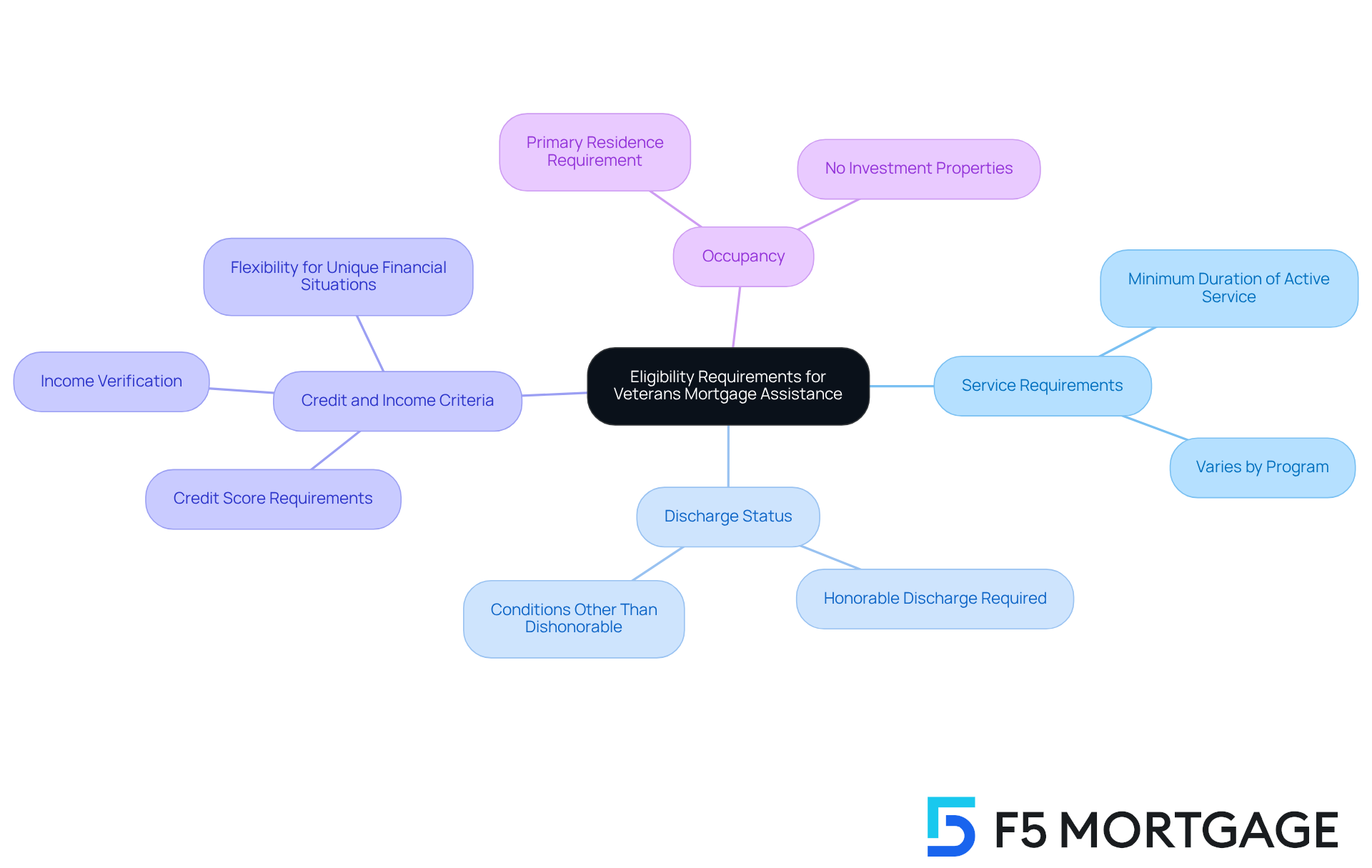

Eligibility for Veterans Mortgage Assistance is determined by several critical factors that we understand can be overwhelming:

- Service Requirements: We know how important it is for applicants to have served in the military, with specific requirements varying by program. Typically, veterans are expected to have fulfilled a minimum duration of active service, which can differ depending on the type of financing.

- Discharge Status: Most programs require an honorable discharge or a discharge under conditions other than dishonorable. This criterion is crucial, as it ensures that veterans mortgage assistance is directed toward those who have served honorably.

- Credit and Income Criteria: Although VA loans are designed to be more accessible, lenders may still impose certain credit score and income requirements to confirm that borrowers can manage repayment. This flexibility is especially beneficial for former service members who may require veterans mortgage assistance due to unique financial situations.

- Occupancy: The property acquired must be intended as the individual’s primary residence. This stipulation is essential for ensuring that the benefits of the VA loan initiative are utilized for homeownership rather than investment purposes.

Comprehending these requirements is essential for former service members to effectively navigate the application process for veterans mortgage assistance. Recent statistics show that as of April 1, 75,000 Veteran borrowers had failed to make three or more installments on their VA-guaranteed mortgages, emphasizing the increasing significance of veterans mortgage assistance initiatives. Real-world examples demonstrate that many veterans effectively fulfill these service criteria, allowing them to obtain the advantages of the VA Loan initiative, which has supported over 24 million veterans since its establishment in 1944. As Mike Calhoun, President of the Center for Responsible Lending, mentioned, “Passage of the partial claim bill will offer significant support to VA borrowers in financial distress.” We’re here to support you every step of the way.

Review Available Programs for Veterans Mortgage Assistance

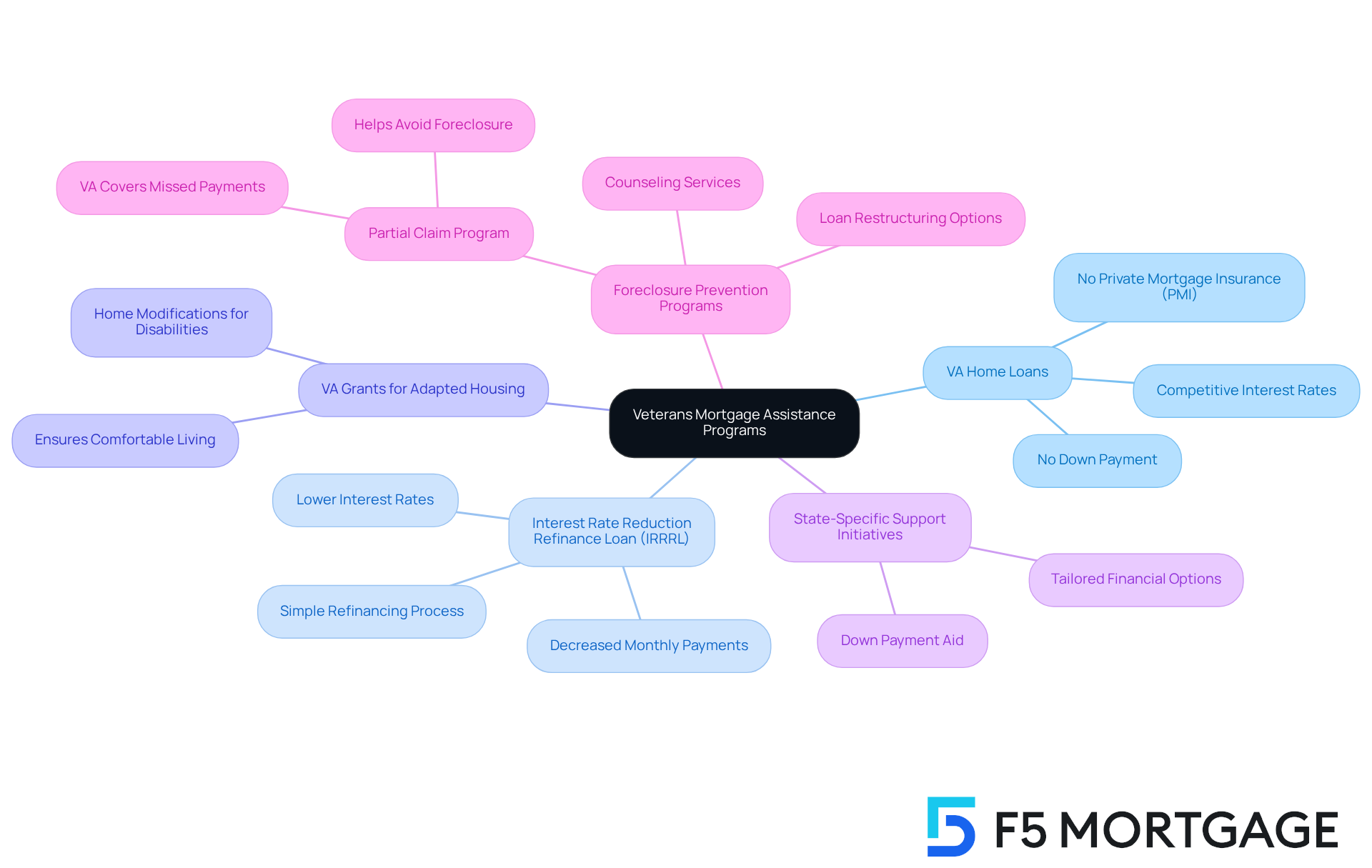

Veterans have access to a variety of mortgage assistance programs tailored to meet their unique needs:

-

VA Home Loans: Backed by the Department of Veterans Affairs, these loans offer significant advantages, including no down payment and no private mortgage insurance (PMI). This makes homeownership more accessible for those who have served.

-

Interest Rate Reduction Refinance Loan (IRRRL): This program allows service members to refinance existing VA loans at lower interest rates, effectively decreasing monthly payments. In 2025, many former service members are anticipated to benefit from this option, as it provides a simple method to alleviate their financial burden.

-

VA Grants for Adapted Housing: For individuals with service-related disabilities, these grants enable essential modifications to residences, ensuring they can live comfortably and safely.

-

State-Specific Support Initiatives: Numerous states provide additional resources, including down payment aid and tailored financial options specifically for former military personnel. This veterans mortgage assistance enhances their capacity to obtain funding.

-

Foreclosure Prevention Programs: Various initiatives are in place to support former military personnel facing financial hardships. These programs offer options for loan restructuring and counseling, assisting in avoiding foreclosure and preserving homeownership. It’s significant to note that almost 70,000 former service members are currently over 90 days overdue on their mortgage obligations, underscoring the urgency of these initiatives.

Understanding these programs is vital for former service members to make informed choices about veterans mortgage assistance options. The recent introduction of the Partial Claim Program allows individuals who are behind on payments to have the VA cover missed payments, providing a crucial lifeline to those in distress. This proactive strategy seeks to safeguard homeowner heroes from losing their residences due to temporary challenges, reinforcing our commitment to assist those who have served our country. As The Sherry Riano Team emphasizes, “homeownership should never be taken away because of temporary setbacks — especially not for those who’ve served our country.” Additionally, with proposed cuts to Medicaid and SNAP potentially straining veterans’ budgets, the importance of these assistance programs becomes even more pronounced.

Conclusion

Veterans mortgage assistance is a vital resource for former military personnel, active service members, and their families, making homeownership more attainable in a supportive manner. Programs like VA home loans are designed to ease the financial burdens often tied to purchasing a home, ensuring that those who have served our nation can secure stable housing without overwhelming costs.

This assistance offers several key benefits:

- The absence of down payments

- Reduced interest rates

- Flexible credit requirements

It is essential to understand the eligibility criteria, ensuring that help reaches those who have honorably served. With a variety of programs available—from VA home loans to state-specific support initiatives—veterans have access to tailored solutions that address their unique financial situations and challenges.

Given the many advantages and opportunities presented by veterans mortgage assistance, it is crucial for service members and their families to explore these options. By taking proactive steps toward understanding and utilizing these resources, they can pave the way toward successful homeownership, fostering long-term financial stability. Supporting veterans in their journey to homeownership not only honors their service but also reinforces the importance of community and care for those who have sacrificed for the greater good.

Frequently Asked Questions

What is veterans mortgage assistance?

Veterans mortgage assistance is a range of financial aid programs designed to support former military personnel, active service members, and their families in achieving homeownership.

What forms does veterans mortgage assistance take?

This assistance can come in various forms, including low-interest financial aid, grants, and specialized refinancing options.

How does F5 Mortgage support service members in the mortgage process?

F5 Mortgage offers user-friendly technology that simplifies the mortgage process, helping service members navigate its complexities with confidence.

What are the advantages of programs like VA home loans?

VA home loans and veterans mortgage assistance provide qualified individuals with advantageous conditions for acquiring homes, such as no initial cost and no private mortgage insurance (PMI).

What additional resources does F5 Mortgage provide?

F5 Mortgage provides detailed information on down assistance initiatives in California and explores alternatives like the ‘Home Sweet Texas’ program to improve options for military personnel.