Overview

Securing a Home Equity Line of Credit (HELOC) with bad credit can feel daunting. We know how challenging this can be, but it is possible with the right approach. By taking strategic steps, you can improve your situation. Start by focusing on enhancing your credit score and assessing your financial landscape.

Understanding lender requirements is crucial. Each lender may have different criteria, so exploring various options is important. Maintaining sufficient home equity is another key factor that can significantly impact your chances. Prepare a thorough application that clearly outlines your financial standing. This preparation can enhance your chances of approval, even if your credit score is lower than ideal.

Remember, you’re not alone in this process. We’re here to support you every step of the way. By acknowledging your challenges and taking actionable steps, you can navigate this journey with confidence.

Introduction

Navigating the world of home equity lines of credit (HELOCs) can be particularly daunting, especially for those with less-than-ideal credit scores. We understand how challenging this can be. These financial tools offer homeowners the flexibility to borrow against their property’s equity, yet securing one with bad credit often feels like an uphill battle.

This guide delves into essential steps and strategies that can empower you to not only understand your options but also successfully obtain a HELOC despite credit challenges.

What are the key factors that can turn the tide in your favor?

How can you effectively position yourself for approval?

We’re here to support you every step of the way.

Understand Home Equity Lines of Credit (HELOC)

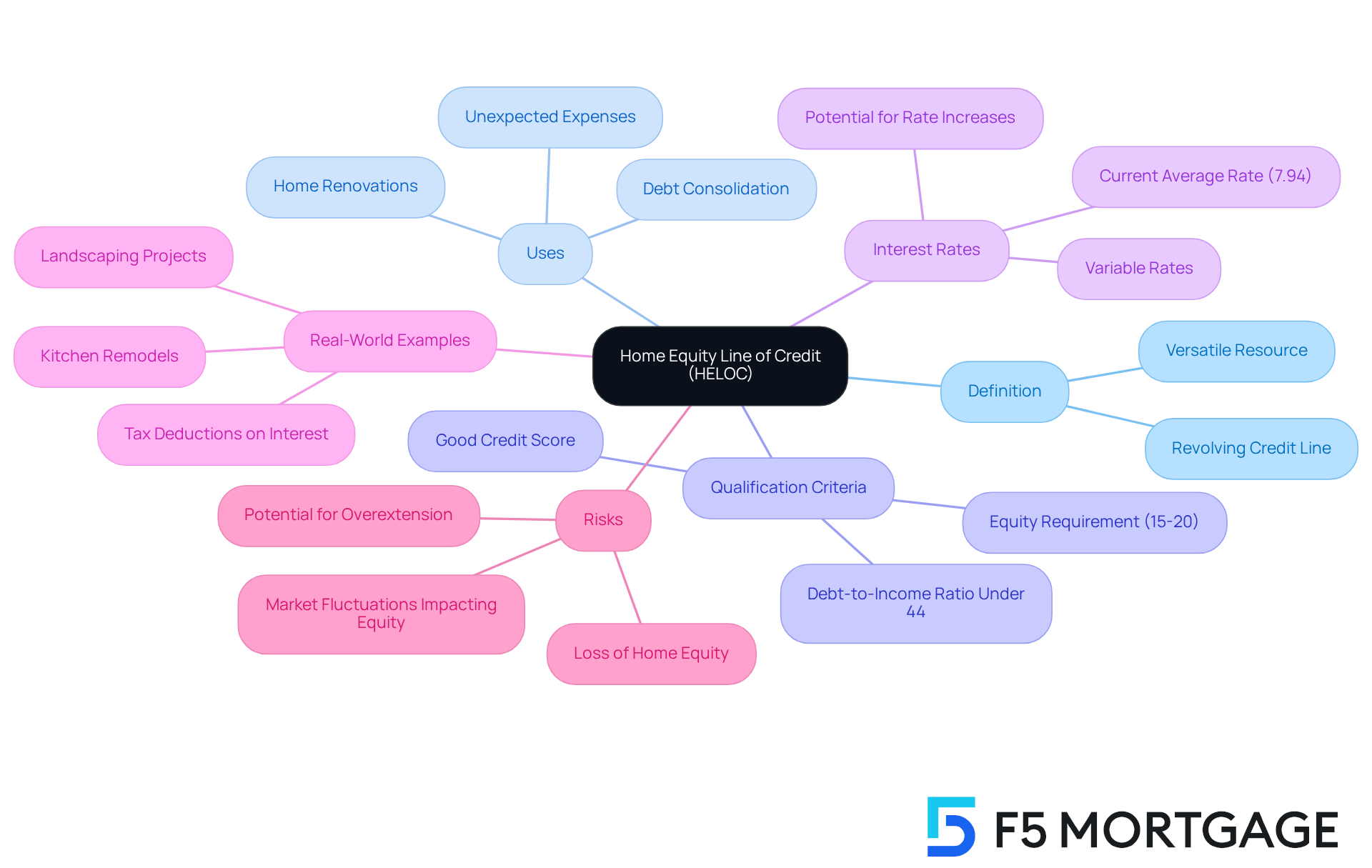

A Home Equity Line of Credit (HELOC) is a versatile resource that allows property owners to borrow against the equity in their homes, functioning much like a credit card. Unlike traditional home equity loans that provide a lump sum, HELOCs enable borrowers to withdraw funds as needed. This flexibility makes them ideal for various purposes, such as:

- Home renovations

- Debt consolidation

- Covering unexpected expenses

We understand that most lenders require homeowners to have at least 15-20% equity in their property to qualify for a HELOC, which is crucial for determining the borrowing limit. For example, if your home is valued at $400,000 and you owe $280,000 on your mortgage, you would have $120,000 in equity, equating to 30%.

HELOCs typically come with variable interest rates that can fluctuate based on market conditions. Understanding how these rates work is essential, as they can impact your monthly payments and overall borrowing costs. Financial advisors emphasize the importance of being aware of the potential for rate increases, which could lead to higher payments if not managed carefully.

Real-world examples illustrate the versatility of HELOCs. Homeowners often use them for renovations that enhance property value, such as kitchen remodels or landscaping projects. These improvements may also qualify for tax deductions on interest payments. However, it’s vital to approach borrowing with intention. Nearly 25% of homeowners plan to tap into their equity in the coming year, highlighting the need for careful planning to avoid overextending financially.

In summary, while HELOCs offer significant benefits, including flexibility and potential tax advantages, they also carry risks, particularly in an unpredictable economic climate. Homeowners should thoroughly evaluate their monetary situation and comprehend the implications of borrowing against their home equity. Additionally, when refinancing in California, it’s essential to consider the costs involved, which typically range from 2% to 5% of the loan amount. This consideration can impact your overall financial strategy, and we’re here to support you every step of the way.

Identify Challenges of Securing a HELOC with Bad Credit

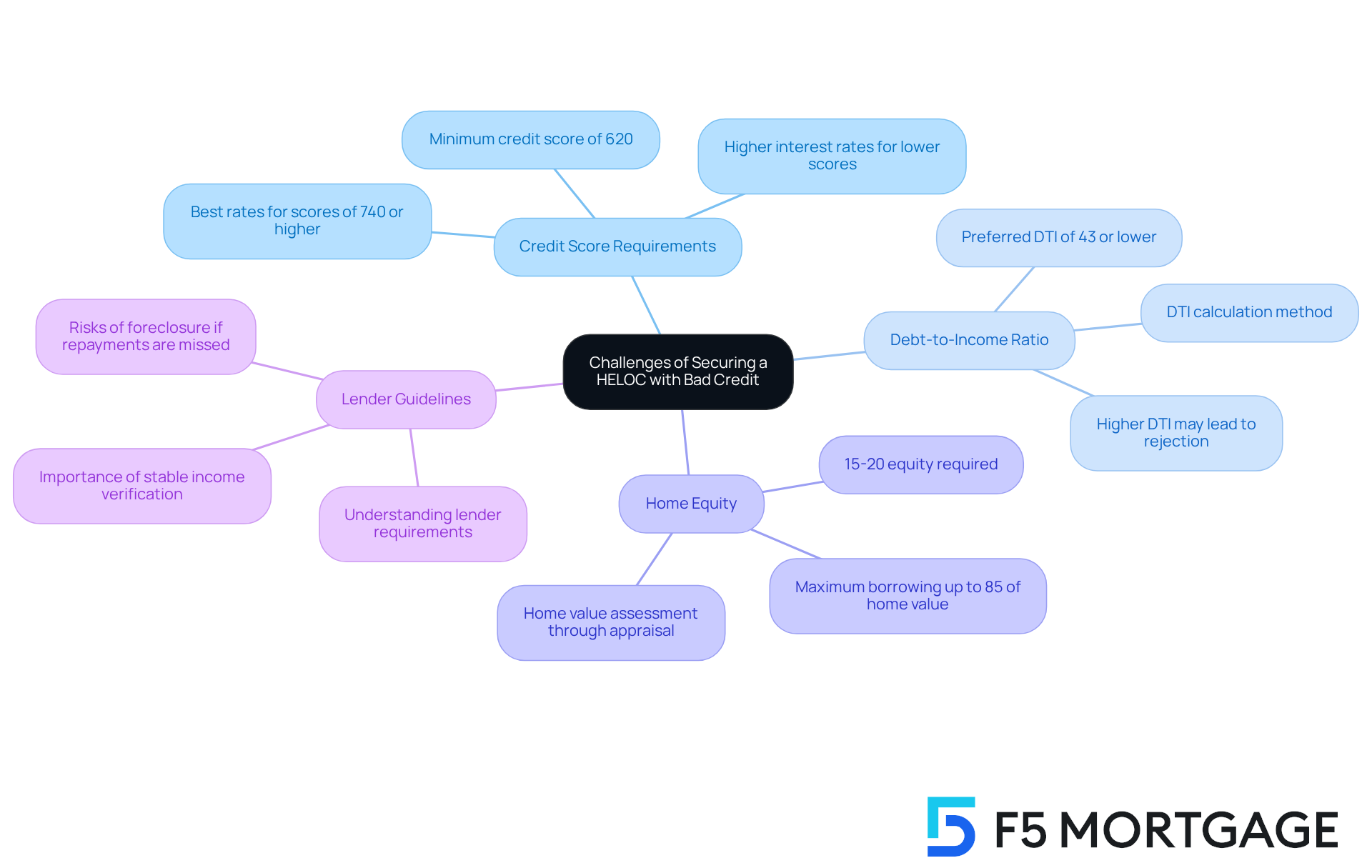

Obtaining a home equity line of credit bad credit can be quite challenging. We know how difficult it can be to navigate these waters. Most financial institutions typically require a credit score of at least 620. If your score falls below this threshold, you may encounter higher interest rates or stricter terms that can feel overwhelming.

In 2025, it’s anticipated that the average debt-to-income (DTI) ratio for HELOC applicants will be under 43%. Lenders prefer borrowers who demonstrate manageable debt levels. A higher DTI can signal over-leverage, which may make lenders hesitant to approve your application. However, having a co-signer with a stronger credit profile can significantly enhance your chances of approval. While this option may not be available to everyone, it’s worth considering.

Lenders will also look at your overall financial health, including your employment history and existing debts. To qualify for a HELOC, homeowners typically need to maintain at least 15% to 20% equity in their home. As industry specialists suggest, improving your credit score can be a vital step in overcoming these obstacles.

For instance, Melissa Cohn, a regional vice president at William Raveis Mortgage, emphasizes the importance of understanding lender guidelines before applying. This understanding can empower you in the process. Additionally, David Friedman, CEO of Knox Financial, points out that a home equity line of credit bad credit can provide more flexibility compared to traditional cash-out refinancing, which can be particularly beneficial for those facing credit challenges.

However, it’s crucial to be aware of the risks associated with HELOCs, including the potential for foreclosure if repayments are not made. By tackling these challenges in advance, you can better equip yourself and explore alternative options that suit your financial circumstances. Remember, we’re here to support you every step of the way.

Assess Your Financial Situation

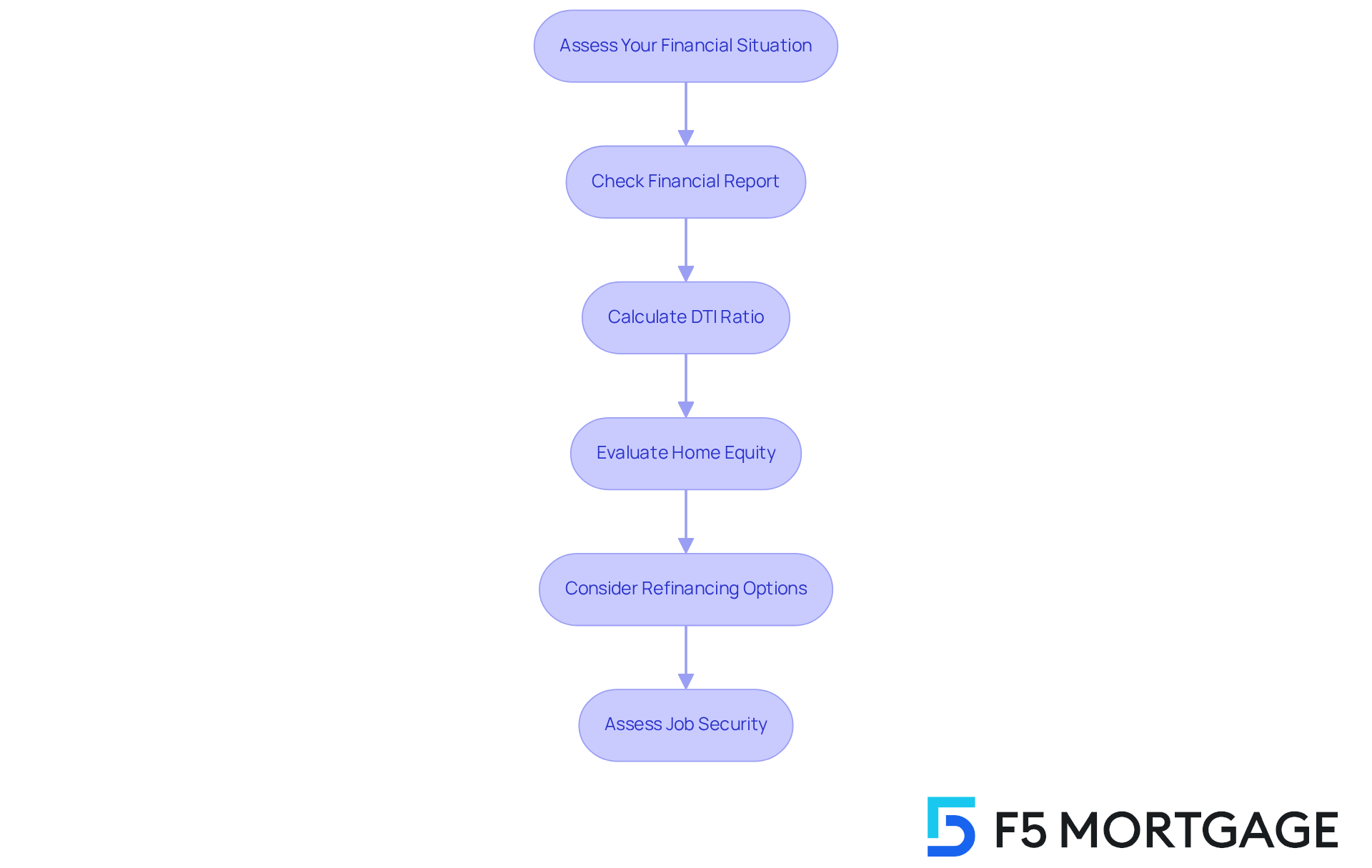

Before applying for a Home Equity Line of Credit (HELOC), we understand how important it is to conduct a thorough assessment of your financial situation. Start by examining your financial report for any errors that could negatively impact your score. You can obtain a free copy from major credit bureaus, which is a crucial first step in ensuring your credit profile is accurate and reliable.

Next, let’s calculate your debt-to-income (DTI) ratio. This is done by dividing your total monthly debt payments by your gross monthly income. A DTI ratio below 43 percent is generally favorable, signaling to lenders that you can handle additional debt responsibly. In Colorado, having a better DTI can lead to more competitive mortgage rates, making it an important factor to consider. For context, a DTI ratio of 33 percent indicates that you spend 33 percent of your monthly income on debt payments, which serves as a useful benchmark for assessing your financial situation.

Additionally, it’s essential to evaluate your home equity. Determine your home’s current market value and subtract any outstanding mortgage balance. This calculation will provide insight into how much you can potentially borrow. For example, property owners in Texas generally require a minimum of 20% equity to be eligible for a home equity line of credit, and they can borrow up to 80% of their equity at any moment. In Colorado, understanding the current market value of your property is vital, as financial institutions will request a home appraisal to assess your equity, which directly influences your mortgage rates.

Furthermore, consider the refinancing options available through F5 Mortgage. This can provide additional pathways to secure favorable terms based on your DTI and home equity. Finally, think about your job security and revenue streams. Financial institutions favor a steady income record to verify your ability to repay the line of credit. By taking these steps, you can place yourself more advantageously in the eyes of financial institutions. This proactive approach enhances your likelihood of obtaining a home equity line of credit bad credit, even if your financial history isn’t perfect. Remember, we’re here to support you every step of the way.

Explore Lender Options

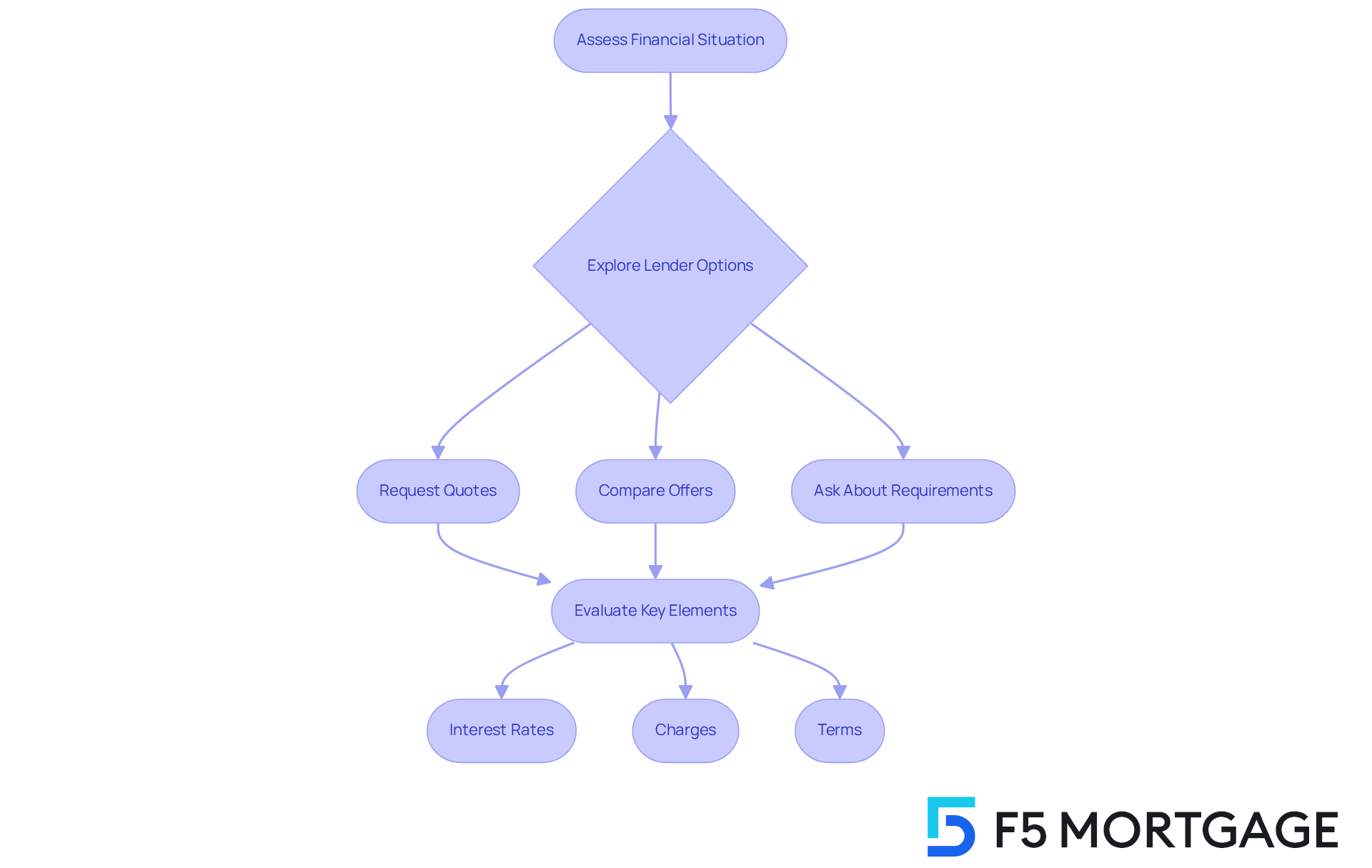

After assessing your financial situation, we know how challenging it can be to explore different borrowing options. Not all institutions use the same standards for approving a home equity line of credit bad credit, particularly for individuals with lower credit scores. Start by looking into financial institutions that specialize in home equity line of credit bad credit solutions. Credit unions and local banks often provide more personalized service and may be more accommodating in their lending practices. Additionally, online providers frequently offer flexible criteria and competitive rates, making them a viable option.

When evaluating financial institutions, focus on key elements like:

- Interest rates

- Charges

- The terms of the home equity line of credit

As of September 2025, the average interest rate for a $30,000 HELOC is around 8.05%, but this can vary significantly among financial institutions and online providers. For example, some credit unions may offer lower rates and fewer fees compared to their online counterparts.

To ensure you secure the best deal, it’s important to:

- Request quotes from various providers

- Compare offers

- Ask about specific requirements for a home equity line of credit bad credit

Engaging directly with lenders can provide valuable insights into their willingness to work with you and help determine the best fit for your financial needs.

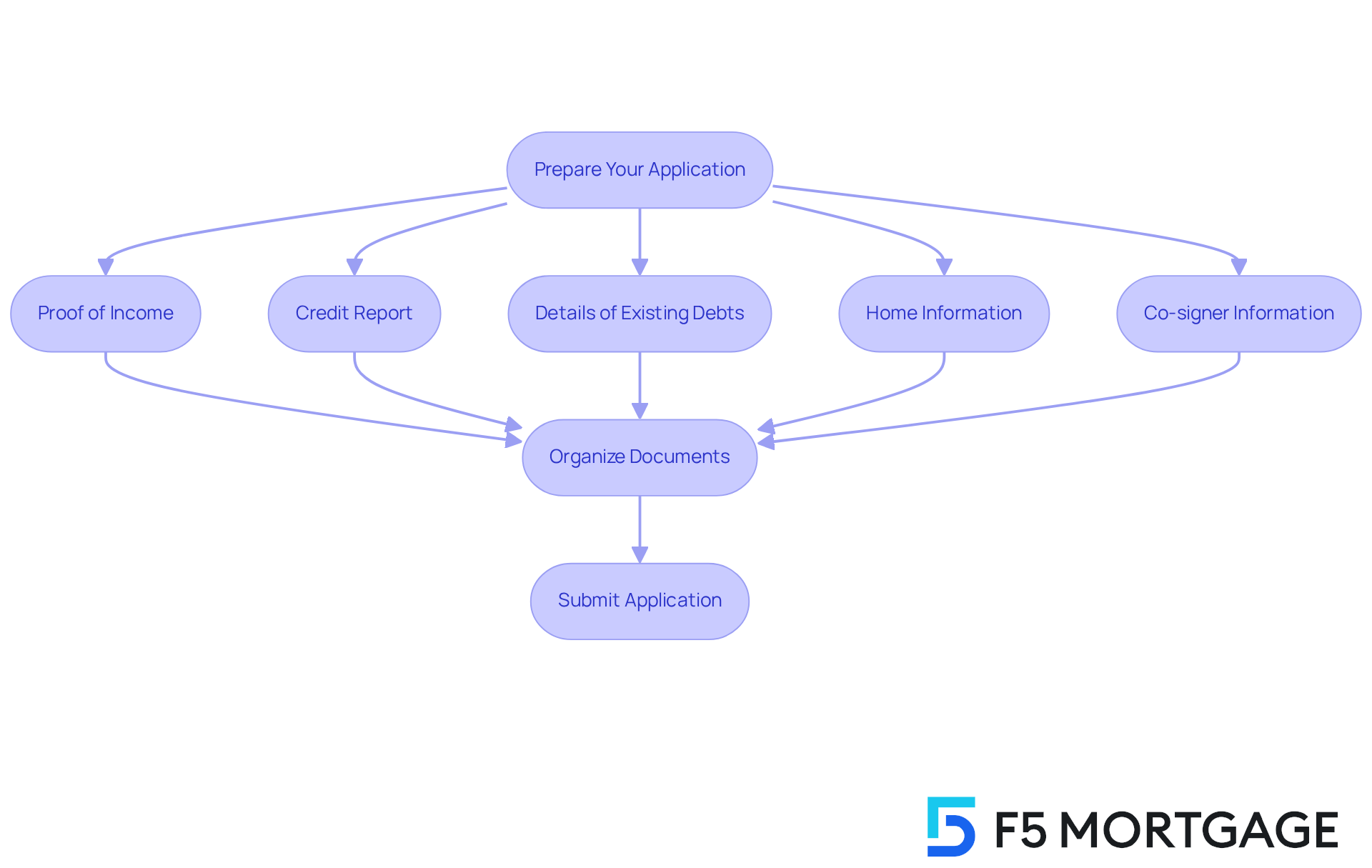

Prepare Your Application

Preparing your application for a Home Equity Line of Credit (HELOC) can feel daunting, but with careful organization of your documentation, you can present a clear picture of your economic situation. We understand how challenging this can be, so let’s break it down together.

Essential documents typically include:

- Proof of income, such as pay stubs or tax returns

- A copy of your credit report

- Details about your existing debts

- Information related to your home, including the most recent mortgage statement and proof of homeowner’s insurance

If applicable, don’t forget to include financial information for any co-signer as well.

Arranging these documents beforehand not only simplifies the application procedure but also shows financial institutions that you are serious and well-prepared. The typical duration required to process HELOC applications varies from two to six weeks, depending on the financial institution and the complexity of your application. To help expedite this timeline, ensure that all required documentation is complete and readily available.

Mortgage professionals emphasize the importance of an organized application, noting that it can significantly enhance your chances of approval. For instance, possessing your last two years of tax returns, recent pay stubs, and a comprehensive list of debts and liabilities can greatly influence how financial institutions evaluate your application. Once your application is complete, submit it to your chosen lender and be prepared to respond promptly to any follow-up inquiries they may have.

Remember, we’re here to support you every step of the way. Taking these proactive steps not only helps you feel more confident but also brings you closer to achieving your financial goals.

Conclusion

Securing a Home Equity Line of Credit (HELOC) with bad credit can feel overwhelming, but we want you to know that it is possible with the right strategies and a clear understanding of the process. This guide highlights the importance of preparation, knowledge of lender requirements, and a thorough assessment of your financial situation to enhance your chances of approval.

We understand the flexibility and benefits that HELOCs can offer, but we also recognize the challenges posed by lower credit scores. Maintaining a favorable debt-to-income ratio is crucial. Exploring various lender options, preparing a comprehensive application, and understanding the associated risks are essential steps in navigating this borrowing landscape effectively. By concentrating on these key areas, you can position yourself for success, even in the face of credit challenges.

Taking proactive measures to improve your financial health is vital. Enhancing your credit scores and understanding the implications of borrowing against your home equity can lead to better outcomes. If you’re considering a HELOC in 2025, staying informed about current market conditions and lender offerings is essential. Embracing these strategies not only empowers you to secure the financial resources you need but also fosters a more stable economic future. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A HELOC is a financial product that allows property owners to borrow against the equity in their homes, functioning similarly to a credit card. It enables borrowers to withdraw funds as needed, unlike traditional home equity loans that provide a lump sum.

What are some common uses for a HELOC?

HELOCs are often used for various purposes, including home renovations, debt consolidation, and covering unexpected expenses.

What equity percentage is typically required to qualify for a HELOC?

Most lenders require homeowners to have at least 15-20% equity in their property to qualify for a HELOC.

How do interest rates work for HELOCs?

HELOCs usually have variable interest rates that can fluctuate based on market conditions. It’s important to understand how these rates work, as they can impact monthly payments and overall borrowing costs.

What are the risks associated with HELOCs?

While HELOCs offer flexibility and potential tax advantages, they also carry risks, particularly the potential for foreclosure if repayments are not made, especially in an unpredictable economic climate.

What challenges might someone face when securing a HELOC with bad credit?

Obtaining a HELOC with bad credit can be challenging, as most financial institutions require a credit score of at least 620. Those with lower scores may face higher interest rates or stricter terms.

What debt-to-income (DTI) ratio do lenders typically prefer for HELOC applicants?

Lenders typically prefer a DTI ratio under 43% for HELOC applicants, as a higher DTI can signal over-leverage and make lenders hesitant to approve an application.

Can having a co-signer improve my chances of getting a HELOC?

Yes, having a co-signer with a stronger credit profile can significantly enhance your chances of HELOC approval.

What factors do lenders consider when evaluating a HELOC application?

Lenders will consider overall financial health, including credit score, employment history, existing debts, and the amount of equity in the home.

What should homeowners do if they want to improve their chances of getting a HELOC?

Homeowners should focus on improving their credit score and understanding lender guidelines before applying, as this knowledge can empower them in the process.