Overview

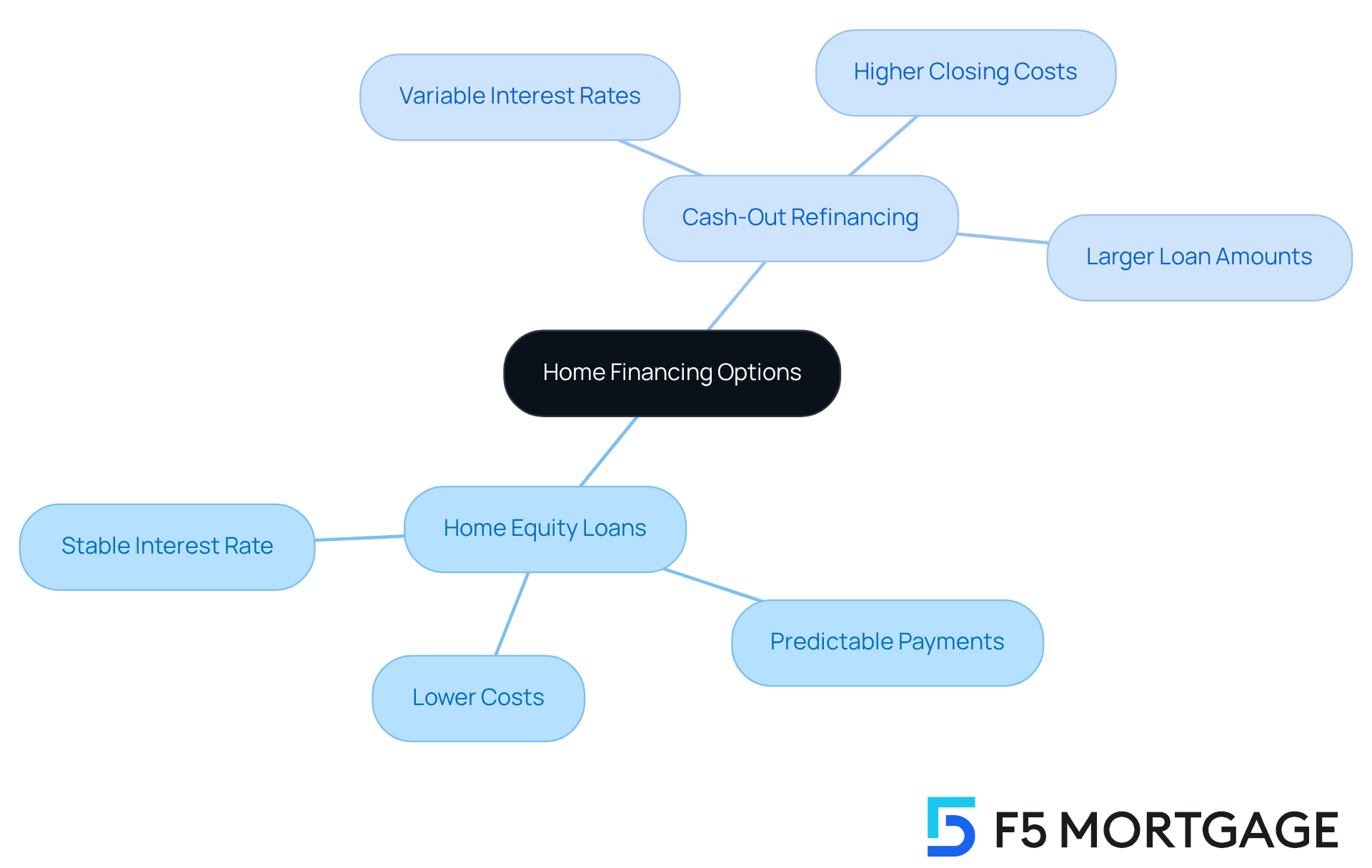

This article delves into the differences between home equity loans and cash-out refinancing, offering valuable insights for families contemplating financial upgrades. We understand how challenging these decisions can be, and we’re here to support you every step of the way. Both options provide homeowners with access to their property value, yet they operate distinctly.

- Home equity loans present predictable payments.

- Cash-out refinancing may offer larger sums of money, albeit with higher risks and costs.

This makes it essential to carefully evaluate your individual financial goals and circumstances before proceeding.

Introduction

As homeowners witness a remarkable surge in property values, it’s natural to feel both excitement and uncertainty. The decision to leverage home equity or refinance can significantly impact your financial future. We understand that families are looking for ways to fund renovations, consolidate debt, or manage education expenses. That’s why understanding the nuances between home equity loans and cash-out refinancing becomes crucial.

However, as the market evolves, you may find yourself facing the challenge of determining which option best aligns with your long-term financial goals. Will you choose the stability of home equity loans, or will you explore the potential for larger sums through cash-out refinancing? We know how challenging this can be, and we’re here to support you every step of the way.

Understanding Home Equity and Refinancing Options

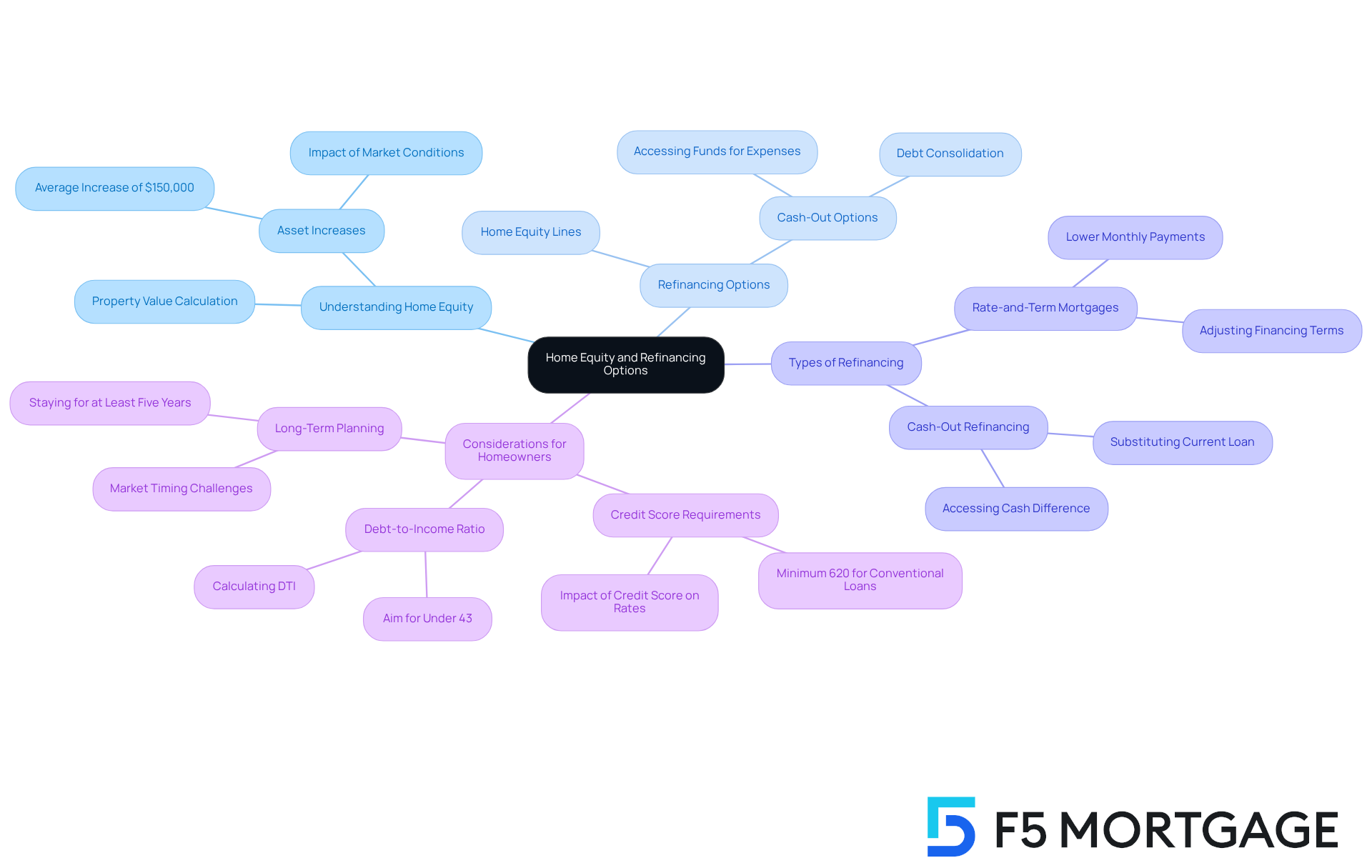

Understanding property value is essential for homeowners. It represents the portion of a residence’s worth that you fully own, calculated by subtracting any remaining mortgage amounts from the current market value. In 2025, many property owners are experiencing a significant boost in their asset percentage, with some seeing increases of nearly $150,000 in wealth over the past five years, thanks to rising property values. This equity can be accessed through various methods, primarily home equity lines or cash-out options.

Refinancing your mortgage can be a smart move, allowing you to replace your current mortgage with a new one. This often helps secure a lower interest rate or adjust the financing term. Among the refinancing options, rate-and-term mortgages are particularly popular among California homeowners. These agreements aim to reduce monthly payments by replacing the existing mortgage with one that offers a better rate or different term length. Homeowners typically pursue these refinances when interest rates decline, seeking to save on their overall debt. Keep in mind that lenders usually require a minimum credit score of 620 for conventional loans, which is an important consideration if you’re thinking about adjusting your mortgage.

You might also consider cash-out mortgage restructuring to tap into your property value. This approach allows you to access funds for significant expenses, such as home improvements or debt consolidation. For instance, homeowners in the Northeastern states have leveraged their increased assets to finance renovations, further enhancing their property value.

While home equity vs refinance options like cash-out mortgages and home asset financing can provide valuable financial support, they operate through different mechanisms. When considering home equity vs refinance, it’s important to note that home equity loans allow you to borrow against your equity, while cash-out mortgage replacement substitutes your current loan with a larger one, providing you with the cash difference. It’s crucial to understand these options thoroughly. As one financial specialist noted, “Homeowners should specify their loan modification objectives, whether it’s reducing payments or attaining long-term savings.” This insight is vital for making informed decisions that align with your financial goals.

Moreover, it’s generally advisable for property owners to plan on staying in their homes for at least five years to ensure that their investment pays off. However, this timeframe can vary based on market conditions and personal situations. Remember, we’re here to support you every step of the way as you navigate these important financial decisions.

Exploring the Benefits of Cash-Out Refinancing

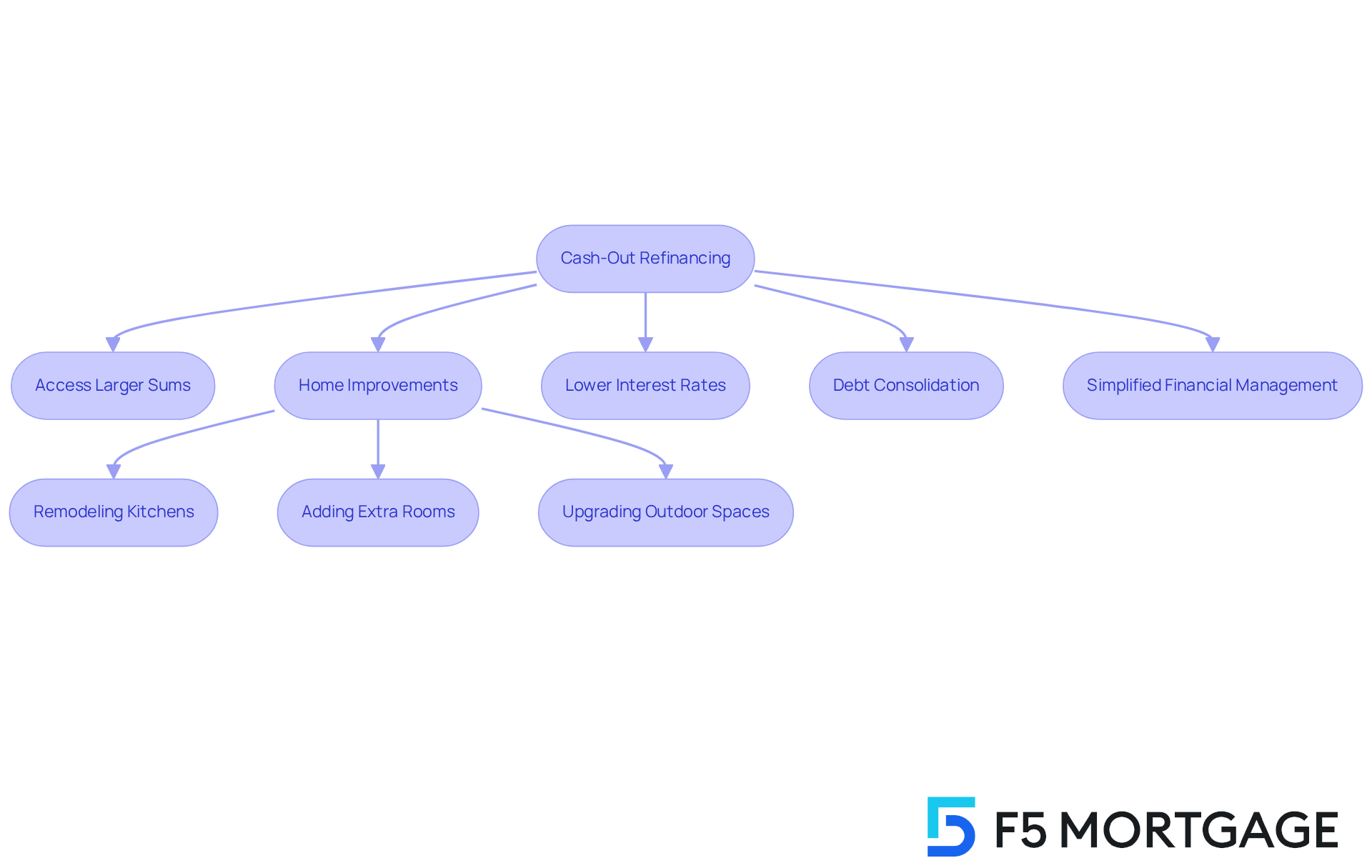

Cash-out refinancing offers many advantages that can be especially helpful for families. It enables property owners to access a larger sum of money compared to traditional equity loans, allowing them to refinance for an amount that exceeds their current mortgage balance. This feature can be particularly useful for funding home improvements, consolidating debt, or managing significant expenses like education costs.

In 2025, homeowners are tapping into an average of $50,000 through cash-out options. This can greatly enhance property value and personal enjoyment when used for renovations. For example, families have transformed their homes by:

- Remodeling kitchens

- Adding extra rooms

- Upgrading outdoor spaces

These improvements not only increase their home’s appeal but also its functionality.

Moreover, cash-out mortgage restructuring generally offers lower interest rates than personal loans or credit cards, making it a more cost-effective borrowing choice. The possibility of tax-deductible interest on the new mortgage adds to its financial allure.

Additionally, cash-out loan restructuring can simplify financial management by consolidating multiple debts into a single monthly payment, making budgeting easier for families. This strategy not only reduces the complexity of handling various payments but also contributes to a healthier financial outlook. We know how challenging this can be, and we’re here to support you every step of the way.

Evaluating the Drawbacks of Cash-Out Refinancing

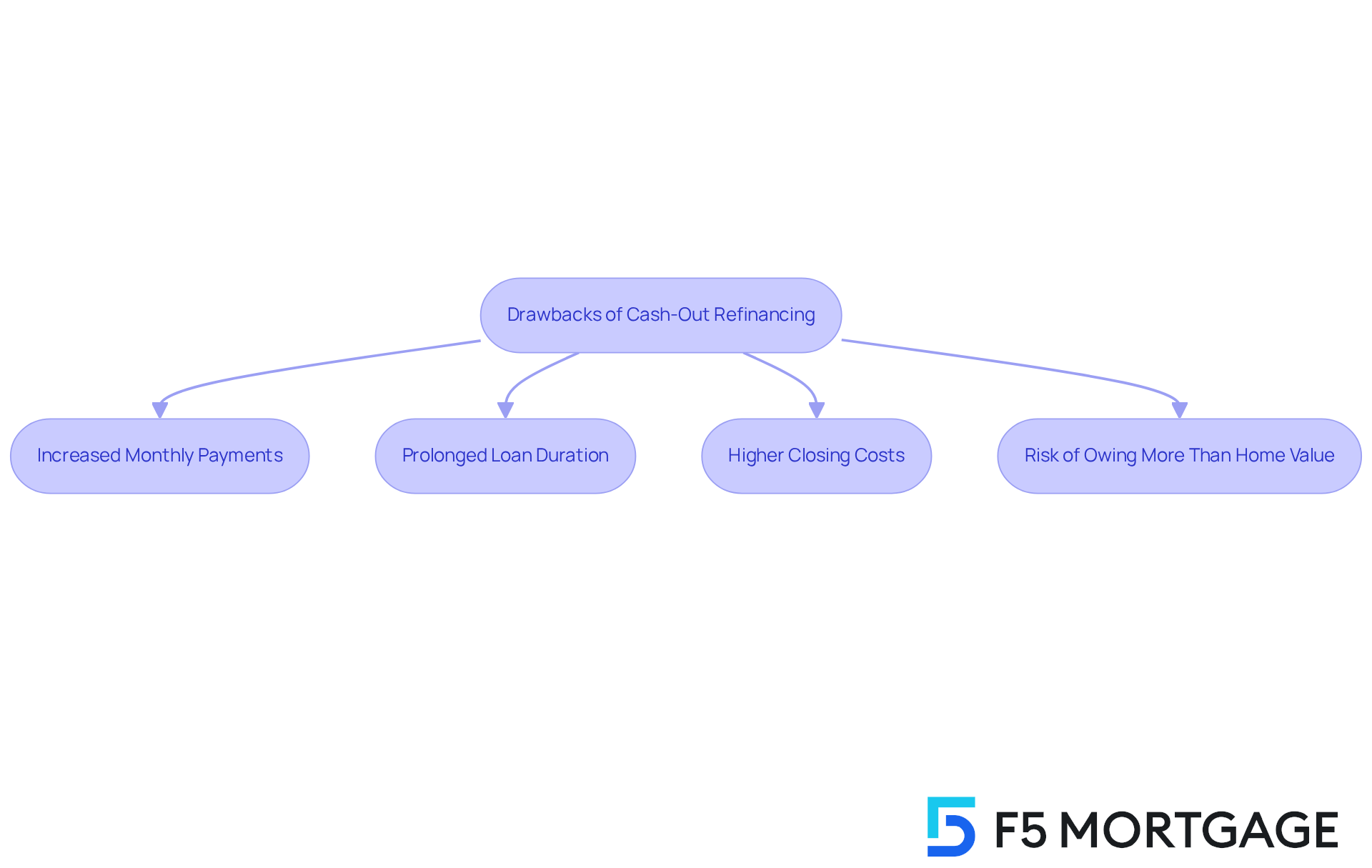

While cash-out loan restructuring can provide immediate financial relief, we know how challenging this decision can be. It’s essential to carefully evaluate the significant drawbacks that may accompany it. One major concern is the potential for increased monthly payments. Homeowners might find themselves facing a larger mortgage balance and possibly a higher interest rate than their initial financing. This can strain budgets, especially if financial circumstances change unexpectedly.

Additionally, cash-out loan restructuring often prolongs the loan duration, which means homeowners could end up paying more interest over the life of the loan. Closing costs associated with restructuring can further inflate the overall expense, making this option less appealing than it initially seems.

In a market where property values can fluctuate, families also face the risk of owing more than their home is worth if values decline. This situation can complicate future financial decisions and may restrict choices for selling or obtaining new financing. Therefore, it’s crucial for families to evaluate their financial stability and long-term objectives thoroughly before committing to cash-out options. We’re here to support you every step of the way as you navigate these important choices.

Comparing Home Equity Loans and Cash-Out Refinancing

When considering financing options, it’s important to recognize the key differences in home equity vs refinance that can impact your decisions. Residential property financing allows homeowners to borrow a specific amount based on their property’s value, typically providing a stable interest rate and clear repayment terms. This structure results in predictable monthly payments, which can greatly simplify budgeting for families. In 2025, the average interest rate for home equity loans remains competitive, often lower than unsecured personal loans or credit cards. This makes them an appealing option for those who need a lump sum for specific purposes, such as home repairs or debt consolidation.

On the other hand, cash-out loan replacement involves replacing your existing mortgage with a new one, allowing you to borrow more than your current mortgage balance. While this option can provide access to larger sums of money, it may also come with variable interest rates and longer repayment terms. As of 2025, many homeowners are hesitant to pursue cash-out options due to high mortgage rates, with less than 1% expressing interest in restructuring at rates above 6%.

It’s also crucial to consider the closing costs associated with each option. Cash-out mortgage restructuring often incurs higher expenses related to establishing a new mortgage, while property value credit options typically have lower charges. This makes them a more cost-effective choice for individuals looking to obtain funds without altering their current mortgage conditions.

Ultimately, the choice between home equity vs refinance relies on your unique financial circumstances, goals, and preferences. We know how challenging this can be, so families should take the time to assess their needs carefully. Consider factors like the purpose of the funds, interest rate expectations, and your overall financial health. Consulting with financial experts can provide valuable insights tailored to your situation, ensuring you make informed choices that align with your long-term objectives. We’re here to support you every step of the way.

Conclusion

Understanding the nuances between home equity and refinancing options is pivotal for families looking to upgrade their financial situations. We know how challenging this can be, and both strategies offer unique benefits and considerations that can significantly impact homeowners’ financial health. By grasping the differences between home equity loans and cash-out refinancing, families can make informed decisions that align with their long-term financial goals.

Key insights reveal that cash-out refinancing can provide access to larger sums of money, making it an attractive option for funding home improvements or consolidating debt. Conversely, home equity loans offer predictable payments and stable interest rates, catering to those who prefer a straightforward borrowing approach. Evaluating these options is crucial, as each comes with its own set of advantages and drawbacks, including potential impacts on monthly payments and overall financial stability.

Ultimately, the choice between home equity and refinancing hinges on individual circumstances and objectives. Homeowners are encouraged to assess their financial situations carefully, consider market conditions, and consult with financial experts to ensure that their decisions support their long-term aspirations. By doing so, families can navigate the complexities of home financing with confidence, paving the way for a more secure financial future.

Frequently Asked Questions

What is home equity and how is it calculated?

Home equity is the portion of a residence’s worth that you fully own, calculated by subtracting any remaining mortgage amounts from the current market value of the property.

How have property values changed for homeowners recently?

In 2025, many property owners are experiencing a significant boost in their asset percentage, with some seeing increases of nearly $150,000 in wealth over the past five years due to rising property values.

What are the primary methods to access home equity?

The primary methods to access home equity are through home equity lines and cash-out mortgage options.

What does refinancing a mortgage involve?

Refinancing a mortgage involves replacing your current mortgage with a new one, often to secure a lower interest rate or adjust the financing term.

What is a rate-and-term mortgage?

A rate-and-term mortgage is a refinancing option that aims to reduce monthly payments by replacing the existing mortgage with one that offers a better rate or different term length.

When do homeowners typically pursue refinancing?

Homeowners typically pursue refinancing when interest rates decline, as they seek to save on their overall debt.

What is the minimum credit score required for conventional loans?

Lenders usually require a minimum credit score of 620 for conventional loans.

What is cash-out mortgage restructuring?

Cash-out mortgage restructuring allows homeowners to tap into their property value by replacing their current loan with a larger one, providing them with the cash difference for significant expenses like home improvements or debt consolidation.

How do home equity loans differ from cash-out mortgage options?

Home equity loans allow you to borrow against your equity, while cash-out mortgage replacement substitutes your current loan with a larger one, providing you with the cash difference.

What should homeowners consider when deciding on refinancing options?

Homeowners should specify their loan modification objectives, whether it’s reducing payments or attaining long-term savings, to make informed decisions that align with their financial goals.

How long should homeowners plan to stay in their homes for their investment to pay off?

It is generally advisable for homeowners to plan on staying in their homes for at least five years to ensure that their investment pays off, although this timeframe can vary based on market conditions and personal situations.