Overview

Missing a mortgage payment can be a daunting experience, and we know how challenging this can be. Immediate consequences may arise, such as:

- Late fees

- A potential drop in your credit score

If multiple payments are missed, the risk of foreclosure becomes a reality. However, timely communication with your lender is crucial. By reaching out and discussing your situation, you can explore proactive measures like repayment plans. These steps can help mitigate the effects of missed payments and support your journey toward financial stability.

Remember, addressing missed payments promptly is vital, and we’re here to support you every step of the way.

Introduction

Missing a mortgage payment can trigger a cascade of financial repercussions that many homeowners may not fully understand. We know how challenging this can be. The immediate concern often revolves around late fees and the potential for a damaged credit score. However, the implications can reach far beyond that, affecting long-term financial health and homeownership stability.

What happens when a single payment is overlooked? As the clock ticks, the risk of foreclosure looms. This raises critical questions about how homeowners can navigate this precarious situation. We’re here to support you every step of the way, helping you safeguard your financial future.

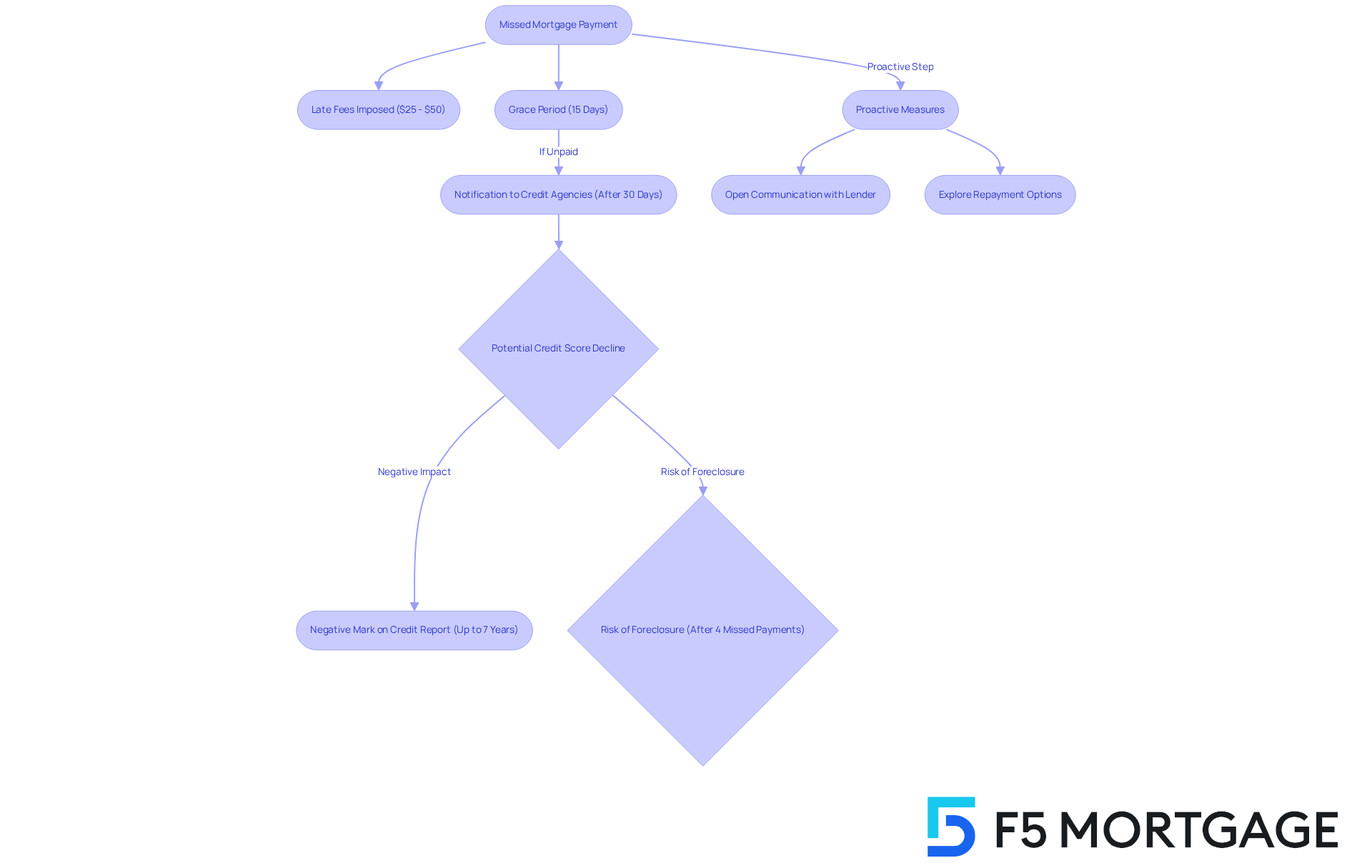

Define Missed Mortgage Payments and Their Consequences

A neglected mortgage installment occurs when a lender fails to make their planned contribution by the due date, typically on a monthly basis. This situation can be distressing, and initially, lenders may impose late fees, usually between $25 and $50, raising concerns about , which can add to the overall cost of the loan. Thankfully, most lenders offer a 15-day grace period before declaring a transaction officially overdue, providing clients with some much-needed flexibility.

If you are wondering what happens if you miss a mortgage payment, the lender will notify the reporting agencies about the overdue obligation if the amount due remains unpaid for 30 days. This can lead to a potential decline in the borrower’s credit score, raising the question of what happens if you miss a mortgage payment, a negative mark that may linger on the credit report for up to seven years, significantly impacting future borrowing opportunities. Moreover, falling four consecutive dues behind could result in foreclosure, which underscores what happens if you miss a mortgage payment.

We understand how challenging this can be, and expert insights emphasize the importance of addressing overlooked financial responsibilities proactively. As Kurt Woock wisely notes, “the sooner you open the lines of communication with your lender, the more options you’ll have to work with them so you can continue to afford the mortgage and keep your home.” Early communication can unlock options for repayment plans or loan modifications, helping to mitigate the financial fallout.

Furthermore, it’s crucial to grasp the implications of late charges; they not only increase the total amount due but can also create a continued late situation, where subsequent dues are considered late until the missed fee is settled. By taking swift action—such as exploring options like mortgage forbearance—individuals can navigate these challenges more effectively and maintain their financial stability. Remember, we’re here to support you every step of the way.

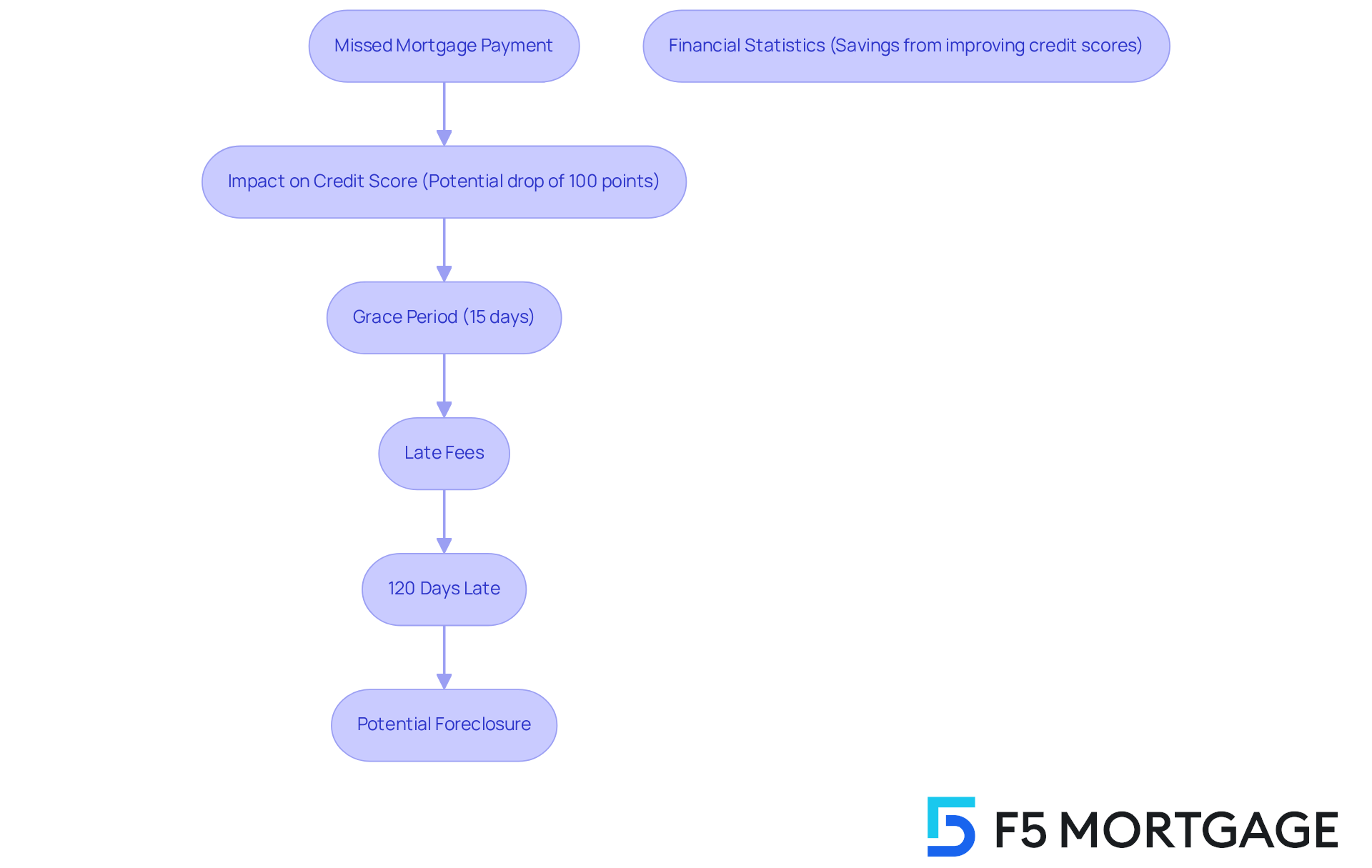

Examine the Impact on Credit Scores

Neglected mortgage dues can profoundly affect your credit rating, and we understand what happens if you miss a mortgage payment is a significant concern. Credit scores are shaped by various factors, with transaction history being one of the most crucial. Just one overlooked payment can diminish your score by 100 points or more, depending on your overall financial profile. This decline can significantly hinder your ability to secure future loans, obtain favorable interest rates, or even rent a home. Moreover, the negative impact can linger for several years, as overdue obligations remain on your financial records for up to seven years. Therefore, understanding the connection between missed payments and credit ratings is vital for anyone striving to maintain their financial well-being.

Most lenders offer a 15-day grace period for late mortgage payments, allowing you a brief window to address overdue amounts without immediate penalties. Additionally, borrowers can fall behind by up to 120 days—or four consecutive payments—before foreclosure actions begin. This timeframe is crucial for tackling missed dues and avoiding serious consequences.

Statistics reveal that improving your score from fair (580-669) to very good (740-799) can save you over $39,000 over the life of your balances, primarily due to lower mortgage costs and better loan rates. The evolving nature of FICO scores suggests that timely payments and wise management of resources can lead to positive changes in your score over time. Conversely, a poor credit score can incur substantial financial costs, potentially totaling tens of thousands of dollars in fees and interest over the years.

Real-world examples illustrate what happens if you miss a mortgage payment. For instance, individuals who default on their mortgage payments may find themselves in precarious financial situations, leading to concerns about what happens if you miss a mortgage payment, and risking foreclosure if they fall more than four consecutive payments behind. Ultimately, is essential for safeguarding your credit health and ensuring access to favorable financial opportunities. Remember, we’re here to support you every step of the way.

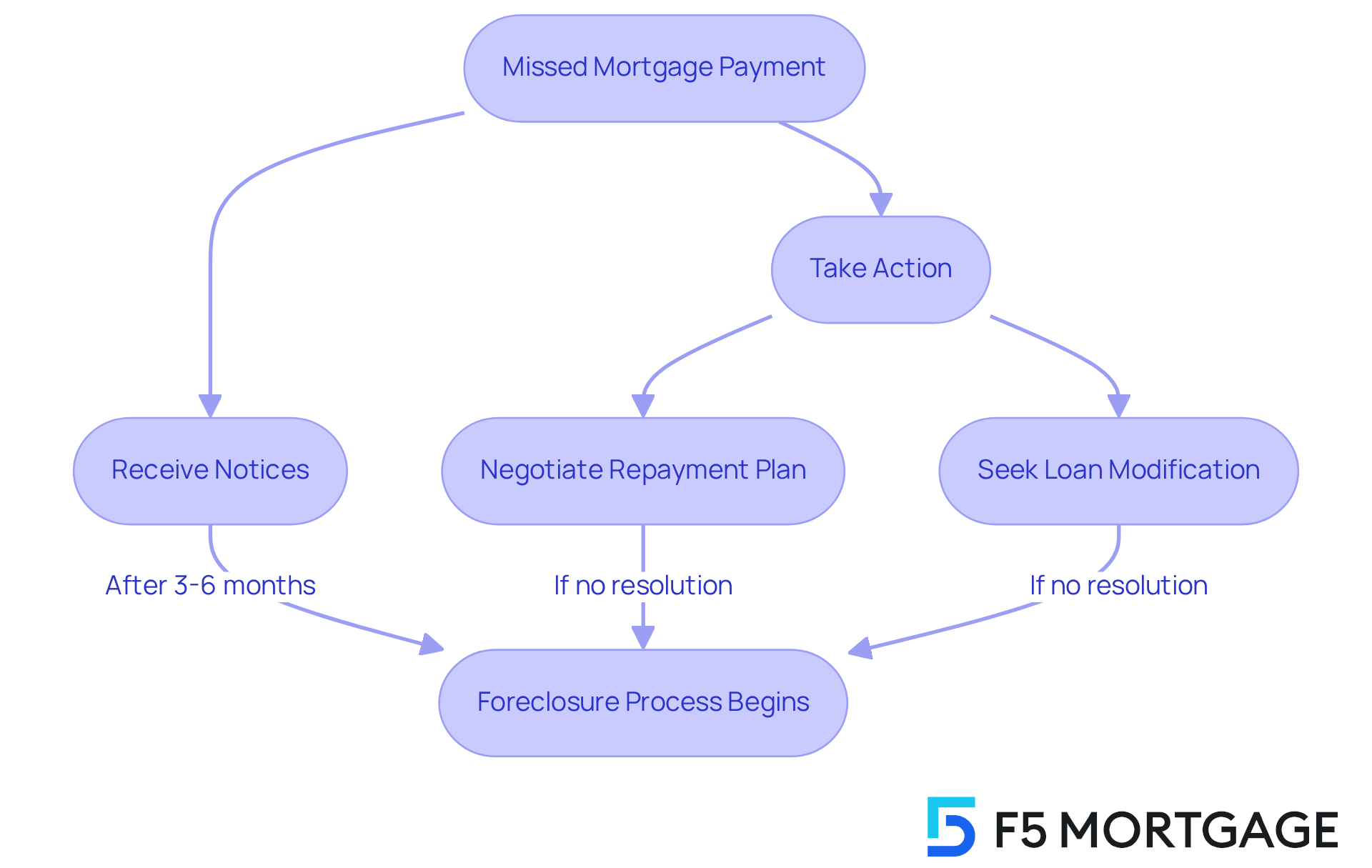

Outline Foreclosure Risks and Timelines

If you find yourself struggling to make mortgage payments, it’s important to understand that repeated missed installments can lead to foreclosure. This legal process allows a lender to take ownership of your property when payments are not made. The timeline for foreclosure can vary by state, but it is important to understand what happens if you miss a mortgage payment, as lenders may begin proceedings after three to six months of missed payments. During this time, you might receive notices and have opportunities to address the situation, such as:

- Negotiating a repayment plan

- Seeking a loan modification

We know how challenging this can be, and it’s crucial to take action. If no steps are taken, the foreclosure process may ultimately lead to the sale of your home at auction, resulting in the loss of your property. Understanding these risks and timelines empowers you to take . Remember, you’re not alone in this journey; we’re here to support you every step of the way.

Conclusion

Missing a mortgage payment can lead to serious repercussions that extend far beyond just a late fee. We understand how challenging this can be, and it’s crucial to grasp the importance of these consequences. Failing to address missed payments can result in significant financial distress, including the potential loss of your home. Awareness and proactive communication with lenders are essential in navigating these tough situations.

Key insights highlight the immediate implications of missed payments, such as:

- Late fees

- Impacts on your credit score

These factors can diminish your financial standing for years. While lenders often provide a grace period, it’s important to remember that the risk of foreclosure looms if payments are not addressed within a certain timeframe. Moreover, the long-term effects on credit ratings can be profound, illustrating how even a single missed payment can drastically lower scores and hinder future borrowing capabilities.

In light of these challenges, it’s imperative for homeowners to take immediate action when facing difficulties with mortgage payments. Engaging with lenders early can open avenues for:

- Repayment plans

- Loan modifications

Taking these proactive steps not only safeguards your personal finances but also fosters a sense of stability in an uncertain situation. Understanding the timeline for foreclosure and the options available can empower you to protect your financial health and homeownership.

Frequently Asked Questions

What are missed mortgage payments?

Missed mortgage payments occur when a borrower fails to make their scheduled payment by the due date, typically on a monthly basis.

What are the immediate consequences of missing a mortgage payment?

Initially, lenders may impose late fees ranging from $25 to $50. Additionally, if the payment remains unpaid for 30 days, the lender will notify credit reporting agencies, which can negatively affect the borrower’s credit score.

How long can a missed payment impact my credit score?

A negative mark from a missed mortgage payment can stay on your credit report for up to seven years.

What could happen if I fall behind on multiple mortgage payments?

Falling four consecutive payments behind may lead to foreclosure.

What should I do if I miss a mortgage payment?

It is important to communicate with your lender as soon as possible. Early communication can provide options for repayment plans or loan modifications, helping to manage the situation.

How do late charges affect my mortgage?

Late charges increase the total amount due and can lead to a situation where subsequent payments are considered late until the missed fee is paid.

Are there options to manage missed payments?

Yes, exploring options like mortgage forbearance can help individuals navigate the challenges of missed payments and maintain financial stability.