Overview

Navigating the world of home equity loans can feel overwhelming, but understanding the requirements can make it easier.

- First, take a moment to evaluate your home equity; this is a crucial step in the journey.

- Next, it’s important to compare interest rates and terms from various lenders, ensuring you find the best fit for your needs.

We know how challenging this can be, especially when it comes to meeting qualifications like credit score and income verification. By following these essential steps, you can feel empowered to make informed borrowing decisions. Remember, we’re here to support you every step of the way as you embark on this important financial journey.

Introduction

Unlocking the potential of your home can truly be a game-changer, especially as property values continue to rise. Home equity loans present a wonderful opportunity to access funds for renovations, debt consolidation, or major purchases, often at lower interest rates than traditional loans. Yet, we know how challenging this can be, as nearly half of U.S. homeowners hesitate to tap into their equity due to concerns about interest rates and repayment risks.

So, how can you navigate the complexities of obtaining a home equity loan while ensuring your financial security? This guide is designed to demystify the process, empowering you to make informed decisions about leveraging your greatest asset.

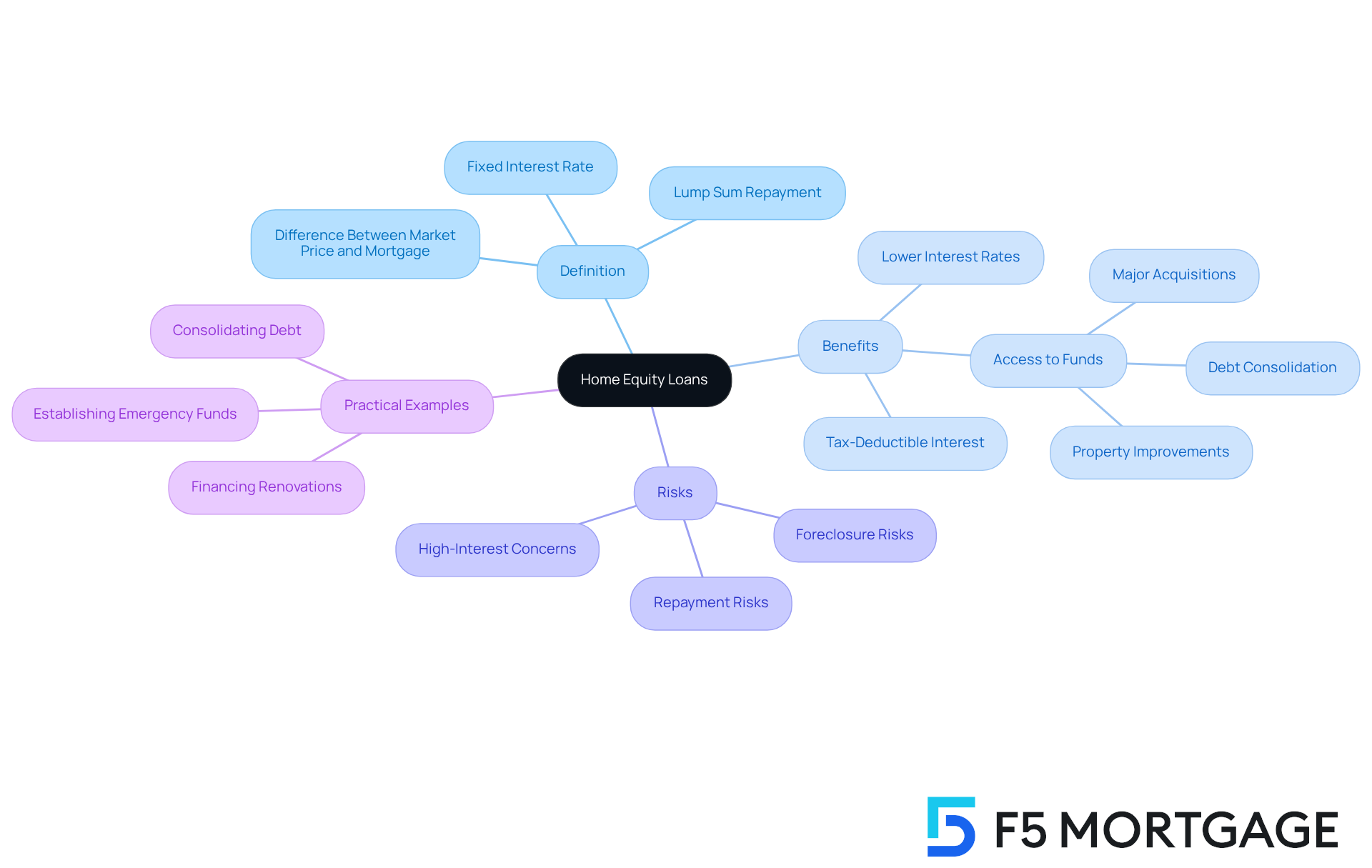

Understand Home Equity Loans

A property value advance offers a way for property owners to tap into the worth of their asset. This value is defined as the difference between the property’s current market price and the remaining mortgage amount. Typically, these credits provide a lump sum that is repaid over a fixed term at a fixed interest rate, currently averaging around 8.22%, the lowest level this year. Understanding where to get a home equity loan is essential, as this financing option can be used for various purposes, such as property improvements, merging debts, or making major acquisitions.

The advantages of residential financing are significant. They provide homeowners with access to funds while often presenting lower interest rates compared to credit cards and personal loans. Additionally, the interest paid on property financing may be tax-deductible if the funds are used for eligible renovations. However, it’s important to recognize the risks involved; since the property serves as collateral, failing to repay the debt could lead to foreclosure.

In 2025, many homeowners are increasingly realizing the potential of utilizing their home value. Nearly half of U.S. homeowners are categorized as ‘wealthy in assets,’ which offers enhanced financial flexibility, including better access to credit and favorable borrowing conditions. Yet, 54% of homeowners remain hesitant to tap into their assets due to worries about high interest rates and repayment risks.

Financial advisors emphasize the importance of understanding where to get a home equity loan and the terms and conditions associated with property value loans before proceeding. As one specialist noted, “With property value levels at another new peak, property owners in need of additional financing or those wishing to establish an emergency funding source may want to educate themselves about the best methods to borrow against their assets now.”

Practical examples illustrate the benefits of residential financing. For instance, a property owner might choose to borrow against their assets to finance a significant renovation, enhancing both their living space and property value. Alternatively, another property owner could consolidate high-interest debt into a single, lower-rate mortgage, simplifying their financial responsibilities.

Ultimately, while property-based borrowing can be a strategic financial tool, it is crucial for property owners to carefully evaluate their options, considering both the benefits and risks involved. We know how challenging this can be, and we’re here to support you every step of the way.

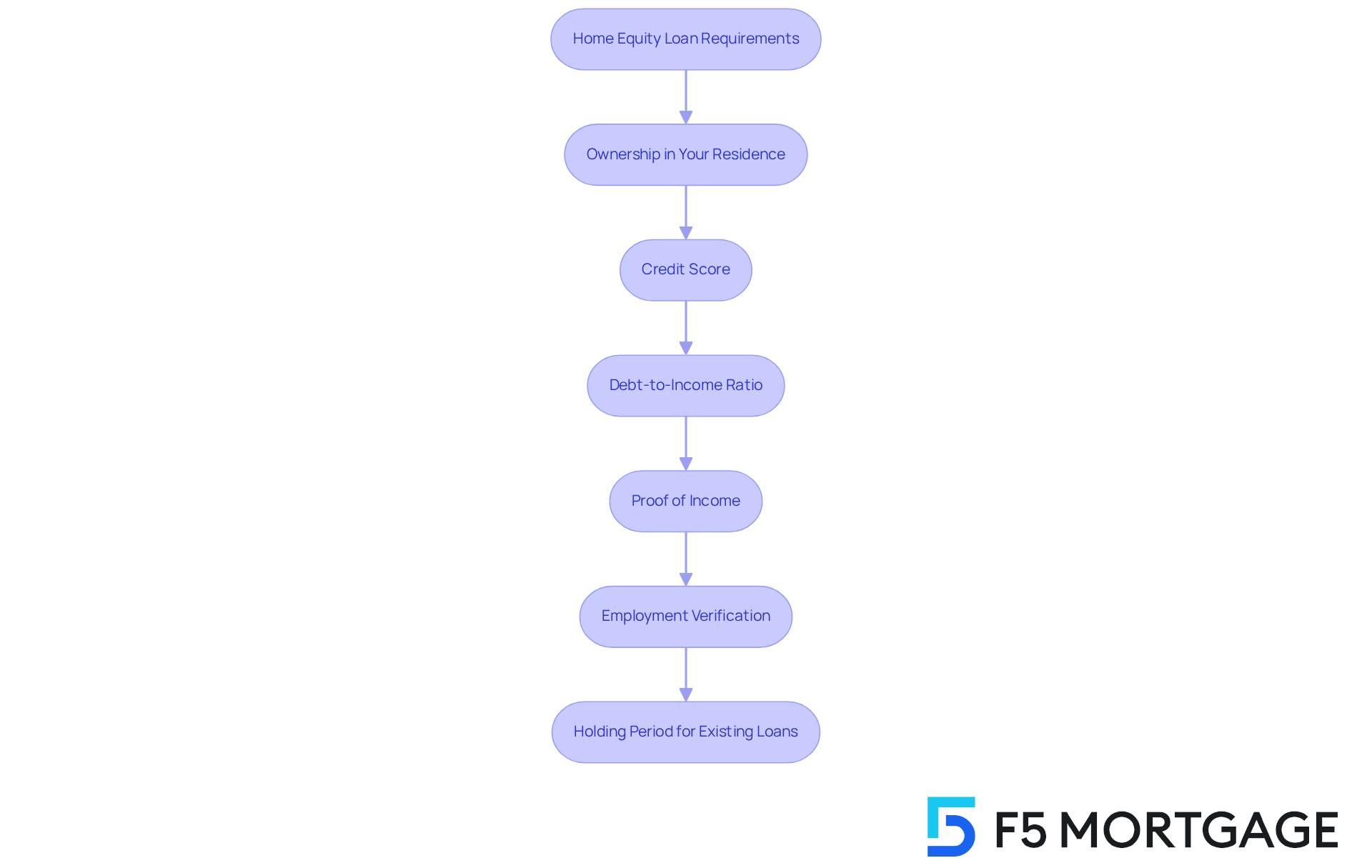

Identify Home Equity Loan Requirements

To qualify for a home equity loan, several key requirements must be met, and we understand that navigating this process can feel overwhelming. Let’s break it down together:

-

Ownership in Your Residence: Most financial institutions require property owners to possess a minimum of 15-20% ownership stake in their property. This means that the remaining mortgage amount should be considerably less than the home’s current market value, allowing you to tap into that asset. A financial institution will arrange an evaluation to determine your property’s current market value, which will reveal how much equity you possess and influence your rates.

-

Credit Score: A strong credit score is crucial, with most lenders looking for a minimum score of 620. However, achieving a score of 700 or higher can significantly improve your chances of securing favorable credit conditions, as it reflects your reliability as a borrower. According to Experian, borrowers generally require a credit score of at least 620 to be eligible for a home equity line of credit or HELOC. FHA mortgages may have lower credit score criteria, which can be beneficial for certain borrowers.

-

Debt-to-Income Ratio: Lenders typically prefer a debt-to-income (DTI) ratio of 43% or lower. This signifies that your total monthly debt obligations should not exceed 43% of your gross monthly earnings, ensuring that you can manage additional payment responsibilities comfortably.

-

Proof of Income: Documentation of your income is essential. This may include recent pay stubs, tax returns, or bank statements, which demonstrate your ability to repay the debt.

-

Employment Verification: Lenders often require proof of stable employment, which can be provided through a letter from your employer or recent pay stubs. As noted by Melissa Cohn, regional vice president at William Raveis Mortgage, “Contact financial institutions and inquire about the criteria for obtaining approval before you submit your application.”

-

Holding Period for Existing Loans: In Colorado, some financial institutions require homeowners to maintain their current loan for a specific duration before they qualify to refinance. For example, the Streamline Refinance program through FHA necessitates at least six months of on-time payments.

Understanding where to get a home equity loan and its requirements is vital for preparing your application and increasing your chances of approval. We know how challenging this can be, but borrowers who maintain timely payments and have a solid income history are more likely to meet these qualifications successfully. As industry experts emphasize, having a clear grasp of these criteria can significantly streamline the application process and enhance your overall borrowing experience. Together, we can navigate this journey and find the best path forward.

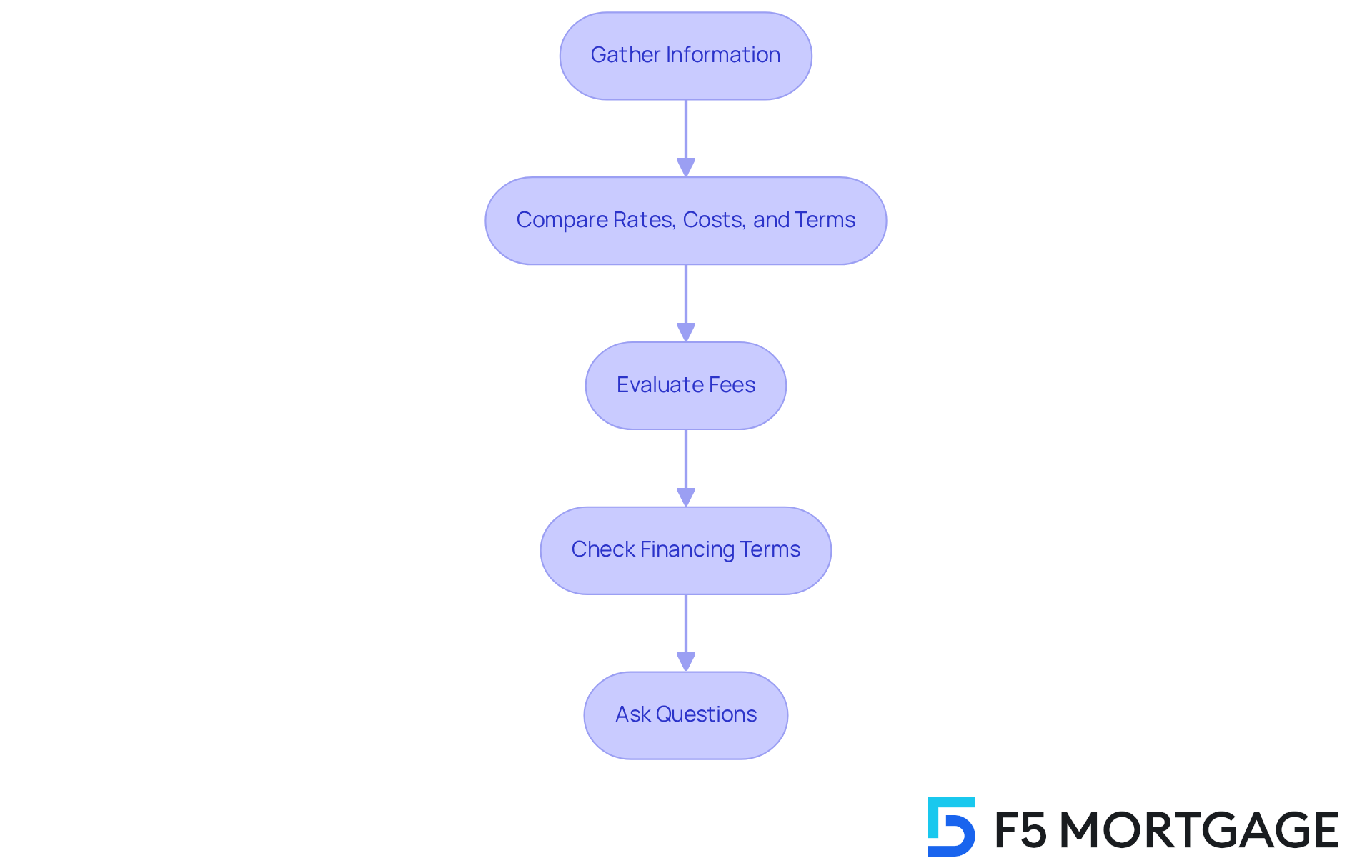

Research and Compare Lenders

Once you comprehend the requirements, the next step is to research and compare financial institutions effectively. We know how challenging this can be, so here’s how to navigate the process with ease:

-

Gather Information: Start by compiling a list of potential financing sources, including banks, credit unions, and online options. Focus on those with strong reputations and positive customer reviews, as these factors can significantly influence your experience. Consider working with F5 Mortgage for competitive rates and personalized service to enhance your options.

-

Compare Rates, Costs, and Terms: Interest rates can vary significantly among lenders, affecting your total borrowing expense. Utilize online comparison tools to identify the best rates available. Remember, even a minor variation in rates can lead to significant savings over time. Locking in your mortgage rate with F5 Mortgage can provide additional peace of mind during this process.

-

Evaluate Fees: Beyond interest rates, take a close look at the fees associated with each borrowing option, such as origination fees and closing costs, which typically range from 2% to 5% of the amount borrowed. Some financial institutions may offer lower rates but balance this with higher fees, so a thorough assessment is crucial.

-

Check Financing Terms: Examine the conditions of each financing option, including repayment durations and payment flexibility. Ensure these terms align with your financial goals and capabilities, as they can affect your long-term financial health. Most financial institutions require a combined loan-to-value ratio (CLTV) of 85 percent or lower, which is essential in assessing financing options.

-

Ask Questions: Don’t hesitate to reach out to financial institutions with any inquiries about their offerings. Gaining clarity on the details can empower you to make a more informed decision. Furthermore, comparing offers from at least three financial institutions is advised to secure the most favorable rate for a property line of credit.

By thoroughly researching and comparing financial institutions, including the competitive offerings from F5 Mortgage, you can identify where to get a home equity loan that best fits your financial situation. We’re here to support you every step of the way, ultimately aiding in your property upgrade journey.

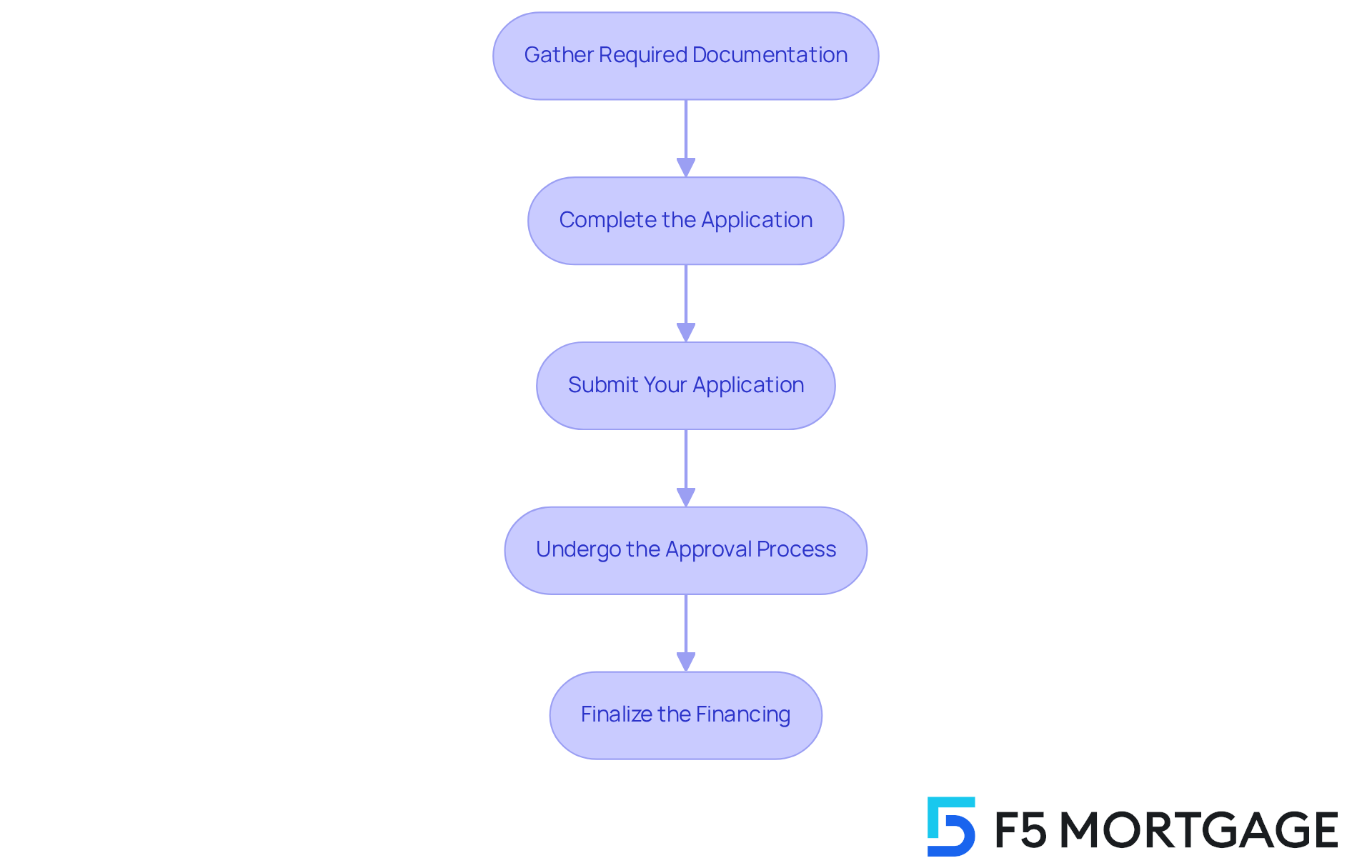

Apply for Your Home Equity Loan

Choosing a lender is an important step, particularly when determining where to get a home equity loan, and we know how challenging this can be. To help you navigate the application process smoothly, here are some essential steps to follow:

-

Gather Required Documentation: Start by preparing the necessary documents. This includes proof of income, tax returns, bank statements, and details about your home, such as the mortgage statement and property tax bill. Remember, homeowners typically need to show consistent income and at least 20% ownership in their property to qualify. Many lenders also require homeowners to maintain a minimum of an 80% home-to-value ratio, which is crucial for understanding equity requirements.

-

Complete the Application: Next, fill out the financial institution’s application form with care. Be sure to detail your financial situation and the purpose of the loan. Many financial institutions now offer online applications for added convenience, allowing you to submit your information quickly.

-

Submit Your Application: After completing your application and gathering all required documents, it’s time to submit them. Ensuring everything is thorough and accurate can help avoid unnecessary delays in the approval process.

-

Undergo the Approval Process: Once submitted, the lender will review your application, which usually includes a credit check and an appraisal of your home. Be prepared to provide additional information or clarification if needed. Lenders often prefer applicants with a credit score of 740 or above, as this can significantly enhance borrowing conditions.

-

Finalize the Financing: If you receive approval, you’ll get a closing disclosure outlining the financing terms. Take the time to review this document carefully before signing. Once you sign the necessary paperwork, the funds will be disbursed according to the agreed-upon terms.

By following these steps, you can approach the application process with confidence, knowing that we’re here to support you every step of the way in finding out where to get a home equity loan that meets your financial needs.

Conclusion

Tapping into home equity can be a powerful financial strategy for homeowners eager to leverage their property’s value. This guide offers a comprehensive overview of how to obtain a home equity loan, highlighting the importance of understanding the requirements, comparing lenders, and navigating the application process with confidence.

We know how challenging this can be, which is why it’s essential to meet ownership and credit score criteria while maintaining a favorable debt-to-income ratio. Thoroughly researching lenders is crucial, as it helps you find the best rates and terms. This ensures that you can make informed decisions that align with your financial goals.

Real-world examples illustrate how home equity loans can be used for renovations or debt consolidation, showcasing their potential benefits. By understanding where to get a home equity loan and the associated steps, you can empower yourself to make strategic financial moves.

As you consider your options, remember that being well-informed and prepared is key. Unlocking the value of your home while managing risks effectively is within your reach. Taking action to educate yourself and explore available resources is crucial for achieving financial success in 2025 and beyond. We’re here to support you every step of the way.

Frequently Asked Questions

What is a home equity loan?

A home equity loan allows property owners to access the value of their asset, defined as the difference between the property’s current market price and the remaining mortgage amount. It typically provides a lump sum that is repaid over a fixed term at a fixed interest rate.

What can a home equity loan be used for?

Home equity loans can be used for various purposes, including property improvements, consolidating debts, or making major acquisitions.

What are the advantages of home equity loans?

Home equity loans offer homeowners access to funds with lower interest rates compared to credit cards and personal loans. Additionally, the interest paid may be tax-deductible if the funds are used for eligible renovations.

What are the risks associated with home equity loans?

The primary risk is that the property serves as collateral; failing to repay the debt could lead to foreclosure.

Why are some homeowners hesitant to use home equity loans?

Many homeowners remain hesitant due to concerns about high interest rates and the risks associated with repayment.

What do financial advisors recommend regarding home equity loans?

Financial advisors emphasize the importance of understanding where to get a home equity loan and the associated terms and conditions before proceeding.

Can you provide examples of how home equity loans can be beneficial?

For instance, a property owner might borrow against their assets to finance a significant renovation, enhancing their living space and property value. Another example is consolidating high-interest debt into a single, lower-rate mortgage to simplify financial responsibilities.

What should property owners consider before taking out a home equity loan?

Property owners should carefully evaluate their options, considering both the benefits and risks involved with property-based borrowing.